Fiduciary Investment Advice Update on DOL Activity Association of

28 Slides325.22 KB

Fiduciary Investment Advice Update on DOL Activity Association of Life Insurance Counsel CLE Series Mike Hadley, Partner Adam McMahon, Associate Davis & Harman LLP

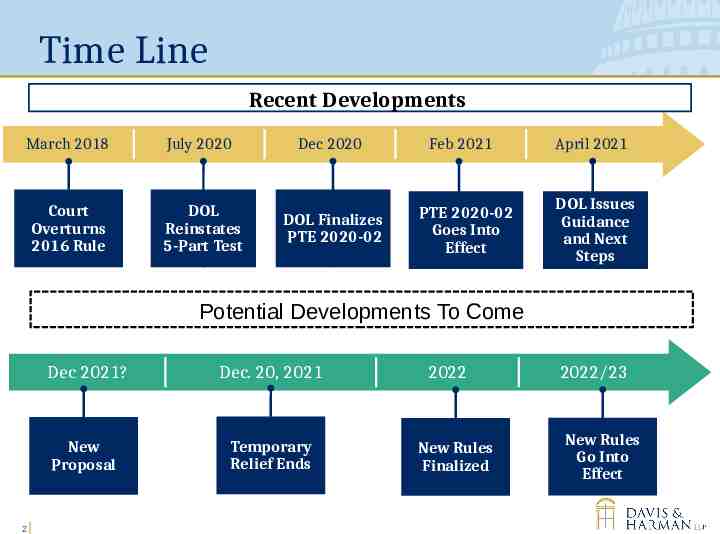

Time Line Recent Developments March 2018 July 2020 Court Overturns 2016 Rule DOL Reinstates 5-Part Test Dec 2020 DOL Finalizes PTE 2020-02 Feb 2021 PTE 2020-02 Goes Into Effect April 2021 DOL Issues Guidance and Next Steps Potential Developments To Come 2 Dec 2021? Dec. 20, 2021 New Proposal Temporary Relief Ends 2022 New Rules Finalized 2022/23 New Rules Go Into Effect

Fiduciary Status and Rollovers

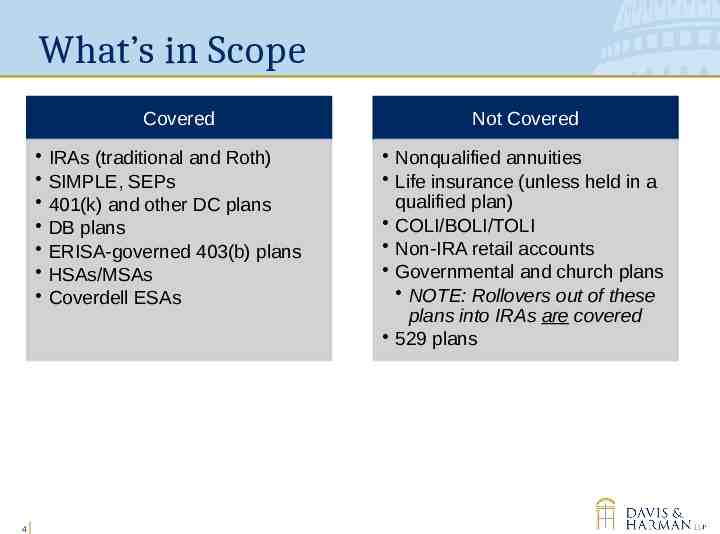

What’s in Scope 4 Covered Not Covered IRAs (traditional and Roth) SIMPLE, SEPs 401(k) and other DC plans DB plans ERISA-governed 403(b) plans HSAs/MSAs Coverdell ESAs Nonqualified annuities Life insurance (unless held in a qualified plan) COLI/BOLI/TOLI Non-IRA retail accounts Governmental and church plans NOTE: Rollovers out of these plans into IRAs are covered 529 plans

