Lenders Handbook Changes VA Pamphlet 26-7 1

55 Slides6.88 MB

Lenders Handbook Changes VA Pamphlet 26-7 1

Dani Terrell, Denver Laura Rodriguez, Houston Steven Roberts, St. Petersburg 2

Chapter 1 Lender Approval Guidelines 3

Underwriter Qualifications 3 years experience processing, preunderwriting or underwriting mortgage loans – 1 year (of last 3) making underwriting decisions on VA loans Current Accredited Mortgage Professional (AMP) designation from MBA, or Current Certified Residential Underwriter (CRU) designation from MBA 4

Underwriter Application Required documentation – VA Form 26-8736a “Non-Supervised Lenders Nomination and Recommendation of Credit Underwriter” and – Resume with VA underwriting experience, and – AMP designation from MBA, or – CRU designation from MBA 5

Agent Relationships Lender must obtain VA approval of an agent relationship for all loans – Previously 4 loans per year allowed without VA recognition 6

Chapter 2 Veteran’s Eligibility and Entitlement 7

Establish Veteran Eligibility The lender MUST ensure the applicant is an eligible Veteran BEFORE a VA appraisal is ordered. Lenders should NEVER close a loan before they establish eligibility. VA will not guaranty a loan for an ineligible borrower. 8

COE Conditions Conditions must be met prior to guaranty Conditions may affect how the loan is processed (list not all-inclusive) – Certifications required i.e. Still serving, Surviving Spouse marital status – Funding fee information i.e. Reserve/Guard, subsequent use, exempt – Prior approval required Submit 8937 or non-service-connected pension 9

Amount of Entitlement If Veteran has partial entitlement available, lender has three options: – Accept limited guaranty – If possible, Veteran may apply for restoration of previously used entitlement – Veteran may make down payment in conjunction with remaining entitlement 10

Down Payment Option Down payment remaining entitlement 25% of loan: – VA does not require that the loan has 25% coverage – This is a lender/investor issue VA employees will not calculate the down payment needed for 25% coverage 11

Chapter 3 The VA Loan and Guaranty 12

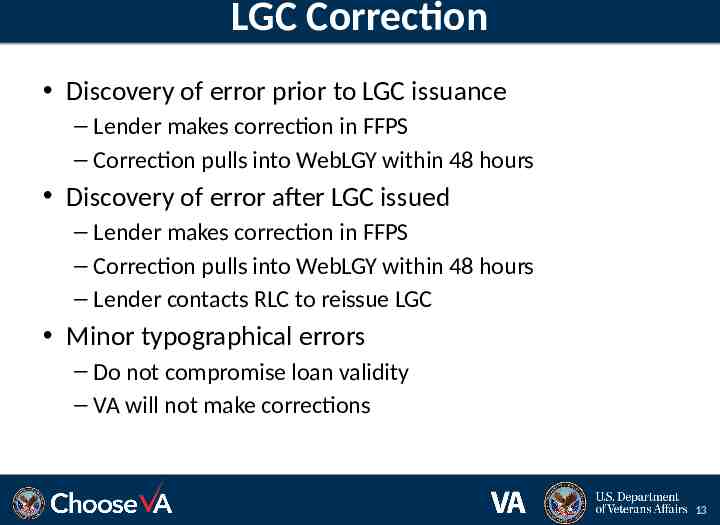

LGC Correction Discovery of error prior to LGC issuance – Lender makes correction in FFPS – Correction pulls into WebLGY within 48 hours Discovery of error after LGC issued – Lender makes correction in FFPS – Correction pulls into WebLGY within 48 hours – Lender contacts RLC to reissue LGC Minor typographical errors – Do not compromise loan validity – VA will not make corrections 13

Chapter 4 Credit Underwriting 14

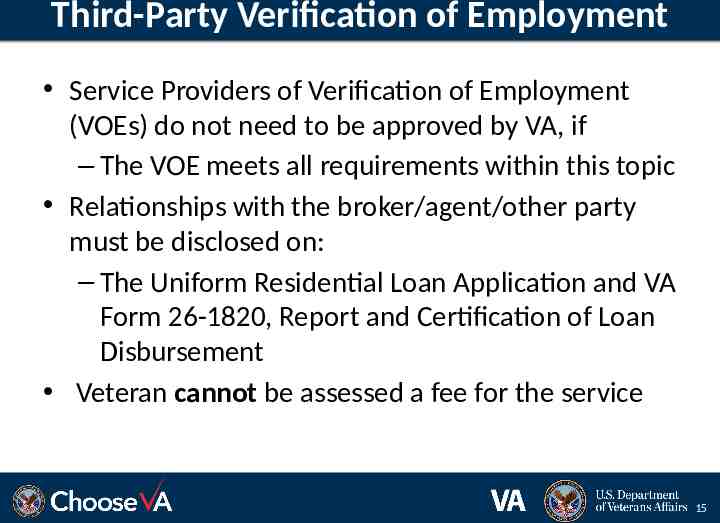

Third-Party Verification of Employment Service Providers of Verification of Employment (VOEs) do not need to be approved by VA, if – The VOE meets all requirements within this topic Relationships with the broker/agent/other party must be disclosed on: – The Uniform Residential Loan Application and VA Form 26-1820, Report and Certification of Loan Disbursement Veteran cannot be assessed a fee for the service 15

