EXPOSING THE MYTHS OF RETIREMENT INVESTING

37 Slides3.08 MB

EXPOSING THE MYTHS OF RETIREMENT INVESTING

BUFFETT & SCHWAB: BE AN INDEXER Low Cost Diversified Index Mutual Funds

BASIC INVESTMENT OPTIONS Individual Stocks Individual Bonds Stock Bond Mutual Funds Mutual Funds

DEFINING RISK Business Risk: The chance a business fails and you lose your money. Systemic Market Risk: The chance the entire market takes a hit. Antidote: Diversify through mutual funds Antidote: Limit the number of shares sold Inflation Risk: “Safe” investments are eroded by inflation. Antidote: Invest in stock mutual funds

UNDERSTANDING THE STOCK MARKET The “Market” is a Bid & Asked Auction The Folly of Trying to Beat the Market The Reasons most Investors don’t get Market Returns The Argument for “Extreme Diversification” The perils of being “Out of the Market”

BID AND ASKED AUCTION A “Willing Buyer” thinks the stock’s future is bright. A “Willing Seller” thinks the stock’s future is dim. Given access to identical historical data, there is perfect disagreement. Both must agree on a price or there is no deal!

MUTUAL FUND OPTIONS “Actively” managed funds: Pick which stocks to buy and when to buy and sell. Fees range from 1% to 2% per year of investment balance. “Passively” managed funds: Buy and hold broad range of stocks that may mirror an index (NASDAQ, S & P 500, MSCI World, etc.). Fees range from 0.1% to 0.3% per year of investment balance.

THE FOLLY OF TRYING TO BEAT THE MARKET Not a one-on-one competition. You against the world. Must Buy at the right time and price and sell at the right time and price. Involves foretelling the future Proven to be most difficult.

QUESTIONS ? [email protected]

THE REASONS MOST INVESTORS DON’T GET MARKET RETURNS Greed drives the market to unsustainable heights. Stocks are making others rich. I need my share! Fear drives the market to unrealistic lows. I am losing my shirt and sell to avoid losing my skin!

THE ARGUMENT FOR “EXTREME DIVERSIFICATION” Defensive Diversification: One company’s failure is covered by other companies’ success. Offensive Diversification: Ensure you own the 10% of the stocks that “Move the market”.

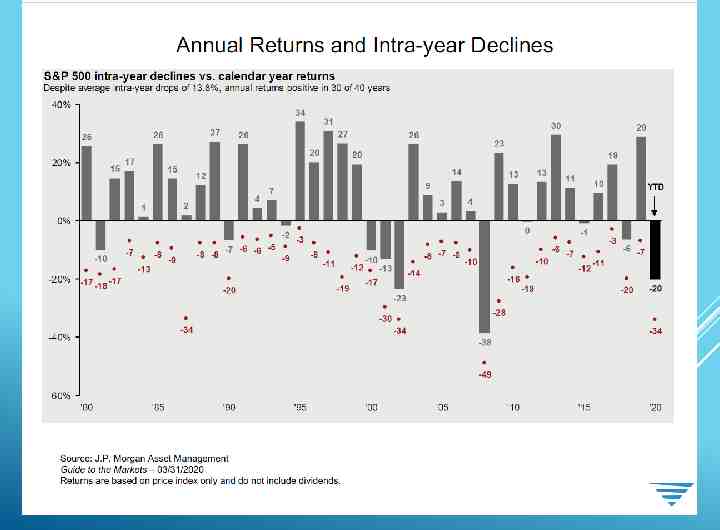

THE PERILS OF BEING “OUT OF THE MARKET” The stock market is volatile, day to day. Big gains can happen in a day.

TAMING THE EMOTIONS Stocks have returned about 10% per year, on average, for 93 years (1926 – 2019). Most investors get much less (including the “professionals”) Emotions trump the math.

SUMMARY POINTS OF PREVIOUS GRAPH In 3 of 4 years the stock market goes up. May go down 3 years in a row Highly unlikely the year will end with an average (10%) increase Average intra-year decline (S & P 500) has been 13.8%

QUESTIONS ? [email protected]

THE DISCIPLINE OF WITHDRAWAL RATE Financial plan should target a percentage annual withdrawal rate. Discipline is selling only enough shares to provide the dollars needed in the financial plan. Absolute commitment not to sell for any other reason.

USING A CERTIFIED FINANCIAL PLANNER (CFP) An effective antidote to fear and greed. CFP has “Fiduciary” responsibility – must act in the best interest of the client. Many other services in addition to investment advice. “Going Rate” is 1% per year of investment balance. Negotiable at balances 1 million.

ANNUITIES: PROS AND CONS Pros: Guaranteed predictable income. Need and can’t get life insurance Need and can’t get long term care insurance Cons: Many. High fees, low returns, less flexibility (surrender charges), high complexity Easier to sell than to educate the buyer.

INVESTMENT STATEMENTS Four things every investor should know: Is the investment strategy recommended in line with the Buffet recommendation? What is the total amount I am paying for all of this investment management (dollars and percentage of investment balance)? What has been my average annual rate of return since the current investment strategy was put into place? What has been the “benchmark” rate of return over that same time period?

SUMMARY Invest in low cost, diversified, index mutual funds. Mitigate all investment risks, Business, Systemic and Inflation. Engage a CFP to help manage greed and fear. Develop a financial plan with a disciplined withdrawal rate. Hold your CFP accountable.

WITHDRAWAL RATE ANALYSIS

QUESTIONS ? [email protected]