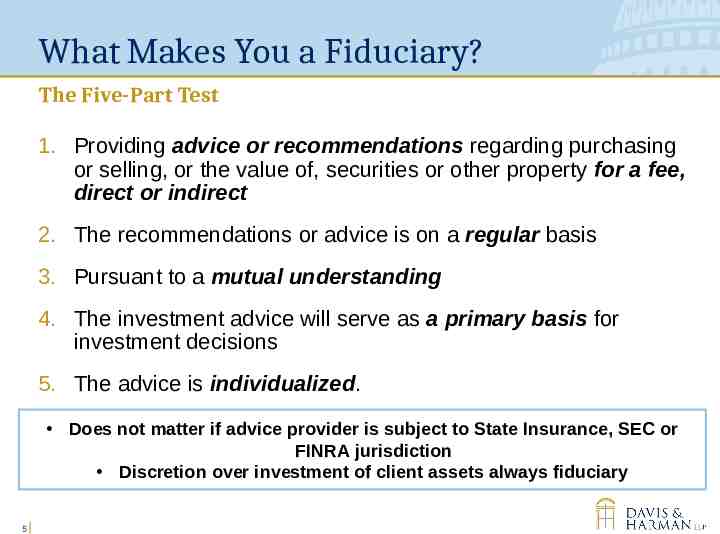

What Makes You a Fiduciary? The Five-Part Test 1. Providing advice or recommendations regarding purchasing or selling, or the value of, securities or other property for a fee, direct or indirect 2. The recommendations or advice is on a regular basis 3. Pursuant to a mutual understanding 4. The investment advice will serve as a primary basis for investment decisions 5. The advice is individualized. Does not matter if advice provider is subject to State Insurance, SEC or FINRA jurisdiction Discretion over investment of client assets always fiduciary 5

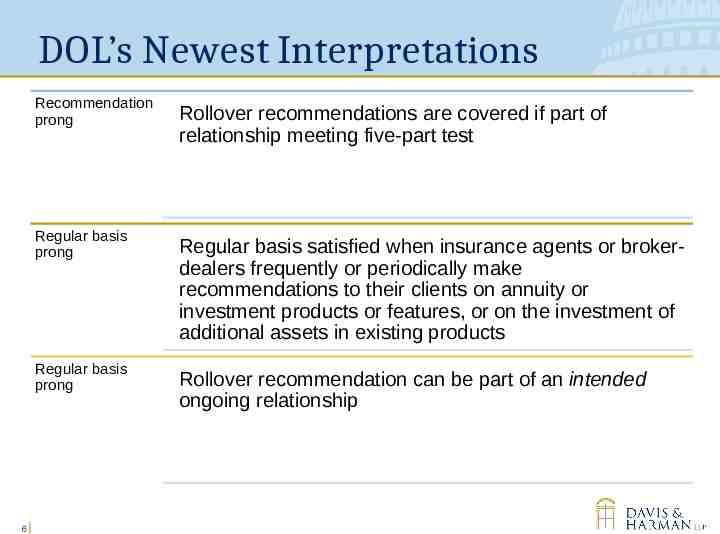

DOL’s Newest Interpretations 6 Recommendation prong Rollover recommendations are covered if part of relationship meeting five-part test Regular basis prong Regular basis satisfied when insurance agents or brokerdealers frequently or periodically make recommendations to their clients on annuity or investment products or features, or on the investment of additional assets in existing products Regular basis prong Rollover recommendation can be part of an intended ongoing relationship

