Welcome! 1

25 Slides7.80 MB

Welcome! 1

www.PBOAdvisory.com Part of the PBO Advisory Group Thought Leadership Series Collection

3

PBO Advisory Group Has Helped Many Secure PPP and ERTC Funding! Successfully completed over 50 PPP Applications and Forgiveness Applications Currently working on 60 ERTC Studies, including 20 Food and Beverage Clients We have helped secure over 20M in additional funds for these companies We are here to help you! 4

Page 5 Payroll Protection Program (PPP) & Employee Retention Tax Credit (ERTC) Update: March 2021 PPP Rounds 1 & 2 CARES ACT Tax Credit 2020 Consolidated Appropriations Act 2021 Credit Extension Does your business qualify? Next steps to get cash in your business

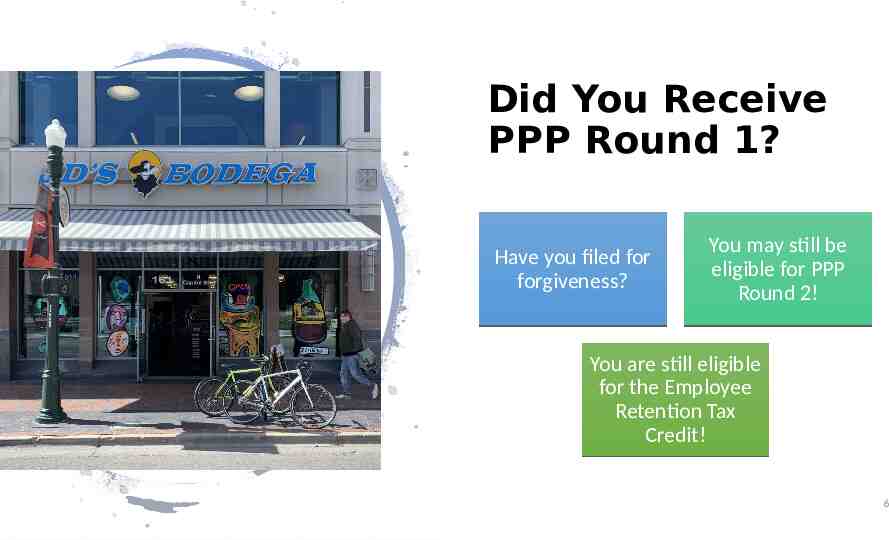

Did You Receive PPP Round 1? Have you filed for forgiveness? You may still be eligible for PPP Round 2! You are still eligible for the Employee Retention Tax Credit! 6

What if I Want to Receive a Second PPP Loan? You can get a second PPP loan and still claim the ERTC Credit! We can help you maximize both of these funding sources by carefully utilizing payroll expenses and other qualifying expenses during the appropriate time frame We will also help with the application and forgiveness for PPP! 7