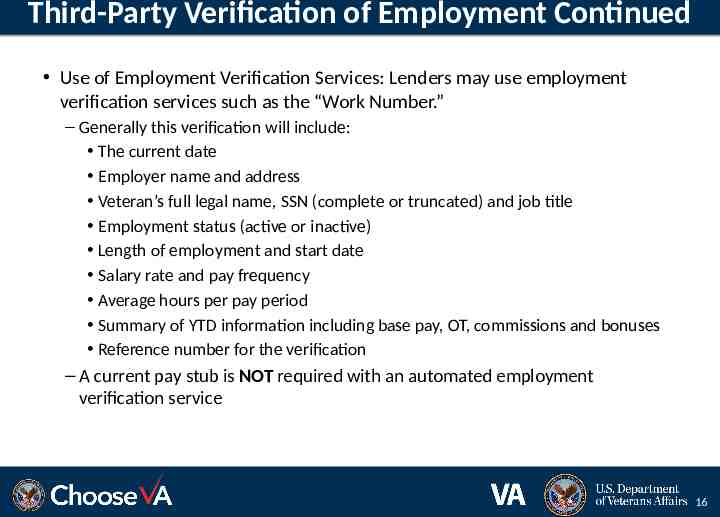

Third-Party Verification of Employment Continued Use of Employment Verification Services: Lenders may use employment verification services such as the “Work Number.” – Generally this verification will include: The current date Employer name and address Veteran’s full legal name, SSN (complete or truncated) and job title Employment status (active or inactive) Length of employment and start date Salary rate and pay frequency Average hours per pay period Summary of YTD information including base pay, OT, commissions and bonuses Reference number for the verification – A current pay stub is NOT required with an automated employment verification service 16

Income – Commission Income From Commissions – Commission employees can no longer use IRS Form 2106 to deduct unreimbursed business expenses – The Tax Cuts and Job Act of 2017 allows Armed Forces Reservist, qualified performing artists, fee basis-state or local officials and employees with impairment-related work expenses to utilize IRS Form 2106 17

Income-Recently Discharged Veterans or Veterans to be Discharged from the Military VA disability income is considered a benefit and does not need to be documented for likelihood of continuance VA disability income verification will be placed on the COE. In some instances, the award amount will not be on the COE: –If the Veteran will be discharging within the next 6 months from the military and has completed a Physical Exam Board (PEB) or Medical Review Board (MEB) and will be filing for disability while still on active duty –Has recently filed for VA disability and determination not yet made –Would be entitled to VA disability, but receives military retirement pay –Received VA disability benefits in the past, or –Is an unmarried surviving spouse eligible to or receiving Dependency and Indemnity Compensation (DIC) –Is in receipt of VA non-service connected pension (not FF exempt) –Has a VA appointed fiduciary to handle financial matters VA Disability income may be verified via bank statements, VA award letters, VA Form, 26 8937 is not required in all cases 18

Income-Recently Discharged Veterans or Veterans to be Discharged from the Military Continued If the Veteran falls under one of the above categories, perform the following: – Submit 26-8937 to RLC where subject property is located and provide any supporting documents including COE to verify Veteran’s VA income – If VA’s Compensation section has not issued a memo rating or completed a claim, the award amount cannot be placed on the COE – A VA awards letter can be used to verify the amount and date a future monthly VA compensation will begin. However, the COE will only reflect whether exempt or non-exempt from paying the funding fee – The 26-8937 MUST be obtained by the lender BEFORE requesting prior approval processing or approving the loan under the automatic basis. The 26-8937 must be retained with the loan package – If the form indicates that the Veteran receives non-service connected pension or has a VA fiduciary, the loan requires prior approval processing and must be uploaded for VA’s review (see Chapter 5 for doc requirements) 19

Income-Rental Verification of Rental Offset of the Property Occupied Prior to the New Home – Obtain copy of rental agreement for property – Use prospective rental income to offset the mortgage payment on the rental – The rental income may not be included in effective income – If no lease on property and local rental market is strong, the lender may consider prospective rental Lender must provide justification on VA Form 26-6393, Loan Analysis Verification of Rental Property Income – Documentation of cash reserves totaling at 3 months mortgage payments PITI, and – Individual income tax returns, signed and dated or lender obtained tax transcripts, plus all applicable schedules for the previous 2 years, must show rental income generated by the property – If the borrower has multiple properties, the borrower must have 3 months PITI documented for each property to consider the rental income. – If no lien on the rental property(ies), 3 months reserves to cover expenses (taxes, hazard/flood insurance, HOA or other recurring fees must be documented. – Equity in the property CANNOT be used as reserves. – Cash proceeds from a VA refinance CANNOT be counted as required reserves. Reserve funds must be in borrower’s account before new VA loan closes – Gift funds CANNOT be used to meet reserve requirements. 20