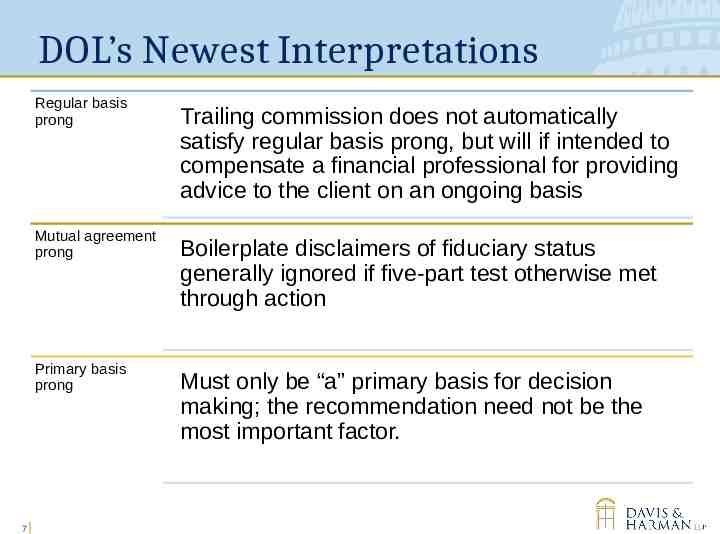

DOL’s Newest Interpretations Regular basis prong Mutual agreement prong Primary basis prong 7 Trailing commission does not automatically satisfy regular basis prong, but will if intended to compensate a financial professional for providing advice to the client on an ongoing basis Boilerplate disclaimers of fiduciary status generally ignored if five-part test otherwise met through action Must only be “a” primary basis for decision making; the recommendation need not be the most important factor.

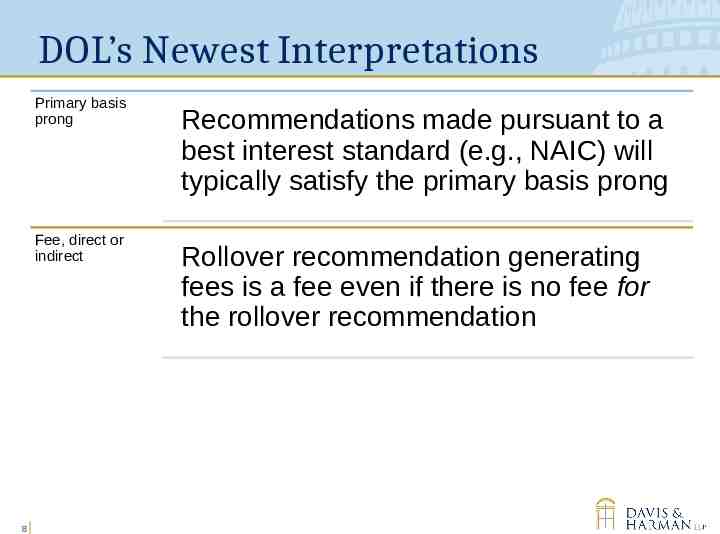

DOL’s Newest Interpretations Primary basis prong Fee, direct or indirect 8 Recommendations made pursuant to a best interest standard (e.g., NAIC) will typically satisfy the primary basis prong Rollover recommendation generating fees is a fee even if there is no fee for the rollover recommendation

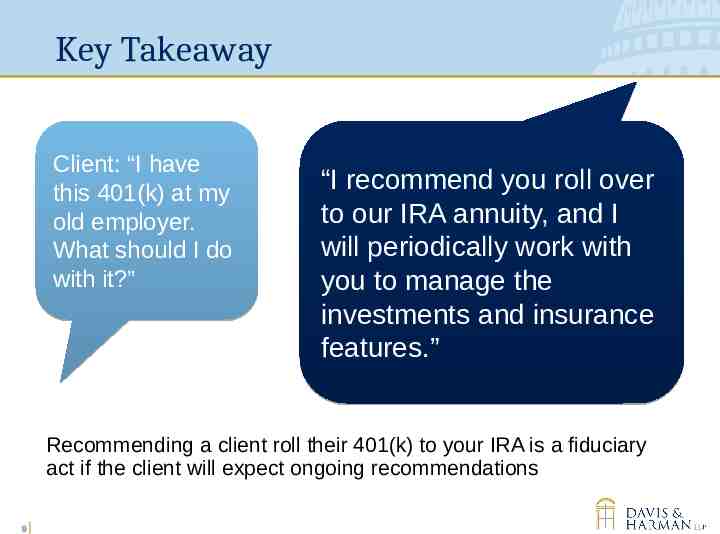

Key Takeaway 9 Client: “I have this 401(k) at my old employer. What should I do with it?” “I recommend you roll over to our IRA annuity, and I will periodically work with you to manage the investments and insurance features.” Recommending a client roll their 401(k) to your IRA is a fiduciary act if the client will expect ongoing recommendations 9

