LMG DATA COUNCIL OVERVIEW SHEILA CAMERON – OCTOBER 2022

12 Slides1.69 MB

LMG DATA COUNCIL OVERVIEW SHEILA CAMERON – OCTOBER 2022

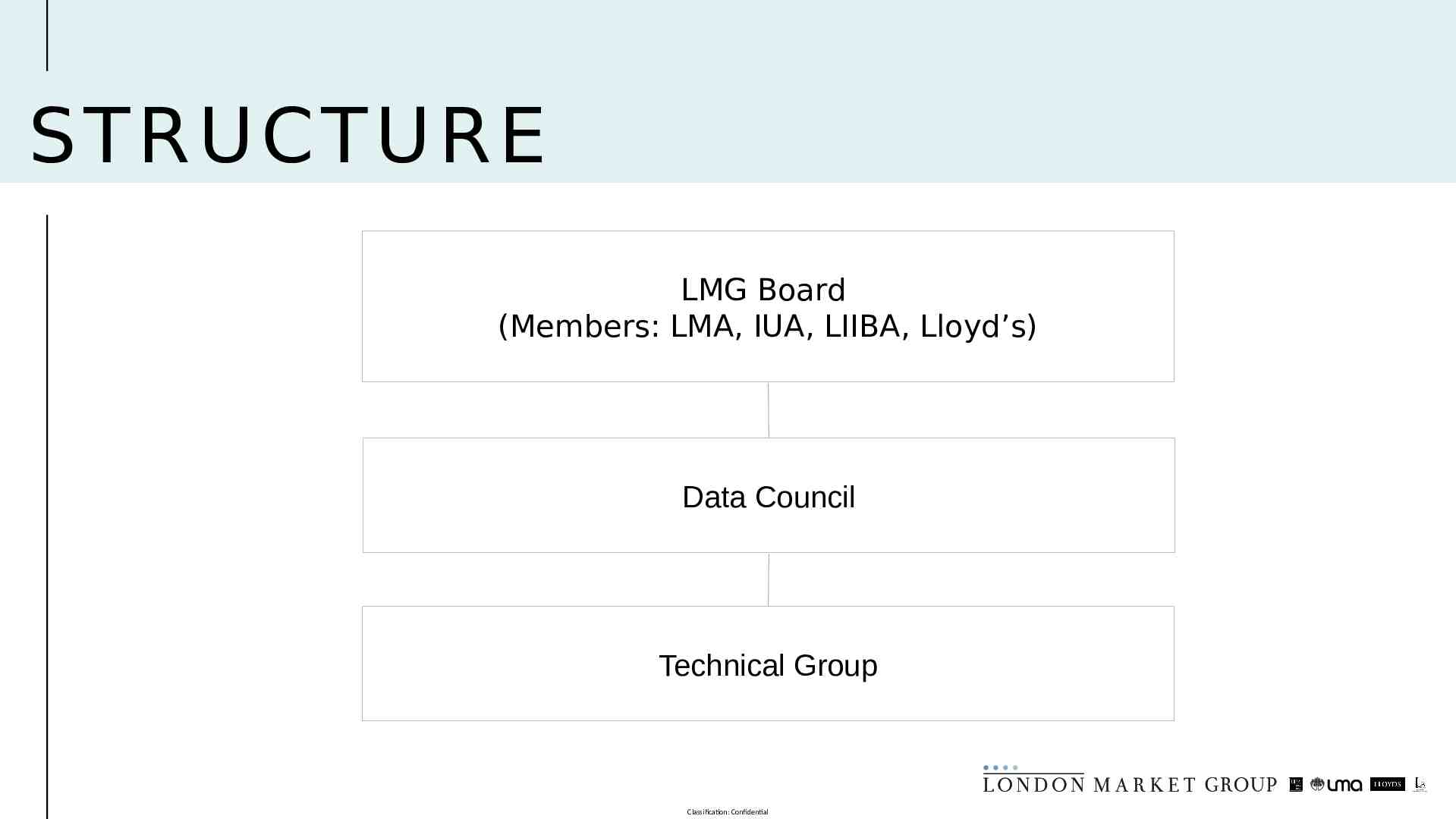

STR U CT U RE LMG Board (Members: LMA, IUA, LIIBA, Lloyd’s) Data Council Technical Group Classification: Confidential

DATA COUNCIL PUR PO SE 1. Drive digitisation of the London Market through a commitment to using standardised and high quality data between all market participants and their clients. 2. Drive adoption of: a. Data standards in conjunction with ACORD b. Open market risk Core Data Records c. Computable contracts d. Data assembly process, including roles and responsibilities e. API standards Classification: Confidential

GUIDI NG PRI NCIPLES 1. The customer’s needs will be prioritised over that of market participants 2. We will embrace and enhance global data standards and remain aligned to them 3. We will drive data assembly solutions that benefit the London Market as a whole and improve the ease of doing business with the London Market, accepting that may mean we need to make compromises within our own firms. 4. We will adopt an 80/20 approach where appropriate, acknowledging that we cannot solve for all situations. 5. A data first approach forms the backbone of our strategy, but in recognition of the starting position of the majority, transition paths will be created to allow gradual adoption. However, we will not move at the pace of the slowest adopter. 6. We will not support adoption transition paths forever, and there is an expectation that at some point (within a reasonable timeframe) everyone will make the investments to move forward 7. The achievement of our objectives is expected to enable further digital innovation and differentiation across market firms, with the Data Council focused on defining areas that firms cannot individually determine themselves, akin to a Highway Code. Classification: Confidential

