Benefits & Wellness For New Employees More information is available

35 Slides1.79 MB

Benefits & Wellness For New Employees More information is available online at www.nova.edu/hr/benefits. For questions or login assistance email [email protected] or call 954-262-HR4U (4748)

Medical & Prescription Plans at NSU

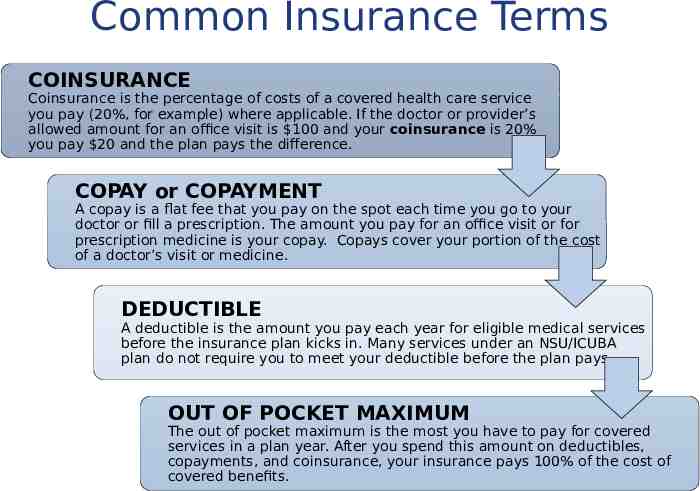

Common Insurance Terms COINSURANCE Coinsurance is the percentage of costs of a covered health care service you pay (20%, for example) where applicable. If the doctor or provider’s allowed amount for an office visit is 100 and your coinsurance is 20% you pay 20 and the plan pays the difference. COPAY or COPAYMENT A copay is a flat fee that you pay on the spot each time you go to your doctor or fill a prescription. The amount you pay for an office visit or for prescription medicine is your copay. Copays cover your portion of the cost of a doctor’s visit or medicine. DEDUCTIBLE A deductible is the amount you pay each year for eligible medical services before the insurance plan kicks in. Many services under an NSU/ICUBA plan do not require you to meet your deductible before the plan pays. OUT OF POCKET MAXIMUM The out of pocket maximum is the most you have to pay for covered services in a plan year. After you spend this amount on deductibles, copayments, and coinsurance, your insurance pays 100% of the cost of covered benefits.

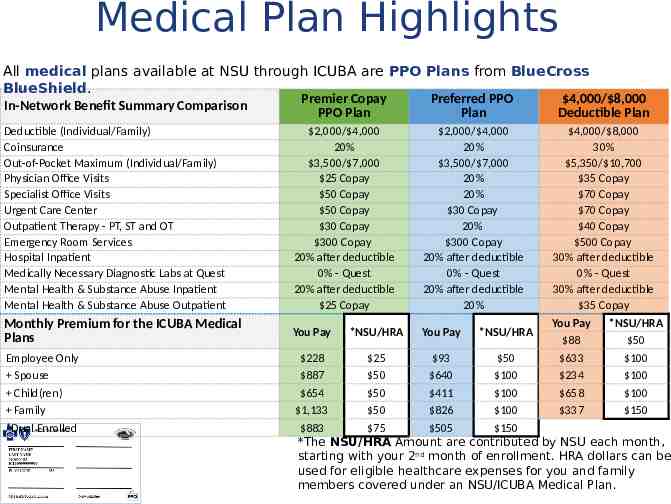

Medical Plan Highlights All medical plans available at NSU through ICUBA are PPO Plans from BlueCross BlueShield. Premier Copay Preferred PPO 4,000/ 8,000 In-Network Benefit Summary Comparison PPO Plan Plan Deductible Plan Deductible (Individual/Family) Coinsurance Out-of-Pocket Maximum (Individual/Family) Physician Office Visits Specialist Office Visits Urgent Care Center Outpatient Therapy - PT, ST and OT Emergency Room Services Hospital Inpatient Medically Necessary Diagnostic Labs at Quest Mental Health & Substance Abuse Inpatient Mental Health & Substance Abuse Outpatient 2,000/ 4,000 20% 3,500/ 7,000 25 Copay 50 Copay 50 Copay 30 Copay 300 Copay 20% after deductible 0% - Quest 20% after deductible 25 Copay 2,000/ 4,000 20% 3,500/ 7,000 20% 20% 30 Copay 20% 300 Copay 20% after deductible 0% - Quest 20% after deductible 20% Monthly Premium for the ICUBA Medical Plans You Pay You Pay Employee Only Spouse Child(ren) Family *Dual Enrolled *NSU/HRA *NSU/HRA 4,000/ 8,000 30% 5,350/ 10,700 35 Copay 70 Copay 70 Copay 40 Copay 500 Copay 30% after deductible 0% - Quest 30% after deductible 35 Copay You Pay 88 633 234 658 337 *NSU/HRA 50 100 100 100 150 228 25 93 50 887 50 640 100 654 50 411 100 1,133 50 826 100 883 75 505 150 *The NSU/HRA Amount are contributed by NSU each month, starting with your 2nd month of enrollment. HRA dollars can be used for eligible healthcare expenses for you and family members covered under an NSU/ICUBA Medical Plan.

