Join your retirement plan today! Presented by: Name(s) The most

20 Slides1.70 MB

Join your retirement plan today! Presented by: Name(s) The most important step to saving for your future is starting. Join the plan Company logo (optional)

Planning made easy Four questions you should ask yourself: 1. Why save now? 2. Why use your plan? 3. How much is enough? 4. What ways can you invest? The most important step to saving for your future is starting. Join the plan 2

Why save now? The most important step to saving for your future is starting. Join the plan 3

Why save now? Retirement can be expensive1 Sources of retirement income2 33% 70% Social Security is roughly the amount of your annual pre-retirement income that many experts estimate you’ll need each year of retirement. Center for Retirement Research at Boston College, Social Security And Total Replacement Rates In Disability And Retirement, http://bit.ly/income-replace, May 2018. 67% All other sources: Company retirement plan Pensions Personal savings and investments Earnings/income Other 1 Social Security Administration, Fast Facts & Figures about Social Security, 2018. 2 The most important step to saving for your future is starting. Join the plan 4

Why save now? Living expenses are on the rise. Look at how prices for everyday items have increased in the last 20 years. 1998 to 2018 0.96 1.99 1.05 2.96 *Source for eggs per dozen, gas per gallon, coffee per pound: Bureau of Labor Statistics; Source for movie ticket: Box Office Mojo 4.69 9.16 3.89 4.29 The most important step to saving for your future is starting. Join the plan 5

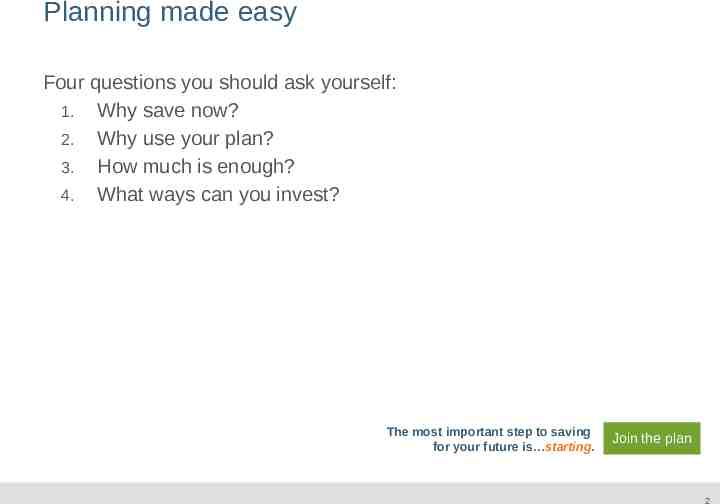

Put time on your side Projected income in retirement [to age 90] 3,095 per month in retirement 2,017 per month in retirement The illustrations above assume a retirement age of 65 and that the individual receives the monthly retirement payment shown until age 90. The amount saved until retirement assumes an annual investment return of 6%. The monthly payment amount in retirement assumes an annual investment return of 5%. The investment performance shown does not represent the return of any particular investment and does not guarantee any future rate of return. The income in retirement does not reflect any taxes or penalties that may be due upon distribution. Withdrawals from a taxdeferred account before age 59½ are subject to a 10% federal penalty tax unless an exception applies. The most important step to saving for your future is starting. Join the plan 6

Why use your plan? Convenience o Automatic payroll deductions will be deposited directly in your account. Ownership o Your contributions and earnings belong to you. Pretax savings advantages o Your money is invested before taxes and you won’t need to pay tax on it until it’s withdrawn. The most important step to saving for your future is starting. Join the plan 7

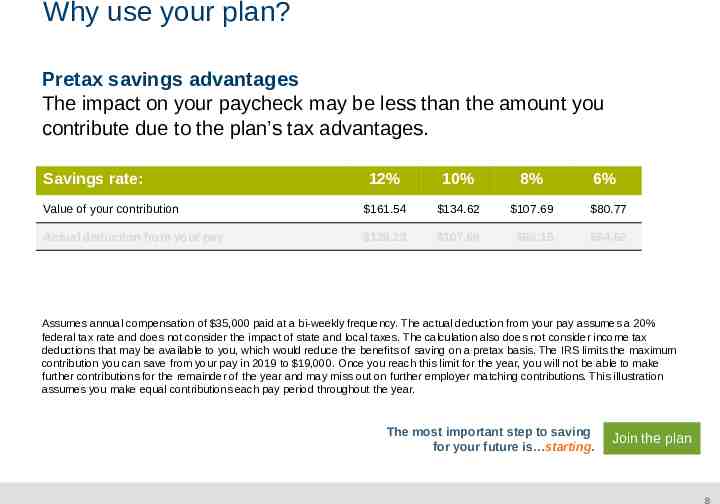

Why use your plan? Pretax savings advantages The impact on your paycheck may be less than the amount you contribute due to the plan’s tax advantages. Savings rate: 12% 10% 8% Value of your contribution 161.54 134.62 107.69 80.77 Actual deduction from your pay 129.23 107.69 86.15 64.62 . 6% Assumes annual compensation of 35,000 paid at a bi-weekly frequency. The actual deduction from your pay assumes a 20% federal tax rate and does not consider the impact of state and local taxes. The calculation also does not consider income tax deductions that may be available to you, which would reduce the benefits of saving on a pretax basis. The IRS limits the maximum contribution you can save from your pay in 2019 to 19,000. Once you reach this limit for the year, you will not be able to make further contributions for the remainder of the year and may miss out on further employer matching contributions. This illustration assumes you make equal contributions each pay period throughout the year. The most important step to saving for your future is starting. Join the plan 8

