Guidelines in the Updating of Tier 1 and Formulation of Tier 2 FY 2021

12 Slides93.20 KB

Guidelines in the Updating of Tier 1 and Formulation of Tier 2 FY 2021 Budget Forum January 2021 Republic of the Philippines DEPARTMENT OF BUDGET AND MANAGEMENT 1

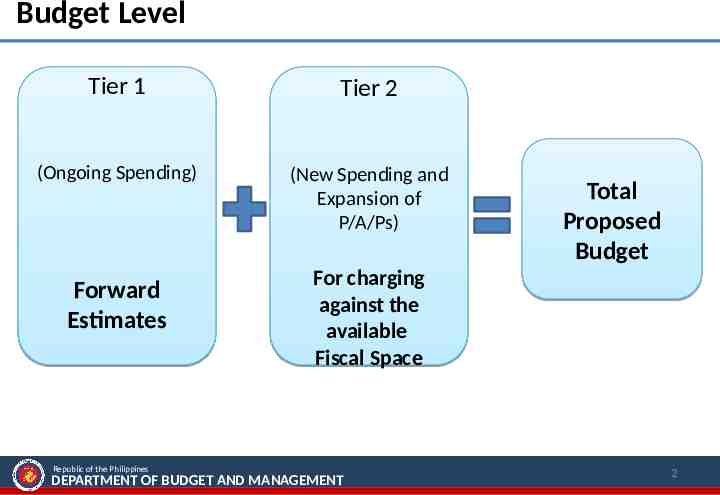

Budget Level Tier 1 Tier 2 (Ongoing Spending) (New Spending and Expansion of P/A/Ps) Forward Estimates Republic of the Philippines Total Proposed Budget For charging against the available Fiscal Space DEPARTMENT OF BUDGET AND MANAGEMENT 2

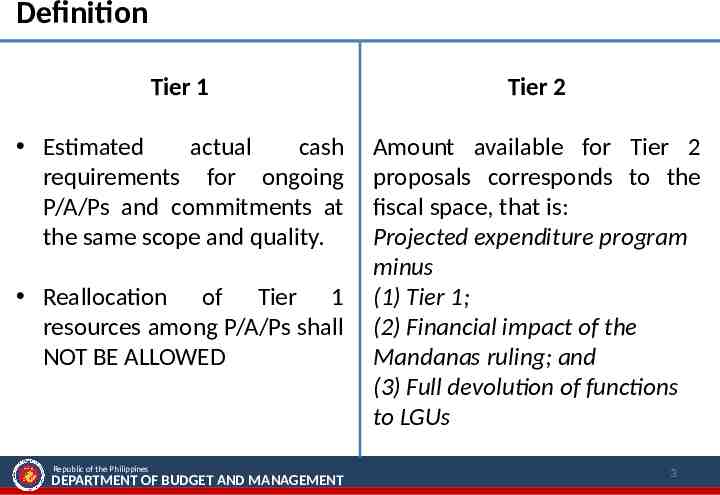

Definition Tier 1 Tier 2 Estimated actual cash requirements for ongoing P/A/Ps and commitments at the same scope and quality. Amount available for Tier 2 proposals corresponds to the fiscal space, that is: Projected expenditure program minus (1) Tier 1; (2) Financial impact of the Mandanas ruling; and (3) Full devolution of functions to LGUs Reallocation of Tier 1 resources among P/A/Ps shall NOT BE ALLOWED Republic of the Philippines DEPARTMENT OF BUDGET AND MANAGEMENT 3