Income-Rental Continued Analysis of Rental Property Income –Each property(ies) must have a 2-year rental history itemized on the borrower’s tax return –Property depreciation claimed as a deduction on the tax returns may be included in effective income –If, after adding depreciation to the negative rental income, the borrower still has rental loss, the negative income should be deducted from the overall income. –If rental income will not or cannot be used, the full mortgage payment should be considered and reserves NOT required. Verification of Multi-Unit Property Securing the VA Loan –The Veteran/borrower must occupy one unit –For calculating guaranty, reference the one-unit limit column on the FHFA Table: https://www.fhfa.gov/DataTools/Downloads/Pages/Conforming-Loan-Limits.aspx –Verify cash reserves totaling at least 6 months mortgage payments (PITI) –Include rental income in effective income only if: Borrower has reasonable likelihood of success as a landlord, and Cash reserves totaling at least 6 months mortgage payments (PITI) –Document borrower’s prior experience managing rental units and/or use of property management company to oversee the property –If each unit is separate and not under one mortgage, 6 months PITI must be verified for each separate unit. –Equity in the property cannot be used as reserves to meet PITI requirements; Must be borrower’s own funds, not a gift –Cash proceeds from a VA regular “Cash-Out” refinance cannot be counted as the required PITI on rental. The reserve funds must be in borrower’s account before new VA Loan closes 21

Income-Rental Boarder Temporary Boarder Rental Income-Single Family Residence – Verification Requirement: 2 years individual income tax returns, signed and dated with all applicable schedules demonstrating boarder income Rental cannot impair the residential character of the property and cannot exceed 25% of total floor area – Include boarder rental income only if: The borrower has reasonable likelihood of continued success Strength of the local rental market is positive Provide a justification on VA Form 26-6393, Loan Analysis – PITI reserves are not necessary and all income may be used in the analysis 22

Credit History-Required Documentation & Analysis Credit Report Standards –If possible, the cost of the credit report must be listed on the credit report. If not possible, an itemized invoice identifying the borrower(s) is required to verify the cost on the Closing Disclosure (CD) when charging the borrower. Collection Accounts –While VA does not require that collection accounts be paid-off prior to closing if overall credit is acceptable, an underwriter must address the collection account(s) with an explanation on VA Form 26-6393, Loan Analysis. –If the collection account is listed on the credit report with a minimum payment, the debt should be recognized at the minimum payment amount. Charged Off Accounts –The underwriter must address the circumstances regarding the negative credit history when reviewing the overall credit. Disputed Accounts –Lenders may consider a Veteran’s claim of bona fide or legal defenses regarding unpaid debts except when the debt has been reduced to judgment –The underwriter should document the reason(s) for not considering an account on VA Form 26-6393, Loan Analysis 23

Credit History-Required Documentation & Analysis continued Judgments – In certain cases when a judgment has only been in place for a few months, an underwriter could justify on VA Form 26-6393, Loan Analysis, a shorter repayment history if the documentation indicates the borrower immediately addressed the judgment after it was filed and began a repayment plan. Foreclosures – If a foreclosure, deed in lieu, or short sale process is in conjunction with a bankruptcy, use the latest date of either the discharge of the bankruptcy or transfer of title for the home to establish the beginning date of re-established credit. Deed in Lieu (DIL) or Short Sale – Develop complete information on the facts and circumstances if the borrower(s) voluntarily surrendered the property. – If the borrower’s payment history before the short sale or DIL was satisfactory, a waiting period from the date of transfer of the property may not be necessary. – If the foreclosure, DIL or short sale was on a VA loan, a borrower may not have full entitlement. 24

Automated Underwriting (AUS) General AUS Information – Although VA has approved the use of AUS systems, we are not the vendor and the terms and conditions of these systems must be negotiated directly with the provider Note: AUS does NOT apply to prior approval loans, therefore reduced documentation requirements do not apply. All prior approval loans are manually underwritten— and must include VA 26-6393, Loan Analysis signed by a VA approved underwriter 25

Automated Underwriting (AUS) Continued Documentation Guidelines for Credit History – Rental Payment History for AUS Refer Cases: Provide a 24 (previously 12) month rental history directly from landlord, through information shown on credit report or by cancelled checks. – Verifying Previous Employment for AUS Refer Cases: No VOE or W-2 Forms are required for a borrower on active duty. The Leave & Earning Statement (LES) should be used. Documentation Guidelines for Closing Costs – Requirement is removed for both AUS accept/approve and refer cases. 26

How to Complete VA Form 26-6393, Loan Analysis Special Instructions for Using Residual Income Table – If a dependent is claimed on the Federal Tax Returns, then the dependent must be considered as a member of the household to calculate residual income Debt-to-Income Ratio – Use a figure of 125% (previously % not defined) of the borrower’s non-taxable income when “grossing up” – Reminder: back out gross up amount so as not to affect residual income 27

