What You Need to Know About Financial Aid 2020-2021

39 Slides3.96 MB

What You Need to Know About Financial Aid 2020-2021

Topics We Will Discuss Tonight What is financial aid? Cost of attendance (COA) Expected family contribution (EFC) Financial need Categories, types, and sources of financial aid Free Application for Federal Student Aid (FAFSA) Special circumstances

What is Financial Aid? Financial aid consists of funds (scholarships, grants, loans, work-study) provided to students and families to help pay for postsecondary educational expenses.

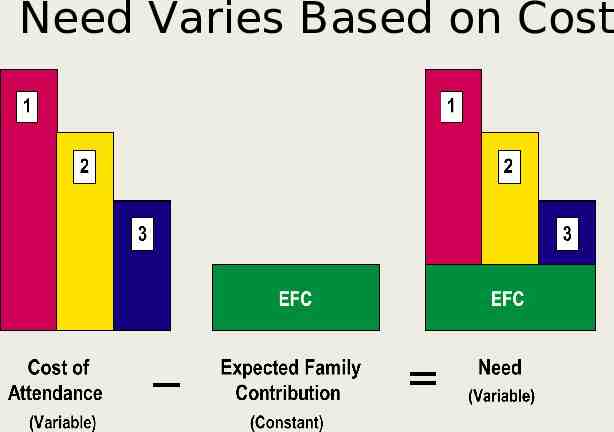

What is Cost of Attendance (COA)? COA includes: – – – – – Tuition & Fees Room & Board Books & Supplies Transportation Personal Expenses Direct v. Indirect Costs COA Varies widely from college to college

What is Expected Family Contribution (EFC)? Amount family can reasonably be expected to contribute Stays the same regardless of college Two components – Parent contribution – Student contribution Calculated using data from a federal application form and a federal formula

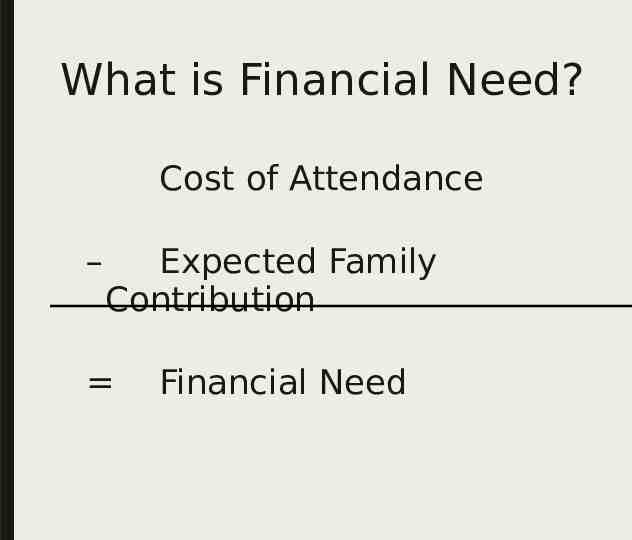

What is Financial Need? Cost of Attendance – Expected Family Contribution Financial Need

Need Varies Based on Cost

Types of Financial Aid Gift Aid Scholarships Grants Self-Help Aid Loans Employment Sources of Financial Aid Federal government States Colleges and universities Private sources Civic organizations and churches Employers

What’s Out There for Students? Pell Grants – Based on EFC – – Automatic with eligibility 2019-20 maximum annual award amount 6,195 FSEOG – Supplemental grant for the neediest of students – Based on availability TEACH Grant – For those planning to teach in high-need fields – Agreement to Serve Kansas Comprehensive Grant – Determined by the KS Legislators – Available at 4-year Colleges & Universities – Based on availability

What’s Out There . . . (continued) Federal Work Study – – Federal dollars paid in exchange for part-time employment in designated jobs School comes first Federal Direct Loans – Subsidized – Unsubsidized – Freshman Annual Loan Limit 5500 – 2019-20 Interest Rate 4.53%

What’s Out There . . . (continued) Federal Direct Loans (cont’d) – Parent PLUS Loans – 2019-20 Interest Rate 7.08% Private/Alternative Loans – Exhaust federal aid options first

