Welcome to Medicare Julie Fick, Elder Benefit Specialist ADRC

51 Slides2.69 MB

Welcome to Medicare Julie Fick, Elder Benefit Specialist ADRC of Buffalo & Pepin Counties April 13th, 2021

2

Presentation Outline Enrollment in Medicare Medicare Basics Your Coverage Choices SeniorCare Help for People with Limited Income Words of Caution Find more detailed information in your Medicare & You 2021 Handbook. 3

What is Medicare Medicare is Health Insurance for three groups of people Age 65 or older Under age 65 with certain disabilities who are entitled to Social Security Disability Any age with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant) 4

Enrollment in Medicare

Enrollment in Medicare If you already get benefits from Social Security or Railroad Retirement, you are automatically enrolled in Part A & B the first day of the month you turn 65. If you are close to 65 but currently don’t receive Social Security benefits, you need to enroll in Part A & B with Social Security during your Initial Enrollment Period. (Next Slide.) How to enroll: Visit socialsecurity.gov or Call Social Security at 1-800-772-1213 Or for the local office: Eau Claire Field Office 1-866-815-2924 If you are under 65 and disabled, you are automatically enrolled in Medicare after receiving 24 consecutive months of SSDI.

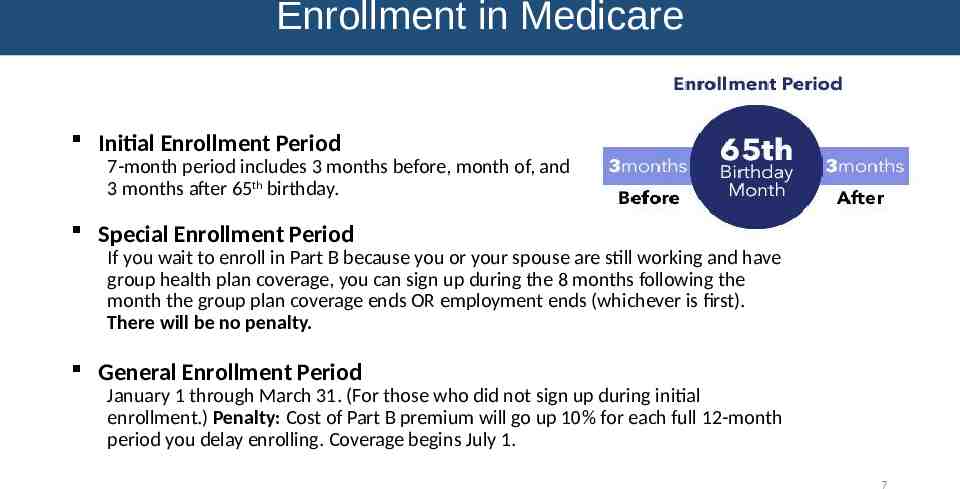

Enrollment in Medicare Initial Enrollment Period 7-month period includes 3 months before, month of, and 3 months after 65th birthday. Special Enrollment Period If you wait to enroll in Part B because you or your spouse are still working and have group health plan coverage, you can sign up during the 8 months following the month the group plan coverage ends OR employment ends (whichever is first). There will be no penalty. General Enrollment Period January 1 through March 31. (For those who did not sign up during initial enrollment.) Penalty: Cost of Part B premium will go up 10% for each full 12-month period you delay enrolling. Coverage begins July 1. 7

