Transactions that affect assets, liabilities, and owner’s

35 Slides112.94 KB

Transactions that affect assets, liabilities, and owner’s equity Chapter 4 Section 1 and Section 2

Chapter 4 learning objectives Prepare a chart of accounts Apply the rules of debit and credit to assets, liability and owner’s equity accounts Use T accounts to analyze a business transaction into its debit and credit parts. Identify the normal balance of the accounts Calculate account balances after recording business transactions Analyze transactions that increase or decrease assets, liabilities, and owner’s capital and record them in T accounts Define and use the accounting terms introduced into this chapter.

Section 1: Accounts and the Doubleentry Accounting System What you will learn: How to use T accounts Why you need a ledger The rules of debits and credits Why it’s important: The rules of debits and credits are the basis for entering transactions into the records of a business

The account Shows the balance for a specific item Office equipment Accounts payable Cash Maria Sanchez, Capital Location within an accounting system in which the increases and the decreases of a specific asset, liability or owner’s equity are recorded and stored Accounts are grouped together in a LEDGER Makes finding information easy to find

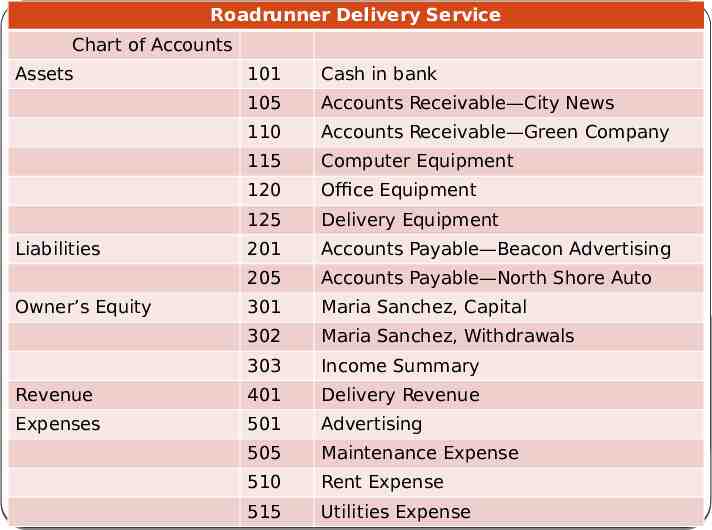

Chart of accounts A business develops this list of all accounts and their assigned account number Number of accounts in a business varies by the business needs and size of business Have to have a numbering system to make it easy to locate individual accounts in the ledger

Numbering the accounts Account numbers have two or more digits Used for sorting information based on the kids of reports the business needs A typical numbering system Asset accounts begin with 1 Liability accounts begin with 2 Owner’s Equity accounts begin with 3 Revenue accounts begin with 4 Expense accounts begin with 5

Roadrunner Delivery Service Chart of Accounts Assets Cash in bank Chart of 101 Accounts 105 Accounts Receivable—City News 110 Accounts Receivable—Green Company 115 Computer Equipment 120 Office Equipment 125 Delivery Equipment 201 Accounts Payable—Beacon Advertising 205 Accounts Payable—North Shore Auto 301 Maria Sanchez, Capital 302 Maria Sanchez, Withdrawals 303 Income Summary Revenue 401 Delivery Revenue Expenses 501 Advertising 505 Maintenance Expense 510 Rent Expense 515 Utilities Expense Liabilities Owner’s Equity

Assigning each account with a number Lists the most liquid assets first Liquid how quickly and cheaply an asset can be converted into cash Each business will have a somewhat different number assignment to the accounts Leave gaps between numbers In the future, if you add accounts you can simply slip it between two accounts without having to completely renumber the chart of accounts Look at example in the book on page 73 Demonstration problem 4-1

Double-entry Accounting System of recordkeeping in which each business transaction affects at least two accounts Used by accountants when analyzing and recording transactions Use T Accounts Shows the dollar increase or decrease in an account that is caused by a transaction Help the accountant analyze the parts of a business transaction

T Accounts Top of T Used for the account name Left of T ALWAYS used for debit amounts Right of T ALWAYS used for credit amounts Debit (DR)—an amount entered on the left side of the T Account* Credit (CR)—an amount entered on the right side of the T Account* * simply the accountant’s term for left and right

