New Hire Reporting Program Center for Workforce Information & Analysis

11 Slides5.01 MB

New Hire Reporting Program Center for Workforce Information & Analysis www.pacareerlink.state.pa.us 1-888-PAHIRES (1-888-724-4737) [email protected]

Who are we? The Personal Responsibility and Work Opportunity Reconciliation Act (PRWORA) of 1996, and Pennsylvania's Act 58 of 1997, requires that all employers submit federally required information about their newly hired employees to a designated state agency. The Commonwealth of Pennsylvania’s New Hire Reporting Program collects information on newly-hired employees―sent by their employers , Certified Public Accountants(CPA), or payroll companies―and transmits that data to the State and National Directory of New Hires. National Directory State Directory Employers www.pacareerlink.state.pa.us PA New Hire Reporting 1-888-PAHIRES State Benefit Programs [email protected] 2

What is a ‘New Hire’? Any newly-hired individual who performs services for wages, or any other form of compensation is defined to be a new hire. Rehired employees are considered to be new hires whenever they are not compensated for a period of 30 or more consecutive days. Volunteers and other non-paid workers should not be reported, since they do not receive wages. www.pacareerlink.state.pa.us 1-888-PAHIRES [email protected] 3

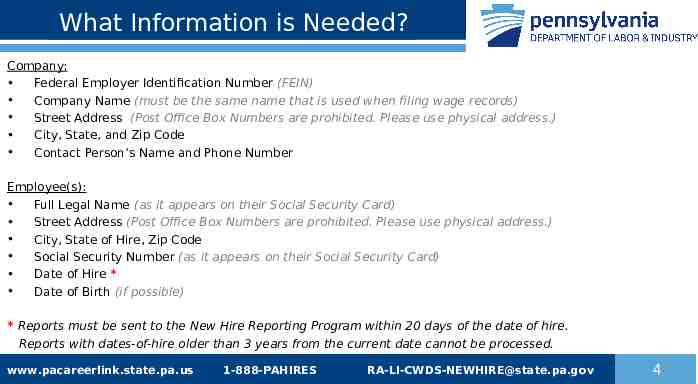

What Information is Needed? Company: Federal Employer Identification Number (FEIN) Company Name (must be the same name that is used when filing wage records) Street Address (Post Office Box Numbers are prohibited. Please use physical address.) City, State, and Zip Code Contact Person’s Name and Phone Number Employee(s): Full Legal Name (as it appears on their Social Security Card) Street Address (Post Office Box Numbers are prohibited. Please use physical address.) City, State of Hire, Zip Code Social Security Number (as it appears on their Social Security Card) Date of Hire * Date of Birth (if possible) * Reports must be sent to the New Hire Reporting Program within 20 days of the date of hire. Reports with dates-of-hire older than 3 years from the current date cannot be processed. www.pacareerlink.state.pa.us 1-888-PAHIRES [email protected] 4

Why Report? Information from New Hire reports is used for: Matching open child support case records Locating non-custodial parents Establishing child support orders or enforcing existing orders Researching labor market information for economic and workforce development. Detecting fraudulent activity and recovering overpayments in Unemployment Compensation (UC) and Workers‘ Compensation (WC) benefit programs New Hire reporting saves employers and taxpayers millions of dollars each year. www.pacareerlink.state.pa.us 1-888-PAHIRES [email protected] 5

Where to Report? Note: Many new hires are reported by Certified Public Accountants(CPA) or a payroll company on behalf of their client employers. www.pacareerlink.state.pa.us www.pacareerlink.state.pa.us www.pacareerlink.state.pa.us 1-888-PAHIRES If you use a CPA or payroll company, please verify that they are reporting your new hires correctly, so that your company remains compliant with state and federal laws. [email protected] 6