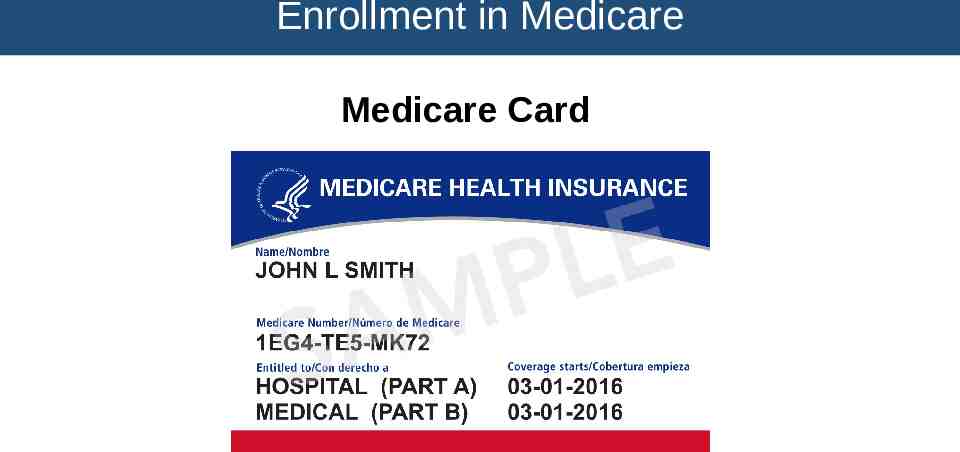

Enrollment in Medicare Medicare Card

Medicare Basics 9

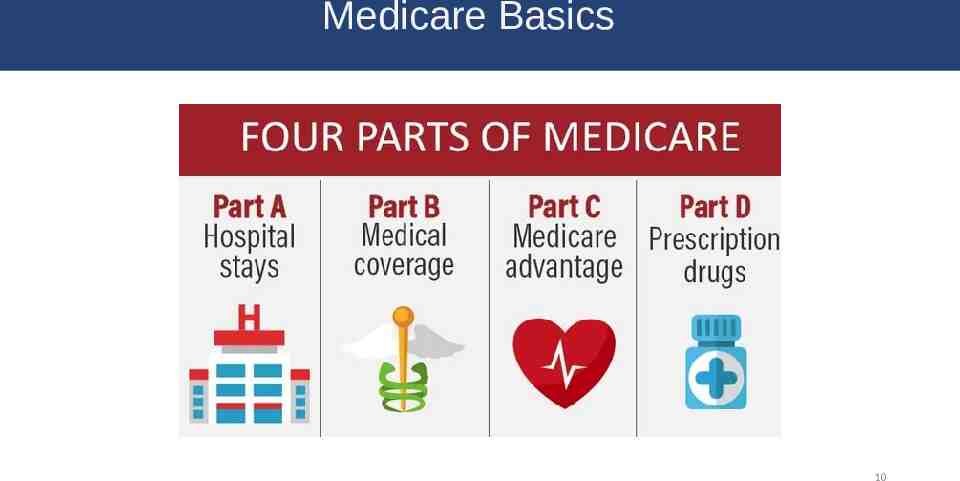

Medicare Basics 10

Medicare Basics Medicare Part A r Part A Hospital Insurance 11

Medicare Part A Part A – Hospital Insurance In general helps cover: Part A Hospital Insurance Inpatient care in a hospital Skilled nursing facility care Nursing home care (must be inpatient care in a skilled nursing facility that’s not custodial or long-term care) Home health care Hospice care 12

Medicare Part A – 2021 Costs Premium — No premium for most people Part A Hospital Insurance Deductible — 1,484 for inpatient stays (days 1-60) Copays – Hospital Inpatient Skilled Nursing Facility Home health care — 0 copay. Hospice care — 0 copay. Out-of-pocket maximum — None in Original Medicare. 13

Medicare Basics Medicare Part B Part B Medical Insurance 14

Medicare Part B Part B — Medical Insurance Helps cover medically necessary: Part B Medical Insurance Doctors’ services Outpatient medical and surgical services and supplies Clinical lab tests Durable medical equipment (may need to use certain suppliers) Diabetic testing supplies Preventive services (like flu shots and a yearly wellness visit) 15

Medicare Part B – 2021 Costs Monthly Premium – Standard premium is 148.50 (or higher depending on your income) Part B Medical Insurance Yearly deductible – 203 Coinsurance – 20% coinsurance for most covered services, like doctor’s services and some preventive services 0 for many preventive services. 16

Your Coverage Choices 17

The Gaps Medicare does not pay 100% of your medical bills. You may choose to purchase a Medicare Supplement (Medigap) policy if you have Original Medicare or You may choose to enroll in a Medicare Advantage Plan. 18

