Housing Tax Credit Carryover, 10 Percent Test, Evidence

30 Slides305.50 KB

Housing Tax Credit Carryover, 10 Percent Test, Evidence of Construction Start and Final Allocation Application Training Workshop September 21, 2017

Table of Contents Topic Carryover Allocation Application 10 Percent Cost Submission Evidence of Construction Start Placed in Service & Final Allocation Application Subsequent Project Requirements (MFA 2017 QAP pp. 48-52) List of Relevant Doc’s on MFA Website New Mexico Mortgage Finance Authority Page 3 13 14 17 Tab 1 Tab 2 2

Carryover Allocation: Reservation vs. Allocation Initially, 8609 was only way to allocate credits (no carryover required); the law was amended to allow for a carryover allocation. Agencies use Reservation as an internal step. MFA issues preliminary and final reservation letters, then issues a carryover allocation; A carryover allocation is required for all projects that will not be placed in service during the year in which a reservation letter is issued. Projects are expected to be placed in service no later than the end of the second year following the year when the reservation letter is issued. Treasury Regulation 1.42-6 defines documents needed for carryover allocation (see page 6) New Mexico Mortgage Finance Authority 3

Carryover- Internal Revenue Code A carryover allocation is an allocation that meets the requirements of §42(h)(1)(E) or (F) I.R.C. §42(h)(1)(E)(i) An allocation meets the requirements of this subparagraph if such allocation is made with respect to a qualified building which is placed in service not later than the close of the second calendar year following the calendar year in which the allocation is made. New Mexico Mortgage Finance Authority 4

10% Basis Test A carryover allocation may only be made with respect to a qualified building. I.R.C. §42(h)(1)(E)(ii) Qualified Building---For purposes of clause (i), the term “qualified building” means any building which is part of a project if the taxpayer’s basis in such project (as of the later of the date which is one year after the date that the allocation was made) is more than 10 percent of the taxpayer’s reasonably expected basis in such project (as of the close of the second calendar year referred to in clause (i)). New Mexico Mortgage Finance Authority 5

Requirements For Allocation Treasury Reg§1.42-6(d)(2) An allocation pursuant to section 42(h)(1)(E) or (F) is made when an allocation document containing the following information is completed, signed and dated by an authorized official of the Agency— (i)The address of each building in the project, or if none exists, a specific description of the location of each building; (ii)The name, address and taxpayer identification number of the taxpayer receiving the allocation; New Mexico Mortgage Finance Authority 6

Requirements (Continued) (iii) (iv) (v) (vi) The name and address of the Agency; The taxpayer identification number of the Agency; The date of the allocation; The housing credit dollar amount allocated to the building or project, as applicable; (vii) The taxpayer’s reasonably expected basis in the project (land and depreciable basis) as of the close of the second calendar year following the calendar year in which the allocation is made; New Mexico Mortgage Finance Authority 7

Requirements (Continued) (viii)The taxpayer’s basis in the project (land and depreciable basis) as of the close of the calendar year of the allocation and the percentage that basis bears to the reasonably expected basis in the project (land and depreciable basis) as of the close of the second following calendar year; (ix) The date that each building in the project is expected to be placed in service; and (x) The Building Identification Number (B.I.N.) to be assigned to each building in the project. New Mexico Mortgage Finance Authority 8

Election to Lock in Tax Credit Rate You have the option to lock in the Credit Rate for the construction/rehabilitation expenditures at time of carryover allocation or at date on which the building is placed in service. The decision to lock or not at carryover is irrevocable. New Mexico Mortgage Finance Authority 9

MFA Carryover Application Requirements: Updated Project Application & Schedules A-F (w/ changes highlighted in yellow); Completion of ‘Assignment of BIN” form; Architect’s Certification Narrative of Material Changes Option to lock Credit Percentage form; Certificate of Partnership; Limited Partnership Agmt or Operating Agmt; Recorded deed or executed lease vested in the name of the entity- this means partnership! New Mexico Mortgage Finance Authority 10

