PROTECTING YOUR PRACTICE During COVID-19 Maryan Hennen, CPCO Dalia

28 Slides3.77 MB

PROTECTING YOUR PRACTICE During COVID-19 Maryan Hennen, CPCO Dalia Cantor, CPA, CVA COO CEO and Founder Billed Right CPA Solutions www.medicusit.com

OUR SPEAKERS Dalia Cantor is a Certified Public Accountant and Certified Valuation Analyst. She is the founder and leader of CPA Solutions. Ms. Cantor has been practicing as an accountant, business consultant and a tax advisor for over 20 years. She is retained by businesses, law firms, financial institutions, and individuals to provide services in diverse areas of business accounting and consulting, taxation, business valuations and forensic accounting. Prior to establishing her own practice, she worked in public accounting managing both domestic and foreign audit and tax clients. In private industry, she was involved in the regulatory environment, specializing in technical accounting, internal controls, SEC reporting and M&A transactions for publicly held international companies.

OUR SPEAKERS Maryan Hennen, CPCO Maryan is the COO of Billed Right and has led the Client Relations department at Billed Right for seven years. She also oversees the Revenue Cycle Management operations & Compliance. She is a Certified Compliance Officer and her expertise are in clinical and billing process design and improvements, as well as compliance education for our clients. Works in harmony with Billed Right’s India leadership team and coding managers to lead a seamless RCM operation for Billed Right and continue to provide expert knowledge to improve our partners clinical and RCM operations.

KEY POINTS 1. Telehealth - What is Telehealth? What are the different types? What are some guideline and latest updates 2. Billing and Coding - 1135 Waiver What is it? How has it changed our workflow? What are the pertinent information I need to know? 3. Communication with Patients - How do I educate my patients about telehealth and what platform do I use? 4. Advance Payment Options - Where and How to apply – step-by-step guide

DO YOU HAVE A PLAN? Prepare your patients Prepare your staff Prepare yourself

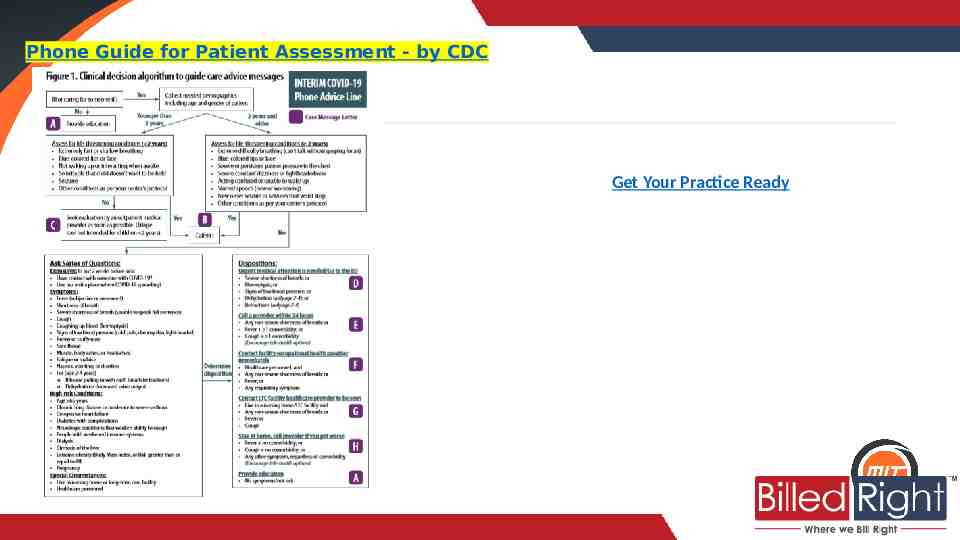

Phone Guide for Patient Assessment - by CDC Get Your Practice Ready

TELEHEALTH Synchronous telemedicine service rendered via a real-time interactive audio and video telecommunications system. Medicare restrictions related to telehealth have been lifted and several guidelines are relaxed-thanks to the 1135 waiver. All E/M and other services that are currently eligible under the Medicare telehealth reimbursement policies are included in this waiver. These are list of eligible CPT/HCPCS codes. Use modifier -95 to claim lines that describe the services provided via telehealth. POS code would be whatever would have been reported had the service been provided in person. AMA coding guidance