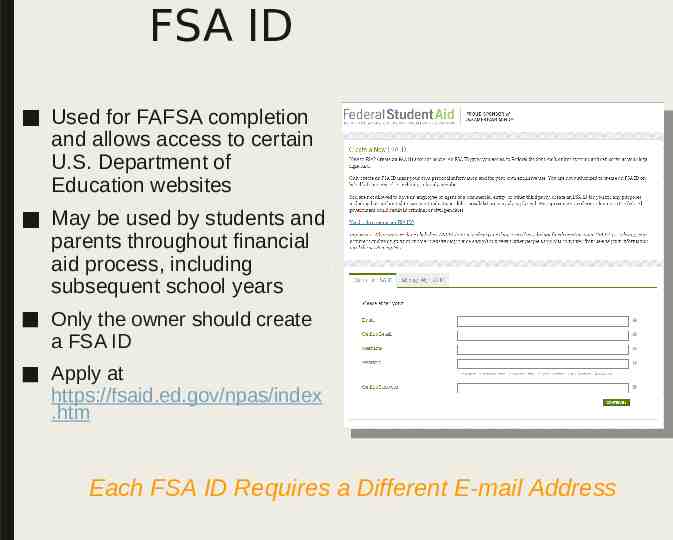

FSA ID Used for FAFSA completion and allows access to certain U.S. Department of Education websites May be used by students and parents throughout financial aid process, including subsequent school years Only the owner should create a FSA ID Apply at https://fsaid.ed.gov/npas/index .htm Each FSA ID Requires a Different E-mail Address

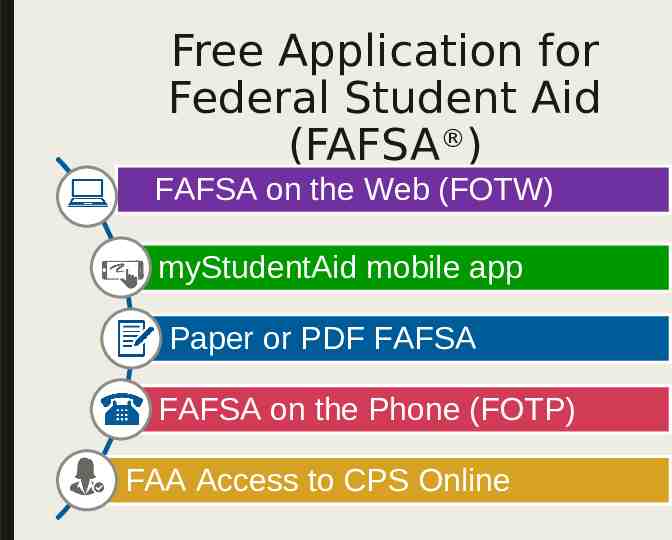

Free Application for Federal Student Aid (FAFSA ) FAFSA on the Web (FOTW) myStudentAid mobile app Paper or PDF FAFSA FAFSA on the Phone (FOTP) FAA Access to CPS Online

FAFSA on the Web (FOTW)

FAFSA on the Web (FOTW)

