Post Award Training 1

38 Slides982.20 KB

Post Award Training 1

About PCCD PCCD's mission is to enhance the quality, coordination, and planning within the criminal and juvenile justice systems, to facilitate the delivery of services to victims of crime, and to increase the safety of our communities. 2

Post Award Training 3

Goals of this training: Provide you with the knowledge and tools to successfully manage your grant(s). To help you better understand the federal and state regulations. To provide you with samples of how to record and report your grant activities. To provide you an overview on what to expect during the life of your grant. 4

Post Award Training 1. 2. 3. 4. 5. Getting Started Grants Reporting Project Modifications Monitoring Closing out a grant 5

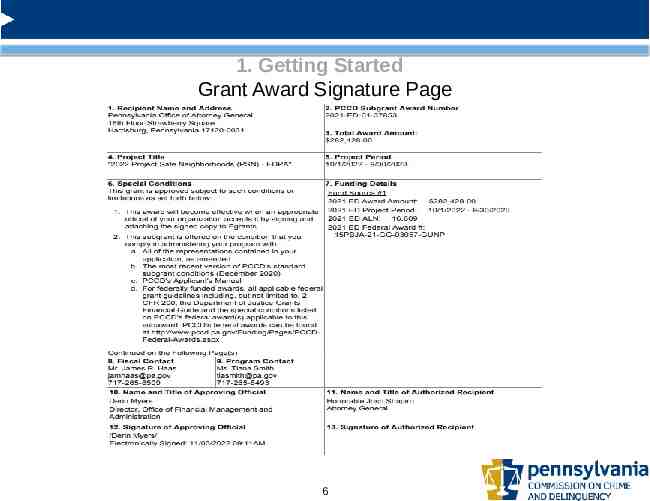

1. Getting Started Grant Award Signature Page 6

1. Getting Started Setting up Systems and Procedures Record Keeping Accounting System Requirements Time and Effort Reporting Procurement Policies 7

1. Getting Started Setting up Systems and Procedures Agencies must have systems and procedures in place in order to safeguard the grants assets. These systems and procedures must include, but are not limited to: Financial Management Internal Controls Time and Effort Policies and Procedures 8

1. Getting Started Financial Management Proper stewardship of grant resources is an essential responsibility of the grantee organization. Award recipients must ensure that PCCD funding and resources are used efficiently and effectively to achieve desired objectives. Organizations should have management processes and controls in place that reasonably ensure all of the following: Funded programs achieve their intended results. Resources are used in a manner consistent with the funding agency’s mission. Programs and resources are protected from waste, fraud, and mismanagement. Laws and regulations are followed. Reliable and timely information is obtained, maintained, reported, and used for decision-making. 9

1. Getting Started Internal Controls An adequate financial management system has strong internal controls. Strong internal controls help to ensure effective and efficient operations, reliable financial reporting, and compliance with applicable laws and regulations. Strong internal controls also help ensure individuals within the organization are not tempted to “bend the rules” in order to personally gain from the awarded funding. Internal controls include written policies and procedures that describe processes for planning, organizing, directing, controlling, and reporting on organizational operations. A system of internal controls should allow recipients and subrecipients to exercise effective control and accountability for all the PCCD funds, real and personal property, and other assets. Recipients or subrecipients must adequately safeguard all such property and assure that it is used solely for authorized purposes. Internal controls seek to guarantee that reliable and timely information is obtained, maintained, reported, and available for use in decision-making. 10

1. Getting Started Internal Controls (Record Keeping) All financial records, supporting documents, statistical records, and all other records pertinent to the award shall be retained by each organization for at least three years after the date of submission of the final fiscal and programmatic reports. In addition, your agency’s record keeping policies must meet the following criteria: Accurate up-to-date records Records should match exactly what was submitted into Egrants (by expenditure category and by reporting period) Your record keeping should be set-up to segregate PCCD grant income and expenditures from all other income and expenditure activities Successful record keeping is the result of a good accounting system 11