Carryover Application Requirements, cont. Evidence of zoning – if exempt at application; Contractor’s resume – if not provided at application; All financing commitments – construction and permanent, including a letter of intent from equity provider; Risk Share financing – HUD Firm Approval Letter required prior to purchase of land and/or buildings; Special Needs Housing Set Aside Agmt. or Marketing Plan; Rehabilitation Projects- appraisal & capital needs assessment; Historic Projects- NPS approval of historic certification. New Mexico Mortgage Finance Authority 11

Carryover Application Copy of application, checklist, sample forms and instructions are available on MFA website at http://housingnm.org/developers/low-incomehousing-tax-credits-lihtc. Submission date 11/15/17- submit Application in conformance with §IV.A.4.b) of QAP (hard copy electronic copy, tabbed, bookmarked). REMEMBER: 500 extension fee per week for submission of late or missing documents. Carryover documents sent out by MFA in early December and must be returned for MFA’s signature before the end of the year. New Mexico Mortgage Finance Authority 12

10% Cost Test Submission Each project issued a carryover allocation must provide evidence that the basis in the project exceeds 10% of the reasonably expected total basis (referred to as the “10% test”). Requirements: Independent Auditor’s Report; Exhibit A to above (itemized expenditures); Owner’s Attorney’s Opinion (required form). Due no later than August 31, 2018 The 10% test is not graded on a curve! New Mexico Mortgage Finance Authority 13

Construction Start MFA must approve construction start (§IV.C.7, p. 39). Applicant Certification required and if there are Material Design Changes, detailed Narrative required. (2017 Mandatory Design Standards, Part B). Architect Bid Amount Due w/in 20 days of billing (§IV.B, p. 35). Each project issued a carryover allocation must also provide evidence of construction start to MFA no later than August 31, 2018. New Mexico Mortgage Finance Authority 14

Construction Start, cont. Requirements: Building Permits Contractor’s Application and Certificate for Payment (if available) Site Photographs (color) Executed partnership agreement Evidence of National Park Service Approval of the Project’s Historic Certification Part 2 (if applicable) New Mexico Mortgage Finance Authority 15

New Mexico Mortgage Finance Authority 16

Placed in Service and Final Allocation Application Process Placement in Service Versus Final Application At a minimum the Placement in Service application must be provided by November 15th (two years from Carryover) REMEMBER: 500 weekly extension fee for late or missing documents - extensions granted at MFA’s discretion Final Allocation Application is required to issue 8609’s REMEMBER: Final Allocation Application should be submitted no later than 120 days from the close of the Project’s first taxable year of the Credit Period. 17 New Mexico Mortgage Finance Authority

Placement in Service Application Requirements: Submit Application in conformance with §IV.A.4.b) of QAP (hard copy electronic copy, tabbed, bookmarked). Partial update of the application; Certificate of occupancy for each building or certificate of completion (rehab); Color Photographs of each building and amenities; Project Ownership Profile; Form 8609 Certification; Recorded consents from every lien holder for recording of LURA; New Mexico Mortgage Finance Authority 18

Final Allocation Application Requirements: Complete updated application and schedules A-1, B, C, D, and F; Schedule “M” Addendum for Final Allocation; Written certification from the equity investor; Owner’s certification Form “A” and Form “A2”; Auditor’s report Form “B”; Certification of Costs Incurred by building Form “C”; Attorney’s opinion (required form); As-Built” Architect Certification (required form); New Mexico Mortgage Finance Authority 19

Final Allocation Application Requirements, cont. New Mexico Mortgage Finance Authority 20

Final Allocation Application Requirements, cont. Copy of recorded LURA Updated service enrichment MOUs/contracts Fully executed Deferred Fee Promissory Note, if applicable Evidence of HERS rating Copy of current rental assistance contract (if applicable) For 4 percent LIHTC bond projects, final executed financing documents from all sources New Mexico Mortgage Finance Authority 21