The Rules of Debit and Credit Used to record the increase or decrease in each account affected by a business transaction FOR EACH DEBIT ENTRY MADE IN ONE ACCOUNT—A CREDIT OF AN EQUAL AMOUNT MUST BE MADE IN ANOTHER AMOUNT Vary according to whether an account is classified as an asset, a liability, or an owner’s capital account. Left—ALWAYS DEBIT Right—ALWAYS CREDIT Each classification of account has a specific side that is its normal balance side Always on the side used to record increases to the account

Rules for Asset Accounts 1. an asset account is increased ( ) on the debit side (left side) 2. An asset account is decreased (-) on the credit side (right side) 3. The normal balance for an asset account is the increase side, or the debit side. Assets normally have debit balances.

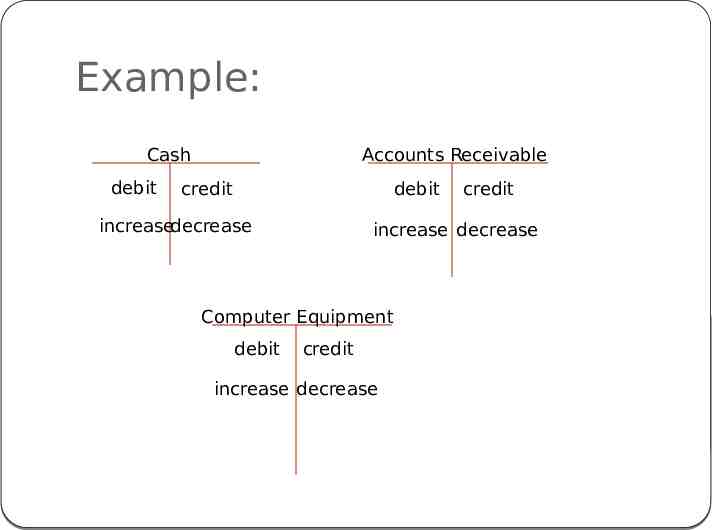

Example: Cash debit Accounts Receivable credit debit increasedecrease increase decrease Computer Equipment debit credit credit increase decrease

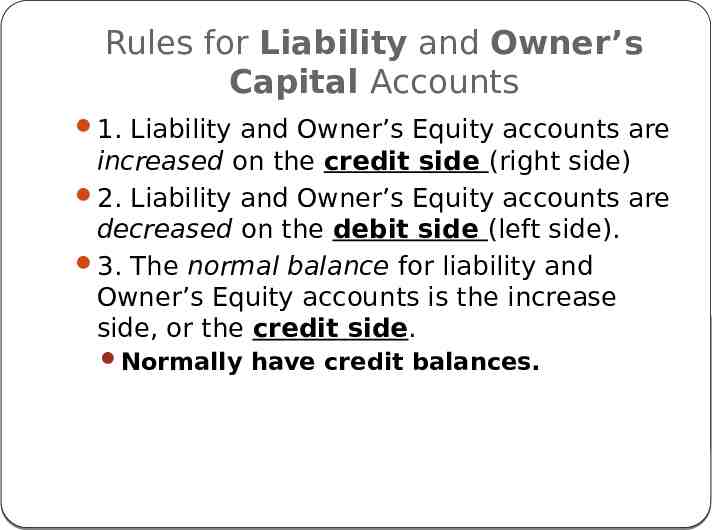

Rules for Liability and Owner’s Capital Accounts 1. Liability and Owner’s Equity accounts are increased on the credit side (right side) 2. Liability and Owner’s Equity accounts are decreased on the debit side (left side). 3. The normal balance for liability and Owner’s Equity accounts is the increase side, or the credit side. Normally have credit balances.

