1 CHDP DIRECTOR/DEPUTY DIRECTOR TRAINING SECTION VIII 7/1/2010

31 Slides290.62 KB

1 CHDP DIRECTOR/DEPUTY DIRECTOR TRAINING SECTION VIII 7/1/2010 Federal Financial Participation and Time Studies

2 FFP Background 7/1/2010

Federal Financial Participation (FFP) 3 Intended to provide local services in support of Medicaid by providing a cost match for personnel Created as part of Title XIX, Social Security Act of 1965 Provides variable federal matching rates for the administrative functions of the Medicaid Program (known as Medi-Cal in CA) 7/1/2010

4 Two Objectives That Permit Claims Under FFP Assisting individuals eligible for MediCal to enroll in the Medi-Cal program Involves outreach, assistance in enrollment and navigating through the various programs Assisting individuals on Medi-Cal to access Medi-Cal providers and services Involves ongoing care coordination to ensure the individuals’ service needs are being addressed 7/1/2010

5 Enhanced and Non-Enhanced Activities 7/1/2010

6 Enhanced and NonEnhanced Activities 2 Within the objectives is a clear need for personnel trained to identify medical issues that a layperson would not recognize Medical activities are referred to as Enhanced Non-medical activities are referred to as Non-Enhanced 7/1/2010

7 Fiscal Implications of Enhanced and Non-Enhanced Activities Enhanced: FFP matching rate of 75% for Skilled Professional Medical Personnel (SPMP) performing activities requiring specialized medical knowledge and skill Non-Enhanced: FFP matching rate of 50% for non-medical activities and the majority of expenses necessary for the proper and efficient operation of the program 7/1/2010

8 Qualifying Employees and SPMP 7/1/2010

9 Criteria Qualifying Personnel For FFP Must be: In an employee-employer relationship with County, or may be contract personnel Involved in activities that are necessary for proper and efficient administration of the Medi-Cal program 7/1/2010

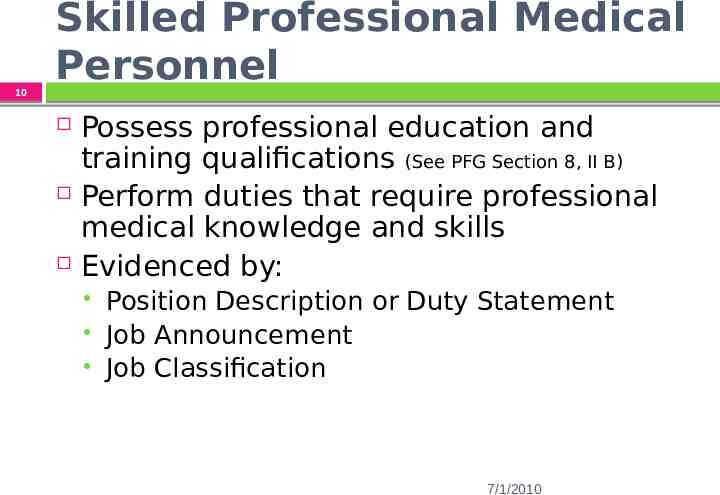

10 Skilled Professional Medical Personnel Possess professional education and training qualifications (See PFG Section 8, II B) Perform duties that require professional medical knowledge and skills Evidenced by: Position Description or Duty Statement Job Announcement Job Classification 7/1/2010

