CORPORATE FINANCE 101 Presented by Lynne Bolduc, Partner FitzGerald

9 Slides726.11 KB

CORPORATE FINANCE 101 Presented by Lynne Bolduc, Partner FitzGerald Kreditor Bolduc Risbrough LLP

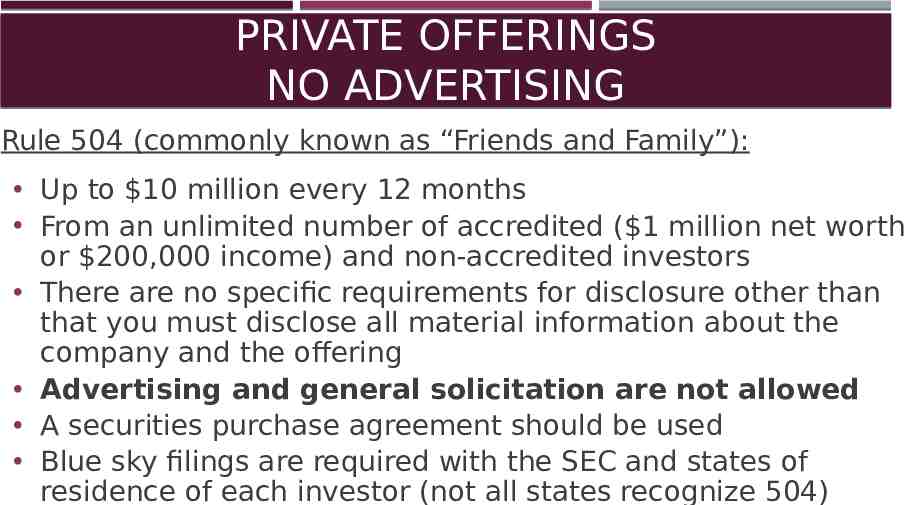

PRIVATE OFFERINGS NO ADVERTISING Rule 504 (commonly known as “Friends and Family”): Up to 10 million every 12 months From an unlimited number of accredited ( 1 million net worth or 200,000 income) and non-accredited investors There are no specific requirements for disclosure other than that you must disclose all material information about the company and the offering Advertising and general solicitation are not allowed A securities purchase agreement should be used Blue sky filings are required with the SEC and states of residence of each investor (not all states recognize 504)

PRIVATE OFFERINGS NO ADVERTISING 506(b): Rule 506(b) is the standard private offering exemption and the one most commonly used. A company can raise: An unlimited amount of money From an unlimited number of accredited ( 1 million net worth or 200,000 income) and up to 35 non-accredited investors A disclosure document is required and usually takes the form of a private placement memorandum (PPM). If the offering is made to accredited investors only, there are no specific requirements for the PPM other than that it contain all material information about the company and the offering. If the offering will include non-accredited investors, the PPM must follow specified disclosure requirements. Advertising and general solicitation are not allowed The investors need only to check a box representing they are accredited, additional information from the investor is not required to verify their representation Blue sky filings are required with the SEC and states of residence of each investor (notice only)

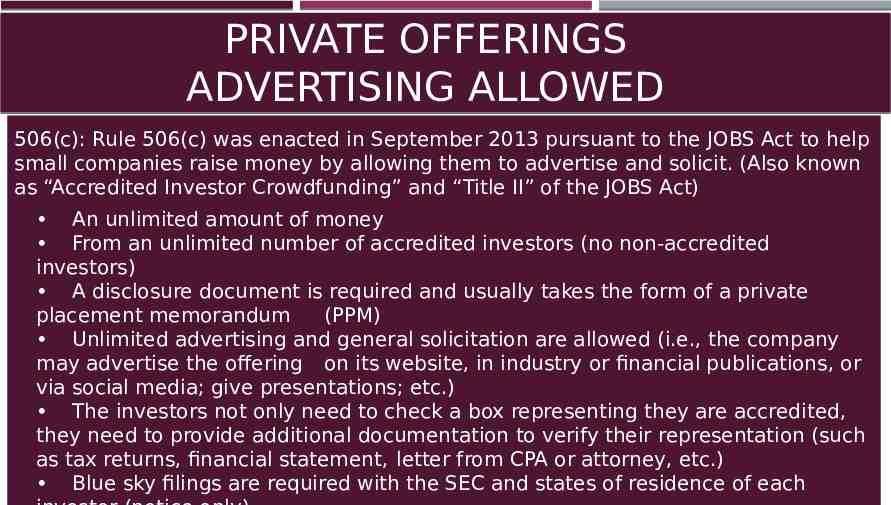

PRIVATE OFFERINGS ADVERTISING ALLOWED 506(c): Rule 506(c) was enacted in September 2013 pursuant to the JOBS Act to help small companies raise money by allowing them to advertise and solicit. (Also known as “Accredited Investor Crowdfunding” and “Title II” of the JOBS Act) An unlimited amount of money From an unlimited number of accredited investors (no non-accredited investors) A disclosure document is required and usually takes the form of a private placement memorandum (PPM) Unlimited advertising and general solicitation are allowed (i.e., the company may advertise the offering on its website, in industry or financial publications, or via social media; give presentations; etc.) The investors not only need to check a box representing they are accredited, they need to provide additional documentation to verify their representation (such as tax returns, financial statement, letter from CPA or attorney, etc.) Blue sky filings are required with the SEC and states of residence of each

