INVENTORY CAS 500 – Audit evidence CAS 501 – Audit evidence – Specific

40 Slides690.00 KB

INVENTORY CAS 500 – Audit evidence CAS 501 – Audit evidence – Specific considerations for selected items CAS 505 – External confirmations CAS 520 Analytical procedures CAS 620 – Using the work of an Auditor’s expert Inventory 1

The Complexity of Inventory Why? A major item Inventory items could Very diverse items are included Valuation needs to consider One client may use several methods Inventory 2

Functions in the Inventory and Warehousing Cycle Process purchase orders Receive new materials Store materials Process goods Store finished goods Ship finished goods Inventory 3

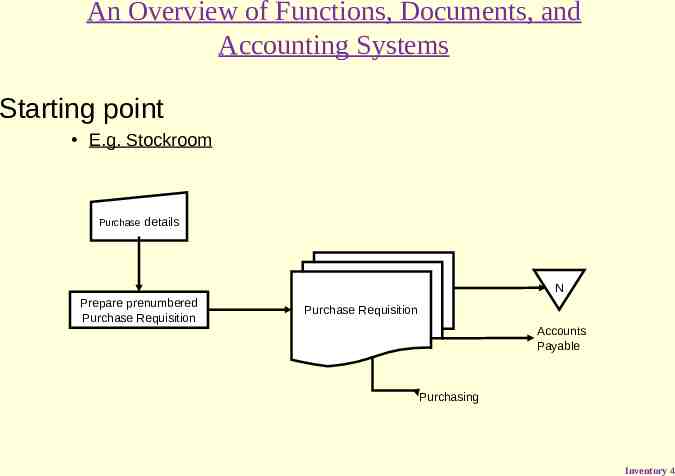

An Overview of Functions, Documents, and Accounting Systems Starting point E.g. Stockroom Purchase details N Prepare prenumbered Purchase Requisition Purchase Requisition Accounts Payable Purchasing Inventory 4

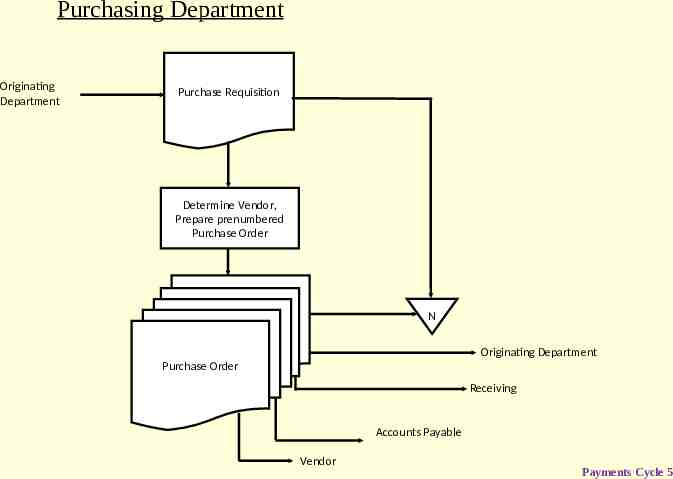

Purchasing Department Originating Department Purchase Requisition Determine Vendor, Prepare prenumbered Purchase Order N Originating Department Purchase Order Receiving Accounts Payable Vendor Payments Cycle 5

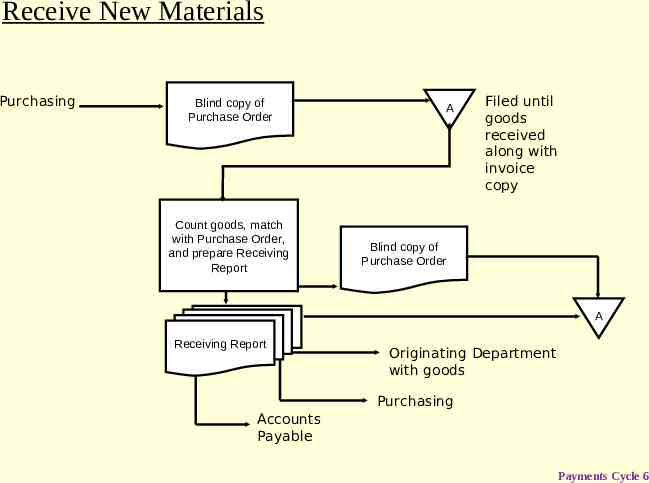

Receive New Materials Purchasing Blind copy of Purchase Order Count goods, match with Purchase Order, and prepare Receiving Report A Filed until goods received along with invoice copy Blind copy of Purchase Order A Receiving Report Originating Department with goods Purchasing Accounts Payable Payments Cycle 6

