Special Education Finance June 1 Application 2023 – 2024

23 Slides1.23 MB

Special Education Finance June 1 Application 2023 – 2024

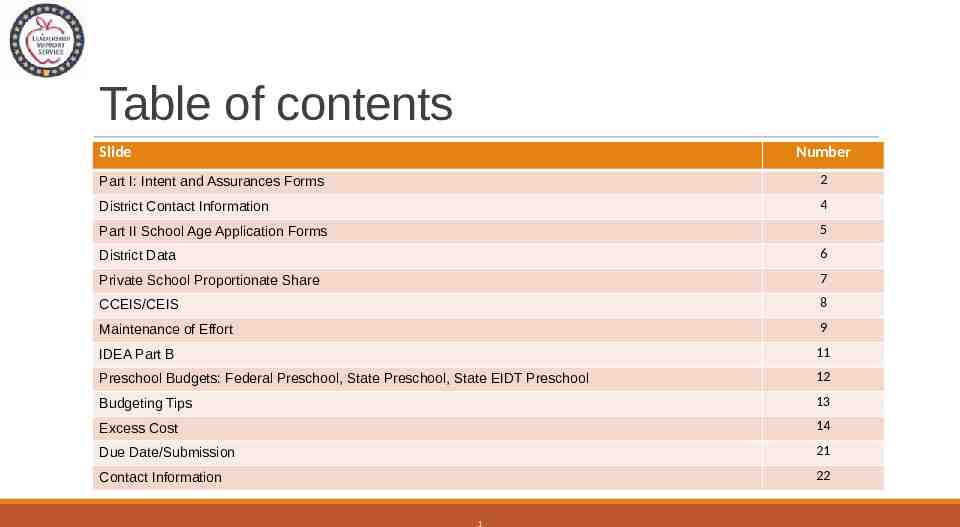

Table of contents Slide Number Part I: Intent and Assurances Forms 2 District Contact Information 4 Part II School Age Application Forms 5 District Data 6 Private School Proportionate Share 7 CCEIS/CEIS 8 Maintenance of Effort 9 IDEA Part B 11 Preschool Budgets: Federal Preschool, State Preschool, State EIDT Preschool 12 Budgeting Tips 13 Excess Cost 14 Due Date/Submission 21 Contact Information 22 1

Part 1: Intent and Assurance Forms Spring School Board Meetings The June 1 deadline will require a spring School Board meeting for approval of the application and signature on the forms. 2

Intent and Assurance Forms Ensure the appropriate signatures are obtained. 3

District Contact Information Please ensure we have the appropriate summer contact information. This will be critical for SPED Finance to contact district staff for corrections during the months of June and July. 4

Part II: School Age Application Forms (Excel Forms) Part II contains the following Excel documents and are available on the Special Education website: District Data Private School Proportionate Share form CCEIS/CEIS form Maintenance of Effort form IDEA Part B School Age Budget (SOF 6702) Federal Preschool Budget (SOF 6710) State Preschool Budget (SOF 2260) State EIDT Preschool Budget (SOF 2262) #1 Excess Cost Enrollment #2 Excess Cost Summary Report 5

