Payroll Administrati on May 2022

60 Slides4.01 MB

Payroll Administrati on May 2022

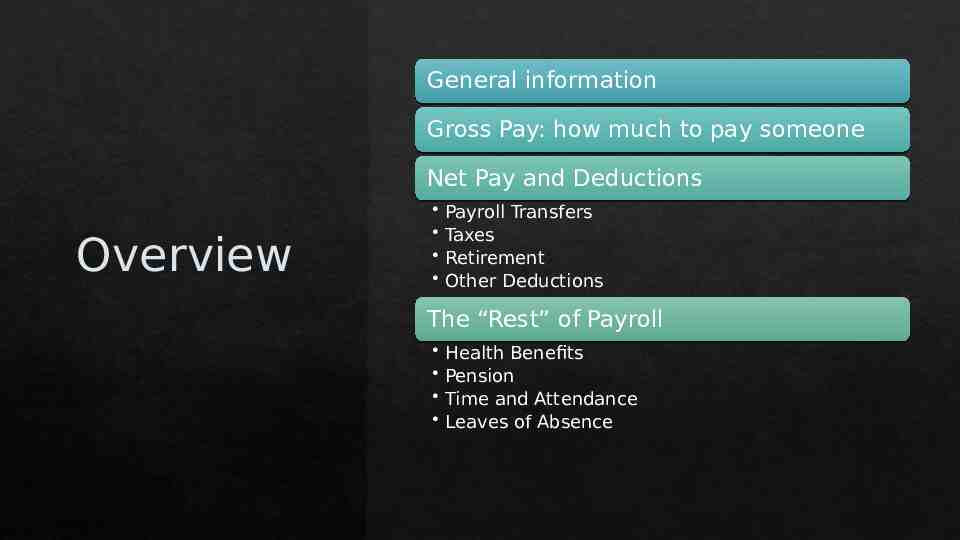

General information Gross Pay: how much to pay someone Net Pay and Deductions Overview Payroll Transfers Taxes Retirement Other Deductions The “Rest” of Payroll Health Benefits Pension Time and Attendance Leaves of Absence

Today’s Seminar Not intended to cover every potential issue/situation in payroll. Intended to provide a general overview of the issues and challenges in a typical payroll office. Individual employment and union contracts may contradict today’s discussion. Consult with board attorneys and auditors if a situation impacts your district. Disclaimer: Nothing in this presentation should be interpreted as legal advice. These presentations are intended to help a person to understand the relevant areas. You should not rely solely on any information in this presentation in making changes to your policies or procedures. This information is not intended to substitute for professional legal advice and does not create an attorney-client relationship. You should accept legal advice only from a licensed legal professional with whom you have an attorney-client relationship.

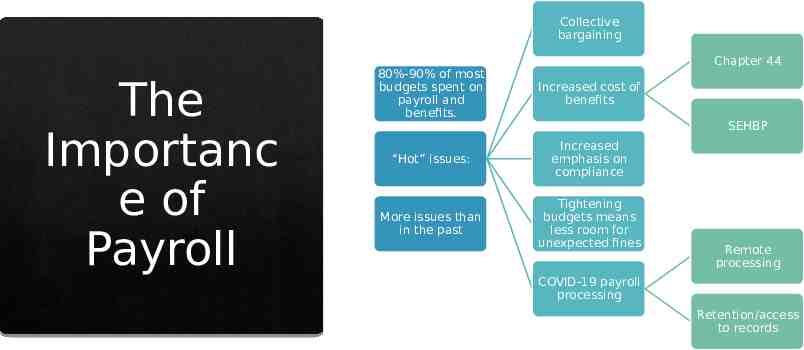

Collective bargaining The Importanc e of Payroll Chapter 44 80%-90% of most budgets spent on payroll and benefits. Increased cost of benefits “Hot” issues: Increased emphasis on compliance More issues than in the past Tightening budgets means less room for unexpected fines SEHBP Remote processing COVID-19 payroll processing Retention/access to records

Payroll: Then and Now Then Now Payroll Administration ADP Handled most administration Payroll administration handled inhouse Automation All processes manual Processes mixed manual/automated Pension Pension: 2 systems; everyone got in 3 systems; multiple eligibility rules Health Benefits One plan; almost everyone got them; no contributions Multiple plans; extreme cost to provide benefits; complicates contribution analysis Collective Bargaining Limited issues; budgets were not capped More likely to be out of contract; creates complicated retro pays. Pay Checks Mostly paper checks Mostly direct deposit

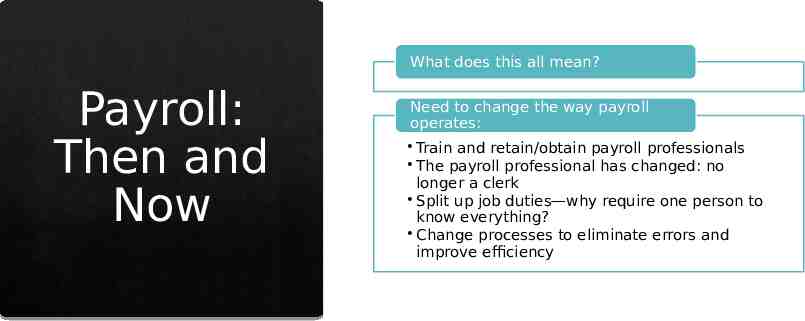

What does this all mean? Payroll: Then and Now Need to change the way payroll operates: Train and retain/obtain payroll professionals The payroll professional has changed: no longer a clerk Split up job duties—why require one person to know everything? Change processes to eliminate errors and improve efficiency

Payroll: Don’t Overcomplicate Simple equation: Gross Pay Net Pay Deductions Gross Pay What It Costs the Board to Pay Employees (Add in other employer responsibilities) Net Pay What Goes to Employees in Their Checks Deductions What Goes to Everyone But Employees

Pay employees on-time and deliver funds on-time Goals for Payroll Deposit deductions with the various agencies for payday Clean reconciliation—payroll reports match the bank withdrawals What are your payroll goals?

Document, Document, Document What happens if you were sick today? For a week? For a month? How would payroll get done? Every BA and payroll person needs to be prepared for the doomsday scenario. Don’t lose sleep—get prepared now.

Getting Prepared to Prevent Doomsday Payroll instructions/standard operating procedures Do you have them? Are they updated? Are they just the steps to operate the software? Do they include administrative steps (when are timesheets due; how do substitutes get paid; what are the rates of pay; when do special assignments get paid)? Have they been updated recently? Are they just for payroll? What about agency/accounting procedures, or HR tasks?

Getting Prepared to Prevent Doomsday Passwords Although not secure, where are passwords for various accounts maintained? Are the passwords kept updated as they change? Are they on a list? Where is it kept? Can I read/understand it? Administrative Where is the check stock located? Tasks How do checks get distributed? Who needs documents each payroll? Treasurer? Superintendent? HR? A/P? Where are files kept/how are they organized? When do the various deductions get paid?

