Preparing for open enrollment 2021 October 1-31, 2021 Coverage

15 Slides441.83 KB

Preparing for open enrollment 2021 October 1-31, 2021 Coverage effective January 1, 2022

What’s new for 2022? A 0.8 percent employer only rate increase. Small increase in Dental Plus premiums. Small increase in State Vision Plan premiums. Dental open enrollment year. New electronic Statement of Health process for life insurance. ASIFlex/HSA Central will administer the new Health Savings Accounts contract. Participant accounts will remain with Central Bank until March 2022. At that time, accounts will move to the HSA Central platform. Be on the lookout for communication about this upgrade in early 2022. Companion Benefit Alternatives (CBA) will administer the new behavioral health manager contract. 2

Open enrollment is October 1-31, 2021 Changes made during open enrollment are effective January 1, 2022. Current coverage will continue in 2022 for employees who do not make changes. Re-enroll in MoneyPlus flexible spending accounts. Make open enrollment changes through MyBenefits. Employees who request life insurance elections that require medical evidence must complete an Active Notice of Election; however, all other open enrollment changes can be made through MyBenefits. Share this flyer that includes details about how to register. 3

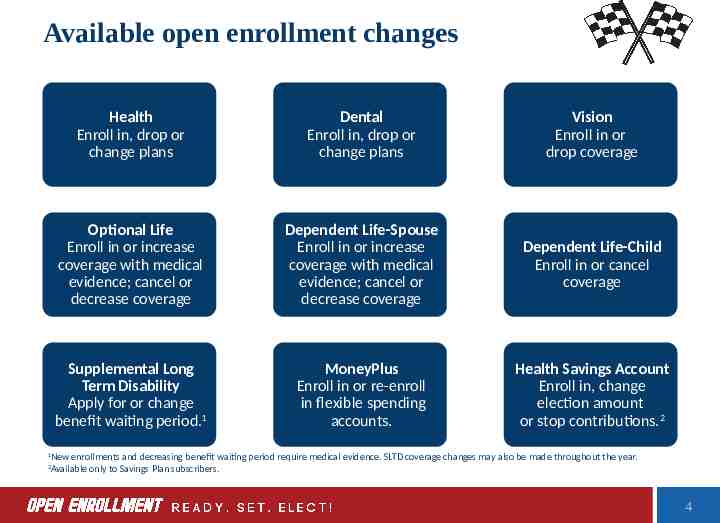

Available open enrollment changes Health Enroll in, drop or change plans Dental Enroll in, drop or change plans Vision Enroll in or drop coverage Optional Life Enroll in or increase coverage with medical evidence; cancel or decrease coverage Dependent Life-Spouse Enroll in or increase coverage with medical evidence; cancel or decrease coverage Dependent Life-Child Enroll in or cancel coverage Supplemental Long Term Disability Apply for or change benefit waiting period.1 MoneyPlus Enroll in or re-enroll in flexible spending accounts. Health Savings Account Enroll in, change election amount or stop contributions.2 New enrollments and decreasing benefit waiting period require medical evidence. SLTD coverage changes may also be made throughout the year. Available only to Savings Plan subscribers. 1 2 4

Newly eligible ongoing employees1 Newly eligible ongoing employees may enroll in the following benefits for coverage effective January 1, 2022: Health; Dental; Vision; Optional Life insurance up to three times their salary rounded down to nearest 10,000 without medical evidence; Dependent Life-Spouse insurance; Dependent Life-Child insurance; Supplemental Long Term Disability; MoneyPlus; and Health Savings Account, if applicable. An ongoing employee credited with an average of 30 hours per week during the Standard Measurement Period may enroll during the annual open enrollment period with coverage effective January 1. 1 5

2022 Monthly premiums Available at peba.sc.gov/monthly-premiums. State Health Plan: A 0.8 percent employer only rate increase will be effective January 1, 2022. No employee rate increase. No change in copayments, deductibles and coinsurance. Small increase in Dental Plus and State Vision Plan premiums. Optional employers should also apply experience rated load factor received in March to the PEBA-published employer and employee health premiums. Use the Monthly premium worksheet for optional employers to notify your employees of their premiums. Contact PEBA’s Customer Service for a copy of your experience rating letter. 6

