4. Impact of Reforms Globally and Latest Developments

20 Slides2.96 MB

4. Impact of Reforms Globally and Latest Developments

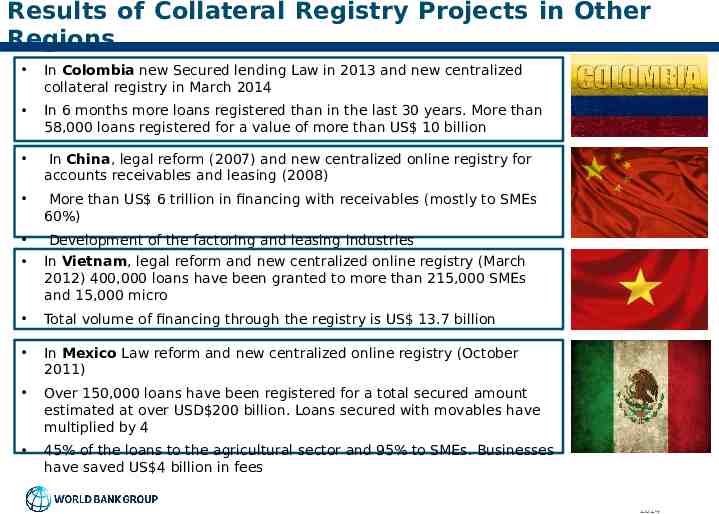

Results of Collateral Registry Projects in Other Regions In Colombia new Secured lending Law in 2013 and new centralized collateral registry in March 2014 In 6 months more loans registered than in the last 30 years. More than 58,000 loans registered for a value of more than US 10 billion In China, legal reform (2007) and new centralized online registry for accounts receivables and leasing (2008) More than US 6 trillion in financing with receivables (mostly to SMEs 60%) Development of the factoring and leasing industries In Vietnam, legal reform and new centralized online registry (March 2012) 400,000 loans have been granted to more than 215,000 SMEs and 15,000 micro Total volume of financing through the registry is US 13.7 billion In Mexico Law reform and new centralized online registry (October 2011) Over 150,000 loans have been registered for a total secured amount estimated at over USD 200 billion. Loans secured with movables have multiplied by 4 45% of the loans to the agricultural sector and 95% to SMEs. Businesses have saved US 4 billion in fees Strictly Confidential 2014

COLLATERAL REGISTRIES - GHANA: IMPACT ON SMEs THORUGH SUPPLY CHAIN FINANCE CAL BANK: Purchase Financing Scheme for Gold Miningfor big Developed a local supply chain mining corporations, through local SME service providers More than 100 local SMEs have received more than US 10 million. Created hundreds of new jobs. SMEs use movable assets (contracts, receivables, equipment) as collateral No defaults in the 30 months that program has been operating OVERALL – 60,000 loans registered for a value of US 14 billion. More than 8,000 SMEs and 30,000 Micro received loans. Collateral by type: Inventory & receivables (25%), Household goods (20%), vehicles (19%)