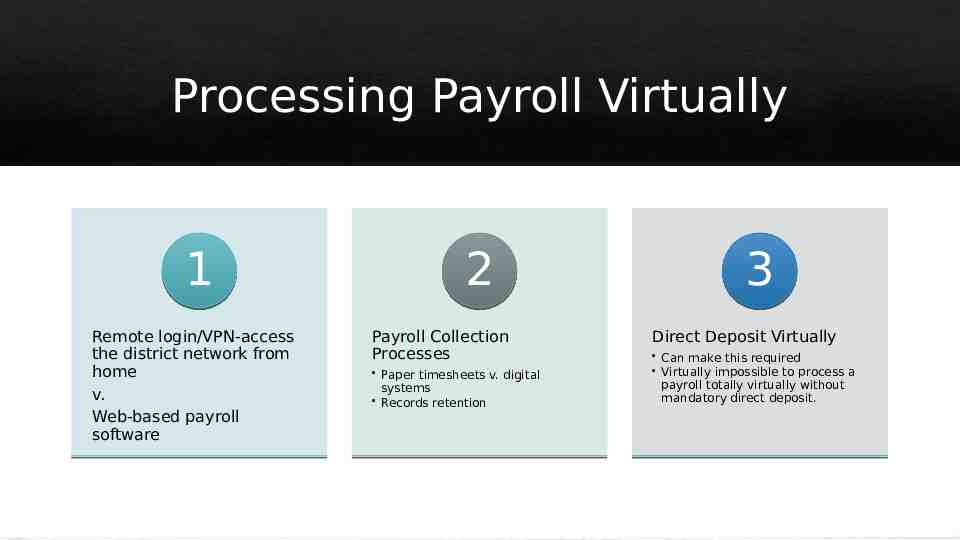

Processing Payroll Virtually 1 Remote login/VPN-access the district network from home v. Web-based payroll software 2 Payroll Collection Processes Paper timesheets v. digital systems Records retention 3 Direct Deposit Virtually Can make this required Virtually impossible to process a payroll totally virtually without mandatory direct deposit.

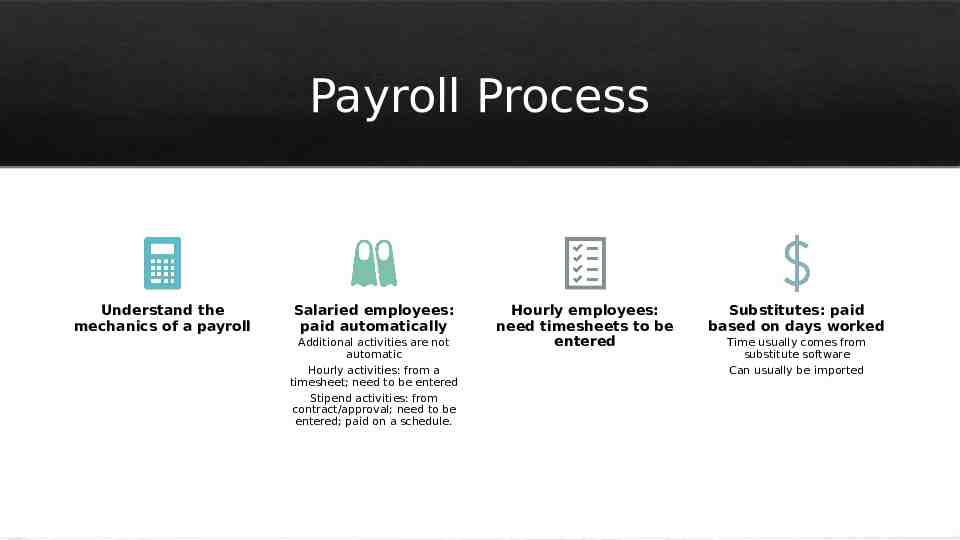

Payroll Process Understand the mechanics of a payroll Salaried employees: paid automatically Additional activities are not automatic Hourly activities: from a timesheet; need to be entered Stipend activities: from contract/approval; need to be entered; paid on a schedule. Hourly employees: need timesheets to be entered Substitutes: paid based on days worked Time usually comes from substitute software Can usually be imported

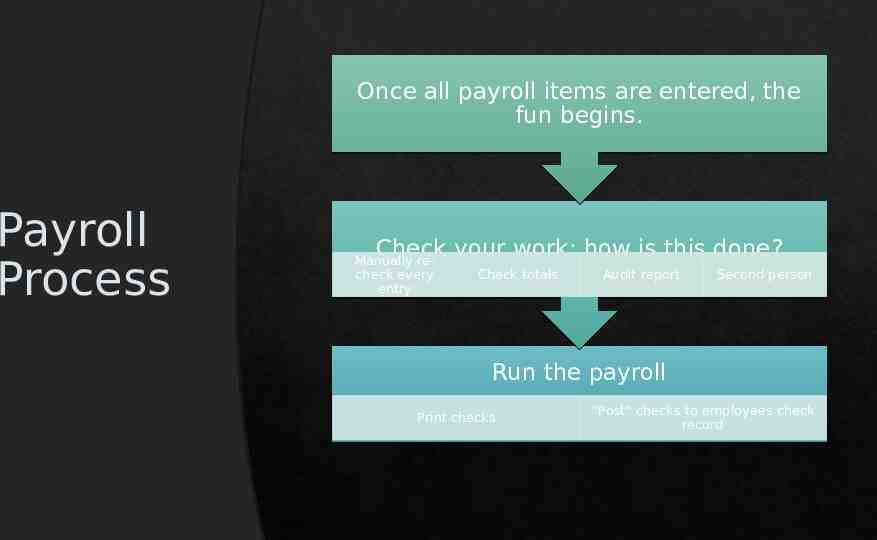

Once all payroll items are entered, the fun begins. Payroll Process Check your work: how is this done? Manually recheck every entry Check totals Audit report Second person Run the payroll Print checks “Post” checks to employees check record

Reports Payroll Process Bank Transfers Agency Post-payroll Print standard reports (check register, earnings/deduction summary) Total payroll amount, divided into multiple subaccounts Determine other payroll liabilities (State/Board share, DCRP employer share) Make payments within the various deduction categories Record entries File Transition to next payroll

Gross Pay: Challenge s Employee reductions in pay Creditable Compensati on Employees v. independen t contractors Wage and hour issues

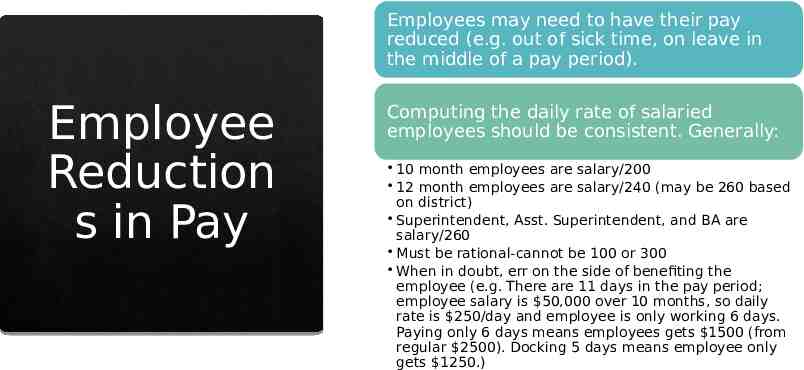

Employees may need to have their pay reduced (e.g. out of sick time, on leave in the middle of a pay period). Employee Reduction s in Pay Computing the daily rate of salaried employees should be consistent. Generally: 10 month employees are salary/200 12 month employees are salary/240 (may be 260 based on district) Superintendent, Asst. Superintendent, and BA are salary/260 Must be rational-cannot be 100 or 300 When in doubt, err on the side of benefiting the employee (e.g. There are 11 days in the pay period; employee salary is 50,000 over 10 months, so daily rate is 250/day and employee is only working 6 days. Paying only 6 days means employees gets 1500 (from regular 2500). Docking 5 days means employee only gets 1250.)

