New Vision of Engineering Economy Teaching تنمية المهارات

60 Slides984.00 KB

New Vision of Engineering Economy Teaching تنمية المهارات االقتصادية 1

Dr. Mohamed F. El-Refaie (Sunday Dr. and Tuesday, L3,L4,L5 and L6) Sayed Kaseb (Saturday and L8) and Wednesday, L1,L2,L7 Module 1 Teaching Team Engineering Economy Module 1: Lectures 1-8 2

Module 1 - Lecture 1 ORIENTATION and INTRODUCTION Dr. Sayed Kaseb Associate Professor, MPED, FECU Manger of Pathways to Higher Education 3

Module 1 Lecture 1 Overview 1.1 VISION Project Overview: Mission, Objective, Outcomes, Outputs EU-Partners, Egyptian team Training approach, Evaluation system Website 1.2 Importance of Engineering Economy 1.3 Principles of Engineering Economy 1.4 Engineering Economy and Design Process 4 1.5 Introduction to Spreadsheet

Few Words About VISION: an international TEMPUS-SCM project 5

Vision Project Financed by EU - TEMPUS program Contractor – Italy Coordinator – Egypt Partners – England and Greece Include a free training program 6

VISION Mission Help Fresh Graduates to compete for distinguished opportunities. 7

Participation of Egyptian staff with EUstaff in training post/under graduate students on engineering economy (EE) and development of a prototype EE educational material that will include the usage of most recent teaching facilities in addition to a wide spectrum of model application 8

Desired outcome VISION Quality Leaders with Economical Vision Graduate Base 9

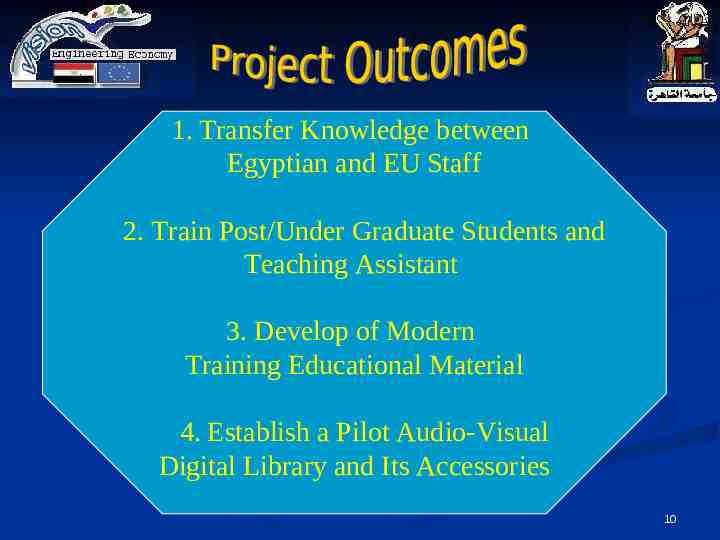

1. Transfer Knowledge between Egyptian and EU Staff 2. Train Post/Under Graduate Students and Teaching Assistant 3. Develop of Modern Training Educational Material 4. Establish a Pilot Audio-Visual Digital Library and Its Accessories 10

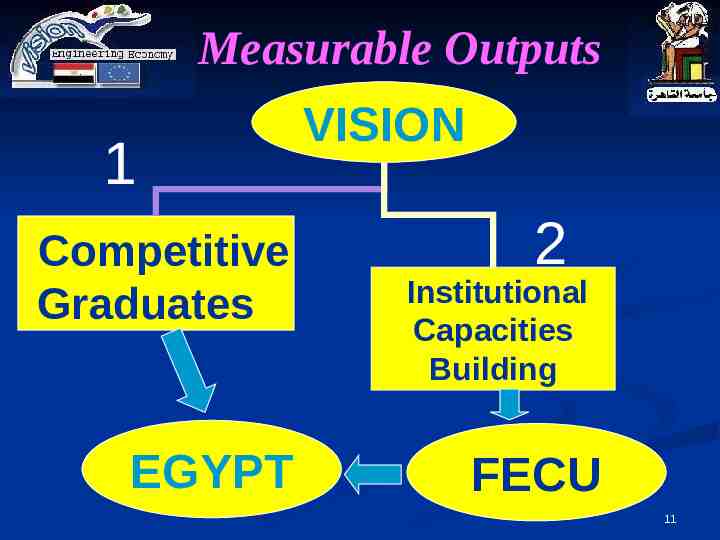

Measurable Outputs 1 Competitive Graduates EGYPT VISION 2 Institutional Capacities Building FECU 11

Naples Federico II Faculty of Engineering Cairo University (FECU) Technological Educational Institutes TEI of Piraeus University of York 12

Prof. Dr. Saad El-Raghy Prof. Dr. Mohamed F. El-Refaie Dr. Sayed Kaseb, Grant Coordinator 13

Eng. Omar Abdel-Aziz Ahmed Eng. Hussein Magdy Mohamed Eng. Amgad Amin El-Dib Eng. Walid Abd-Elsamea Maarouf 14

Mr. Abdullah Mohamed AhmedEng. Manar Mohamed Eng. Mustafa Abdel-Shafi Al-Sayed Ms. Fatma Moahmed Fahmy Abd El Baky Mr. Mohamed Abdou Mohamed 15