Chapter 5 How to Process VA Loans 28

Loan Processing Procedures To avoid delays in closing, VA recommends the lender take the following actions in the early stages of loan processing. – Obtain a COE – Request an appraisal assignment in WebLGY – Initiate the Credit Alert Interactive Verification Report System (CAIVRS) and, if applicable, complete VA Form 268937, Verification of VA Benefits (see Topic 6, Chapter 4 of the Lender’s Handbook) – Request a credit report and verifications (see Topic 7, Chapter 4 of the Lenders Handbook) 29

Requirements for Active Duty Service Members Ensure the Veteran, eligible as active duty, is still on active duty at the time of loan closing if the COE reads: “Valid unless discharged or released subsequent to date of this certificate. A certification of continuous active duty as of the date of note is required.” Loan CANNOT close unless the VA re-establishes the Veteran’s eligibility A Veteran released from active duty must have a DD-214 form (member 4 copy) with time served, Character of Service Discharge, and reason for the discharge listed. It must be uploaded into WebLGY for the issuance of a new COE 30

Requirements for Active Duty Service Members Continued Loan CANNOT close unless the VA re-establishes the Veteran’s eligibility A Veteran release from the National Guard or Reserves must have evidence of time served and an Honorable discharge. Upload into WebLGY for the issuance of a new COE. It a COE as issued based upon active duty service and the Veteran has been separated, eligibility MUST be redetermined based upon their length of service and character of service 31

Prior Approval Processing Lenders must upload all prior approval documents into WebLGY, for RLC review. Upon approval the VA Regional Loan Center (RLC) will issue a Certificate of Commitment (COC). Lender must comply with any conditions listed on the COC. To obtain loan guaranty certificate, the closing package must be uploaded into WeLGY, and the appropriate RLC notified. 32

Prior Approval Timelines VA has a 10-business day timeliness requirement for prior approvals Process time is extended for loans involving the receipt of VA pension income or a Veteran with a VA Fiduciary VA’s certificate of commitment must be obtained prior to closing VA may cancel a commitment if the validity period of the certificate exceeds 180 days. 33

Prior Approval Documents Purchase and regular “cash-out” refinance prior approvals must have the following documents uploaded to WebLGY in the order listed. –Lender’s cover or transmittal letter –VA Form 26-8937, Verification of VA Benefits (if applicable) –URLA (Uniform Residential Loan Application) with revised VA Form 26-1802a, Department of Housing and Urban Development (HUD)/VA Addendum to URLA. Final forms must be properly completed and, legible, signed and date –VA Form 26-8497, Request for Verification of Employment, or alternative verification of employment (VOE), and other verifications of income such as paystubs and tax returns. –Credit Alert Verification Reports System (CAIVRS): borrower/co-borrower –All original credit reports obtained in connection with the loan and any related documents –VA Form 26-8497a, Request for Verification of Deposit or alternative verification of deposit (VOD) 34

Prior Approval Documents Continued – VA Form 26-6393, Loan Analysis, completed and legibly signed – VA Form 26-0592, Counseling Checklist for Military Homebuyers (if applicant is on active duty) – Loan Estimate – Documentation of the cost of energy improvements to be included in the loan. The energy improvement loan amount cannot exceed 6,000 – Any other necessary documents. For example, but not limited to: loan payoff statement, power of attorney (POA), lenders loan quality certification, verification of rent for a 12-month rental history 35

Prior Approval IRRRL Documents An IRRRL made to refinance a loan that will be 30 or more days past due as of the date of closing, must be submitted for prior approval. –Lender’s cover or transmittal letter –VA Form 26-8937, Verification of VA Benefits (if applicable) –Statement signed by the Veteran acknowledging the effect of the refinancing loan on the Veteran’s loan payments and interest rate. The statement must include: The interest rate and monthly payments for the new loan versus that of the old loan, and How long it will take to recoup ALL closing costs (both those included in the loan and those paid outside of closing). –VA Form 26-8923, Interest Rate Reduction Refinancing Loan –Credit Alert Verification Reports System (CAIVRS); borrower/co-borrower –URLA (Uniform Residential Loan Application) with revised VA Form 26-1802a, (HUD)/VA Addendum to URLA. Final forms must be properly completed and, legible, signed and date –VA Form 26-0503, Federal Collection Policy Notice 36