Employees v. Independent Contractors Generally, it is very simple to distinguish between employees and independent contractors. Specific areas of concern: Retired employees Former employees Outsourced employees Why does this matter? Employers withhold taxes and pay employer match on taxes for employees, but not independent contractors, and paying the cost of worker’s compensation insurance, benefits, time off, and more only for employees. May be other ancillary issues (e.g. pension bona fide severance of employment). Tests for determining vary under federal and state law.

Employees v. Independent Contractors Key questions to consider: Who controls the individual’s work? Who trains the individual? Who purchases the equipment the individual uses? Is payment hourly, daily, or a flat fee? Does the individual receive any benefits typically given to employees? How permanent is the relationship? Does the individual work only for the employer, or for several employers? The primary focus is control. If unsure, file form SS-8 with government for a determination.

Wage and Hour Issues All districts governed by Fair Labor Standards Act (FLSA). Issues/concerns: Who is entitled to overtime? What hours count towards overtime? How much of an overtime premium are employees entitled to? Unauthorized overtime Potential penalties

Who Is Entitled to Overtime? All employees are “entitled” to overtime when working over 40 hours per week, unless an exemption applies. 40 hours worked: under federal law, does not include time off. E.g. Employee works 8 hours per day, Monday-Friday. Works an additional 10 hours on Sunday. However, is out sick Monday and Tuesday. Under federal law, there is no requirement to pay overtime because employee has not “worked” 40 hours. Employee would receive 50 hours at regular time. Common exemptions: Administrative-office worker, related to management of business and exercise of independent discretion or judgement. Executive-management, e.g. superintendent, directors, business administrator Professional-e.g. lawyers, doctors, teachers, accountants, etc.

Overtime Issues Office personnel not classified as executive may be entitled to overtime. Factors to consider: Whether the employee has authority to formulate, affect, interpret, or implement management policies or operating practices. Whether the employee carries out major assignments in conducting the operations of the business. Whether the employee performs work that affects business operations to a substantial degree. Whether the employee has authority to commit the employer in matters that have significant financial impact. Whether the employee has authority to waive or deviate from established policies and procedures without prior approval. The exercise of discretion and independent judgment must be more than the use of skill in applying wellestablished techniques, procedures or specific standards. The exercise of discretion and independent judgment does not include clerical or secretarial work or performing mechanical, repetitive or recurrent work.

Overtime: What Hours Count? Generally, all hours worked by a non-exempt employee count towards overtime. Two positions: all hours count towards the 40 hour threshold. The rate of pay for OT when multiple jobs is the weighted average of the two rates: E.g. Employee works 40 hours as a bus driver for 20/hr and on weekends works 10 hours as a chaperone at sports activities for 10/hr. 10 hours may be eligible for overtime. E.g. From above example, Employee would be paid 40 hours at 20/hr, 10 hours at 10/hr. Total hours 50; Total base compensation 900; 900/50 18 weighted rate; 18/2 9, times 10 hours a 90 overtime premium for Employee. Non-compensable time: Meal break of 30 minutes or more, provided employee is completely relieved of duties Time waiting to use a time clock Training outside of work, even if employer pays for the training

Overtime: Occasional or Sporadic Limited exception for occasional or sporadic employment Where State or local government employees, solely at their option, work occasionally or sporadically on a part-time basis for the same public agency in a different capacity from their regular employment, the hours worked in the different jobs shall not be combined for the purpose of determining overtime liability under the FLSA. Additional hours must be “infrequent, irregular, or occurring in scattered instances” and not in the same category of the employee’s regular work. An activity does not fail to be occasional merely because it is recurring. In contrast, for example, if a parks department clerk, in addition to his or her regular job, also regularly works additional hours on a part-time basis (e.g., every week or every other week) at a public park food and beverage sales center operated by that agency, the additional work does not constitute intermittent and irregular employment and, therefore, the hours worked would be combined in computing any overtime compensation due.

Overtime: Unauthorize d Time When employees come in early, stay late, or otherwise work additional time without authorization, they MUST be paid for the time, but can be disciplined. Only applicable if the employer knew or should have known that the employee was working beyond their prescribed hours.

FLSA: Complaints Employees have 2-3 years to file complaints for violation of the FLSA. Penalties may include: Back wages Fees (10% of wages for 1st violation; 18% for 2nd; 25% for 3 or more) Penalties Every day where the employee is paid incorrectly is a separate violation Standard penalty of 500- 1,000 per offense, up to 100 days under NJ law Violation for one employee may lead to further investigation Penalties do not include incidental costs (e.g. legal fees, time spent providing documentation)

Creditable Compensation Not all earnings are eligible as creditable compensation for TPAF/PERS/DCRP: Must be received each paycheck One position only Treated the same way for everyone (and forever) Not extra compensation Exceptions might include additional teaching periods, longevity, and other adjustments to base salary.

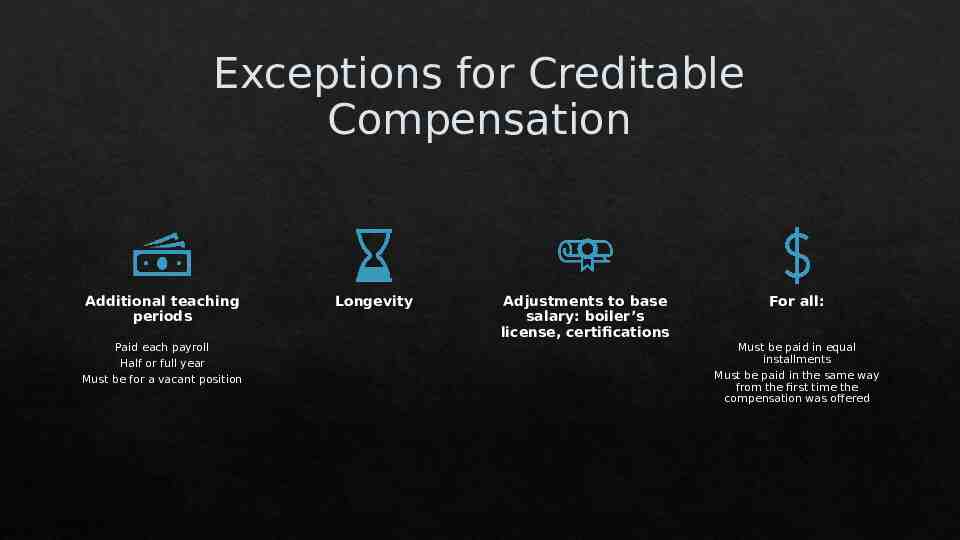

Exceptions for Creditable Compensation Additional teaching periods Paid each payroll Half or full year Must be for a vacant position Longevity Adjustments to base salary: boiler’s license, certifications For all: Must be paid in equal installments Must be paid in the same way from the first time the compensation was offered

Steps to Take Now 1 2 3 Check systems for verifying the accuracy of payroll entries Review per diem and hourly calculations to ensure consistency Evaluate which employees may be entitled to overtime Are they being paid correctly? Blended rate? 4 Review creditable compensation for pension purposes.