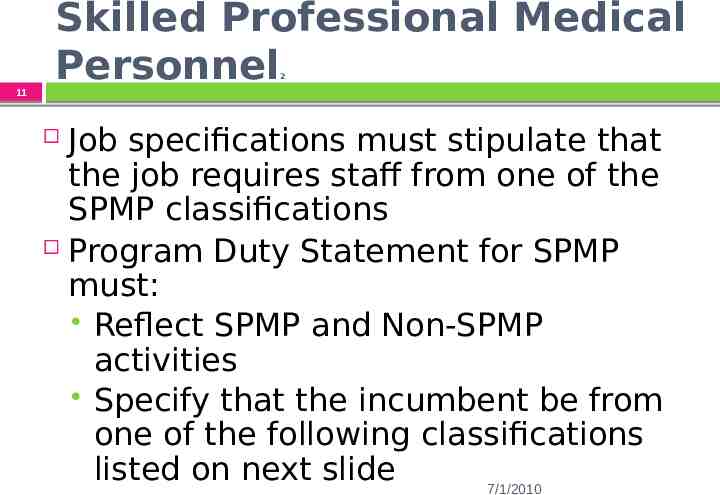

Skilled Professional Medical Personnel 2 11 Job specifications must stipulate that the job requires staff from one of the SPMP classifications Program Duty Statement for SPMP must: Reflect SPMP and Non-SPMP activities Specify that the incumbent be from one of the following classifications listed on next slide 7/1/2010

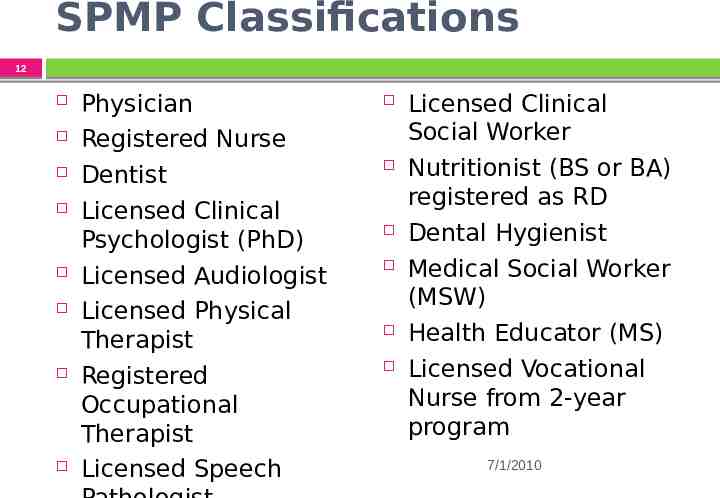

SPMP Classifications 12 Physician Registered Nurse Dentist Licensed Clinical Psychologist (PhD) Licensed Audiologist Licensed Physical Therapist Registered Occupational Therapist Licensed Speech Licensed Clinical Social Worker Nutritionist (BS or BA) registered as RD Dental Hygienist Medical Social Worker (MSW) Health Educator (MS) Licensed Vocational Nurse from 2-year program 7/1/2010

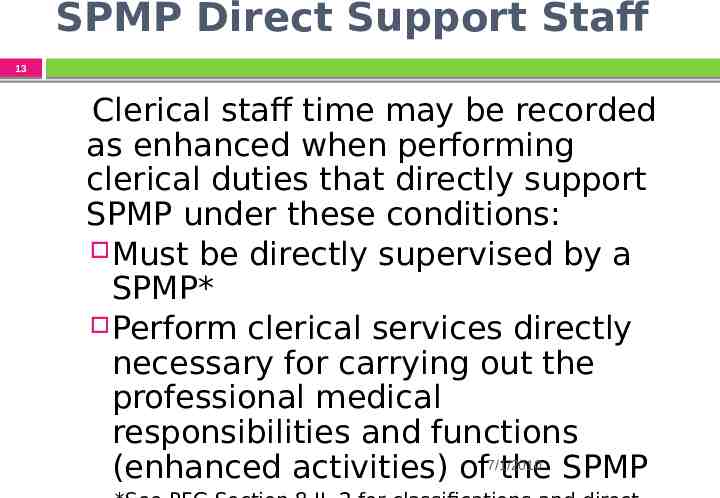

SPMP Direct Support Staff 13 Clerical staff time may be recorded as enhanced when performing clerical duties that directly support SPMP under these conditions: Must be directly supervised by a SPMP* Perform clerical services directly necessary for carrying out the professional medical responsibilities and functions (enhanced activities) of7/1/2010 the SPMP

14 Time Studies 7/1/2010

15 Personnel Required to Time Study Personnel who: Perform any combination of SPMP, non-SPMP, and/or non-claimable functions Work for more than one program Are funded through more than one budget 7/1/2010