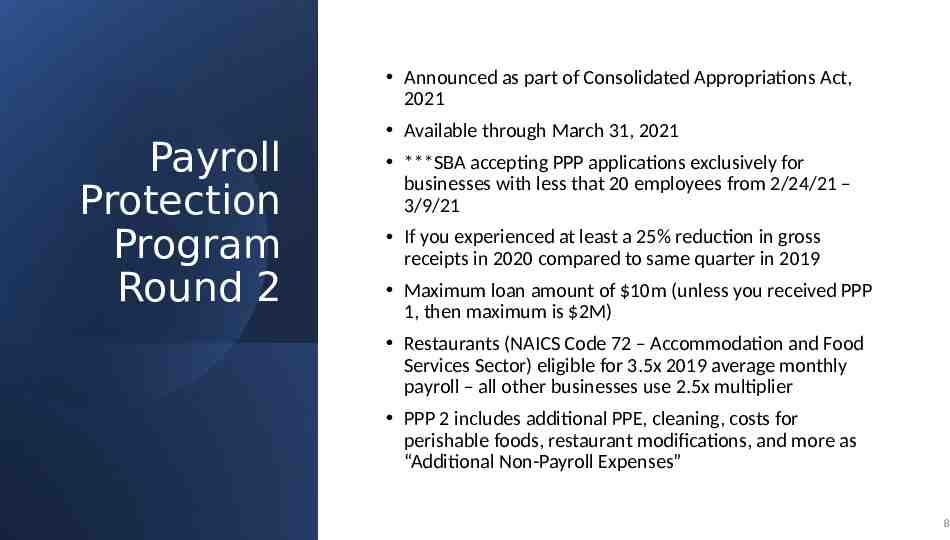

Announced as part of Consolidated Appropriations Act, 2021 Payroll Protection Program Round 2 Available through March 31, 2021 ***SBA accepting PPP applications exclusively for businesses with less that 20 employees from 2/24/21 – 3/9/21 If you experienced at least a 25% reduction in gross receipts in 2020 compared to same quarter in 2019 Maximum loan amount of 10m (unless you received PPP 1, then maximum is 2M) Restaurants (NAICS Code 72 – Accommodation and Food Services Sector) eligible for 3.5x 2019 average monthly payroll – all other businesses use 2.5x multiplier PPP 2 includes additional PPE, cleaning, costs for perishable foods, restaurant modifications, and more as “Additional Non-Payroll Expenses” 8

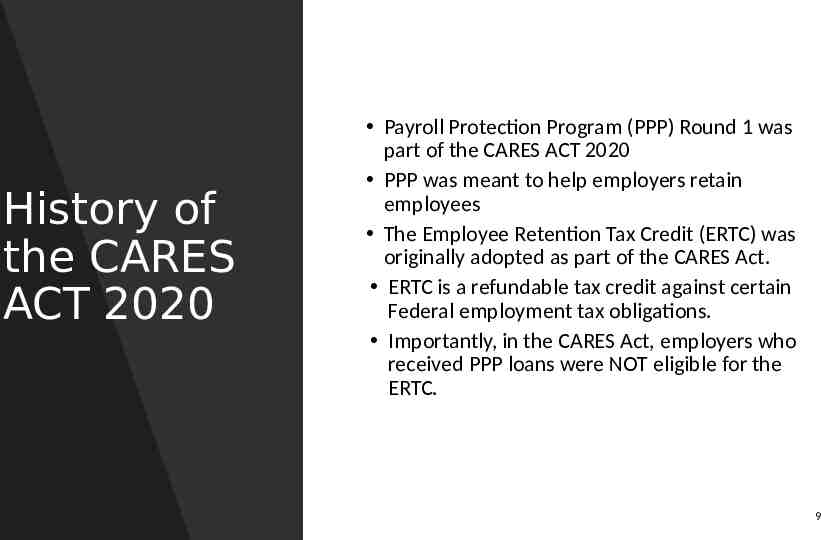

History of the CARES ACT 2020 Payroll Protection Program (PPP) Round 1 was part of the CARES ACT 2020 PPP was meant to help employers retain employees The Employee Retention Tax Credit (ERTC) was originally adopted as part of the CARES Act. ERTC is a refundable tax credit against certain Federal employment tax obligations. Importantly, in the CARES Act, employers who received PPP loans were NOT eligible for the ERTC. 9

Consolidated Appropriations Act 2021 (“Stimulus Bill”) Signed on December 27, 2020. Allows PPP borrowers to be eligible for ERTC, if they meet certain criteria. Extended the applicability of the ERTC to wages paid through June 31, 2021. Also enhanced the amount of the credit available for those wages paid for Q1 – 2021 and Q2 – 2021. 10

11 Period of Credit Availability CARES ACT: Qualified wages paid after March 12, 2020 and before January 1, 2021. 12 Mar. 2020 1 July 2021 Stimulus Bill: Qualified wages paid after March 12, 2020 and before July 1, 2021. Extended availability for Q1 and Q2 of 2021.

