Processing Deposits Revised July, 2020

5 Slides420.53 KB

Processing Deposits Revised July, 2020

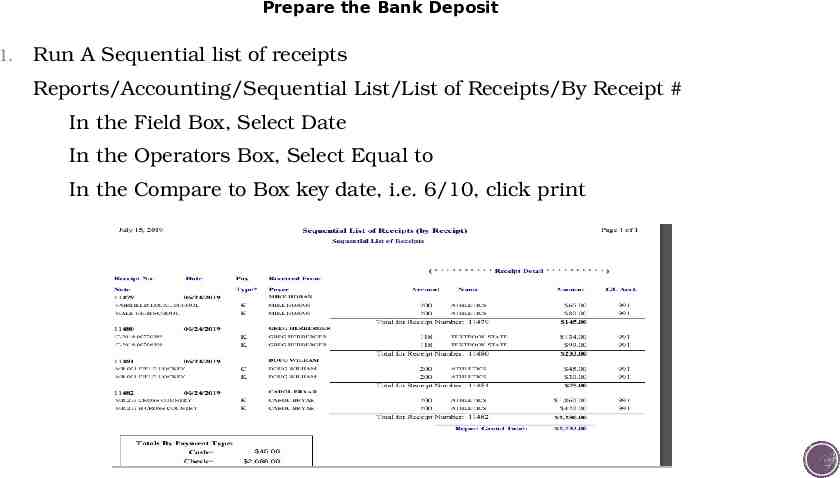

Prepare the Bank Deposit 1. Run A Sequential list of receipts Reports/Accounting/Sequential List/List of Receipts/By Receipt # In the Field Box, Select Date In the Operators Box, Select Equal to In the Compare to Box key date, i.e. 6/10, click print

Preparing the Bank Deposit Continued 2. Reconcile checks/cash to the Sequential List of Receipts Reminder – when processing receipts through EPES, always key separate line items for cash vs. checks Provides a balancing tool so checks/cash can be compared Allows for easier bank deposit balancing Retain a copy of all checks to include with the daily deposit documentation Once reconciled, proceed to step 3 3. Prepare the deposit ticket in duplicate Writing each check number and the check writer’s last name is not required on the bank deposit ticket Cash, coin & total check dollar amount is sufficient Endorse checks as they are received

Preparing the Bank Deposit Continued 4. The bookkeeper must coordinate the bank deposit with the EPES software, i.e. tell EPES you are going to the bank In EPES, go to Accounting/Accounting/Transfers & Deposits A “deposit amount” box is displayed, the amount of the deposit reflects the bank deposit Beneath the deposit amount display box is a gray button labeled “post deposit.” Click this button once you have confirmed the amount in the deposit box matches the bank deposit. If it does not match, STOP review the deposit to see if you can determine the reason. If you are unable to make the determination, call 485-3367 for assistance –Go ahead and make the make the bank deposit When “cash on hand” is posted in EPES, the dollar amount moves to the general ledger indicating a bank deposit was made Should you realize the following day this step was missed, simply “swipe” through the date in the EPES system & change the date to the date you made the actual bank deposit. Then post the deposit.

Preparing the Bank Deposit, contd. 5. The Sequential List of Receipts, the bank deposit slip and the EPES general ledger transfer dates should ALL be the same day. 6. Upon returning from the bank, staple the bank deposit ticket to the sequential list of receipts preferably where the total receipts & bank stamped verification can be viewed simultaneously. 7. The daily deposit documentation should include: o The printed Sequential List of Receipts run through the applicable day(s). o The bookkeeper’s portion of the pre-numbered EPES generated receipt in receipt number order. o Copies of all checks. o F-SA-17 Sales from Inventory Form; if applicable. 8. The Daily Deposit documentation must be verified by the principal or their designee & their initials should be on the bank stamp as well as the Sequential List of Receipts. The total receipts must be compared to the BANK STAMPED VERIFICATION & the amount on the deposit ticket & initialed in both locations. 9. File in date order.