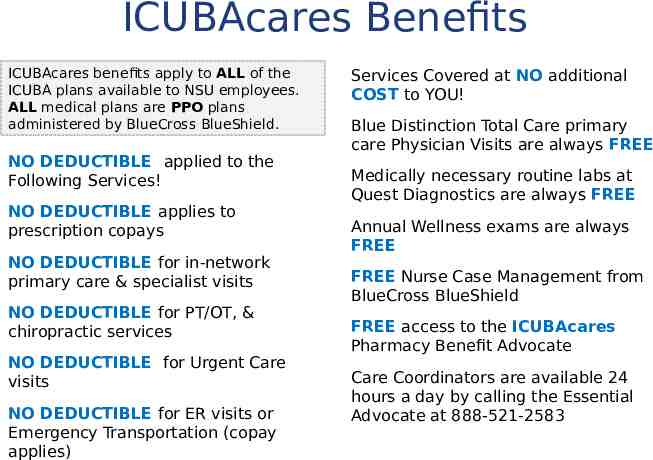

ICUBAcares Benefits ICUBAcares benefits apply to ALL of the ICUBA plans available to NSU employees. ALL medical plans are PPO plans administered by BlueCross BlueShield. NO DEDUCTIBLE applied to the Following Services! NO DEDUCTIBLE applies to prescription copays NO DEDUCTIBLE for in-network primary care & specialist visits NO DEDUCTIBLE for PT/OT, & chiropractic services NO DEDUCTIBLE for Urgent Care visits NO DEDUCTIBLE for ER visits or Emergency Transportation (copay applies) Services Covered at NO additional COST to YOU! Blue Distinction Total Care primary care Physician Visits are always FREE Medically necessary routine labs at Quest Diagnostics are always FREE Annual Wellness exams are always FREE FREE Nurse Case Management from BlueCross BlueShield FREE access to the ICUBAcares Pharmacy Benefit Advocate Care Coordinators are available 24 hours a day by calling the Essential Advocate at 888-521-2583

Benefits without Barriers Lab Tests Pap Tests Urinalysis Colorectal Screenings Prostate Cancer Screenings Please note: Lab tests performed at an innetwork physicians office and not sent to Quest Diagnostics may be subject to coinsurance (deductible does not apply beginning 04/01/18). Electrocardiograms Echocardiograms Mammograms Colonoscopies and Sigmoidoscopies Immunizations Allergy Injections Bone Mineral Density Tests Ultrasounds of the Breast Primary Care BDTC Visits Our Employee Assistance Program is available to all members of your household Receive up to 6 FREE face-to-face counseling sessions per plan year Call the Resources for Living EAP 24-hours a day at 1-877-398-5816 Prescribed diabetic supplies including meters, lancing devices, lancets, test strips, control solution, needles, and syringes Prescribed Aspirin for adults Prescribed generic folic acid and generic prenatal vitamins for pregnancy Prescribed generic statins (if eligible)

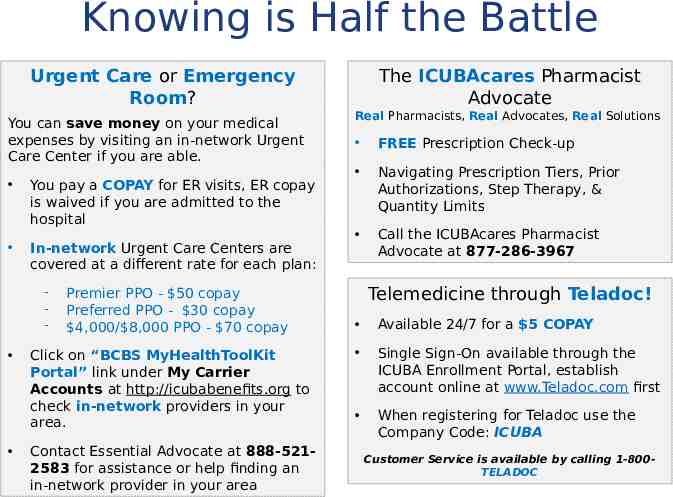

Knowing is Half the Battle Urgent Care or Emergency Room? You can save money on your medical expenses by visiting an in-network Urgent Care Center if you are able. You pay a COPAY for ER visits, ER copay is waived if you are admitted to the hospital In-network Urgent Care Centers are covered at a different rate for each plan: - Premier PPO - 50 copay Preferred PPO - 30 copay 4,000/ 8,000 PPO - 70 copay Click on “BCBS MyHealthToolKit Portal” link under My Carrier Accounts at http://icubabenefits.org to check in-network providers in your area. Contact Essential Advocate at 888-5212583 for assistance or help finding an in-network provider in your area The ICUBAcares Pharmacist Advocate Real Pharmacists, Real Advocates, Real Solutions FREE Prescription Check-up Navigating Prescription Tiers, Prior Authorizations, Step Therapy, & Quantity Limits Call the ICUBAcares Pharmacist Advocate at 877-286-3967 Telemedicine through Teladoc! Available 24/7 for a 5 COPAY Single Sign-On available through the ICUBA Enrollment Portal, establish account online at www.Teladoc.com first When registering for Teladoc use the Company Code: ICUBA Customer Service is available by calling 1-800TELADOC