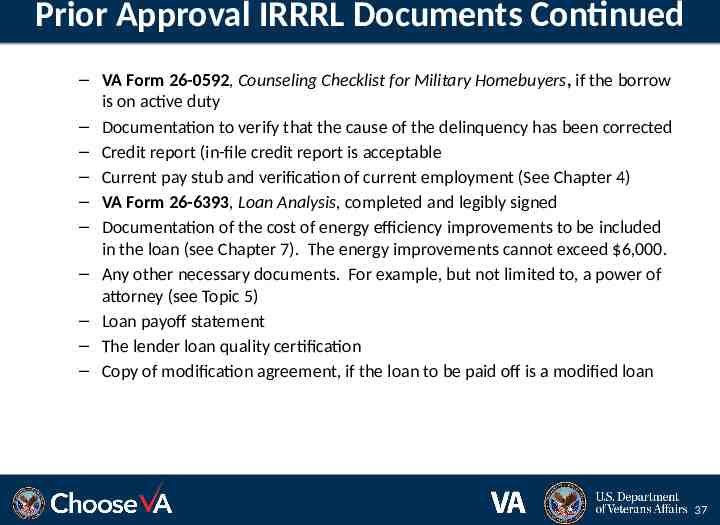

Prior Approval IRRRL Documents Continued – VA Form 26-0592, Counseling Checklist for Military Homebuyers, if the borrow is on active duty – Documentation to verify that the cause of the delinquency has been corrected – Credit report (in-file credit report is acceptable – Current pay stub and verification of current employment (See Chapter 4) – VA Form 26-6393, Loan Analysis, completed and legibly signed – Documentation of the cost of energy efficiency improvements to be included in the loan (see Chapter 7). The energy improvements cannot exceed 6,000. – Any other necessary documents. For example, but not limited to, a power of attorney (see Topic 5) – Loan payoff statement – The lender loan quality certification – Copy of modification agreement, if the loan to be paid off is a modified loan 37

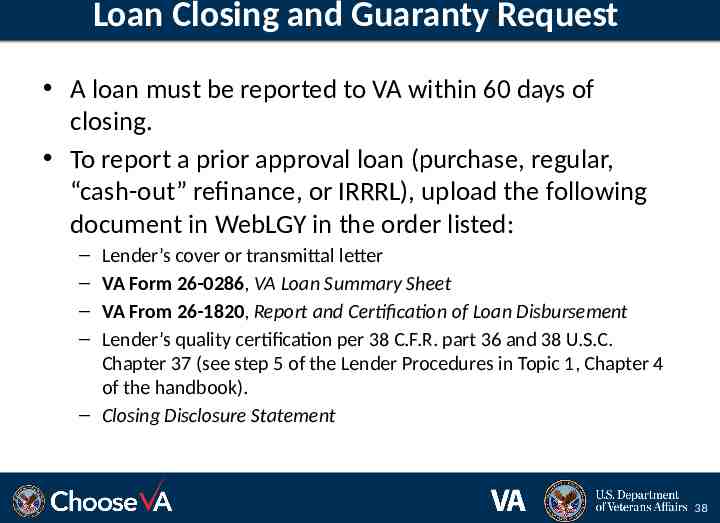

Loan Closing and Guaranty Request A loan must be reported to VA within 60 days of closing. To report a prior approval loan (purchase, regular, “cash-out” refinance, or IRRRL), upload the following document in WebLGY in the order listed: – – – – Lender’s cover or transmittal letter VA Form 26-0286, VA Loan Summary Sheet VA From 26-1820, Report and Certification of Loan Disbursement Lender’s quality certification per 38 C.F.R. part 36 and 38 U.S.C. Chapter 37 (see step 5 of the Lender Procedures in Topic 1, Chapter 4 of the handbook). – Closing Disclosure Statement 38

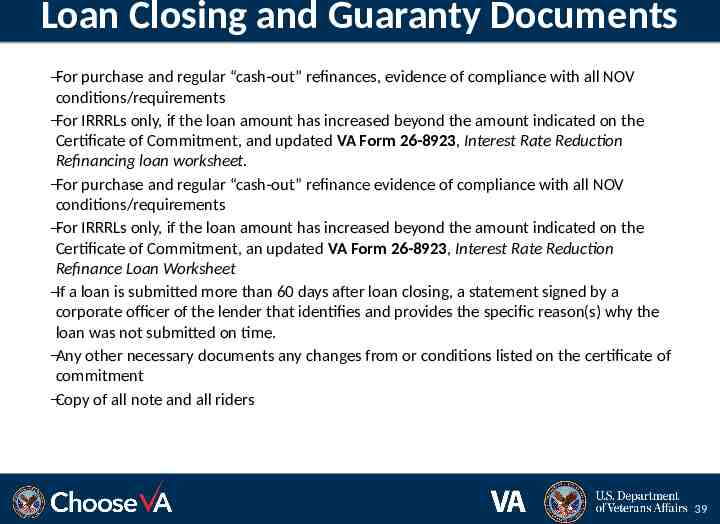

Loan Closing and Guaranty Documents –For purchase and regular “cash-out” refinances, evidence of compliance with all NOV conditions/requirements –For IRRRLs only, if the loan amount has increased beyond the amount indicated on the Certificate of Commitment, and updated VA Form 26-8923, Interest Rate Reduction Refinancing loan worksheet. –For purchase and regular “cash-out” refinance evidence of compliance with all NOV conditions/requirements –For IRRRLs only, if the loan amount has increased beyond the amount indicated on the Certificate of Commitment, an updated VA Form 26-8923, Interest Rate Reduction Refinance Loan Worksheet –If a loan is submitted more than 60 days after loan closing, a statement signed by a corporate officer of the lender that identifies and provides the specific reason(s) why the loan was not submitted on time. –Any other necessary documents any changes from or conditions listed on the certificate of commitment –Copy of all note and all riders 39

