Fair Labor Standards Act Regular Rate Final Rule The contents of

27 Slides259.14 KB

Fair Labor Standards Act Regular Rate Final Rule The contents of this document do not have the force and effect of law and are not meant to bind the public in any way. This document is intended only to provide clarity to the public regarding existing requirements under the law or agency policies. . UNITED STATES DEPARTMENT OF LABOR WAGE AND HOUR DIVISION

Topics Topics: I. Introduction to the Regular Rate II. General Principles Regarding the Regular Rate III. 2019 Final Rule Overview IV. Exclusions from the Regular Rate V. The Basic Rate VI. Conclusion

Introduction to the Regular Rate The Fair Labor Standards Act (FLSA) is the federal law that requires employers to pay their employees minimum wage and overtime compensation. The amount of overtime pay due to an employee is based on the employee’s regular rate of pay and the number of hours worked in a workweek. Earnings may be determined on a piece-rate, salary, commission, or some other basis, but in all such cases the overtime pay due must be computed on the basis of the average hourly rate derived from such earnings.

Introduction to the Regular Rate The regular rate of pay is based upon actual facts. The regular rate may not be lower than the applicable minimum wage. If the regular rate is higher than the federal minimum wage, then overtime pay must be calculated using that higher rate. The regular rate is determined by dividing total earnings (except for statutory exclusions) in the workweek by total number of hours worked in the workweek: Total Compensation in the workweek (except for statutory exclusions) Total Hours Worked in the workweek Regular Rate for the workweek Total earnings include, among other things, commissions, certain bonuses, and cost of room, board, and other facilities provided primarily for the employee’s benefit .

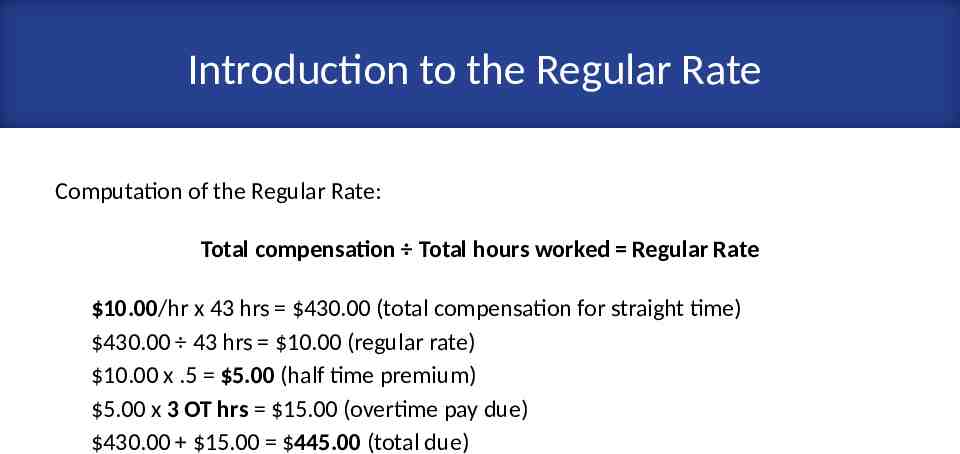

Introduction to the Regular Rate Computation of the Regular Rate: Total compensation Total hours worked Regular Rate 10.00/hr x 43 hrs 430.00 (total compensation for straight time) 430.00 43 hrs 10.00 (regular rate) 10.00 x .5 5.00 (half time premium) 5.00 x 3 OT hrs 15.00 (overtime pay due) 430.00 15.00 445.00 (total due)

General Principles Regarding the Regular Rate The FLSA’s eight categories of excludable payments are exhaustive. The Final Rule makes clear, however, that, because it is impossible to address all of the various compensation and benefits arrangements that may exist between employers and employees, both now and in the future, the examples of excludable and nonexcludable payments and benefits in the updated regulations are not exhaustive. There may be other types of payments not discussed or used as examples that nonetheless qualify as excludable payments under the statute. It is important to remember that, when a payment is a wage supplement, even if not directly related to employee performance or hours worked, it is still compensation for “hours of employment” and must be included in the regular rate. The determination of whether a particular payment, "perk", or benefit may be excluded from the regular rate is made on a case-by-case basis applying the requirements set out in the statute to the specific circumstances.

2019 Final Rule Overview The regulations interpreting the regular rate under the FLSA have remained mostly unchanged since 1968. This Final Rule, which is effective January 15, 2020, clarifies and updates the Department’s interpretation of the regular rate and the types of payments that fall within the statutory exclusions from the regular rate.

2019 Final Rule Overview The Final Rule updates a number of regulations to: Provide appropriate and updated guidance in an area of evolving law and practice. Encourage employers to provide additional innovative benefits to workers. Make clear that certain benefits that may have a positive impact on workplace morale, employee compensation, and employee retention are excludable from the regular rate.