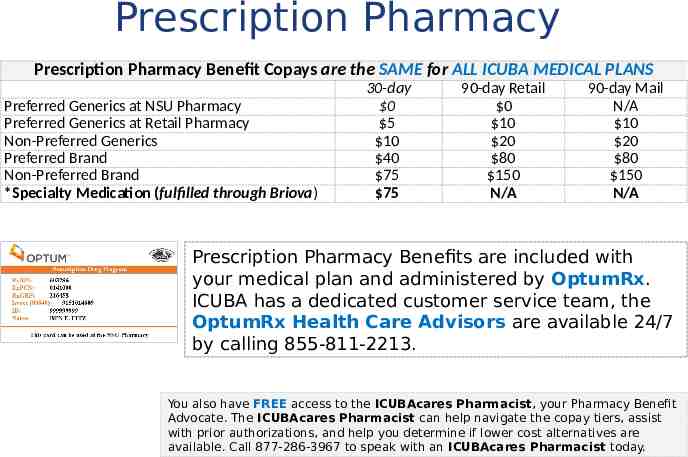

Prescription Pharmacy Prescription Pharmacy Benefit Copays are the SAME for ALL ICUBA MEDICAL PLANS Preferred Generics at NSU Pharmacy Preferred Generics at Retail Pharmacy Non-Preferred Generics Preferred Brand Non-Preferred Brand *Specialty Medication (fulfilled through Briova) 30-day 0 5 10 40 75 75 90-day Retail 0 10 20 80 150 N/A 90-day Mail N/A 10 20 80 150 N/A Prescription Pharmacy Benefits are included with your medical plan and administered by OptumRx. ICUBA has a dedicated customer service team, the OptumRx Health Care Advisors are available 24/7 by calling 855-811-2213. You also have FREE access to the ICUBAcares Pharmacist, your Pharmacy Benefit Advocate. The ICUBAcares Pharmacist can help navigate the copay tiers, assist with prior authorizations, and help you determine if lower cost alternatives are available. Call 877-286-3967 to speak with an ICUBAcares Pharmacist today.

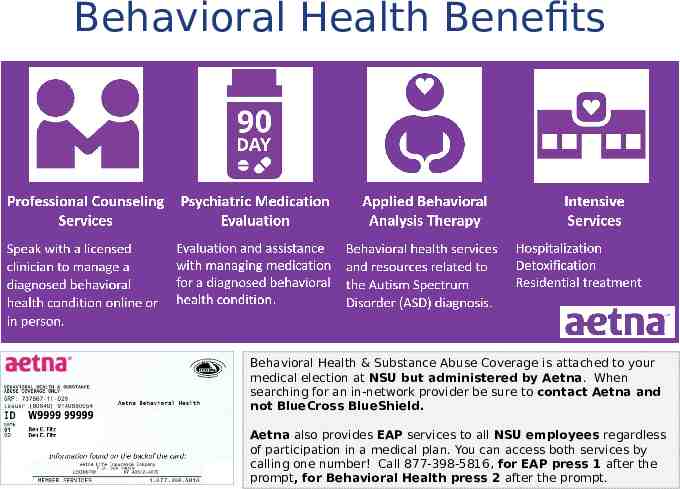

Behavioral Health Benefits Behavioral Health & Substance Abuse Coverage is attached to your medical election at NSU but administered by Aetna. When searching for an in-network provider be sure to contact Aetna and not BlueCross BlueShield. Aetna also provides EAP services to all NSU employees regardless of participation in a medical plan. You can access both services by calling one number! Call 877-398-5816, for EAP press 1 after the prompt, for Behavioral Health press 2 after the prompt.