Land Use Restriction Agreement “LURA” I.R.C. Section 42(h)(6) requires imposition of “an extended low-income housing commitment” LURA sets forth: Covenants running with the land for a minimum 30 years or longer; Compliance fees; Set-asides; Special housing needs to be served; Any other such commitments. Can not be terminated prior to its term for any reason other than foreclosure. Owner does not have the right to require MFA to present a qualified contract. A LURA must be executed and recorded prior to December 31st to claim credits in the year that the buildings are placed in service. New Mexico Mortgage Finance Authority 22

MFA Placed in Service and Final Allocation Application Forms LIHTC application packages on MFA’s website at: www.housingnm.org/low-income-housing-tax- credits-lihtc New Mexico Mortgage Finance Authority 23

Underwriting Considerations Tax Credit Rates Developer and Builder Fees Cost Limits Basis Boost New Mexico Mortgage Finance Authority 24

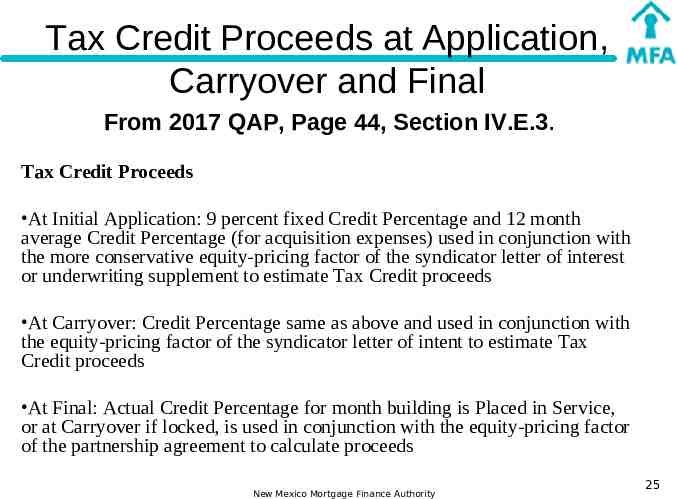

Tax Credit Proceeds at Application, Carryover and Final From 2017 QAP, Page 44, Section IV.E.3. Tax Credit Proceeds At Initial Application: 9 percent fixed Credit Percentage and 12 month average Credit Percentage (for acquisition expenses) used in conjunction with the more conservative equity-pricing factor of the syndicator letter of interest or underwriting supplement to estimate Tax Credit proceeds At Carryover: Credit Percentage same as above and used in conjunction with the equity-pricing factor of the syndicator letter of intent to estimate Tax Credit proceeds At Final: Actual Credit Percentage for month building is Placed in Service, or at Carryover if locked, is used in conjunction with the equity-pricing factor of the partnership agreement to calculate proceeds New Mexico Mortgage Finance Authority 25

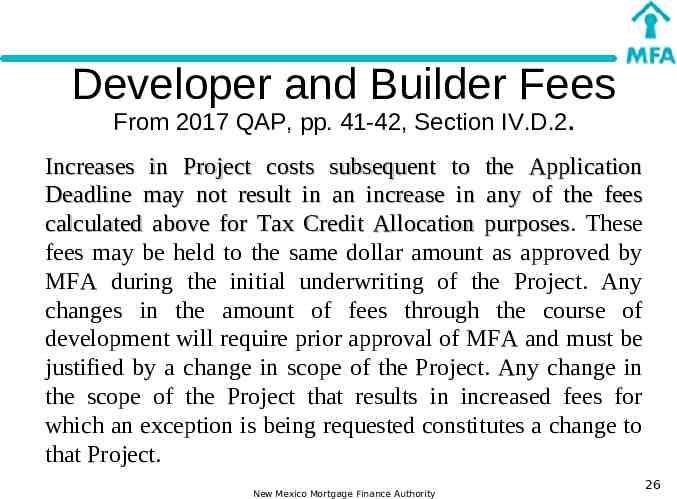

Developer and Builder Fees From 2017 QAP, pp. 41-42, Section IV.D.2. Increases in Project costs subsequent to the Application Deadline may not result in an increase in any of the fees calculated above for Tax Credit Allocation purposes. purposes These fees may be held to the same dollar amount as approved by MFA during the initial underwriting of the Project. Any changes in the amount of fees through the course of development will require prior approval of MFA and must be justified by a change in scope of the Project. Any change in the scope of the Project that results in increased fees for which an exception is being requested constitutes a change to that Project. New Mexico Mortgage Finance Authority 26