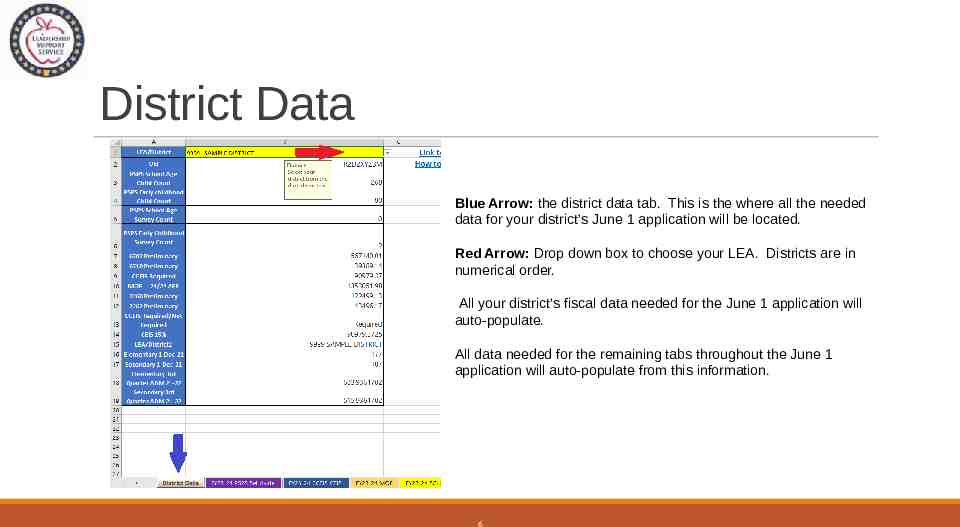

District Data Blue Arrow: the district data tab. This is the where all the needed data for your district’s June 1 application will be located. Red Arrow: Drop down box to choose your LEA. Districts are in numerical order. All your district’s fiscal data needed for the June 1 application will auto-populate. All data needed for the remaining tabs throughout the June 1 application will auto-populate from this information. 6

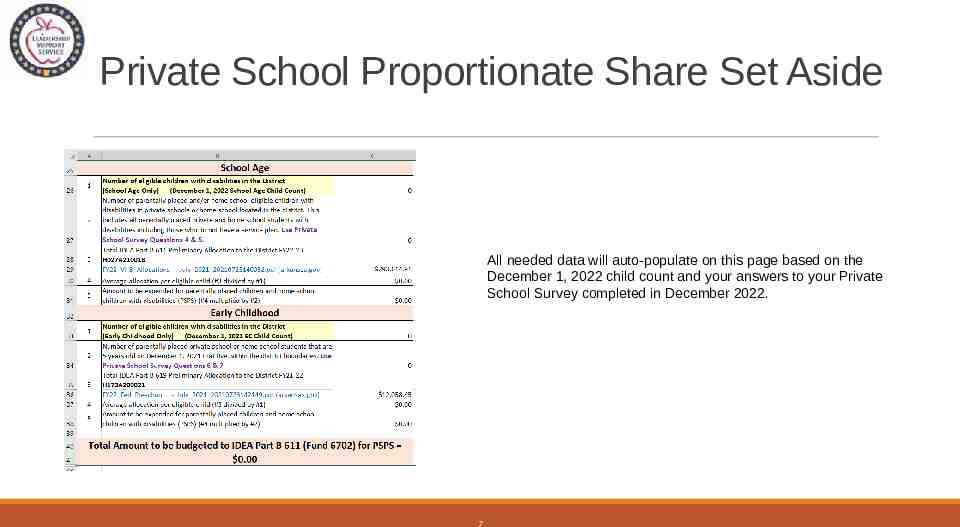

Private School Proportionate Share Set Aside All needed data will auto-populate on this page based on the December 1, 2022 child count and your answers to your Private School Survey completed in December 2022. 7

