FINANCIAL AID 101 FOR NEW COUNSELORS FALL 2021 THESE SLIDES WILL BE

45 Slides1.83 MB

FINANCIAL AID 101 FOR NEW COUNSELORS FALL 2021 THESE SLIDES WILL BE POSTED ON WWW.OASFAA.ORG (RESOURCES/COUNSELORS) Presenter: Faith Phillips Title: Director, Student Financial Services College: Central Ohio Technical College/ Ohio State Newark Email: [email protected]

ABOUT OASFAA & THIS PRESENTATION This webinar is sponsored by the Ohio Association of Student Financial Aid Administrators (OASFAA), a non-profit organization comprised of volunteer financial aid professionals. The OASFAA Outreach Committee is a committee that serves as a primary resource of pertinent and current financial aid information. The committee disseminates this information through a variety of activities including training programs for various stakeholders external to OASFAA such as admissions staff, high school counselors, access advisors, TRIO, etc.

ABOUT OASFAA & THIS PRESENTATION OASFAA has is providing the information today as a free service to counselors. You have permission to copy and distribute these materials to your students and families. Charges may not be assessed for the material or for the information presented. Permission must be granted for other use of this information or these materials. Contact the OASFAA Outreach Chairperson(s) listed on the OASFAA website or email the OASFAA Outreach Committee at [email protected].

FINANCIAL AID 101 This presentation draws on information from OASFAA, the National Association of Student Financial Aid Administrators (NASFAA) and Federal Student Aid (FSA). Today’s webinar in an introduction to financial aid. For a more in- depth presentation and discussion you are encouraged to attend an OASFAA counselor workshop being offered in November.

FALL 2021 COUNSELOR WORKSHOPS Registration is requested and will be open soon @ www.oasfaa.org (Resources Counselors). Bowling Green State University: November 3, 2021 Baldwin Wallace University: November 8, 2021 Central Ohio Technical College/OSU Newark: November 15, 2021 University of Cincinnati: November 16, 2021 Ohio University Southern Campus: November 19, 2021 Virtual: November 30, 2021

LET’S GET STARTED This Photo by Unknown Author is licensed under CC BY-SA-NC

WHAT IS FAFSA AND FINANCIAL AID? FAFSA Standard F R E E form that collects information about the student and the parent. Submission of the FAFSA is FREE. Caution to families to not pay to submit the application or to pay for any scholarship applications. Financial aid Funds provided to students and families to help pay for educational expenses.

FAFSA Information used to calculate the Expected Family Contribution (EFC) – Measure of taxable and untaxable income (2020) and current assets of student and parent – Also based on family size, number in college and other demographic info such as marital status Colleges use the EFC to award financial aid EFC stays the same regardless of where the student goes to college For the 2022-2023 academic year, the FAFSA may be filed beginning October 1, 2021 Remind students they must re-apply for financial aid every year The earlier a student files, the earlier they may receive an aid package and the more aid they may be offered Admissions process vs. Financial Aid process

A WORD ABOUT DEADLINES ority i r P FAFSA lines Dead How/When to file if dealing with early deadlines: Follow FAFSA directions per College or University What are Ohio colleges and universities doing about deadlines? See the OASFAA website under counselor resources for the FAFSA Priority Deadlines for Ohio Schools Note: There may be other forms and other deadlines Example: CSS College Profile Form Early Decision Transcripts Verification/FA Additional Forms

PRINCIPLES OF NEED ANALYSIS Parents have the primary responsibility in paying for dependent child’s education (to extent they are able) Students also have a responsibility to contribute to their educational costs A family’s ability to pay for educational costs must be evaluated equitably and consistently Families should be evaluated in their present financial condition For the 2022-2023 FAFSA, families will report their 2020 taxable and untaxable income The Covid-19 pandemic may necessitate more professional judgements by the institutions Recognizing that special circumstances can and do affect a family’s ability to pay

WHAT IS EXPECTED FAMILY CONTRIBUTION (EFC)? Two components Student contribution (Income Assets) Parent contribution (Income Assets) (for dependent students) Amount family can reasonably be expected to contribute? Index: “This is the number that is used to determine eligibility for federal student financial aid.” The formula does not measure willingness to pay Stays the same regardless of college Calculated using a federal formula based on the information provided on the FAFSA