Implications of Fiduciary Status

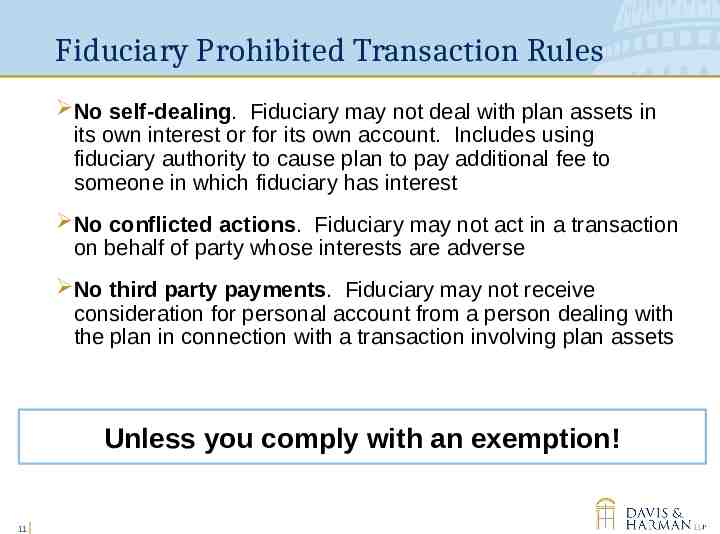

Fiduciary Prohibited Transaction Rules No self-dealing. Fiduciary may not deal with plan assets in its own interest or for its own account. Includes using fiduciary authority to cause plan to pay additional fee to someone in which fiduciary has interest 11 No conflicted actions. Fiduciary may not act in a transaction on behalf of party whose interests are adverse No third party payments. Fiduciary may not receive consideration for personal account from a person dealing with the plan in connection with a transaction involving plan assets Unless you comply with an exemption! 11

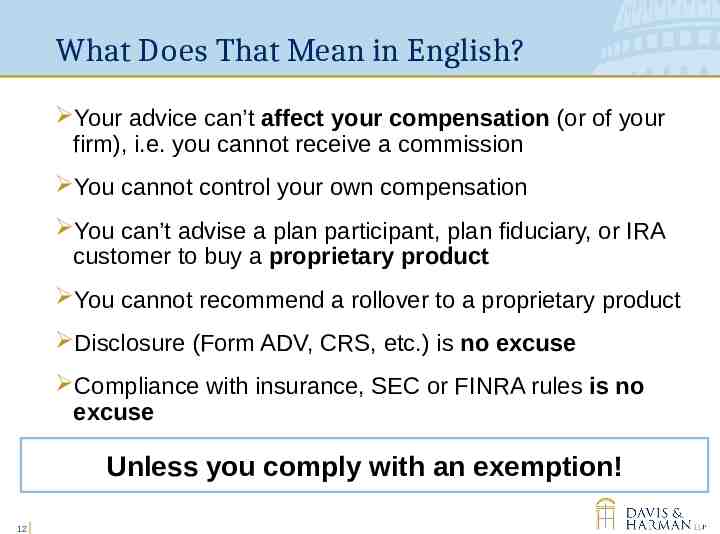

What Does That Mean in English? 12 Your advice can’t affect your compensation (or of your firm), i.e. you cannot receive a commission You cannot control your own compensation You can’t advise a plan participant, plan fiduciary, or IRA customer to buy a proprietary product You cannot recommend a rollover to a proprietary product Disclosure (Form ADV, CRS, etc.) is no excuse Compliance with insurance, SEC or FINRA rules is no excuse Unless you comply with an exemption! 12