Vision Training Approach Planned No. of Trainees Expected Date 73 Feb. 12, 2005 Egyptian 33 19 12 Teaching Staff Italian and Feb. 26, 2005 British Italian and June 25,2005 Greek July 23, 2005 Italian Country Week Egypt One Egypt Two Egypt Three Italy Four 16

Outline of the approach taken to develop EE Course Define the content and scope of the course. Divide it into parts and lectures. Decide the learning objectives for each lecture. Develop the complete content of each lecture. Design the lecture and prepare lecture notes and presentation materials. Design exercises and case studies with worked examples and tutor support notes for each lecture. Submit these to the project team and students to get their feedback. Develop the final version of the material after enhancement and approval from the project team. 17

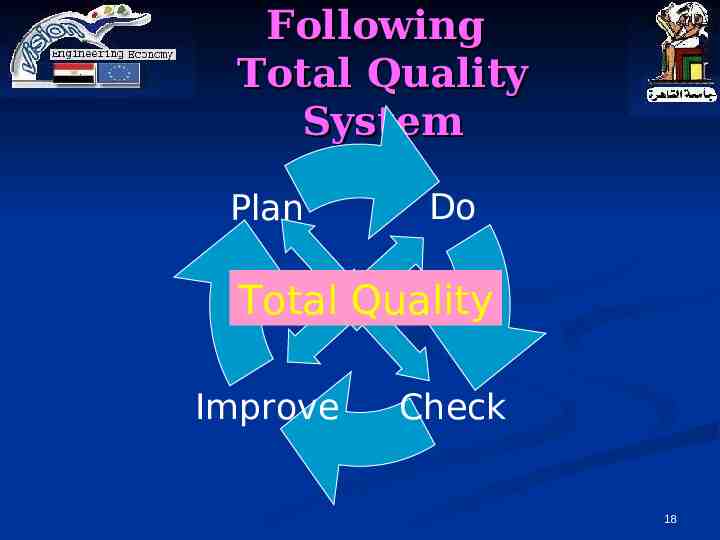

Following Total Quality System Plan Do Total Quality Improve Check 18

Plan Needs Assessment Facing future challenges 19

DO Main Components of Training System Trainee TMS 2 1 3 Trainer Topics Fulfillment of mission 5 Venue Materials 4 20

Check and Manage Change Without change output may deviate away from expectations. We Consider change as a natural phenomenon. 21

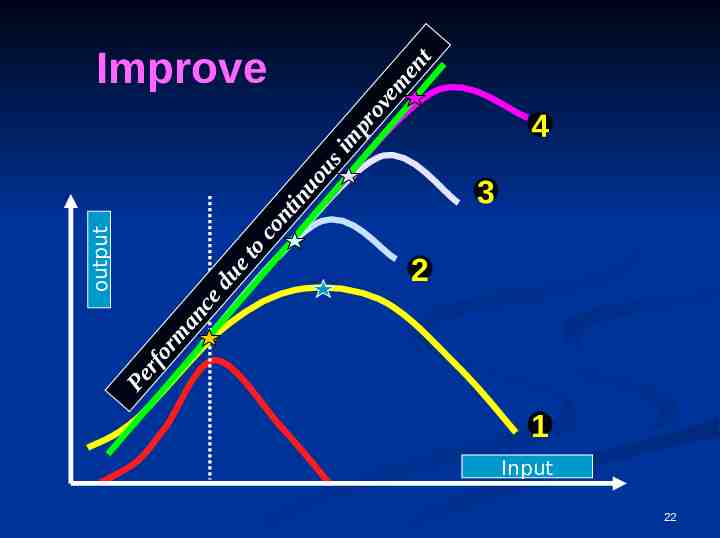

Pe r fo rm an ce du et oc on tin uo us output im pr ov em en t Improve 4 3 2 1 Input 22

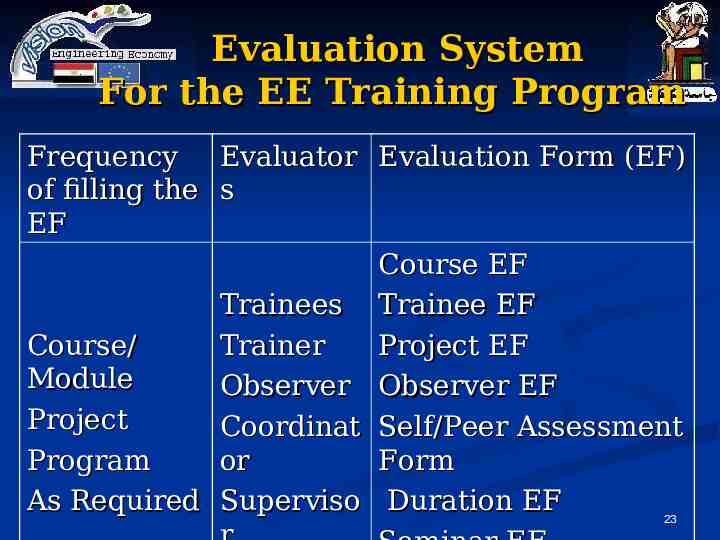

Evaluation System For the EE Training Program Frequency Evaluator Evaluation Form (EF) of filling the s EF Course EF Trainees Trainee EF Course/ Trainer Project EF Module Observer Observer EF Project Coordinat Self/Peer Assessment Program or Form As Required Superviso Duration EF 23

