American Society of Naval Engineers – Tidewater Section Dinner

17 Slides1.51 MB

American Society of Naval Engineers - Tidewater Section Dinner Presented By: VADM David H. Lewis, USN 19 February 20 Use Only OneUnclassified//For team, one voice deliveringOfficial global acquisition insight.

Agenda DCMA 101 DCMA vs DCAA DIB CMMC One team, one voice delivering global acquisition insight. 2

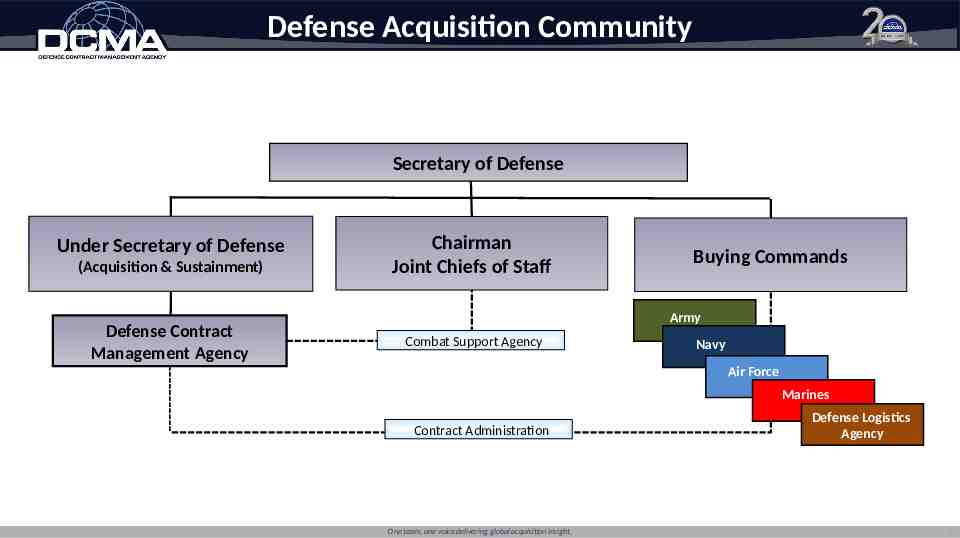

Defense Acquisition Community Secretary of Defense Under Secretary of Defense (Acquisition & Sustainment) Defense Contract Management Agency Chairman Joint Chiefs of Staff Buying Commands Army Combat Support Agency Navy Air Force Marines Contract Administration One team, one voice delivering global acquisition insight. Defense Logistics Agency 3

DCMA Chartered Mission (DoD Directive 5105.64) “Mission: DCMA performs Contract Administration Services (CAS) for DoD, other authorized Fed Agencies, foreign gov’ts, int’l organizations, and others as authorized. Specific guidance on roles and responsibilities for contract administration and management outlined in FAR 42.302 and DFARS 242.302 Predominant workload delegations are on major production type contracts. Other type contracts delegations accepted on case by case basis. Exceptions where contract administration is generally retained by the military services include: SUPSHIPS contracts Office of Naval Research contracts Ammunition contracts Army Corps of Engineer contracts and most facilities type contracts “Post, Camp, and Station” contracts One team, one voice delivering global acquisition insight. 4

DCMA Alignment to the SECDEF Priorities Support to the Warfighter Enhanced product delivery for lethality and readiness Increased Affordability Support to our Allies Business Reforms Foreign Military Sales International Presence Commercial Items Canceling Funds One team, one voice delivering global acquisition insight. 5