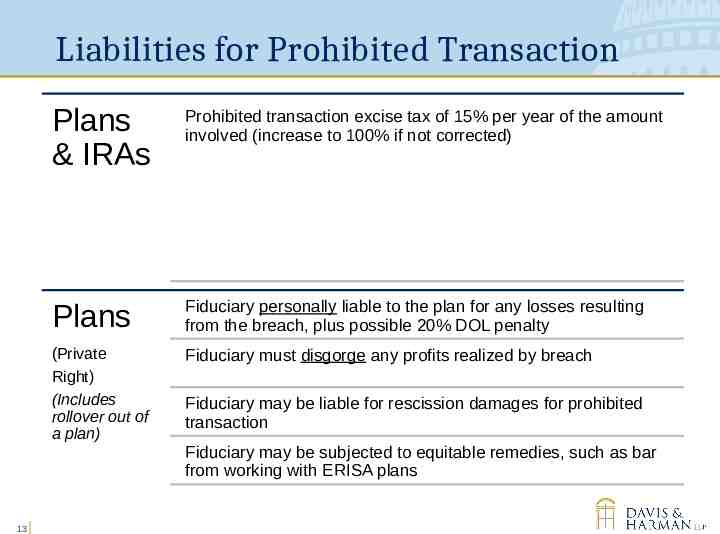

Liabilities for Prohibited Transaction 13 13 Plans & IRAs Prohibited transaction excise tax of 15% per year of the amount involved (increase to 100% if not corrected) Plans Fiduciary personally liable to the plan for any losses resulting from the breach, plus possible 20% DOL penalty (Private Right) (Includes rollover out of a plan) Fiduciary must disgorge any profits realized by breach Fiduciary may be liable for rescission damages for prohibited transaction Fiduciary may be subjected to equitable remedies, such as bar from working with ERISA plans

Prohibited Transaction Exemption 84-24 Is it viable long term?

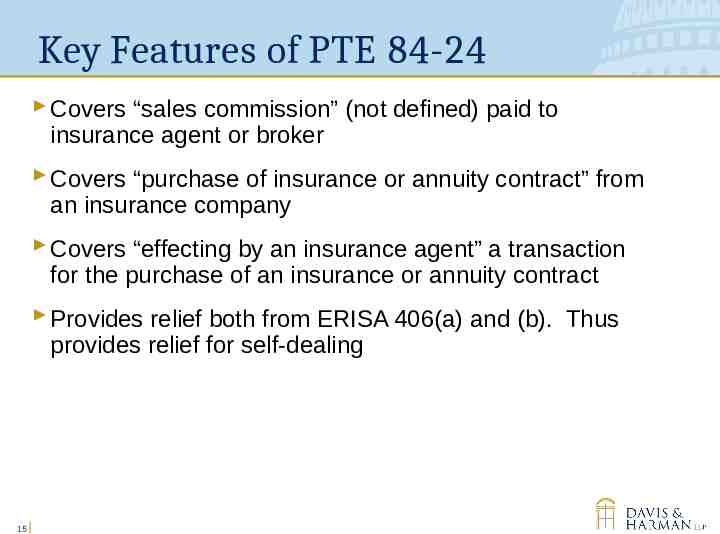

Key Features of PTE 84-24 Covers “sales commission” (not defined) paid to insurance agent or broker Covers “purchase of insurance or annuity contract” from an insurance company Covers “effecting by an insurance agent” a transaction for the purchase of an insurance or annuity contract Provides relief both from ERISA 406(a) and (b). Thus provides relief for self-dealing 15

