MyFRS FINANCIAL GUIDANCE PROGRAM Income Tax Planning MyFRS Financial

50 Slides2.73 MB

MyFRS FINANCIAL GUIDANCE PROGRAM Income Tax Planning MyFRS Financial Guidance Line: 1-866-44-MyFRS MyFRS.com

The Reasons We Are Here Review and understand federal tax form 1040 Recognize opportunities to reduce and manage your taxes throughout the year Identify tax planning opportunities to help accomplish your financial goals Learn to use the tools and resources available to you Know which steps to take next 2

Tools and Resources MyFRS.com 3 MyFRS Financial Guidance Line 866-446-9377 Employee workshops Print and e-mail communications

Personal Action Plan Action Steps See Appendix G for your own Personal Action Plan 4 Done

Federal Tax Form 1040 5

Federal Tax Form 1040 6 See Appendix B for form 1040

Federal Tax Calculation Part 1 Gross Income - Adjustments Adjusted Gross Income (AGI) - Standard/Itemized Deductions Taxable Income 7

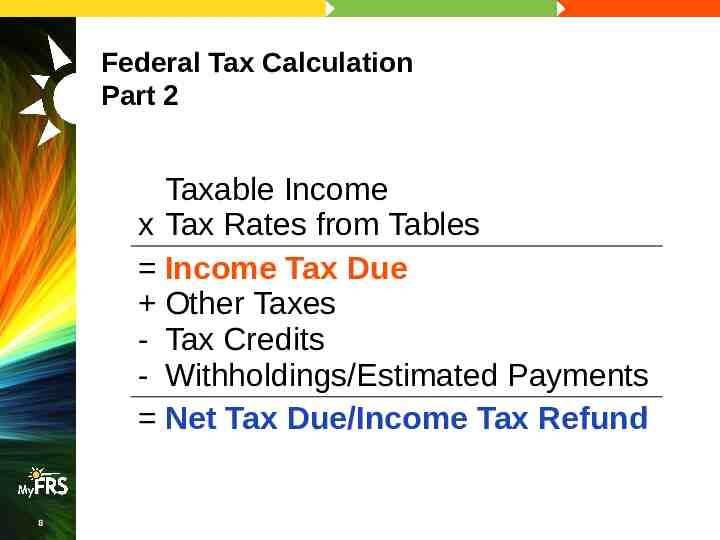

Federal Tax Calculation Part 2 Taxable Income x Tax Rates from Tables Income Tax Due Other Taxes - Tax Credits - Withholdings/Estimated Payments Net Tax Due/Income Tax Refund 8

2021 Standard Deductions Filing Status Standard Deduction Single 12,550 Married Filing Jointly (MFJ) 25,100 Married Filing Separately (MFS) 12,550 Head of Household 18,800 Note: An additional standard deduction for elderly or blind taxpayers is also available 9

Itemized Deductions Mortgage interest expense State, local, and real estate taxes Charitable contributions Medical and dental expenses Investment interest expense See Appendix C for Schedule A 10

2021 Tax Rates 10% 12% 22% 24% 32% 35% 37% 11 Married Filing Jointly (MFJ) Single 0 - 19,900 19,901 - 81,050 81,051 - 172,750 172,751 - 329,850 329,851 - 418,850 418,851 - 628,300 628,301 0 - 9,950 9,951 - 40,525 40,526 - 86,375 86,376 - 164,925 164,926 - 209,425 209,426 - 523,600 523,601

Changing Tax Rates Tax Year Tax Rates 2013-2017 10% 15% 25% 28% 33% 35% 39.6% 2018-2025 10% 12% 22% 24% 32% 35% 37% 2026 10% 15% 25% 28% 33% 35% 39.6% Recognize your current and future potential marginal tax bracket when making financial planning decisions 12

Comparison of Highest and Lowest Marginal Tax Rates Morningstar. All Rights Reserved. 13

Which is Better? A. 500 Tax Deduction B. 500 Tax Credit 14

Family-Based Credits Child tax credit 2,000 credit per eligible child 500 credit per eligible non-child Reduced if AGI (Adjusted Gross Income) is over a certain threshold Dependent care tax credit Credit ranges from 35% - 20% of AGI Gross Income) When AGI 43,000 20% Maximum expenses considered: 3,000 (one child) 6,000 (two or more children) 15 (Adjusted See IRS Publications 972 and 503 for more information