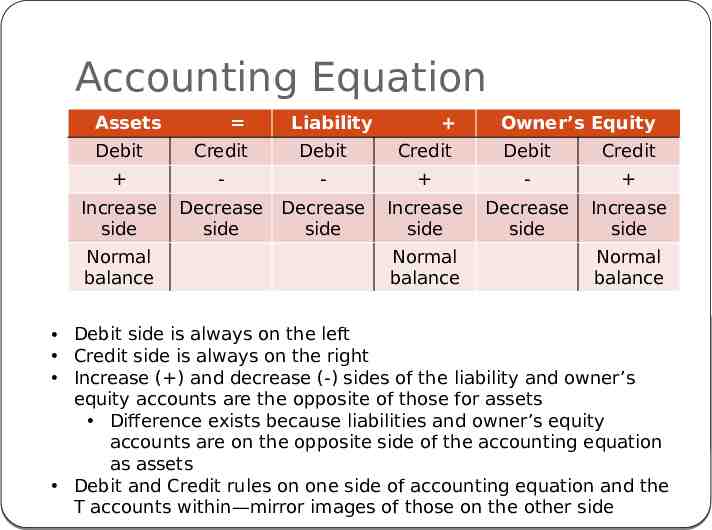

Accounting Equation Assets Liability Owner’s Equity Debit Credit Debit Credit Debit Credit - - - Increase side Decrease side Increase side Increase side Normal balance Decrease Decrease side side Normal balance Normal balance Debit side is always on the left Credit side is always on the right Increase ( ) and decrease (-) sides of the liability and owner’s equity accounts are the opposite of those for assets Difference exists because liabilities and owner’s equity accounts are on the opposite side of the accounting equation as assets Debit and Credit rules on one side of accounting equation and the T accounts within—mirror images of those on the other side

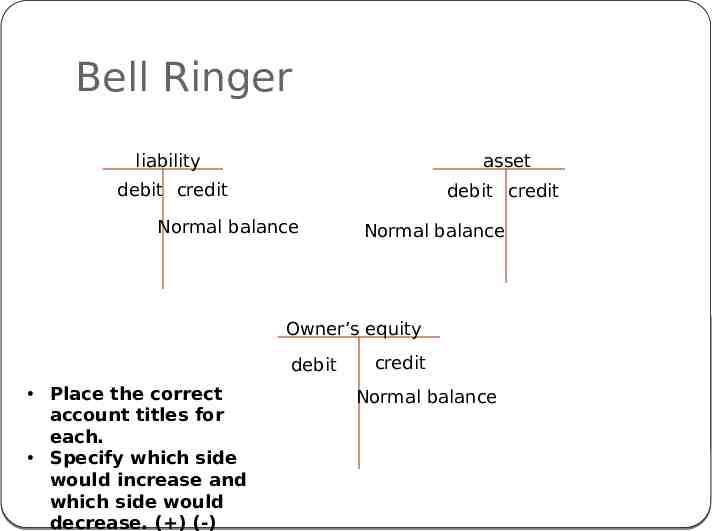

Bell Ringer liability asset debit credit debit credit Normal balance Normal balance Owner’s equity debit Place the correct account titles for each. Specify which side would increase and which side would decrease. ( ) (-) credit Normal balance

Chapter 4: Section 2 Applying the rules of Debits and Credits

4-2 What you will learn: How to analyze a transaction affecting assets, liabilities, and owner’s equity. Why it’s important: You need to analyze transactions properly so that you can record them correctly.

Business Transaction Analysis Step 1: Identify the accounts being affected Step 2: Classify the accounts affected Step 3:Determine the amount of increase or decrease for each account affected. Step 4:Which account is debited? For what DR/CR rule amount? Step 5: Which account is credited? For what amount? Account Name Account Name Step 6: What is the complete entry in T account form?

T Account Review For every transaction, total debits must equal total credits. T accounts demonstrate the effects of transaction on the accounting equation A debit in one account is offset by a credit in another account

Business Transaction 1 On October 1 Maria Sanchez took 25,000 from personal savings and deposited that amount to open a business checking account in the name of Roadrunner Delivery Service. Step 1:Identify Cash Maria Sanchez, Capital Step 2: Classify Cash-asset Maria Sanchez, Capital—owner’s equity Step 3: / Cash-- 25,000 increase ( ) M. Sanchez, Capital-- 25,000 increase ( )

