1st Mariner Bank Group 6: Julie Tadros Sahil Ranjhan Mohammed Patwary

15 Slides810.90 KB

1st Mariner Bank Group 6: Julie Tadros Sahil Ranjhan Mohammed Patwary Ly Huynh Connor Quinn Kate Ulma

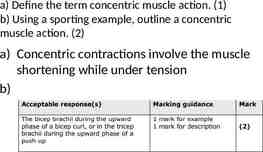

Introduction External Analysis Internal Analysis Our Recommendation Barriers to Imitation Cost Analysis Milestones

External Analysis of the Industry High focus on customer service Building image and increase recognition Technology changes is the largest trend dictating the market Community banks as a whole are facing the same dilemma of reaching new consumers Threat of entry for the market is low because community banks are not entering the market Buyer power is much stronger than supplier power

Key Success Factors of the Industry Technology Best Rates Product Innovation Quality Brand Image (Recognition) Size of the Company Location and Convenience Customer Service

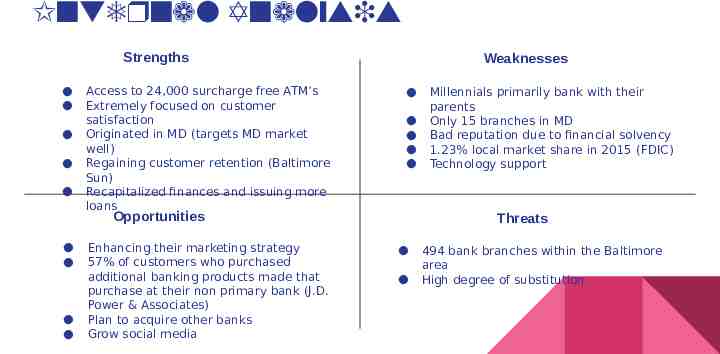

Internal Analysis Strengths Access to 24,000 surcharge free ATM’s Extremely focused on customer satisfaction Originated in MD (targets MD market well) Regaining customer retention (Baltimore Sun) Recapitalized finances and issuing more loans Weaknesses Opportunities Enhancing their marketing strategy 57% of customers who purchased additional banking products made that purchase at their non primary bank (J.D. Power & Associates) Plan to acquire other banks Grow social media Millennials primarily bank with their parents Only 15 branches in MD Bad reputation due to financial solvency 1.23% local market share in 2015 (FDIC) Technology support Threats 494 bank branches within the Baltimore area High degree of substitution

Recommendation Cultivate relationships with local incubators on college campuses including: Towson University Johns Hopkins University Loyola University (Baltimore) University of Maryland Baltimore County University of Maryland College Park Upgrade the technology capabilities to be more active towards

Recommendation cont. Creating strategic alliances will allow First Mariner bank to work closely with organizations who share the same vision for millennials in the startup industry. Forbes recently released an article titled “The Business Of Startups Has Become A Startup Business”. Furthermore this allows First Mariner to express the benefits they have to offer to the primary demographic whom they are targeting

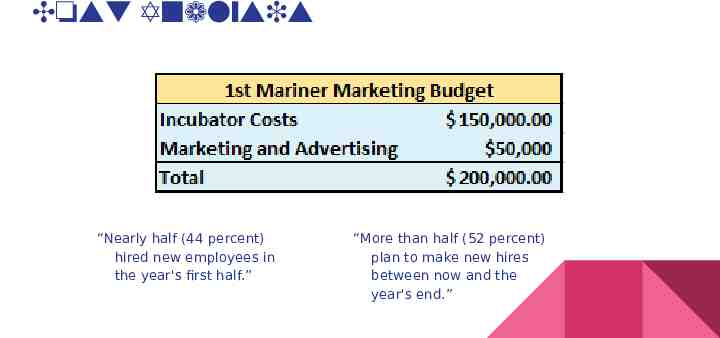

Allocation of Funds Of the 200,000 budget, each of the five schools will receive a total of 30,000 in “bonuses”, which will be allocated to the top teams at the discretion of leaders of the incubators and management at First Mariner. A contest will be held where the top three start-up’s receive a bonus in respect to the outcome of the contest 1st Place - 15,000 2nd Place - 10,000 3rd Place - 5,000 The Remaining 50,000 will be used to fund print, digital, and TV advertising expressing the message of inclusion with Maryland Universities and investing

Recommendation cont. Each of the top three startups from each school will be eligible to receive the said “bonus money”, if the teams agree to sign a business loan out with First Marinar Each loan can be negotiable at level of principal and interest rate, but below subprime rate If parents and/or guardians cannot act as guarantor for the loan, the loans will be made as a 7a loan through the U.S. Small Business Administration (SBA)

Cost Analysis “Nearly half (44 percent) hired new employees in the year's first half.” “More than half (52 percent) plan to make new hires between now and the year's end.”

Barriers to Imitation 1st Mariner is a local community bank Has closer relationships to local schools and alumni networks, so it has an easier time approaching schools to do a incubator tailored competition Can understand and work with local start-ups better than the megabanks 1st Mariner can make decisions incorporating local business conditions and can make those decisions quickly. When improving its technology and accessibility through its mobile

Milestone Breakdown: College Startup Program Year 1 Month 3: Agreements with at least 4 colleges have been attained. Month 5: Startup competitions are ready to begin. Month 12: Winners of the competition are declared and awarded.

Milestone Breakdown: College Startup Program Year 2 Month 3: The program and outcome of the first round of the competition has been analyzed. Month 5: Necessary revisions have been made to the program. The next round of the competition is set to begin. Month 12: Winners of the competition are declared and awarded.

Milestone Breakdown: College Startup Program Year 3 Month 3: Start-up winners conference is held. Month 4: An analysis of the program as a whole so far has been completed. Month 6: A decision is made on the outcomes of the program and if it will continue. Month 12: Winners of the 3rd round of the program will be declared and awarded OR unveiling of the replacement the program.

Sources http://businesscenter.jdpower.com/news/pressrelease.aspx?ID 2011020 https://www.americanexpress.com/us/small-business/openforum/articles/why-millennials-could-be-the-most-entrepreneur ial-generation-ever/ http://www.baltimoresun.com/business/bs-bz-first-mariner-first-year-20150623-story.html https://sites.google.com/site/bankingindustryandtheinternet/home/5-forces http://www.bizjournals.com/baltimore/blog/lists/2013/12/baltimores-top-10-banks.html https://www5.fdic.gov/sod/sodMarketRpt.asp?barItem 2 http://www.baltimoresun.com/business/bs-bz-bank-mergers-20151016-story.html http://mba-lectures.com/management/strategic-management/819/key-success-factors-of-banking-industry.html http://www.bizjournals.com/baltimore/news/2016/02/10/first-mariner-banks-overhaulcontinues-as-2015-was.html http://smallbusiness.chron.com/average-interest-rate-small-business-loans-15342.html