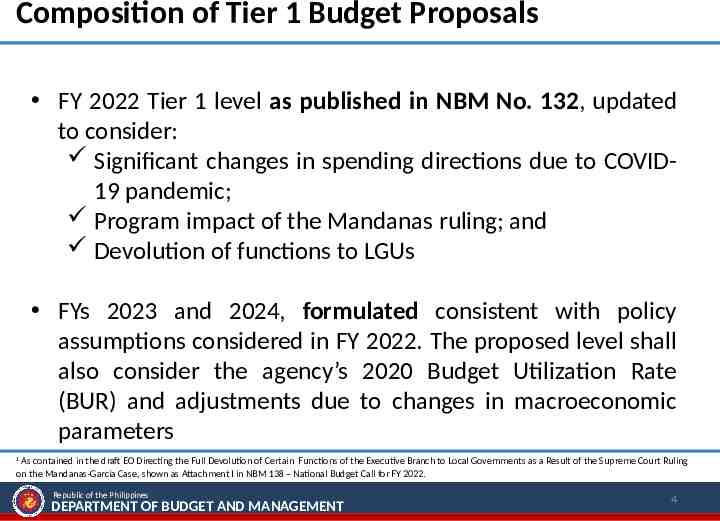

Composition of Tier 1 Budget Proposals FY 2022 Tier 1 level as published in NBM No. 132, updated to consider: Significant changes in spending directions due to COVID19 pandemic; Program impact of the Mandanas ruling; and Devolution of functions to LGUs FYs 2023 and 2024, formulated consistent with policy assumptions considered in FY 2022. The proposed level shall also consider the agency’s 2020 Budget Utilization Rate (BUR) and adjustments due to changes in macroeconomic parameters As contained in the draft EO Directing the Full Devolution of Certain Functions of the Executive Branch to Local Governments as a Result of the Supreme Court Ruling on the Mandanas-Garcia Case, shown as Attachment I in NBM 138 – National Budget Call for FY 2022. 1 Republic of the Philippines DEPARTMENT OF BUDGET AND MANAGEMENT 4

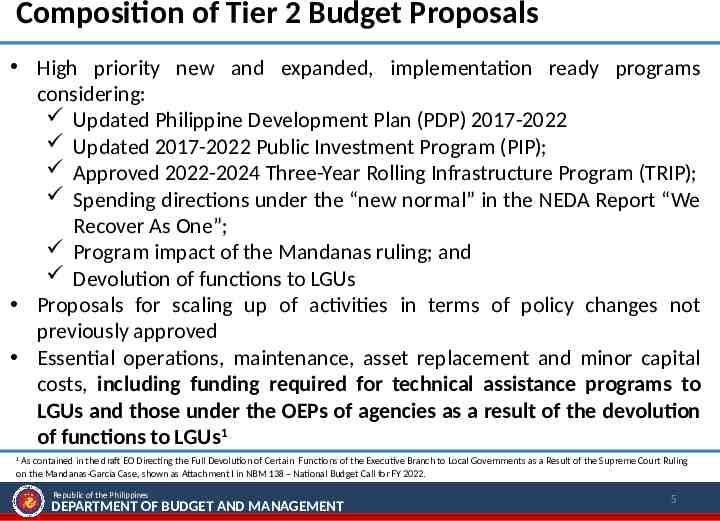

Composition of Tier 2 Budget Proposals High priority new and expanded, implementation ready programs considering: Updated Philippine Development Plan (PDP) 2017-2022 Updated 2017-2022 Public Investment Program (PIP); Approved 2022-2024 Three-Year Rolling Infrastructure Program (TRIP); Spending directions under the “new normal” in the NEDA Report “We Recover As One”; Program impact of the Mandanas ruling; and Devolution of functions to LGUs Proposals for scaling up of activities in terms of policy changes not previously approved Essential operations, maintenance, asset replacement and minor capital costs, including funding required for technical assistance programs to LGUs and those under the OEPs of agencies as a result of the devolution of functions to LGUs1 As contained in the draft EO Directing the Full Devolution of Certain Functions of the Executive Branch to Local Governments as a Result of the Supreme Court Ruling on the Mandanas-Garcia Case, shown as Attachment I in NBM 138 – National Budget Call for FY 2022. 1 Republic of the Philippines DEPARTMENT OF BUDGET AND MANAGEMENT 5