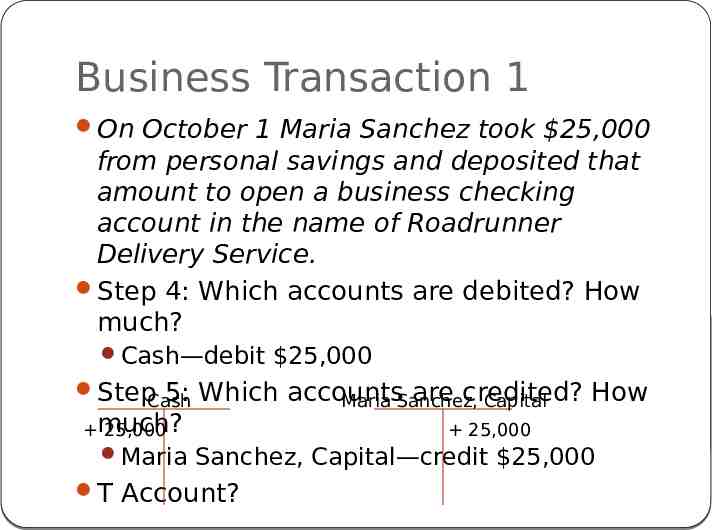

Business Transaction 1 On October 1 Maria Sanchez took 25,000 from personal savings and deposited that amount to open a business checking account in the name of Roadrunner Delivery Service. Step 4: Which accounts are debited? How much? Cash—debit 25,000 Step 5: Which accounts are credited? How Maria Sanchez, Capital Cash much? 25,000 25,000 Maria Sanchez, Capital—credit 25,000 T Account?

Business Transaction #2 On October 2nd Maria Sanchez took two telephones valued at 200 each from her home and transferred them to the business as office equipment. Step 1: Identify Office Equipment M. Sanchez, Capital Step 2: Classify Office Equipment—asset M. Sanchez, Capital—owner’s equity Step 3: / Office equipment-- 400 increase ( ) M. Sanchez, Capital-- 400 increase (-)

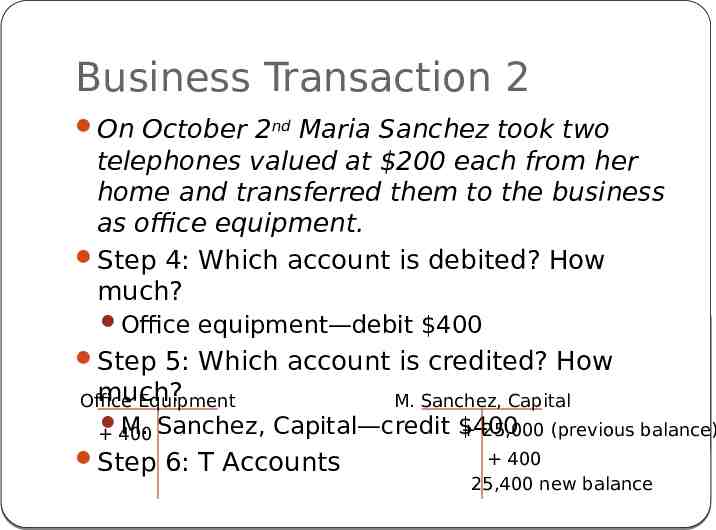

Business Transaction 2 On October 2nd Maria Sanchez took two telephones valued at 200 each from her home and transferred them to the business as office equipment. Step 4: Which account is debited? How much? Office equipment—debit 400 Step 5: Which account is credited? How much? Office Equipment M. Sanchez, 400 M. Sanchez, Capital Capital—credit 400 25,000 (previous balance) Step 6: T Accounts 400 25,400 new balance

Business Transaction 3 On October 4 Roadrunner issued Check 101 for 3000 to buy a computer system. Step 1: Identify Cash in Bank Computer Equipment Step 2: Classify Cash in bank—asset Computer Equipment—asset Step 3: / Cash-- 3000 decrease (-) Computer Equipment-- 3000 increase ( )