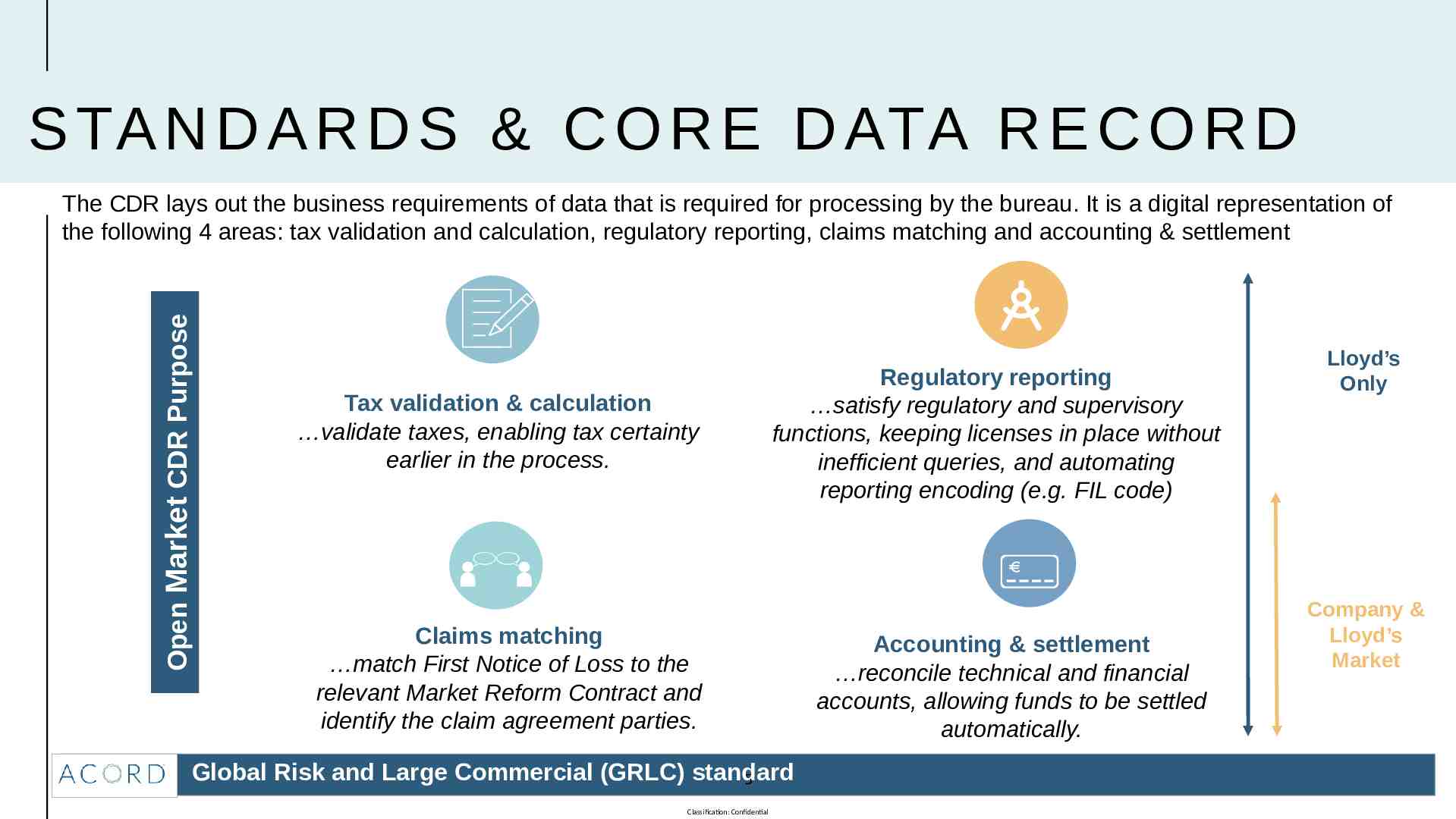

S TA N D A R D S & C O R E D ATA R E C O R D Open Market CDR Purpose The CDR lays out the business requirements of data that is required for processing by the bureau. It is a digital representation of the following 4 areas: tax validation and calculation, regulatory reporting, claims matching and accounting & settlement Tax validation & calculation validate taxes, enabling tax certainty earlier in the process. Regulatory reporting satisfy regulatory and supervisory functions, keeping licenses in place without inefficient queries, and automating reporting encoding (e.g. FIL code) Claims matching match First Notice of Loss to the relevant Market Reform Contract and identify the claim agreement parties. Global Risk and Large Commercial (GRLC) standard 5 Classification: Confidential Accounting & settlement reconcile technical and financial accounts, allowing funds to be settled automatically. Lloyd’s Only Company & Lloyd’s Market