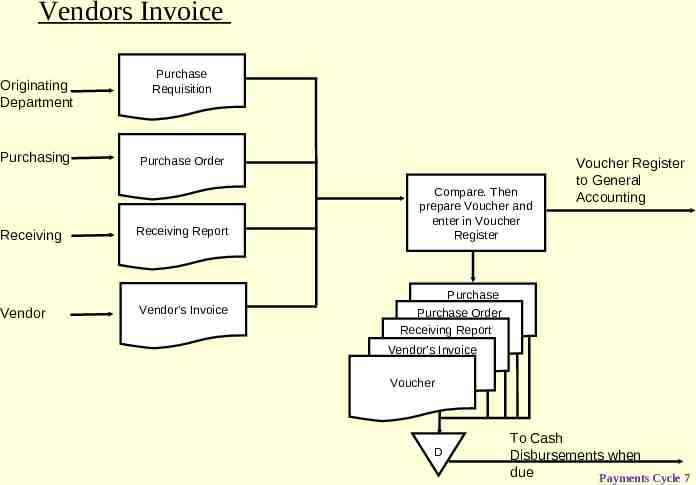

Vendors Invoice Originating Department Purchasing Receiving Vendor Purchase Requisition Purchase Order Receiving Report Vendor’s Invoice Compare. Then prepare Voucher and enter in Voucher Register Voucher Register to General Accounting Purchase Requisition Purchase Order Receiving Report Vendor’s Invoice Voucher D To Cash Disbursements when due Payments Cycle 7

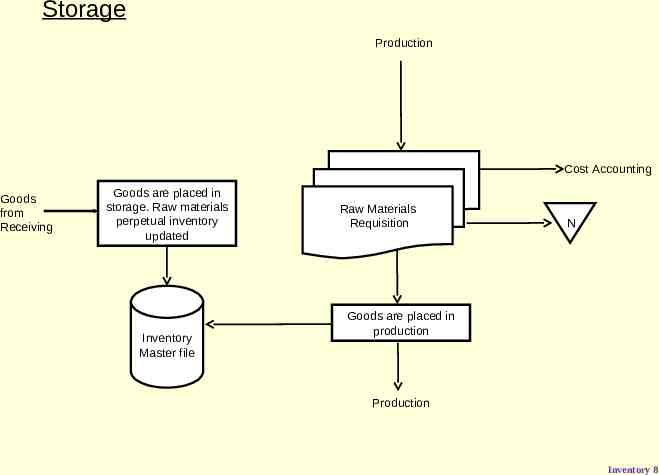

Storage Production Goods are placed in storage. Raw materials perpetual inventory updated Inventory Master file RawRequisition Materials Requisition Cost Accounting N Goods from Receiving Raw Materials Raw Requisition Materials Goods are placed in production Production Inventory 8

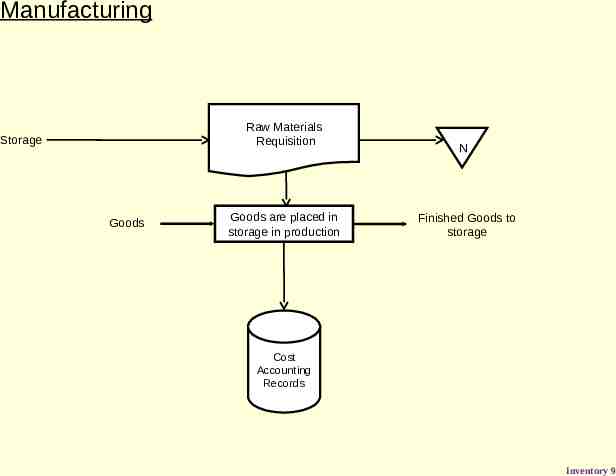

Manufacturing Goods Goods are placed in storage in production N Raw Materials Requisition Storage Finished Goods to storage Cost Accounting Records Inventory 9