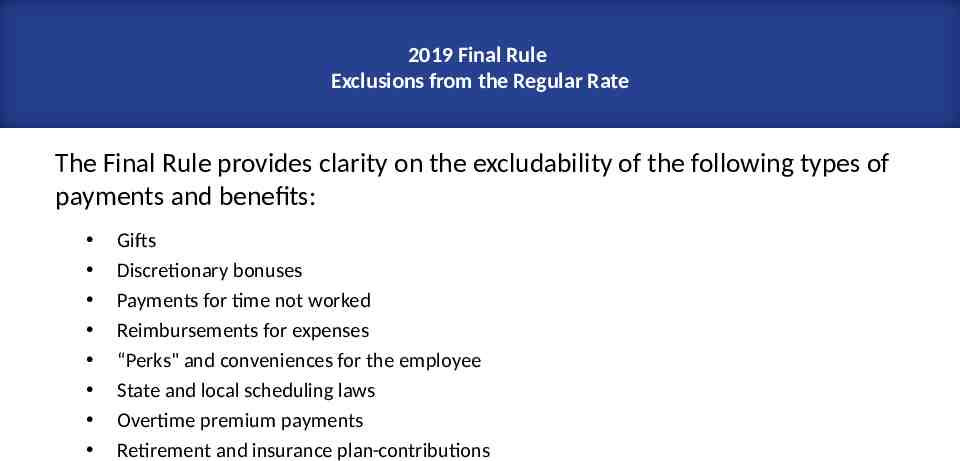

2019 Final Rule Exclusions from the Regular Rate The Final Rule provides clarity on the excludability of the following types of payments and benefits: Gifts Discretionary bonuses Payments for time not worked Reimbursements for expenses “Perks" and conveniences for the employee State and local scheduling laws Overtime premium payments Retirement and insurance plan contributions

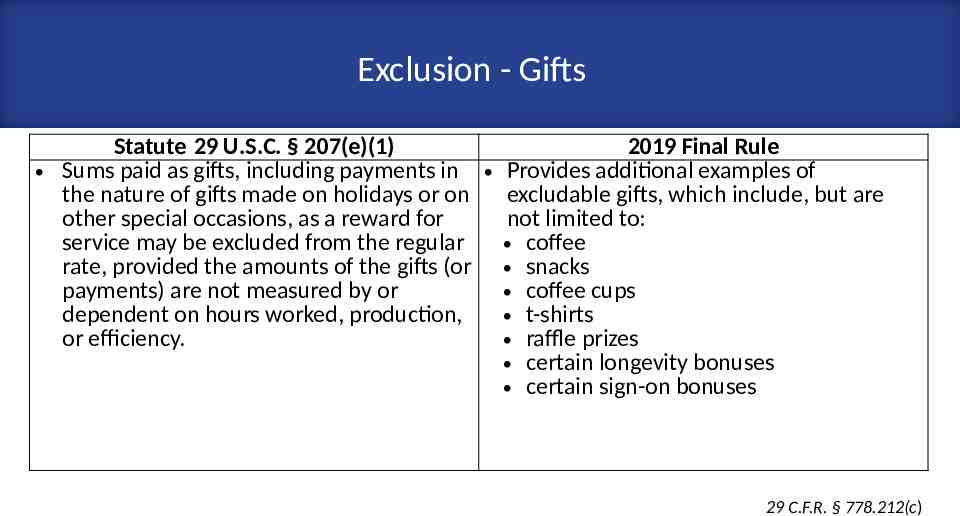

Exclusion - Gifts Statute 29 U.S.C. § 207(e)(1) 2019 Final Rule Sums paid as gifts, including payments in Provides additional examples of the nature of gifts made on holidays or on excludable gifts, which include, but are other special occasions, as a reward for not limited to: service may be excluded from the regular coffee rate, provided the amounts of the gifts (or snacks payments) are not measured by or coffee cups dependent on hours worked, production, t-shirts or efficiency. raffle prizes certain longevity bonuses certain sign-on bonuses 29 C.F.R. § 778.212(c)

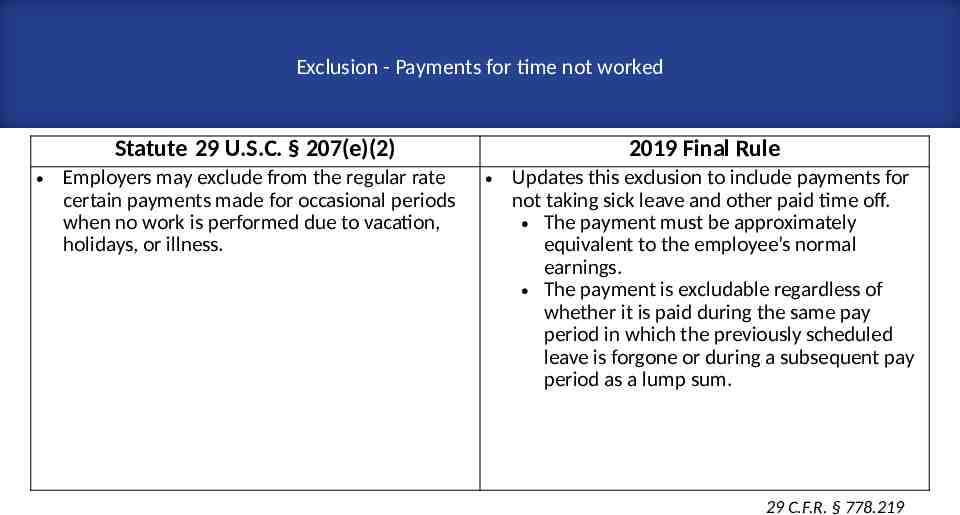

Exclusion - Payments for time not worked Statute 29 U.S.C. § 207(e)(2) Employers may exclude from the regular rate certain payments made for occasional periods when no work is performed due to vacation, holidays, or illness. 2019 Final Rule Updates this exclusion to include payments for not taking sick leave and other paid time off. The payment must be approximately equivalent to the employee’s normal earnings. The payment is excludable regardless of whether it is paid during the same pay period in which the previously scheduled leave is forgone or during a subsequent pay period as a lump sum. 29 C.F.R. § 778.219

