Financial System Strategy 2020 NIGERIA’S FINANCIAL SYSTEM

45 Slides816.50 KB

Financial System Strategy 2020 NIGERIA’S FINANCIAL SYSTEM STRATEGY 2020 PLAN “OUR DREAM” Presented by: Prof. Chukwuma C. Soludo, CFR at the FSS 2020 International Conference, Abuja, Nigeria 1 JUNE 18TH 2007

Presentation Outline Financial System Strategy 2020 I: INTRODUCTION/BACKGROUND – Why FSS2020? II: WHERE ARE WE NOW?: RECENT REFORMS AND OUTCOMES WHERE WE WANT TO BE – OVERALL STRATEGIC DIRECTION 2

I: Why Financial System Strategy 2020? Financial System Strategy 2020 THE WORLD IS RAPIDLY CHANGING, AND NIGERIA/AFRICA MUST CLAIM THE 21ST CENTURY. ALREADY, NIGERIA IS SEEN AS ONE MAJOR PROMISE IN AFRICA . – Global trends – BRICs trends – Emergence of the Next 11 – Nigerian Financial Industry reforms 3

Global Context - Pace of globalisation and its effect on the world today. Financial System Strategy 2020 Increase in capital flow Broadened Scope of Investments Rise in global merchandise exports Emerging role of China Increase in manufacturing capacity Foreign Direct Investment 4

BRIC Economies Are Overtaking The G6 Nations Financial System Strategy 2020 Extensive work done by Goldman Sachs in 2001, projected that the economies of Brazil, Russia, India & China (BRIC) would surpass that of the G6 nations based on extrapolation of growth rates, demographic changes, capital accumulation, diminishing returns with development, exchange rates etc. 5

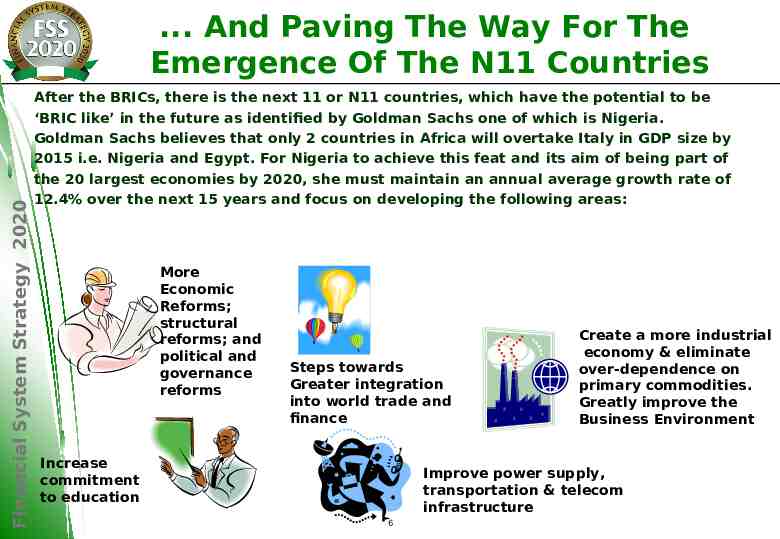

Financial System Strategy 2020 . And Paving The Way For The Emergence Of The N11 Countries After the BRICs, there is the next 11 or N11 countries, which have the potential to be ‘BRIC like’ in the future as identified by Goldman Sachs one of which is Nigeria. Goldman Sachs believes that only 2 countries in Africa will overtake Italy in GDP size by 2015 i.e. Nigeria and Egypt. For Nigeria to achieve this feat and its aim of being part of the 20 largest economies by 2020, she must maintain an annual average growth rate of 12.4% over the next 15 years and focus on developing the following areas: More Economic Reforms; structural reforms; and political and governance reforms Steps towards Greater integration into world trade and finance Increase commitment to education Create a more industrial economy & eliminate over-dependence on primary commodities. Greatly improve the Business Environment Improve power supply, transportation & telecom infrastructure 6

Financial System Strategy 2020 Why FSS2020? TO ACHIEVE GOLDMAN SACH’S PREDICTION OF THE N-11s, THERE IS NEED FOR A ROBUST AND VIBRANT FINANCIAL SYSTEM THAT WILL POWER NEW ECONOMY FOR NIGERIA TO PROPEL THE REST OF AFRICAN ECONOMY, AN INTEGRATED FINANCIAL SYSTEM IS CRITICAL 7