Break

Payroll transfers Two primary transfers: General Fund to Payroll Account (net pay) General Fund to Agency Account (deductions) Also need to fund board/state share of FICA and Medicare Usually done with transfer from General Fund to Agency Account May have special accounts/transfers: Health benefit contributions FSA/Dependent Care Summer Pay SUI/FLI Taxes

Deductions Payments to everyone but employees. General categories: Taxes: Fed, FICA, MEDI, NJ, SUI, FLI, PA Retirement Programs: pension, 403(b), 457 Mandatory Programs: Dues, HB Contributions, Garnishments Voluntary Programs: STD/LTD, Credit Union, Summer Pay Worker’s Compensation

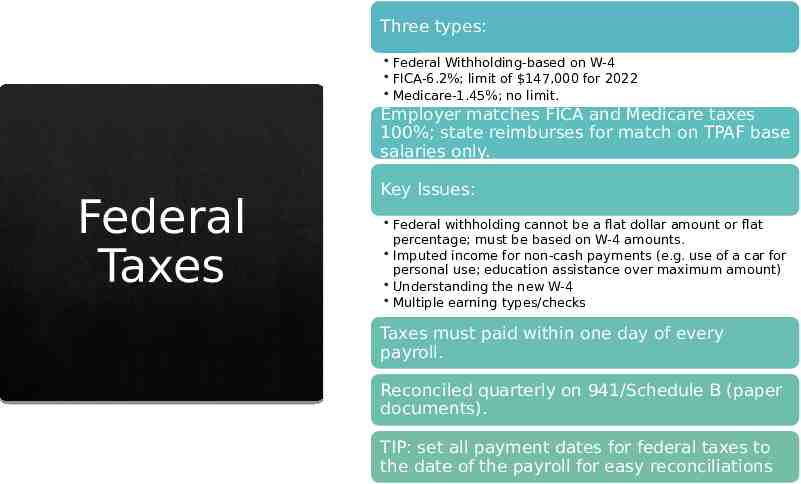

Three types: Federal Withholding-based on W-4 FICA-6.2%; limit of 147,000 for 2022 Medicare-1.45%; no limit. Employer matches FICA and Medicare taxes 100%; state reimburses for match on TPAF base salaries only. Federal Taxes Key Issues: Federal withholding cannot be a flat dollar amount or flat percentage; must be based on W-4 amounts. Imputed income for non-cash payments (e.g. use of a car for personal use; education assistance over maximum amount) Understanding the new W-4 Multiple earning types/checks Taxes must paid within one day of every payroll. Reconciled quarterly on 941/Schedule B (paper documents). TIP: set all payment dates for federal taxes to the date of the payroll for easy reconciliations

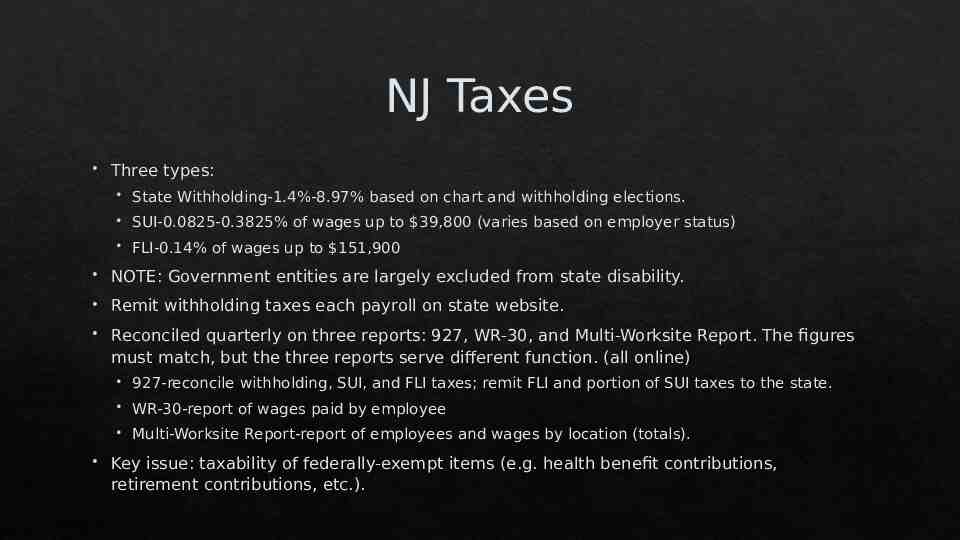

NJ Taxes Three types: State Withholding-1.4%-8.97% based on chart and withholding elections. SUI-0.0825-0.3825% of wages up to 39,800 (varies based on employer status) FLI-0.14% of wages up to 151,900 NOTE: Government entities are largely excluded from state disability. Remit withholding taxes each payroll on state website. Reconciled quarterly on three reports: 927, WR-30, and Multi-Worksite Report. The figures must match, but the three reports serve different function. (all online) 927-reconcile withholding, SUI, and FLI taxes; remit FLI and portion of SUI taxes to the state. WR-30-report of wages paid by employee Multi-Worksite Report-report of employees and wages by location (totals). Key issue: taxability of federally-exempt items (e.g. health benefit contributions, retirement contributions, etc.).

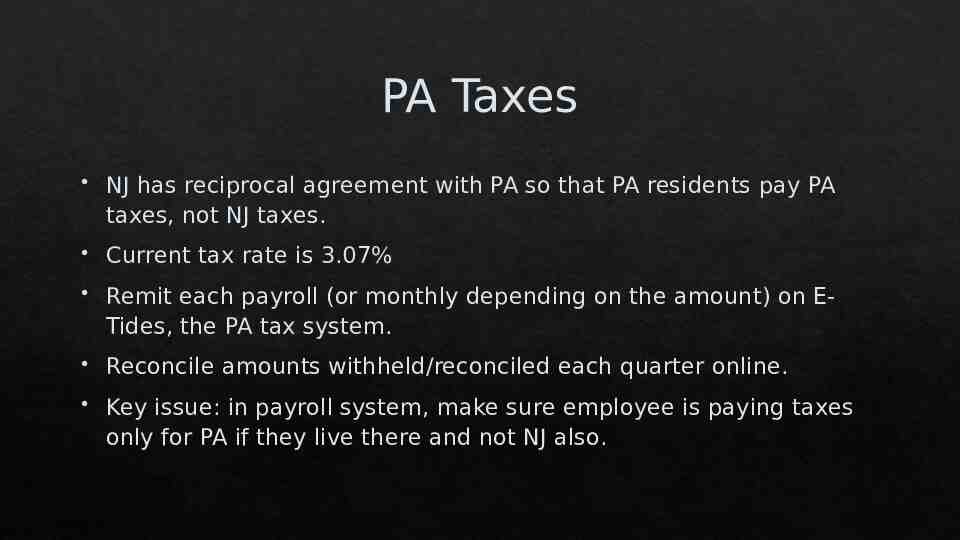

PA Taxes NJ has reciprocal agreement with PA so that PA residents pay PA taxes, not NJ taxes. Current tax rate is 3.07% Remit each payroll (or monthly depending on the amount) on ETides, the PA tax system. Reconcile amounts withheld/reconciled each quarter online. Key issue: in payroll system, make sure employee is paying taxes only for PA if they live there and not NJ also.