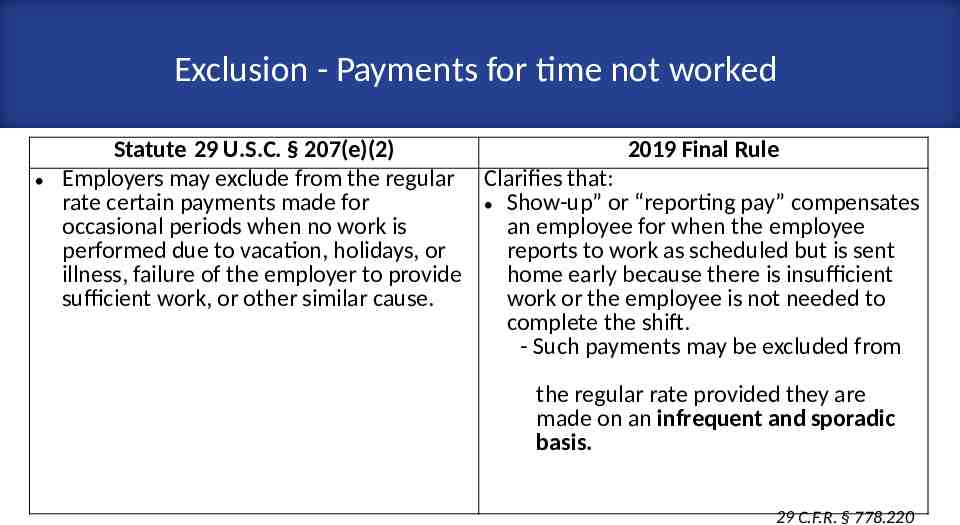

Exclusion - Payments for time not worked Statute 29 U.S.C. § 207(e)(2) 2019 Final Rule Employers may exclude from the regular Clarifies that: rate certain payments made for Show-up” or “reporting pay” compensates occasional periods when no work is an employee for when the employee performed due to vacation, holidays, or reports to work as scheduled but is sent illness, failure of the employer to provide home early because there is insufficient sufficient work, or other similar cause. work or the employee is not needed to complete the shift. - Such payments may be excluded from the regular rate provided they are made on an infrequent and sporadic basis. 29 C.F.R. § 778.220

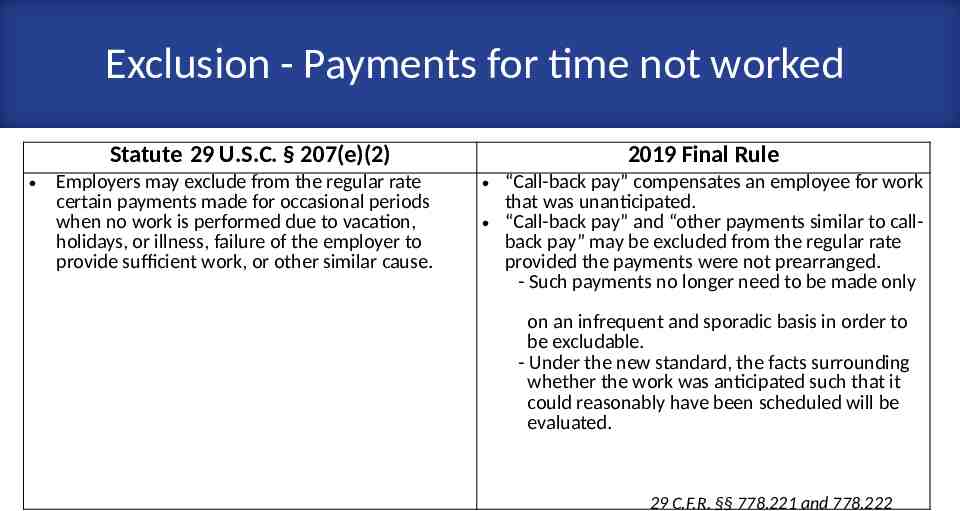

Exclusion - Payments for time not worked Statute 29 U.S.C. § 207(e)(2) Employers may exclude from the regular rate certain payments made for occasional periods when no work is performed due to vacation, holidays, or illness, failure of the employer to provide sufficient work, or other similar cause. 2019 Final Rule “Call-back pay” compensates an employee for work that was unanticipated. “Call-back pay” and “other payments similar to callback pay” may be excluded from the regular rate provided the payments were not prearranged. - Such payments no longer need to be made only on an infrequent and sporadic basis in order to be excludable. - Under the new standard, the facts surrounding whether the work was anticipated such that it could reasonably have been scheduled will be evaluated. 29 C.F.R. §§ 778.221 and 778.222