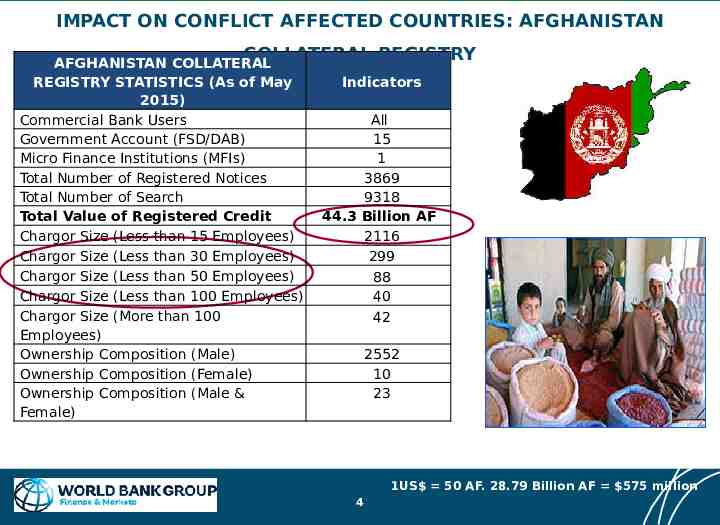

IMPACT ON CONFLICT AFFECTED COUNTRIES: AFGHANISTAN COLLATERAL REGISTRY AFGHANISTAN COLLATERAL REGISTRY STATISTICS (As of May 2015) Commercial Bank Users Government Account (FSD/DAB) Micro Finance Institutions (MFIs) Total Number of Registered Notices Total Number of Search Total Value of Registered Credit Chargor Size (Less than 15 Employees) Chargor Size (Less than 30 Employees) Chargor Size (Less than 50 Employees) Chargor Size (Less than 100 Employees) Chargor Size (More than 100 Employees) Ownership Composition (Male) Ownership Composition (Female) Ownership Composition (Male & Female) Indicators All 15 1 3869 9318 44.3 Billion AF 2116 299 88 40 42 2552 10 23 1US 50 AF. 28.79 Billion AF 575 million 4

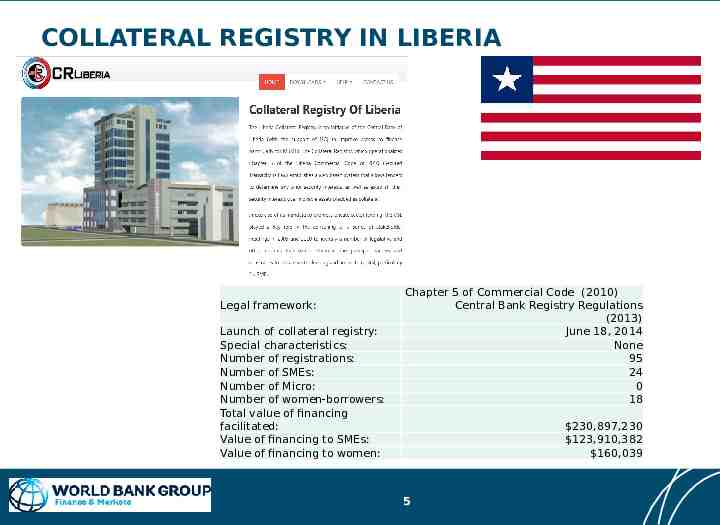

COLLATERAL REGISTRY IN LIBERIA Legal framework: Launch of collateral registry: Special characteristics: Number of registrations: Number of SMEs: Number of Micro: Number of women-borrowers: Total value of financing facilitated: Value of financing to SMEs: Value of financing to women: Chapter 5 of Commercial Code (2010) Central Bank Registry Regulations (2013) June 18, 2014 None 95 24 0 18 230,897,230 123,910,382 160,039 5

UZBEKISTAN COLLATERAL REGISTRY Law on Collateral Registry adopted in 2013 Registry launched in 2014 Currently more than 270,000 registrations New package of legislative amendments to be adopted 6

MALAWI PERSONAL PROPERTY SECURITY REGISTRY Personal Property and Security Act adopted in 2013; Registry launched in December 2015; Operated by the Department of Registrar General (DRG). 7

These Countries Also Started Developing Modern Registries: Decree on Collateral Registry was signed by the President of Belarus in December 2015 and the Registry will become operational by September 2016 The modern Law on Secured Transactions was enacted in Egypt (a first country in MENA to do so) Similar to Palestine, Jordan will launch the new registry for lessors’ interests under Leasing Law which can be expended once the Secured Transactions law is enacted by the Parliament 8