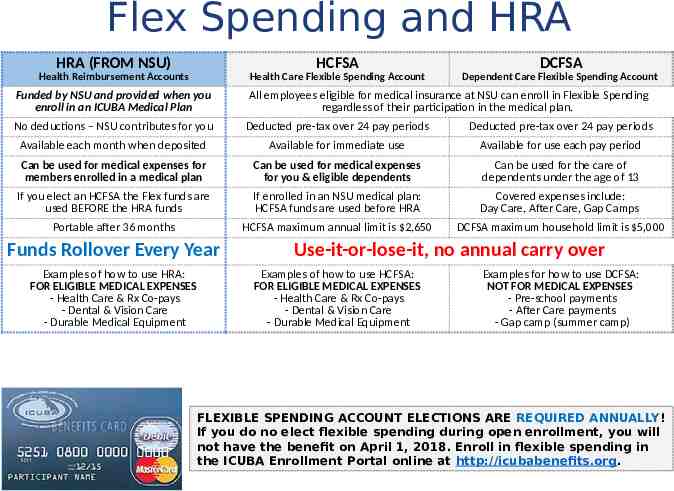

Flex Spending and HRA HRA (FROM NSU) HCFSA DCFSA Health Reimbursement Accounts Health Care Flexible Spending Account Dependent Care Flexible Spending Account Funded by NSU and provided when you enroll in an ICUBA Medical Plan All employees eligible for medical insurance at NSU can enroll in Flexible Spending regardless of their participation in the medical plan. No deductions – NSU contributes for you Deducted pre-tax over 24 pay periods Deducted pre-tax over 24 pay periods Available each month when deposited Available for immediate use Available for use each pay period Can be used for medical expenses for members enrolled in a medical plan Can be used for medical expenses for you & eligible dependents Can be used for the care of dependents under the age of 13 If you elect an HCFSA the Flex funds are used BEFORE the HRA funds If enrolled in an NSU medical plan: HCFSA funds are used before HRA Covered expenses include: Day Care, After Care, Gap Camps Portable after 36 months HCFSA maximum annual limit is 2,650 DCFSA maximum household limit is 5,000 Funds Rollover Every Year Examples of how to use HRA: FOR ELIGIBLE MEDICAL EXPENSES - Health Care & Rx Co-pays - Dental & Vision Care - Durable Medical Equipment Use-it-or-lose-it, no annual carry over Examples of how to use HCFSA: FOR ELIGIBLE MEDICAL EXPENSES - Health Care & Rx Co-pays - Dental & Vision Care - Durable Medical Equipment Examples for how to use DCFSA: NOT FOR MEDICAL EXPENSES - Pre-school payments - After Care payments - Gap camp (summer camp) FLEXIBLE SPENDING ACCOUNT ELECTIONS ARE REQUIRED ANNUALLY! If you do no elect flexible spending during open enrollment, you will not have the benefit on April 1, 2018. Enroll in flexible spending in the ICUBA Enrollment Portal online at http://icubabenefits.org.

Keep Track of Your Cards! Medical Insurance Benefits are administered by BlueCross BlueShield. When electing a medical insurance plan, prescription coverage, behavioral health coverage, and the ICUBA MasterCard accompany your medical insurance election and are administered separately! Prescription Pharmacy Benefits are administered by OptumRx. OptumRx Health Care Advisors are available 24/7 by calling 855-811-2213. You also have FREE access to the ICUBAcares Pharmacist by calling 877-286-3967. Behavioral Health & Substance Abuse coverage is administered by Aetna. You can call Aetna to verify coverage and find innetwork providers by calling 877-398-5816 and pressing 2 after the prompt. The ICUBA MasterCard accompanies your medical election and is one way you will access your HRA from NSU as well as your Flexible Spending Account Elections (HCFSA & DCFSA). For customer service contact an ICUBA Benefits Administrator at 866-377-5102.

Employee Well-Being Programs at NSU

Employee Well-Being 2017 Overview 97 Wellness Events CAMPUS WIDE 4,328 2,924 NSU Sharks Using Rally NSU Sharks at Wellness Events & MORE THAN 300,000 IN RALLY DOLLARS EARNED BY NSU SHARKS

Employee Well-Being NSU has a dedicated Employee Wellness Program Administrator providing educational opportunities and programs centered around Employee Health and Wellness. Wellness Programs are available throughout the year at various campus locations and online, some sessions count as “onsite events” and allow ICUBA health care participants to earn incentives for attending. Wellness Programs are made available to all employees at NSU regardless of enrollment in health care coverage. Employee Wellness incentives are integrated with health care claims, available incentives are credited once claims are processed by BlueCross BlueShield and Rally. Additional incentives are available for attending on-site events online or at a campus location. For more information visit the Wellness page online at http://www.nova.edu/hr/wellness/index.html

Annual Health & Wellness Fair The annual NSU Employee Health and Wellness Fair is coming to you on Wednesday, October 24, from 10:00 am to 2:00 pm on the Main Court of the Don Taft University Center! Get informed, be inspired, and empower yourself to achieve your physical and emotional best in your personal and professional life. Connect with NSU colleagues who can help move your pursuit of wellness forward Be bold - get a flu shot Eat and be healthy - enjoy a portion controlled lunch Win awesome door prizes - like the 32 GB iPad mini or cardio cycle machine Don’t forget to bring your Shark Card!