Financial System Strategy 2020 II: Where Are We Now? Recent Reforms And Outcomes Nigeria’s financial system nascent; had chequered history 8

Where We Were Financial System Strategy 2020 Before 2004, Nigeria’s financial system could not deliver on its defined roles and was characterised by: – Low aggregate banking credit to the domestic economy (20% as percentage of GDP) – Systemic crisis; growing resort to Central Bank bail Out – Inadequate capital base – Oligopolistic structure -10 (out of 89) banks accounted for over 50% of total banking system asset – Poor corporate governance – Low banking/population density - 1:30,432 – Payment system that encouraged cash-based transactions – Insurance industry was weak, undercapitalized – Pension Funds were largely absent – Stock market was shallow 9

Elements of the Reforms . Financial System Strategy 2020 Banking Industry Consolidation: – increased bank capital base from 15 million to 200 million through: merger and acquisition, and/or injection of fresh capital – adoption of risk focused and rule-based regulatory framework – adoption of zero tolerance in data returns by DMBs – automation of the banking system through e-FASS – PLAN to establish an Assets Management Company as an important element of distress resolution. – strict enforcement of the contingency planning framework for systemic banking distress. – enforcement of dormant laws. – Adoption of new code of corporate governance – Deployment of IT in all banking operations 10

Elements of the Reforms . Financial System Strategy 2020 Recapitalization and consolidation in the insurance and capital markets . Micro finance banks, and conversion of community banks Establishment of the Africa Finance Corporation (AFC) Pension reforms--- to generate long-term investible funds and solve the pension crisis 11

Financial System Strategy 2020 Elements Of Reforms---- Reserves And Exchange Rate Management Full liberalisation of foreign exchange market Foreign exchange market liberalisation through (WDAS, admission of Bureaux de Change into official foreign exchange market). Unification of rates in all segments of the market Easier access to foreign exchange by end users Capital account liberalisation More efficient management of external reserves--building internal capacity for reserve management Encouraging Strategic Partnership between Nigerian banks and International Asset Managers for managing Nigeria’s Foreign Reserves Increased Deposits to Subsidiaries of Nigerian banks in OECD countries 12

Financial System Strategy 2020 Elements Of Reforms--- Payments System Restructuring of Nigeria Security Printing & Minting Company (NSPMC) to: – Promote efficient payment through clean, costeffective and responsive currency notes and coins. – Ensure 100% domestic production of currency – Comprehensive review and redesign of currency notes and coins – Standardise checking standards and promote use of cheques – Promote e-payments system – Enforce Anti-Money Laundering Laws and Rules 13

Elements Of Reforms Monetary Policy Financial System Strategy 2020 Monetary Policy reforms – Establishment of a new Monetary Policy Department to refocus CBN on its primary (core) mandate. – Daily liquidity forecasting for effective liquidity management – Generation of daily CBN Balance Sheet – Support to National Bureau of Statistics (NBS) for timely provision of Statistics --- to assist Monetary Policy Revamping of monetary targeting as framework for monetary policy – Adoption of medium- term monetary policy programme – Enhanced transparency in the conduct of monetary policy – Effective Communication Zero tolerance to Ways and Means advances to Government Sterilisation of crude oil receipts above the benchmark price 14

Key Outcomes . Financial System Strategy 2020 GDP ( 142 billion in 2006); per capita income of 1,050 Sound and stable banking system: – Emergence of 25 strong banks (down from 89) – Larger capital base (from under US 3 billion to over US 9 billion) – Rating of Nigerian banks by international rating agencies (S & P; Fitch) for the first time – Branch network increased from 3,200 in 2004 to 3,866 in April 2007 – 919 community/Micro Finance Banks (capital requirement about 156,000) – Non-performing loans/total loans down from 23% to about 7% in 2006 – Credit to Private Sector growing rapidly – Longer-tenored deposits growing relative to total 15

Outcomes .? Financial System Strategy 2020 New banking system powering new economy – Over 7 banks expected to have over US 1 billion each in Tier-1 capital by end of 2007 – 11 banks now have market capitalisation ranging between 1 bn and 5.3 billion; and would range between US 2 billion and US 7 billion by end 2007 – 16 banks now in top 1000 in the world: There was none in 2003; and 5 now out of top 10 in Africa – Banks now the soundest and safest they have ever been – Big ticket assets are now being created by banks – Nigerian banks described as ‘fastest growing’ in Africa in Financial Times, December 2006 16