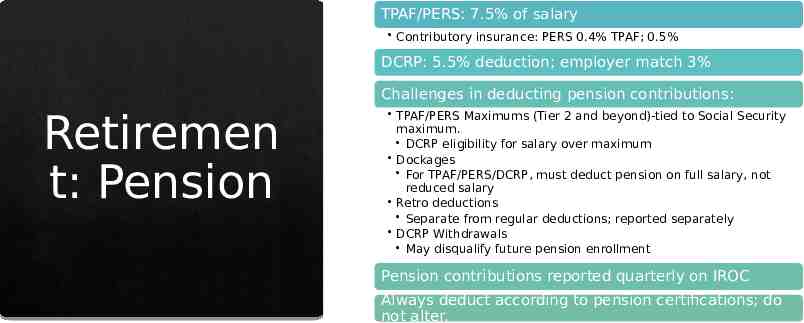

TPAF/PERS: 7.5% of salary Contributory insurance: PERS 0.4% TPAF; 0.5% DCRP: 5.5% deduction; employer match 3% Challenges in deducting pension contributions: Retiremen t: Pension TPAF/PERS Maximums (Tier 2 and beyond)-tied to Social Security maximum. DCRP eligibility for salary over maximum Dockages For TPAF/PERS/DCRP, must deduct pension on full salary, not reduced salary Retro deductions Separate from regular deductions; reported separately DCRP Withdrawals May disqualify future pension enrollment Pension contributions reported quarterly on IROC Always deduct according to pension certifications; do not alter.

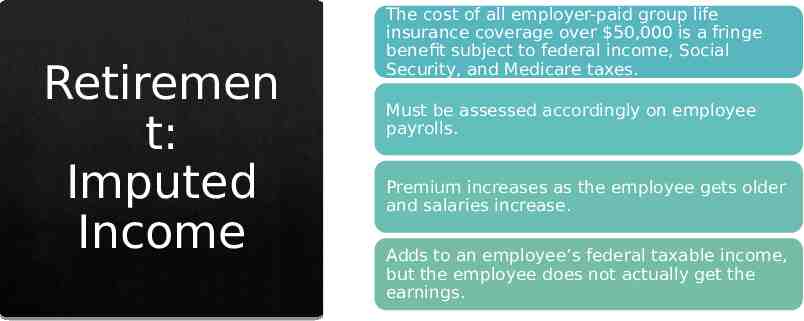

Retiremen t: Imputed Income The cost of all employer-paid group life insurance coverage over 50,000 is a fringe benefit subject to federal income, Social Security, and Medicare taxes. Must be assessed accordingly on employee payrolls. Premium increases as the employee gets older and salaries increase. Adds to an employee’s federal taxable income, but the employee does not actually get the earnings.

Retirement: 403(b)/457(b) Voluntary retirement programs offered in most districts. Allows employees to contribute 20,500 per year to each ( 6,000 if over 50) Can be pre-tax or Roth contributions (if your plan allows both) Challenges in administering the 403(b)/457(b) programs: Remittances: must send contribution information and contributions to each company; requirement that all contributions be paid by the 15th of the following month. Compliance: specific rules about loans and distributions; requirement of universal availability and notice TIP: Use of a third-party administrator can greatly aid in smooth administration The penalty for non-compliance is disqualification of the plan.

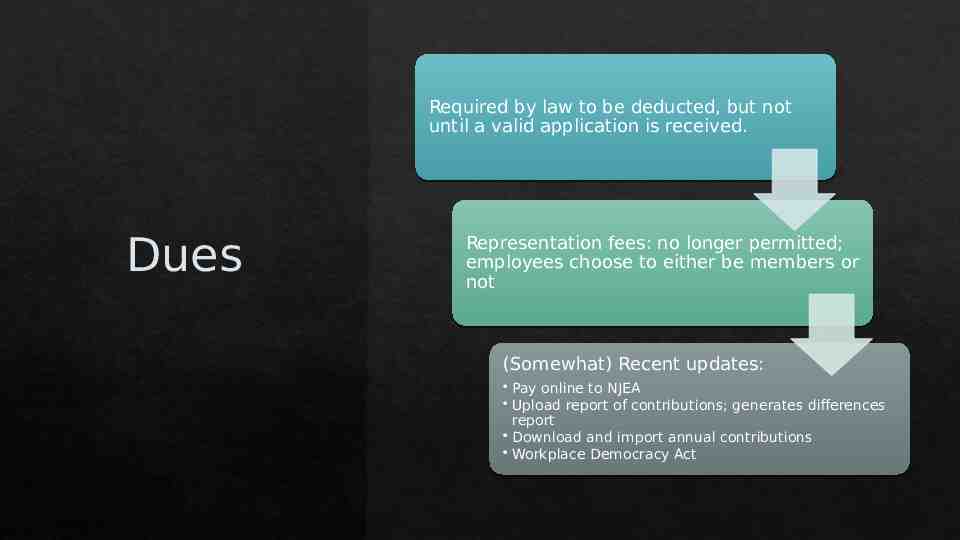

Required by law to be deducted, but not until a valid application is received. Dues Representation fees: no longer permitted; employees choose to either be members or not (Somewhat) Recent updates: Pay online to NJEA Upload report of contributions; generates differences report Download and import annual contributions Workplace Democracy Act

Health Benefit Contributions Chapter 78 contributions—everyone in year 4: percentage of premium. Some CBA’s modified this to earlier years or a new chart Chapter 44: percentage of salary Calculate on base salary per payroll Federally tax-exempt deductions. FSA/Dependent Care: also federally tax-exempt deductions. Upcharges: charging individuals to upgrade to better benefits, or higher levels of coverage. Also tax-exempt

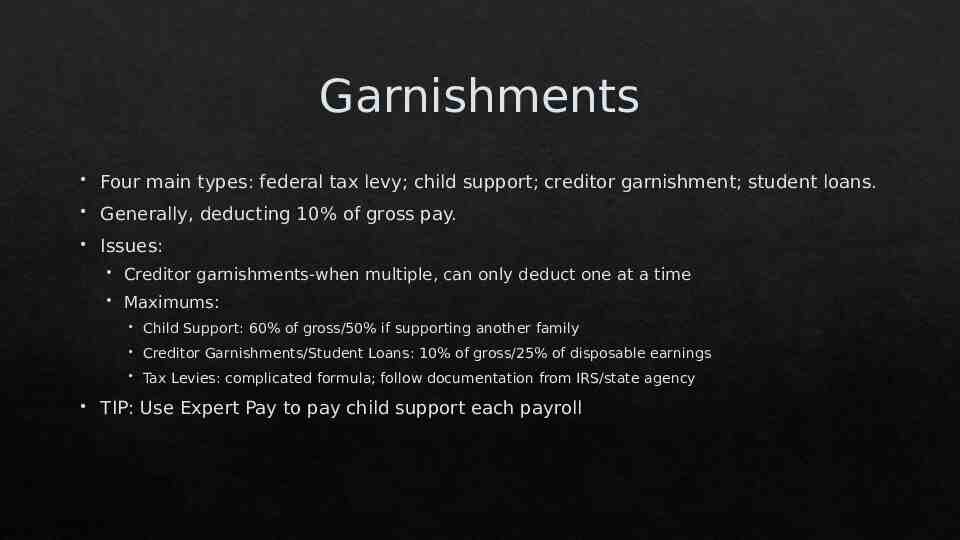

Garnishments Four main types: federal tax levy; child support; creditor garnishment; student loans. Generally, deducting 10% of gross pay. Issues: Creditor garnishments-when multiple, can only deduct one at a time Maximums: Child Support: 60% of gross/50% if supporting another family Creditor Garnishments/Student Loans: 10% of gross/25% of disposable earnings Tax Levies: complicated formula; follow documentation from IRS/state agency TIP: Use Expert Pay to pay child support each payroll