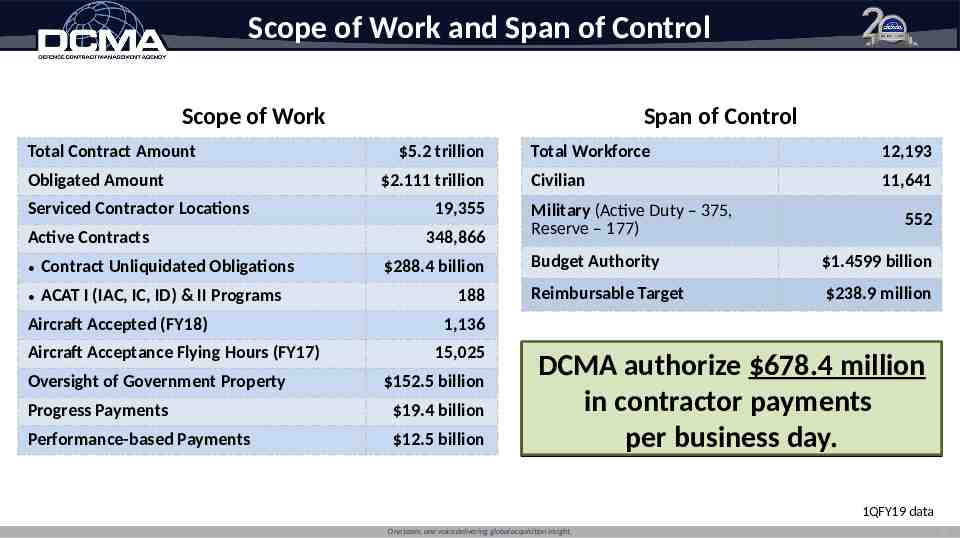

Scope of Work and Span of Control Scope of Work Total Contract Amount Obligated Amount Serviced Contractor Locations Active Contracts Contract Unliquidated Obligations ACAT I (IAC, IC, ID) & II Programs Aircraft Accepted (FY18) Aircraft Acceptance Flying Hours (FY17) Oversight of Government Property Span of Control 5.2 trillion 2.111 trillion 19,355 348,866 288.4 billion 188 Total Workforce 12,193 Civilian 11,641 Military (Active Duty – 375, Reserve – 177) 552 Budget Authority 1.4599 billion Reimbursable Target 238.9 million 1,136 15,025 152.5 billion Progress Payments 19.4 billion Performance-based Payments 12.5 billion DCMA authorize 678.4 million in contractor payments per business day. 1QFY19 data One team, one voice delivering global acquisition insight. 6

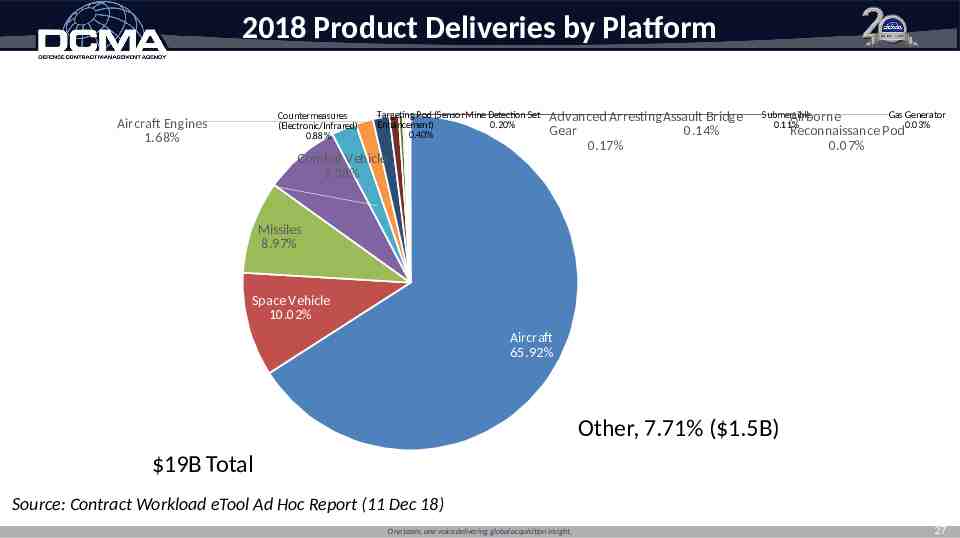

2018 Product Deliveries by Platform Missile System 2.44% Aircraft Engines Systems 1.59% 1.68% Countermeasures (Electronic/Infrared) 0.88% Targeting Pod (Sensor Mine Detection Set 0.20% Enhancement) 0.40% Combat Vehicle 7.38% Advanced ArrestingAssault Bridge Gear 0.14% 0.17% Submersible Airborne 0.11% Gas Generator 0.03% Reconnaissance Pod 0.07% Missiles 8.97% Space Vehicle 10.02% Aircraft 65.92% Other, 7.71% ( 1.5B) 19B Total Source: Contract Workload eTool Ad Hoc Report (11 Dec 18) One team, one voice delivering global acquisition insight. 27