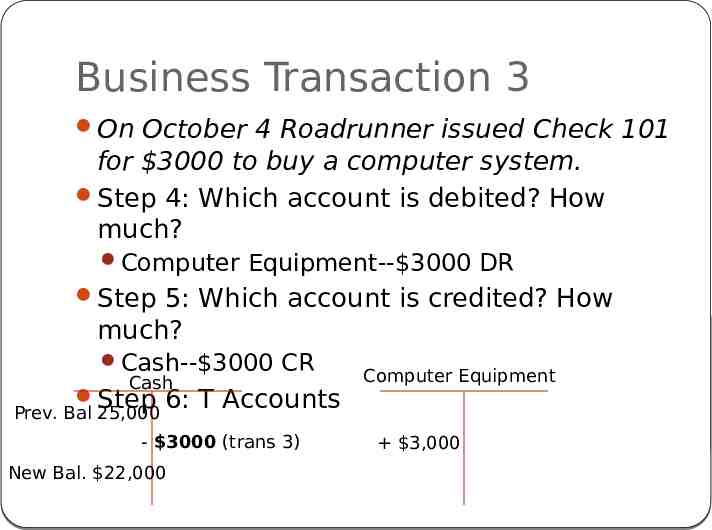

Business Transaction 3 On October 4 Roadrunner issued Check 101 for 3000 to buy a computer system. Step 4: Which account is debited? How much? Computer Equipment-- 3000 DR Step 5: Which account is credited? How much? Cash-- 3000 CR Cash Step 6: T Accounts Computer Equipment Prev. Bal 25,000 - 3000 (trans 3) New Bal. 22,000 3,000

Business Transaction 4 On October 9th Roadrunner bought a used truck on account from North Shore Auto for 12,000. Step 1: Identify Delivery Equipment Accounts Payable—North Shore Auto Step 2: Classify Delivery Equipment—asset Accounts Payable—North Shore Auto--liability Step 3: / Delivery equipment-- 12,000 increase ( ) Accounts Payable—North Shore Auto-- 12,000 increase ( )

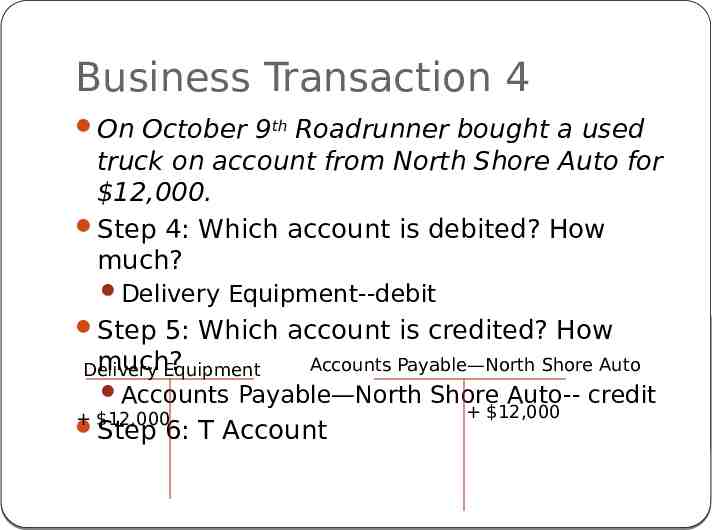

Business Transaction 4 On October 9th Roadrunner bought a used truck on account from North Shore Auto for 12,000. Step 4: Which account is debited? How much? Delivery Equipment--debit Step 5: Which account is credited? How much? Delivery Equipment Accounts Payable—North Shore Auto Accounts Payable—North Shore Auto-- credit 12,000 Step 6: T Account 12,000

Business Transaction 5 On Oct 11 Roadrunner sold one phone on account to Green Company for 200. Step 1: Identify Accounts Receivable—Green Company Office Equipment Step 2: Classify Accounts Receivable—Green Company—Asset Office Equipment--Asset Step 3: / Accounts Receivable—Green Co.-- 200 increase ( ) Office Equipment-- 200 decrease (-)

