SMALL CONTRACTORS INITIATIVE BONDING & ACCESS TO CAPITAL

35 Slides1.74 MB

SMALL CONTRACTORS INITIATIVE BONDING & ACCESS TO CAPITAL

SMALL CONTRACTORS INITIATIVE SESSION 1 INTRODUCTION TO BONDING AND BUSINESS PLANNING

WELCOME Introductions Course overview Sponsored by the U.S. Department of Housing and Urban Development (HUD) Delivered by a local intermediary. U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 3

COURSE OVERVIEW Session 1: Introduction to Bonding and Business Planning Session 2: Requirements: Applicability & Reporting Session 3: Business Planning Session 4: Financial Management Session 5: Working Capital and Loan Applications Session 6: Contracting Opportunities Session 7: Bonding Session 8: Wrap-up U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 4

SESSION OVERVIEW Part A: Bonding Surety Bond Basics Bonds vs. Insurance Types of Surety Bonds Why Get a Bond? Underwriting: Capacity, Financial Strength, Character, Guarantee Part B: Business Plan Why Plan? Parts of a Business Plan Examples Resources U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 5

PART A: INTRODUCTION TO BONDING U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 6

LEARNING OBJECTIVES Learn why bonds are important and desirable for your business. Learn the history of bonds and the different types of bonds. Learn how to obtain performance bonds. Identify criteria and/or documentation your company already has in place and what to focus on during course. U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 7

HISTORY OF BONDING Surety bonds have existed for thousands of years. First known example is from 2750 BCE: A Mesopotamian tablet stated that a farmer would work another farmer’s field because he had to serve in the army. The two farmers agreed to split the profit evenly. A local merchant served as the world's first known surety by guaranteeing that the second farmer would keep his word. In the mid-1800s, surety companies were established in the United States and England. In 1894, Congress passed the Heard Act, which required surety bonds on all federally funded projects. Bonds provide a guarantee against failure to perform work. U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 8

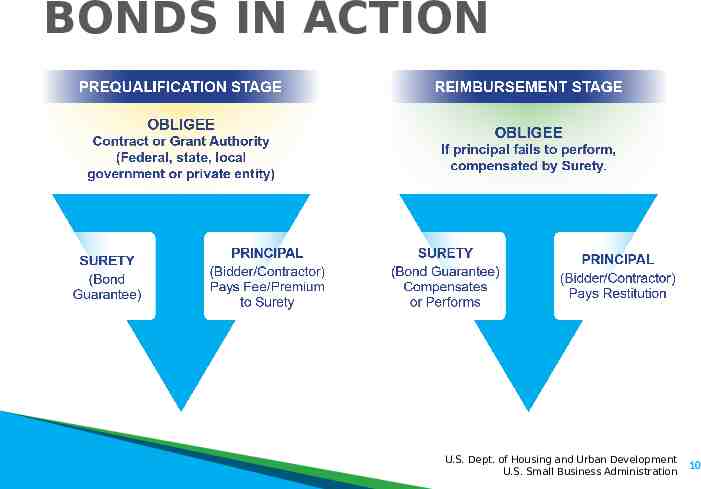

SURETY BOND BASICS A surety bond is defined as a contract among at least three parties: The obligee: The recipient of an obligation (e.g., the U.S. Government). The principal: The primary party who will perform the contractual obligation (e.g., your business). The surety: The party who assures the obligee that the principal can perform the task (e.g., the bonding company). What is a surety bond? “Essentially, a surety bond is an insurance policy between the contractor, the client, and a third-party surety bond company that covers your promise—and ability—to complete the terms of a contractual agreement. Instead of you having to put up cash as a deposit, you get a surety bond.” -Nico Janssen, U.S. SBA U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 9

BONDS IN ACTION U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 10

DO I NEED A SURETY BOND? Establishes your company as credible and capable. Lowers the risk of hiring your company. May be required by an agency, owner, or general contractor—will therefore allow you to access more opportunities. Federal construction contracts over 150,000 require surety bonds, as do most State and municipal governments and many U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 11

BONDS vs. INSURANCE Insurance policies cover damages or loss to people or property. To get fire insurance, you pay a premium. If the house burns, insurance covers the cost to rebuild. Insurance does not cover losses if a contractor fails to perform. To get a bond, you also pay a premium. If you default on your contract, the surety ensures that the work is completed and everyone is paid. The surety then looks to you to recover all their losses. U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 12

TYPES OF SURETY BONDS BID BONDs ensure that the bidder on a contract will enter into the contract and will furnish the required payment and performance bonds if awarded the contract. PAYMENT BONDs ensure that suppliers and subcontractors are paid for work performed under the contract. PERFORMANCE BONDs ensure that the contract will be completed in accordance with its terms and conditions. ANCILLARY BONDs ensure that requirements integral to the contract, but not directly performance-related, are performed. U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 13