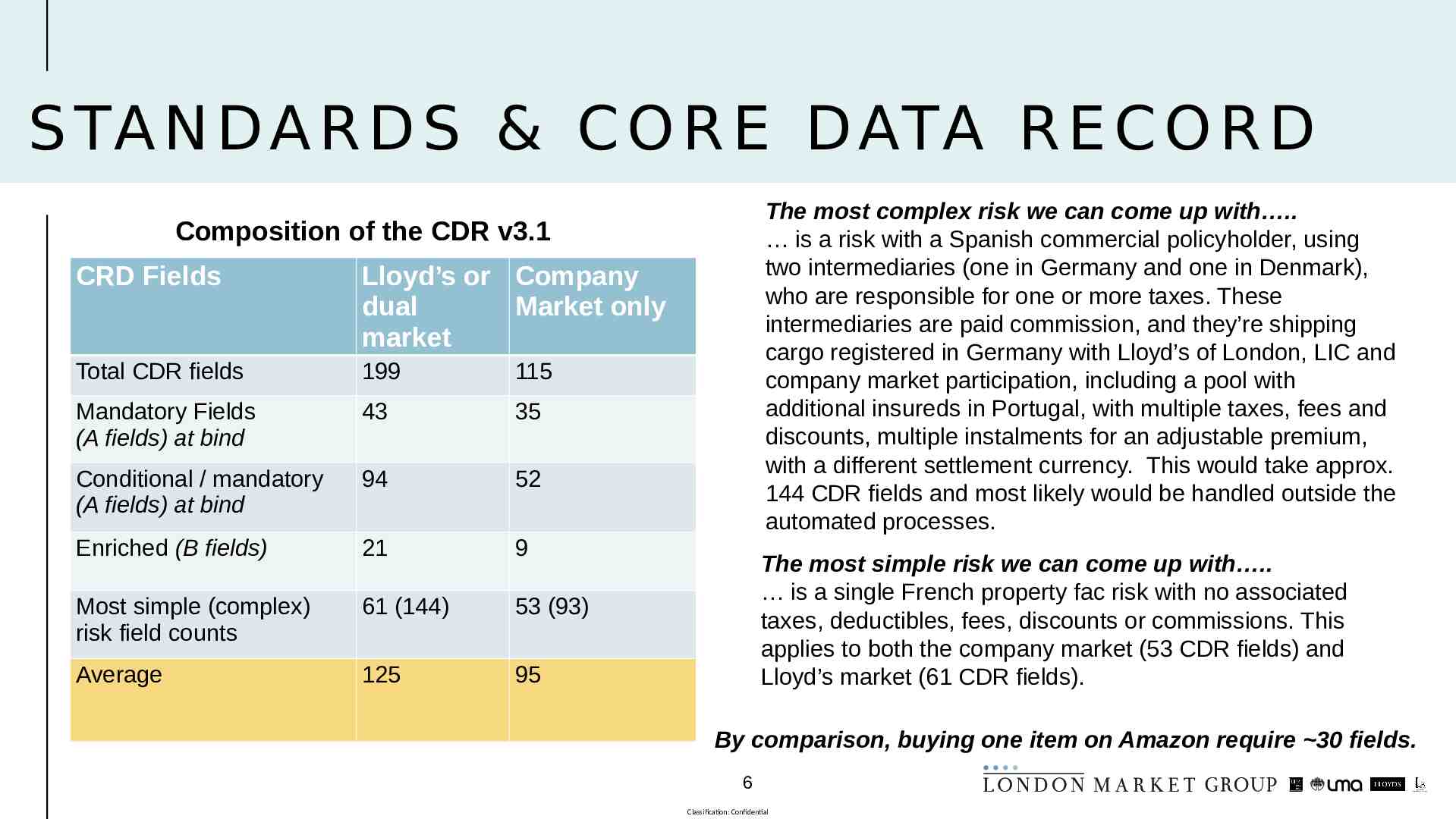

S TA N D A R D S & C O R E D ATA R E C O R D The most complex risk we can come up with . is a risk with a Spanish commercial policyholder, using two intermediaries (one in Germany and one in Denmark), who are responsible for one or more taxes. These intermediaries are paid commission, and they’re shipping cargo registered in Germany with Lloyd’s of London, LIC and company market participation, including a pool with additional insureds in Portugal, with multiple taxes, fees and discounts, multiple instalments for an adjustable premium, with a different settlement currency. This would take approx. 144 CDR fields and most likely would be handled outside the automated processes. Composition of the CDR v3.1 CRD Fields Lloyd’s or Company dual Market only market Total CDR fields 199 115 Mandatory Fields (A fields) at bind 43 35 Conditional / mandatory (A fields) at bind 94 52 Enriched (B fields) 21 9 Most simple (complex) risk field counts 61 (144) 53 (93) Average 125 95 The most simple risk we can come up with . is a single French property fac risk with no associated taxes, deductibles, fees, discounts or commissions. This applies to both the company market (53 CDR fields) and Lloyd’s market (61 CDR fields). By comparison, buying one item on Amazon require 30 fields. 6 Classification: Confidential