16 Documents Required for Claiming FFP Documents that must be on file in local program: Organizational Chart Civil Service Job Classification/Specification Job Duty Statement for each position A completed SPMP Questionnaire (See PFG Section 8 pages 13 & 14) for each SPMP performing enhanced activities Time Cards or other time certification that document hours worked and paid time away from work, signed by employee’s 7/1/2010 supervisor

Supporting Documents for Time Study 17 Time Study supporting claiming materials include: Day Logs Appointment Books Meeting Agendas or Minutes SPMP Medical Training Documentation 7/1/2010

Record Retention 18 Original signed Time Studies, Time Study support documents, and the documents required for claiming FFP must be retained for a period no less than three (3) years after the reimbursement or until the completion of any current federal financial audit, whichever time is longer. 7/1/2010

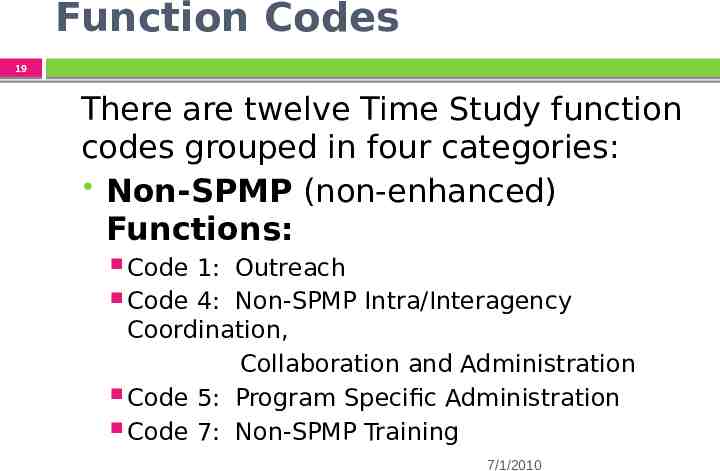

Function Codes 19 There are twelve Time Study function codes grouped in four categories: Non-SPMP (non-enhanced) Functions: Code 1: Outreach Code 4: Non-SPMP Intra/Interagency Coordination, Collaboration and Administration Code 5: Program Specific Administration Code 7: Non-SPMP Training 7/1/2010

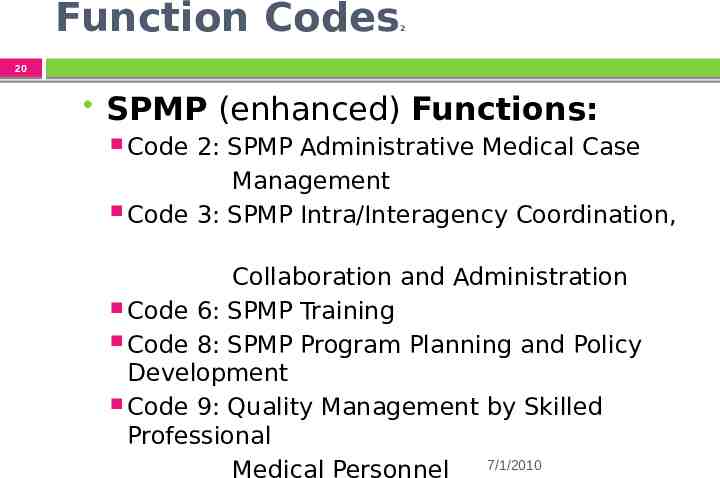

Function Codes 2 20 SPMP (enhanced) Functions: Code 2: SPMP Administrative Medical Case Management Code 3: SPMP Intra/Interagency Coordination, Collaboration and Administration Code 6: SPMP Training Code 8: SPMP Program Planning and Policy Development Code 9: Quality Management by Skilled Professional 7/1/2010 Medical Personnel