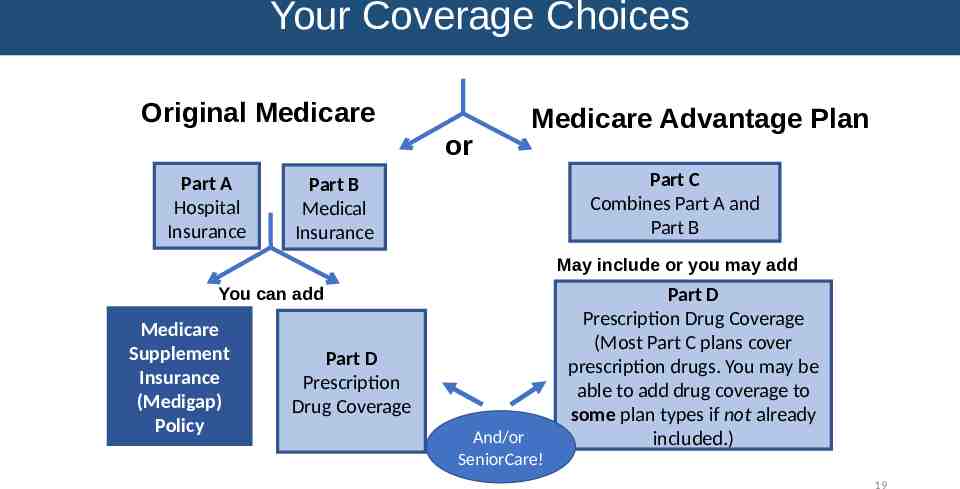

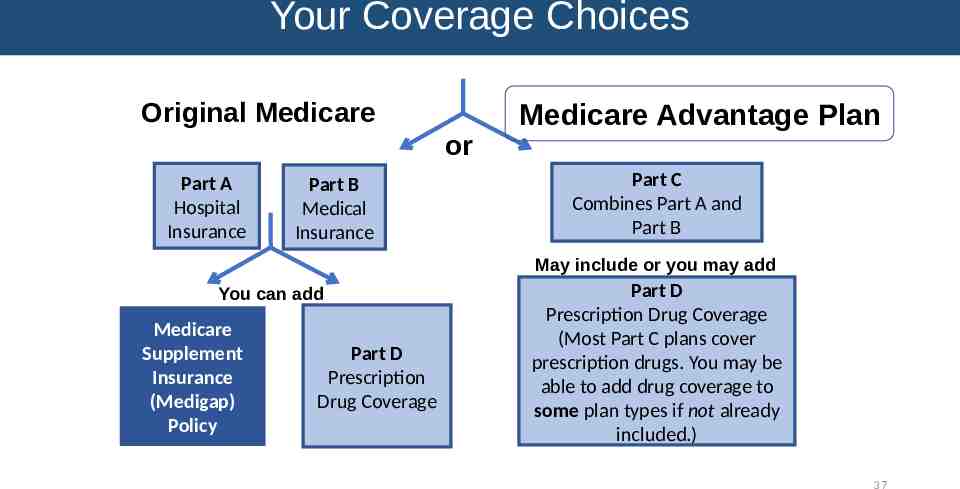

Your Coverage Choices Original Medicare or Part A Hospital Insurance Medicare Advantage Plan Part C Combines Part A and Part B Part B Medical Insurance May include or you may add You can add Medicare Supplement Insurance (Medigap) Policy Part D Prescription Drug Coverage And/or SeniorCare! Part D Prescription Drug Coverage (Most Part C plans cover prescription drugs. You may be able to add drug coverage to some plan types if not already included.) 19

Original Medicare Part A Hospital Insurance Original Medicare is Part A (Hospital Insurance) and/or Part B (Medical Insurance). Medicare provides coverage. You have your choice of doctors, hospitals, and other providers that accept Medicare Part B Medical Insurance You can add Medicare Supplement (Medigap) Insurance Part D 20

Original Medicare Medicare Supplement Policies (Medigap) 21

Medicare Supplement (Medigap) Insurance Private Insurance to supplement Original Medicare. All policies are Approved & regulated by WI Commissioner of Insurance. Helps pay some health care costs that Original Medicare doesn’t cover. Once Medicare pays its share of Medicare-approved amounts for covered costs, then your Medigap policy pays its share. You pay a monthly premium for this type of plan. ( 125 to 350 month) Costs vary depending on insurance company, optional benefits selected, age of applicant, where applicant lives. No need to review coverage yearly. 22

Medigap Insurance Types of Policies Traditional Medicare Supplement Policies Attained Age – As you age your premiums will change to meet your age range and premiums become higher.* Issue Age – Premiums are set at the age you are when you buy the policy and will not increase because you get older.* Premiums may increase for other reasons. Cost-Sharing Supplemental Policies (50% or 25% cost sharing) High-Deductible Medicare Supplement Medicare Select 23

Medigap Insurance Basic Benefits: 20% approved amount after Medicare on most services Wisconsin Mandated Benefits:: Wisconsin insurance law requires that supplement polices contain certain mandated benefits. These benefits are available even when Medicare does not cover the expenses. Only applies to policies issued in Wisconsin to Wisconsin residents 24

Medigap Insurance Optional Riders (Benefits): Part A Deductible (or Part A 50% Deductible) Part B Deductible* Part B Copay/Coinsurance (reduces premiums) Part B Excess Charges Additional Home Health (up to 365 visits per year) Emergency Foreign Travel *As of January 1, 2020 the Part B Deductible rider is no longer an option for people newly eligible for Medicare. (Still available for those eligible prior to 1/1/20.) 25

Medigap Insurance Office of the Commissioner of Insurance of Wisconsin (OCI) 2021 Medicare Supplement Insurance Policies List (companies selling Medicare supplement policies in Wisconsin) Guide to Health Insurance for People with Medicare in Wisconsin OCI's mission is www.oci.wi.gov or 1-800-236-8517 to protect and educate Wisconsin consumers by maintaining and promoting a strong insurance industry. 26