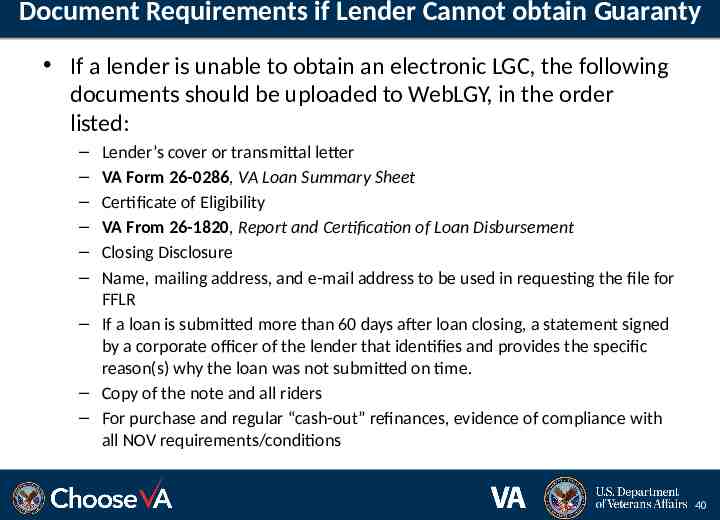

Document Requirements if Lender Cannot obtain Guaranty If a lender is unable to obtain an electronic LGC, the following documents should be uploaded to WebLGY, in the order listed: – – – – – – Lender’s cover or transmittal letter VA Form 26-0286, VA Loan Summary Sheet Certificate of Eligibility VA From 26-1820, Report and Certification of Loan Disbursement Closing Disclosure Name, mailing address, and e-mail address to be used in requesting the file for FFLR – If a loan is submitted more than 60 days after loan closing, a statement signed by a corporate officer of the lender that identifies and provides the specific reason(s) why the loan was not submitted on time. – Copy of the note and all riders – For purchase and regular “cash-out” refinances, evidence of compliance with all NOV requirements/conditions 40

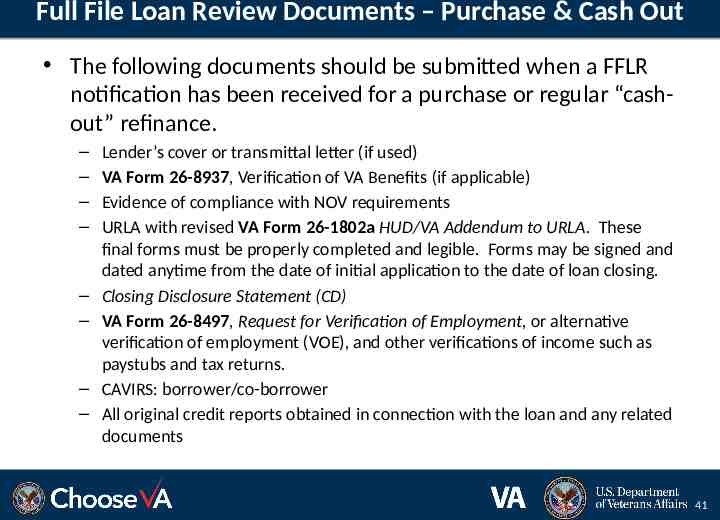

Full File Loan Review Documents – Purchase & Cash Out The following documents should be submitted when a FFLR notification has been received for a purchase or regular “cashout” refinance. – – – – – – – – Lender’s cover or transmittal letter (if used) VA Form 26-8937, Verification of VA Benefits (if applicable) Evidence of compliance with NOV requirements URLA with revised VA Form 26-1802a HUD/VA Addendum to URLA. These final forms must be properly completed and legible. Forms may be signed and dated anytime from the date of initial application to the date of loan closing. Closing Disclosure Statement (CD) VA Form 26-8497, Request for Verification of Employment, or alternative verification of employment (VOE), and other verifications of income such as paystubs and tax returns. CAVIRS: borrower/co-borrower All original credit reports obtained in connection with the loan and any related documents 41