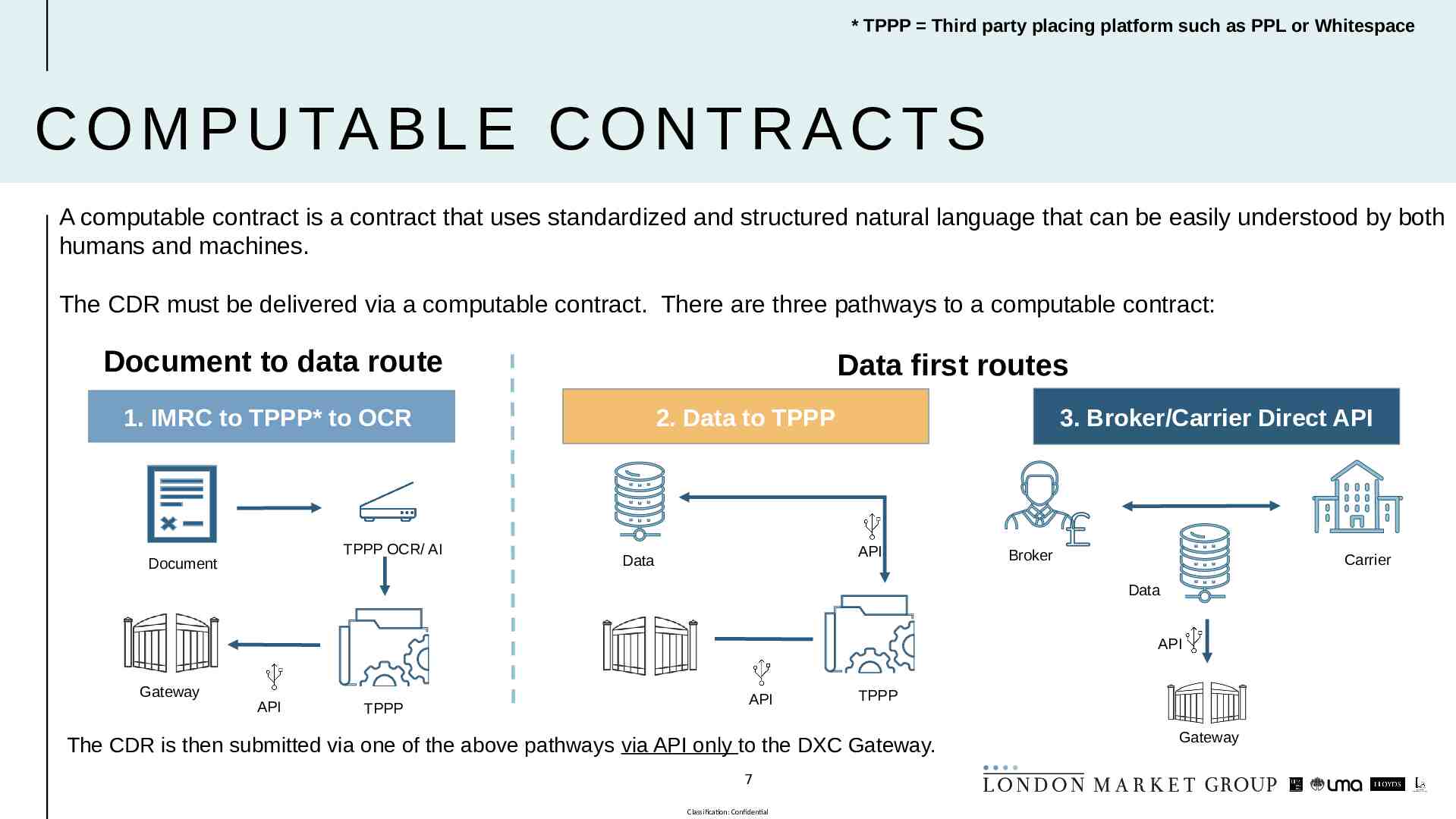

* TPPP Third party placing platform such as PPL or Whitespace C O M P U TA B L E C O N T R A C T S A computable contract is a contract that uses standardized and structured natural language that can be easily understood by both humans and machines. The CDR must be delivered via a computable contract. There are three pathways to a computable contract: Document to data route Data first routes 2. Data to TPPP 1. IMRC to TPPP* to OCR TPPP OCR/ AI Document 3. Broker/Carrier Direct API API Data Broker Carrier Data API Gateway Gateway API TPPP API TPPP The CDR is then submitted via one of the above pathways via API only to the DXC Gateway. 7 Classification: Confidential Gateway