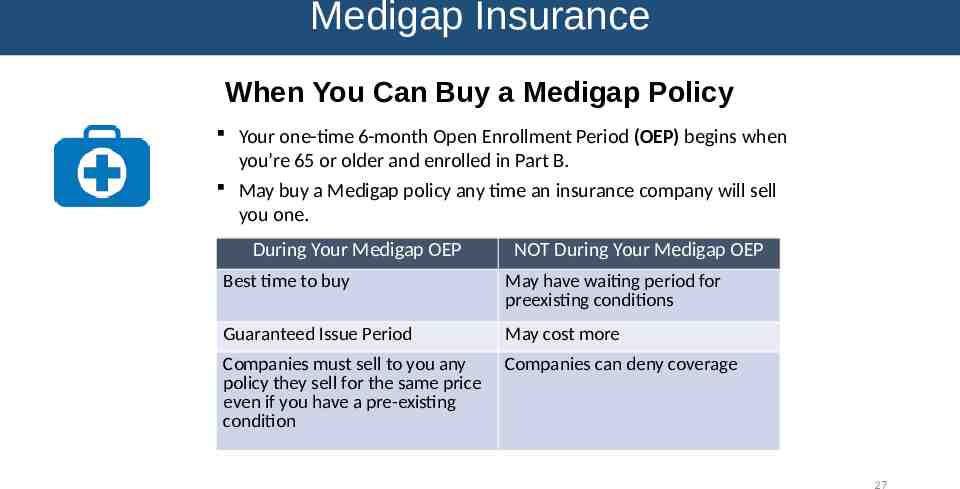

Medigap Insurance When You Can Buy a Medigap Policy Your one-time 6-month Open Enrollment Period (OEP) begins when you’re 65 or older and enrolled in Part B. May buy a Medigap policy any time an insurance company will sell you one. During Your Medigap OEP NOT During Your Medigap OEP Best time to buy May have waiting period for preexisting conditions Guaranteed Issue Period May cost more Companies must sell to you any policy they sell for the same price even if you have a pre-existing condition Companies can deny coverage 27

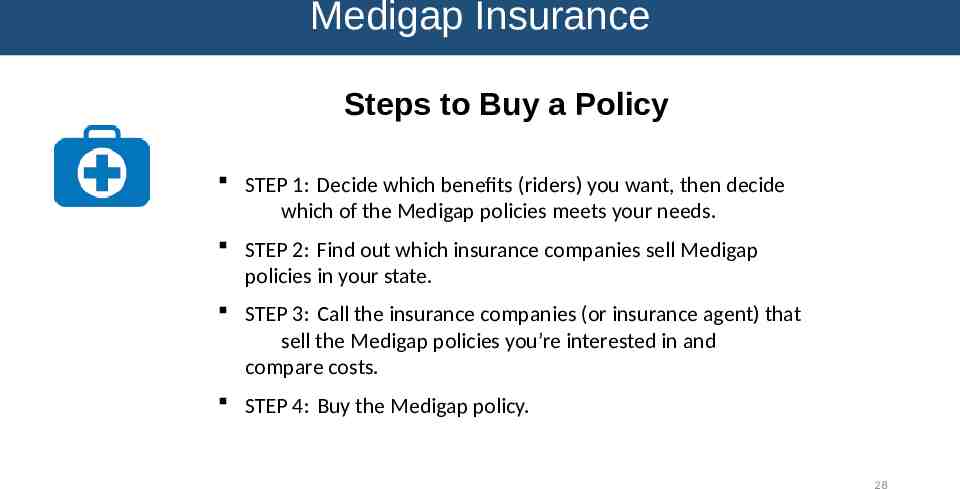

Medigap Insurance Steps to Buy a Policy STEP 1: Decide which benefits (riders) you want, then decide which of the Medigap policies meets your needs. STEP 2: Find out which insurance companies sell Medigap policies in your state. STEP 3: Call the insurance companies (or insurance agent) that sell the Medigap policies you’re interested in and compare costs. STEP 4: Buy the Medigap policy. 28

Medigap Insurance For Questions Contact: WI SHIP Medigap Helpline 1-800-242-1060 Commissioner of Insurance 1-800-236-8517 https://oci.wi.gov Medicare 1-800-MEDICARE www.Medicare.gov ADRC of Buffalo & Pepin Co 1-866-578-2372 www.adrc-bcp.com January 2021 Welcome to Medicare Presentation 29

Medicare Part D Part D Medicare prescription drug coverage Medicare Prescription Drug Coverage 30

Medicare Part D To receive Part D coverage, you must enroll in a Part D Plan. Part D Medicare prescription drug coverage Covers prescription medications. Run by private companies that contract with Medicare. Part D Plans are provided through: Medicare Prescription Drug Plans (PDPs) that work with Original Medicare. Medicare Advantage Prescription Drug Plans (MA-PDs). You can compare plans and enroll in a plan on the Plan Finder at: www.medicare.gov 31