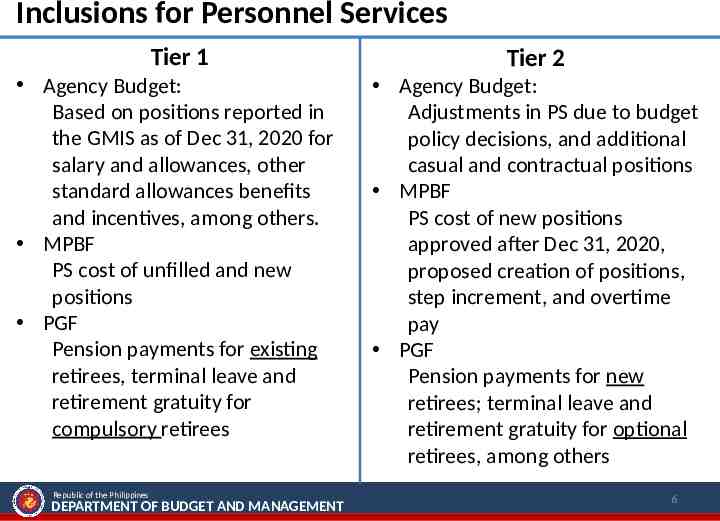

Inclusions for Personnel Services Tier 1 Agency Budget: Based on positions reported in the GMIS as of Dec 31, 2020 for salary and allowances, other standard allowances benefits and incentives, among others. MPBF PS cost of unfilled and new positions PGF Pension payments for existing retirees, terminal leave and retirement gratuity for compulsory retirees Republic of the Philippines DEPARTMENT OF BUDGET AND MANAGEMENT Tier 2 Agency Budget: Adjustments in PS due to budget policy decisions, and additional casual and contractual positions MPBF PS cost of new positions approved after Dec 31, 2020, proposed creation of positions, step increment, and overtime pay PGF Pension payments for new retirees; terminal leave and retirement gratuity for optional retirees, among others 6

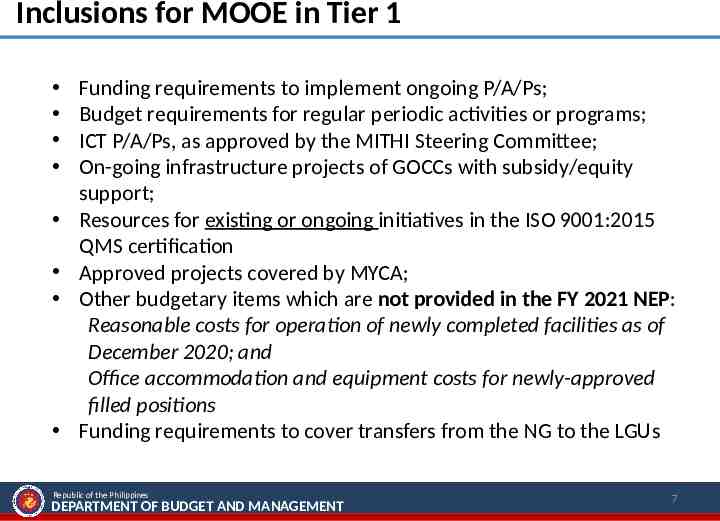

Inclusions for MOOE in Tier 1 Funding requirements to implement ongoing P/A/Ps; Budget requirements for regular periodic activities or programs; ICT P/A/Ps, as approved by the MITHI Steering Committee; On-going infrastructure projects of GOCCs with subsidy/equity support; Resources for existing or ongoing initiatives in the ISO 9001:2015 QMS certification Approved projects covered by MYCA; Other budgetary items which are not provided in the FY 2021 NEP: Reasonable costs for operation of newly completed facilities as of December 2020; and Office accommodation and equipment costs for newly-approved filled positions Funding requirements to cover transfers from the NG to the LGUs Republic of the Philippines DEPARTMENT OF BUDGET AND MANAGEMENT 7