Publications for 2022 Insurance Summary PEBA will not print and distribute the Insurance Summary. Available online before open enrollment. Benefits Advantage newsletter PEBA will print the Benefits Advantage and mail it to retirees, COBRA subscribers, survivors and former spouses in advance of open enrollment. Available online before open enrollment. Insurance Benefits Guide PEBA will not print the Insurance Benefits Guide. Available online before open enrollment. 7

Federally mandated notices Federal laws require written notification of many notices prior to open enrollment. Sending notices electronically does not comply with these federal laws. PEBA will print the required notices for delivery to employers. Notices will be delivered August 23 through September 10. Notices will include a printed open enrollment checklist that employees can use to plan their 2022 coverage changes. You must provide a printed copy of the notices to your insurance-eligible employees by October 1, 2021. 8

Where to find employer resources Open enrollment resources at peba.sc.gov/oe-employers. Publications for 2022 Open enrollment worksheets Monthly premiums for 2022 Navigating Your Benefits flyers Monthly premium worksheet for optional employers Marketing toolkit with ready-to-go materials to promote open enrollment 9

Your responsibility as an employer Review other insurance products that you may offer. You may not offer an insurance benefit that is available through PEBA. You may offer products not available through PEBA; however, premiums for those products may not be paid pretax through MoneyPlus. Distribute hard copies of federally mandated notices to employees; include COBRA initial notice, if applicable. Provide employees with a link to PEBA’s open enrollment webpage, peba.sc.gov/oe. Encourage employees to use MyBenefits to: Review current coverage and life insurance beneficiaries, even if they don’t plan to make changes. Make open enrollment changes and upload supporting documentation. 10

Your responsibility as an employer Review EBS Console daily to approve transactions. Deadline to approve transactions is December 1. Document all changes for appropriate recordkeeping. During the first week of December, view Report HIS759 for a list of open enrollment transactions that have not been approved. PEBA will purge outstanding transactions on December 13, 2021. Confirm January 2022 payroll deductions correspond with approved open enrollment transactions. Advise employees to review payroll deductions in January. 11

New electronic Statement of Health process for life insurance Employees who request life insurance elections in MyBenefits will see message for amounts that require medical evidence. If medical evidence is required, employee must complete an Active Notice of Election. All other open enrollment changes can be made through MyBenefits. Employer will submit information about the life insurance election in EBS via the Life Ins SOH button. PEBA will send a weekly file to MetLife, and MetLife will email employees a link to an online Statement of Health form within three days. MetLife will send reminder emails at Day 7 and Day 14. If employee does not submit online form, MetLife will mail a paper form. Employers will continue to receive approval reports from MetLife and should submit the NOE to PEBA once they receive approval. 12

Submitting SLTD salary information Employers must review and update the salary information for Supplemental Long Term Disability (SLTD) subscribers during open enrollment.1 If salary information is not updated, premiums and any benefits paid will be based on the last salary information submitted to PEBA. Submit salaries as of October 1 in EBS between September 15 and October 31. Once confirmed in EBS, no further changes are allowed. View the SLTD salary updates resource document at peba.sc.gov/insurance-training. Not applicable to Comptroller General agencies. 1 13

Important reminders Open enrollment begins October 1 and ends October 31 at 11:59 p.m. Can begin making open enrollment changes September 15. Employees use MyBenefits to make coverage selections during open enrollment. HSA enrollees must open a bank account with Central Bank and provide validation code in MyBenefits to complete enrollment. Current 2021 Medical Spending Account (MSA) and Limited-use MSA participants can carry over the full amount of unused funds into the 2022 plan year. Employees should consider this when making 2022 elections. Review EBS Console daily to approve transactions. Open enrollment mail must be postmarked by November 15. Deadline to approve transactions is December 1. 14

Disclaimer This presentation does not constitute a comprehensive or binding representation of the employee benefit programs PEBA administers. The terms and conditions of the employee benefit programs PEBA administers are set out in the applicable statutes and plan documents and are subject to change. Benefits administrators and others chosen by your employer to assist you with your participation in these employee benefit programs are not agents or employees of PEBA and are not authorized to bind PEBA or make representations on behalf of PEBA. Please contact PEBA for the most current information. The language used in this presentation does not create any contractual rights or entitlements for any person. 15