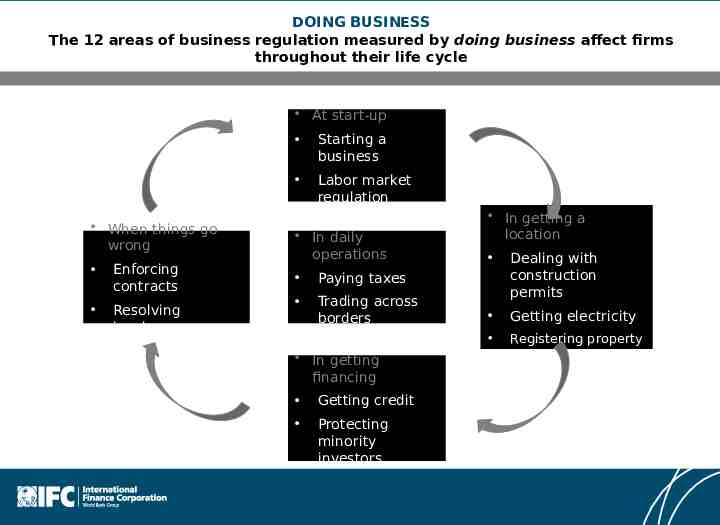

DOING BUSINESS The 12 areas of business regulation measured by doing business affect firms throughout their life cycle At start-up When things go wrong Enforcing contracts Resolving insolvency Starting a business Labor market regulation In daily operations Paying taxes Trading across borders In getting financing 9 Getting credit Protecting minority investors In getting a location Dealing with construction permits Getting electricity Registering property

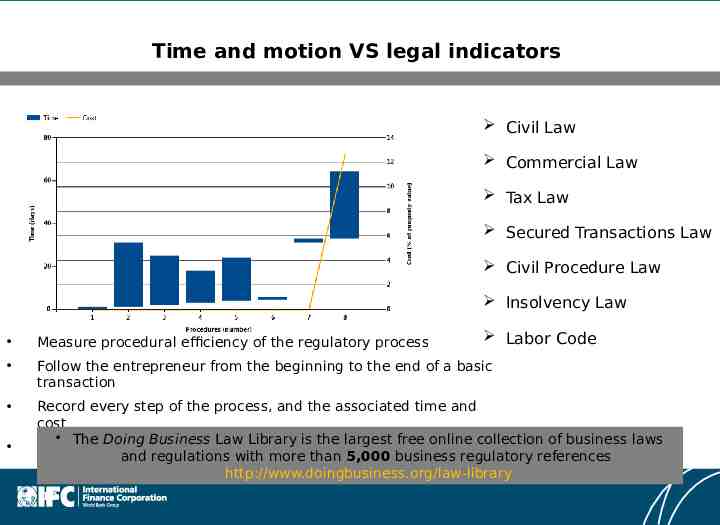

Time and motion VS legal indicators Civil Law Commercial Law Tax Law Secured Transactions Law Civil Procedure Law Insolvency Law Labor Code Measure procedural efficiency of the regulatory process Follow the entrepreneur from the beginning to the end of a basic transaction Record every step of the process, and the associated time and cost The Doing Business Law Library is the largest free online collection of business laws Gather all the relevant laws, regulations, decrees and fee and regulations with more than 5,000 business regulatory references schedules http://www.doingbusiness.org/law-library 10