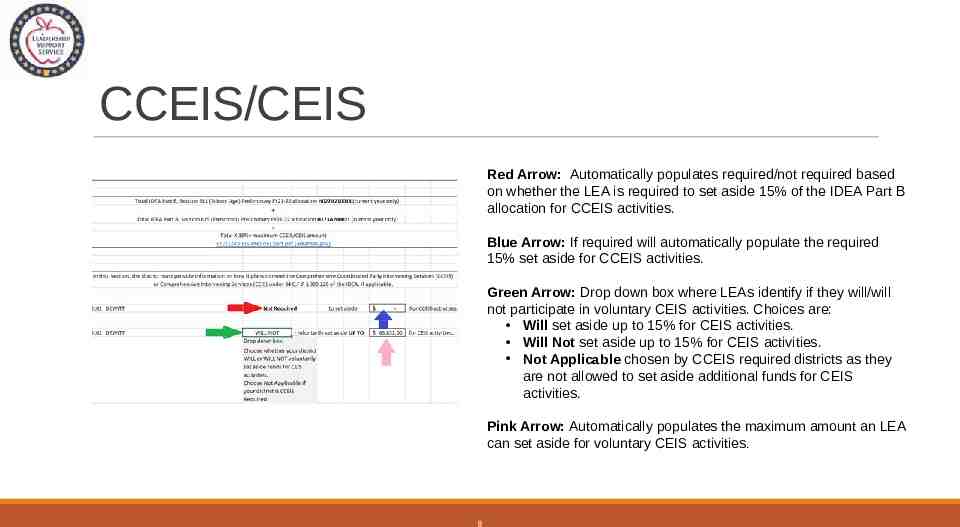

CCEIS/CEIS Red Arrow: Automatically populates required/not required based on whether the LEA is required to set aside 15% of the IDEA Part B allocation for CCEIS activities. Blue Arrow: If required will automatically populate the required 15% set aside for CCEIS activities. Green Arrow: Drop down box where LEAs identify if they will/will not participate in voluntary CEIS activities. Choices are: Will set aside up to 15% for CEIS activities. Will Not set aside up to 15% for CEIS activities. Not Applicable chosen by CCEIS required districts as they are not allowed to set aside additional funds for CEIS activities. Pink Arrow: Automatically populates the maximum amount an LEA can set aside for voluntary CEIS activities . 8

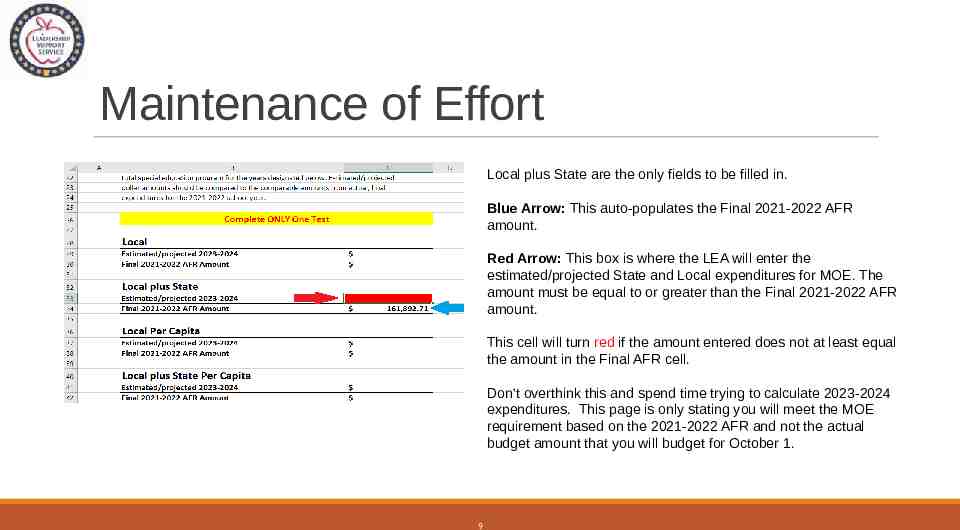

Maintenance of Effort Local plus State are the only fields to be filled in. Blue Arrow: This auto-populates the Final 2021-2022 AFR amount. Red Arrow: This box is where the LEA will enter the estimated/projected State and Local expenditures for MOE. The amount must be equal to or greater than the Final 2021-2022 AFR amount. This cell will turn red if the amount entered does not at least equal the amount in the Final AFR cell. Don’t overthink this and spend time trying to calculate 2023-2024 expenditures. This page is only stating you will meet the MOE requirement based on the 2021-2022 AFR and not the actual budget amount that you will budget for October 1. 9