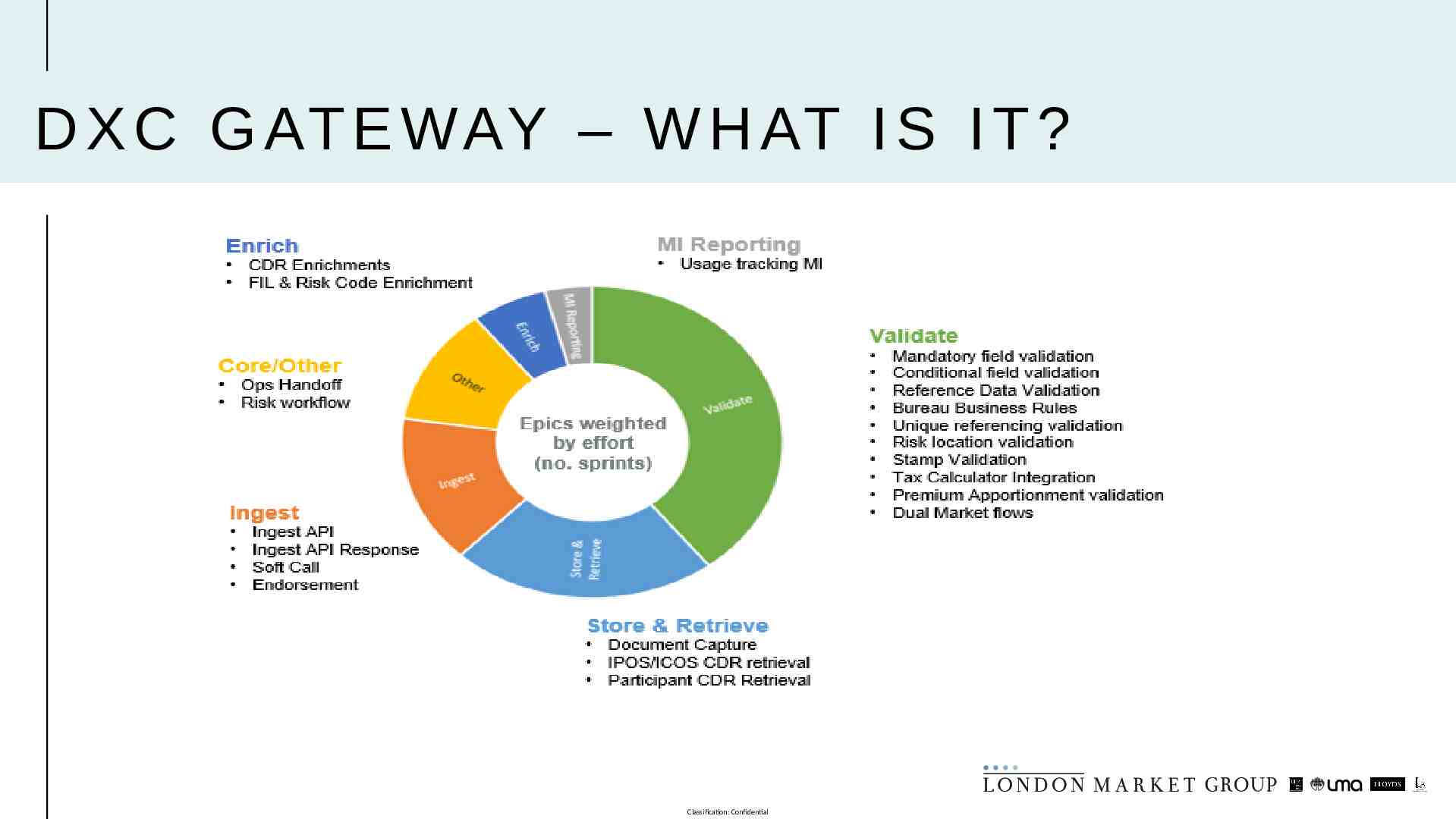

D X C G AT E WAY – W H AT I S I T ? Classification: Confidential

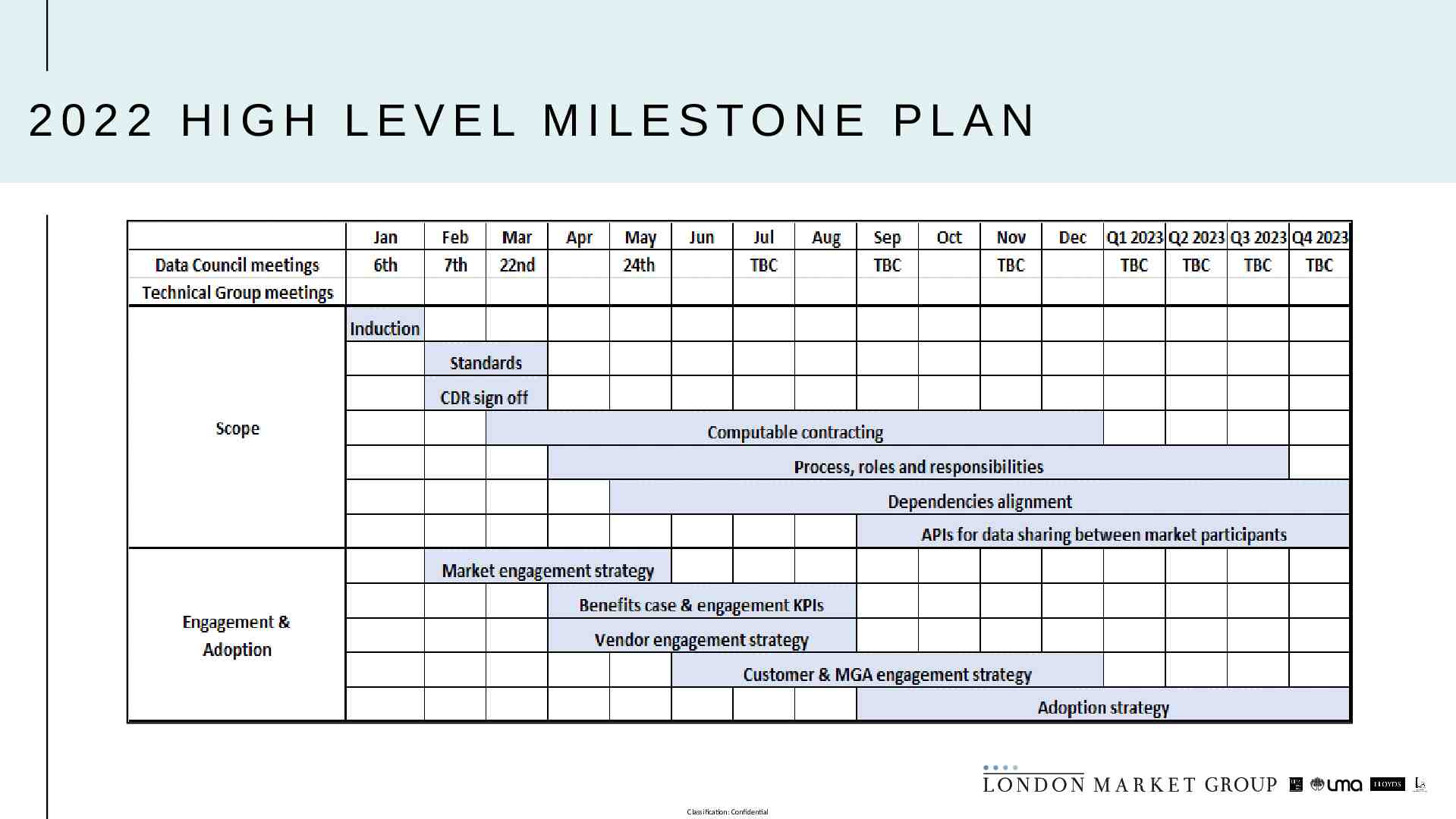

2022 HIGH LEVEL MILESTONE PLAN Classification: Confidential

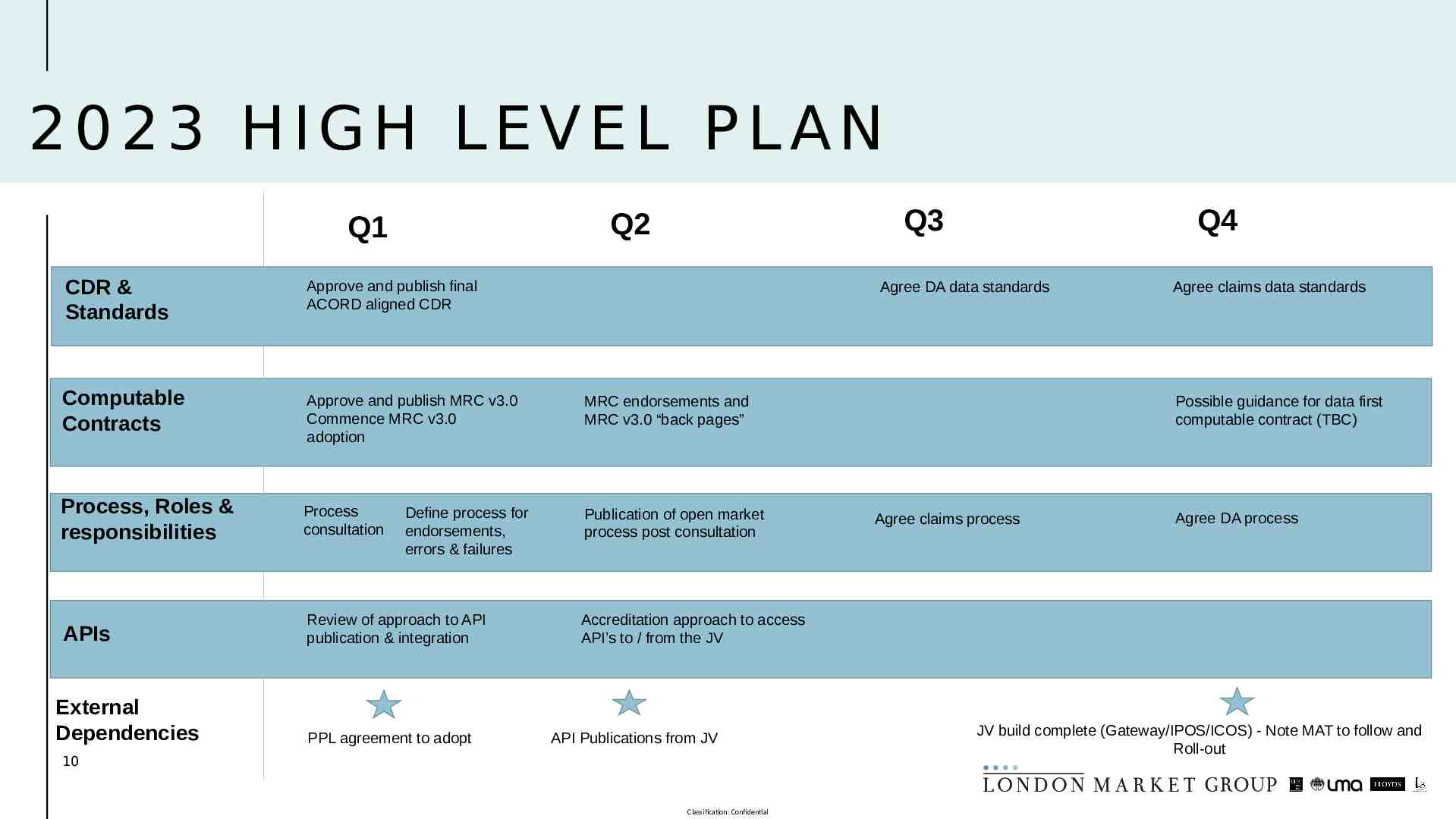

2023 HIGH LEVEL PLAN Q3 Q2 Q1 CDR & Standards Approve and publish final ACORD aligned CDR Computable Contracts Approve and publish MRC v3.0 Commence MRC v3.0 adoption MRC endorsements and MRC v3.0 “back pages” Process, Roles & responsibilities Process consultation Publication of open market process post consultation APIs Review of approach to API publication & integration External Dependencies Define process for endorsements, errors & failures PPL agreement to adopt Q4 Agree DA data standards Agree claims data standards Possible guidance for data