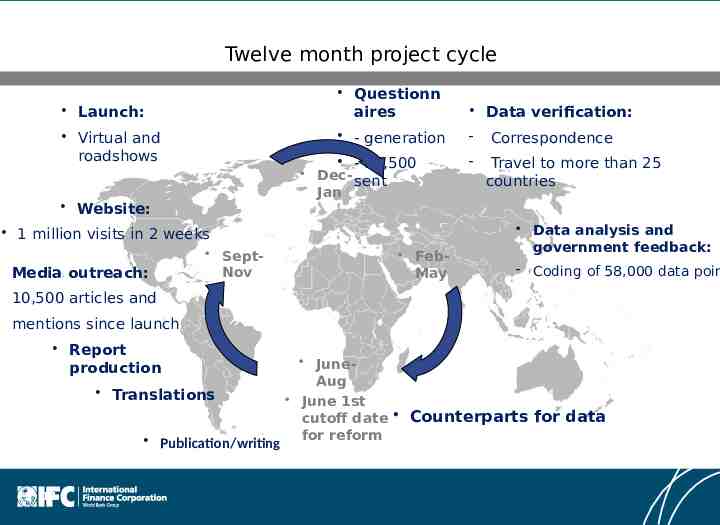

Twelve month project cycle Launch: Virtual and roadshows Website: Data verification: - generation - - 17,500 - Decsent Jan JULY SeptNov SEPT 1 million visits in 2 weeks Media outreach: Questionn aires JAN – FebMAY May Correspondence Travel to more than 25 countries Data analysis and government feedback: - Coding of 58,000 data poin 10,500 articles and mentions since launch Report production Translations Publication/writing 11 June Aug MAY June 1st JUNE cutoff date Counterparts for data for reform

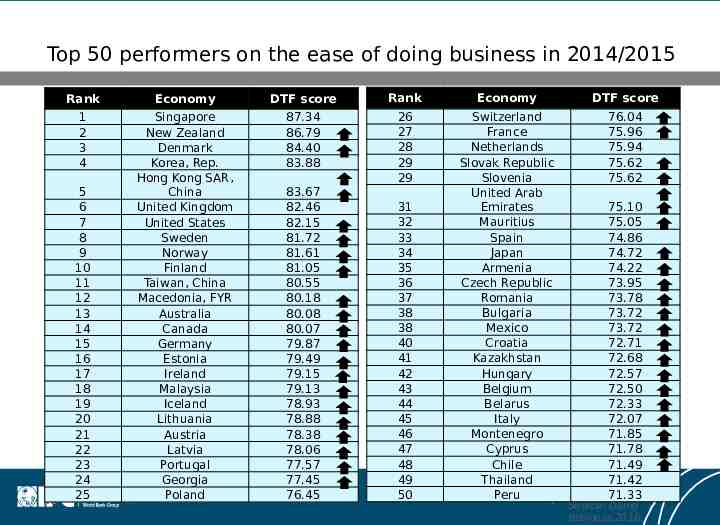

Top 50 performers on the ease of doing business in 2014/2015 12 Rank Economy DTF score Rank Economy DTF score 1 2 3 4 Singapore New Zealand Denmark Korea, Rep. Hong Kong SAR, China United Kingdom United States Sweden Norway Finland Taiwan, China Macedonia, FYR Australia Canada Germany Estonia Ireland Malaysia Iceland Lithuania Austria Latvia Portugal Georgia Poland 87.34 86.79 84.40 83.88 26 27 28 29 29 Switzerland France Netherlands Slovak Republic Slovenia United Arab Emirates Mauritius Spain Japan Armenia Czech Republic Romania Bulgaria Mexico Croatia Kazakhstan Hungary Belgium Belarus Italy Montenegro Cyprus Chile Thailand Peru 76.04 75.96 75.94 75.62 75.62 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 83.67 82.46 82.15 81.72 81.61 81.05 80.55 80.18 80.08 80.07 79.87 79.49 79.15 79.13 78.93 78.88 78.38 78.06 77.57 77.45 76.45 31 32 33 34 35 36 37 38 38 40 41 42 43 44 45 46 47 48 49 50 75.10 75.05 74.86 74.72 74.22 73.95 73.78 73.72 73.72 72.71 72.68 72.57 72.50 72.33 72.07 71.85 71.78 71.49 71.42 71.33 Source: Doing Business 2016.