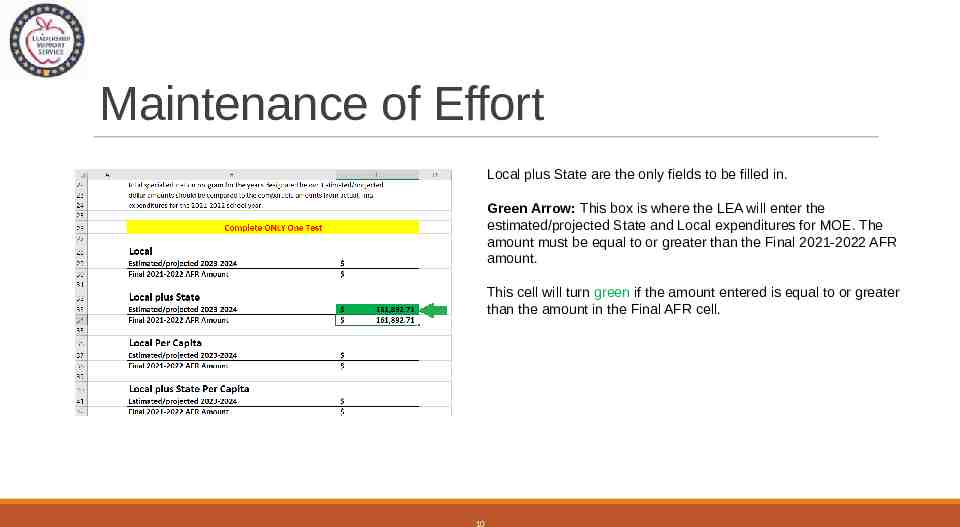

Maintenance of Effort Local plus State are the only fields to be filled in. Green Arrow: This box is where the LEA will enter the estimated/projected State and Local expenditures for MOE. The amount must be equal to or greater than the Final 2021-2022 AFR amount. This cell will turn green if the amount entered is equal to or greater than the amount in the Final AFR cell. 10

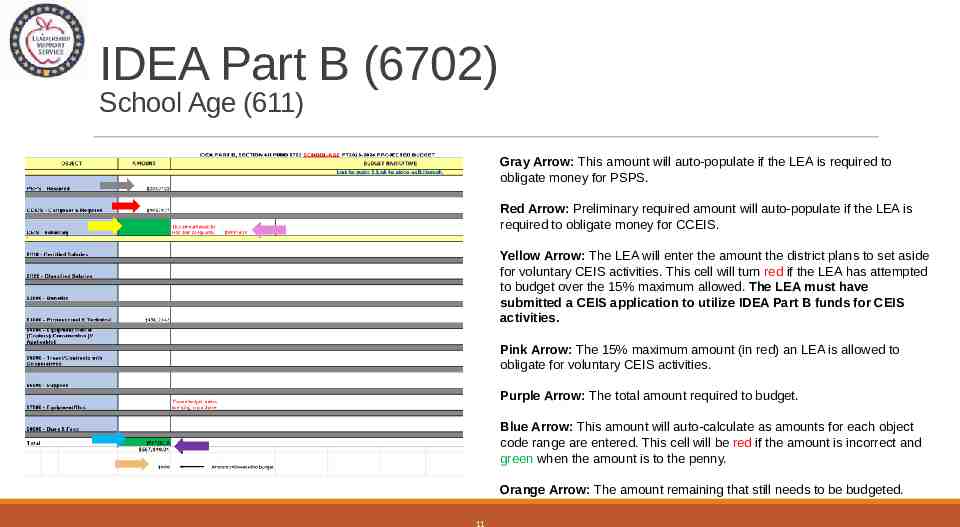

IDEA Part B (6702) School Age (611) Gray Arrow: This amount will auto-populate if the LEA is required to obligate money for PSPS. Red Arrow: Preliminary required amount will auto-populate if the LEA is required to obligate money for CCEIS. Yellow Arrow: The LEA will enter the amount the district plans to set aside for voluntary CEIS activities. This cell will turn red if the LEA has attempted to budget over the 15% maximum allowed. The LEA must have submitted a CEIS application to utilize IDEA Part B funds for CEIS activities. Pink Arrow: The 15% maximum amount (in red) an LEA is allowed to obligate for voluntary CEIS activities. Purple Arrow: The total amount required to budget. Blue Arrow: This amount will auto-calculate as amounts for each object code range are entered. This cell will be red if the amount is incorrect and green when the amount is to the penny. Orange Arrow: The amount remaining that still needs to be budgeted. 11