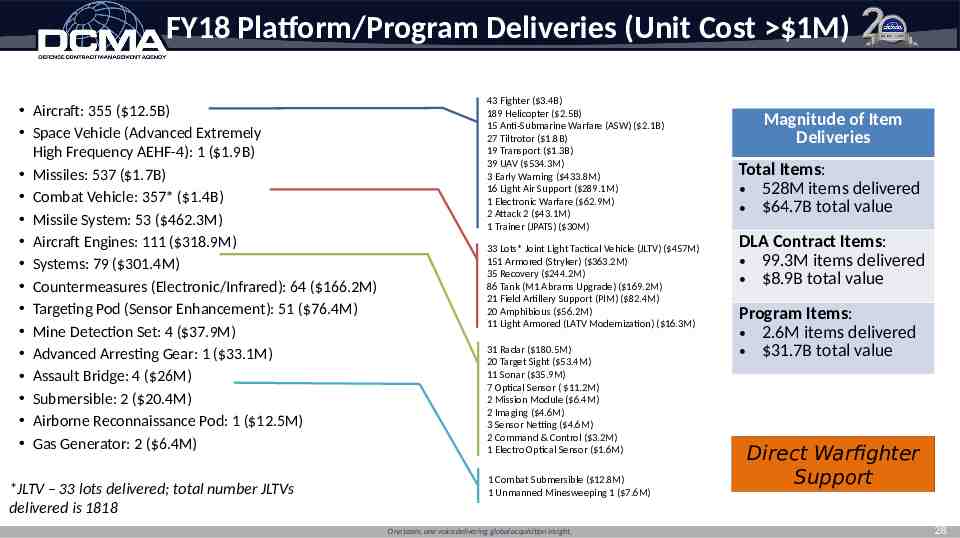

FY18 Platform/Program Deliveries (Unit Cost 1M) Aircraft: 355 ( 12.5B) Space Vehicle (Advanced Extremely High Frequency AEHF-4): 1 ( 1.9B) Missiles: 537 ( 1.7B) Combat Vehicle: 357* ( 1.4B) Missile System: 53 ( 462.3M) Aircraft Engines: 111 ( 318.9M) Systems: 79 ( 301.4M) Countermeasures (Electronic/Infrared): 64 ( 166.2M) Targeting Pod (Sensor Enhancement): 51 ( 76.4M) Mine Detection Set: 4 ( 37.9M) Advanced Arresting Gear: 1 ( 33.1M) Assault Bridge: 4 ( 26M) Submersible: 2 ( 20.4M) Airborne Reconnaissance Pod: 1 ( 12.5M) Gas Generator: 2 ( 6.4M) *JLTV – 33 lots delivered; total number JLTVs delivered is 1818 43 Fighter ( 3.4B) 189 Helicopter ( 2.5B) 15 Anti-Submarine Warfare (ASW) ( 2.1B) 27 Tiltrotor ( 1.8B) 19 Transport ( 1.3B) 39 UAV ( 534.3M) 3 Early Warning ( 433.8M) 16 Light Air Support ( 289.1M) 1 Electronic Warfare ( 62.9M) 2 Attack 2 ( 43.1M) 1 Trainer (JPATS) ( 30M) 33 Lots* Joint Light Tactical Vehicle (JLTV) ( 457M) 151 Armored (Stryker) ( 363.2M) 35 Recovery ( 244.2M) 86 Tank (M1 Abrams Upgrade) ( 169.2M) 21 Field Artillery Support (PIM) ( 82.4M) 20 Amphibious ( 56.2M) 11 Light Armored (LATV Modernization) ( 16.3M) 31 Radar ( 180.5M) 20 Target Sight ( 53.4M) 11 Sonar ( 35.9M) 7 Optical Sensor ( 11.2M) 2 Mission Module ( 6.4M) 2 Imaging ( 4.6M) 3 Sensor Netting ( 4.6M) 2 Command & Control ( 3.2M) 1 Electro Optical Sensor ( 1.6M) 1 Combat Submersible ( 12.8M) 1 Unmanned Minesweeping 1 ( 7.6M) One team, one voice delivering global acquisition insight. Magnitude of Item Deliveries Total Items: 528M items delivered 64.7B total value DLA Contract Items: 99.3M items delivered 8.9B total value Program Items: 2.6M items delivered 31.7B total value Direct Warfighter Support 28