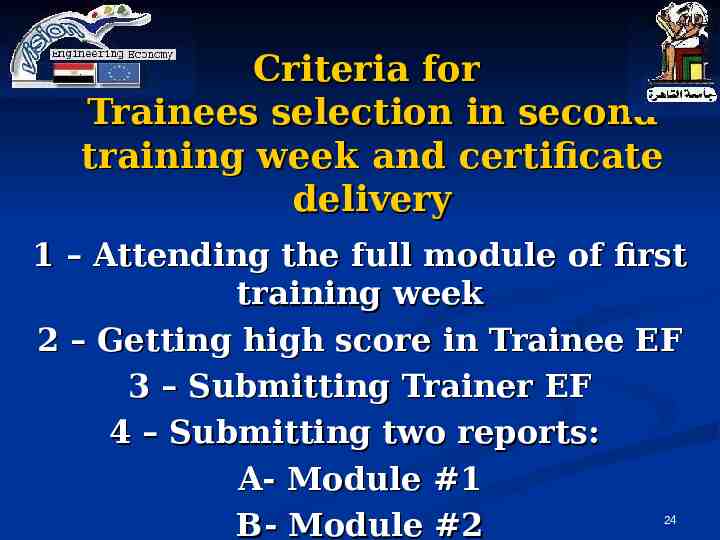

Criteria for Trainees selection in second training week and certificate delivery 1 – Attending the full module of first training week 2 – Getting high score in Trainee EF 3 – Submitting Trainer EF 4 – Submitting two reports: A- Module #1 B- Module #2 24

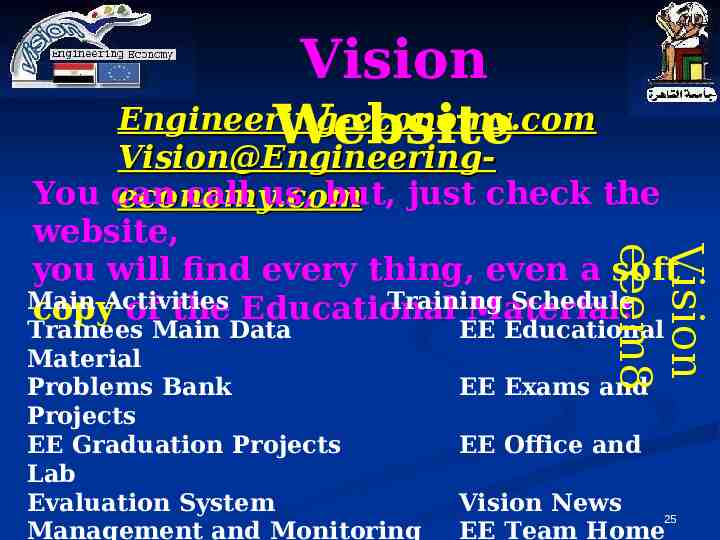

Vision Engineering-economy.com Website Vision@Engineering- Trainees Main Data Material Problems Bank Projects EE Graduation Projects Lab Evaluation System Management and Monitoring Vision eeem8 You can call us, but, just check the economy.com website, you will find every thing, even a soft Main Training Schedule copyActivities of the Educational Material: EE Educational EE Exams and EE Office and Vision News 25 EE Team Home

1.2 Importance of Engineering Economy Engineering, without economy, makes no sense at all The Accreditation Board for Engineering and Technology (ABET) states that “engineering is the profession in which a knowledge of the mathematical and natural science gained by study, experience, and practice is applied with judgment to develop ways to utilize economically, the materials and forces of nature for the mankind” Economical role of an engineer is emphasized as well as his technical role 26

Examples of question arising from various activities Should we make an interview to 400 applicant or develop other economical filtering process? How can we create an investment alternatives for very small projects (Budgets L.E. 10 000, 30 000, 50 000)? If a computer system replaces the human inspector in performing quality tests, will costs decrease over a time horizon of 5 years? Should a highway bypass be constructed around a city of 25,000 people, or should the current roadway through the city be expanded? Will we make the required rate of return if we install the newly offered technology onto our system? 27

For Public Sector Projects and Government Agencies For Individuals Do the benefits outweigh the costs of a bridge over the Intercostals waterway at this point? Is it cost-effective for the state to cost-share with a contractor to construct a new toll road? Should the state university contract with a local community college to teach foundation level undergraduate courses or have university faculty teach them? What are graduate studies worth financially over my professional career? Exactly what rate of return did we make on our stock investments? Should I buy or lease my next car, or keep the one I have now and invest in a small project? 28

Example 1.1 Two lead engineers with a mechanical design company and a structural analysis firm work together often. They have decided that, due to their joint and frequent commercial airline travel around the region, they should evaluate the purchase of a plane co-owned by the two companies. What are some of the economics-based questions the engineers should answer as they evaluate the alternatives: (1) co-own a plane or (2) continue to fly commercially? 29