Medicare Part D – Costs Premiums, Deductibles, and Copays or Coinsurance Part D Medicare prescription drug coverage Costs vary by plan and change annually. 2021 plan premiums range from 7.30 to 132.30 per month. 2021 deductible is 445. Copays and coinsurance may vary per drug, per plan, per pharmacy. Note: Income Related Monthly Adjustment Amount (IRMAA) People with Part D who have higher incomes will pay an additional amount on top of their premium. 32

Medicare Part D – Costs Part D Medicare prescription drug coverage Late Enrollment Penalty You may pay a late enrollment penalty if you did not enroll in Part D during the IEP and did not have other creditable coverage*. The penalty is 1% of the average national monthly premium for every month you delayed enrollment. The penalty will be added to your monthly premium if and when you enroll in a Part D plan, and it will continue as long as you are enrolled *Creditable Coverage: Other prescription drug coverage that is expected to pay, on average, at least as much as Medicare’s standard Part D coverage, such as: Veterans drug coverage SeniorCare Some types of Employer Coverage 33

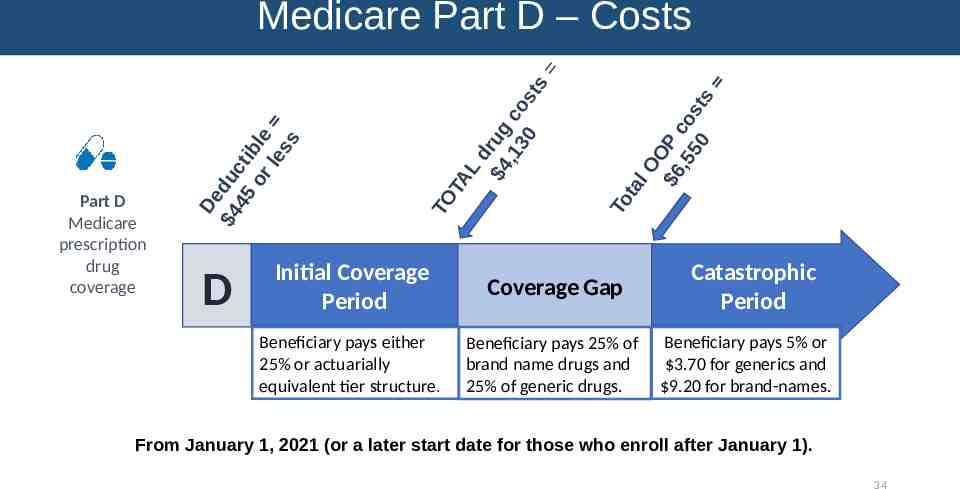

D s al OO 6 P ,5 co 50 st To t dr 4 ug ,1 co 30 s t TO TA L Part D Medicare prescription drug coverage De 4 du 45 cti or bl e le ss s Medicare Part D – Costs Initial Coverage Period Coverage Gap Beneficiary pays either 25% or actuarially equivalent tier structure. Beneficiary pays 25% of brand name drugs and 25% of generic drugs. Catastrophic Period Beneficiary pays 5% or 3.70 for generics and 9.20 for brand-names. From January 1, 2021 (or a later start date for those who enroll after January 1). 34

Medicare Part D What is Covered Part D Medicare prescription drug coverage Prescribed medications Medications that are included in a plan’s formulary- which is the plan’s list of covered drugs **Not all medications are covered by all plans** Medications must be for medically prescribed use. 35

Medicare Part D What Is Not Covered? Medications that are not on a plan’s formulary are usually not covered. Non-prescription, over-the-counter drugs Drugs that are not approved by the Federal Drug Administration (FDA) Vitamins and minerals Cough medicine Drugs for cosmetic purposes Weight loss or weight gain Hair loss 36

Your Coverage Choices Original Medicare or Part A Hospital Insurance Part B Medical Insurance Medicare Advantage Plan Part C Combines Part A and Part B May include or you may add You can add Medicare Supplement Insurance (Medigap) Policy Part D Prescription Drug Coverage Part D Prescription Drug Coverage (Most Part C plans cover prescription drugs. You may be able to add drug coverage to some plan types if not already included.) 37