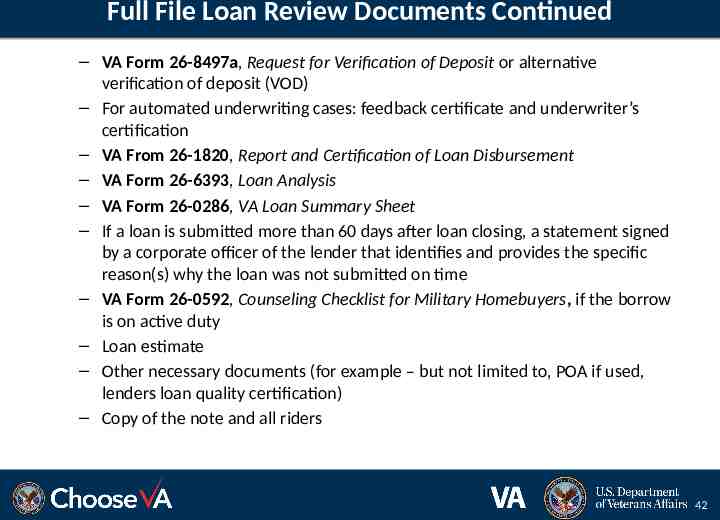

Full File Loan Review Documents Continued – VA Form 26-8497a, Request for Verification of Deposit or alternative verification of deposit (VOD) – For automated underwriting cases: feedback certificate and underwriter’s certification – VA From 26-1820, Report and Certification of Loan Disbursement – VA Form 26-6393, Loan Analysis – VA Form 26-0286, VA Loan Summary Sheet – If a loan is submitted more than 60 days after loan closing, a statement signed by a corporate officer of the lender that identifies and provides the specific reason(s) why the loan was not submitted on time – VA Form 26-0592, Counseling Checklist for Military Homebuyers, if the borrow is on active duty – Loan estimate – Other necessary documents (for example – but not limited to, POA if used, lenders loan quality certification) – Copy of the note and all riders 42

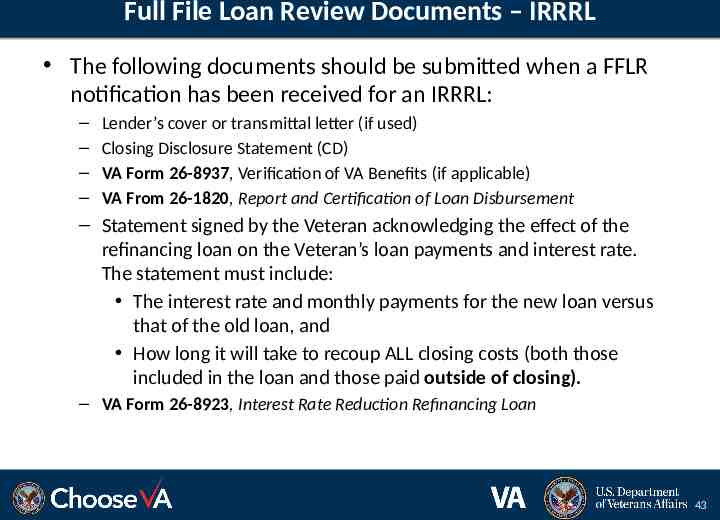

Full File Loan Review Documents – IRRRL The following documents should be submitted when a FFLR notification has been received for an IRRRL: – – – – Lender’s cover or transmittal letter (if used) Closing Disclosure Statement (CD) VA Form 26-8937, Verification of VA Benefits (if applicable) VA From 26-1820, Report and Certification of Loan Disbursement – Statement signed by the Veteran acknowledging the effect of the refinancing loan on the Veteran’s loan payments and interest rate. The statement must include: The interest rate and monthly payments for the new loan versus that of the old loan, and How long it will take to recoup ALL closing costs (both those included in the loan and those paid outside of closing). – VA Form 26-8923, Interest Rate Reduction Refinancing Loan 43

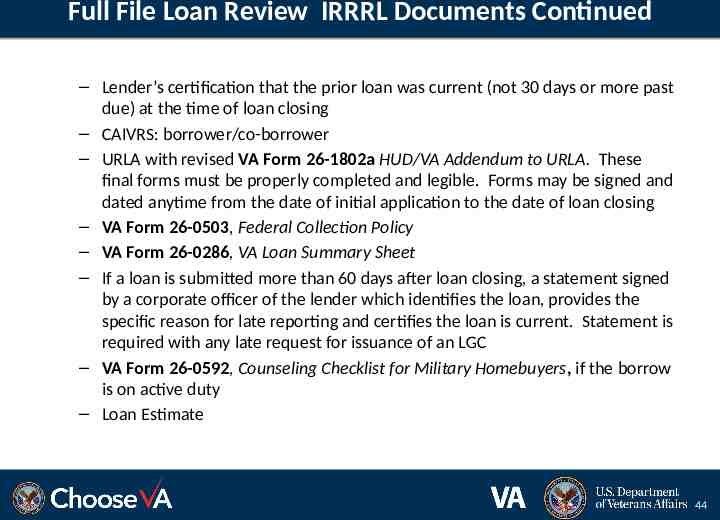

Full File Loan Review IRRRL Documents Continued – Lender’s certification that the prior loan was current (not 30 days or more past due) at the time of loan closing – CAIVRS: borrower/co-borrower – URLA with revised VA Form 26-1802a HUD/VA Addendum to URLA. These final forms must be properly completed and legible. Forms may be signed and dated anytime from the date of initial application to the date of loan closing – VA Form 26-0503, Federal Collection Policy – VA Form 26-0286, VA Loan Summary Sheet – If a loan is submitted more than 60 days after loan closing, a statement signed by a corporate officer of the lender which identifies the loan, provides the specific reason for late reporting and certifies the loan is current. Statement is required with any late request for issuance of an LGC – VA Form 26-0592, Counseling Checklist for Military Homebuyers, if the borrow is on active duty – Loan Estimate 44