Comments Some questions, and needs, for each alternative: How much will it cost each year? (Cost estimates are needed.) How do we pay for it? (A financing plan is needed.) Are there tax advantages? (Tax law and tax rates are needed.) What is the basis for selecting an alternative? (A selection criterion is needed.) What is the expected rate of return? (Equations are needed.) What happens if we fly more or less than now? (Sensitivity analysis is needed.)30

Engineering Economy Engineering Economy is involved with Formulation, Estimation, and Evaluation of Economic Outcomes between Possible Alternatives 31

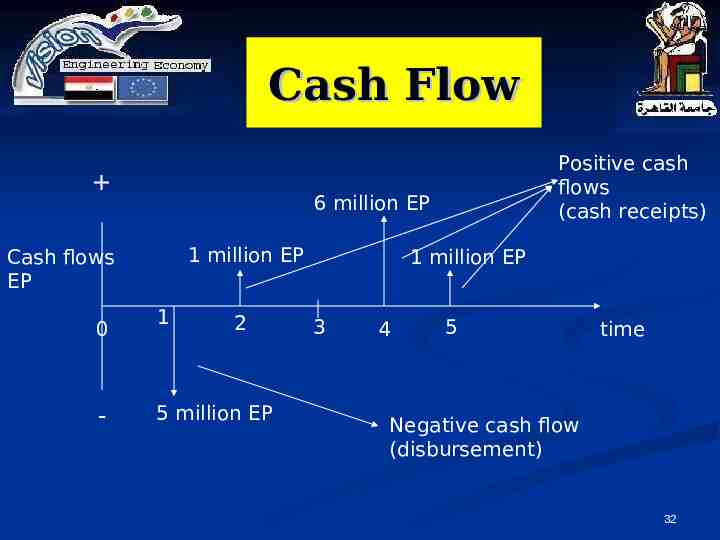

Cash Flow 6 million EP 1 million EP Cash flows EP 0 - Positive cash flows (cash receipts) 1 2 5 million EP 1 million EP 3 4 5 time Negative cash flow (disbursement) 32

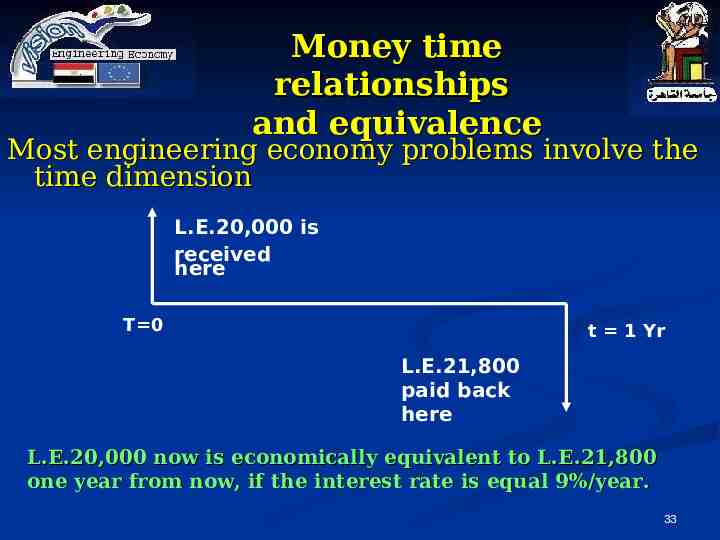

Money time relationships and equivalence Most engineering economy problems involve the time dimension L.E.20,000 is received here T 0 t 1 Yr L.E.21,800 paid back here L.E.20,000 now is economically equivalent to L.E.21,800 one year from now, if the interest rate is equal 9%/year. 33

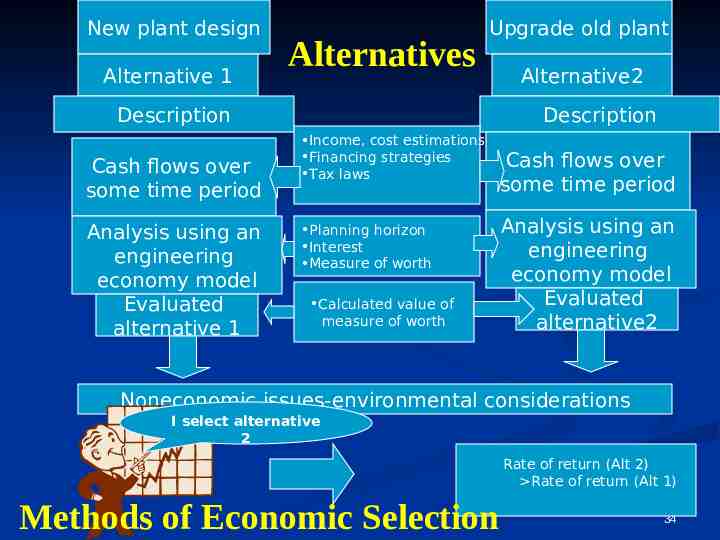

New plant design Alternative 1 Alternatives Upgrade old plant Description Cash flows over some time period Analysis using an engineering economy model Evaluated alternative 1 Alternative2 Description Income, cost estimations Financing strategies Tax laws Planning horizon Interest Measure of worth Calculated value of measure of worth Cash flows over some time period Analysis using an engineering economy model Evaluated alternative2 Noneconomic issues-environmental considerations I select alternative 2 Rate of return (Alt 2) Rate of return (Alt 1) Methods of Economic Selection 34

