HIDDEN DESCRIPTION SLIDE — NOT TO BE SHOWN TO THE PUBLIC

39 Slides8.74 MB

HIDDEN DESCRIPTION SLIDE — NOT TO BE SHOWN TO THE PUBLIC Compensation Planning Guide Catalogue code: B08 Full presentation or module? Full Slide numbers: B08-1 to B08-38 Registered/Non-Registered Usage: All (Choices: registered rep use only, not for registered rep use, allowed for all, partial limitations) Last update info: Date updated: 2014-12-18 Project #25410 Description of changes: update background to new template, update slide B08-21, and slide B08-23. Filed with FINRA? No Notes: If yes, date:

Compensation Planning Guide B08-1

COMPENSATION PLANNING GUIDE Overview Compensation planning: A. Why it’s important B. Who is responsible C. Before you begin D. Six essential steps B08-2

COMPENSATION PLANNING GUIDE A. Why It’s Important Honors God’s Word For the Scripture says, “You shall not muzzle an ox while it treads out the grain,” and, “The laborer is worthy of his wages” (1 Tim. 5:18 NKJV). “Even so the Lord has commanded that those who preach the gospel should live from the gospel” (1 Cor. 9:14 NKJV). B08-3

COMPENSATION PLANNING GUIDE A. Why It’s Important Provides structure and protection: Ensures appropriate spending Clarifies personal income Extends employee tenure Protects minister and church Enhances clarity and stability Helps church comply with tax regulations B08-4

COMPENSATION PLANNING GUIDE Overview Compensation planning: A. Why it’s important B. Who is responsible C. Before you begin D.Six essential steps B08-5

COMPENSATION PLANNING GUIDE B. Who Is Responsible Church treasurer Personnel committee Ministers Church employees B08-6

COMPENSATION PLANNING GUIDE Overview Compensation planning: A. Why it’s important B. Who is responsible C. Before you begin D.Six essential steps B08-7

COMPENSATION PLANNING GUIDE C. Before You Begin (Page 2) 1. Benefits of a compensation plan 2. Dangers of lump sum or package approach 3. Eligibility requirements of a Minister for Tax Purposes B08-8

COMPENSATION PLANNING GUIDE C. Before You Begin (Page 2) 1. Benefits of a compensation plan: It reduces confusion It ensures funds are spent appropriately It lets ministers and staff know you value them B08-9

COMPENSATION PLANNING GUIDE C. Before You Begin (Page 2) 1. Benefits of a compensation plan 2. Dangers of lump sum or package approach: Often causes ministers to pay higher taxes May lead to a financial hardship for the church Distorts minister’s amount of actual income B08-10

COMPENSATION PLANNING GUIDE C. Before You Begin (Page 2) 1. Benefits of a compensation plan 2. Dangers of lump sum or package approach 3. Eligibility requirements of a Minister for Tax Purposes: Ordained, licensed or commissioned Administers ordinances Conducts worship Management responsibilities Religious leader B08-11

COMPENSATION PLANNING GUIDE C. Before You Begin (Page 2) 3. Ministers for Tax Purposes — dual tax status: Employee for income tax purposes Self-employed for Social Security purposes B08-12

COMPENSATION PLANNING GUIDE C. Before You Begin 3. Ministers for Tax Purposes: Exempt from mandatory federal income tax withholding Eligible for church-designated housing allowance Must pay SECA taxes for Social Security coverage B08-13

COMPENSATION PLANNING GUIDE Overview Compensation planning: A. Why it’s important B. Who is responsible C. Before you begin D. Six essential steps B08-14

COMPENSATION PLANNING GUIDE Create Your Compensation Plan Six essential steps: Step 1. Determine the needs B08-15

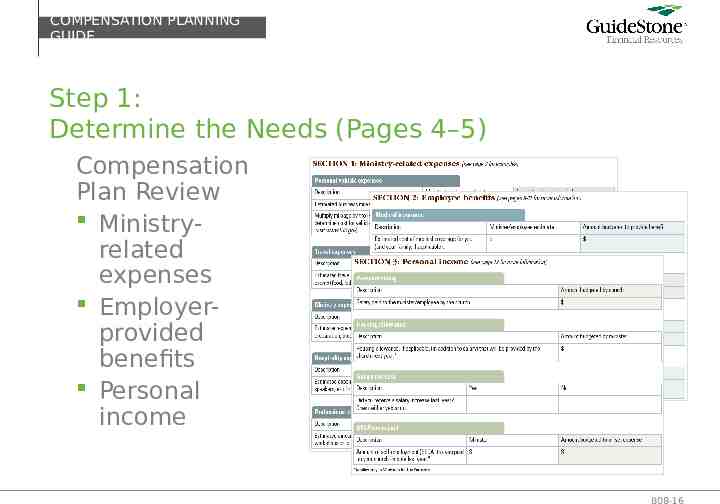

COMPENSATION PLANNING GUIDE Step 1: Determine the Needs (Pages 4–5) Compensation Plan Review Ministryrelated expenses Employerprovided benefits Personal income B08-16

COMPENSATION PLANNING GUIDE Create Your Compensation Plan Six essential steps: Step 1. Determine the needs Step 2. Establish written policies B08-17

COMPENSATION PLANNING GUIDE Step 2: Establish Written Policies (Page 6) Policies should cover four major areas: Ministry-related expenses Employee benefits Personal income Personnel policies B08-18

COMPENSATION PLANNING GUIDE Create Your Compensation Plan Six essential steps: Step 1. Determine the needs Step 2. Establish written policies Step 3. Provide for ministry-related expenses B08-19