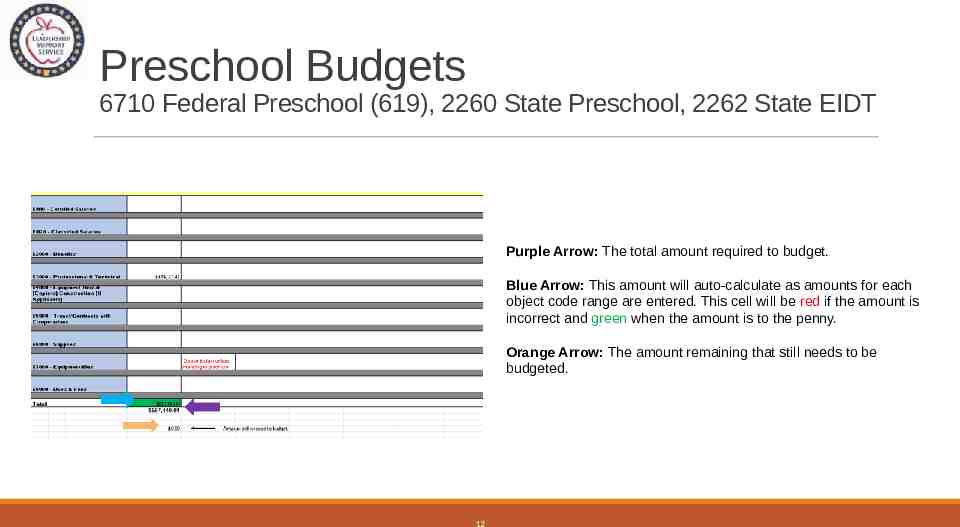

Preschool Budgets 6710 Federal Preschool (619), 2260 State Preschool, 2262 State EIDT Purple Arrow: The total amount required to budget. Blue Arrow: This amount will auto-calculate as amounts for each object code range are entered. This cell will be red if the amount is incorrect and green when the amount is to the penny. Orange Arrow: The amount remaining that still needs to be budgeted. 12

Budgeting Tips Contracted early childhood budget in function 1290 and object range 65000. District provided early childhood – budget accordingly. Do not budget equipment unless intending to purchase equipment that is 5000.00 per line item or over. Ensure the equipment is budgeted before you submit an equipment purchase request. Use the October 1 budget as a guide to complete the June 1 application. This will help to identify foundational expenses for the current FY. When budgeting, start with your foundational expenses: CCEIS, PSPS, salaries/benefits, early childhood, contract services, travel, and transportation. Start with your large expenses that occur annually. 13

Federal Definition of Excess Cost §300.16 Excess costs means those costs that are in excess of the average annual per student expenditure in an LEA during the preceding school year for an elementary school or secondary school student. §300.202 The excess cost requirement prevents an LEA from using funds provided under Part B to pay for all the costs directly attributable to the education of a child with a disability. Part B Fiscal Accountability Procedures Manual pages 50-51 14

Excess Cost Intent At both the elementary and secondary school levels (computed separately), the excess cost requirement stipulates the district must spend (in state and local funds) at least as much (average amount per pupil) on students with disabilities, as the district is spending on all students (average amount per pupil). The federal intent recognized that each school district would provide students with disabilities everything a non-disabled student has (desks, books, classroom, school teacher ). The federal intent also recognized that after these students are found eligible to receive special education services and had an individual program of instruction designed to meet their unique needs (the IEP), it was going to cost the district MORE to serve these students. Part B Fiscal Accountability Procedures Manual pages 50-51 15

Excess Cost Intent Therefore, the federal intent was to provide funding to assist districts with the excess cost of providing special education and related services to students with disabilities. The intent was also to ensure districts spend dollars to cover all those basic costs they would be providing anyway, if these students with disabilities did not have any extra or special needs “before” spending their federal Part B dollars. In summary, a district must document that it is spending at least as much (in state and local funding) on students with disabilities, as the district spends on students without disabilities. By meeting both the Maintenance of Effort and Excess Cost requirements, a district is in compliance with the non-supplanting provisions of federal law and regulation. Part B Fiscal Accountability Procedures Manual pages 50-51 16

Excess Cost Calculation Appendix A to the IDEA regulations: Four components to the Excess Cost Calculation: 1. Compute total expenditures 2. Subtract certain expenditures 3. Compute average annual per pupil amount 4. Determine minimum amount of funds to spend for students with disabilities as defined by the IDEA. Part B Fiscal Accountability Procedures Manual page 51 17