1.3 PRINCIPLES OF ENGINEERING ECONOMY :Engineering Economy “Is a collection of mathematical techniques which simplify economic comparisons among alternatives”. :Alternatives “An alternative is stand-alone solution for a given situation”. 35

Principles of Engineering Economy Principle 1: Develop the alternative As engineering economy is defined as the mathematical technique to compare between alternatives, therefore alternatives should exist. These alternatives should be identified and well defined in order to be able to compare between them. Principle 2: Focus on the difference Comparison between alternative is based only on the difference in the expected future outcomes, if all alternatives have the same future outcomes comparison is meaningless. All common future outcomes could be eliminated from the analysis process. 36

Principles of Engineering Economy Principle 3: Use a consistent view point All alternatives should be defined from one point of view (one perspective), which is usually the decision maker perspective. It is preferred first that the perspective of a particular decision is defined, and then it could be used in the analysis and comparison of the alternatives. Principle 4: Use a common unit of measure Using a common unit of measurement for the prospective outcomes simplifies the analysis and comparison process, as it makes the outcomes directly comparable. In economic field it preferred to use a monetary unit as pounds (L.E.) as a unit of measure. 37

PRINCIPLES OF ENGINEERING ECONOMY Principle 5: Consider all relevant criteria The main criterion for selection between alternatives is the maximum return interest; however there are some objectives that you would like to achieve with your decision. These objectives might not be expressed in monetary unit; it should be considered and given a weight in the decision process (such that psychological objective). 38

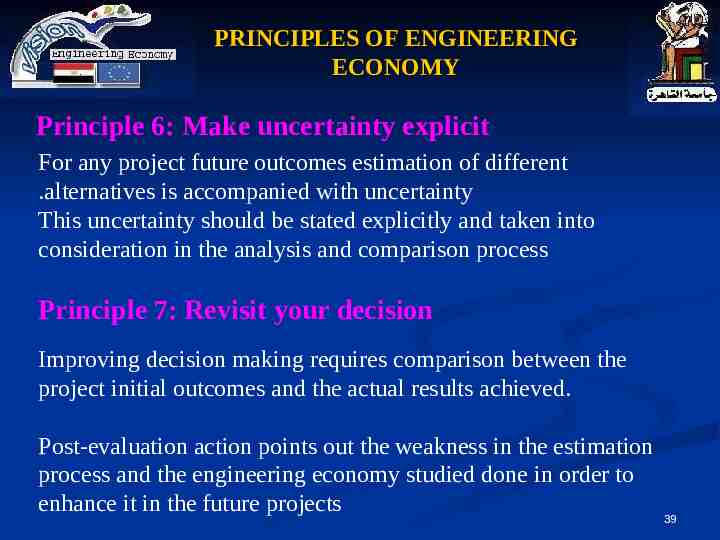

PRINCIPLES OF ENGINEERING ECONOMY Principle 6: Make uncertainty explicit For any project future outcomes estimation of different .alternatives is accompanied with uncertainty This uncertainty should be stated explicitly and taken into consideration in the analysis and comparison process Principle 7: Revisit your decision Improving decision making requires comparison between the project initial outcomes and the actual results achieved. Post-evaluation action points out the weakness in the estimation process and the engineering economy studied done in order to enhance it in the future projects 39

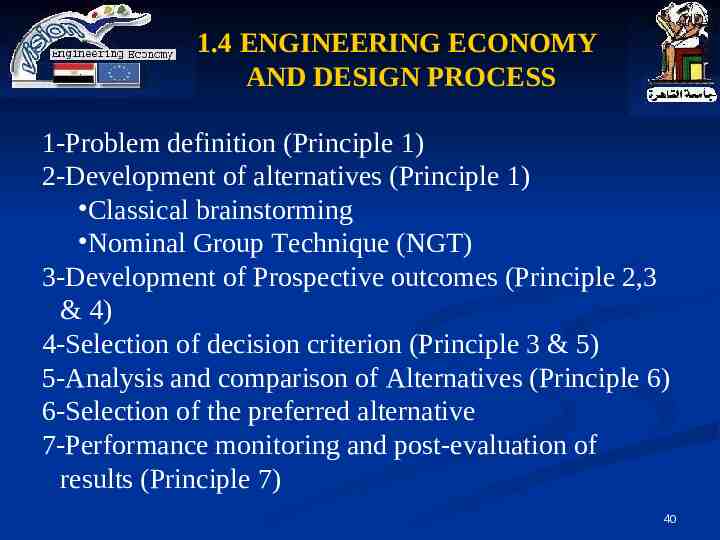

1.4 ENGINEERING ECONOMY AND DESIGN PROCESS 1-Problem definition (Principle 1) 2-Development of alternatives (Principle 1) Classical brainstorming Nominal Group Technique (NGT) 3-Development of Prospective outcomes (Principle 2,3 & 4) 4-Selection of decision criterion (Principle 3 & 5) 5-Analysis and comparison of Alternatives (Principle 6) 6-Selection of the preferred alternative 7-Performance monitoring and post-evaluation of results (Principle 7) 40