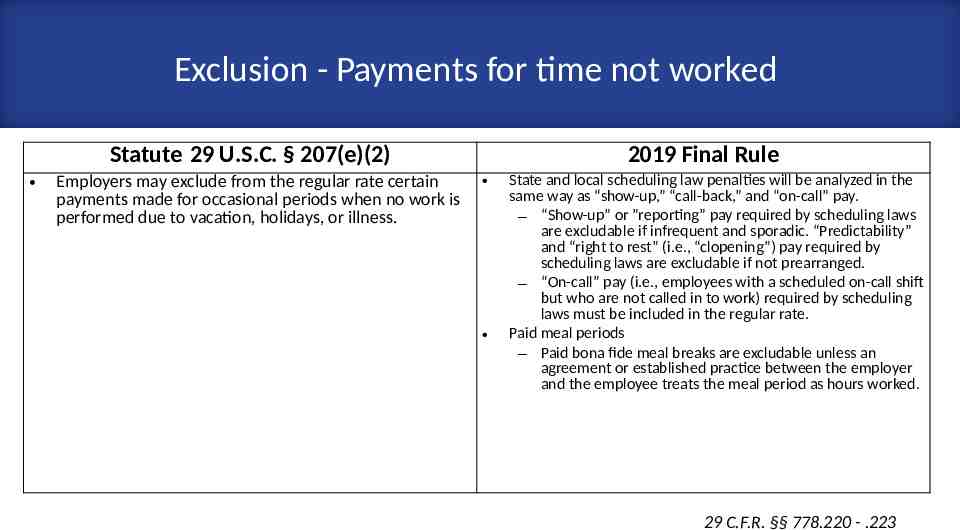

Exclusion - Payments for time not worked Statute 29 U.S.C. § 207(e)(2) Employers may exclude from the regular rate certain payments made for occasional periods when no work is performed due to vacation, holidays, or illness. 2019 Final Rule State and local scheduling law penalties will be analyzed in the same way as “show-up,” “call-back,” and “on-call” pay. – “Show-up” or ”reporting” pay required by scheduling laws are excludable if infrequent and sporadic. “Predictability” and “right to rest” (i.e., “clopening”) pay required by scheduling laws are excludable if not prearranged. – “On-call” pay (i.e., employees with a scheduled on-call shift but who are not called in to work) required by scheduling laws must be included in the regular rate. Paid meal periods – Paid bona fide meal breaks are excludable unless an agreement or established practice between the employer and the employee treats the meal period as hours worked. 29 C.F.R. §§ 778.220 - .223

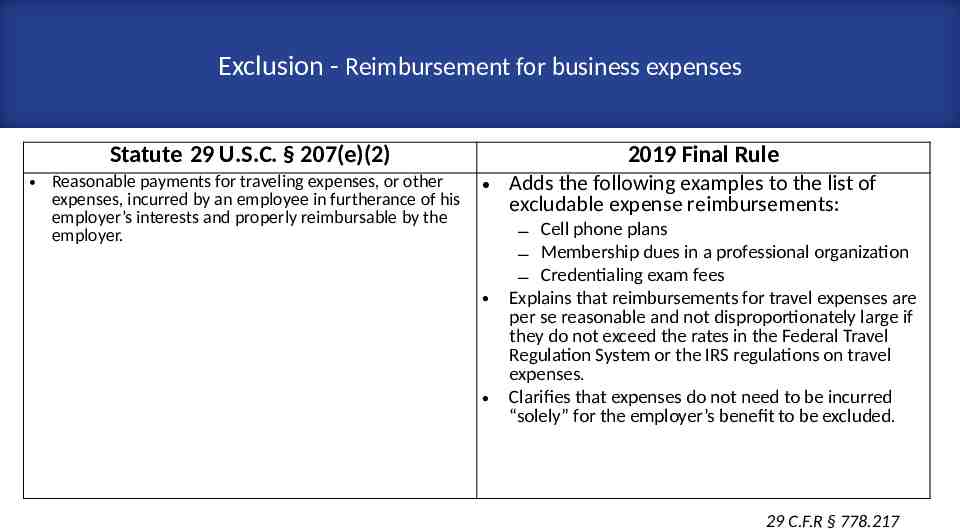

Exclusion - Reimbursement for business expenses Statute 29 U.S.C. § 207(e)(2) Reasonable payments for traveling expenses, or other expenses, incurred by an employee in furtherance of his employer’s interests and properly reimbursable by the employer. 2019 Final Rule Adds the following examples to the list of excludable expense reimbursements: – Cell phone plans – Membership dues in a professional organization – Credentialing exam fees Explains that reimbursements for travel expenses are per se reasonable and not disproportionately large if they do not exceed the rates in the Federal Travel Regulation System or the IRS regulations on travel expenses. Clarifies that expenses do not need to be incurred “solely” for the employer’s benefit to be excluded. 29 C.F.R § 778.217