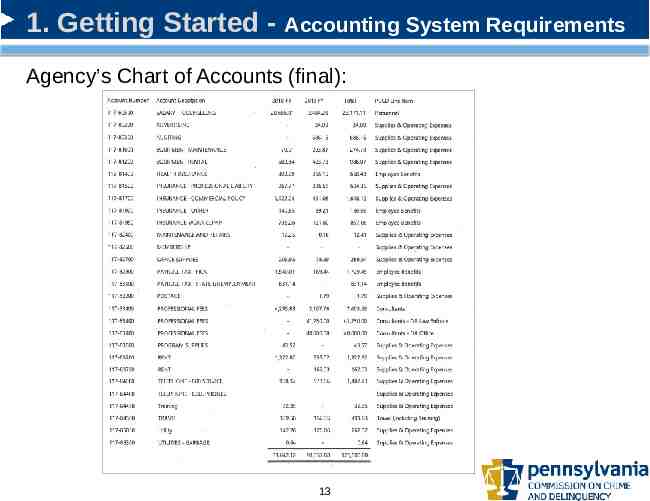

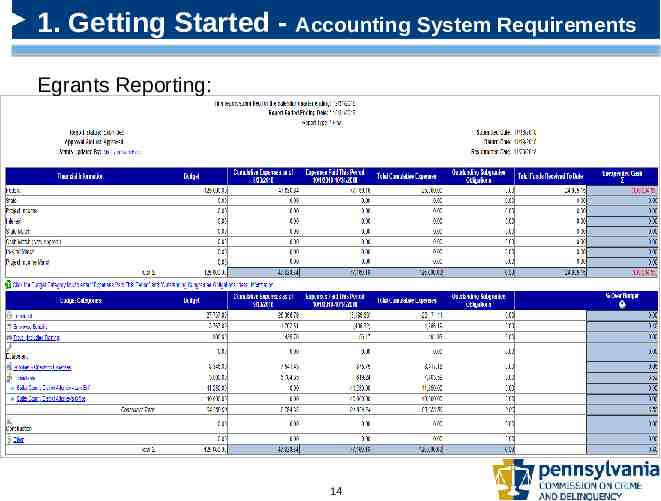

1. Getting Started Internal Controls (Accounting System Requirements) The subgrantee must maintain an accounting system that properly and accurately documents and controls the receipt and disbursement of PCCD grant funds. (Applicant’s Manual) Accounting system documentation must be able to identify revenue and expenditures for each PCCD grant separately from all other revenue and expenditure sources. Accounting system records should identify the receipts of funds from all sources and be summarized in the cash receipts journals. In addition, the disbursement of funds should be identified by the payee, expenditure type, and be summarized in the cash disbursement journals. The subgrantee is responsible for establishing and maintaining an adequate system of accounting and internal controls for itself. Up next, an example of good accounting system reporting. 12

1. Getting Started - Accounting System Requirements Agency’s Chart of Accounts (final): 13

1. Getting Started - Accounting System Requirements Egrants Reporting: 14

1. Getting Started Time and Effort (Recording and Reporting) Time and effort reports (timesheets) are required for all personnel which are funded with PCCD grants. (Applicant’s Manual) Minimum standards for employees working on more than one activity: Must be an after-the-fact determination of the employee's actual effort. (Using a budget estimate instead of reporting the actual time the employee spent working on the project does not qualify as support for charges to awards) Must account for total activity (grant and non-grant) for which employees are compensated and which is required in fulfillment of their obligations to the organization. 15

1. Getting Started Time and Effort Reporting Minimum standards for employees working on more than one activity: (continued) Timesheets must be signed by both the employee and a supervisor with first-hand knowledge of the activities performed by the employee. (Note: Executive Director and Supervisor’s timesheets must also be signed. The Executive Director’s timesheet must be signed by a member of the Board of Directors.) Must be prepared at least monthly to correspond to one or more pay periods. Volunteer time and personnel costs being used as match must be accounted for in the same manner as personnel being charged to the grant. 16

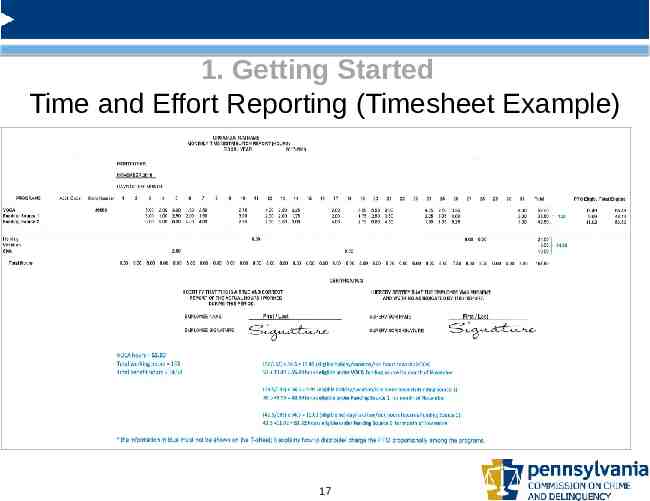

1. Getting Started Time and Effort Reporting (Timesheet Example) 17

1. Getting Started Time and Effort Reporting Minimum standards for employees working on a single activity: Must be an after-the-fact certification that the employee worked 100 percent of their time on activities eligible for reimbursement under the grant project. Must be prepared no less frequently than every 6 months. Must have certification statements signed by both the employee and a supervisor with firsthand knowledge of the activities performed by the employee. (Note: Executive Director and Supervisor’s certifications must also be signed. The Executive Director’s timesheet must be signed by a member of the Board of Directors.) Applies to full-time and part-time employees. 18