Dental & Vision Plans at NSU

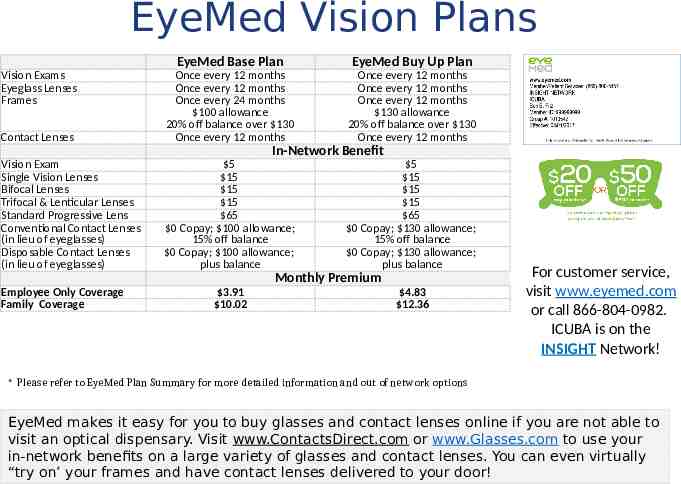

EyeMed Vision Plans EyeMed Base Plan EyeMed Buy Up Plan Contact Lenses Once every 12 months Once every 12 months Once every 24 months 100 allowance 20% off balance over 130 Once every 12 months Once every 12 months Once every 12 months Once every 12 months 130 allowance 20% off balance over 130 Once every 12 months Vision Exam Single Vision Lenses Bifocal Lenses Trifocal & Lenticular Lenses Standard Progressive Lens Conventional Contact Lenses (in lieu of eyeglasses) Disposable Contact Lenses (in lieu of eyeglasses) 5 15 15 15 65 0 Copay; 100 allowance; 15% off balance 0 Copay; 100 allowance; plus balance Vision Exams Eyeglass Lenses Frames In-Network Benefit 5 15 15 15 65 0 Copay; 130 allowance; 15% off balance 0 Copay; 130 allowance; plus balance Monthly Premium Employee Only Coverage Family Coverage 3.91 10.02 4.83 12.36 For customer service, visit www.eyemed.com or call 866-804-0982. ICUBA is on the INSIGHT Network! * Please refer to EyeMed Plan Summary for more detailed information and out of network options EyeMed makes it easy for you to buy glasses and contact lenses online if you are not able to visit an optical dispensary. Visit www.ContactsDirect.com or www.Glasses.com to use your in-network benefits on a large variety of glasses and contact lenses. You can even virtually “try on’ your frames and have contact lenses delivered to your door!

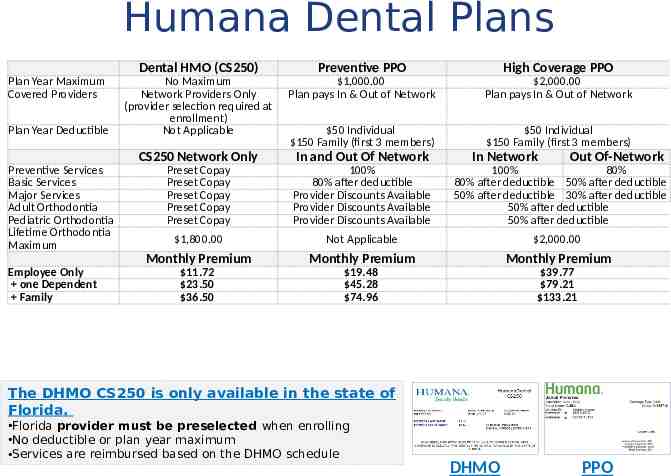

Humana Dental Plans Plan Year Maximum Covered Providers Plan Year Deductible Preventive Services Basic Services Major Services Adult Orthodontia Pediatric Orthodontia Lifetime Orthodontia Maximum Employee Only one Dependent Family Dental HMO (CS250) Preventive PPO High Coverage PPO No Maximum Network Providers Only (provider selection required at enrollment) Not Applicable 1,000.00 Plan pays In & Out of Network 2,000.00 Plan pays In & Out of Network 50 Individual 150 Family (first 3 members) 50 Individual 150 Family (first 3 members) CS250 Network Only In and Out Of Network Preset Copay Preset Copay Preset Copay Preset Copay Preset Copay 100% 80% after deductible Provider Discounts Available Provider Discounts Available Provider Discounts Available 1,800.00 Not Applicable 2,000.00 Monthly Premium Monthly Premium Monthly Premium 11.72 23.50 36.50 19.48 45.28 74.96 39.77 79.21 133.21 In Network Out Of-Network 100% 80% 80% after deductible 50% after deductible 50% after deductible 30% after deductible 50% after deductible 50% after deductible The DHMO CS250 is only available in the state of Florida. Florida provider must be preselected when enrolling No deductible or plan year maximum Services are reimbursed based on the DHMO schedule DHMO PPO