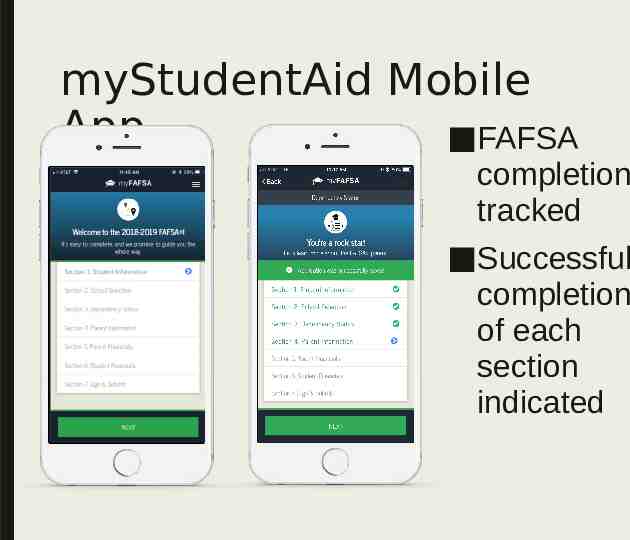

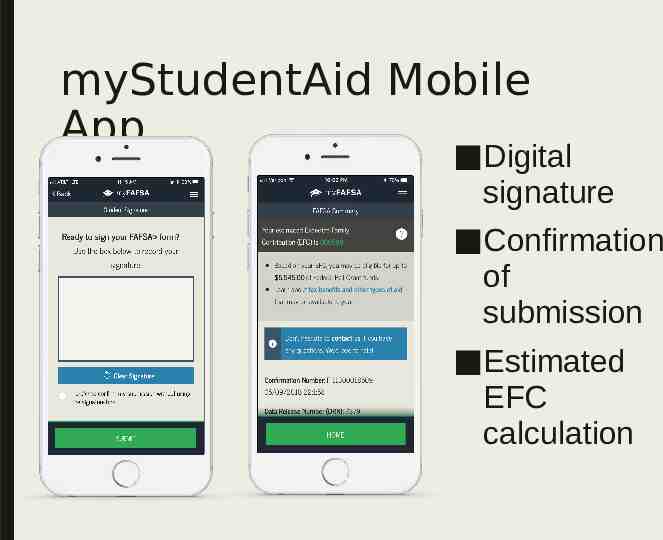

myStudentAid Mobile App Mobile ability to begin, complete, save, and submit the FAFSA

myStudentAid Mobile App Information protected the same as FOTW Prompts applicant to create a save key, allowing completion at later time

myStudentAid Mobile App FAFSA completion tracked Successful completion of each section indicated

myStudentAid Mobile App Digital signature Confirmation of submission Estimated EFC calculation

FAFSA

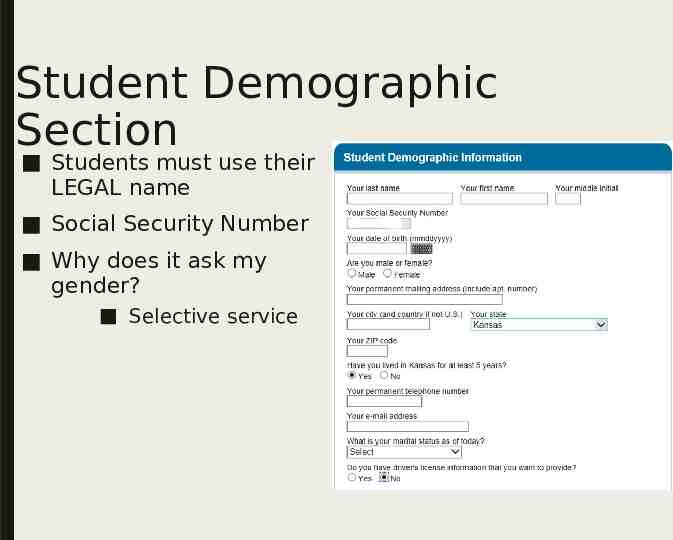

Student Demographic Section Students must use their LEGAL name Social Security Number Why does it ask my gender? Selective service