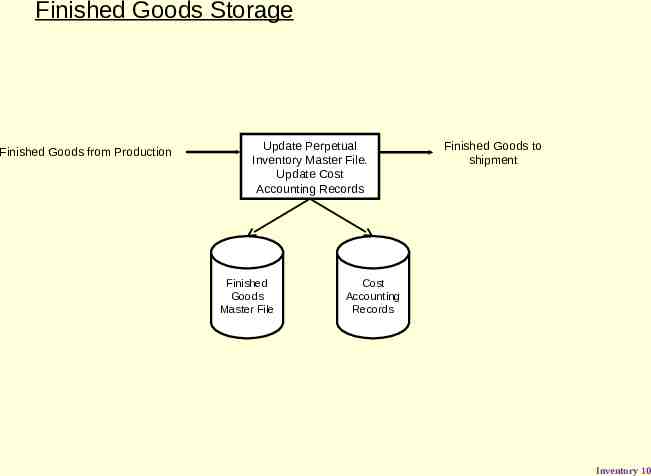

Finished Goods Storage Finished Goods from Production Update Perpetual Inventory Master File. Update Cost Accounting Records Finished Goods Master File Finished Goods to shipment Cost Accounting Records Inventory 10

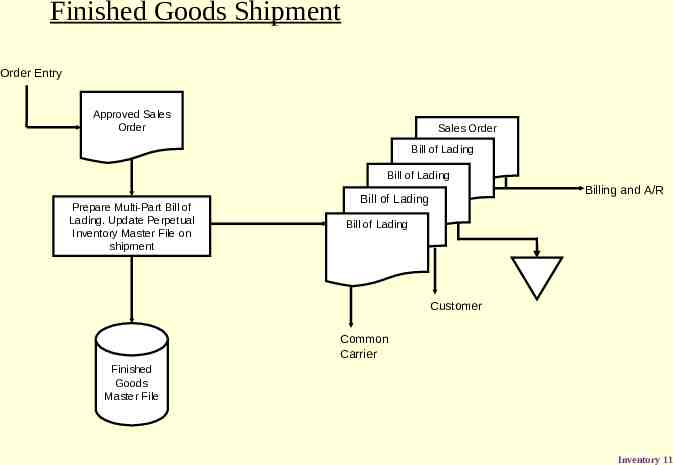

Finished Goods Shipment Order Entry Approved Sales Order Sales Order Bill of Lading Bill of Lading Prepare Multi-Part Bill of Lading. Update Perpetual Inventory Master File on shipment Billing and A/R Bill of Lading Bill of Lading Customer Common Carrier Finished Goods Master File Inventory 11

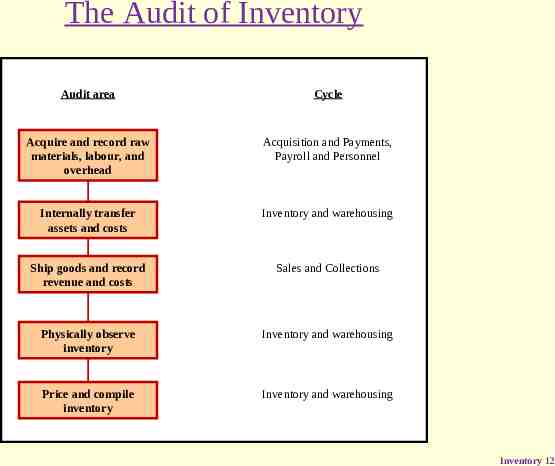

The Audit of Inventory Audit area Cycle Acquire and record raw materials, labour, and overhead Acquisition and Payments, Payroll and Personnel Internally transfer assets and costs Inventory and warehousing Ship goods and record revenue and costs Sales and Collections Physically observe inventory Inventory and warehousing Price and compile inventory Inventory and warehousing Inventory 12

Cost Accounting Typical Controls Good controls are essential 1. Physical controls Inventory must be protected from theft and misuse What does the auditor look for? If auditor assesses the physical controls and inadequate? Inventory 13