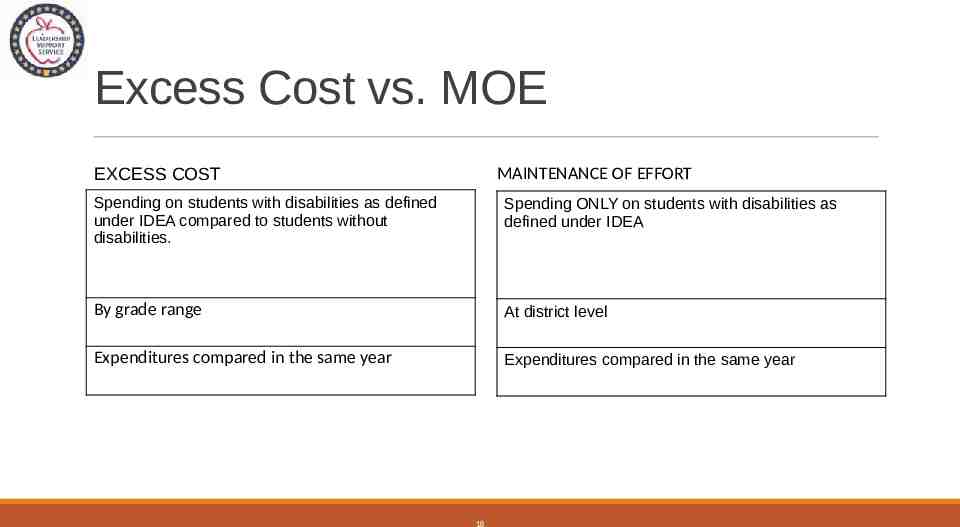

Excess Cost vs. MOE EXCESS COST MAINTENANCE OF EFFORT Spending on students with disabilities as defined under IDEA compared to students without disabilities. Spending ONLY on students with disabilities as defined under IDEA By grade range At district level Expenditures compared in the same year Expenditures compared in the same year 18

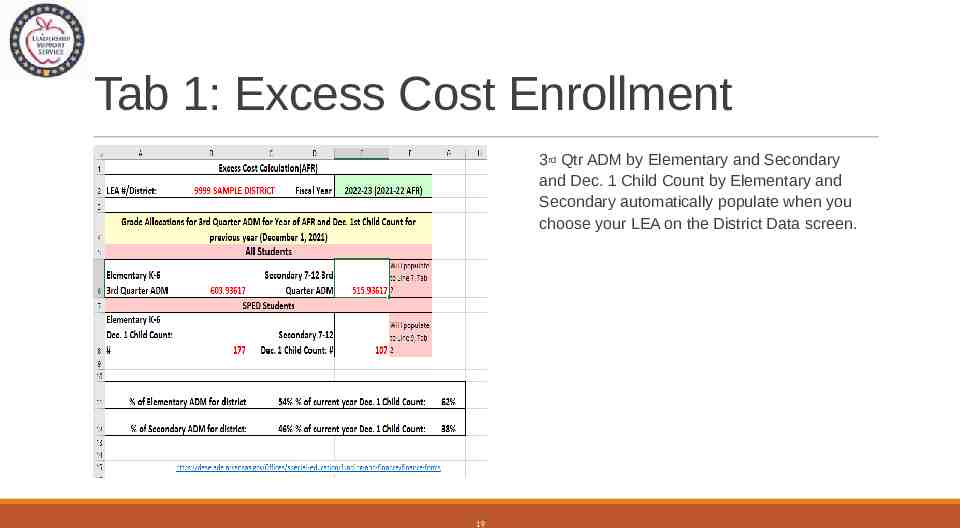

Tab 1: Excess Cost Enrollment 3rd Qtr ADM by Elementary and Secondary and Dec. 1 Child Count by Elementary and Secondary automatically populate when you choose your LEA on the District Data screen. 19

