I.A.T.S.E. Annuity Fund

10 Slides714.55 KB

I.A.T.S.E. Annuity Fund

FUND OFFICE CONTACTS Executive Office Anne Zeisler Executive Director x 8301 Benefits Department Scott J. Trivigno Director of Benefits x 8302 Casey Cirillo Manager – Retirement Svcs. x 8303 [email protected] [email protected] John Blondek Supervisor – Retirement Svcs. x 8317 [email protected] Participant Services Center 800-456-3863 Fax # 212-792-3863 [email protected]

HOW PARTICIPANTS CAN CONTACT US Given the volume of inquiries and number of Plan Participants, the Funds have numerous ways to assist: The Funds website has real-time information. Visit us at www.iatsenbf.org. Our toll-free number is 1-800-456-FUND (3863), Monday thru Thursday 9am to 5pm and Friday’s until 4:30pm EST. Participants should ask to be directed to the Annuity Fund Participant Services Center for any benefit matter, demographic change, forms request or contribution inquiry. Our interactive voice response system is available 24/7 by using the toll-free number listed above. We have a dedicated e-mail addresses for inquiries for those who cannot call during our business hours or who are having difficulty reaching a representative: [email protected] .

WHAT’S GOOD ABOUT BEING A PARTICIPANT OF THE ANNUITY FUND? The I.A.T.S.E. Annuity Fund exists to help be yet another source of retirement income. If you work under negotiated agreements providing both employer pension and annuity contributions, you have multiple retirement savings structures. Being able to defer pre-tax salary to the Annuity Fund can bolster your savings and save you on taxes during your working career. While it’s unpredictable that certain hardships arise, it is important to remember that this Fund will add VERY valuable resources to you at retirement. Finding other sources to pay for things such as higher education tuition would be very prudent. You are vested in the Annuity Fund with the very first dollar submitted on your behalf. Upon the posting of that contribution to your record at the National Benefit Funds, the funds are then transferred to the current service provider, Wells Fargo, into an account in your name. Those contributions are subject to market fluctuations and administrative fees.

The Plan is a Defined Contribution Profit Sharing Plan Wells Fargo has been our service provider since December 1, 2015. The Principle Group will be taking over from Wells Fargo in the Spring of 2021. There are in excess of 80,000 accounts with active balances at Wells Fargo There are no required employer contributions – rates can be based on a daily, hourly, % of salary, monthly are acceptable. If the CBA requires, and employer contributions are made at the rate of 3% of wages or more, the employees on that job have the option of making a pre-tax salary deferrals to the Plan’s 401(k) component. If a participant works on any Motion Picture production, they also have the option of a pre-tax salary deferral. For these agreements HCE’s (Highly Compensated Employees) are not permitted to contribute. The IRS HCE limit is 130,000 per employer, in 2020 (also for 2021). The IRS changes this limit each year so please check if it may be applicable to you. If you hit that maximum wage base from anyone (1) employer, you cannot defer in the next year. SOME FACTS ABOUT YOUR ANNUITY FUND PLAN

Normal retirement age is 65 If you are under age 55 and out of work (no contributions to this Plan) for 6 or more complete calendar months a termination benefit may be available. If you are over age 55, the separation is only 2 complete calendar months. There are no loans permitted. What funds can be withdrawn under the hardship withdrawal provision of the Plan? Effective 01/01/2010: ALL Employer contributions received that are ‘not’ safe harbored are hardship eligible Safe harbored funds: contributions that are 3% of your salary (any % above 3% or below 3% are not safe harbored) Effective 01/01/2010: All salary deferred contributions received are hardship eligible Effective 03/01/2019: ALL Employer contributions received for work performed starting with the first full week of March, are contributions are hardship eligible (regardless of the % or amount submitted – no safe harbor provision) The list of available hardships, as provided by the IRS, can be found in the Plan’s SPD. SOME MORE FACTS .

HOW DO I FIND OUT WHAT MY ANNUITY FUND BALANCE IS? Call the Retirement Services division at 800-456-3863 and request to speak to an Annuity Fund Coordinator or you can submit an E-mail to [email protected] requesting information on your Annuity Fund balance. You can also log in to the Fund’s website at www.iatsenbf.org. If you have any Annuity Fund balance, you will see an “Annuity Fund” panel on the main dashboard screen of your web account. There will be a balance listed within that panel. That dollar amount represents the balance in your Annuity Fund account as of the prior day’s close of business. If you click on the “Wells Fargo Balance” link at the top of the Annuity panel, you will be brought to the Wells Fargo website where you can register to view your Annuity Fund account in detail and make changes to investments and allocations as well as view/download past and present quarterly statements issued by Wells Fargo.