2. Documents and Records If testing internal controls Auditor examines Testing a series of documents Does the auditor always test the controls around inventory production? Inventory 14

3. Inventory files When does the auditor examine the Perpetual Inventory system? If level of control risk is low This can be assessed by Inventory 15

Analytical Procedures Compare gross margin percentage with previous years Compare inventory turnover with previous years Compare unit costs of inventory with previous years Compare extended inventory value with previous years Compare current-year manufacturing costs with previous year Inventory 16

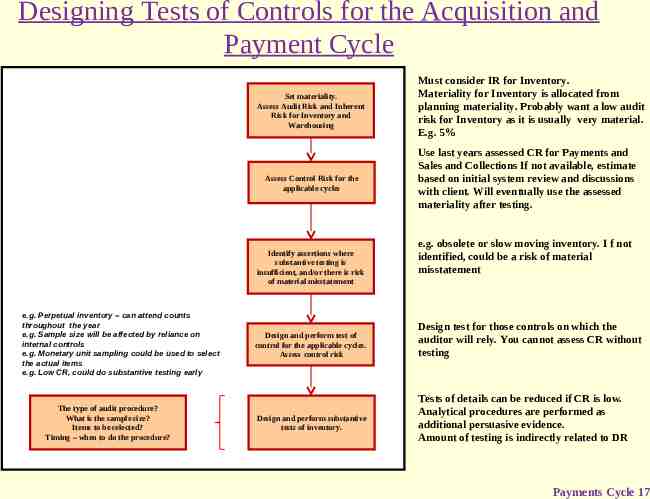

Designing Tests of Controls for the Acquisition and Payment Cycle Set materiality. Assess Audit Risk and Inherent Risk for Inventory and Warehousing Assess Control Risk for the applicable cycles Identify assertions where substantive testing is insufficient, and/or there is risk of material misstatement e.g. Perpetual inventory – can attend counts throughout the year e.g. Sample size will be affected by reliance on internal controls e.g. Monetary unit sampling could be used to select the actual items e.g. Low CR, could do substantive testing early The type of audit procedure? What is the sample size? Items to be selected? Timing – when to do the procedure? Design and perform test of control for the applicable cycles. Assess control risk Design and perform substantive tests of inventory. Must consider IR for Inventory. Materiality for Inventory is allocated from planning materiality. Probably want a low audit risk for Inventory as it is usually very material. E.g. 5% Use last years assessed CR for Payments and Sales and Collections If not available, estimate based on initial system review and discussions with client. Will eventually use the assessed materiality after testing. e.g. obsolete or slow moving inventory. I f not identified, could be a risk of material misstatement Design test for those controls on which the auditor will rely. You cannot assess CR without testing Tests of details can be reduced if CR is low. Analytical procedures are performed as additional persuasive evidence. Amount of testing is indirectly related to DR Payments Cycle 17

Physical Inventory Observation: Existence Remember McKesson & Robbins 1937 Select a random sample of tag numbers If inventory is not tagged Movement of inventory Inventory 18

Auditor’s Observation of Inventory First task is to review client’s inventory-taking instructions. Auditor will also perform test counts. Inventory 19

Items of Special Note Physical inventory not on year-end date: Cycle inventory counting: Auditors not present at client’s inventory count: Inventories located off the client’s premises: Inventory 20

Special Notes: Physical Inventory Observation Auditors not present at client’s inventory count: Inventory 21

Physical Inventory Observation: Completeness Tagging inventory If tags are not used Enquire as to inventory in other locations. Inventory 22

Physical Inventory Observation: Accuracy Recount client’s counts What should be in the auditor’s sample? Should also trace inventory in both directions. Perpetual inventory master file Record client counts test-counted for subsequent testing. Inventory 23

Physical Inventory Observation: Classification Examine inventory tags: What to look for? How about percentage of completion for work-in-process? Inventory 24

Physical Inventory Observation: Cutoff Record for subsequent follow-up Inventory for that shipment Review shipping area for inventory The receiving process Inventory 25

Physical Inventory Observation: Valuation What is the auditor looking for? What else should the auditor do? Inventory 26