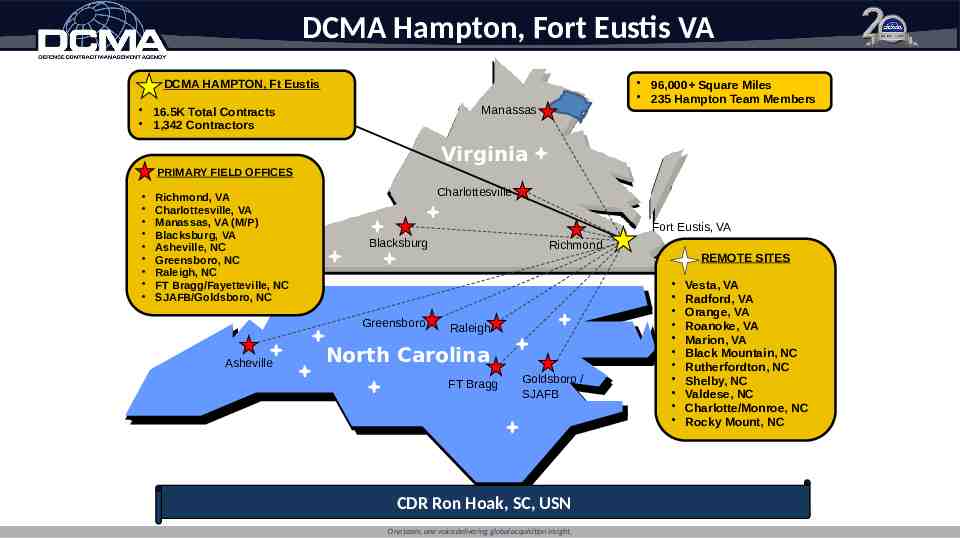

DCMA Hampton, Fort Eustis VA DCMA HAMPTON, Ft Eustis 96,000 Square Miles 235 Hampton Team Members Manassas 16.5K Total Contracts 1,342 Contractors Virginia PRIMARY FIELD OFFICES Richmond, VA Charlottesville, VA Manassas, VA (M/P) Blacksburg, VA Asheville, NC Greensboro, NC Raleigh, NC FT Bragg/Fayetteville, NC SJAFB/Goldsboro, NC Charlottesville Fort Eustis, VA Blacksburg Greensboro Asheville Richmond Raleigh North Carolina FT Bragg Goldsboro / SJAFB CDR Ron Hoak, SC, USN One team, one voice delivering global acquisition insight. REMOTE SITES Vesta, VA Radford, VA Orange, VA Roanoke, VA Marion, VA Black Mountain, NC Rutherfordton, NC Shelby, NC Valdese, NC Charlotte/Monroe, NC Rocky Mount, NC 9