Outcomes ? Financial System Strategy 2020 Price and Monetary Stability: – Achieved Reserved Money and Broad Money targets – Inflationary pressures subdued and down to single digit since May 2006 – Stable real GDP growth rate of about 6% since 2004 and programmed to attain 7.6% in 2007 17

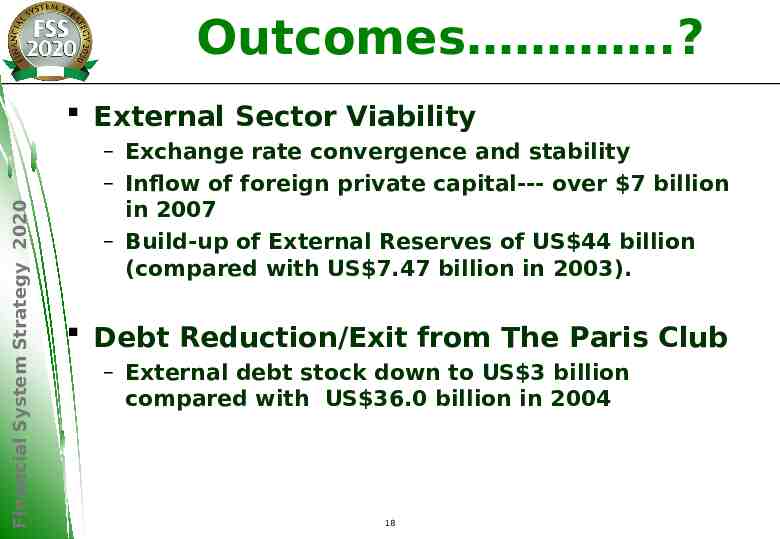

Outcomes .? Financial System Strategy 2020 External Sector Viability – Exchange rate convergence and stability – Inflow of foreign private capital--- over 7 billion in 2007 – Build-up of External Reserves of US 44 billion (compared with US 7.47 billion in 2003). Debt Reduction/Exit from The Paris Club – External debt stock down to US 3 billion compared with US 36.0 billion in 2004 18

Outcomes .? Financial System Strategy 2020 Improved Payments system – Effective cost of currency notes production down by 41- 58% and coins production down by 60% . – New bank notes and coins issued in November 2006 – Standardisation of Nigerian cheques for greater efficiency of clearing operations through reduced reject rates have been implemented. – High level of efficiency in currency processing and distribution has been achieved – Enhanced e-payment system I T deployment in the entire banking system 19

Outcomes .? Financial System Strategy 2020 Capital Market Explosion: – About 19 companies now have market cap of US 1 billion and above (India has about 100): About 20 in West Africa, out of which 19 in Nigeria. None in 1999. – 11 of these 19 companies are BANKS – Stable prices (exchange rate, inflation) and stronger banking system powering NSE – Hundreds of thousands of Nigerians are making money out of the capital market – Nigerian Stock Exchange Capitalization of about 65 billion, and expected at about US 100 billion in 20072008, ahead of Egypt and second only to JSE – Banking sector stocks growing faster than NSE index – Pension assets (over N600 billion--- 5 billion) and longterm capital 20

Outcomes ? The World Is Voting for the Nigerian Economy Financial System Strategy 2020 – – – – – – Nigeria exited external debt ---freer economic space--- less intrusion by BWIs and Creditors FATF has de-listed Nigeria Fitch and S&P rated Nigeria BBFDI and portfolio inflows more than doubling every year---- about US 7 billion in 2006 Non-oil exports grew by 24% in 2006 and China and India becoming preferred partners Diaspora remittances now over 4 billion per annum 21

The Nigerian FS Industry Structure The Structure of the Nigerian Financial Services I ndustry Today Financial System Strategy 2020 Insurance General Pension Funds Management Banking Capital Markets Issuing houses Infrastructure Providers Specialized FIs Reformed Stock brokers Reinsurance Life Development banks Banks – Universal, Community, Microfinance PMIs Nigerian Insurance Commission Finance Companies Discount Houses Central Bank of Nigeria/ Nigeria Deposit Insurance Corporation Regulatory Influence Pension Fund Administrators Portfolio Managers Pension fund custodians Investment Advisers Trustees National Pension Commission Universal Banking Other providers: Securicor, Excel Cash Services, Rating Agencies Payments: Interswitch, Valucard, ATMC, NIBBS, CSCS, 22 Security & Exchange Commission