Physical Inventory Observation: Rights and Obligations Ownership of inventory is the prime focus in this instance About what type of item is the auditor concerned? Inventory 27

Tests for Compilation and Detail tie-in What about accounting principles? What does compilation mean? What items should be used in this test? What else should be done? Detail tie-in? Inventory 28

Tests for Existence What items should be used for this test? What type of test is performed? Inventory 29

Tests for Completeness What about unused tags? How about the tags sequence? Hand-held computers Allows the user to scan inventory products After the inventory count, When the inventory count is synced with the system, Inventory 30

Tests for Accuracy Want to ensure that the counts are accurate. What type of test? Perform pricing tests. Type of tests? Manufacturing Non-Manufacturing Inventory 31

Tests for Classification Want to inventory is classified correctly as to the type of inventory Inventory 32

Tests of Valuation Remember the physical inventory observation. What was performed in this regard? Perform test of lower of cost or market, selling price, and obsolescence Inventory 33

Tests for Rights and Obligations The auditor is concerned about what type of inventory? What type of test? Consigned –in: Consigned –out: Inventory 34

Tests for Presentation and Disclosure What document should be examined here? The financial statements Inventory 35

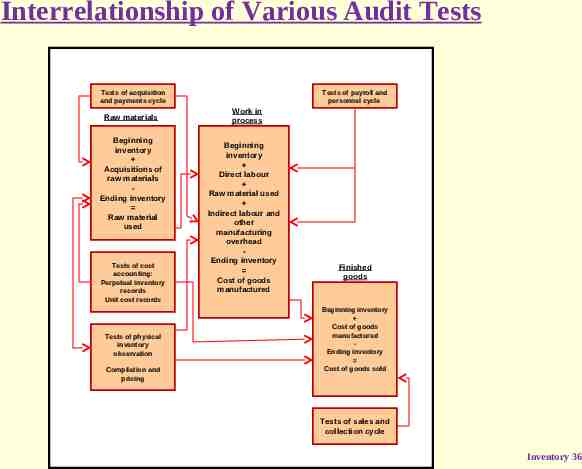

Interrelationship of Various Audit Tests Tests of acquisition and payments cycle Raw materials Beginning inventory Acquisitions of raw materials Ending inventory Raw material used Tests of cost accounting: Perpetual inventory records Unit cost records Tests of physical inventory observation Compilation and pricing Tests of payroll and personnel cycle Work in process Beginning inventory Direct labour Raw material used Indirect labour and other manufacturing overhead Ending inventory Cost of goods manufactured Finished goods Beginning inventory Cost of goods manufactured Ending inventory Cost of goods sold Tests of sales and collection cycle Inventory 36

Problem EP 12-10, Page 679 Consider the following examples of inventories in various businesses: 1.Pharmaceuticals in a drug company. 2.Fine chemical compounds in a biotechnical company. 3.Software in an information technology development company. 4.New condominium office units in a commercial real estate developer. 5.Fine art works in an interior design business. Required: For each item, indicate the challenges auditor's would face in trying to count and measure the inventory, and suggest an approach to obtain sufficient appropriate audit evidence. Inventory 37

