Operational Assets Intangibles Chapter 12 Kieso, Weygandt, Warfield

16 Slides210.50 KB

Operational Assets Intangibles Chapter 12 Kieso, Weygandt, Warfield

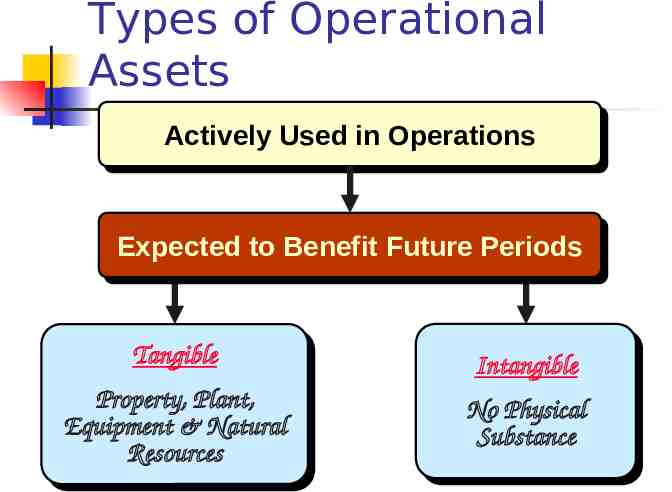

Types of Operational Assets Actively Actively Used Used in in Operations Operations Expected Expected to to Benefit Benefit Future Future Periods Periods Tangible Tangible Property, Property,Plant, Plant, Equipment Equipment& &Natural Natural Resources Resources Intangible Intangible No NoPhysical Physical Substance Substance

Intangible Assets Two features of Intangible Assets 1. They lack physical existence 2. They are not financial instruments ** Examples include: Trademarks, Copyrights, Patents, Agreements, and Goodwill Franchise

Purchased Intangibles Intangibles purchased from another party are recorded at cost [all costs necessary to make the intangible asset ready for its intended use].

Internally Created Intangibles Intangibles created internally are generally expensed as incurred. The only internal costs capitalized to intangible asset accounts are direct costs such as legal costs and fees.

Research & Development Costs Research and Development (R&D) Costs are not intangible assets. Any R&D costs incurred in the development of intangibles such as copyrights, patents, or trademarks MUST be expensed when incurred.

Limited Life Intangibles Intangibles with a limited life are amortized over time using Straight-Line Amortization. There is typically no salvage value for an intangible asset. Ex) A patent is purchased for 50,000 with a useful remaining life of 10 years. Amortization for the patent would be recorded as follows: Amortization Expense 5,000 Accumulated Amortization 5,000

Indefinite-Life Intangibles Intangibles with indefinite lives are NOT amortized over time. Ex) Trademarks, Trade Names, Goodwill

Types of Intangibles Trademarks – Marketing Related Intangible A trademark is a word, phrase, or symbol that identifies a particular company or product. Registration with the U.S. Patent and Trademark Office provides legal protection for an indefinite number of renewals for periods of 10 years each. Trademarks are considered to have an indefinite life and are typically not amortized. ex.) Kleenex, GE, Amazon.com

Types of Intangibles Copyrights – Artistic Related Intangible Copyrights are federally granted rights to artistic creations with a life of the creator plus 70 years. Copyrights are not renewable. Copyrights are to be amortized over the lesser of their useful life or their legal life. Generally, the useful life is less than the legal life, and therefore, the asset is amortized over its useful life. Legal costs or fees incurred during the life of a Copyright asset for the purpose of defending the copyright may be capitalized to the cost of the Asset and amortized over its remaining useful life. ex) Songs, Paintings, Books, etc.

Types of Intangibles Patent – Technology Related Intangibles A patent gives the holder the right to use, manufacture, and sell a product or process for a period of 20 years without interference or infringement by others. The original patent is not renewable, but small changes may lead to a new patent extending the life another 20 years. [Pharmaceutical companies often do this by simply changing the color of a pill.] A patent should be amortized over its legal life of 20 years or its useful life – whichever is shorter. Legal costs or fees incurred during the life of the patent to successfully defend the Asset are capitalized to the Patent Asset account and amortized over its remaining useful life.

Patents Torch, Torch,Inc. Inc.has hasdeveloped developedaanew newdevice. device. Research Researchand and development developmentcosts coststotaled totaled 30,000. 30,000. Patent Patentregistration registration costs costsconsisted consistedof of 2,000 2,000ininattorney attorneyfees feesand and 1,000 1,000inin federal federalregistration registrationfees. fees. What WhatisisTorch’s Torch’spatent patentcost costto tobe becapitalized? capitalized? Torch’s Torch’scost costfor forthe thenew newpatent patent isis 3,000. 3,000. The The 30,000 30,000RR & &DDcost costisisexpensed expensedas asincurred. incurred.

Types of Intangibles Goodwill – “The most intangible of the intangibles” Goodwill is only recorded when an entire business has been purchased. Goodwill is the difference between FMV of the Net Identifiable Assets and the Purchase Price of the business. Goodwill has an indefinite life and should NOT be amortized. If the Purchase Price of a company is less than the FMV of Net Identifiable Assets then there is Negative Goodwill. Negative Goodwill is reported as a Gain on the Purchase and is disclosed in the Non-Operating section of the Income Statement.

Goodwill Goodwill Occurs when one company buys another company. Only purchased goodwill is an intangible asset. The amount by which the purchase price exceeds the fair market value of net assets acquired.

Goodwill Eddy EddyCompany Companypaid paid 1,000,000 1,000,000to topurchase purchaseall allof ofJames James Company’s Company’sassets assetsand andassumed assumedJames JamesCompany’s Company’s liabilities liabilitiesof of 200,000. 200,000. James JamesCompany’s Company’sassets assetswere were appraised appraisedat ataafair fairvalue valueof of 900,000. 900,000.

Goodwill What amount goodwill Whatamount amount of goodwill What of goodwill should What amount ofof goodwill should should be on Eddy be on Company should be recorded recorded on Eddy be recorded recorded on Eddy Eddy Company Company books? books? Company books? books? 100,000 a. a. 100,000 100,000 a.a. 100,000 200,000 b. 200,000 200,000 b. b.b. 200,000 c. 300,000 c. 300,000 c. 300,000 c. 300,000 d. 400,000 d. 400,000 d. d. 400,000 400,000