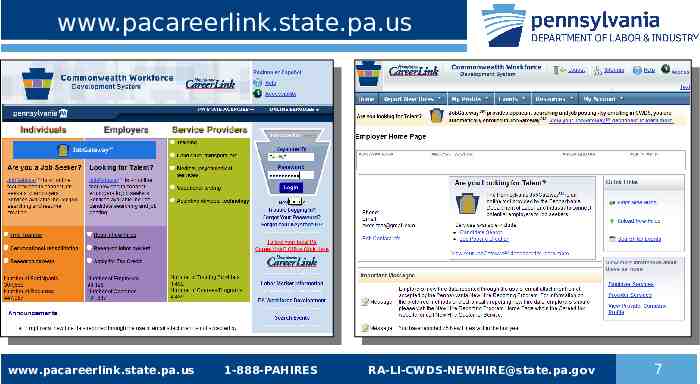

www.pacareerlink.state.pa.us www.pacareerlink.state.pa.us 1-888-PAHIRES [email protected] 7

When to Report Employers are legally responsible for reporting their newly hired --or rehired-- employees no later than 20 days after that employee’s date of hire. The Date of Hire is defined as: The first day an employee performs services for wages or any other form of compensation. If the employee is a rehire and has not been compensated for a period of more than 30 consecutive days, then their date of hire is their return-to-work date. If an employer neglects to report their new-hires within 20 days after the date of hire, the employer may face fines and civil penalties for noncompliance with both state and federal law. www.pacareerlink.state.pa.us 1-888-PAHIRES [email protected] 8

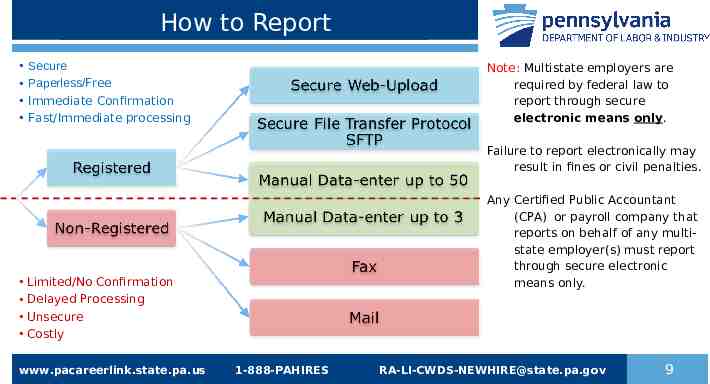

How to Report Secure Paperless/Free Immediate Confirmation Fast/Immediate processing Note: Multistate employers are required by federal law to report through secure electronic means only. Failure to report electronically may result in fines or civil penalties. Any Certified Public Accountant (CPA) or payroll company that reports on behalf of any multistate employer(s) must report through secure electronic means only. Limited/No Confirmation Delayed Processing Unsecure Costly www.pacareerlink.state.pa.us 1-888-PAHIRES [email protected] 9

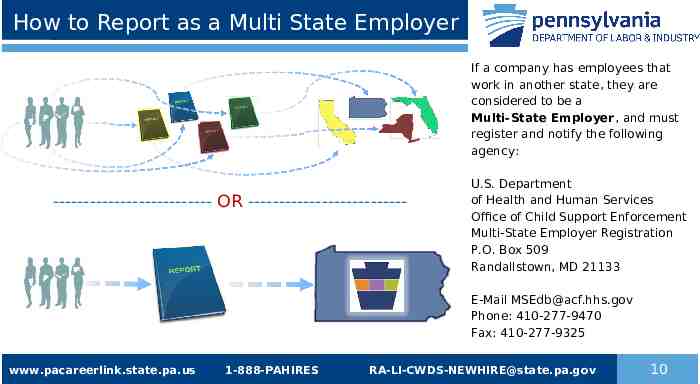

How to Report as a Multi State Employer If a company has employees that work in another state, they are considered to be a Multi-State Employer, and must register and notify the following agency: -------------------------- OR -------------------------- U.S. Department of Health and Human Services Office of Child Support Enforcement Multi-State Employer Registration P.O. Box 509 Randallstown, MD 21133 E-Mail [email protected] Phone: 410-277-9470 Fax: 410-277-9325 www.pacareerlink.state.pa.us 1-888-PAHIRES [email protected] 10

Contact Us The Pennsylvania New Hire Reporting Program Administered by the: Center for Workforce Information & Analysis Website: www.pacareerlink.state.pa.us Phone: 1-888 PAHIRES (1-888-724 4737) Email: [email protected] - Thank You - www.pacareerlink.state.pa.us 1-888-PAHIRES [email protected] 11