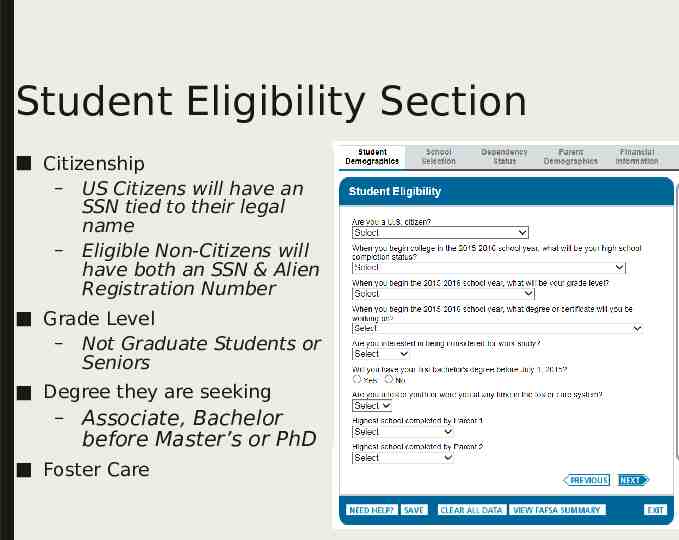

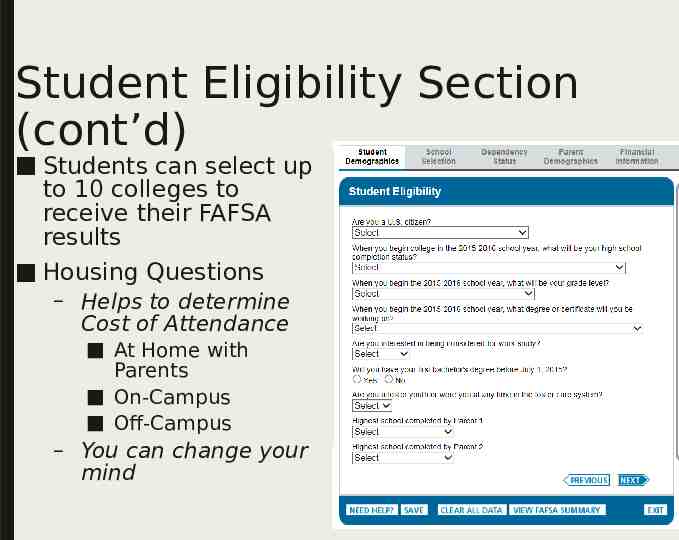

Student Eligibility Section Citizenship – US Citizens will have an SSN tied to their legal name – Eligible Non-Citizens will have both an SSN & Alien Registration Number Grade Level – Not Graduate Students or Seniors Degree they are seeking – Associate, Bachelor before Master’s or PhD Foster Care

Student Eligibility Section (cont’d) Students can select up to 10 colleges to receive their FAFSA results Housing Questions – Helps to determine Cost of Attendance At Home with Parents On-Campus Off-Campus – You can change your mind

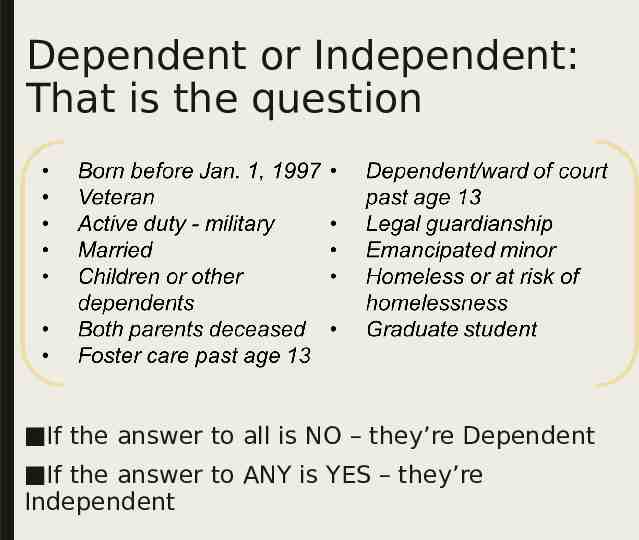

Dependent or Independent: That is the question If the answer to all is NO – they’re Dependent If the answer to ANY is YES – they’re Independent

Parent Information on the FAFSA Who is my parent when it comes to the FAFSA? – If parents are living together, regardless of marital status, include their combined financial information This includes same-sex partners – If parents are divorced or separated, include the financial information for the parent you lived with more during the past 12 months. If that parent is remarried, you must include your stepparent’s financial information. Grandparents, foster parents, and legal guardians are NOT considered parents unless they legally adopted you

What information do I need to have with me to complete the FAFSA? Taxes, Income information, benefit summaries Asset information – NOT 401(k) or IRA balances – NOT the value of your primary residence Untaxed income such as child support received

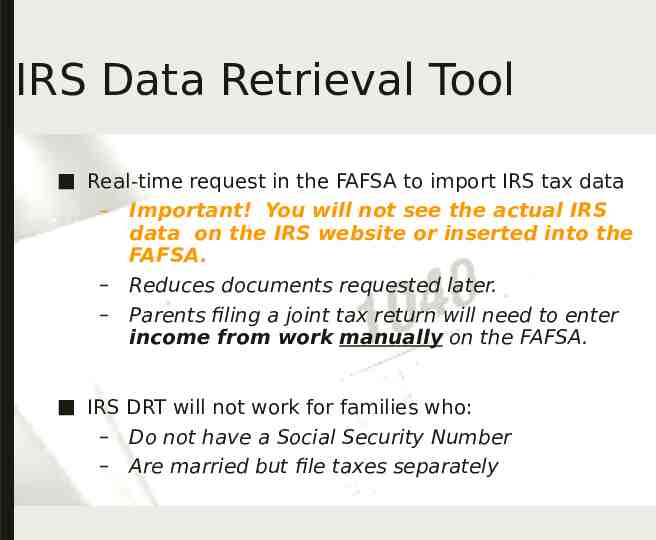

IRS Data Retrieval Tool Real-time request in the FAFSA to import IRS tax data – Important! You will not see the actual IRS data on the IRS website or inserted into the FAFSA. – Reduces documents requested later. – Parents filing a joint tax return will need to enter income from work manually on the FAFSA. IRS DRT will not work for families who: – Do not have a Social Security Number – Are married but file taxes separately