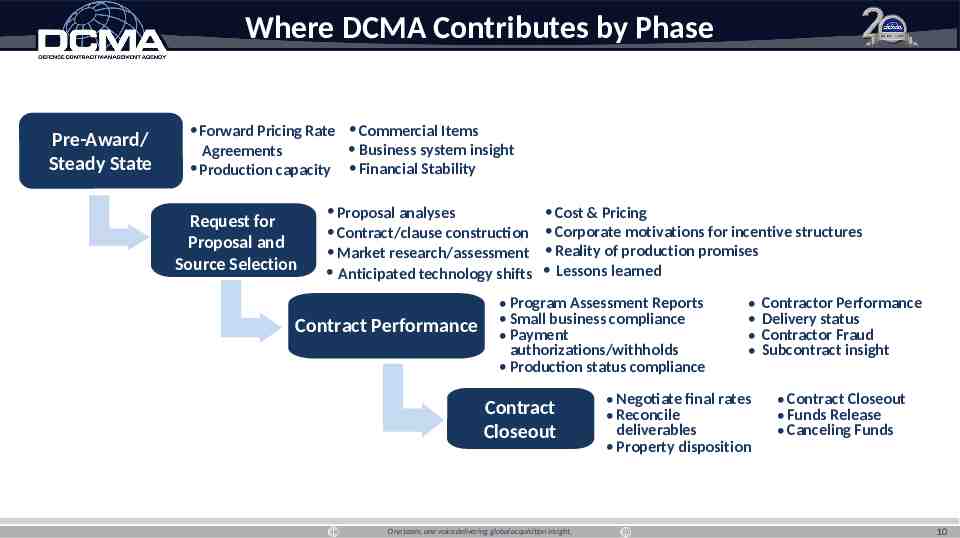

Where DCMA Contributes by Phase Pre-Award/ Steady State Forward Pricing Rate Commercial Items Business system insight Agreements Production capacity Financial Stability Request for Proposal and Source Selection Proposal analyses Contract/clause construction Market research/assessment Anticipated technology shifts Contract Performance Cost & Pricing Corporate motivations for incentive structures Reality of production promises Lessons learned Program Assessment Reports Small business compliance Payment authorizations/withholds Production status compliance Contract Closeout One team, one voice delivering global acquisition insight. Negotiate final rates Reconcile deliverables Property disposition Contractor Performance Delivery status Contractor Fraud Subcontract insight Contract Closeout Funds Release Canceling Funds 10