DEFINITION OF NEED Cost of Attendance - Expected Family Contribution (EFC) Eligibility (Need-Based Aid) www.StudentAid.gov/how-calculated

WHAT IS COST OF ATTENDANCE (COA)? Estimation of expected costs Direct Costs Tuition and fees Room and board Indirect Costs Transportation Miscellaneous personal expenses Books and supplies

NEED COMPARISON Cost of Attendance -EFC Need/Eligibility Higher Cost Institution Mid Cost Institution Lower Cost Institution 58,000 40,000 22,000 8,000 8,000 8,000 50,000 32,000 14,000 The Federal Expected Family Contribution (EFC) is the same at each institution.

MULTIPLE WAYS TO COMPLETE FAFSA FOTW (Desktop)* https:// studentaid.gov/ Paper FAFSA FOTW (Mobile)* My Student Aid App* *IRS DRT Can Be Used

FAFSA ON THE WEB (FOTW) Built-in edits to prevent costly errors Skip logic allows student and/or parent to skip unnecessary questions Option for IRS Data Retrieval Tool More timely submission More detailed instructions and “help” (use of ? Beside each question) Simplified Process for future years

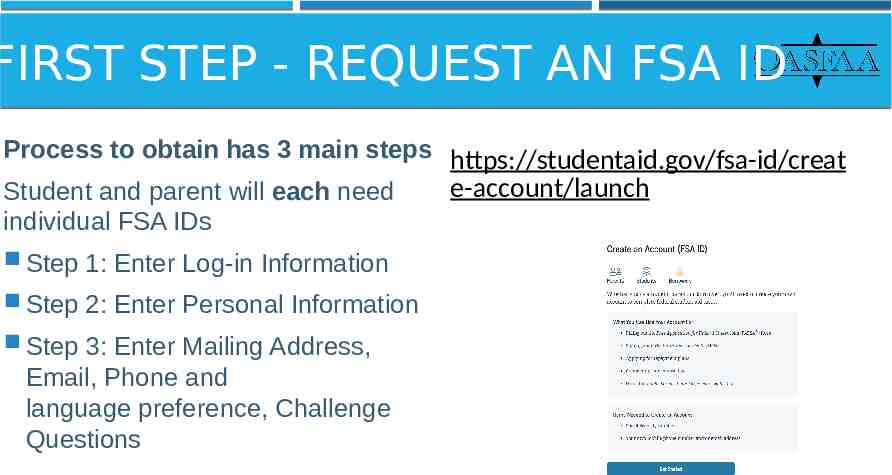

FIRST STEP - REQUEST AN FSA ID Process to obtain has 3 main steps https://studentaid.gov/fsa-id/creat e-account/launch Student and parent will each need individual FSA IDs Step 1: Enter Log-in Information Step 2: Enter Personal Information Step 3: Enter Mailing Address, Email, Phone and language preference, Challenge Questions

PARENTS AND STUDENTS MUST CREATE THEIR OWN FSA ID Parent and student MAY NOT use the same email address Do not use High School email accounts Parent only needs one FSA ID for multiple children Each student must have their own FSA ID and FAFSA Used for FAFSA completion and allows access to certain U.S. Department of Education websites Only the owner should create the FSA ID When possible, verify email and mobile phone # using secure code provided

FAFSA ON THE WEB https://studentaid.gov/h/apply-

Filing the Wrong FASFA year Failing to use student’s legal name Missing financial aid deadlines Transposing digits or inserting extra digits FREQUENT FAFSA ERRORS Using incorrect Social Security Numbers/Date of Birth Submitting wrong parent’s financial information/not including step- parent What untaxed income to report Incorrectly reporting Household size/number of household members in college What to include for investment net worth

COLLEGE AND HOUSING INFORMATION Students can add up to 10 colleges on FAFSA. For more information and college comparisons, visit the College Navigator website. The following is just some of the information on the website: College’s website School type Tuition and fees Net price average Graduation rates Retention rates Transfer rates

SUBMIT THE FAFSA

MAKING FAFSA CORRECTIONS Corrections to FAFSA data may be made on FAFSA on the Web Add more schools Correct any mistakes (school may ask student to document the changes made) UPDATEs to data such as assets/savings is not permitted. It is captured at the time the FAFSA is originally submitted and is not updateable. Corrections may be made by submitting documentation to the financial aid office in some cases