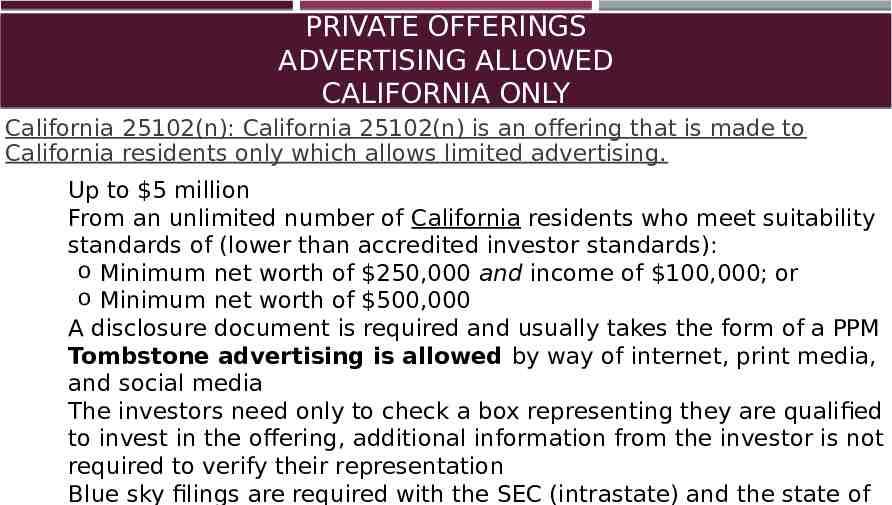

PRIVATE OFFERINGS ADVERTISING ALLOWED CALIFORNIA ONLY California 25102(n): California 25102(n) is an offering that is made to California residents only which allows limited advertising. Up to 5 million From an unlimited number of California residents who meet suitability standards of (lower than accredited investor standards): o Minimum net worth of 250,000 and income of 100,000; or o Minimum net worth of 500,000 A disclosure document is required and usually takes the form of a PPM Tombstone advertising is allowed by way of internet, print media, and social media The investors need only to check a box representing they are qualified to invest in the offering, additional information from the investor is not required to verify their representation Blue sky filings are required with the SEC (intrastate) and the state of

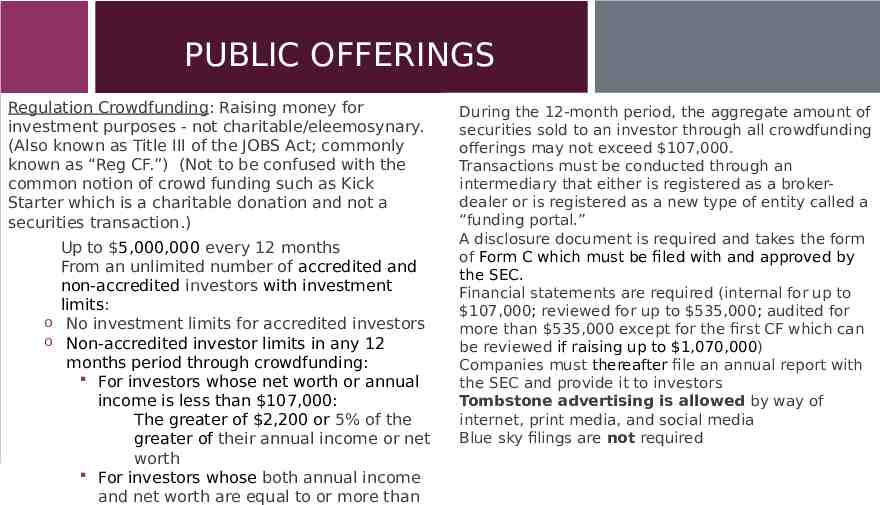

PUBLIC OFFERINGS Regulation Crowdfunding: Raising money for investment purposes - not charitable/eleemosynary. (Also known as Title III of the JOBS Act; commonly known as “Reg CF.”) (Not to be confused with the common notion of crowd funding such as Kick Starter which is a charitable donation and not a securities transaction.) Up to 5,000,000 every 12 months From an unlimited number of accredited and non-accredited investors with investment limits: o No investment limits for accredited investors o Non-accredited investor limits in any 12 months period through crowdfunding: For investors whose net worth or annual income is less than 107,000: The greater of 2,200 or 5% of the greater of their annual income or net worth For investors whose both annual income and net worth are equal to or more than During the 12-month period, the aggregate amount of securities sold to an investor through all crowdfunding offerings may not exceed 107,000. Transactions must be conducted through an intermediary that either is registered as a brokerdealer or is registered as a new type of entity called a “funding portal.” A disclosure document is required and takes the form of Form C which must be filed with and approved by the SEC. Financial statements are required (internal for up to 107,000; reviewed for up to 535,000; audited for more than 535,000 except for the first CF which can be reviewed if raising up to 1,070,000) Companies must thereafter file an annual report with the SEC and provide it to investors Tombstone advertising is allowed by way of internet, print media, and social media Blue sky filings are not required