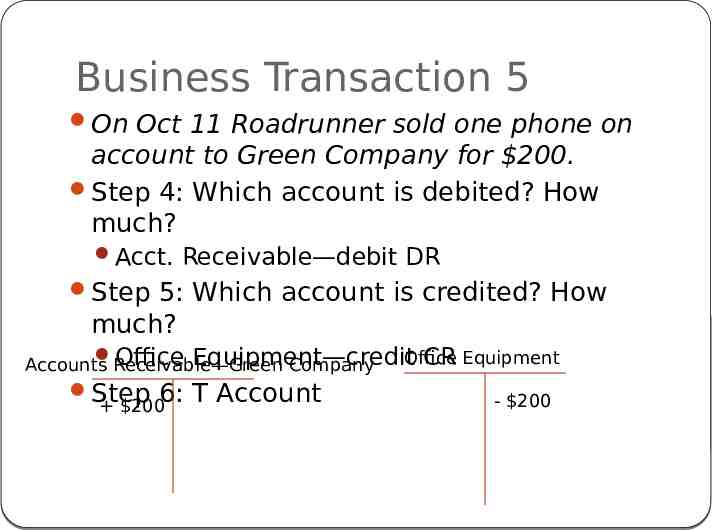

Business Transaction 5 On Oct 11 Roadrunner sold one phone on account to Green Company for 200. Step 4: Which account is debited? How much? Acct. Receivable—debit DR Step 5: Which account is credited? How much? Office Equipment—credit Office CR Equipment Accounts Receivable—Green Company Step 6: T Account 200 - 200

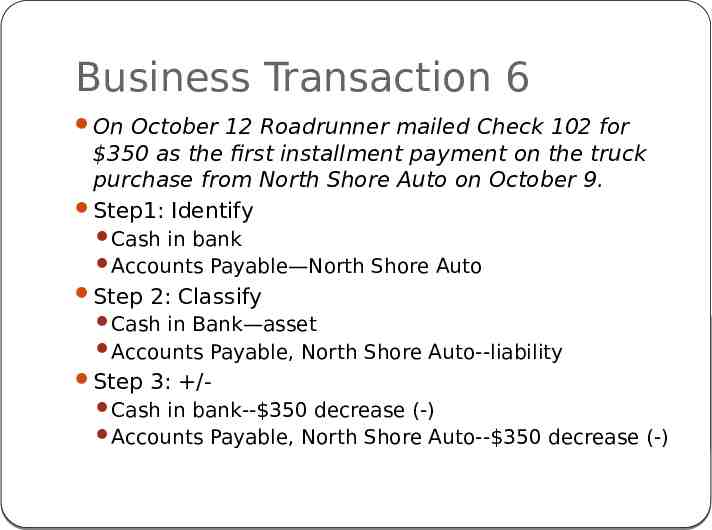

Business Transaction 6 On October 12 Roadrunner mailed Check 102 for 350 as the first installment payment on the truck purchase from North Shore Auto on October 9. Step1: Identify Cash in bank Accounts Payable—North Shore Auto Step 2: Classify Cash in Bank—asset Accounts Payable, North Shore Auto--liability Step 3: / Cash in bank-- 350 decrease (-) Accounts Payable, North Shore Auto-- 350 decrease (-)

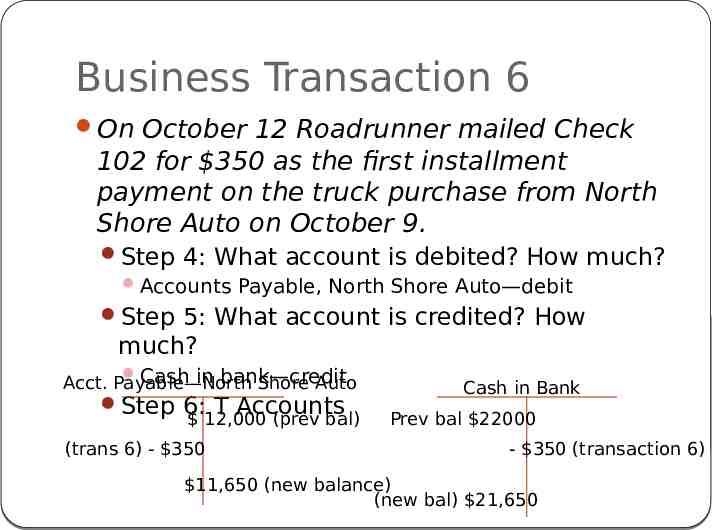

Business Transaction 6 On October 12 Roadrunner mailed Check 102 for 350 as the first installment payment on the truck purchase from North Shore Auto on October 9. Step 4: What account is debited? How much? Accounts Payable, North Shore Auto—debit Step 5: What account is credited? How much? Cash in bank—credit Acct. Payable—North Shore Auto Step 6: T Accounts 12,000 (prev bal) (trans 6) - 350 Cash in Bank Prev bal 22000 - 350 (transaction 6) 11,650 (new balance) (new bal) 21,650