first computable contract (TBC) Agree claims process Agree DA process Accreditation approach to access API’s to / from the JV API Publications from JV 10 Classification: Confidential JV build complete (Gateway/IPOS/ICOS) - Note MAT to follow and Roll-out

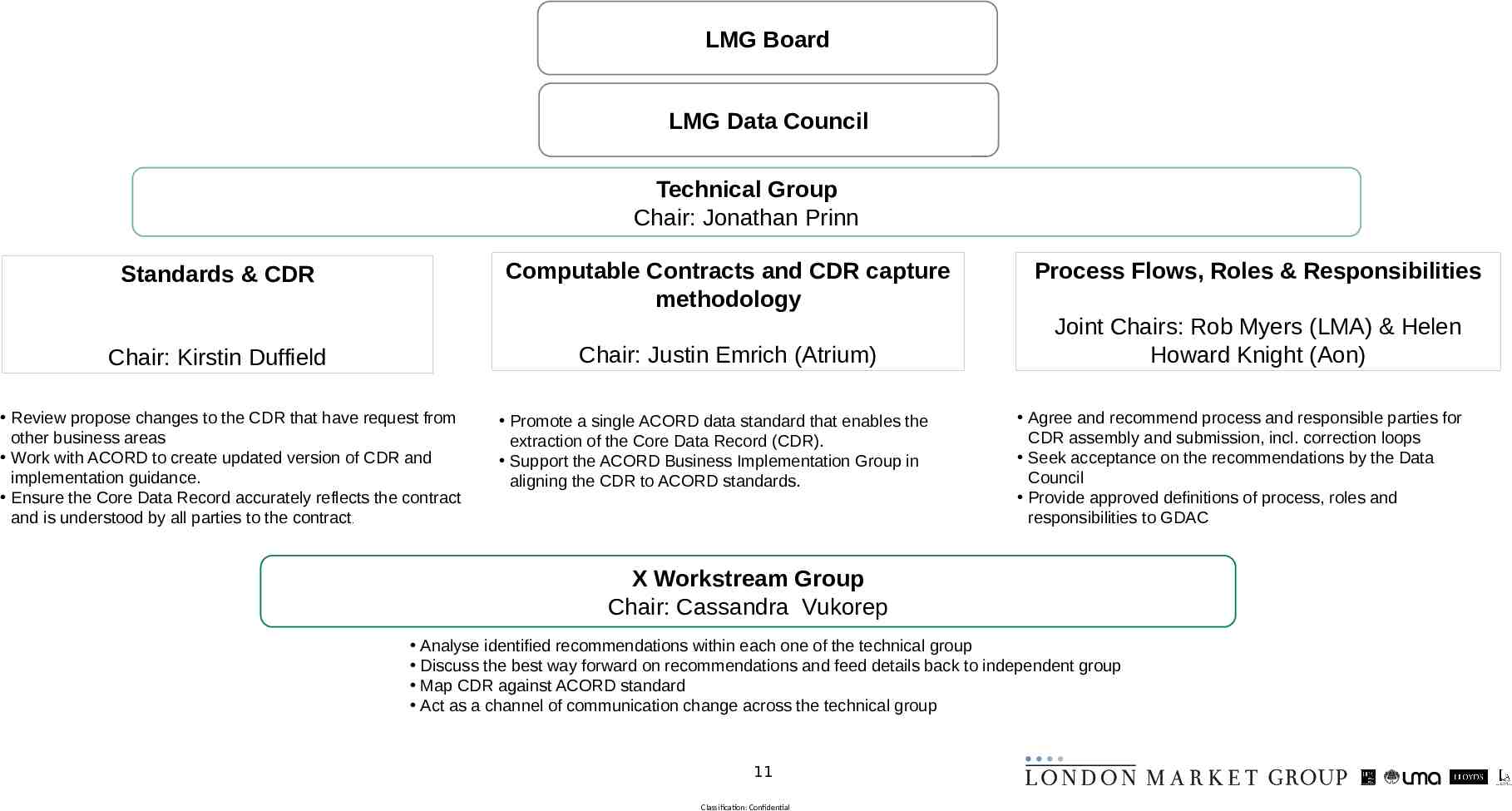

LMG Board LMG Data Council Technical Group Chair: Jonathan Prinn Computable Contracts and CDR capture methodology Standards & CDR Chair: Justin Emrich (Atrium) Chair: Kirstin Duffield Review propose changes to the CDR that have request from other business areas Work with ACORD to create updated version of CDR and implementation guidance. Ensure the Core Data Record accurately reflects the contract and is understood by all parties to the contract. Promote a single ACORD data standard that enables the extraction of the Core Data Record (CDR). Support the ACORD Business Implementation Group in aligning the CDR to ACORD standards. Process Flows, Roles & Responsibilities Joint Chairs: Rob Myers (LMA) & Helen Howard Knight (Aon) Agree and recommend process and responsible parties for CDR assembly and submission, incl. correction loops Seek acceptance on the recommendations by the Data Council Provide approved definitions of process, roles and responsibilities to GDAC X Workstream Group Chair: Cassandra Vukorep Analyse identified recommendations within each one of the technical group Discuss the best way forward on recommendations and feed details back to independent group Map CDR against ACORD standard Act as a channel of communication change across the technical group 11 Classification: Confidential