Key Strategies in Tax Planning Defer Shift Deduct Exclude Comply 16

Key Strategies in Tax Planning Defer Shift Deduct Exclude Comply 17

Benefits of Deferring Taxes Hypothetical value of 10,000 invested in stocks. This example is for an investor in the 28% bracket using the 2019 tax code. Assumes an 8% annual total return. Estimates are not guaranteed. This is for illustrative purposes only and not indicative of any investment. Morningstar. All Rights Reserved. 18

Tax Deferral Opportunities 403(b), 457, 401(k) Plans Tax-Deferred Savings Vehicles Individual Retirement Accounts (IRAs) Other-Tax Deferred Savings Plans Annuities Call the MyFRS Financial Guidance Line to discuss retirement saving opportunities 19

2021 Maximum Contribution Limits (403(b), 457, 401(k)) 457 Plan – Deferred Comp Contribution Limits Catch-Up Contributions 401(k) Plan 19,500 Additional contributions allowed if you are 50 and older. Each plan has other “special catch-up” rules based on the time until retirement or length of service. Contact your plan administrator to see if you qualify for special catch-up contributions 20 403(b) Plan – Tax-Sheltered Annuity 6,500

Traditional IRA Tax-deferred growth Possible current deduction defers the tax on the contribution amount Deduction is taken on page one of the 1040 – no need to itemize Contributions can be made until April 15th of the following year 2021 contribution limits are 6,000; 7,000 if age 50 or older Income limits for deductibility 21

2021 Traditional IRA Deductibility of Contributions If an Active Participant in a Retirement Plan, IRA Deductibility Depends on AGI Single or Head of Household Married Filing Jointly (MFJ)* Non-Deductible 76,000 Non-Deductible 125,000 66,000 Deductible 105,000 Deductible *These MFJ limits apply when BOTH are active participants in a retirement plan 22

Key Strategies in Tax Planning Defer Shift Deduct Exclude Comply 23

Taxable Income Defer Income Monday January 3, 2022 Accelerate Deductions Friday December 31, 2021 Depending on the changing tax laws and your own situation, it may be more advantageous to accelerate income and defer deductions 24

Capital Gains Short-Term Investment held one year or less Gain is taxed at ordinary income tax rates Long-Term Investment held more than one year Gain is taxed at lower capital gains rates (0%, 15%, or 20%) 25

Key Strategies in Tax Planning Defer Shift Deduct Exclude Comply 26

Itemized Deductions: Mortgage Interest Interest is fully deductible on: Mortgages prior to 10/13/87 Mortgages from 10/14/87-12/15/17 up to 1,000,000 Mortgages after 12/15/17 up to 750,000 Loan must be secured by a principal or second home owned by you Cannot be for more than the home’s current fair market value Call the MyFRS Financial Guidance Line or see IRS Publication 936 for more information 27

Itemized Deductions: Taxes Limited to 10,000 General rules for deducting taxes: The tax must be imposed on you The tax must be paid during your tax year State & local income taxes Includes withholdings, estimated payments, refunds credited, and payments with your return Real estate taxes Based on the assessed value of the real property 28

Maximize Itemized Deductions Consider prepaying taxes: Real estate, state and local Document charitable contributions: Cash property “Bunch” in one year other deductions: Medical/dental (7.5%) Consider in which year it is better to pay your real estate taxes Consider bunching expenses or donations into one year 29

Key Strategies in Tax Planning Defer Shift Deduct Exclude Comply 30

Roth IRA Tax-free savings vehicle Provides no tax deduction upon contribution Tax-free distributions Account established for 5 tax years, and First-time home purchase Death or disability After age 59½ You can withdraw your contributed principal without tax or penalty at any time 31

Roth IRA Contributions Eligibility Phase-Out Single: 125,000 - 140,000 MFJ: 198,000 - 208,000 Contributions can be made until April 15 of the following year 2021 contribution limits are 6,000; 7,000 if age 50 or older Call the MyFRS Financial Guidance Line or review IRS Publication 590 for more information 32

Roth IRA Conversion Ordinary income tax on pre-tax contributions and earnings Considerations: 33 Tax rate at time of conversion and at distribution Ability to pay taxes from other sources Other sources of retirement income Number of years you will allow the Roth IRA to grow