Financial System Strategy 2020 Challenges Remain . Sustaining macroeconomic Stability Deepening the Banking/Financial System: Evolving appropriate regulations and laws Poor state of infrastructure: power & roads Challenge of continuing fight against corruption Shortage of qualified and experienced manpower Poor corporate governance and risk management framework in an era where the regulator has become stricter Risk- averse operator, regulator-led market Total credit as % of GDP just about 30% Total credit to SME about 1% of total Low savings rate Formal banking only covers about 40% of the bankable public Insurance and Capital Markets still below potentials Mortgage System largely absent Consumer Credit not developed 23

Financial System Strategy 2020 OVERALL STRATEGIC DIRECTION 24

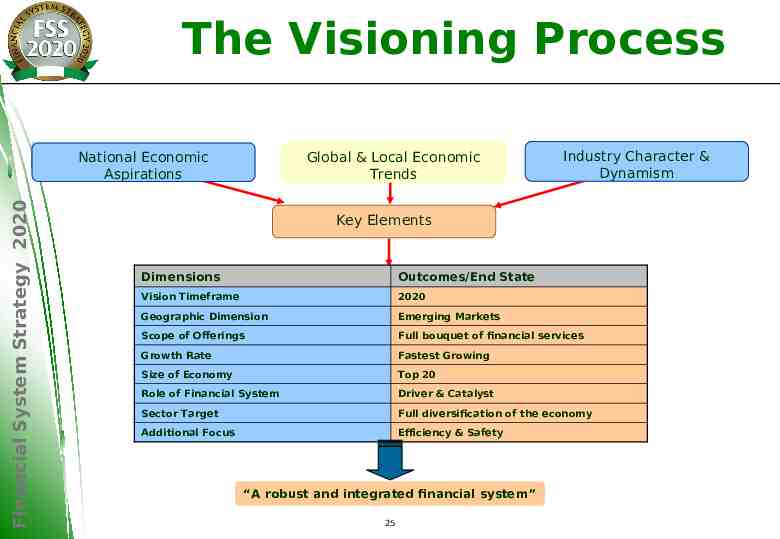

The Visioning Process Global & Local Economic Trends Financial System Strategy 2020 National Economic Aspirations Industry Character & Dynamism Key Elements Dimensions Outcomes/End State Vision Timeframe 2020 Geographic Dimension Emerging Markets Scope of Offerings Full bouquet of financial services Growth Rate Fastest Growing Size of Economy Top 20 Role of Financial System Driver & Catalyst Sector Target Full diversification of the economy Additional Focus Efficiency & Safety “A robust and integrated financial system” 25

Overriding Financial System Aspirations –Vision & Mission Our Vision To be the safest and fastest growing financial system amongst emerging markets Financial System Strategy 2020 Key Elements of the Vision “Fastest growing – Our rate of growth will be measured by clearly defined parameters that would enable us become one of the worlds 20 largest economies, through the strengthening of our financial system” “Safest – The Nigerian financial system will be modeled to provide unparalleled safety, in order to mitigate the perception usually associated with emerging economies. Our financial system will be re-configured with shock-recovery capabilities and sensitivity” “Emerging markets – We intend to conquer and use the key emerging markets as our initial benchmark. Emerging markets will be as defined by World Bank and IMF e.g. the BRICs” Our Mission “To drive rapid and sustainable economic growth primarily in Nigeria and Africa” 26

Financial System Strategy 2020 OUR GROWTH STRATEGY 27

Growth Approach - Rationale Financial System Strategy 2020 To achieve our objectives requires a unique blend of outlook and a carefully defined implementation framework that embodies the peculiarities of Nigeria. These would be guided by the following: A sense of urgency: We are a country in a hurry. We’ve started late in the race to become a major financial and economic centre globally. A clear recognition of national potential: We have over the years suffered major economic set back due to our inability to fully leverage the areas of national strength and comparative advantage A clear identification of FS & non-FS related factors including politics, infrastructure and fiscal measures : We recognise that these factors, if not identified, highlighted and consciously planned for (despite being outside the ambit of financial services), will prevent the attainment of our financial services vision. An appropriate implementation model: To ensure we achieve our desired targets within our planning timeframe, we will adopt an “engineered growth” approach as opposed to an organic approach. 28