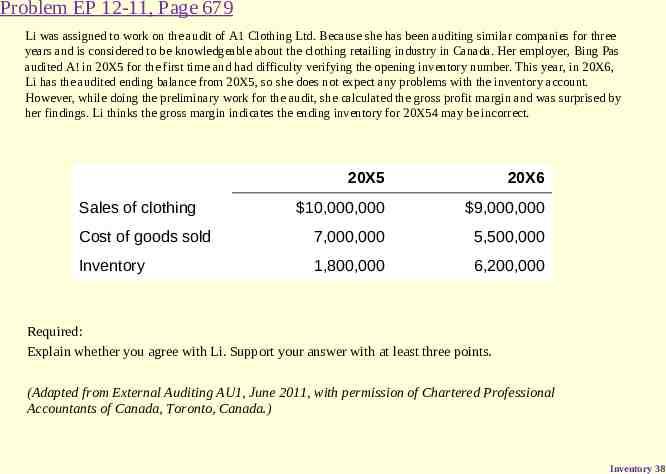

Problem EP 12-11, Page 679 Li was assigned to work on the audit of A1 Clothing Ltd. Because she has been auditing similar companies for three years and is considered to be knowledgeable about the clothing retailing industry in Canada. Her employer, Bing Pas audited A! in 20X5 for the first time and had difficulty verifying the opening inventory number. This year, in 20X6, Li has the audited ending balance from 20X5, so she does not expect any problems with the inventory account. However, while doing the preliminary work for the audit, she calculated the gross profit margin and was surprised by her findings. Li thinks the gross margin indicates the ending inventory for 20X54 may be incorrect. 20X5 20X6 10,000,000 9,000,000 Cost of goods sold 7,000,000 5,500,000 Inventory 1,800,000 6,200,000 Sales of clothing Required: Explain whether you agree with Li. Support your answer with at least three points. (Adapted from External Auditing AU1, June 2011, with permission of Chartered Professional Accountants of Canada, Toronto, Canada.) Inventory 38

Problem EP 12-14, Page 681 During his examination of the inventories and related accounts of Consumer Electronics Inc., a manufacturer and distributor of small appliances, and auditor encountered the following: a)Several trucks loaded with finished goods were parked at the shipping dock. The contents of the trucks were excluded from the physical inventory. b)The finished goods inventory included high volumes of several products, and many of their cartons were old and covered with dust. In response to the auditor’s questions, the plant manager stated that there was no problem as “all of these goods will eventually be sold, although some price incentives may be necessary.” c)While reviewing the complex calculations used to develop the unit production costs of items in finished goods, the auditor noted that the costs of the company’s electrical engineering department had been treated as period expenses in previous years but were included in manufacturing overhead in the current year. d)The company installed a new perpetual inventory system during the year. The auditor noted that many of the company’s year-end quantities differed from the actual physical inventory counts. Partly because of these problems, the company took a complete physical inventory at year-end. Required: Describe the additional audit procedures (if any) that the auditors should perform to obtain sufficient appropriate audit evidence in each of the preceding situations. (Adapted from External Auditing AU1, June 2011, with permission of Chartered Professional Accountants of Canada, Toronto, Canada.) Inventory 39

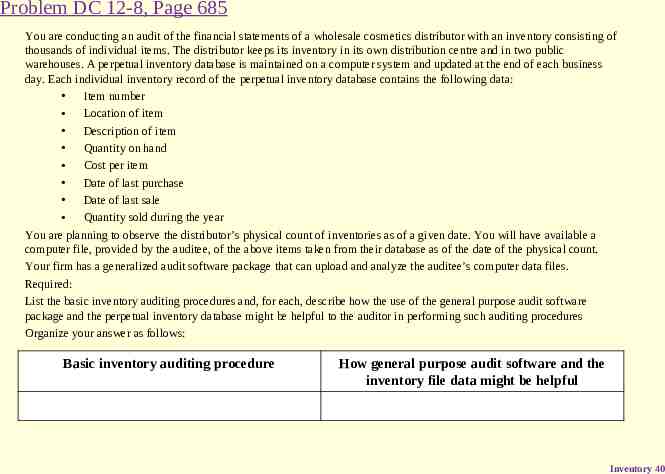

Problem DC 12-8, Page 685 You are conducting an audit of the financial statements of a wholesale cosmetics distributor with an inventory consisting of thousands of individual items. The distributor keeps its inventory in its own distribution centre and in two public warehouses. A perpetual inventory database is maintained on a computer system and updated at the end of each business day. Each individual inventory record of the perpetual inventory database contains the following data: Item number Location of item Description of item Quantity on hand Cost per item Date of last purchase Date of last sale Quantity sold during the year You are planning to observe the distributor’s physical count of inventories as of a given date. You will have available a computer file, provided by the auditee, of the above items taken from their database as of the date of the physical count. Your firm has a generalized audit software package that can upload and analyze the auditee’s computer data files. Required: List the basic inventory auditing procedures and, for each, describe how the use of the general purpose audit software package and the perpetual inventory database might be helpful to the auditor in performing such auditing procedures Organize your answer as follows: Basic inventory auditing procedure How general purpose audit software and the inventory file data might be helpful Inventory 40