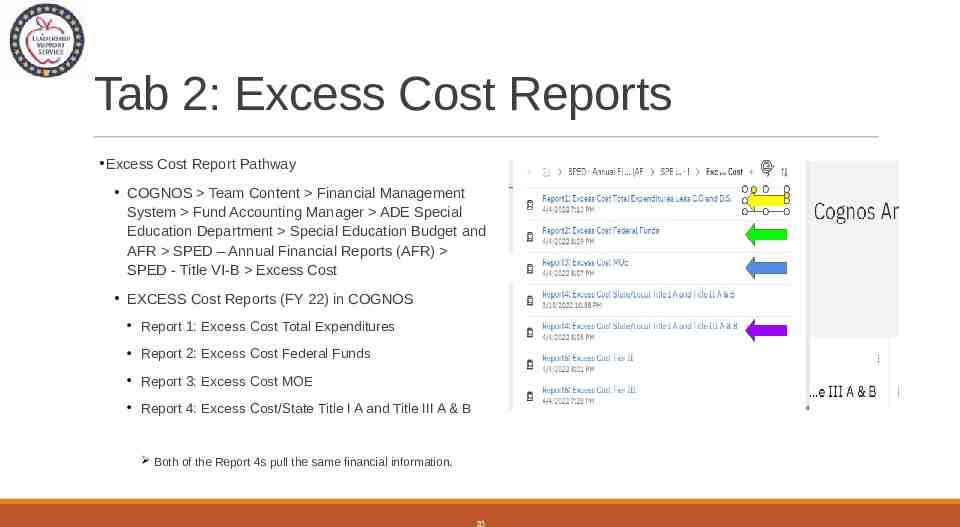

Tab 2: Excess Cost Reports Excess Cost Report Pathway COGNOS Team Content Financial Management System Fund Accounting Manager ADE Special Education Department Special Education Budget and AFR SPED – Annual Financial Reports (AFR) SPED - Title VI-B Excess Cost EXCESS Cost Reports (FY 22) in COGNOS Report 1: Excess Cost Total Expenditures Report 2: Excess Cost Federal Funds Report 3: Excess Cost MOE Report 4: Excess Cost/State Title I A and Title III A & B Both of the Report 4s pull the same financial information. 20

Due Date June 1 Application Part 1 Requires School Board approval. Only send the signature sheets and the contact information, along with the June 1 IDEA Part B Part 2 to DESE – Office of Special Education June 1 Application Part 1 and Part 2 are due June 1, 2023. Email applications to: [email protected] Include in subject area: LEA #, Name of District: June 1 Application 21

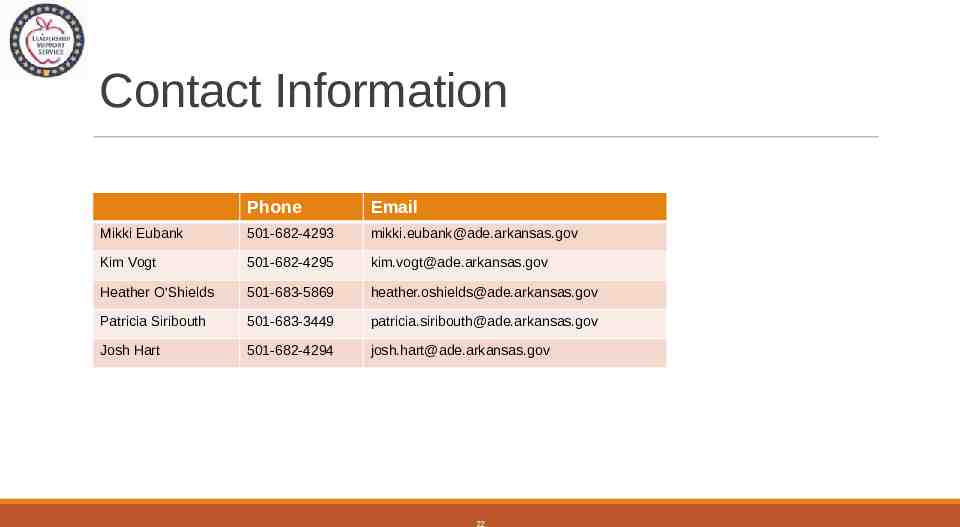

Contact Information Phone Email Mikki Eubank 501-682-4293 [email protected] Kim Vogt 501-682-4295 [email protected] Heather O’Shields 501-683-5869 [email protected] Patricia Siribouth 501-683-3449 [email protected] Josh Hart 501-682-4294 [email protected] 22