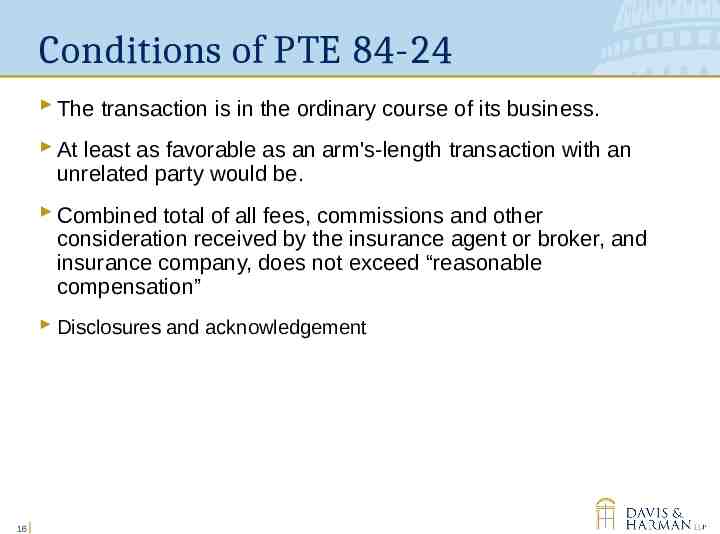

Conditions of PTE 84-24 The transaction is in the ordinary course of its business. At least as favorable as an arm's-length transaction with an unrelated party would be. Combined total of all fees, commissions and other consideration received by the insurance agent or broker, and insurance company, does not exceed “reasonable compensation” Disclosures and acknowledgement 16

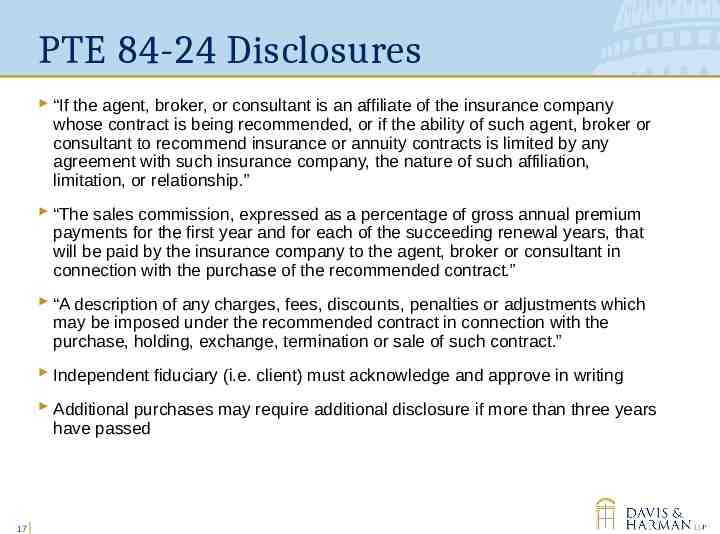

PTE 84-24 Disclosures “If the agent, broker, or consultant is an affiliate of the insurance company whose contract is being recommended, or if the ability of such agent, broker or consultant to recommend insurance or annuity contracts is limited by any agreement with such insurance company, the nature of such affiliation, limitation, or relationship.” “The sales commission, expressed as a percentage of gross annual premium payments for the first year and for each of the succeeding renewal years, that will be paid by the insurance company to the agent, broker or consultant in connection with the purchase of the recommended contract.” “A description of any charges, fees, discounts, penalties or adjustments which may be imposed under the recommended contract in connection with the purchase, holding, exchange, termination or sale of such contract.” Independent fiduciary (i.e. client) must acknowledge and approve in writing Additional purchases may require additional disclosure if more than three years have passed 17