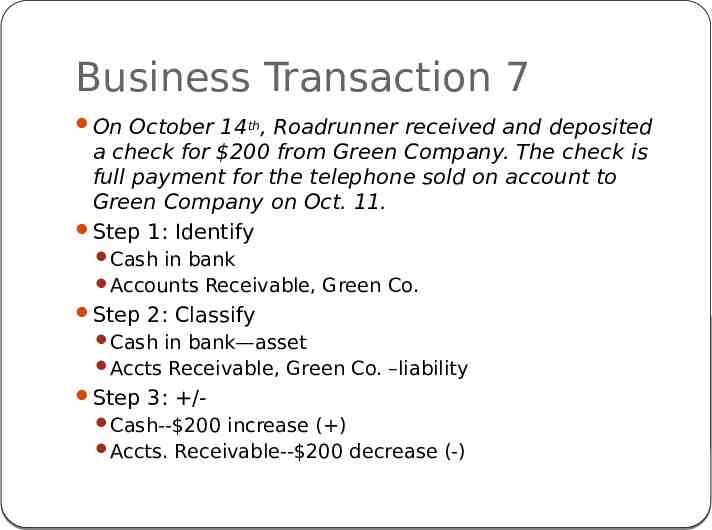

Business Transaction 7 On October 14th, Roadrunner received and deposited a check for 200 from Green Company. The check is full payment for the telephone sold on account to Green Company on Oct. 11. Step 1: Identify Cash in bank Accounts Receivable, Green Co. Step 2: Classify Cash in bank—asset Accts Receivable, Green Co. –liability Step 3: / Cash-- 200 increase ( ) Accts. Receivable-- 200 decrease (-)

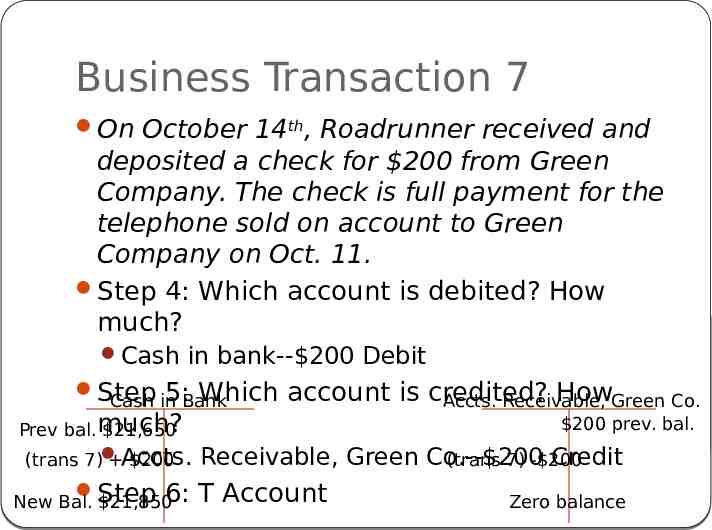

Business Transaction 7 On October 14th, Roadrunner received and deposited a check for 200 from Green Company. The check is full payment for the telephone sold on account to Green Company on Oct. 11. Step 4: Which account is debited? How much? Cash in bank-- 200 Debit Step 5:Bank Which account is credited? HowGreen Co. Cash in Accts. Receivable, Prev bal.much? 21,650 (trans 7) Accts. 200 New Bal. Step 21,8506: 200 prev. bal. Receivable, Green Co.-- 200 Credit (trans 7) - 200 T Account Zero balance

Thinking Critically What is the debit-credit rule used in business transaction analysis? There will always be a debit entry and there will always be a credit entry. In double-entry accounting, for each transaction there must be at least two entries. If you are increase the Cash in Bank account, what other accounts might be affected? Owner’s equity or capital account will probably increase