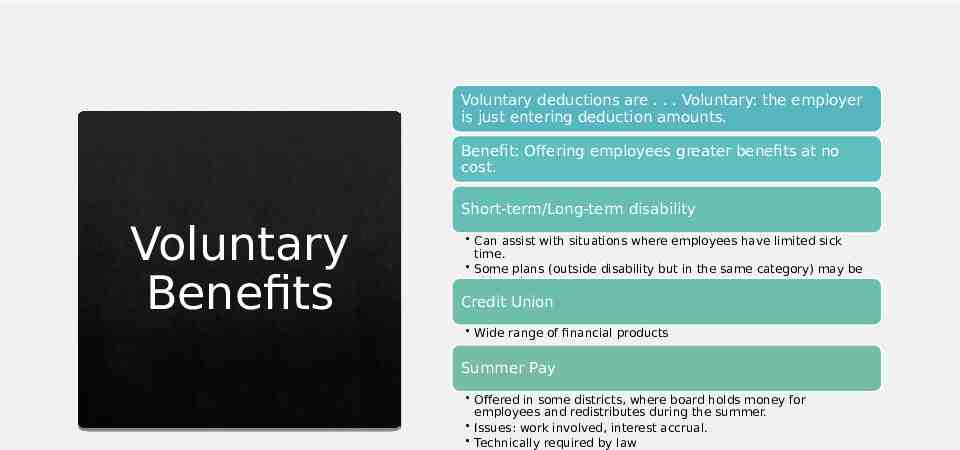

Voluntary deductions are . . . Voluntary: the employer is just entering deduction amounts. Benefit: Offering employees greater benefits at no cost. Voluntary Benefits Short-term/Long-term disability Can assist with situations where employees have limited sick time. Some plans (outside disability but in the same category) may be able to be tax-exempt Credit Union Wide range of financial products Summer Pay Offered in some districts, where board holds money for employees and redistributes during the summer. Issues: work involved, interest accrual. Technically required by law

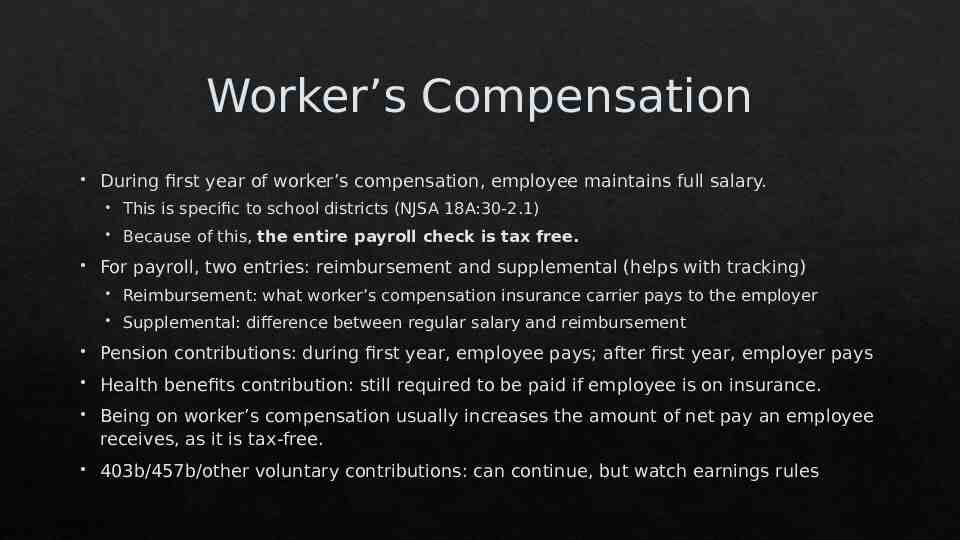

Worker’s Compensation During first year of worker’s compensation, employee maintains full salary. This is specific to school districts (NJSA 18A:30-2.1) Because of this, the entire payroll check is tax free. For payroll, two entries: reimbursement and supplemental (helps with tracking) Reimbursement: what worker’s compensation insurance carrier pays to the employer Supplemental: difference between regular salary and reimbursement Pension contributions: during first year, employee pays; after first year, employer pays Health benefits contribution: still required to be paid if employee is on insurance. Being on worker’s compensation usually increases the amount of net pay an employee receives, as it is tax-free. 403b/457b/other voluntary contributions: can continue, but watch earnings rules

Break

The “Rest” of Payroll Potentially more time-consuming than payroll itself. Key areas of interest: Health Benefits Pension Leaves of Absence Time and Attendance

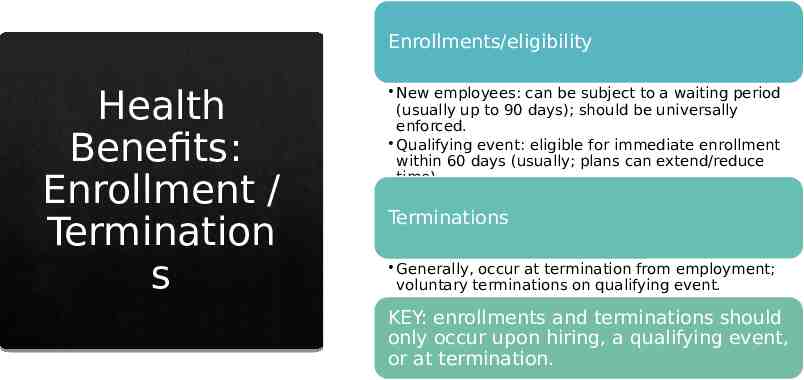

Enrollments/eligibility Health Benefits: Enrollment / Termination s New employees: can be subject to a waiting period (usually up to 90 days); should be universally enforced. Qualifying event: eligible for immediate enrollment within 60 days (usually; plans can extend/reduce time). Open enrollment: employees can make changes Terminations Generally, occur at termination from employment; voluntary terminations on qualifying event. KEY: enrollments and terminations should only occur upon hiring, a qualifying event, or at termination.