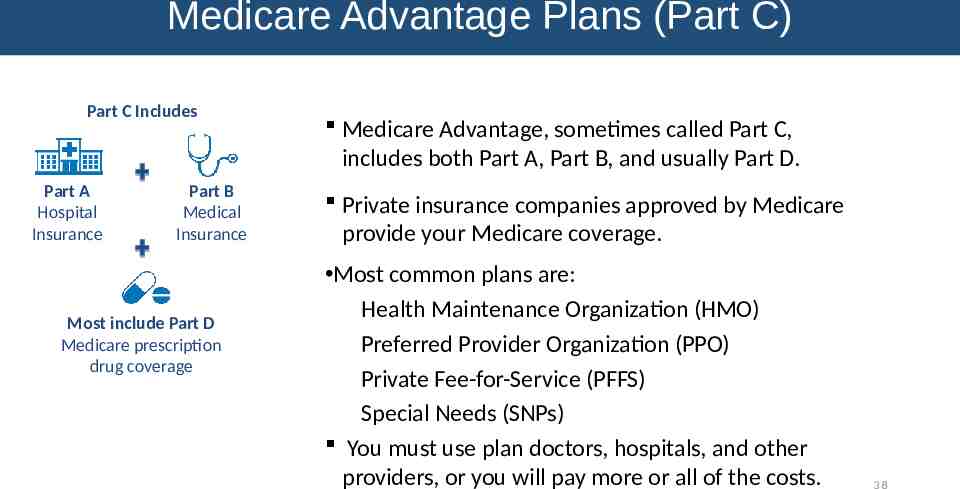

Medicare Advantage Plans (Part C) Part C Includes Part A Hospital Insurance Part B Medical Insurance Most include Part D Medicare prescription drug coverage Medicare Advantage, sometimes called Part C, includes both Part A, Part B, and usually Part D. Private insurance companies approved by Medicare provide your Medicare coverage. Most common plans are: Health Maintenance Organization (HMO) Preferred Provider Organization (PPO) Private Fee-for-Service (PFFS) Special Needs (SNPs) You must use plan doctors, hospitals, and other providers, or you will pay more or all of the costs. 38

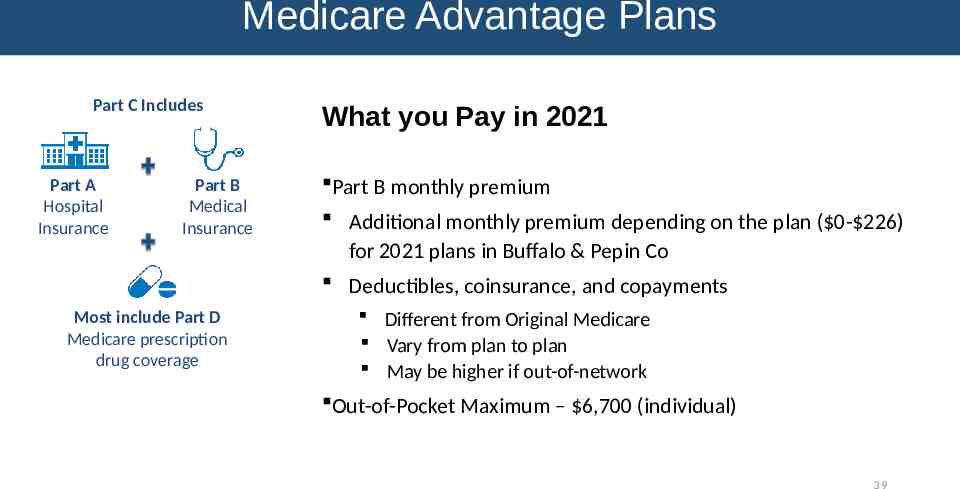

Medicare Advantage Plans Part C Includes Part A Hospital Insurance Part B Medical Insurance Most include Part D Medicare prescription drug coverage What you Pay in 2021 Part B monthly premium Additional monthly premium depending on the plan ( 0- 226) for 2021 plans in Buffalo & Pepin Co Deductibles, coinsurance, and copayments Different from Original Medicare Vary from plan to plan May be higher if out-of-network Out-of-Pocket Maximum – 6,700 (individual) 39

Medicare Advantage Plans Part C Includes Part A Hospital Insurance Part B Medical Insurance Most include Part D Medicare prescription drug coverage If you join a Medicare Advantage Plan you: Still get all services covered by Part A and Part B, but you get them through the Medicare Advantage Plan. May choose a plan that includes Part D prescription drug coverage. Can’t be charged more for certain services than you would pay under Original Medicare. May choose a plan that includes extra benefits not covered by Original Medicare, such as vision, hearing or dental care. 40

Medicare Parts C & D Annual Open Enrollment Period October 15th – December 7th Medicare Advantage Plans (Part C) and Medicare Prescription Drug Plans (Part D) can change their plan details each year. Plan formularies, pharmacy networks, premiums, and other costs can change each year. Review your current plan each year! 41

The Medicare Plan Finder Click “Find Health & Drug Plans?” Compare plans at www.medicare.gov Personalize your search to find plans that meet your needs. Compare plans based on star ratings, formularies, benefits, costs, and more. 42