WHY GET A BOND? Construction is a risky business. According to BizMiner, one in four contractors fails. The owner should rely on a surety bond for the best protection on a project. The surety guarantees that the contractor has the means to complete the project. U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 14

KEY UNDERWRITING CRITERIA 1. Capacity and Experience 2. Financial Strength (Business and Personal) 3. Character and Management 4. Guarantee What is surety underwriting? It is the process of vetting the business to decide on the risks that the suretor is willing to take. The bonder must review the business’s status to understand whether it can take the risk of issuing the bond. U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 15

1. CAPACITY and EXPERIENCE Can I manage the construction work and business aspects of the job? Abilities. Management. Work experience. Company history. How will I demonstrate that I have the capacity? Business Plan. Track record. Licenses and certifications. U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 16

2. FINANCIAL STRENGTH Does your business have a demonstrated ability to manage its finances well and maintain working capital? Financial history. Financial management systems. Working capital available. How will I demonstrate this? Financial statements. Systems in place, or supports available. Cash on-hand and/or line of credit. U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 17

3. CHARACTER and MANAGEMENT Can your firm be trusted to deliver on its commitments and complete the work, even if it encounters problems on the job? How will you demonstrate this? Personal and corporate history and references. Credit. Evidence of clearing up past problems. Continuity plan. U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 18

4. GUARANTEE If your capacity and financial strength are not enough, how can you give the surety the confidence they need that they will not suffer a loss on this job? Funds control: Proper control by management to ensure authorized use. Collateral: Security pledged for payment of a loan. Co-Obligee or partner. SBA Bond Guarantee. U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 19

REVIEW OF KEY IDEAS Key components designed to help you establish your qualification for a bond: Business planning. Financial management. Working capital. The bonding process. Other components will help you search for contracting opportunities and understand likely benefits and challenges of those opportunities: Procurement and partnering. Federal requirements. U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 20

LINK TO ACTION PLAN Contractors review their draft Action Plan. We will identify where each action item is addressed in the course. Review with facilitator for required updates or revisions. Participants share highlights of their Action Plans with the cohort. U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 21

BONDING RESOURCES Links with detailed information on bonding: SBA, “Surety Bonds.” JW Surety, “What is a Payment Bond?” Surety Information Office, “How to Obtain Surety Bonds.” Donahue & Thomas, “ Construction Surety Bonds In Plain English.” Attachments with more information on bonding: Performance Bond Application Payment Bond Application Surety 101 U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 22

PART B: INTRODUCTION TO BUSINESS PLANNING U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 23

LEARNING OBJECTIVES 1. Understand how this course will help to prepare a business plan. 2. Understand what a business plan is. 3. Understand how a business plan will aid in obtaining a bond. 4. Identify the essential sections of a business plan that are required for a bonding application. U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 24

WHY PLAN A BUSINESS? Avoid failure. Apply for a working capital loan. Receive a bond. Grow your business. https://www.flickr.com/photos/usacehq/6141166487 U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 25

A BUSINESS PLAN IS https://www.flickr.com/photos/ocarchives/3952964087/ U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 26

BUSINESS PLANS CONTAIN: U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 27

A BONDABLE PLAN Is feasible and realistic. Indicates pipeline. Offers sophisticated management and accounting. Highlights profit. Provides continuity. Proves capacity. Provides a good financial and operational picture of the business. U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 28

EXAMPLES OF PLANS Large general contractor. Small general contractor. Electrical subcontractor. https://www.flickr.com/photos/ganatlguard/5891371057 U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 29

WE WILL USE – Reference manual. – Business Plan template. – Examples. – Your business. – Mentoring site visits. – Multiple edits. U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 30

BUSINESS PLAN TEMPLATE On USB drive. Word document. Excel workbooks. PowerPoint shell. Rename file. Two-minute cover page. U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 31

8 PLANNING STEPS Clarify vision & mission Describe your business Verify your environment Build a team Project financials Marketing for image & products Identify & defeat risk Revise, develop, sell U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 32

CREATING YOUR BUSINESS PLAN How will you create a powerful document? Who When What List tasks for preparing companyspecific business plan. Due dates Assignments U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 33

HOW WILL YOU BEGIN? DESCRIBE YOUR BUSINESS: THE 1-HOUR BUSINESS PLAN APPLICATION U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 34

PLANNING RESOURCES Links with detailed information on business planning: Business planning software. Bplans: The Complete Guide to Business Planning Business Plan Pro: Business Planning Software Sol ution National Association of Home Builders (NAH B) Market analysis. Markup benchmarks. US Small Business Administration Learning Center. Create Your Business Plan. U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 35