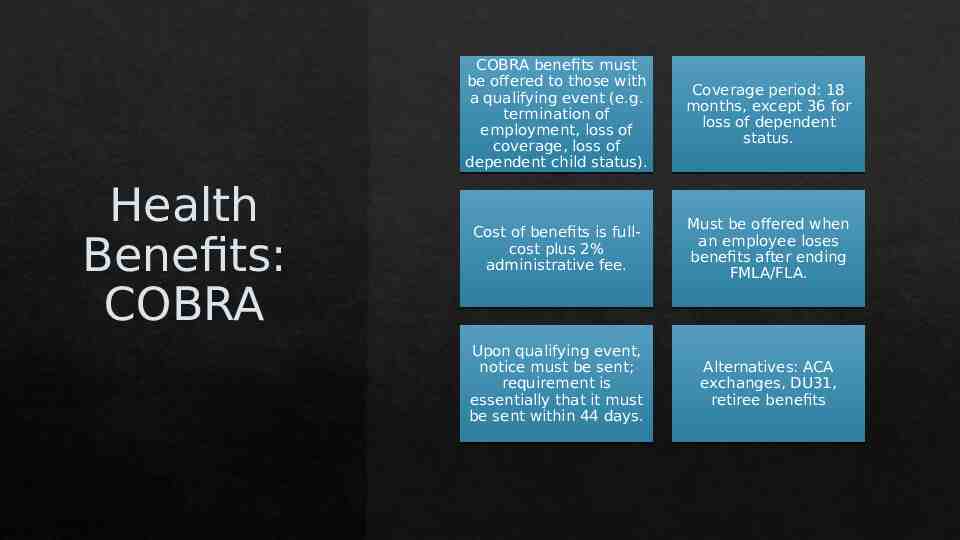

Health Benefits: COBRA COBRA benefits must be offered to those with a qualifying event (e.g. termination of employment, loss of coverage, loss of dependent child status). Coverage period: 18 months, except 36 for loss of dependent status. Cost of benefits is fullcost plus 2% administrative fee. Must be offered when an employee loses benefits after ending FMLA/FLA. Upon qualifying event, notice must be sent; requirement is essentially that it must be sent within 44 days. Alternatives: ACA exchanges, DU31, retiree benefits

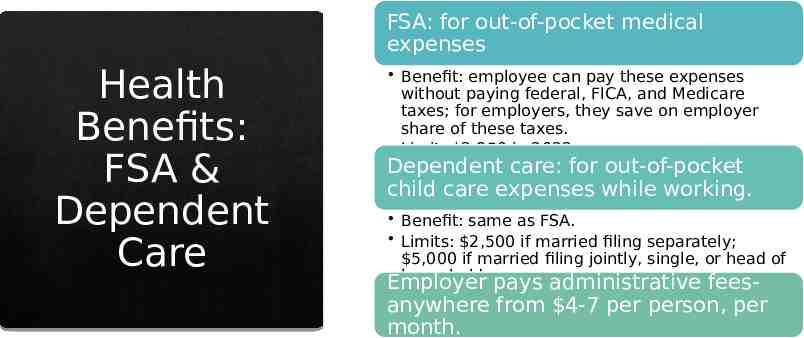

FSA: for out-of-pocket medical expenses Health Benefits: FSA & Dependent Care Benefit: employee can pay these expenses without paying federal, FICA, and Medicare taxes; for employers, they save on employer share of these taxes. Limit: 2,850 in 2022 Dependent care: for out-of-pocket child care expenses while working. Benefit: same as FSA. Limits: 2,500 if married filing separately; 5,000 if married filing jointly, single, or head of household. pays administrative feesEmployer anywhere from 4-7 per person, per month.

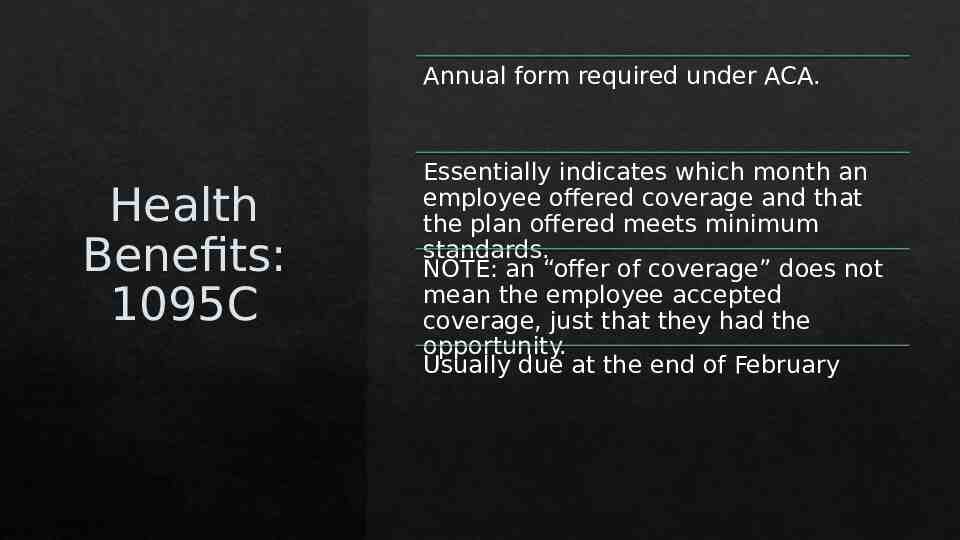

Annual form required under ACA. Health Benefits: 1095C Essentially indicates which month an employee offered coverage and that the plan offered meets minimum standards. NOTE: an “offer of coverage” does not mean the employee accepted coverage, just that they had the opportunity. Usually due at the end of February

Employer pension responsibilities: Pension: Avoid Fines and Employee Hassle Enroll employees properly Remit contributions once per month (by 5th of the next month-TPAF/PERS); remit DCRP contributions each payroll Quarterly submit IROC Pay PERS appropriation bill once annually Most common issues: Not enrolling employees properly/timely Remitting contributions late Submitting IROC late

General pension rule: employers have 15 days from an employees start date to enroll them Pension Enrollmen t Real rule: no fines/penalties as long as the employee is enrolled within 1 year of starting. Employees will be annoyed paying back pension. Avoid delays whenever possible Number 1 area of concern with pension: perform audits to ensure no one is missing