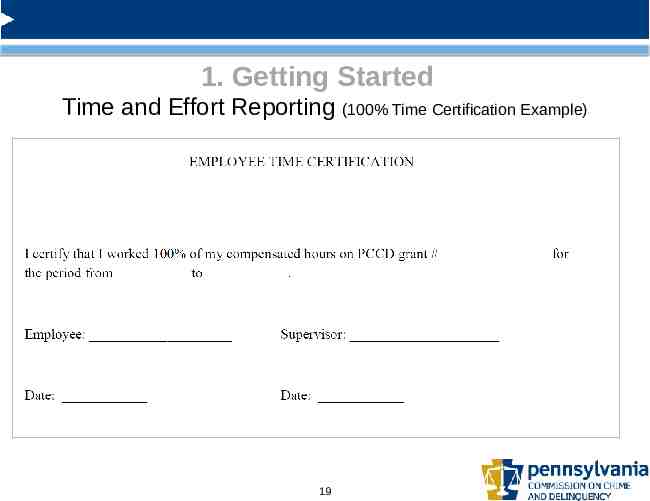

1. Getting Started Time and Effort Reporting (100% Time Certification Example) 19

1. Getting Started Procurement Policies Methods of Procurement – Subgrantees must use one of the following methods of procurement: Procurement by micro-purchases. Procurement by micro-purchase is the acquisition of supplies or services, the aggregate dollar amount of which does not exceed the micropurchase threshold (more than 10,000.00). To the extent practicable, the subgrantee must distribute micro-purchases equitably among qualified suppliers. While competitive purchasing is always encouraged, micro-purchases may be awarded without soliciting competitive quotations if the subgrantee considers the price to be reasonable. Procurement by small purchase procedures. Small purchase procedures are those relatively simple and informal procurement methods for securing services, supplies, or other property that do not cost more than the Simplified Acquisition Threshold ( 10,000.00 250,000.00). If small purchase procedures are used, price or rate quotations must be obtained from an adequate number of qualified sources. The applicant agency must keep documentation on file to support, verify, and justify the competitive method of procurement. Note: A proposed formal advertised or competitive negotiated procurement for which only one bid or proposal is received is deemed to be a noncompetitive procurement. If this occurs, a PCCD sole source approval must be secured – Please reach out to the PCCD fiscal contact listed on your grant for assistance as special rules may apply. 20

1. Getting Started Procurement Policies (continued) Procurement by sealed bids. Formal advertising is required for items that exceed the Simplified Acquisition Threshold (over 250,000.00). Bids are publicly solicited, and a firm fixed price contract (lump sum or unit price) is awarded to the responsible bidder whose bid, conforming with all the material terms and conditions of the invitation for bids, is the lowest in price. The applicant agency must follow the sealed bids/formal advertising procurement procedures and is required to maintain documentation on file to support and verify the sealed bid/formal advertising procurement. Please note: All procurement transactions shall be conducted in a manner which provides; maximum, open, free, and fair competition. Procurement by competitive proposals is normally conducted when price or rate quotations are obtained from multiple qualified sources. A proposed formal advertised or competitive negotiated procurement for which only one bid or proposal is received is deemed to be a noncompetitive procurement. If this occurs, a PCCD sole source approval must be secured – Please reach out to the PCCD fiscal contact listed on your grant for assistance as special rules may apply. 21

2. Grants Reporting Submitting Quarterly Fiscal Reports Submitting Interim Reports Fiscal and Program Reporting Requirements 22

2. Grants Reporting Submitting Quarterly Fiscal Reports Subgrantees are required to report the fiscal status of each PCCD-funded project on a quarterly basis throughout the life of the project. Fiscal reports are due within 20 days after the end of the calendar quarters (March 31, June 30, September 30, December 31). Fiscal reports form the basis for determining disbursements of federal/state funds and it is essential that these reports be submitted on time. Grantees have the option of reporting more frequently than a quarterly basis (IE monthly). Please check with your fiscal contact for more information. 23