COMPENSATION PLANNING GUIDE Step 3: Provide for Ministry-Related Expenses (Page 7) Address these expenses with an Accountable Reimbursement Plan (ARP) Vehicle use for business purposes Meetings, workshops and conferences Books, periodicals, software, etc. Continuing education opportunities Provisions for ministry-related hospitality B08-20

COMPENSATION PLANNING GUIDE Step 3: Provide for Ministry-Related Expenses (Page 7) Requirements for an ARP Expenses must have a business purpose Document amount, date, place and purpose Expenses substantiated within 60 days Excess advances returned within 120 days B08-21

COMPENSATION PLANNING GUIDE Step 3: Provide for Ministry-Related Expenses (Page 7) Requirements for an ARP IRS-approved standard rate for transportation (mileage rate), meals and lodging Unused ARP money should not be given as a bonus or additional income (See page 15 of workbook for sample ARP) B08-22

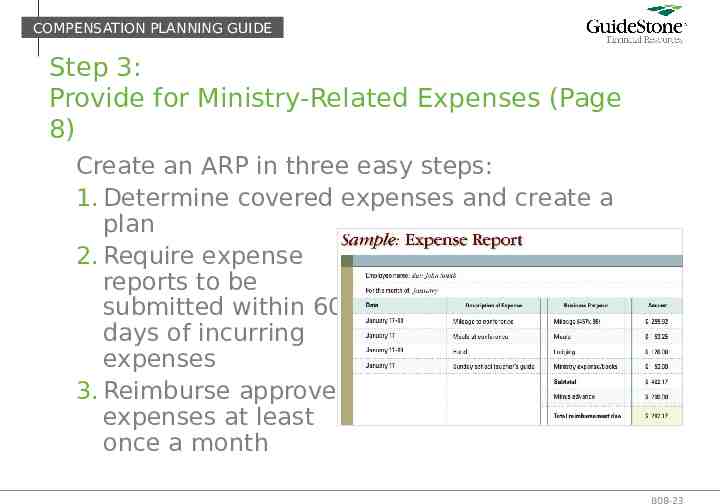

COMPENSATION PLANNING GUIDE Step 3: Provide for Ministry-Related Expenses (Page 8) Create an ARP in three easy steps: 1. Determine covered expenses and create a plan 2. Require expense reports to be submitted within 60 days of incurring expenses 3. Reimburse approved expenses at least once a month B08-23

COMPENSATION PLANNING GUIDE Create Your Compensation Plan Six essential steps: Step 1. Determine the needs Step 2. Establish written policies Step 3. Provide for ministry-related expenses Step 4. Provide employee benefits B08-24

COMPENSATION PLANNING GUIDE Step 4: Provide Employee Benefits (Page 9) A strong benefit plan Has tax advantages Offers insurance coverage benefits Protects church Provides appropriate coverage for staff Includes retirement contributions B08-25

COMPENSATION PLANNING GUIDE Step 4: Provide Employee Benefits Insurance coverage can include: Term life Employee accident Medical Disability Dental B08-26

COMPENSATION PLANNING GUIDE Step 4: Provide Employee Benefits (Page 10) A retirement plan Paid service ends: income needs do not Employer contributions Employee contributions B08-27

COMPENSATION PLANNING GUIDE Step 4: Provide Employee Benefits (Page 10) A GuideStone retirement plan features: Tax-sheltered contributions Designed exclusively for ministries No SECA taxes for eligible ministers Housing allowance benefit Roth contributions (not available in all plans) B08-28

COMPENSATION PLANNING GUIDE Step 4: Provide Employee Benefits (Page 11) The Church Retirement Plan for SBC churches Potential benefits Disability income Survivor protection Matching contribution Mission Church Assistance Fund (MCAF) B08-29

COMPENSATION PLANNING GUIDE Create Your Compensation Plan Six essential steps: Step 1. Determine the needs Step 2. Establish written policies Step 3. Provide for ministry-related expenses Step 4. Provide employee benefits Step 5. Determine personal income B08-30

COMPENSATION PLANNING GUIDE Step 5: Determine Personal Income (Page 12) Factors for determining personal income: Responsibilities and experience Inflation Social Security Minister’s housing allowance B08-31

COMPENSATION PLANNING GUIDE Step 5: Determine Personal Income (Page 12) How to designate a housing allowance: Minister’s responsibility Present an estimate of housing expenses Church’s responsibility Designate amount prior to paying minister Review annually Record it as set until changed by official decision Remember housing allowance limits B08-32

COMPENSATION PLANNING GUIDE Step 5: Determine Personal Income Use the SBC Compensation Study See compensation trends for ministers and staff at like-sized SBC churches in your region Help determine adequate compensation for your church staff B08-33

COMPENSATION PLANNING GUIDE Create Your Compensation Plan Six essential steps: Step 1. Determine the needs Step 2. Establish written policies Step 3. Provide for ministry-related expenses Step 4. Provide employee benefits Step 5. Determine personal income Step 6. Complete a compensation planning summary B08-34

COMPENSATION PLANNING GUIDE Step 6: Complete a Compensation Planning Summary (Page 14) About the summary Develops plan for new budget year Categories are not to be added together Be mindful of federal reporting requirements for churches (see our Ministers’ Tax Guide) B08-35

COMPENSATION PLANNING GUIDE Next Steps Church reviews and implements the six steps: 1. Determine the needs 2. Establish written compensation policies 3. Provide for ministry-related expenses 4. Provide employee benefits 5. Determine personal income 6. Complete a compensation planning summary B08-36

COMPENSATION PLANNING GUIDE Contact GuideStone with Any Questions 1-888-98-GUIDE (1-888-984-8433) 7 a.m. to 6 p.m. CST, Monday through Friday [email protected] B08-37

B08-38