Personal Insurance at NSU

Offset your DeDUCKtible! Aflac can help you manage medical costs! Did you know? 49% of employees have less than 1,000 on hand to pay out-of-pocket medical expenses? Get the “AFLACTS” and lower your BILLS! Aflac Hospital Advantage pays cash benefits directly to you to help with out-of-pocket expenses. Copays and deductibles Transportation & Ambulance Costs Emergency Room and Doctor Visits Medical & Diagnostic Imaging Rehabilitation Facilities --------------------------------------------------------------------Contact Nova Southeastern University’s Independent Aflac Representative, Joe Evans for more information! Phone: 954-560-6000 Email: [email protected]

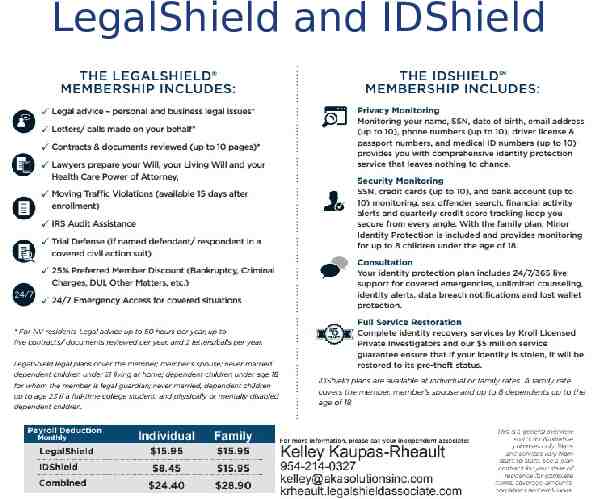

LegalShield and IDShield

Life Insurance Options at NSU

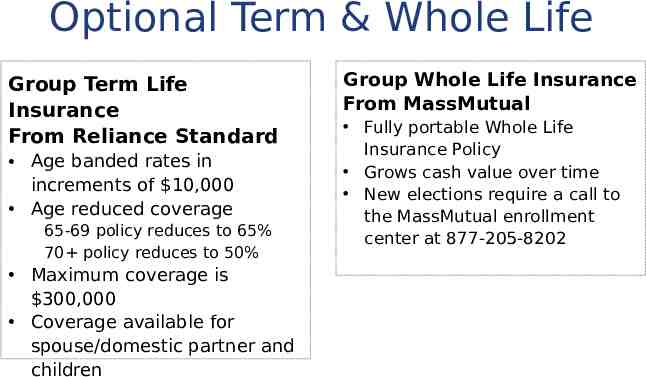

Optional Term & Whole Life Group Term Life Insurance From Reliance Standard Age banded rates in increments of 10,000 Age reduced coverage 65-69 policy reduces to 65% 70 policy reduces to 50% Maximum coverage is 300,000 Coverage available for spouse/domestic partner and children Group Whole Life Insurance From MassMutual Fully portable Whole Life Insurance Policy Grows cash value over time New elections require a call to the MassMutual enrollment center at 877-205-8202