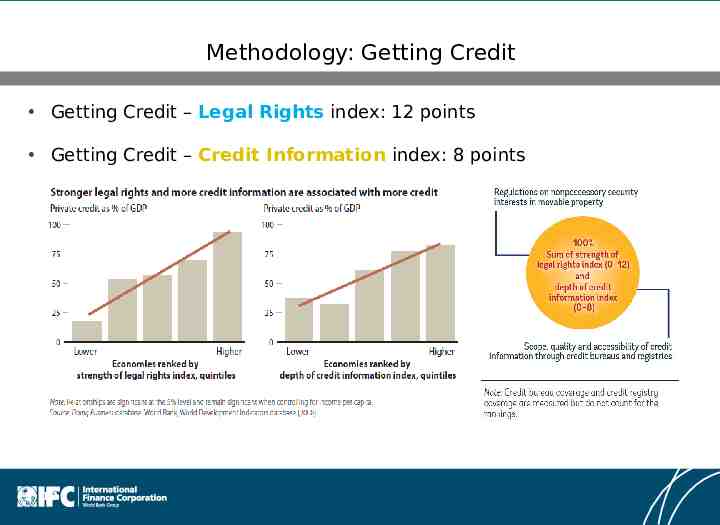

Methodology: Getting Credit Getting Credit – Legal Rights index: 12 points Getting Credit – Credit Information index: 8 points 13

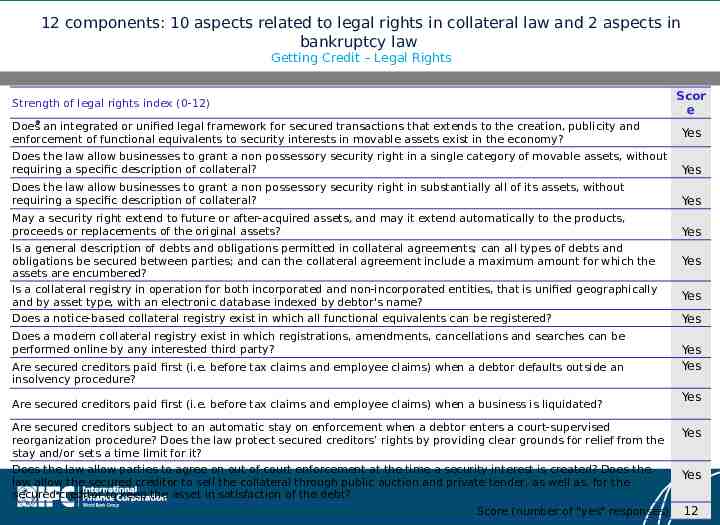

12 components: 10 aspects related to legal rights in collateral law and 2 aspects in bankruptcy law Getting Credit – Legal Rights Strength of legal rights index (0-12) Does an integrated or unified legal framework for secured transactions that extends to the creation, publicity and enforcement of functional equivalents to security interests in movable assets exist in the economy? Scor e Yes Does the law allow businesses to grant a non possessory security right in a single category of movable assets, without requiring a specific description of collateral? Yes Does the law allow businesses to grant a non possessory security right in substantially all of its assets, without requiring a specific description of collateral? Yes May a security right extend to future or after-acquired assets, and may it extend automatically to the products, proceeds or replacements of the original assets? Yes Is a general description of debts and obligations permitted in collateral agreements; can all types of debts and obligations be secured between parties; and can the collateral agreement include a maximum amount for which the assets are encumbered? Is a collateral registry in operation for both incorporated and non-incorporated entities, that is unified geographically and by asset type, with an electronic database indexed by debtor's name? Does a notice-based collateral registry exist in which all functional equivalents can be registered? Does a modern collateral registry exist in which registrations, amendments, cancellations and searches can be performed online by any interested third party? Are secured creditors paid first (i.e. before tax claims and employee claims) when a debtor defaults outside an insolvency procedure? Are secured creditors paid first (i.e. before tax claims and employee claims) when a business is liquidated? Are secured creditors subject to an automatic stay on enforcement when a debtor enters a court-supervised reorganization procedure? Does the law protect secured creditors’ rights by providing clear grounds for relief from the stay and/or sets a time limit for it? Does the law allow parties to agree on out of court enforcement at the time a security interest is created? Does the law allow the secured creditor to sell the collateral through public auction and private tender, as well as, for the secured 14 creditor to keep the asset in satisfaction of the debt? Score (number of "yes" responses) Yes Yes Yes Yes Yes Yes Yes Yes 12