SeniorCare Wisconsin’s Prescription Drug Assistance Program Available to Wisconsin residents age 65 and over who are U.S. citizens or have qualifying immigrant status. 30 annual application fee. (No monthly premium.) No asset limit. Creditable coverage. Your annual income determines your level of coverage. No deductible at Level 1. Level 2a and 2b have a deductible. Level 3 has a deductible and spenddown. May use alone or in addition to Part D. For more information or to access an application online: www.dhs.Wisconsin.gov/seniorcare Or call: 1-800-657-2038 43

Other Types of Health Insurance Employer/Retiree Group Health Plan Some offer creditable prescription coverage. Contact your employer or union benefits administrator to find out how your insurance works with Medicare. Military Coverage: VA or TriCare Medical Assistance/Low Income Programs 44

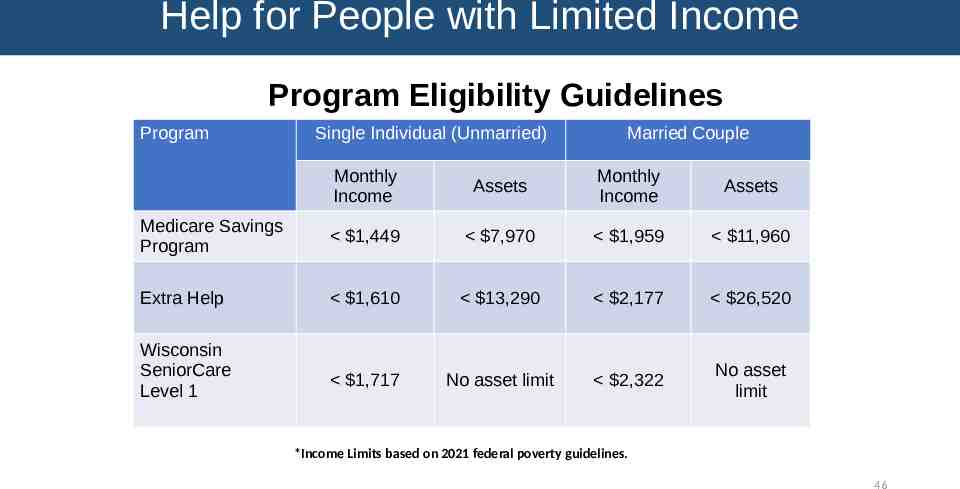

Help for People with Limited Income Medicare Savings Programs If eligible, your Medicare Part B premium will be paid for you. Some also have Medicare copays and deductibles paid (eligibility based on income and assets) Extra Help (Low Income Subsidy) Assistance with Medicare prescription drug coverage. Reduces Part D premiums, deductibles, and copays (eligibility based on income and assets) Senior Care Level of assistance depends on annual income. Level 1 has no deductible and pay 5 generic/ 15 brand name prescription 45

Help for People with Limited Income Program Eligibility Guidelines Program Single Individual (Unmarried) Married Couple Monthly Income Assets Monthly Income Assets Medicare Savings Program 1,449 7,970 1,959 11,960 Extra Help 1,610 13,290 2,177 26,520 1,717 No asset limit 2,322 No asset limit Wisconsin SeniorCare Level 1 *Income Limits based on 2021 federal poverty guidelines. 46

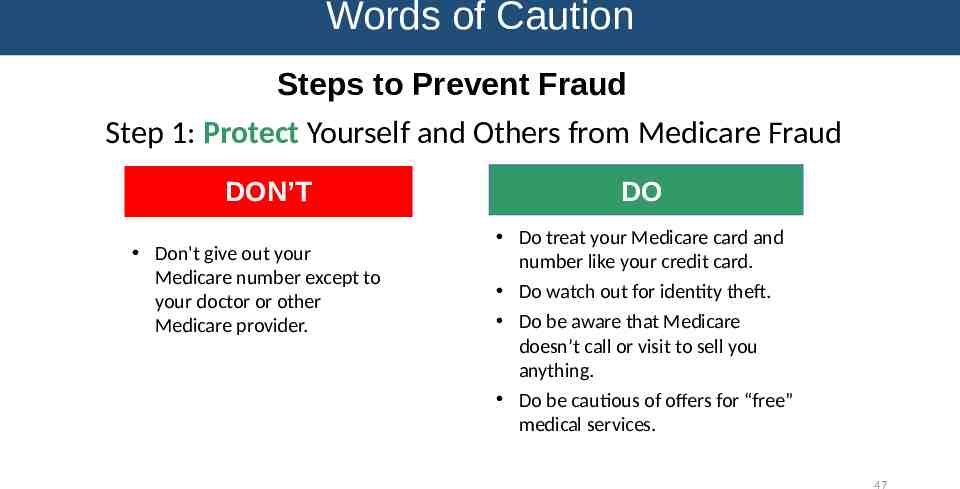

Words of Caution Steps to Prevent Fraud Step 1: Protect Yourself and Others from Medicare Fraud DON’T Don't give out your Medicare number except to your doctor or other Medicare provider. DO Do treat your Medicare card and number like your credit card. Do watch out for identity theft. Do be aware that Medicare doesn’t call or visit to sell you anything. Do be cautious of offers for “free” medical services. 47