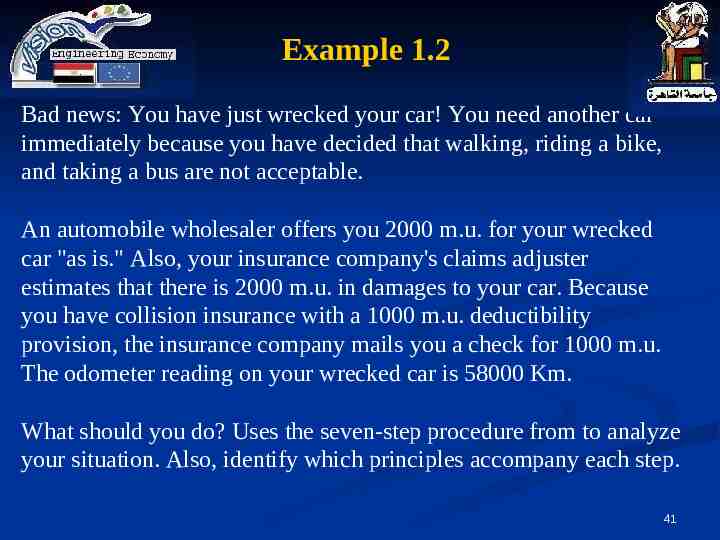

Example 1.2 Bad news: You have just wrecked your car! You need another car immediately because you have decided that walking, riding a bike, and taking a bus are not acceptable. An automobile wholesaler offers you 2000 m.u. for your wrecked car "as is." Also, your insurance company's claims adjuster estimates that there is 2000 m.u. in damages to your car. Because you have collision insurance with a 1000 m.u. deductibility provision, the insurance company mails you a check for 1000 m.u. The odometer reading on your wrecked car is 58000 Km. What should you do? Uses the seven-step procedure from to analyze your situation. Also, identify which principles accompany each step. 41

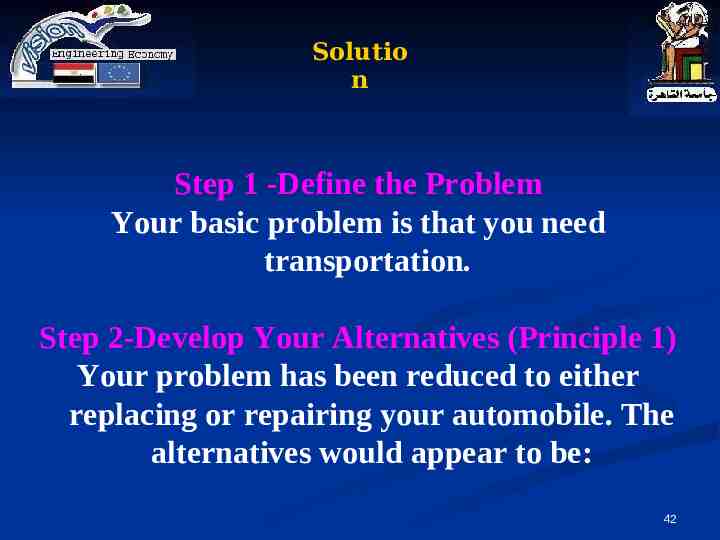

Solutio n Step 1 -Define the Problem Your basic problem is that you need transportation. Step 2-Develop Your Alternatives (Principle 1) Your problem has been reduced to either replacing or repairing your automobile. The alternatives would appear to be: 42

Solutio n 1. Sell the wrecked car for 2000 m.u. to the wholesaler and spend this money, the 1000 m.u. insurance check, and all of your 7000 m.u. savings account on a newer car. The total amount paid out of your savings account is m.u.7000, and the car will have 28000 Km of prior use. 2. Spend the 1000 m.u. insurance check and m.u.1000 m.u. of savings to fix the car. The total amount paid out of your savings is 1000 m.u., and the car will have 58000 Km of prior use. 3. Spend the 1000 m.u. insurance check and 1000 m.u. of your savings to fix the car and then sell the car for 4500 m.u. Spend the 4500 m.u. plus 5500 m.u. of additional savings to buy the newer car. The total amount paid out of savings is 6500 m.u., and the car will have 28000 Km. 43

Solutio n 4. Give the car to a part-time mechanic, who will repair it for 1100 m.u. (1000 m.u. insur ance and 100 m.u. of your savings), but will take an additional month of repair time. You will also have to rent a car for that time at 400m.u./month (paid out of savings). The total amount paid out of savings is 500 m.u., and the car will have 58000 Km on the odometer. 5. Same as Alternative 4, but you then sell the car for 4500 m.u. and use this money plus 5500 m.u. of additional savings to buy the newer car. The total amount paid out of savings is 6000 m.u., and the newer car will have 28000 Km of prior use. 44