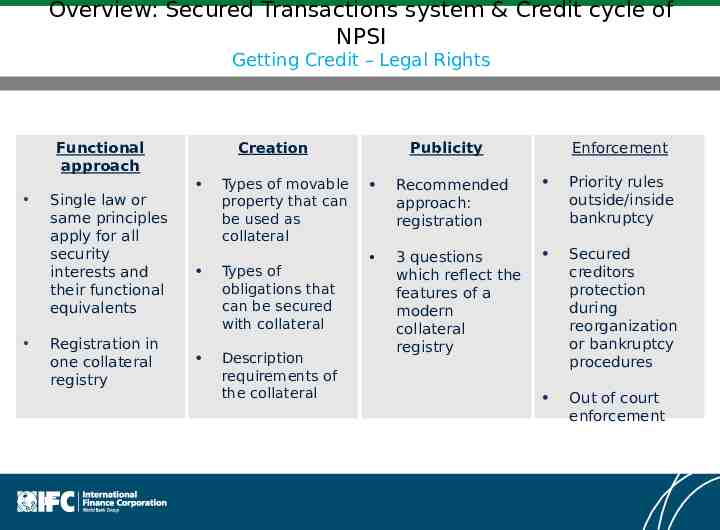

Overview: Secured Transactions system & Credit cycle of NPSI Getting Credit – Legal Rights Functional approach Single law or same principles apply for all security interests and their functional equivalents Registration in one collateral registry 15 Publicity Creation Types of movable property that can be used as collateral Types of obligations that can be secured with collateral Description requirements of the collateral Enforcement Recommended approach: registration Priority rules outside/inside bankruptcy 3 questions which reflect the features of a modern collateral registry Secured creditors protection during reorganization or bankruptcy procedures Out of court enforcement

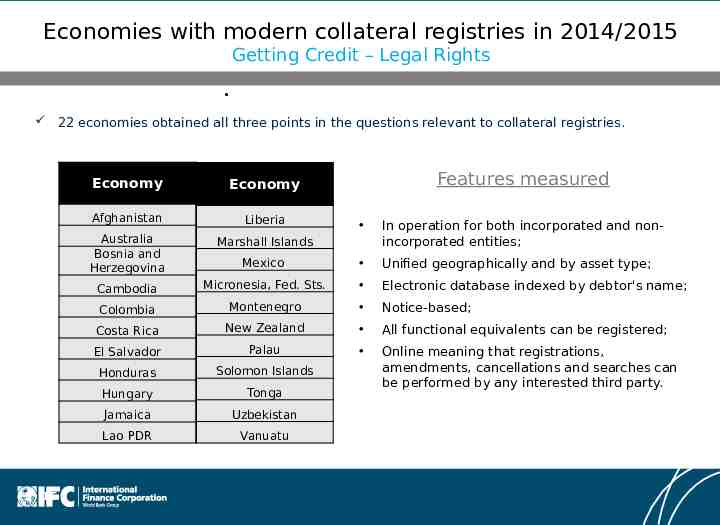

Economies with modern collateral registries in 2014/2015 Getting Credit – Legal Rights 22 economies obtained all three points in the questions relevant to collateral registries. 16 Economy Economy Afghanistan Liberia Australia Bosnia and Herzegovina Marshall Islands Features measured In operation for both incorporated and nonincorporated entities; Mexico Unified geographically and by asset type; Cambodia Micronesia, Fed. Sts. Electronic database indexed by debtor's name; Colombia Montenegro Notice-based; Costa Rica New Zealand All functional equivalents can be registered; El Salvador Palau Honduras Solomon Islands Hungary Tonga Online meaning that registrations, amendments, cancellations and searches can be performed by any interested third party. Jamaica Uzbekistan Lao PDR Vanuatu