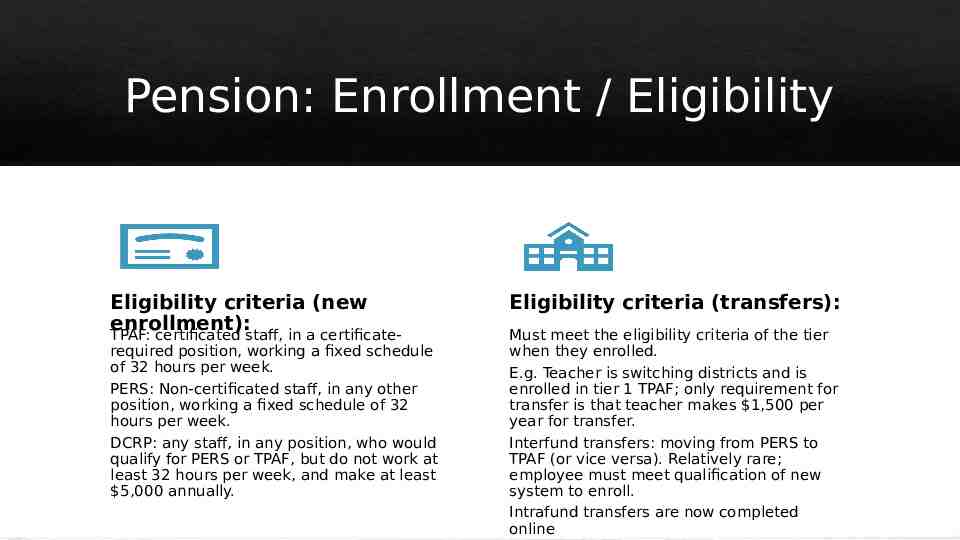

Pension: Enrollment / Eligibility Eligibility criteria (new enrollment): TPAF: certificated staff, in a certificate- required position, working a fixed schedule of 32 hours per week. PERS: Non-certificated staff, in any other position, working a fixed schedule of 32 hours per week. DCRP: any staff, in any position, who would qualify for PERS or TPAF, but do not work at least 32 hours per week, and make at least 5,000 annually. Eligibility criteria (transfers): Must meet the eligibility criteria of the tier when they enrolled. E.g. Teacher is switching districts and is enrolled in tier 1 TPAF; only requirement for transfer is that teacher makes 1,500 per year for transfer. Interfund transfers: moving from PERS to TPAF (or vice versa). Relatively rare; employee must meet qualification of new system to enroll. Intrafund transfers are now completed online

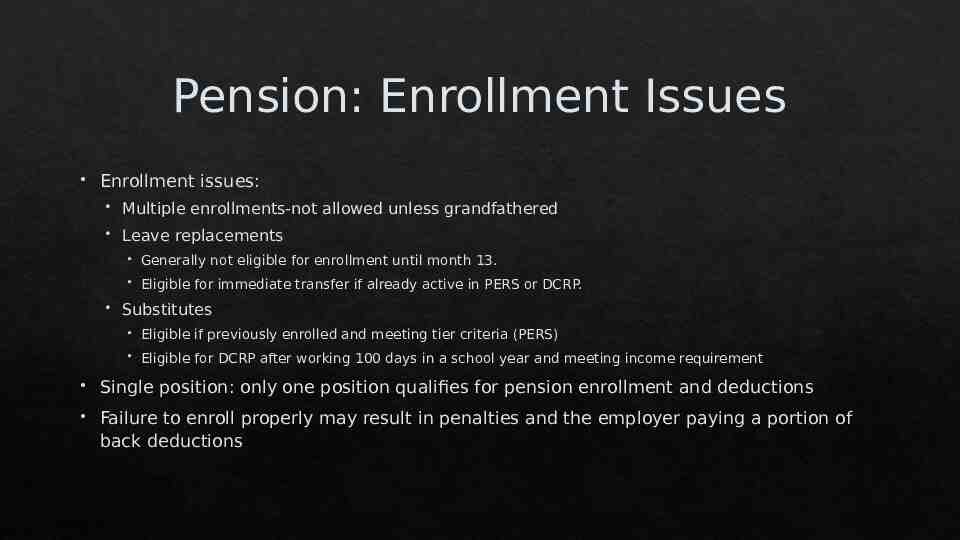

Pension: Enrollment Issues Enrollment issues: Multiple enrollments-not allowed unless grandfathered Leave replacements Generally not eligible for enrollment until month 13. Eligible for immediate transfer if already active in PERS or DCRP. Substitutes Eligible if previously enrolled and meeting tier criteria (PERS) Eligible for DCRP after working 100 days in a school year and meeting income requirement Single position: only one position qualifies for pension enrollment and deductions Failure to enroll properly may result in penalties and the employer paying a portion of back deductions

Eligibility Eligibility based based on on pension pension tier tier (TPAF (TPAF and and PERS). PERS). Pension: Retiremen ts Employee Employee employee employee submits submits retirement retirement on on MBOS MBOS (TIP: (TIP: Do Do nothing nothing until until the the submits a letter to the district). submits a letter to the district). Employer “certifies” retirement: Answer questions about final date; submit information on final year’s salary. Other Other information information sent sent directly directly to to employee. employee. Securing Securing your your retirement: retirement: Employees Employees eligible eligible to to retire retire submit submit a a retirement retirement application application but but are are not not actually actually leaving. leaving. Benefit: Benefit: “secures” “secures” the the retirement retirement benefit benefit for for a a beneficiary. beneficiary. COMPLETELY COMPLETELY allowed allowed under under pension pension rules. rules.

Pension: Purchases Some eligibility to purchase additional service time. Benefit: enhanced retirement benefit. Qualifying types: Temporary/Substitute; Former Membership Service; U.S. Government Service; Uncredited Service; Unpaid LOA; Out-of-State Service; Military Service; Local Retirement System Service. Out-of-State Service and U.S. Government Service purchases no longer count towards 25 year requirement for health benefits. Purchases and LOA Can purchase up to 2 years of unpaid time for personal illness Only up to 3 months for personal reasons, including maternity

Must have three years of posted contributions. PERS and TPAF employees can borrow one half of contributions, up to 50,000. Pension: Loans Can only take loan twice per year. Eligibility/Rules: Tip: avoid continually retaking a loan-interest is charged on the entire unpaid loan balance each time it is retaken. Must be fully repaid within five years (IRS rule). Repayment cannot exceed 25% of base salary (per pay) and be no less than your pension contribution.

Leaves of Absence FMLA-federal law; covers family leave AND personal medical leave FLA-state law; covers family leave only. Periods to qualify: FMLA: 12 weeks in 12 months; employee must work for employer for at least 12 months and work at least 1250 hours during the immediately-preceding 12 months FLA: 12 weeks in any 24 month period; 12 month requirement, but only 1000 hours FLI: providesup to 85% of employee’s wages, up to 993 per week, for 12 weeks To be eligible based on the need to care for an ill or injured loved one you must: Have earned at least 12,000 total or 240 weekly for 20 weeks total in employment in the 18 months prior to the start of your claim Stop working due to your need to care for an ill or injured family member/loved one; *see the law’s generous definition of family at myleavebenefits.nj.gov/caregiver Health insurance must continue while on FMLA/FLA, subject to contributions. FMLA and FLA run concurrently when eligible for both. Major challenge: maternity leaves

Attendance: directly impacts pay Time and Attendanc e Employees without time off may need to be docked Substitute employees usually linked to employee absences Key: integrating attendance data with payroll data clocks Time Used for hourly employees; numerous types and companies available. Provide accurate data about employee time; can be integrated with payroll to reduce manual entry. Substitute/PT Employee services Services that take over these functions; remove substitutes as employees of the district and make them employees of the agency. May reduce costs associated with attendance and substitute tracking.

Reports: Due Dates All reports due quarterly—941, 927, WR-30, Multi Worksite Report, PA-W3, IROC. IROC-due by the 7th of month following quarter end; 15-day grace period. All others due final day of month following quarter end. Quarter 1: January, February, March (reports due in April) Quarter 2: April, May, June (reports due in July) Quarter 3: July, August, September (reports due in October) Quarter 4: October, November, December (reports due in January) Also due for Quarter 4: W-2s, 1095C, NJ W3

Questions/Contact Me Stephen Frost Business Administrator/Board Secretary Randolph Township Schools 973-361-0808 x 8202 [email protected]