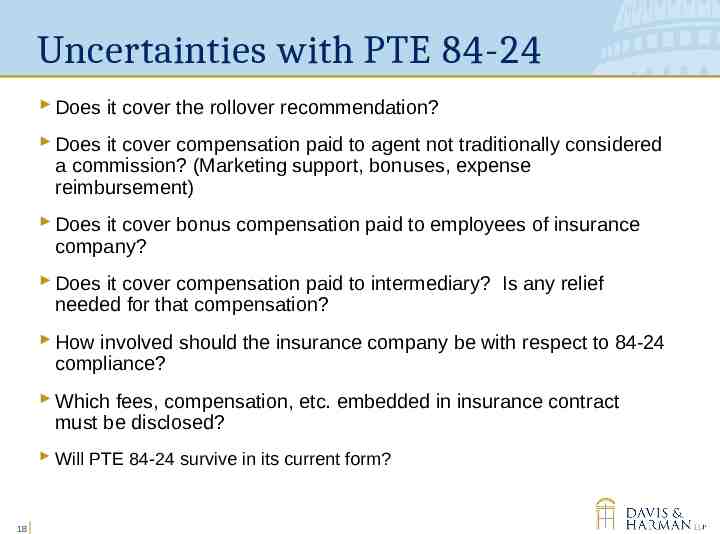

Uncertainties with PTE 84-24 Does it cover the rollover recommendation? Does it cover compensation paid to agent not traditionally considered a commission? (Marketing support, bonuses, expense reimbursement) Does it cover bonus compensation paid to employees of insurance company? Does it cover compensation paid to intermediary? Is any relief needed for that compensation? How involved should the insurance company be with respect to 84-24 compliance? Which fees, compensation, etc. embedded in insurance contract must be disclosed? Will PTE 84-24 survive in its current form? 18

New PTE 2020-02

Conditions of PTE 2020-02 Easier Conditions Investment professional must be overseen by eligible financial institution Includes insurance companies, RIAs and broker/dealers No conviction of certain crimes in prior 10 years Impartial conduct standards Advice must be in client’s “best interest” All compensation receive must be reasonable, and best execution must be sought No misleading statements Cannot be purely robo-advice / cannot be for discretionary management of assets. (Note: the rollover transaction is considered non-discretionary even if funds go into a managed account.) 20

Insurance Intermediaries Rules under PTE 2020-02 IMOs, BGAs, FMOs do not qualify as “Financial Institution” unless they are otherwise a qualifying institution. This means that generally, the insurance company must serve the oversight role Intermediaries may apply for an exemption From DOL preamble: “The Department acknowledges that some commenters felt this approach would put insurance intermediaries at a disadvantage as compared to other Financial Institutions.” 21

Conditions of PTE 2020-02 Disclosures Financial institution and investment professional must acknowledge fiduciary status in writing Written description of services to be provided Written description of material conflicts of interest Including disclosure of limitations on investments you can use and use of proprietary/affiliated products Must provide written documentation of rollover recommendation (more on that in a minute) 22

Conditions of PTE 2020-02 New policies and procedures Policies to ensure advice is in best interest Policies to mitigate conflicts of interest in making recommendations Annual retrospective review reasonably designed to detect compliance with exemption conditions Senior executive officer must review and certify this compliance review Retention of materials for six years 23

Rollover Documentation Must document why rollover recommendation is in client’s best interest and provide that to client Must ask for or seek out information on current plan: the alternatives to a rollover, including leaving the money in the investor’s employer’s plan, if permitted; the fees and expenses associated with both the plan and the IRA; whether the employer pays for some or all of the plan’s administrative expenses; and the different levels of services and investments available under the plan and the IRA 24

Rollover Documentation I can’t find any of this information for my plan. What to do Explain how to find the information (latest statement, annual investment disclosure, SPD) Explain significance of it Rely on alternative data sources, such as 5500 or reliable benchmarks Document alternatives used 25

What’s Next For DOL

Likely Next Steps for DOL DOL implying December 20, 2021 expiration of good faith relief is unlikely to be pushed back DOL will propose new rules, currently targeting December 2021. DOL has signaled: More activities could be investment advice More conditions could be added to PTE 2020-02 Other exemptions (i.e. 84-24) could be modified to add Impartial Conduct Standards It will not get easier. DOL will not back off on need to document rollover recommendations. 27

QUESTIONS? Michael Hadley Partner Davis & Harman LLP 202.662.2298 [email protected] Adam McMahon Associate Davis & Harman LLP 202.662.2279 [email protected]