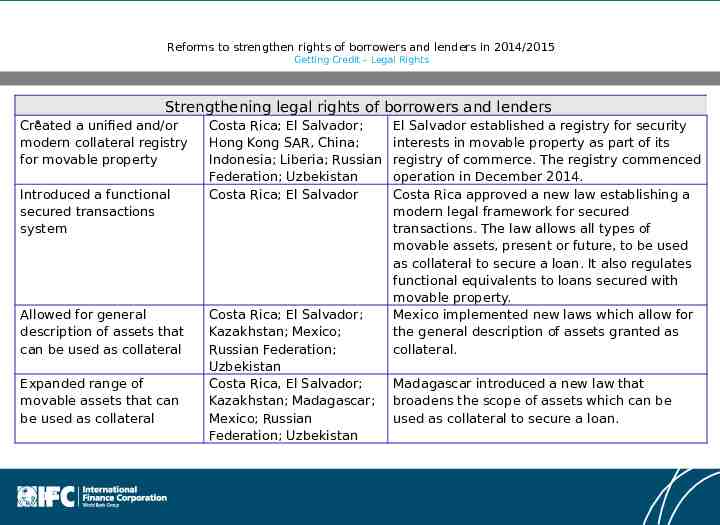

Reforms to strengthen rights of borrowers and lenders in 2014/2015 Getting Credit – Legal Rights Strengthening legal rights of borrowers and lenders Created a unified and/or modern collateral registry for movable property Introduced a functional secured transactions system Allowed for general description of assets that can be used as collateral Expanded range of movable assets that can be used as collateral 17 Costa Rica; El Salvador; Hong Kong SAR, China; Indonesia; Liberia; Russian Federation; Uzbekistan Costa Rica; El Salvador Costa Rica; El Salvador; Kazakhstan; Mexico; Russian Federation; Uzbekistan Costa Rica, El Salvador; Kazakhstan; Madagascar; Mexico; Russian Federation; Uzbekistan El Salvador established a registry for security interests in movable property as part of its registry of commerce. The registry commenced operation in December 2014. Costa Rica approved a new law establishing a modern legal framework for secured transactions. The law allows all types of movable assets, present or future, to be used as collateral to secure a loan. It also regulates functional equivalents to loans secured with movable property. Mexico implemented new laws which allow for the general description of assets granted as collateral. Madagascar introduced a new law that broadens the scope of assets which can be used as collateral to secure a loan.

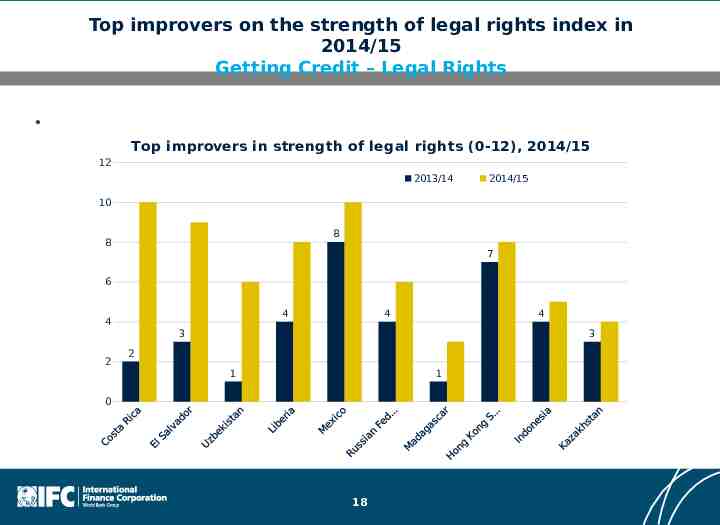

Top improvers on the strength of legal rights index in 2014/15 Getting Credit – Legal Rights Top improvers in strength of legal rights (0-12), 2014/15 12 2013/14 10 10 2014/15 10 9 8 8 8 8 7 6 6 6 5 4 4 4 4 3 2 3 2 1 1 0 18 4 3

Top performers in 2014/15 Getting Credit – Legal Rights Good common practices 19 1. Colombia 2. Montenegro 3. New Zealand 4. Australia 5. Cambodia 6. Micronesia, Fed. Sts. Establishing a functional approach to secured transactions Allowing a general description of collateral Maintaining a unified registry 7. Rwanda 8. United States 9. Costa Rica Protecting secured creditors’ rights during an automatic stay when a debtor enters a court-supervised reorganization procedure 10. Hungary Allowing out-of-court-enforcement

THANK YOU