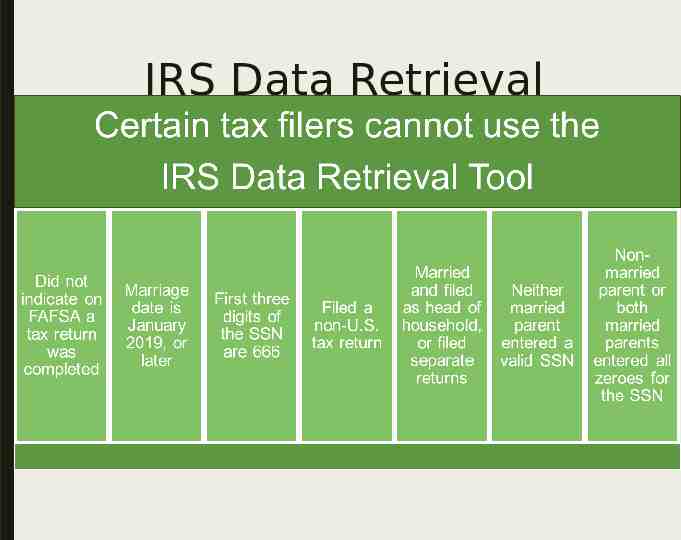

IRS Data Retrieval Tool

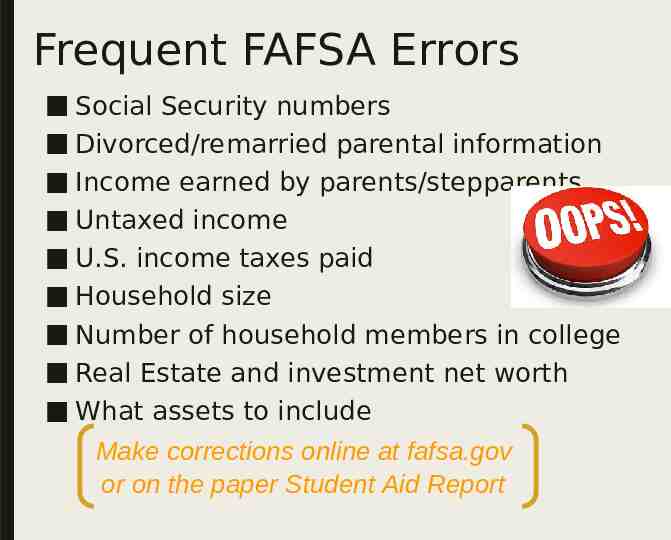

Frequent FAFSA Errors Social Security numbers Divorced/remarried parental information Income earned by parents/stepparents Untaxed income U.S. income taxes paid Household size Number of household members in college Real Estate and investment net worth What assets to include Make corrections online at fafsa.gov or on the paper Student Aid Report

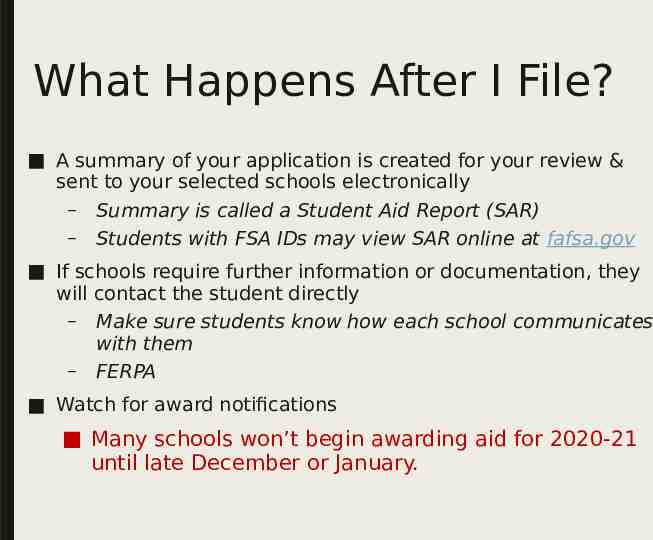

What Happens After I File? A summary of your application is created for your review & sent to your selected schools electronically – Summary is called a Student Aid Report (SAR) – Students with FSA IDs may view SAR online at fafsa.gov If schools require further information or documentation, they will contact the student directly – Make sure students know how each school communicates with them – FERPA Watch for award notifications Many schools won’t begin awarding aid for 2020-21 until late December or January.