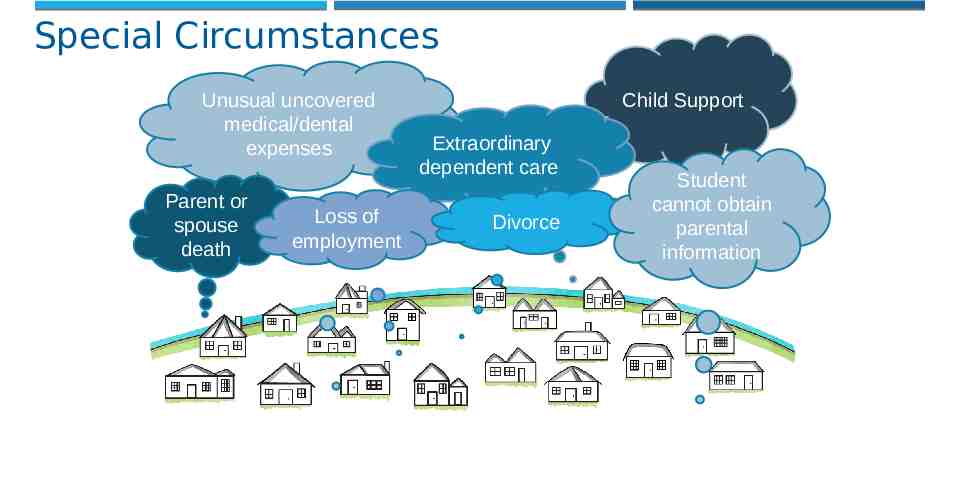

SPECIAL CIRCUMSTANCES Conditions exist that cannot be documented with the FAFSA. Student should file the FAFSA as directed and send written explanation and documentation to the college’s financial aid office explaining their special circumstance. Most colleges have an appeal process to address special circumstances. The college will review and request additional information if necessary. If the student's circumstances are warranted, the FAA will submit corrections to the FAFSA to reflect the changes. Each college may have a different way of reviewing special circumstances. Students should be prepared to appeal at all schools they are considering and could receive different responses per college. Decisions are final and cannot be appealed to the U.S. Department of Education.

Special Circumstances Unusual uncovered medical/dental expenses Parent or spouse death Loss of employment Child Support Extraordinary dependent care Divorce Student cannot obtain parental information

Students may be selected for a process called verification and must submit documents to confirm FAFSA information. Roughly 22% of FAFSAs are selected for verification by the U.S. Department of Education. (**Waiver for 21-22 will not renew in 22-23) Students should respond quickly to any requests for information from the college. If selected, commonly requested documents include: Verification Worksheet (these can look different across varying colleges and universities) VERIFICATIO N Federal Tax Return Transcript or Federal Tax Return for parents/student if they filed 2020 taxes an alternative to submitting documentation of taxes is completing the IRS Data Retrieval Process within the FAFSA W-2(s) for parents/students if they worked in 2020 but did not file taxes Verification of Non-Filing Letter for parents and independent students who did not file 2020 taxes – this is NOT needed for dependent students

VERIFICATION Federal Income Tax Return Institutions may accept a signed copy of the federal income tax return for the applicable tax year that the tax filer submitted to the IRS or other relevant tax authorities. (This includes a signed copy of the income tax return for amended tax filers and victims of identity theft.) IRS Tax Return Transcripts Institutions may accept a signed copy of the IRS Tax Return Transcript which can be requested at https://www.irs.gov/individuals/get-transcript or 1-800-908-9946 Via online account creation or request to be mailed Tax Return Transcripts cannot be mailed to a third party (i.e. directly to the college or university)

FINANCIAL AID OFFICE Reviews the FAFSA and any requested additional verification documents Determines the Financial Aid Offer Financial aid offers may be mailed or emailed and may look different from college to college Offer should include: The cost of attendance and EFC used to determine the offer The amount of aid awarded from each program An explanation of how and when aid is disbursed A reference to the terms and conditions of the offer

SOURCES OF FINANCIAL AID Federal Government Employers Private Sources States College and Universities