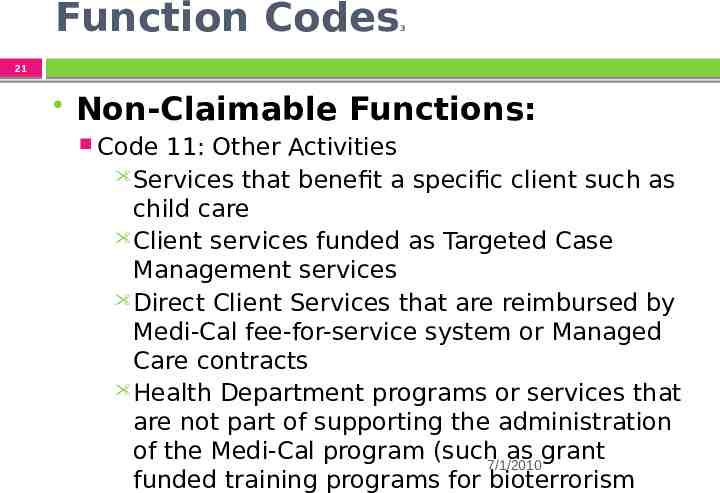

Function Codes 3 21 Non-Claimable Functions: Code 11: Other Activities Services that benefit a specific client such as child care Client services funded as Targeted Case Management services Direct Client Services that are reimbursed by Medi-Cal fee-for-service system or Managed Care contracts Health Department programs or services that are not part of supporting the administration of the Medi-Cal program (such7/1/2010 as grant funded training programs for bioterrorism

Function Codes 4 22 Allocated Functions: Code 10: Non-Program Specific General Administration (activities such as general staff meetings, computer training, budget development, overtime, earned compensatory time, etc.) Code 12: Paid Time Off (includes vacation, holiday, sick, or other paid time off) 7/1/2010

Function Codes 5 23 Only SPMP and qualifying clerical staff may record their time under all of the function codes. Staff qualifying as Non-SPMP are not to record any time under the SPMP function codes. 7/1/2010

24 General Time Study Instructions Must: Utilize the code numbers and function titles as specified and defined by the Department of Health Care Services’ Systems of Care Division Be completed during the same month (first, middle, or last) of each quarter for the fiscal year Reflect actual time spent on the functions for each program Account for all time each workday of the time study month Be signed and dated by the employee and 7/1/2010 the employee’s immediate supervisor

General Time Study Instructions 2 25 Complete time study form on a daily basis. Specify the program for which activities are performed. Record all time worked for the day (earned overtime/comp time recorded under General Administration function, regardless of activity). Round recorded time under a function to the nearest half-hour unless employer elects to have time rounded to a smaller increment. 7/1/2010

General Time Study Instructions 3 26 Record time for performing paperwork and travel under the function to which it pertains. If multiple functions or no identifiable function, record time under General Administration. Record time going to, attending, and returning from meetings to the function to which the meeting pertains. Do not record lunch, regular days off, leave without pay, or comp time taken. For Clerical staff when recording SPMP function in support of SPMP: Use the same function codes that reflect the SPMP’s 7/1/2010 activities.

Other Time Study Conditions 27 Staff who vacate before or are newly hired after the time study month may time study the month they are available during the quarter. Staff not performing their regular duties for more than two weeks of the time study month due to extended absences, may use the average of more than two previous Time Studies for that position or time study the next quarter and apply those to the previous quarter with a supplemental invoice. Call your Regional Consultant for technical 7/1/2010 assistance under other conditions.

Calculating FFP 28 There are two parts to calculating FFP for use in the quarterly program invoices. Time Study activity recording Calculating Time Study data into the FFP calculation file worksheets 7/1/2010

29 Time Study Recording Forms Time Study Forms may be monthly, weekly or daily and must contain: Name of staff Time study period All time the staff is reimbursed for Clearly identified function codes Clearly identified program code with each function code Signature of staff and supervisor verifying accuracy 7/1/2010

30 Monthly Time Study Form Example 7/1/2010

31 FFP Calculation Worksheets Calculations of the amounts of FFP require the use of the CMS-FFP Excel File found at the CHDP website under PFG Fill-in Forms. The CMS-FFP Calc is an Excel Workbook with three worksheets; two worksheets require data entry and one that produces the FFP allocation report. A CMS-FFP Calc must be completed for each employee time study. See PFG Section 8 to view 7/1/2010 the FFP