Retirement Savings Options at NSU

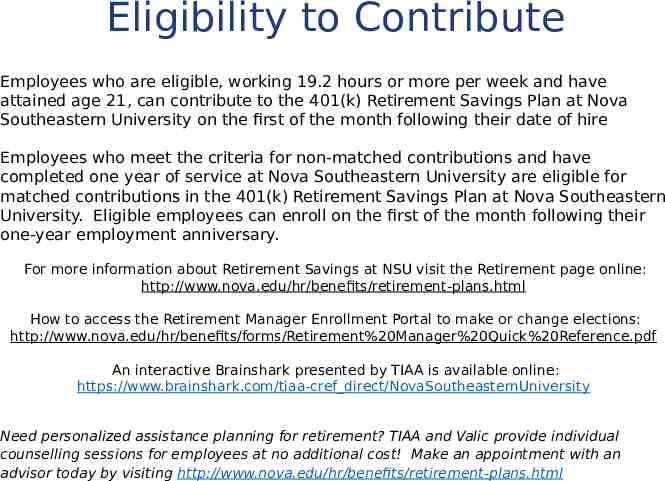

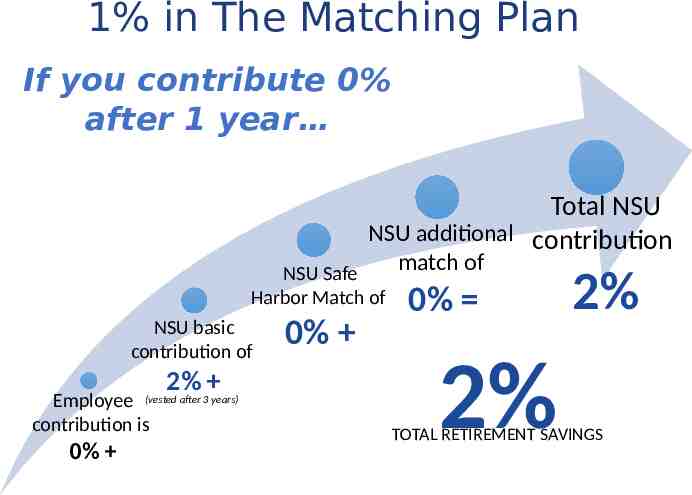

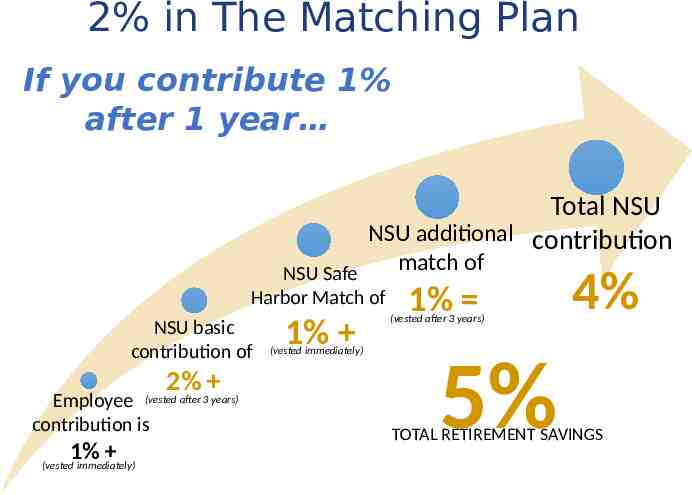

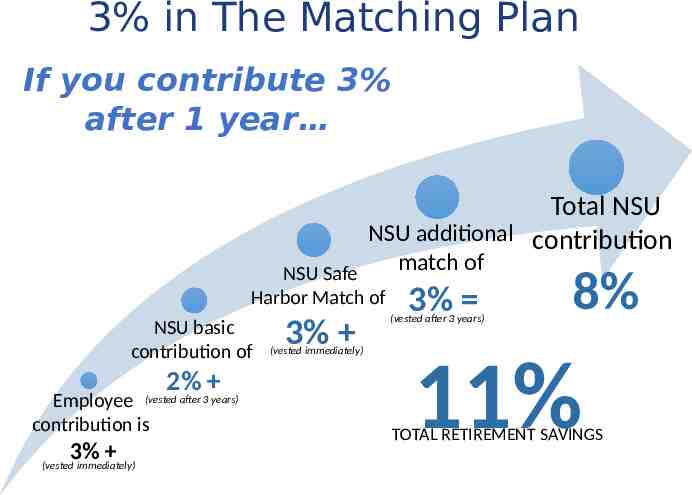

Eligibility to Contribute Employees who are eligible, working 19.2 hours or more per week and have attained age 21, can contribute to the 401(k) Retirement Savings Plan at Nova Southeastern University on the first of the month following their date of hire Employees who meet the criteria for non-matched contributions and have completed one year of service at Nova Southeastern University are eligible for matched contributions in the 401(k) Retirement Savings Plan at Nova Southeastern University. Eligible employees can enroll on the first of the month following their one-year employment anniversary. For more information about Retirement Savings at NSU visit the Retirement page online: http://www.nova.edu/hr/benefits/retirement-plans.html How to access the Retirement Manager Enrollment Portal to make or change elections: http://www.nova.edu/hr/benefits/forms/Retirement%20Manager%20Quick%20Reference.pdf An interactive Brainshark presented by TIAA is available online: https://www.brainshark.com/tiaa-cref direct/NovaSoutheasternUniversity Need personalized assistance planning for retirement? TIAA and Valic provide individual counselling sessions for employees at no additional cost! Make an appointment with an advisor today by visiting http://www.nova.edu/hr/benefits/retirement-plans.html

1% in The Matching Plan If you contribute 0% after 1 year Total NSU NSU additional contribution match of NSU Safe Harbor Match of NSU basic contribution of 2% Employee (vested after 3 years) contribution is 0% 0% 0% 2% 2% TOTAL RETIREMENT SAVINGS

2% in The Matching Plan If you contribute 1% after 1 year Total NSU NSU additional contribution match of NSU Safe Harbor Match of NSU basic contribution of 2% Employee (vested after 3 years) contribution is 1% (vested immediately) 1% (vested immediately) 1% (vested after 3 years) 5% 4% TOTAL RETIREMENT SAVINGS

3% in The Matching Plan If you contribute 2% after 1 year (vested after 3 years) (vested immediately) (vested after 3 years) 8% TOTAL RETIREMENT SAVINGS (vested immediately)

3% in The Matching Plan If you contribute 3% after 1 year Total NSU NSU additional contribution match of NSU Safe Harbor Match of NSU basic contribution of 2% Employee (vested after 3 years) contribution is 3% (vested immediately) 3% (vested immediately) 3% (vested after 3 years) 8% 11% TOTAL RETIREMENT SAVINGS