Telephone Evaluation and Management Services (CPT 99441-99443) On March 30, 2020, CMS finalized payment for telephone evaluation and management (E/M) services (CPT 99441-99443). Effective March 1, 2020, the codes will be considered active and payable for the duration of the COVID-19 pandemic. CMS will allow physicians to provide telephone E/M services to new and established patients. Telephone E/M services are provided to a patient, parent, or guardian and do not originate from a related E/M service within the previous seven days and do not lead to an E/M service or procedure within the next 24 hours or soonest available appointment. The following codes may be used by physicians or other qualified health professionals who may report E/M services: 99441: telephone E/M service; 5-10 minutes of medical discussion 99442: telephone E/M service; 11-20 minutes of medical discussion 99443: telephone E/M service, 21-30 minutes of medical discussion. Physicians can reduce or waive cost-sharing for these services.

Medicare Virtual Check-ins (G2012) Enable a quick visit with a patient to determine if an in-person visit is necessary. Effective March 1, 2020, these services can be provided to new and established patients. Are brief (5-10 minutes) conversations with a physician or other clinician, where the communication is not be related to a medical visit within the previous seven days and does not lead to medical visit within the next 24 hours (or soonest appointment available). Can be conducted through multiple communication technology modalities, including synchronous telephone conversation or exchange of information through video or image. Physician or other clinician may respond to patient by telephone, audio/video, secure text messaging, email, or patient portal. Are initiated by the patient, and patient must provide verbal consent. Consent may be obtained before or at the time of service. Physicians can reduce or waive cost-sharing for these services. G2010 can be used when a captured video or image is sent to the physician. The physician must follow up with the patient within 24 business hours. The consultation must not originate from an evaluation and management (E/M) service provided within the previous seven days or lead to an E/M service within the next 24 hours (or soonest available appointment).

Medicare E-Visits (online digital evaluation and management services) Are non-face-to-face, patient-initiated communications with the physician through an online patient portal. The communications can occur over a seven-day period, and the exchange must be stored permanently. Effective March 1, 2020, these services can be provided to new and established patients. Patients must verbally consent to services. Consent may occur before or at the time of service. Physicians can reduce or waive cost-sharing for these services. Physicians and other clinicians who may independently bill Medicare for E/M services can use the following codes. 99421: Online digital evaluation and management service, for a patient, for up to 7 days, cumulative time during the 7 days; 5-10 minutes 99422: Online digital evaluation and management service, for a patient, for up to 7 days, cumulative time during the 7 days; 11-20 minutes 99423: Online digital evaluation and management service, for a patient, for up to 7 days, cumulative time during the 7 days; 21 or more minutes

Documentation Requirements For Telehealth Same as those for documenting in-person care. CMS has also removed any requirements regarding documentation of history and/or physical exam in the medical record for Telehealth visits. Telehealth E/M levels can be based on Medical Decision Making (MDM) OR time (total time associated with the E/M on the day of the encounter). Proof of time must be documented if codes are ‘time based’ CMS is allowing physicians to select the level of office/outpatient visit E/M for services delivered via telehealth using either time or medical decision making. Time is defined as all time associated with the E/M on the day of the encounter. Notate that the consult/visit was held via telemedicine (first line), patient location and referring physician o Example: This office visit was completed via telemedicine assessment. The patient gave full consent to perform the telemedicine visit. The patient was at home, and alone, during the assessment. Names of all people present during a telemedicine consultation and their role o Example: The provider completed the assessment in a private office location.