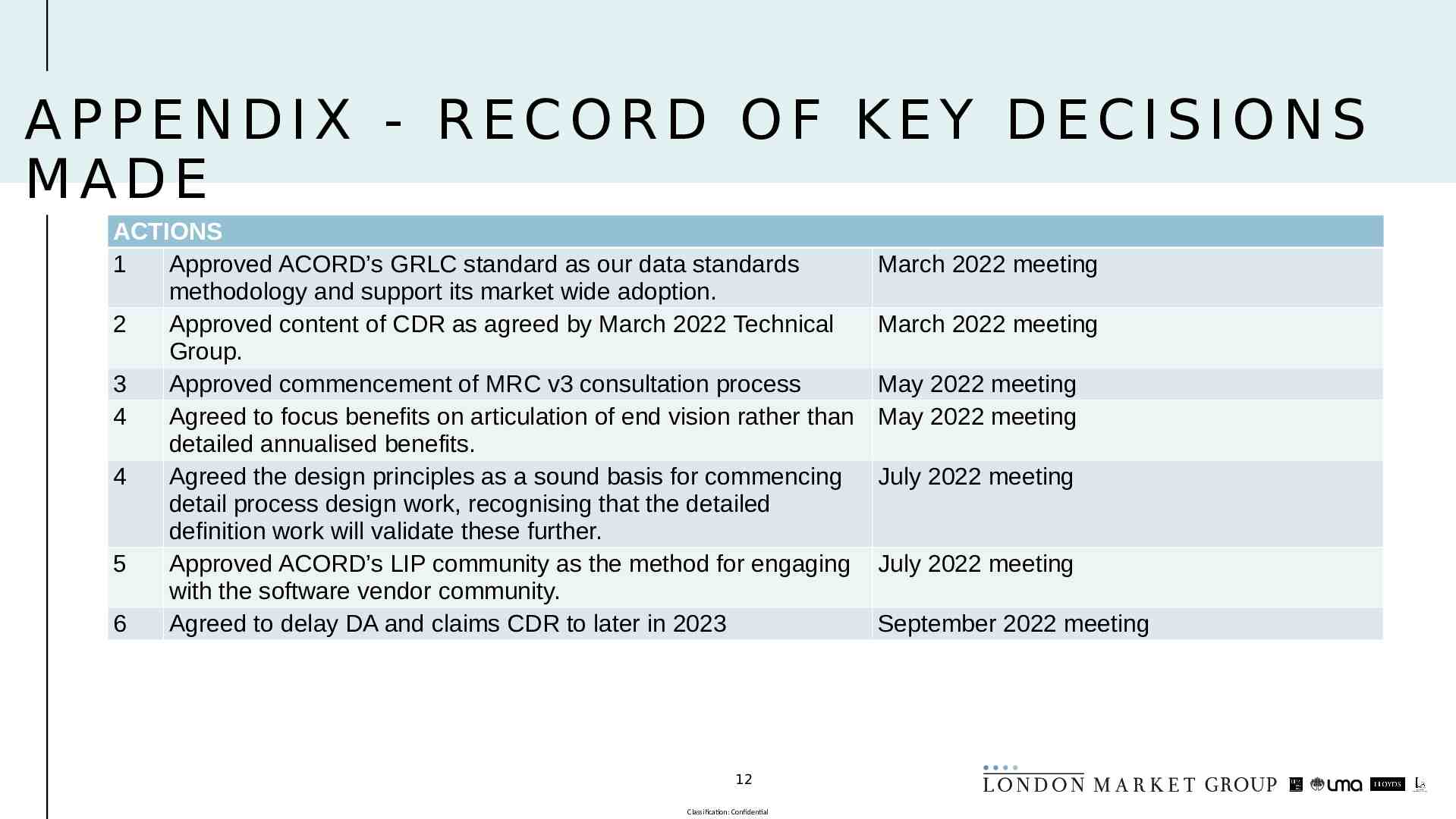

APPENDIX - RECORD OF KEY DECISIONS MADE ACTIONS 1 Approved ACORD’s GRLC standard as our data standards methodology and support its market wide adoption. 2 Approved content of CDR as agreed by March 2022 Technical Group. 3 Approved commencement of MRC v3 consultation process 4 Agreed to focus benefits on articulation of end vision rather than detailed annualised benefits. 4 Agreed the design principles as a sound basis for commencing detail process design work, recognising that the detailed definition work will validate these further. 5 Approved ACORD’s LIP community as the method for engaging with the software vendor community. 6 Agreed to delay DA and claims CDR to later in 2023 12 Classification: Confidential March 2022 meeting March 2022 meeting May 2022 meeting May 2022 meeting July 2022 meeting July 2022 meeting September 2022 meeting