APPLYING FOR A BENEFIT NORMAL RETIREMENT BENEFIT FULL OR PARTIAL DISTRIBUTION How do I apply for a full or partial distributions of benefits? You should call and speak with an Annuity Fund Coordinator in the Retirement Services Division to find out if you are eligible to withdraw any or all funds from the Annuity Fund. Depending upon your age and last employer contribution received, you may or may not be eligible for any distribution of funds. See below for a guidelines: If you are 55 years old or younger AND you were not working in covered employment for 6 consecutive calendar months, you can apply for a full or partial distribution of your Annuity Fund account – there is an IRS 10% excise tax penalty of the distribution for early withdrawal of retirement monies for those under age 59 ½. If you are between the ages of 55 and 65 AND you were not credited with employer contributions for 2 consecutive months, you can apply for a full or partial distribution of your Annuity Fund account. There is an IRS 10% excise tax penalty of the distribution for early withdrawal of retirement monies if you are under age 59 ½. Once you reach age 59 ½, you are eligible to withdraw, without IRS penalty, any 401(k) salary deferral amounts credited to your account as that is normal retirement age for that portion of your account. Once you reach age 65, you can withdraw, without IRS penalty, any part of your Annuity Fund balance. Additional information on withdrawals can be found in the Annuity Fund SPD which can be downloaded from the Fund’s website at www.iatsenbf.org You must take a minimum distribution no later than the April 1 st following attainment of age 72. You will be contacted by both Wells Fargo and the Fund Office if you are required to take a distribution.

APPLYING FOR A BENEFIT HARDSHIP WITHDRAWAL How do I apply for a Hardship Withdrawal? You should call and speak with an Annuity Fund Coordinator in the Retirement Services Division to find out if you are eligible to withdraw under the hardship provisions of the Annuity Fund. Should you wish to obtain funds from your Annuity Fund account, you need to meet specific I.R.S. criteria. See below for those circumstances that qualify for a hardship withdrawal as per the I.R.S.: Unpaid Medical Expenses Purchase of a primary residence Payment of Tuition or Related Education expenses Prevention of Eviction or Foreclosure Burial and/or Funeral Expenses Expenses for the repair or damage to your primary residence that would qualify for the “Casualty Deduction”. Expenses and losses due to a Federally declared disaster Expenses and losses due to COVID-19 If you qualify, you can obtain an application from one of the Annuity Fund Coordinators by calling 800-456-3863. For further information on this provision, please refer to the Summary Plan Description booklet.

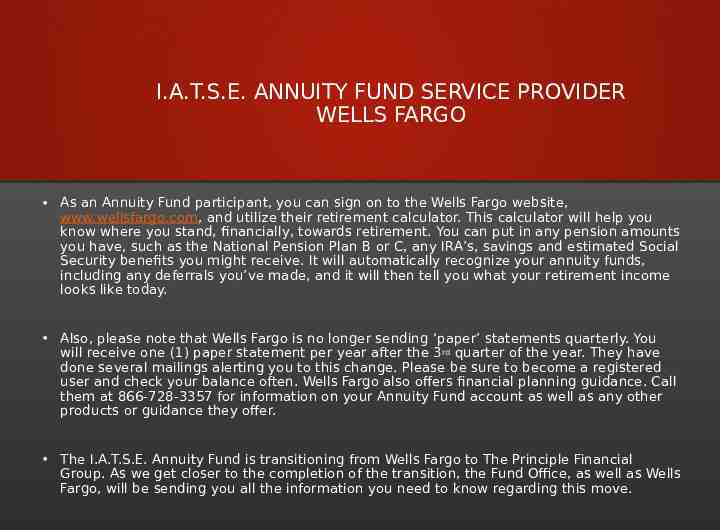

I.A.T.S.E. ANNUITY FUND SERVICE PROVIDER WELLS FARGO As an Annuity Fund participant, you can sign on to the Wells Fargo website, www.wellsfargo.com, and utilize their retirement calculator. This calculator will help you know where you stand, financially, towards retirement. You can put in any pension amounts you have, such as the National Pension Plan B or C, any IRA’s, savings and estimated Social Security benefits you might receive. It will automatically recognize your annuity funds, including any deferrals you’ve made, and it will then tell you what your retirement income looks like today. Also, please note that Wells Fargo is no longer sending ‘paper’ statements quarterly. You will receive one (1) paper statement per year after the 3rd quarter of the year. They have done several mailings alerting you to this change. Please be sure to become a registered user and check your balance often. Wells Fargo also offers financial planning guidance. Call them at 866-728-3357 for information on your Annuity Fund account as well as any other products or guidance they offer. The I.A.T.S.E. Annuity Fund is transitioning from Wells Fargo to The Principle Financial Group. As we get closer to the completion of the transition, the Fund Office, as well as Wells Fargo, will be sending you all the information you need to know regarding this move.