Coverdell Education Savings Account Tax-free savings vehicle for education Tax-free distributions for qualified higher education expenses Tax and penalties apply if not used for qualified education expenses 2,000 contribution limit per year per beneficiary Call the MyFRS Financial Guidance Line or review IRS Publication 970 for more information 34

Section 529 Plans Contributions are after-tax Growth is tax-deferred Distributions are tax-free if used for qualified education expenses State tax-free status varies by state plan Donors not subject to income limitations Tax and penalties apply if not used for qualified education expenses In 2021, you can contribute 15,000 ( 30,000 married) per beneficiary per year without triggering gift tax 35

Home Sale Exclusion Capital gains exclusion conditions: Owned home two of last five years Lived in home two of last five years Have not used the exclusion in two-year period ending on sale date Exclusion Amount Single 250,000 Married 500,000 (if both meet the “lived-in-it” and “have-not-used” requirements; otherwise 250,000) 36

Key Strategies in Tax Planning Defer Shift Deduct Exclude Comply 37

Complying: Documentation and Recordkeeping Social Security numbers for dependents Itemized deductions Cost basis of capital assets Non-deductible IRAs Withholding requirement 38

Pros and Cons of Receiving a Tax Refund Pros Cons A method of forced saving Reduces your monthly cash flow Lump sum payment Could be used more available for goals effectively during the year Funding IRA Vacation Pay down debts Lost opportunity to earn Makes you feel like you “did a good job” preparing interest your tax return Consider the size of the refund (if any) you would like to receive 39

Withholding Safe Harbor To avoid the underpayment penalty, you must withhold the lesser of: 90% of the tax shown on the 2021 return 100% of the tax shown on the 2020 tax return 110% if 2020 AGI was over 150,000 filing Single/MFJ or 75,000 MFS Penalty does not apply if tax due is less than 1,000 40

How Do You Pay Your Taxes? W-4 withholding Withholding amount based on the W-4 you submit Mandatory withholding 20% on distributions from employer plans (IP, 403(b), 457,401(k).) Estimated quarterly payments For those with income sources not subject to withholding, or who may be subject to the underpayment penalty Balance due when filing tax return Check / Credit Card 41

What Determines Withholding Using the Redesigned Form W-4? Filing status Multiple jobs or spousal employment Child tax credit Other adjustments Other income (not from jobs) Itemized deductions Extra withholding See Appendix D for W-4 42

Updating Your W-4 Any time your filing status, deductions, or credits change Marriage/divorce, birth/death Increase/decrease in income Contact your payroll department (or visit irs.gov) to obtain form W-4 Tax Withholding Estimator and worksheets available to assist with appropriate withholding Submit your updated W-4 to your payroll department If you last submitted a W-4 prior to 2020, consider submitting a new W-4 for more accurate tax withholding 43

Additional Tax The Importance of Saving Considerations AND Investing

Tax Planning Techniques for Life Events Getting married or divorced: New filing status Phase-outs Withholdings Gaining or losing dependents: New filing status Tax credits Withholdings Purchasing a home Itemized deductions Withholdings 45

How Do You Avoid the 10% Penalty on Retirement Plan Distributions? Distributions From: Some Exceptions to the 10% Penalty: FRS Plans 403(b)/401(k) Plans IRAs FRS Plans 403(b)/401(k) Plans IRAs 46 Separate from service in the year of or after turning age 55 Qualified higher education expenses Qualified first-time homebuyer distribution Distributions at or after age 59 ½ Distributions because of: Medical expenses (over 10% of AGI) Disability Death Distributions calculated by using Substantially Equal Periodic Payments Qualified birth/adoption costs

Tools and Resources MyFRS.com 47 MyFRS Financial Guidance Line 866-446-9377 Employee workshops Print and e-mail communications

Next Steps: Personal Action Plan Action Steps Determine your financial goals Review your most recent tax returns Identify opportunities to reduce your taxes that are in line with your goals Project your taxes and withhold properly Call the MyFRS Financial Guidance Line at 1-866-44-MyFRS 48 Done

Questions and Answers 49

MyFRS FINANCIAL GUIDANCE PROGRAM Income Tax Planning MyFRS Financial Guidance Line: 1-866-44-MyFRS MyFRS.com