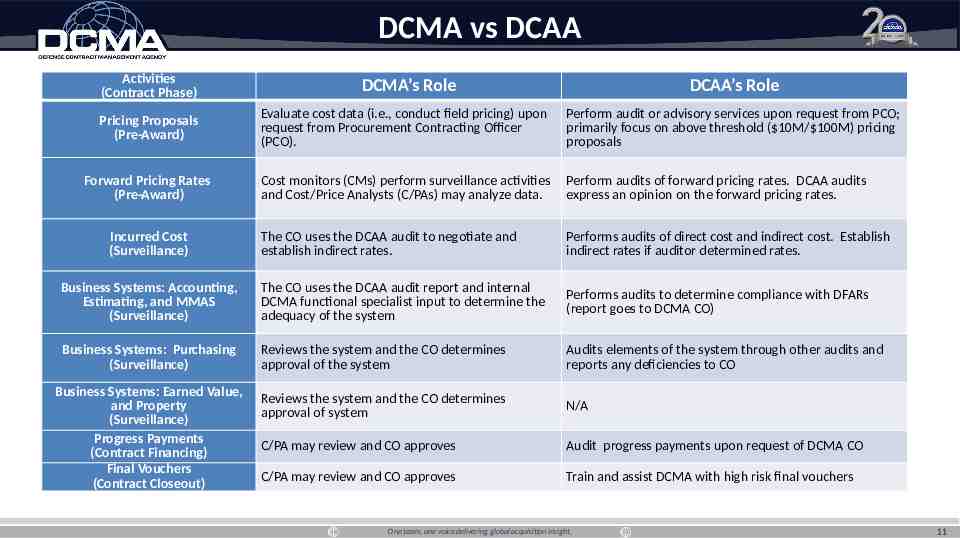

DCMA vs DCAA Activities (Contract Phase) DCMA’s Role DCAA’s Role Pricing Proposals (Pre-Award) Evaluate cost data (i.e., conduct field pricing) upon request from Procurement Contracting Officer (PCO). Perform audit or advisory services upon request from PCO; primarily focus on above threshold ( 10M/ 100M) pricing proposals Forward Pricing Rates (Pre-Award) Cost monitors (CMs) perform surveillance activities and Cost/Price Analysts (C/PAs) may analyze data. Perform audits of forward pricing rates. DCAA audits express an opinion on the forward pricing rates. The CO uses the DCAA audit to negotiate and establish indirect rates. Performs audits of direct cost and indirect cost. Establish indirect rates if auditor determined rates. Business Systems: Accounting, Estimating, and MMAS (Surveillance) The CO uses the DCAA audit report and internal DCMA functional specialist input to determine the adequacy of the system Performs audits to determine compliance with DFARs (report goes to DCMA CO) Business Systems: Purchasing (Surveillance) Reviews the system and the CO determines approval of the system Audits elements of the system through other audits and reports any deficiencies to CO Business Systems: Earned Value, and Property (Surveillance) Progress Payments (Contract Financing) Final Vouchers (Contract Closeout) Reviews the system and the CO determines approval of system N/A C/PA may review and CO approves Audit progress payments upon request of DCMA CO C/PA may review and CO approves Train and assist DCMA with high risk final vouchers Incurred Cost (Surveillance) One team, one voice delivering global acquisition insight. 11

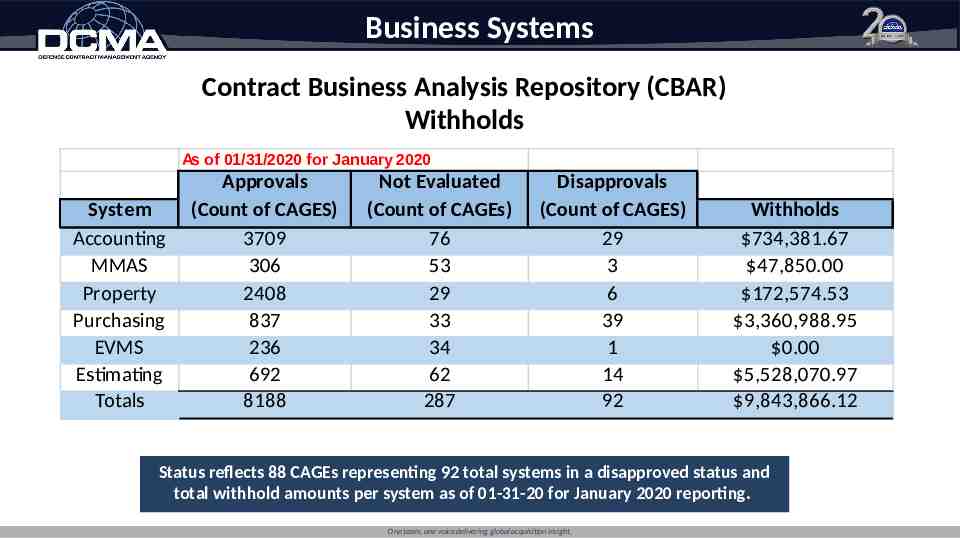

1 2 Business Systems Contract Business Analysis Repository (CBAR) Withholds System Status and Withholds As of 01/31/2020 for January 2020 System Accounting MMAS Property Purchasing EVMS Estimating Totals Approvals (Count of CAGES) 3709 306 2408 837 236 692 8188 Not Evaluated (Count of CAGEs) 76 53 29 33 34 62 287 Disapprovals (Count of CAGES) 29 3 6 39 1 14 92 Withholds 734,381.67 47,850.00 172,574.53 3,360,988.95 0.00 5,528,070.97 9,843,866.12 Status reflects 88 CAGEs representing 92 total systems in a disapproved status and total withhold amounts per system as of 01-31-20 for January 2020 reporting. One team, one voice delivering global acquisition insight.