Solutio n Step 3-Estimate the Cash Flows for Each Alternative (Principle 2) Alternative 1 varies from all others because the car is not to be repaired at all but merely sold. This eliminates the benefit of the m.u.500 increase in the value of the car when it is repaired and then sold. Also this alternative leaves no money in your savings account. There is a cash flow of -8000 m.u. to gain a newer car valued at 10000 m.u. Alternative 2 varies from Alternative 1 because it allows the old car to be repaired. Alternative 2 differs from Alternatives 4 and 5 because it utilizes a more expensive (500 m.u. more) and less risky repair facility. It also varies from Alter natives 3 and 5 because 'the car will be kept. The cash flow is -2000 m.u. and the repaired car can be sold for 4500 m.u. Alternative 3 gains an additional 500 m.u. by repairing the car and selling it to buy the same car as in Alternative 1. The cash flow is 45 7500 m.u. to gain the newer car valued at 10000 m.u.

Solutio n Step 3-Estimate the Cash Flows for Each Alternative (Principle 2) Alternative 4 uses the same idea as Alternative 2, but involves a less expensive repair shop. The repair shop is more risky in the quality of its end product, but will only cost 1100 m.u. in repairs and 400 m.u. in an additional month's rental of a car. The cash flow is -1500 m.u. to keep the older car valued at 4500 m.u. Alternative 5 is the same as Alternative 4, but gains an additional 500 m.u. by selling the repaired car and purchasing a newer car as in Alternatives 1 and 3. The cash flow is -7000 m.u. to obtain the newer car valued at 10000 m.u. 46

Solutio n Step 4-Select a Criterion It is very important to use a consistent viewpoint (Principle 3) and a common unit of measure (Principle 4) in performing this step. The viewpoint in this situation is yours (the owner of the wrecked car). The value of the car to the owner is its market value (i.e., 10000 m.u. for the newer car and 4500 m.u. for, the repaired car). Hence, the dollar is used as the consistent value against which everything is measured. This reduces all decisions to a quantitative level, which can then be reviewed later with qualitative factors that may carry their own dollar value (e.g., how much is low mileage or a reliable repair shop worth?). 47

Solutio n Step 5-Analyze and Compare the Alternatives (Principle 5). Make sure you consider all relevant criteria 1. Alternative 1 is eliminated, because Alternative 3 gains the same end result and would also provide the car owner with 500 m.u. more cash. This is experienced with no change in the risk to the owner. (Car value 10000 m.u., savings 0, total worth 10000 m.u. ) . 2. Alternative 2 is a good alternative to consider, because it spends the least amount of cash, leaving 6000 m.u. in the bank. Alternative 2 provides the same end result as Alternative 4, but costs 500 m.u. more to repair. Therefore, Alternative 2 is elimi nated. (Car value 4500 m.u., savings m.u., total worth 10500 m.u. ) 48

Solutio n Step 5-Analyze and Compare the Alternatives (Principle 5). Make sure you consider all relevant criteria 3. Alternative 3 is eliminated, because Alternative 5 also repairs the car but at a lower out-of-savings cost (500 m.u. difference), and both Alternatives 3 and 5 have the same end result of buying the newer car. (Car value 10000 m.u., savings 500 m.u., total worth 10500 m.u. ) 4. Alternative 4 is a good alternative, because it saves m.u.500 m.u. by using a cheaper repair facility, provided that the risk of a poor repair job is judged to be small. (Car value m.u.4500 m.u., savings 6500 m.u., total worth 11000 m.u. ) 5. Alternative 5 repairs the car at a lower cost (m.u.500 cheaper) and eliminates the risk of breakdown by selling the car to someone else at an additional 500 m.u. gain. (Car value 10000 m.u., savings 1000 m.u., total worth 11000 m.u.) 49

Solutio n Step 6-Select the Best Alternative When performing this step of the procedure, you should make uncertainty explicit (Principle 6). Among the uncertainties that can be found in this problem, the following are the most relevant to the decision. If the original car is repaired and kept, there is a possibility that it would have a higher frequency of breakdowns (based on personal experience). If a cheaper repair facility is used, the chance of a later breakdown is even greater (based on personal experience). Buying a newer car will use up most of your savings. Also, the newer car purchased may be too ex pensive, based on the additional price paid (which is at least 6000 m.u. /30000 Km 20 cents per Km). Finally, the newer car may also have been in an accident and could have a worse repair history than the presently owned car. Based on the information in all previous steps, alternative 5 was, actually chosen. 50

Solutio n Finally, the newer car may also have been in an accident and could have a worse repair history than the presently owned car. Based on the information in all previous steps, alternative 5 was, actually chosen. Step 7-Monitor tile Performance of Your Choice This step goes hand-in-hand with Principle 7 (revisit your decisions). The newer car turned out after being "test driven" for 20000 Km to be a real beauty. Mileage was great, and no repairs were needed. The systematic process of identi fying and analyzing alternative solutions to this problem really paid off! 51

Example 1.3 Buying or renting a flat? Open Discussions: Engineering Economic Analysis steps 1. Problem definition 2. Development of alternatives 3. Development of Prospective outcomes 4. Selection of decision criterion 5. Analysis and comparison of Alternatives 6. Selection of the preferred alternative 7. Performance monitoring and postevaluation of results 52