COMMUNICATION IS KEY Providers: Prepare to be an advocate of telehealth-your patients need you and trust you! Educate your patients. There are options available that suit each patient, as not everyone will prefer video calls. Consider having a patient advocate knowledgeable to educate your patients about the different options available. Promote it across all channels- Website, email, text messaging, social media, patient portal, flyers and signage on your clinic doors. Make the appointment process simple. Check if your telehealth app has text and email capability to suit patients across all ages. Doxy.me is an example of a simple to use app. Recognize your limit. Determine how you will fit telehealth visits in your schedule and designate an owner of this process in your practice to manage this process from A-Z.

KNOW THERE ARE MANY RESOURCES AND OPTIONS TO HELP YOU, YOUR PATIENTS AND YOUR STAFF

Advance Payment Option by CMS On March 28, 2020, the Trump Administration announced a plan to offer advance Medicare fee-for-service payments, as well as accelerated reimbursements, to all Medicare Part A and B providers. This type of accelerated reimbursement is allowed during certain situations, such as in the event of a natural disaster or other national emergency the country may be facing. Most providers who bill under Medicare Parts A and B can request up to 100% of their Medicare payment for a three-month period in advance, which will then be repaid via an automated recoupment process. The form can be found on your Medicare Administrative Contractor (MAC) website and can be submitted online. After your request is received, payment is expected within 7 calendar days from the date of the request. To be eligible for this assistance, you must meet the following: 1. Have billed Medicare for claims within 180 days immediately prior to the date of signature on the provider’s/supplier’s request form, 2. Not be in bankruptcy, 3. Not be under active medical review or program integrity investigation, and 4. Not have any outstanding delinquent Medicare overpayments.

Amount of Payment: Most Part B providers will be able to request up to 100% of their historical Medicare payment for a 3-month period. Processing Time: Each MAC will work to review and issue payments within seven (7) calendar days of receiving the request. Repayment: Begins 120 days after the date of issuance of the payment. Providers/ suppliers will receive full payments for their claims during the 120-day delay period. At the end of the 120-day period, every claim submitted will be offset from the new claims to repay the accelerated/advance payment. The following process applies by provider type All other Part A providers and Part B suppliers will have 210 days to repay. FACT SHEET: EXPANSION OF THE ACCELERATED AN D ADVANCE PAYMENTS PROGRAM FOR PROVIDERS AND SUPPLIERS DURING COVID-19 EMERGENCY

CONSIDERATIONS FOR THIS ADVANCED PAYMENT OPTION Consider it an advance loan, no interest and is quick to obtain If you have stable finances, you can still apply and keep this money for reserve If you need assistance with rent, payroll or other practice related expenses, this can help you in the short term Note that after 120 days, you will receive your MCR payments, minus this amount This is NOT an increase in payment, it is only an advance payment

Resources https://www.cms.gov/about-cms/emergency-preparedness-response-operations/current-emer gencies/coronavirus-waivers AMA’s COVID-19 Resource Center for Physicians. AMA Data File requests (CPT data file, etc.). CMS Telehealth Services Fact Sheet (PDF) American Psychiatric Association: General resource page and toolkit on COVID-19 and telepsychiatry American Academy of Child & Adolescent Psychiatry: Telepsychiatry Toolkit American Academy of Pediatrics resources on telemedicine. American College of Physicians resources on COVID-19 and telemedicine Quick-reference flowchart that outlines CPT reporting for COVID-19 testing (PDF) Scenario based coding! https://www.ama-assn.org/system/files/2020-04/covid-19-coding-advice.pdf Phone Advice Line Tools Guidelines for Children (2-17 years) or Adults ( 18 years) with Possib le COVID-19 https://www.cdc.gov/coronavirus/2019-ncov/phone-guide/phone-guide-H.pdf Free COVID-19 Posters https://www.healthstream.com/quarterly-pages/coronavirus https://www.ama-assn.org/system/files/2018-10/ama-chart-telemedicine-patient-physician-

KEY POINTS 1. Managing your overhead – What steps can you take to minimize costs before financing assistance comes? 2. Financial assistance available - What help can you get? What is an EIDL loan? What is a PPP loan? How are they different? Which one is right for you? How to apply for these loans? 3. Your current debt obligations – Can you defer any loan payments? What if you already have an SBA loan? What covenants to look out for? 4. Financial accountability – What documents to provide for PPP loan? What to expect after you receive your loan? How to account for approved spending?