2. Grants Reporting Quarterly Fiscal Report Substantiation Items needed: 1. Accounting documentation – Verification that your agency expended the funding. 2. Egrants budget – Verifying that your fiscal report is within budget will avoid delays in your fiscal reporting being approved for reimbursement. 3. Supporting documentation – Documentation must be kept on file that supports the expenditures you are requesting reimbursement for. For example, time and effort reports must support payroll expenditures, invoices must support supplies expenditures, etc. 24

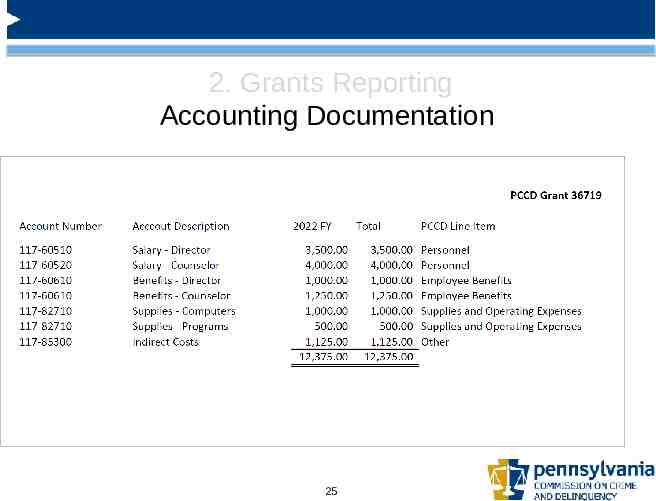

2. Grants Reporting Accounting Documentation 25

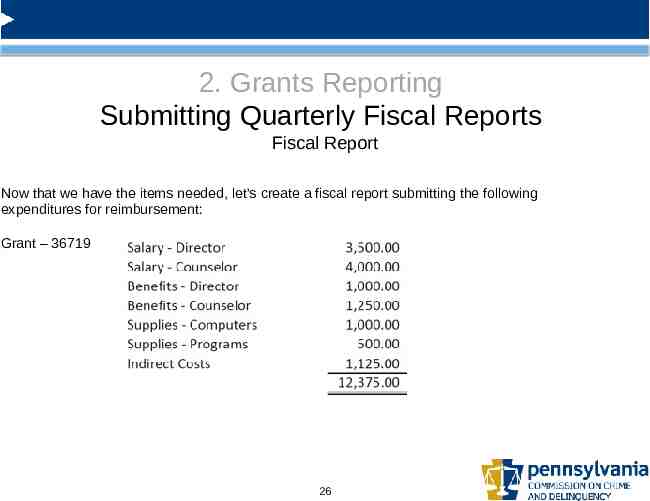

2. Grants Reporting Submitting Quarterly Fiscal Reports Fiscal Report Now that we have the items needed, let’s create a fiscal report submitting the following expenditures for reimbursement: Grant – 36719 26

2. Grants Reporting Submitting an Interim Report Submitting an Interim report is done in the same manner as filing a Quarterly report. This report can be filed anytime during the quarter but not in lieu of the Quarterly report. The two main reasons for filing an Interim report are to correct an error on a previous fiscal report or to file more frequently for cash flow purposes. 27

2. Grants Reporting Fiscal and Program Reporting Requirements For most projects, subgrantees are required to report the fiscal and programmatic status of each PCCD-funded project on a quarterly basis throughout the life of the project. Some state and federal awards have different reporting requirements. If additional reports are needed, or the reporting schedule is different than the standard quarterly schedule, the additional requirements will be explained in the funding guidelines during the solicitation process. All reports are submitted online though Egrants. The following reports are required: 1. Cumulative Fiscal Report; and 2. Program Report. A section explaining reporting requirements is available in Egrants. In addition, alerts are sent via e-mail to all subgrant contacts established in Egrants indicating that reporting due dates are approaching. NOTE: Fiscal and program reports are due within 20 days after the end of the calendar quarters (March 31, June 30, September 30, December 31) unless otherwise noted. Since both fiscal and program reports form the basis for determining further disbursements of federal/state funds, it is essential that these reports be submitted on time. 28