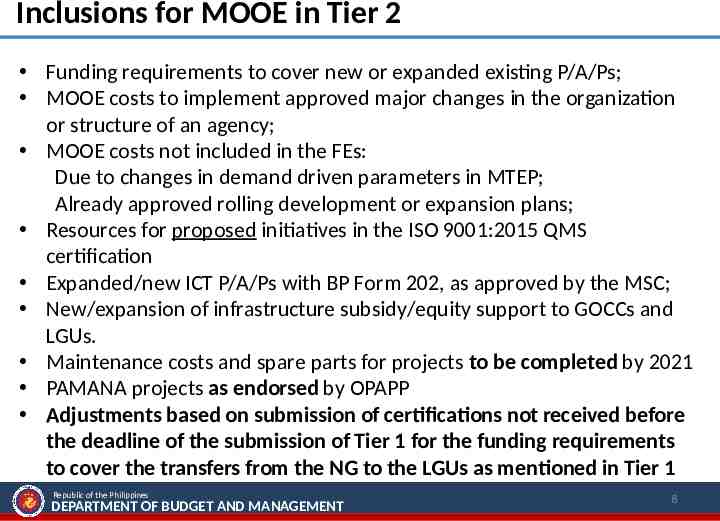

Inclusions for MOOE in Tier 2 Funding requirements to cover new or expanded existing P/A/Ps; MOOE costs to implement approved major changes in the organization or structure of an agency; MOOE costs not included in the FEs: Due to changes in demand driven parameters in MTEP; Already approved rolling development or expansion plans; Resources for proposed initiatives in the ISO 9001:2015 QMS certification Expanded/new ICT P/A/Ps with BP Form 202, as approved by the MSC; New/expansion of infrastructure subsidy/equity support to GOCCs and LGUs. Maintenance costs and spare parts for projects to be completed by 2021 PAMANA projects as endorsed by OPAPP Adjustments based on submission of certifications not received before the deadline of the submission of Tier 1 for the funding requirements to cover the transfers from the NG to the LGUs as mentioned in Tier 1 Republic of the Philippines DEPARTMENT OF BUDGET AND MANAGEMENT 8

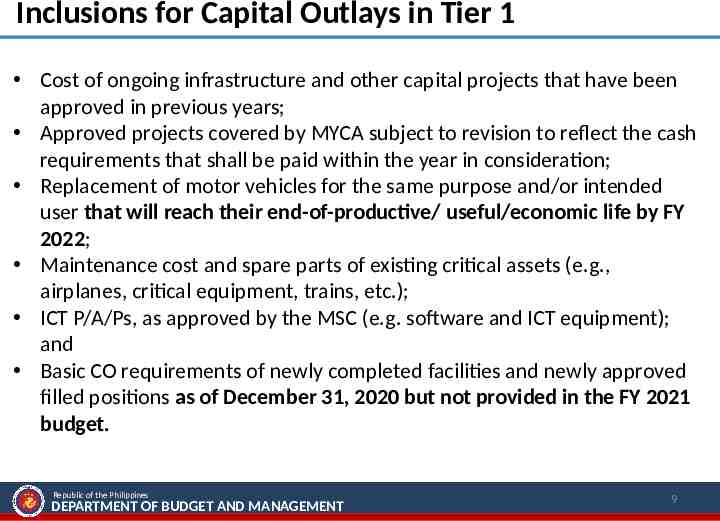

Inclusions for Capital Outlays in Tier 1 Cost of ongoing infrastructure and other capital projects that have been approved in previous years; Approved projects covered by MYCA subject to revision to reflect the cash requirements that shall be paid within the year in consideration; Replacement of motor vehicles for the same purpose and/or intended user that will reach their end-of-productive/ useful/economic life by FY 2022; Maintenance cost and spare parts of existing critical assets (e.g., airplanes, critical equipment, trains, etc.); ICT P/A/Ps, as approved by the MSC (e.g. software and ICT equipment); and Basic CO requirements of newly completed facilities and newly approved filled positions as of December 31, 2020 but not provided in the FY 2021 budget. Republic of the Philippines DEPARTMENT OF BUDGET AND MANAGEMENT 9