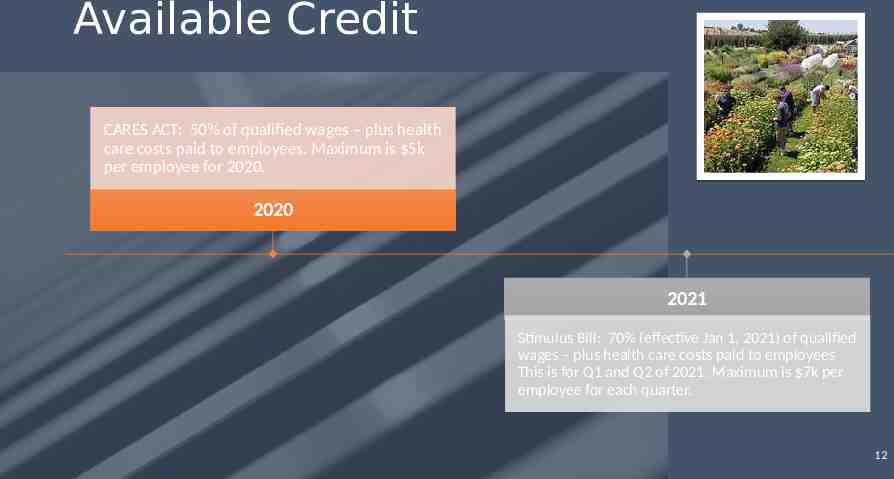

Available Credit CARES ACT: 50% of qualified wages – plus health care costs paid to employees. Maximum is 5k per employee for 2020. 2020 2021 Stimulus Bill: 70% (effective Jan 1, 2021) of qualified wages – plus health care costs paid to employees This is for Q1 and Q2 of 2021. Maximum is 7k per employee for each quarter. 12

Maximum Amount of Credit 2020: 5,000 ( 10k in qualified wages X 50% tax credit) per employee Q1 and Q2 2021: 7,000 for each quarter ( 10k in qualified wages X 70% tax credit). Maximum 2021 credit 14,000 Maximum potential credit 19k per employee! 13

ERTC 2020 Calculation Example 1 Employee x 12,000 in quarterly wages 12,000 12,000 - 10,000 (max qualifying wage amount) 10,000 10,000 x 50% (eligible credit percentage) 5,000 employee retention credit (ERC) 5,000 in ERC - (employment taxes) Refund amount if credit exceeds employment taxes for the quarter. Multiply the credit by the number of qualifying employees Example – if you have 10 employees with qualifying quarterly wages of at least 10k per quarter then the credit is 50,000 14

ERTC 2021 Calculation Example 1 Employee x 12,000 in quarterly wages 12,000 12,000 - 10,000 (max qualifying wage amount) 10,000 10,000 x 70% (eligible credit percentage for Q1) 7,000 employee retention tax credit (ERTC) 10,000 x 70% (eligible credit percentage for Q2) 7,000 employee retention tax credit (ERTC) Potential 14,000 ERTC per qualifying employee for Q1 and Q2 – 2021 Example – if you have 10 employees with qualifying quarterly wages of at least 10k per quarter, then the credit is 140k Monetized by taking a credit on payroll tax return, reducing Federal Tax Deposits or requesting direct refund. 15

Eligibility Requiremen ts for Employee Retention Tax Credit For any quarter in 2020, IF gross receipts are less than 50% of gross receipts for the same quarter in 2019; OR Business operations were either fully or partially suspended by a COVID-19 governmental order Stimulus bill expanded eligibility by reducing the required quarterly gross receipts drop from 50% to 20% in 2021. (compared to 2019). Also provides a safe-harbor allowing employers to use prior quarter gross receipts to determine eligibility;(for 1Q21, you can use 4Q20 compared to 4Q19) OR Business operations were either fully or partially suspended by a COVID-19 lockdown order** **MOST RESTAURANTS, BARS, FARMS AND PROVISIONERS WERE AFFECTED BY GOVERNMENT ORDERS** 16

ERTC EligibilitySmall Employers v. Large Employers For 2020: A company with 100 or less employees (small employer) are eligible for the credit, even if the employee is providing services. For 2021: Increases threshold to businesses with 500 or fewer employees for Q1 and Q2 – 2021, even if the employee is providing services. Note: Employees of “affiliated” companies sharing more than 50% common ownership are aggregated to determine size standard. “Large employers” can claim the wages of employees being paid, but not providing services (i.e. furloughed employees). 17

For 2020 – FILE FORM 941X: The credit will be filed on an IRS Form 941X, an amendment to your Q4 941. There is a line to include the credit and you can choose to either receive a credit toward 2021 payroll taxes or a check from the IRS. How To Claim the ERTC For 2021 – Apply the credit to your Q1 and Q2 Form 941 and keep the remaining funds in your bank account! **Different payroll providers may have specific requirements for reporting the credit 18

First Steps to Qualify for ERTC Determine if business meets the Gross Receipts qualification criteria for 2020 and expects to meet this for Q1 and Q2 2021. This is done by comparing all four quarters of 2020 to 2019 and then comparing estimates for the first two quarters of 2021 to the same quarters in 2019. Were there reductions in Gross Receipts in excess of 50% for 2020 and 20% in 2021? If not, then see below: OR Determine if, and when, the business was partially or fully suspended by governmental orders. This alternative test has been interpreted very broadly and can easily be met by most food and beverage establishments. 19