Why use your plan? What about Roth? Consider a different type of tax advantage: Roth This feature allows you to pay taxes upfront so you can make tax-free withdrawals later. Even earnings are tax-free when certain withdrawal requirements are met. The most important step to saving for your future is starting. Join the plan 9

Why use your plan? Give your savings a boost Don’t leave money on the table. Your employer wants to see you succeed and is willing to help you along the way with additional employer contributions. The most important step to saving for your future is starting. Join the plan 10

How much is enough? Experts recommend saving at least 10-15% * If you have to, start small and make gradual increases each year. Remember, every bit counts. *CNN Money, Ultimate Guide To Retirement, bit.ly/ret-save-amt, accessed March 2019. The most important step to saving for your future is starting. Join the plan 11

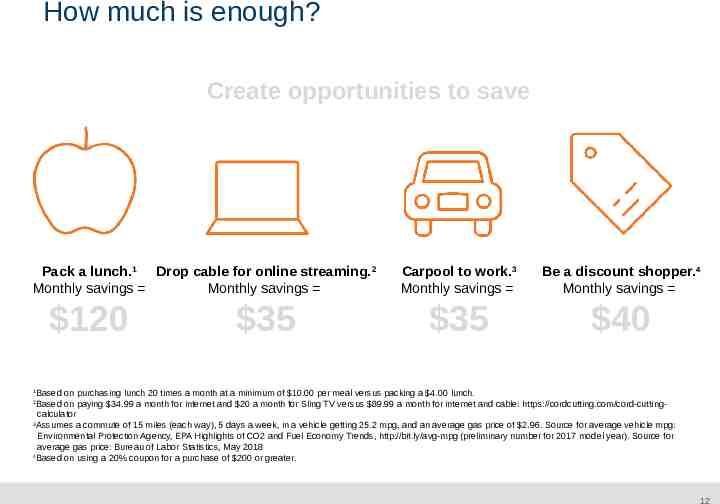

How much is enough? Create opportunities to save Pack a lunch.1 Drop cable for online streaming.2 Monthly savings Monthly savings 120 35 Carpool to work.3 Monthly savings Be a discount shopper.4 Monthly savings 35 40 Based on purchasing lunch 20 times a month at a minimum of 10.00 per meal versus packing a 4.00 lunch. Based on paying 34.99 a month for internet and 20 a month for Sling TV versus 89.99 a month for internet and cable: https://cordcutting.com/cord-cuttingcalculator 3 Assumes a commute of 15 miles (each way), 5 days a week, in a vehicle getting 25.2 mpg, and an average gas price of 2.96. Source for average vehicle mpg: The most important toforsaving Environmental Protection Agency, EPA Highlights of CO2 and Fuel Economy Trends, http://bit.ly/avg-mpg (preliminarystep number 2017 model year). JoinSource the for plan average gas price: Bureau of Labor Statistics, May 2018 for your future is starting. 4 Based on using a 20% coupon for a purchase of 200 or greater. 1 2 12

What ways can you invest? The most important step to saving for your future is starting. Join the plan 13

By Default 1. Your plan offers investment options that provide a way to get in the plan and begin saving now. 2. However, if you complete the enrollment process, but do not make any investment elections, your savings will be invested in the plan’s default investment. The most important step to saving for your future is starting. Join the plan 14

By Design Morningstar Retirement ManagerSM: A personalized solution just for you Let the professionals at Morningstar do it for you. Morningstar Investment Management LLC is part of Morningstar’s Investment Management group—a global leader with over 197 billion in assets under management and advisement.* Morningstar Retirement ManagerSM is an online service that creates a personalized retirement strategy just for you. *Data as of December 31, 2018. Includes assets under management and advisement for Morningstar Investment Management LLC, Morningstar Investment Services LLC, Morningstar Investment Management Europe Ltd., Morningstar Investment Management Australia Ltd., Ibbotson Associates Japan, Inc., and Morningstar Investment Management South Africa (PTY) LTD all of which are subsidiaries of Morningstar, Inc. Advisory services listed are provided by one or more of these entities, which are authorized in the appropriate jurisdiction to provide such services. Investment advice generated by Morningstar Retirement Manager is based on information provided and limited to the investment options available in the defined contribution plan. Projections and other information regarding the likelihood of various retirement income and/or investment outcomes are hypothetical in nature, do not reflect actual results, and are not guarantees of future results. Results may vary with each use and over The most time. Morningstar Investment Management and its affiliates are not affiliated with Ascensus, LLC.important step to saving for your future is starting. Join the plan 15

By Design Morningstar Managed Accounts: Tailored advice based on your individual profile The professionals at Morningstar Investment Management can create a personal savings strategy just for you. They will: consider your unique situation make savings rate and investment recommendations provide ongoing oversight and account management The most important step to saving for your future is starting. Join the plan 16

By Myself Your plan offers high-quality investments to create a custom mix. o Online fund information and resources allow you to make the best choices for your personal situation. o The online learning center provides easy access to educational guides, relevant financial articles, and tools. Use these online tools to help you plan Calculators Investment info Performance history Market update Join the plan The most important step to saving for your future is starting. 17

What’s Next? Enroll in the plan. o See your enrollment guide for details. Track your progress. o Use our online planning calculator. Stay informed. o Go online to access account details, fund information, education, relevant financial articles, and tools. Update your strategy. o Consider reviewing and updating your savings strategy at least once a year. This is particularly important if you experience a major life event. The most important step to saving for your future is starting. Join the plan 18

Ready to get started? You have the ability to register, enroll, and track your progress right from your mobile phone. The most important step to saving for your future is starting. Join the plan 19

This is your opportunity. The decision to save today can shape your future. You’ll thank yourself later. Join the plan. Online: Phone: Form: The most important step to saving for your future is starting. Join the plan Copyright 2019 Ascensus, LLC. All Rights Reserved. 20