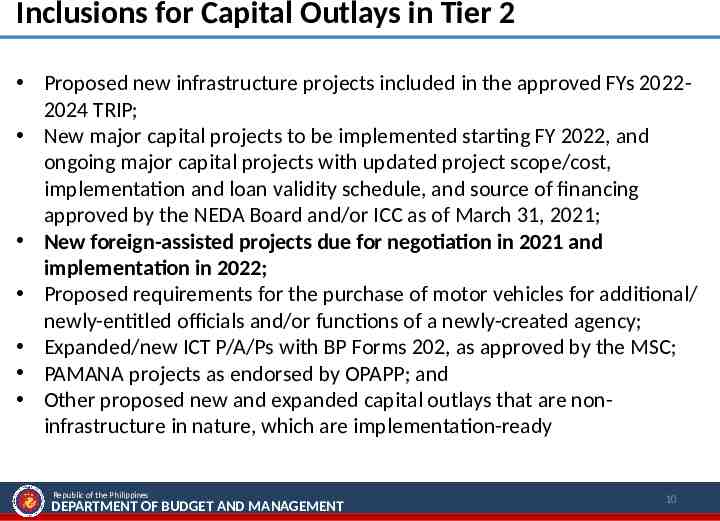

Inclusions for Capital Outlays in Tier 2 Proposed new infrastructure projects included in the approved FYs 20222024 TRIP; New major capital projects to be implemented starting FY 2022, and ongoing major capital projects with updated project scope/cost, implementation and loan validity schedule, and source of financing approved by the NEDA Board and/or ICC as of March 31, 2021; New foreign-assisted projects due for negotiation in 2021 and implementation in 2022; Proposed requirements for the purchase of motor vehicles for additional/ newly-entitled officials and/or functions of a newly-created agency; Expanded/new ICT P/A/Ps with BP Forms 202, as approved by the MSC; PAMANA projects as endorsed by OPAPP; and Other proposed new and expanded capital outlays that are noninfrastructure in nature, which are implementation-ready Republic of the Philippines DEPARTMENT OF BUDGET AND MANAGEMENT 10

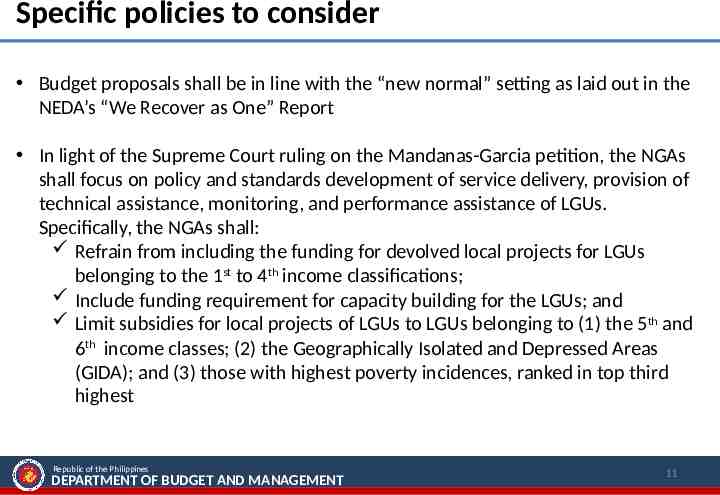

Specific policies to consider Budget proposals shall be in line with the “new normal” setting as laid out in the NEDA’s “We Recover as One” Report In light of the Supreme Court ruling on the Mandanas-Garcia petition, the NGAs shall focus on policy and standards development of service delivery, provision of technical assistance, monitoring, and performance assistance of LGUs. Specifically, the NGAs shall: Refrain from including the funding for devolved local projects for LGUs belonging to the 1st to 4th income classifications; Include funding requirement for capacity building for the LGUs; and Limit subsidies for local projects of LGUs to LGUs belonging to (1) the 5th and 6th income classes; (2) the Geographically Isolated and Depressed Areas (GIDA); and (3) those with highest poverty incidences, ranked in top third highest Republic of the Philippines DEPARTMENT OF BUDGET AND MANAGEMENT 11

Thank you! FY 2021 Budget Forum January 2021 Republic of the Philippines DEPARTMENT OF BUDGET AND MANAGEMENT 12