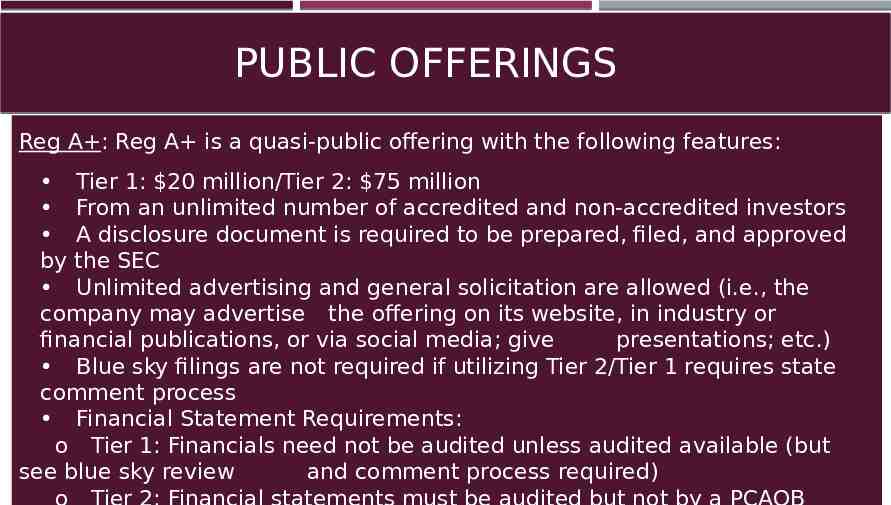

PUBLIC OFFERINGS Reg A : Reg A is a quasi-public offering with the following features: Tier 1: 20 million/Tier 2: 75 million From an unlimited number of accredited and non-accredited investors A disclosure document is required to be prepared, filed, and approved by the SEC Unlimited advertising and general solicitation are allowed (i.e., the company may advertise the offering on its website, in industry or financial publications, or via social media; give presentations; etc.) Blue sky filings are not required if utilizing Tier 2/Tier 1 requires state comment process Financial Statement Requirements: o Tier 1: Financials need not be audited unless audited available (but see blue sky review and comment process required)

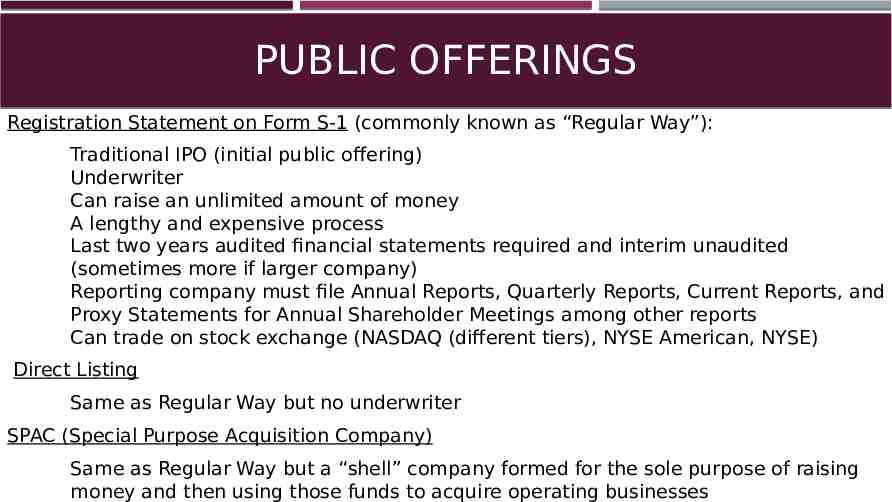

PUBLIC OFFERINGS Registration Statement on Form S-1 (commonly known as “Regular Way”): Traditional IPO (initial public offering) Underwriter Can raise an unlimited amount of money A lengthy and expensive process Last two years audited financial statements required and interim unaudited (sometimes more if larger company) Reporting company must file Annual Reports, Quarterly Reports, Current Reports, and Proxy Statements for Annual Shareholder Meetings among other reports Can trade on stock exchange (NASDAQ (different tiers), NYSE American, NYSE) Direct Listing Same as Regular Way but no underwriter SPAC (Special Purpose Acquisition Company) Same as Regular Way but a “shell” company formed for the sole purpose of raising money and then using those funds to acquire operating businesses

FUN FACT THE FIRST IPO WAS IN THE NETHERLANDS. THE FIRST PONZI SCHEME WAS ALSO IN THE NETHERLANDS; IT INVOLVED TULIP BULBS. Q&A Lynne Bolduc, Partner FitzGerald Kreditor Bolduc Risbrough LLP Offices in Orange County and Los Angeles [email protected] (949) 788-8900 www.FKBRlegal.com THANKS FOR LISTENING!