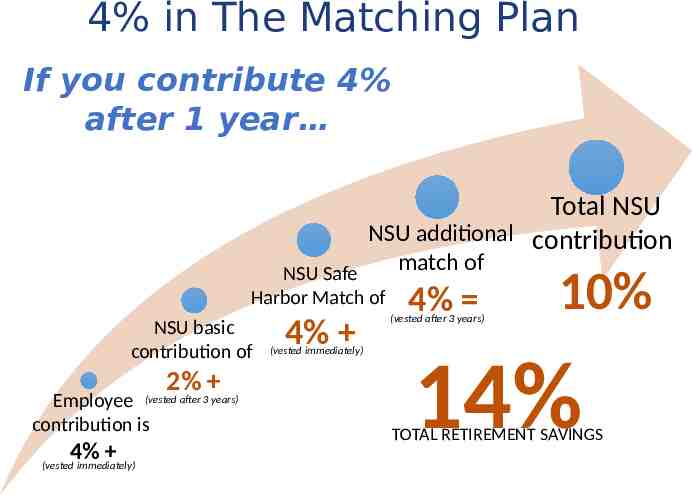

4% in The Matching Plan If you contribute 4% after 1 year Total NSU NSU additional contribution match of NSU Safe Harbor Match of NSU basic contribution of 2% Employee (vested after 3 years) contribution is 4% (vested immediately) 4% (vested immediately) 4% (vested after 3 years) 10% 14% TOTAL RETIREMENT SAVINGS

Benefits Included with Employment at NSU

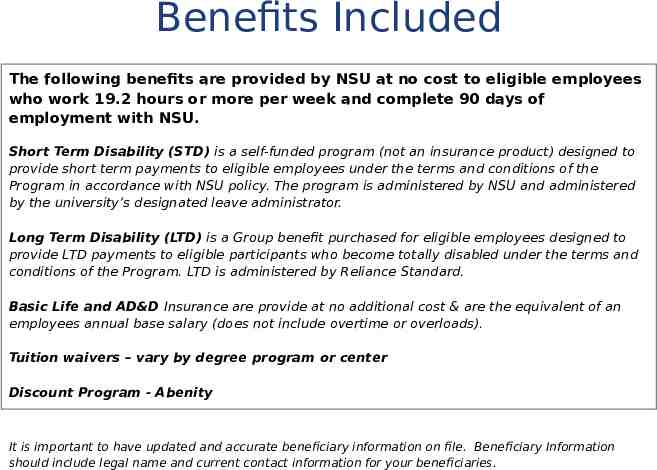

Benefits Included The following benefits are provided by NSU at no cost to eligible employees who work 19.2 hours or more per week and complete 90 days of employment with NSU. Short Term Disability (STD) is a self-funded program (not an insurance product) designed to provide short term payments to eligible employees under the terms and conditions of the Program in accordance with NSU policy. The program is administered by NSU and administered by the university’s designated leave administrator. Long Term Disability (LTD) is a Group benefit purchased for eligible employees designed to provide LTD payments to eligible participants who become totally disabled under the terms and conditions of the Program. LTD is administered by Reliance Standard. Basic Life and AD&D Insurance are provide at no additional cost & are the equivalent of an employees annual base salary (does not include overtime or overloads). Tuition waivers – vary by degree program or center Discount Program - Abenity It is important to have updated and accurate beneficiary information on file. Beneficiary Information should include legal name and current contact information for your beneficiaries.

Where to Enroll for Benefits at NSU

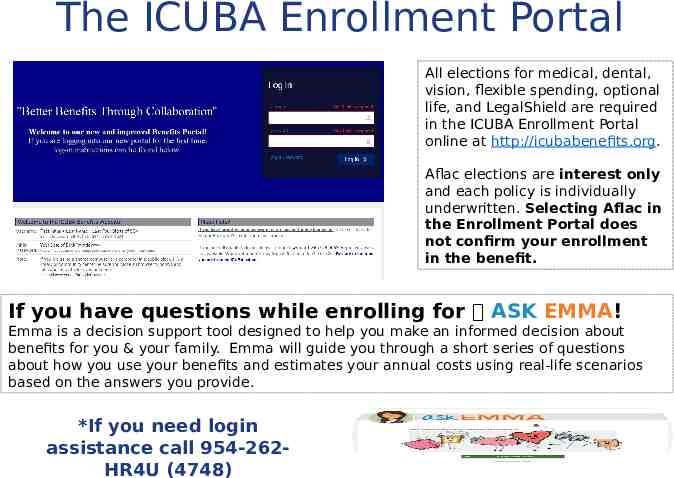

The ICUBA Enrollment Portal All elections for medical, dental, vision, flexible spending, optional life, and LegalShield are required in the ICUBA Enrollment Portal online at http://icubabenefits.org. Aflac elections are interest only and each policy is individually underwritten. Selecting Aflac in the Enrollment Portal does not confirm your enrollment in the benefit. If you have questions while enrolling for ASK EMMA! Emma is a decision support tool designed to help you make an informed decision about benefits for you & your family. Emma will guide you through a short series of questions about how you use your benefits and estimates your annual costs using real-life scenarios based on the answers you provide. *If you need login assistance call 954-262HR4U (4748)