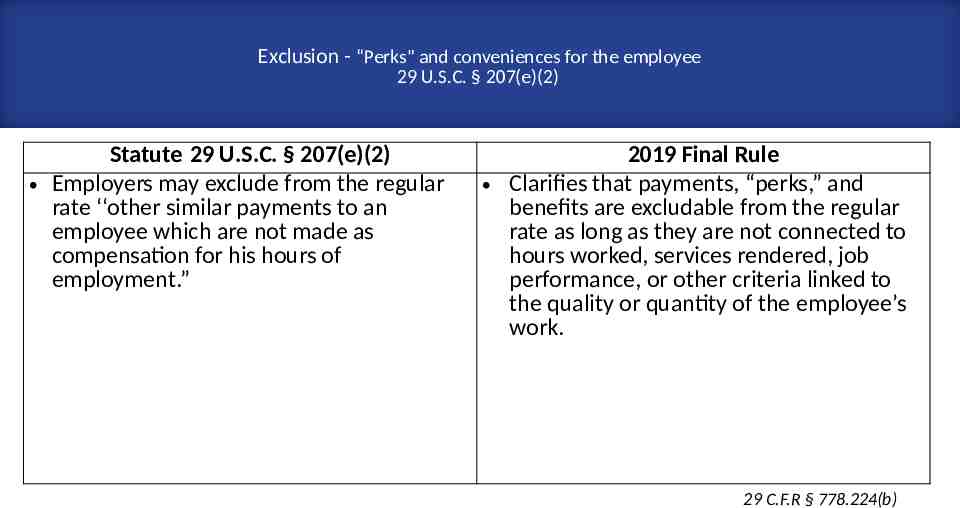

Exclusion - “Perks" and conveniences for the employee 29 U.S.C. § 207(e)(2) Statute 29 U.S.C. § 207(e)(2) Employers may exclude from the regular rate ‘‘other similar payments to an employee which are not made as compensation for his hours of employment.” 2019 Final Rule Clarifies that payments, “perks,” and benefits are excludable from the regular rate as long as they are not connected to hours worked, services rendered, job performance, or other criteria linked to the quality or quantity of the employee’s work. 29 C.F.R § 778.224(b)

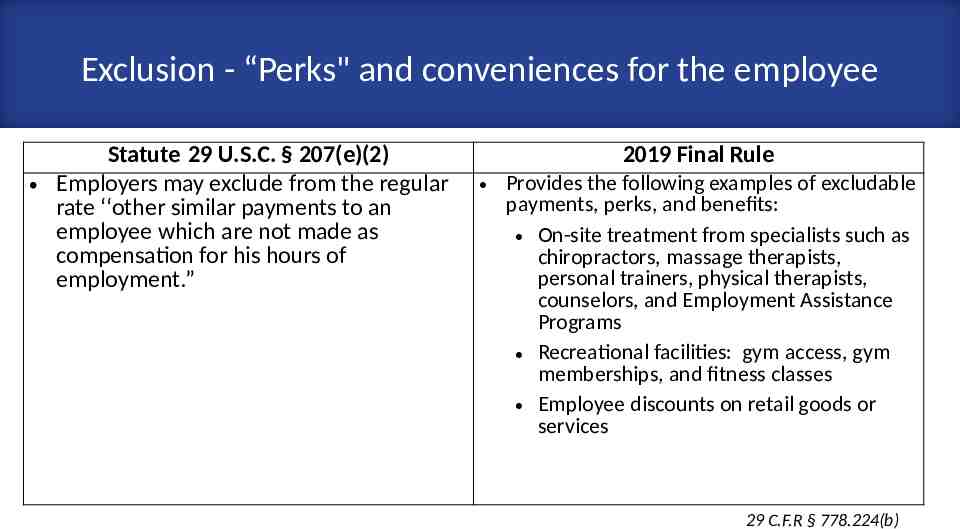

Exclusion - “Perks" and conveniences for the employee Statute 29 U.S.C. § 207(e)(2) Employers may exclude from the regular rate ‘‘other similar payments to an employee which are not made as compensation for his hours of employment.” 2019 Final Rule Provides the following examples of excludable payments, perks, and benefits: On-site treatment from specialists such as chiropractors, massage therapists, personal trainers, physical therapists, counselors, and Employment Assistance Programs Recreational facilities: gym access, gym memberships, and fitness classes Employee discounts on retail goods or services 29 C.F.R § 778.224(b)