Overarching Strategy Strategy Aspiration To Be The Safest & Fastest Growing Financial System amongst Emerging Economies Financial Sector as Catalyst & I FC Evolution Strengthen Domestic Financial Markets Provide Enabling Environment & I nfrastructure Establish Financial System as Growth Catalyst Enhance I ntegration with External Financial Markets Develop Financial Sector & Engineer I nt’l Financial Center Build I nternational Financial Center Human Capital I CT I nfrastructure M o n ey & Fo rE x I n su ra n ce C ap ita l M a rk ets M o rtg a g e S M E Fin a n ce FSS2020 Strategy: Develop Financial Sector & Engineer Nigeria’s Evolution into I FC C re dit T o B e a m o n g th e to p 2 0 eco n o m ies b y 2 0 2 0 Financial System Strategy 2020 The Financial System Strategy 2020 blueprint will be used in achieving these goals: developing and transforming Nigeria’s financial sector into a growth catalyst and engineering Nigeria’s evolution into an international financial centre. Drivers Payment Systems Enablers Legal Reforms Central Banking 29 Regulatory Reforms

The Engineered Growth –Concept and Components Economic growth over time Financial System Strategy 2020 To accomplish these goals, we plan to concurrently strengthen our domestic financial markets; enhance integration with external financial markets; and engineer Nigeria’s evolution into an international financial centre. Strengthen the domestic financial market Enhance integration with external financial markets Build an International Financial Centre Develop internal capacity Export brands & skills Establish financial Free Zone Develop varied products Pursue Naira convertibility Encourage diversified market Integrate with major external markets Foster an open market Entrench the rule of law Enhance payment processes Develop credit system Encourage savings culture Stabilise foreign exchange rates Attract FDI into domestic market Encourage entrance of foreign FS operators 30

Financial System Strategy 2020 DETAILED FS-WIDE STRATEGIES 31

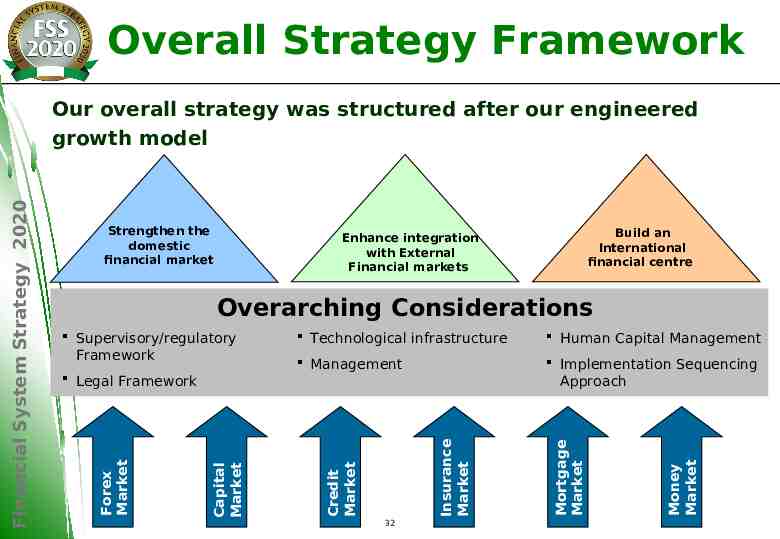

Overall Strategy Framework Strengthen the domestic financial market Build an International financial centre Enhance integration with External Financial markets Overarching Considerations Human Capital Management Management Implementation Sequencing Approach Insurance Market Credit Market Capital Market Legal Framework 32 Money Market Technological infrastructure Mortgage Market Supervisory/regulatory Framework Forex Market Financial System Strategy 2020 Our overall strategy was structured after our engineered growth model

Financial System Strategy 2020 How to strengthen the domestic financial markets 33

How to strengthen the domestic financial markets Financial System Strategy 2020 The first prong of our strategy for achieving our national aspirations focuses on strengthening our domestic financial markets. We will then use our strengthened financial sector as a catalyst to drive overall economic growth. To develop our financial sector, we plan to: Develop competence and skills for financial services industry Leverage on the oil and gas sector to develop the non-oil sectors Integrate the informal financial sector into the formal financial sector Improve access to finance Build an integrated infrastructure for the financial industry 34

Financial System Strategy 2020 Enhancing Integration with External Financial Markets 35