3.Project Modification Requests There may be occasions in which a modification is needed to your budget or program to improve the effectiveness of grant activities. Some examples are: A change(s) between budget categories: Changes that exceed 10% of total project cost. (Total project cost is the sum of the PCCD, project income and applicant's match funds.) A change(s) to purchase additional items or other items that were not included in the approved project budget. A change(s) to the personnel positions listed in the approved project budget including major salary reductions and increases. A change which affects the project’s objectives or scope, e.g., a change in the target population and/or services to be provided. Minor changes in a project are to be reported on the Quarterly Progress Report. A change in dates of the project’s duration. 29

3. Project Modification Requests (continued) Applicants who are unsure as to whether or not a Project Modification Request is needed should contact their PCCD fiscal or program contact for the project. Below is a walkthrough guide to help you through this process. Project Modification Walkthrough 30

4. Monitoring As part of the grant’s financial management requirements, PCCD is required to monitor their grantees. In this section we will discuss: Purpose of monitoring Grantee selection Sample of a monitoring request 31

4. Monitoring Purpose PCCD monitors grantees to ensure that grant funds are expended in accordance with the approved grant budget and that the grantee complied with relevant federal and state regulations and guidelines. Additionally, PCCD monitors to ensure that the project is implemented as described in the application and is achieving the appropriate and expected results. As a result of monitoring, PCCD will request supporting documentation for reported expenditures on the fiscal reports and reported outcomes on the program reports. 32

4. Monitoring Grantee Selection On a quarterly basis, PCCD randomly selects grantees to monitor. The chance of being monitored is related to your agency’s risk level as determined by PCCD. Grantees that are new to PCCD are more likely to be monitored. New grantees are normally set in high-risk status. Once a favorable history is established, the grantee’s risk level may be lowered. PCCD may also conduct monitoring at any time if there is significant program or financial concern. Continued inability to provide appropriate documentation to support expenditures or program operations may result in a range on monitoring remedies up to and including grant revocation. 33

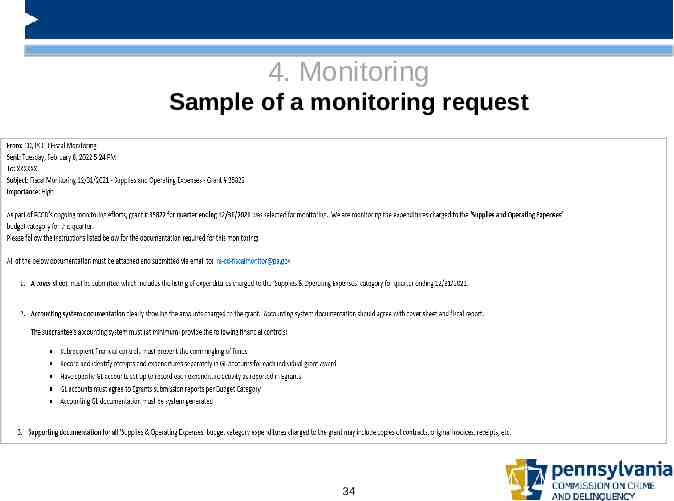

4. Monitoring Sample of a monitoring request 34

5. Closing out a grant Project Close-Out Prepare and submit the final Fiscal Report, the Final Programmatic Report, and the Inventory Report (if necessary). Determine cash balances and return unexpended funds to PCCD. Make all necessary accounting entries to close out project records. Disposition of Property – Please refer to the Applicants Manual for guidance in the deposition of property acquired in whole or in part with federal and/or state funds. 35

Additional Resources PCCD Applicant's Manual - January 2022 A comprehensive Financial and Administrative Guide for managing PCCD grants. Standard Subgrant Conditions - December 2020 The current version of the Standard Subgrant Conditions. Accounting System Requirements The accounting system requirements as outlined in PCCD’s Applicant’s Manual. Time and Effort Reporting Overview An overview of PCCD’s Time and Efforts Requirements. Time and Effort Reporting Policy - Example A sample of a Time and Efforts Reporting Policy. Completed Timesheet Example A sample of a completed timesheet. Timesheet Template.xlsx An excel timesheet template. Employee Time Certification Form A time certification form for employees who work 100 percent on a grant-funded project. 36

Additional Resources (Continued) 2 CFR Part 200 Uniform Guidance The Administrative Uniform Guidance and Audit Requirements for Federal Awards. Department of Justice Grants Financial Guide The Department of Justice (DOJ) Grants Financial Guide. The resources are also available at PCCD’s homepage at: https://www.pccd.pa.gov/ or you can request them through the Grant Management’s Resource Account at: [email protected] Please note: If using the homepage, please use the search function icon “ 37 “ to locate the resources.

Questions? 38