Special Circumstances Cannot be documented using FAFSA – Change in employment status – Unusual medical expenses not covered by insurance – Change in parent marital status Send written explanation and documentation to financial aid office at each college College will review and request additional information if necessary Decisions are final and cannot be appealed to U.S. Department of Education

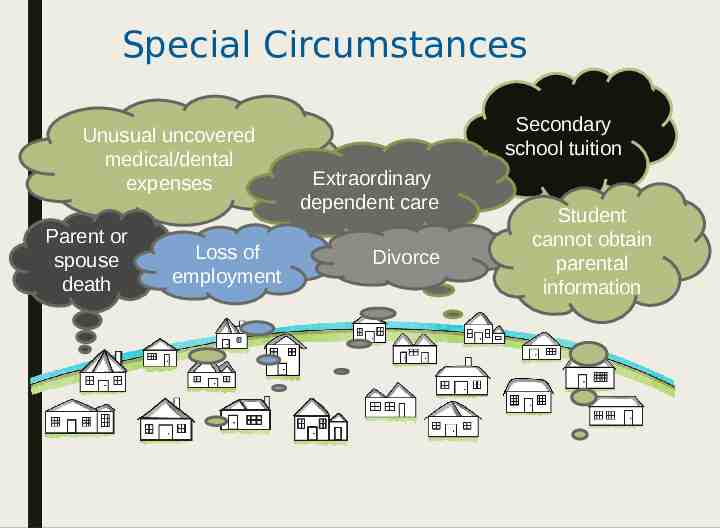

Special Circumstances Unusual uncovered medical/dental expenses Parent or spouse death Loss of employment Secondary school tuition Extraordinary dependent care Divorce Student cannot obtain parental information

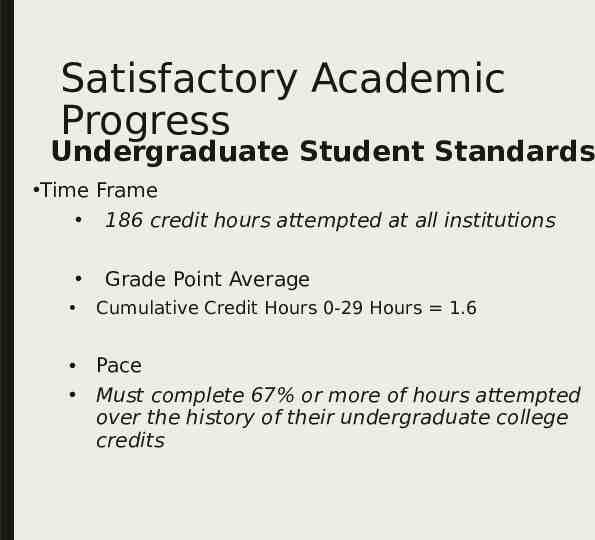

Satisfactory Academic Progress Undergraduate Student Standards Time Frame 186 credit hours attempted at all institutions Grade Point Average Cumulative Credit Hours 0-29 Hours 1.6 Pace Must complete 67% or more of hours attempted over the history of their undergraduate college credits

How Do Scholarships Work? Scholarships are considered “gift aid” similar to grants – Some have restrictions on what they will pay Direct costs only? Are there enrollment restrictions? – They come from multiple sources Institutions Organizations Employers The list is growing every day

Where Do I Find Them? Institutions – Is there an application? Are there MULTIPLE applications? – When do I apply? What is the deadline? – Is it based on Merit or Need? What do they need to determine eligibility? – – Does it require follow-up? Is it renewable? What are the requirements for renewal?

Kansas Board of Regents http://kansasregents.org/students/student financial aid/scho larships and grants

Kansas State Programs Kansas State Scholarship Kansas Ethnic Minority Scholarship Career Technical Workforce Grant Kansas Career Work Study Program Military Service Scholarship Kansas Teacher Service Scholarship Kansas Nursing Service Scholarship National Guard Educational Assistance Program ROTC Tuition Waiver Dependents & Spouses of Deceased Public Safety Officers Dependents & Spouses of Military Personnel Former Prisoners of War

Where do I go from here? Obtain and review admissions and financial aid Web sites and materials for each school to which you are applying. Meet all application deadlines. – Complete FAFSA and other application materials. Submit all requested follow-up documents. Investigate other sources of aid.

QUESTIONS?