Financial System Strategy 2020 Enhancing Integration with External Financial Markets The second prong of our strategy focuses on enhancing integration with external financial markets. We plan to focus on initiatives that would enable the financial sector to reinforce the expansion of our export base. In integrating with external markets, we plan to start with our regional bloc, and then expand to other global economic blocs. We will do these by: Creating a platform for seamless and robust link to international financial markets Pursuing currency convertibility while maintaining macroeconomic stability Maintaining a healthy foreign reserves level Assisting in the progressive unification of trade and commercial laws among ECOWAS and AU countries Creating an enabling environment for entry of global financial services providers and export of local financial services operators 36

Financial System Strategy 2020 Building an International Financial Centre 37

Financial System Strategy 2020 Building An International Financial Centre The third prong of our financial system strategy focuses on engineering Nigeria’s evolution into an international financial centre. We plan to become an international financial centre in the medium- to long-term. We intend to leverage an area of strength as a key differentiating factor. 38

Building An International Financial Centre Financial System Strategy 2020 To further enable us achieve our objective of transforming Nigeria into an International Financial Centre, we would attract global players by: Creating a pool base of knowledgeable and skilled personnel Creating appropriate and consistent awareness that attracts/creates a positive image Providing world-class communication and technology infrastructure in the Financial Services Sector Developing the physical beauty of the IFC (city spectacle) Growing our local customer base (size of the market – integrate West Africa) Leveraging on our previous track record Creating World-class legal and regulatory framework and practices linked to international jurisdiction Establishing a capital account liberalisation and currency convertibility environment 100% foreign ownership Creating sophisticated market operations Internationally competitive tax rate on income and profits 39

Financial System Strategy 2020 Building An International Financial Centre Name: Lekki Financial Corridor (LFC) Location: Lekki Peninsula Form: a corporation with different arms responsible for implementation of the strategy. It is also responsible for marketing the LFC, the Nigerian financial market, infrastructure development and management amongst others. Infrastructure: it would be quarantined from the rest of the country to provide superior service at all levels; it will have its own institutions that would be at a more advanced level of development (infrastructure-wise). Funding: use of Public-Private Partnerships (PPPs) among the government, private sector and international development agencies. Governance: the LFC would be run by a board of directors who will be heads of the different regulatory bodies and the head (Mayor) of the LFC. Our implementation strategies are as follows: 1. Institutionalise the FSS2020 initiative in Government 2. Set-up governance and implementation structures 3. Adopt PPP approach where possible in implementing the initiatives 40

Implementation Structure Financial System Strategy 2020 The proposed implementation structure is a corporation, tentatively called the FSS2020 Corporation. The corporation’s governance structure and “lines of business” are depicted in the chart below: FSS2020 Corporation I nfrastructure Development & Management Division Marketing & Business Development Division External Relations Division Media Relations/ Corporate Comm. Community Relations Division 41 Markets & Segments Division Technology & Human Capital Division Performance Management Division

Implementation Horizon Financial System Strategy 2020 Implementation of the strategy has been split into three phases: Phase 1 (June 2007 – December 2012): This phase includes quick-wins that will be implemented within the first year, especially around the review and updating of the legal framework. This phase also commences the physical development of the LFC and implementing the technology and human capital initiatives. It requires concerted efforts and high level energy to give the implementation high momentum to drive it through the other years. Phase 2 (January 2013 – December 2016): Emergence of global brands & world class players, integration of African financial markets & regulatory environment. Development of the physical site for the LFC would continue with a review and revalidation of the strategic objectives and initiatives carried out. Phase 3 (January 2017 – December 2020): Emergence of world class financial services industry consistent with the objectives of the FSS 2020 concept. The final years would be spent consolidating all initiatives toward the final performance review of the strategy. 42

Mitigants To Anticipated Challenges & Issues Financial System Strategy 2020 Political Stability Developing the right level of political will to see the initiative through Ensuring the continuity of the initiative through all new regimes by setting up bodies backed up by appropriate laws Implementation Building an implementation plan with well identified milestones and realistic timeframes Identification and adoption of quick-wins Obtaining implementation support from relevant institutions Setting up an empowered implementation committee Continuous evaluation and re-strategising Providing adequate and timely funding 43

Financial System Strategy 2020 Mitigants To Anticipated Challenges & Issues Infrastructure Communication infrastructural requirements transportation, telecommunication, technology, etc Adequate educational coverage Availability of credible, comprehensive and timely data Change management Ensuring adequate participation of all stakeholders Ensuring buy-in by all stakeholders Converting passive stakeholders into active advocates for the change 44

Financial System Strategy 2020 THANK YOU FOR LISTENING 45