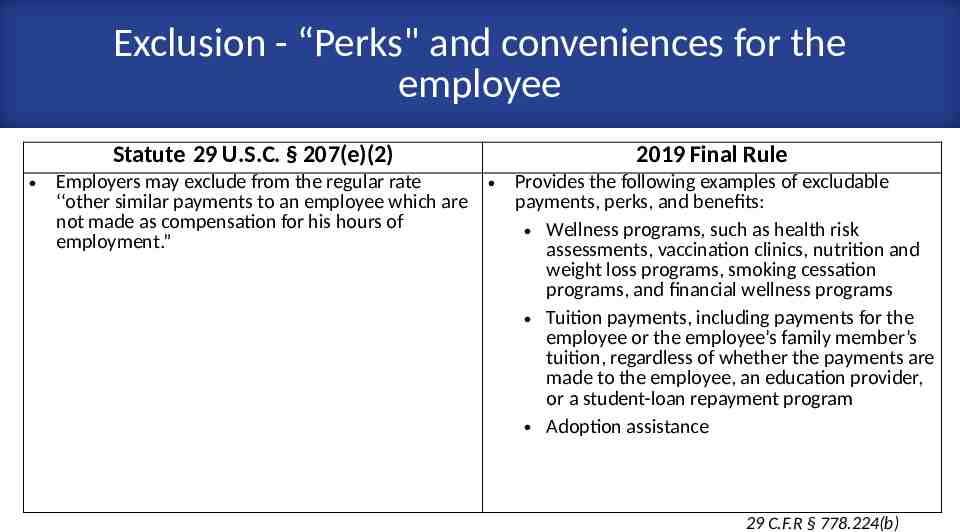

Exclusion - “Perks" and conveniences for the employee Statute 29 U.S.C. § 207(e)(2) 2019 Final Rule Employers may exclude from the regular rate ‘‘other similar payments to an employee which are not made as compensation for his hours of employment.” Provides the following examples of excludable payments, perks, and benefits: Wellness programs, such as health risk assessments, vaccination clinics, nutrition and weight loss programs, smoking cessation programs, and financial wellness programs Tuition payments, including payments for the employee or the employee’s family member’s tuition, regardless of whether the payments are made to the employee, an education provider, or a student-loan repayment program Adoption assistance 29 C.F.R § 778.224(b)

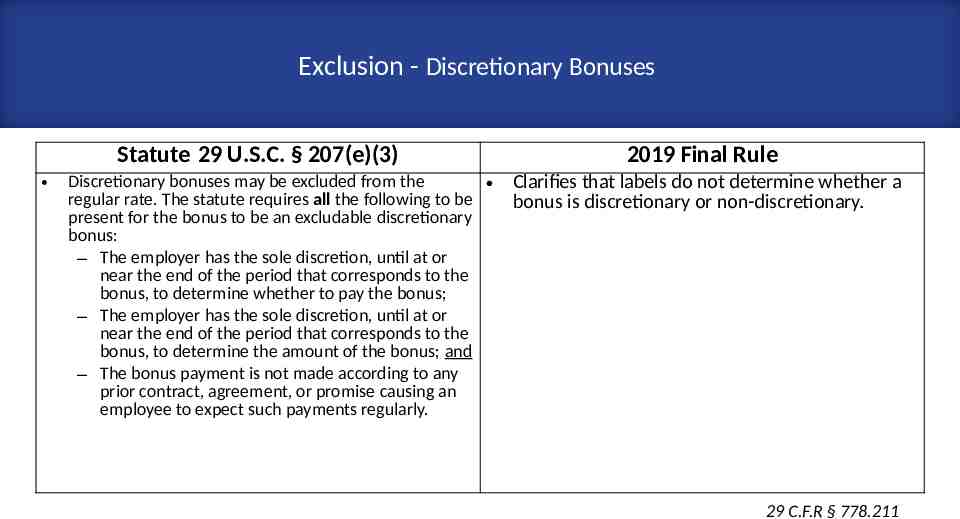

Exclusion - Discretionary Bonuses Statute 29 U.S.C. § 207(e)(3) Discretionary bonuses may be excluded from the regular rate. The statute requires all the following to be present for the bonus to be an excludable discretionary bonus: – The employer has the sole discretion, until at or near the end of the period that corresponds to the bonus, to determine whether to pay the bonus; – The employer has the sole discretion, until at or near the end of the period that corresponds to the bonus, to determine the amount of the bonus; and – The bonus payment is not made according to any prior contract, agreement, or promise causing an employee to expect such payments regularly. 2019 Final Rule Clarifies that labels do not determine whether a bonus is discretionary or non-discretionary. 29 C.F.R § 778.211