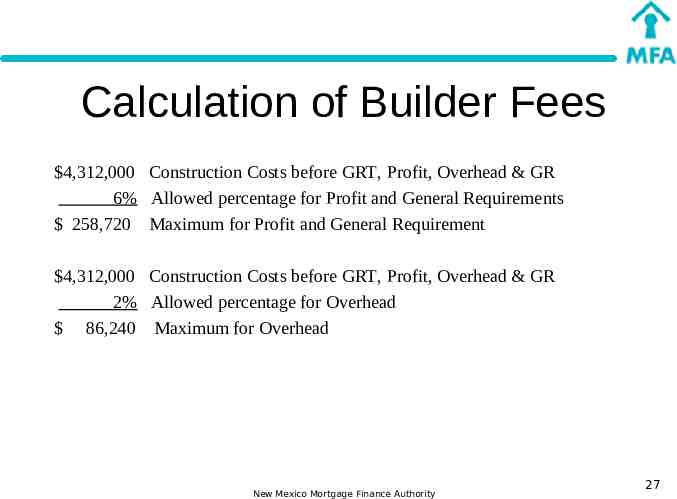

Calculation of Builder Fees 4,312,000 Construction Costs before GRT, Profit, Overhead & GR 6% Allowed percentage for Profit and General Requirements 258,720 Maximum for Profit and General Requirement 4,312,000 Construction Costs before GRT, Profit, Overhead & GR 2% Allowed percentage for Overhead 86,240 Maximum for Overhead New Mexico Mortgage Finance Authority 27

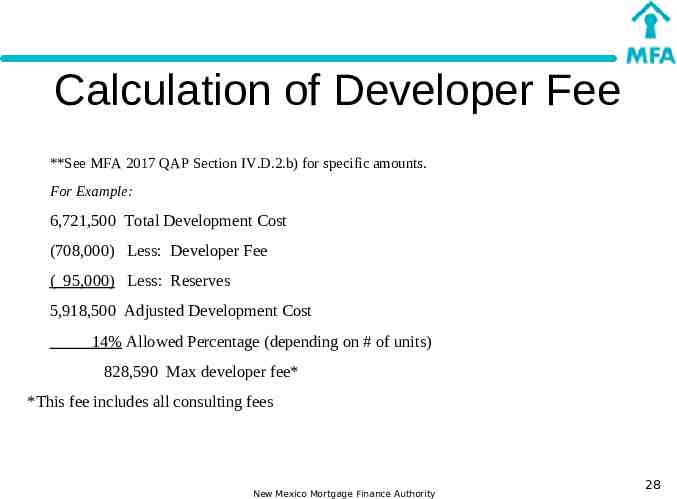

Calculation of Developer Fee **See MFA 2017 QAP Section IV.D.2.b) for specific amounts. For Example: 6,721,500 Total Development Cost (708,000) Less: Developer Fee ( 95,000) Less: Reserves 5,918,500 Adjusted Development Cost 14% Allowed Percentage (depending on # of units) 828,590 Max developer fee* *This fee includes all consulting fees New Mexico Mortgage Finance Authority 28

Cost Limits New Construction – 130% of weighted average per new construction unit TDC Rehabilitation – 100% of weighted average per new construction unit TDC 2017 QAP, Page 37, Section IV.C.2. Costs that exceed these limits will be excluded when calculating the Tax Credit amount. These limits are binding through Final Allocation. New Mexico Mortgage Finance Authority 29

New Mexico Mortgage Finance Authority 30