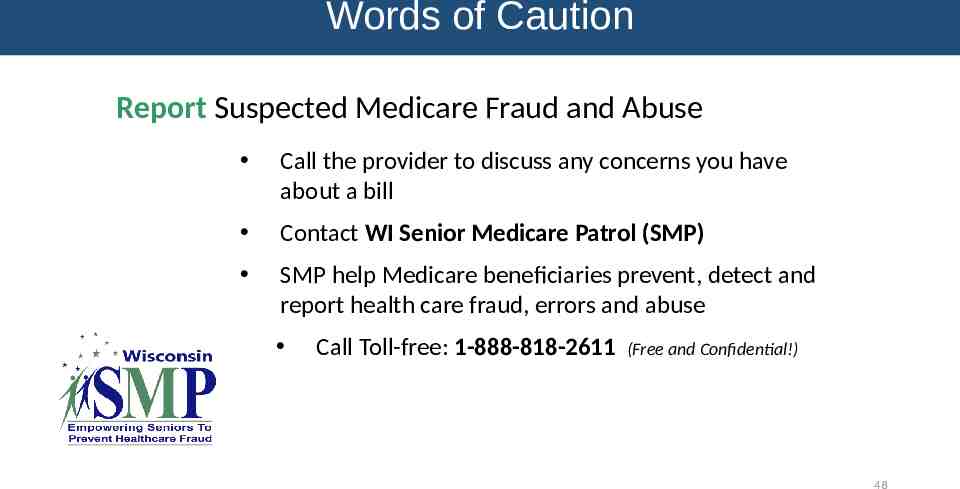

Words of Caution Report Suspected Medicare Fraud and Abuse Call the provider to discuss any concerns you have about a bill Contact WI Senior Medicare Patrol (SMP) SMP help Medicare beneficiaries prevent, detect and report health care fraud, errors and abuse Call Toll-free: 1-888-818-2611 (Free and Confidential!) 48

49

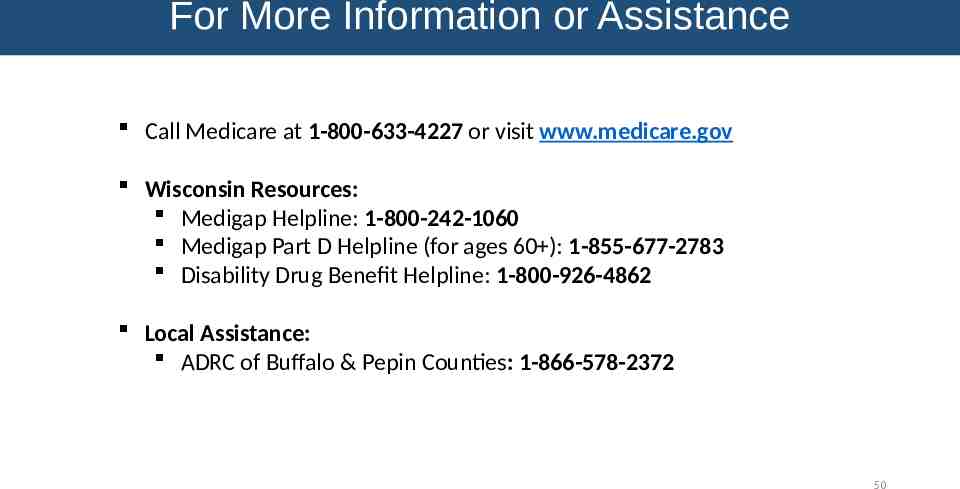

For More Information or Assistance Call Medicare at 1-800-633-4227 or visit www.medicare.gov Wisconsin Resources: Medigap Helpline: 1-800-242-1060 Medigap Part D Helpline (for ages 60 ): 1-855-677-2783 Disability Drug Benefit Helpline: 1-800-926-4862 Local Assistance: ADRC of Buffalo & Pepin Counties: 1-866-578-2372 50

For More Information or Assistance Contact: ADRC of Buffalo & Pepin Counties: 1-866-578-2372 Visit our website at: https://www.adrc-bcp.com/ Find us on facebook https://www.facebook.com/ADRCBu ffaloAndPepinCounties/ 51