CATEGORIES OF FINANCIAL AID Gift Aid Grants Scholarships (need based) Self-Help Aid Some require a FAFSA, some do not BUT always encourage to file a FAFSA Loans Subsidized and Unsubsidized student loans Parent Loans Private student loans VA Benefits Work-study Jobs (Institutional) Merit Based Scholarships (performance)

SCHOLARSHIP SEARCHES & SCAMS Scholarship Scams (free vs. paying a fee) Buyer beware Pursue local scholarships! Local foundations, Civic Organizations, Churches, Employers, Financial Institutions, etc. Check with Colleges and Universities They may be aware of external scholarships in addition to institutional scholarships Scholarship Search Engines

Ohio College Opportunity Grant (OCOG) OHIO AID PROGRAMS 2022-2023 Ohio War Orphans Scholarship & Severely Disabled Veteran’s Children’s Scholarship Program Ohio Army National Guard Scholarship Ohio Safety Officers College Memorial Fund Nurse Education Assistance Loan Program (NEALP) Choose Ohio First Scholarship: STEMM Disciplines 33

OHIO COLLEGE OPPORTUNITY GRANT (OCOG) OCOG Eligibility criteria FAFSA filed by indicated deadline (October 1, 2022 for 2022-2023) Ohio resident Attend eligible OH or Pennsylvania institution Public and Private Colleges participate EFC 2190 Maximum household income of 96,000 Can receive for maximum of 10 semesters or 15 quarters of enrollment 34

OHIO COLLEGE OPPORTUNITY GRANT (OCOG), 2021-2022 Students attending community colleges and regional campuses are eligible to receive OCOG if they are eligible for ETV, as foster youth students and in a few other circumstances 19 From https://www.ohiohighered.org/ocog

FEDERAL AID PROGRAMS Federal Pell Grant Federal Supplement Education Opportunity Grant Federal Work Study Federal Direct Student Loans

FEDERAL PELL/SEOG GRANTS Pell Grant (2021-2022) Need based grant (as demonstrated by the EFC. FAFSA Priority Deadline for ca mpus-based programs EFC of 0000 6,495 maximum Pell EFC of 5576 672 minimum Pell Federal SEOG Grant: (Campus Based) Student must demonstrate exceptional financial need Awarded first to students with the lowest EFC (Pell Eligible students are priority) Award ranges from 100 to 4,000 (typical award is between 100 and 500 per semester)37

FEDERAL WORK-STUDY Undergraduate or graduate students are eligible Employment can be on or off campus FWS wages excluded from EFC calculation!!! for e n i l ead ms D y t i gra ior r o r P p A d FAFS pus base cam Eligible employers School Federal, state, or local public agency Private non-profit organization in academically relevant jobs For-profit organization in academically relevant jobs Community service activities Ohio minimum wage in 2021: 8.80 per

FEDERAL STUDENT LOANS Key Points: Students can borrow direct loans without any credit check or income Parents can borrow direct PLUS loans on behalf of their dependent student. Their credit record will be checked. Only borrow what is really needed Look at loans as an investment in the future

STUDENT LOANS PROCESS File the FAFSA Review financial aid award letters from schools to learn about eligibility Go to www.studentaid.gov Sign in using your Federal Student Aid ID (FSA ID) Student: Complete Entrance Counseling AND MPN (Master Promissory Note) Parent (for Parent PLUS loan only): Complete PLUS application AND MPN

NEED MORE HELP? Federal Student Aid Information Center: EMAIL: [email protected] 1-800-433-3243 (1-800-4fedaid)

The OASFAA Outreach Committee can help facilitate your school's Financial Aid Night by helping to connect you with local financial aid professionals willing to present at your school.

OASFAA OUTREACH [email protected] Make sure you put your name and email address into our College Access and School Counselors Contact Database Web: http://www.oasfaa.org/ (page for counselors) Request an OASFAA volunteer High School Financial Aid Night presenter. Register for the Counselor Workshops (available soon). Sign up for our email database to be sure you are notified for all events.

FAFSA LINE-BY-LINE TRAINING Thursday, October 14, 1:00 – 2:30 Tuesday, October 26, 9:00 – 10:30 Registration at: https://www.oasfaa.org/counselors

QUESTIONS