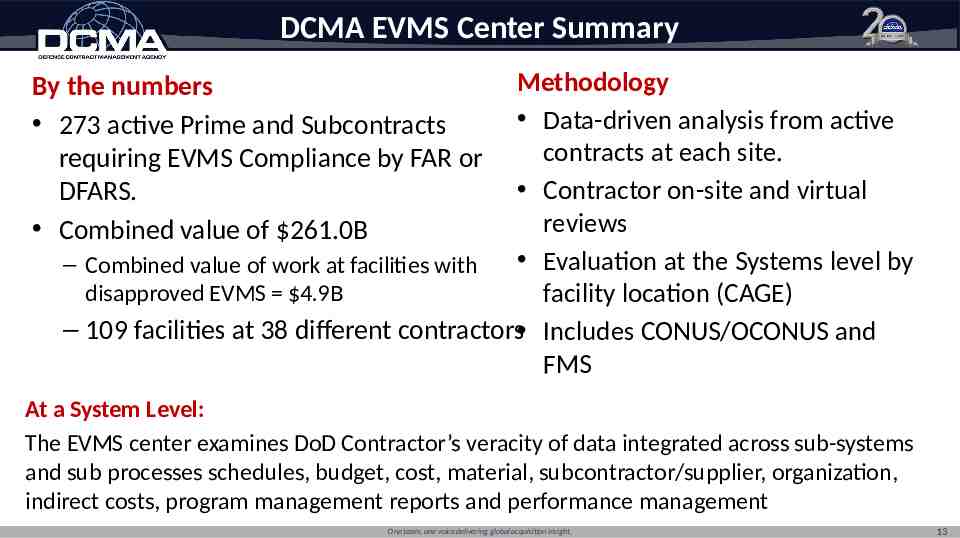

DCMA EVMS Center Summary Methodology Data-driven analysis from active contracts at each site. Contractor on-site and virtual reviews Evaluation at the Systems level by – Combined value of work at facilities with disapproved EVMS 4.9B facility location (CAGE) – 109 facilities at 38 different contractors Includes CONUS/OCONUS and FMS By the numbers 273 active Prime and Subcontracts requiring EVMS Compliance by FAR or DFARS. Combined value of 261.0B At a System Level: The EVMS center examines DoD Contractor’s veracity of data integrated across sub-systems and sub processes schedules, budget, cost, material, subcontractor/supplier, organization, indirect costs, program management reports and performance management One team, one voice delivering global acquisition insight. 13

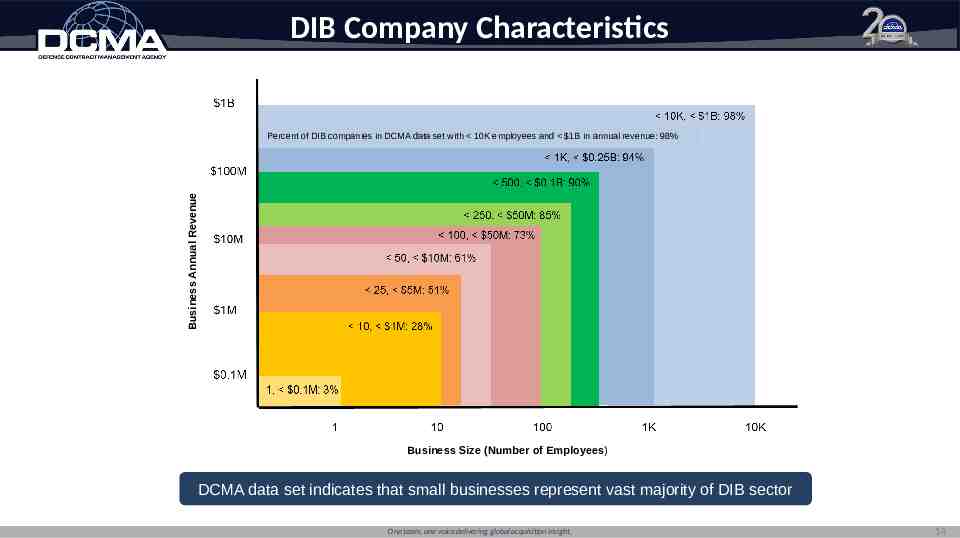

DIB Company Characteristics Business Annual Revenue Percent of DIB companies in DCMA data set with 10K employees and 1B in annual revenue: 98% Business Size (Number of Employees) DCMA data set indicates that small businesses represent vast majority of DIB sector One team, one voice delivering global acquisition insight. 14