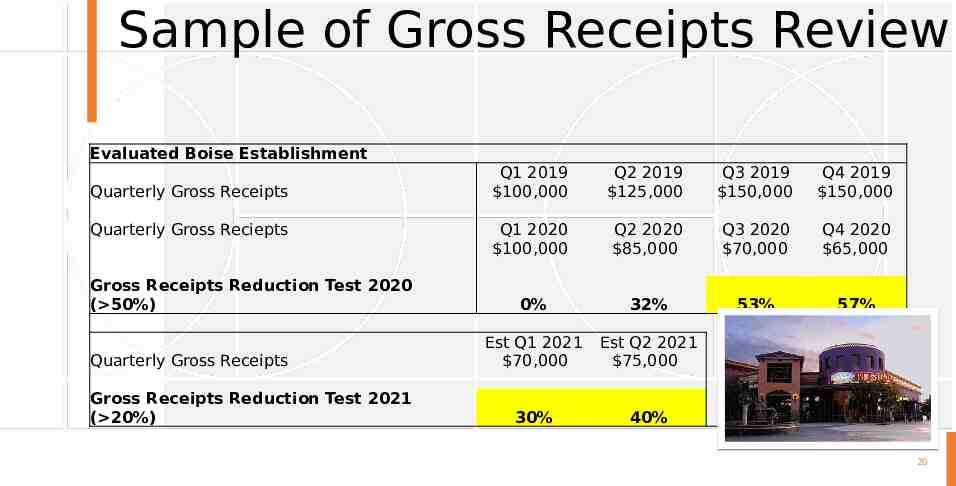

Sample of Gross Receipts Review Evaluated Boise Establishment Quarterly Gross Receipts Quarterly Gross Reciepts Gross Receipts Reduction Test 2020 ( 50%) Quarterly Gross Receipts Gross Receipts Reduction Test 2021 ( 20%) Q1 2019 100,000 Q2 2019 125,000 Q3 2019 150,000 Q4 2019 150,000 Q1 2020 100,000 Q2 2020 85,000 Q3 2020 70,000 Q4 2020 65,000 0% 32% 53% 57% Est Q1 2021 70,000 Est Q2 2021 75,000 30% 40% 20

Key Takeaways You can get both ERTC AND PPP 2!!! For ERTC qualification - Determine Change in Gross Receipts by Calendar Quarter by comparing to corresponding Quarter in 2019. If you don’t meet those criteria, a facts and circumstances analysis is needed to illustrate that you can qualify based on the governmental order impact. Detailed Payroll Analysis to determine wages eligible wages for ERTC, which is Gross wages less PPP funded wages less any C-19 sick (paid by Fed). Planning is critical if you are getting PPP 2 so you can receive maximum forgiveness and fully utilize the ERTC. Contact us for assistance! Page 21

28 billion dollar relief broken down into maximum 10m government funded grants ( 10m per restaurant group and 5m per restaurant location). Retroactive covered period of 2/15/20 - 12/31/21 Restaurants Relief Bill – About to be Approved! Restaurants who have received PPP and ERTC can still qualify for this relief. Any amount of relief calculated will have any PPP funds backed out. Restaurants opened in 2018 or earlier calculation - Average monthly 2019 revenues x 12 less Average monthly 2020 revenues x 12 less any PPP loans received in 2020. For restaurants opened in 2019 the calculation is the same as above For restaurants opened in 2020 - calculation is bases on eligible expenses less any PPP loans received in 2020. Grants can be spent on payroll and benefits up to 100,000 a year, mortgage, rent, utilities, maintenance, supplies (including PPE and cleaning products), food and beverages, supplier costs, operational expenses, and paid sick leave 22

Page 23 QUESTIONS & ANSWERS

PRESENTER PRESENTER Lorin Port Francesca San Diego [email protected] [email protected] Phone: (858) 935-4867 Phone: (858) 935-4846 The PBO Advisory Group Presenters 24

Disclaimer PBO believes the analysis and comments that follow are correct. However, as with all the guidance in connection with the CARES Act and the Consolidated Appropriations Act, 2021 (the “Stimulus Bill”), it continues to evolve. This presentation is for general information purposes only and is not intended to constitute legal advice. As necessary and appropriate you should consult the applicable professionals with respect to the specific situation on any specific matters. This deck is based on IRS information December 28, 2020. Page 25