MANAGE YOUR OVERHEAD Review in detail your current monthly expenses Suspend or reduce any non-essential business expenses such as club and association dues, auto and travel allowances, printing and promotional expenses, etc. Align ordering of clinical and lab supplies with your current billing If you have had to lay employees off, review items for which you pay “per seat” fee – number of phone lines, licensing fees, EMR subscriptions, etc. Discuss your insurance coverage with your broker – malpractice, workers comp, business interruption Review your terms with major vendors

GET FINANCIAL ASSISTANCE Florida Small Business Emergency Bridge Loan Program Eligible business applicants can apply for an interest-free, 1-year loan for up to 50,000 This is not a grant and it will have to be paid back SBA Economic Injury Disaster Loan (EIDL) Eligible business applicants can apply for a working capital loan up to 2M Interest rate for this loan is 3.75%, repayment term up to 30 years Deferred payments for first year, interest does not accrue Applicants can request advance of up to 10,000. This advance will not have to be repaid but it will be subtracted from your PPP loan Apply through SBA.gov EIDL loans over 200,000 need personal guarantee and collateral Good for working capital needs (excluding payroll costs) SBA Express Bridge Loan Designed for businesses to obtain a quick cash influx up to 25,000 through SBA Express Lender with less paperwork Can be used to bridge the gap while applying for EIDL loan

GET FINANCIAL ASSISTANCE (CONTINUED) CARES Act Paycheck Protection Program (PPP) Available for businesses with employees Maximum loan amount 2.5X average monthly payroll costs – salaries and wages health insurance retirement benefits. Annual compensation amount per employee is capped at 100,000 per year This loan will be forgiven if at least 75% of employees are retained The funds must be used during an 8-week period after receipt for specific business expenses - payroll, rent, utilities, or mortgage/debt interest If you had to furlough your employees due to closure, as long as you rehire them by June 30 you are still eligible for forgiveness Repayment terms are 2 years at 0.98% interest for the portion that is not forgiven The PPP will be available through June 30, 2020 Applications are processed through approved SBA lender First come first serve basis No income tax will be due on the amount forgiven

GET FINANCIAL ASSISTANCE (CONTINUED) Considerations when applying for SBA loans Use holistic approach when deciding which loans you should apply for Discuss with your banker your current financing facility and covenants that may preclude you from obtaining additional financing You can apply for both – PPP and EIDL but they cannot be used for the same purpose Have a clear picture of your overall operating cash needs Will PPP be enough to sustain your cash flow needs Will you need additional capital to purchase clinical and lab supplies – lean on your suppliers for extended terms before you consider additional debt Calculating your maximum PPP loan amount The measurement period is fiscal 2019. Can also use rolling last 12 months if necessary Choosing your lender Your current bank should be your first choice You will not be able to apply through a different bank if you don’t have banking relationship Non-bank lenders might be an alternative

BE PREPARED FOR FINANCIAL ACCOUNTABILITY All the financial assistance applications require submission of various financial records We suggest to lean on your CPA as typically they already would have mass majority of your financial records available What records will you need to provide with your PPP application 2019 quarterly and annual Federal payroll tax returns (Forms 941 and 940) 2019 W-2s and W-3 2019 and YTD (through 2/15) payroll registers 2019 business tax return or financial statements Loan calculation worksheet Some banks may require additional documents such as bank statements For PPP loan to be forgiven you will need to proof the usage of funds so in this case is not “if” but “when” you get audited Open a new bank account when the loan is received and utilize only that bank account to pay allowable expenses

UPCOMING WEBINARS HR Policies Legal considerations Marketing strategies Commercial lending

Questions? Dalia Cantor, CPA, CVA Email: [email protected] Phone: 407-650-9088 Web: www.mycpasolutions.com Maryan Hennen, CPCO Email: [email protected] Phone: (321)-282-3063 Web: www.billedright.com

PROTECTING YOUR PRACTICE During COVID19 THANK YOU!