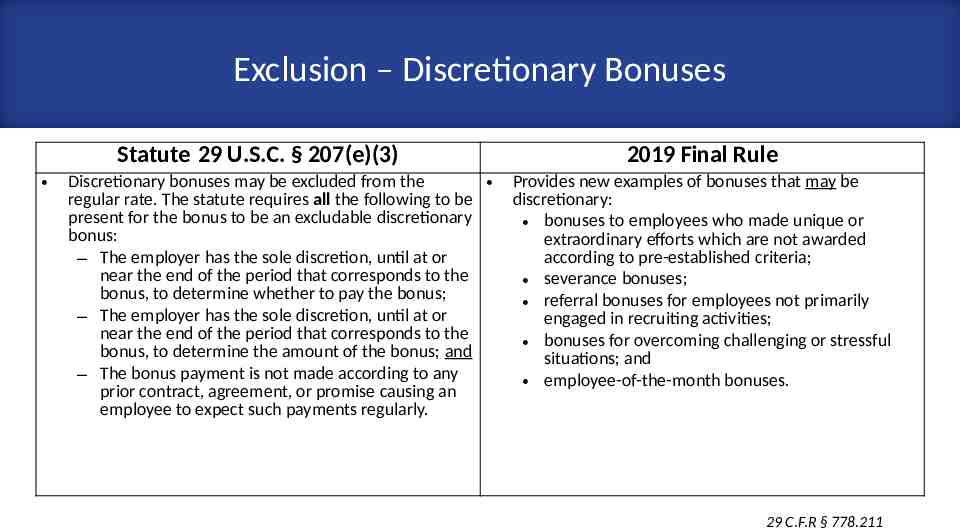

Exclusion – Discretionary Bonuses Statute 29 U.S.C. § 207(e)(3) Discretionary bonuses may be excluded from the regular rate. The statute requires all the following to be present for the bonus to be an excludable discretionary bonus: – The employer has the sole discretion, until at or near the end of the period that corresponds to the bonus, to determine whether to pay the bonus; – The employer has the sole discretion, until at or near the end of the period that corresponds to the bonus, to determine the amount of the bonus; and – The bonus payment is not made according to any prior contract, agreement, or promise causing an employee to expect such payments regularly. 2019 Final Rule Provides new examples of bonuses that may be discretionary: bonuses to employees who made unique or extraordinary efforts which are not awarded according to pre-established criteria; severance bonuses; referral bonuses for employees not primarily engaged in recruiting activities; bonuses for overcoming challenging or stressful situations; and employee-of-the-month bonuses. 29 C.F.R § 778.211

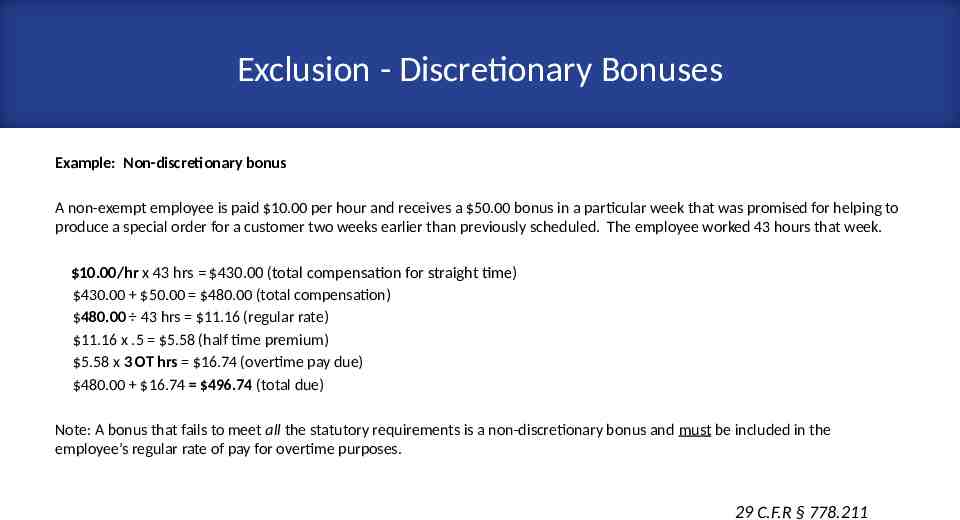

Exclusion - Discretionary Bonuses Example: Non-discretionary bonus A non-exempt employee is paid 10.00 per hour and receives a 50.00 bonus in a particular week that was promised for helping to produce a special order for a customer two weeks earlier than previously scheduled. The employee worked 43 hours that week. 10.00/hr x 43 hrs 430.00 (total compensation for straight time) 430.00 50.00 480.00 (total compensation) 480.00 43 hrs 11.16 (regular rate) 11.16 x .5 5.58 (half time premium) 5.58 x 3 OT hrs 16.74 (overtime pay due) 480.00 16.74 496.74 (total due) Note: A bonus that fails to meet all the statutory requirements is a non-discretionary bonus and must be included in the employee’s regular rate of pay for overtime purposes. 29 C.F.R § 778.211