Full File Loan Review IRRRL Documents Continued – Documentation of the cost of energy efficient improvements included in the loan. For cash reimbursement of the Veteran, the improvements must have been completed within the 90 days immediately preceding the date of the loan (See Chapter 7) – Other necessary documents (for example – but not limited to, POA if used, lenders loan quality certification) – Copy of the note and all riders – Copy of a loan modification agreement, if the loan to be paid off is a modified loan 45

Chapter 7 Special Handling 46

Joint Loan Terminology Entitlement and funding fees are separate. Funding fees are always calculated equally by the number of people on the loan. It is based on each Veteran paying their equal share of the loan. On a Veteran/non-Veteran loan, the funding fee is based on half of the base loan amount, downpayment and sales price for the correct funding fee charge. 47

Occupancy Non-Veteran Occupancy Certification – The non-Veteran does not have to certify occupancy. – This statement has been removed from the Lender’s Handbook. 48

Calculate Guaranty and Entitlement Guaranty Entitlement: – Percentage of entitlement has no bearing on the amount of funding fee to be paid. (See Chapter 8) – Lenders can not guaranty a prior approval loan. If two married Veterans are both using their entitlement, VA must perform the guaranty procedure to ensure proper calculation. 49

Construction/Permanent Home Loans VA expects all Lenders to have the specialized experience to originate, process, underwrite (borrower, project and builder), close, service and administer such loans. Builders are no longer responsible for paying commitment fees. 50

Energy Efficient Mortgages The mortgage may be increased by: – Up to 3,000 based solely on the documented costs. – Up to 6,000 provided the increase in monthly mortgage payment does not exceed the likely reduction in utility costs. – VA does NOT permit EEMS of more than 6,000 U.S.C. 3710 51

Chapter 9 Legal Instruments, Liens, Escrows and Related Issues 52

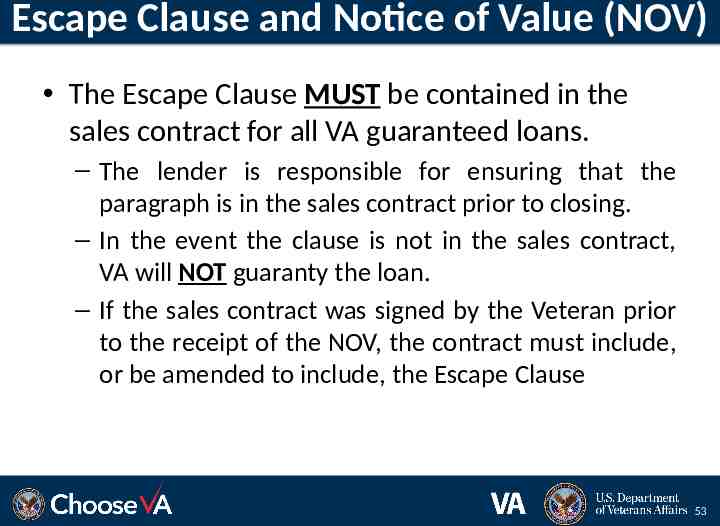

Escape Clause and Notice of Value (NOV) The Escape Clause MUST be contained in the sales contract for all VA guaranteed loans. – The lender is responsible for ensuring that the paragraph is in the sales contract prior to closing. – In the event the clause is not in the sales contract, VA will NOT guaranty the loan. – If the sales contract was signed by the Veteran prior to the receipt of the NOV, the contract must include, or be amended to include, the Escape Clause 53

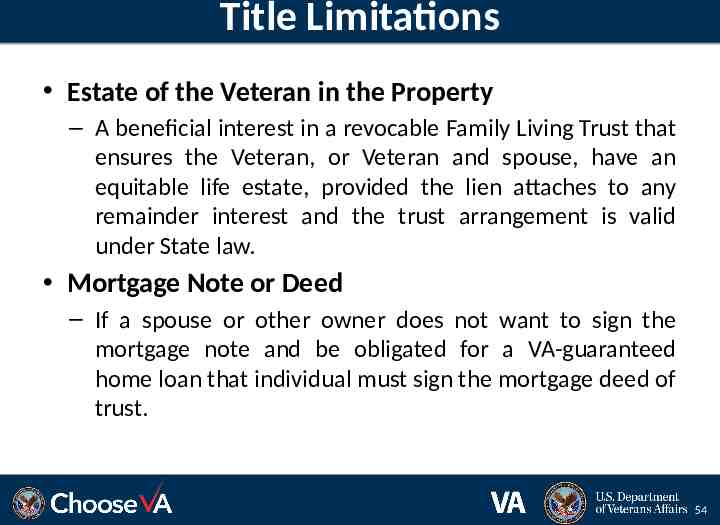

Title Limitations Estate of the Veteran in the Property – A beneficial interest in a revocable Family Living Trust that ensures the Veteran, or Veteran and spouse, have an equitable life estate, provided the lien attaches to any remainder interest and the trust arrangement is valid under State law. Mortgage Note or Deed – If a spouse or other owner does not want to sign the mortgage note and be obligated for a VA-guaranteed home loan that individual must sign the mortgage deed of trust. 54

FOR VA INTERAL USE ONLY 55