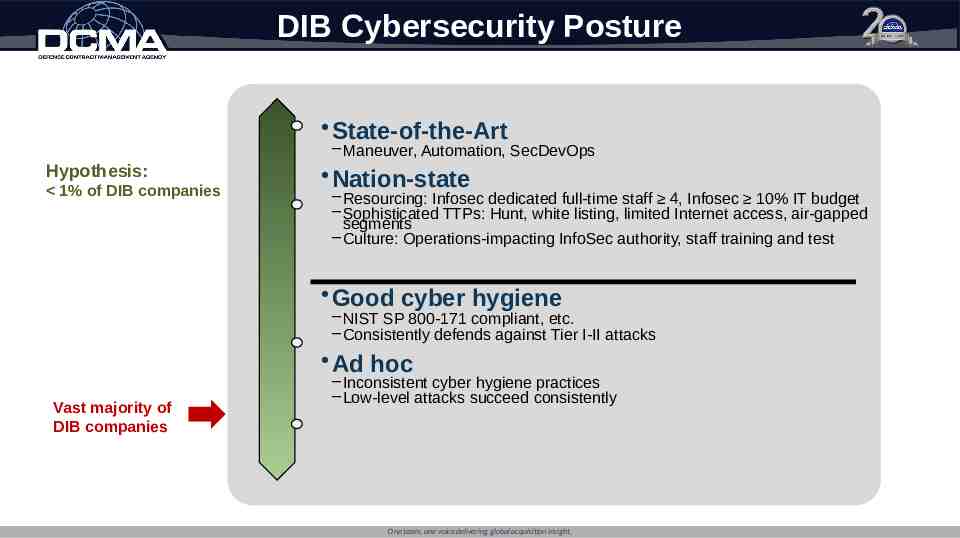

DIB Cybersecurity Posture State-of-the-Art – Maneuver, Automation, SecDevOps Hypothesis: 1% of DIB companies Nation-state – Resourcing: Infosec dedicated full-time staff 4, Infosec 10% IT budget – Sophisticated TTPs: Hunt, white listing, limited Internet access, air-gapped segments – Culture: Operations-impacting InfoSec authority, staff training and test Good cyber hygiene – NIST SP 800-171 compliant, etc. – Consistently defends against Tier I-II attacks Ad hoc Vast majority of DIB companies – Inconsistent cyber hygiene practices – Low-level attacks succeed consistently One team, one voice delivering global acquisition insight. 15

Cybersecurity Maturity Model Certification (CMMC) The DoD is working with John Hopkins University Applied Physics Laboratory (APL) and Carnegie Mellon University Software Engineering Institute (SEI) to review and combine various cybersecurity standards into one unified standard for cybersecurity. The new standard and maturity model will be named Cybersecurity Maturity Model Certification (CMMC) The CMMC levels will range from basic hygiene to “State-of-the-Art” and will also capture both security control and the institutionalization of processes that enhance cybersecurity for DIB companies. The required CMMC level (notionally between 1 – 5) for a specific contract will be contained in the RFP secti ons L & M, and will be a “go/no-go decision”. The CMMC must be semi-automated and, more importantly, cost effective enough so that Small Businesses can achieve the minimum CMMC level of 1. The CMMC model will be agile enough to adapt to emerging and evolving cyber threats to the DIB sector. A neutral 3rd party will maintain the standard for the Department. The CMMC will include the development and deployment of a tool that 3rd party cybersecurity certifiers will use to conduct audits, collect metrics, and inform risk mitigation for the entire supply chain. One team, one voice delivering global acquisition insight. 16

Questions One team, one voice delivering global acquisition insight. 17