Introduction to 1.4 Spreadsheet Application Most engineering economy problems are amenable to spreadsheet solution since: They consist of structured, repetitive calculations that can be expressed as formulas that rely on a few functional relationships. Problems are similar, but not identical. The parameters of the problem are subject to change. The results and the underlying calculations must be documented. Graphical output is often required, as well as control over the format of the graphs. The user desires control of the format and appearance of the output. 53

Differences between Spreadsheet and Hand Solutions The answer will be the same with either approach, subject to rounding errors, with the spreadsheet being more accurate than the hand solution. With a spreadsheet, the primary focus is on the actual cash flows instead of the discount factors. The general approach to solving a problem with a spreadsheet consists of: Plan the approach to the problem before sitting at the keyboard. Cash flow diagrams or tables are useful. Enter the periodic cash flows, the interest rate (MARR) and any other pertinent information from the problem statement into separate cells of the spreadsheet. Determine and enter the necessary formulas (generally needed only for time period 1). Copy the formulas as required to all remaining time periods to complete the model. Use the appropriate formulas and functions to arrive at a measure of merit (PW, IRR, etc.). Verify the formulas and functions by using sample values (0 and 1 work well). Values from solved examples can also be used. Document and save the spreadsheet template for future use. 54

INTRODUCTION TO SPREADSHEET APPLICATION Excel 55

Microsoft Use of a spreadsheet similar to Excel Microsoft’s Excel is fundamental to the analysis of engineering economy problems. All engineers are expected by training to know how to manipulate data, macros, and the various built-in functions common to spreadsheets. 56

Spreadsheet s Excel supports (among many others) many built-in functions to assist in time value of money analysis Master each on your own and set up a variety of the homework problems (on your own) Terminology and Symbols: At least 4 symbols: { P, F, A, i% and n } (and G , E, SV, BV, MV, D, . ) 57

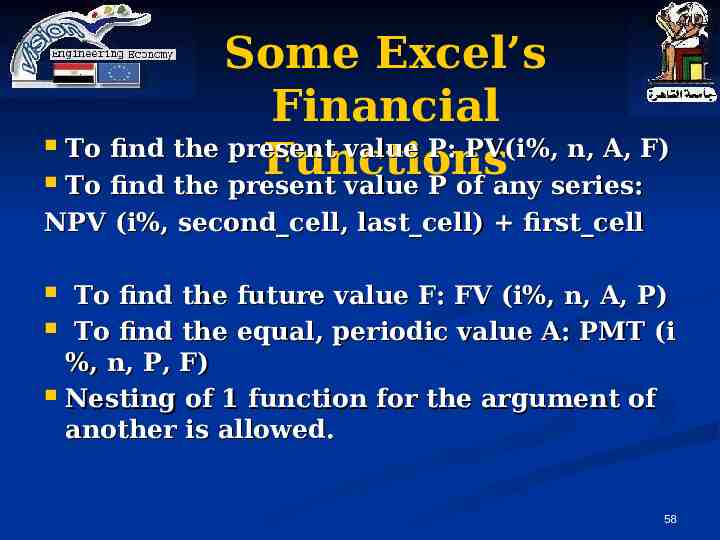

Some Excel’s Financial To find the present value P: PV(i%, n, A, F) Functions To find the present value P of any series: NPV (i%, second cell, last cell) first cell To find the future value F: FV (i%, n, A, P) To find the equal, periodic value A: PMT (i %, n, P, F) Nesting of 1 function for the argument of another is allowed. 58

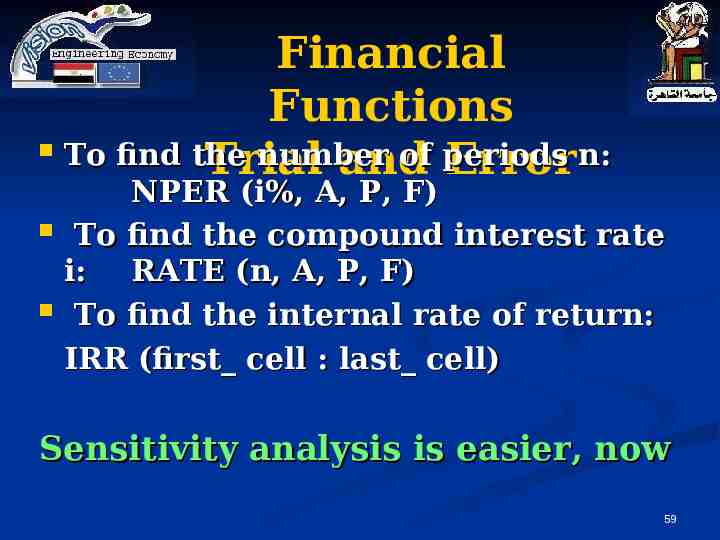

Financial Functions To find the number of periods n: Trial and Error NPER (i%, A, P, F) To find the compound interest rate i: RATE (n, A, P, F) To find the internal rate of return: IRR (first cell : last cell) Sensitivity analysis is easier, now 59

Contacts Engineering-economy.com Vision@Engineering- economy.com Tel: 5678907 – 012 7457966 Fax: 5713852 60