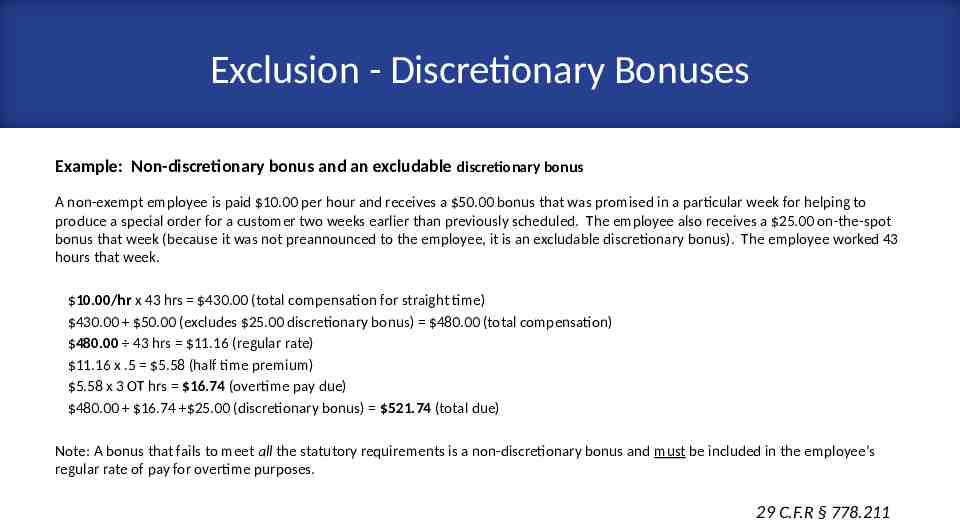

Exclusion - Discretionary Bonuses Example: Non-discretionary bonus and an excludable discretionary bonus A non-exempt employee is paid 10.00 per hour and receives a 50.00 bonus that was promised in a particular week for helping to produce a special order for a customer two weeks earlier than previously scheduled. The employee also receives a 25.00 on-the-spot bonus that week (because it was not preannounced to the employee, it is an excludable discretionary bonus). The employee worked 43 hours that week. 10.00/hr x 43 hrs 430.00 (total compensation for straight time) 430.00 50.00 (excludes 25.00 discretionary bonus) 480.00 (total compensation) 480.00 43 hrs 11.16 (regular rate) 11.16 x .5 5.58 (half time premium) 5.58 x 3 OT hrs 16.74 (overtime pay due) 480.00 16.74 25.00 (discretionary bonus) 521.74 (total due) Note: A bonus that fails to meet all the statutory requirements is a non-discretionary bonus and must be included in the employee’s regular rate of pay for overtime purposes. 29 C.F.R § 778.211

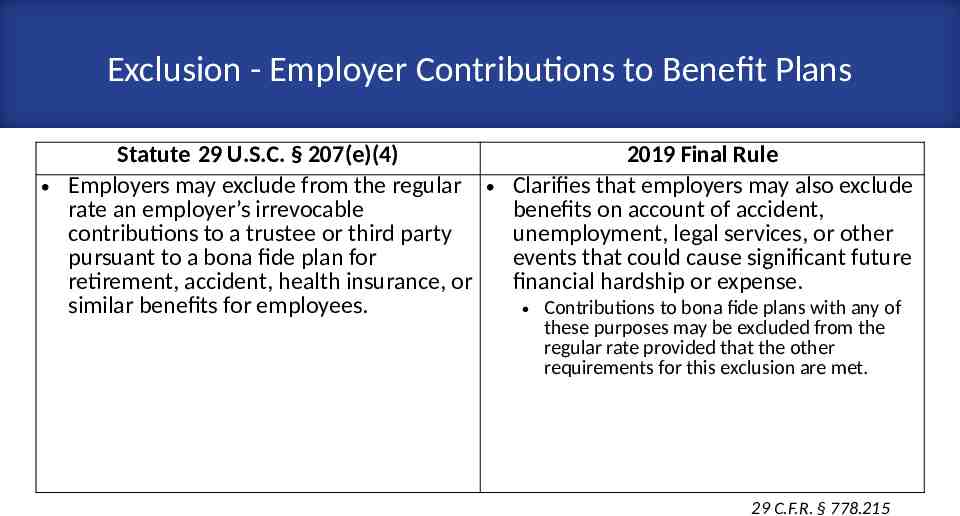

Exclusion - Employer Contributions to Benefit Plans Statute 29 U.S.C. § 207(e)(4) 2019 Final Rule Employers may exclude from the regular Clarifies that employers may also exclude rate an employer’s irrevocable benefits on account of accident, contributions to a trustee or third party unemployment, legal services, or other pursuant to a bona fide plan for events that could cause significant future retirement, accident, health insurance, or financial hardship or expense. similar benefits for employees. Contributions to bona fide plans with any of these purposes may be excluded from the regular rate provided that the other requirements for this exclusion are met. 29 C.F.R. § 778.215

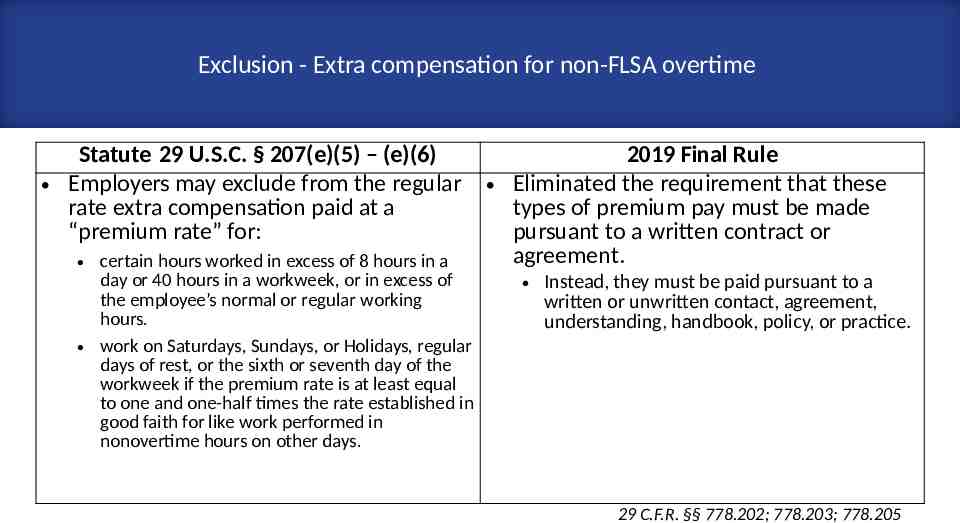

Exclusion - Extra compensation for non-FLSA overtime Statute 29 U.S.C. § 207(e)(5) – (e)(6) Employers may exclude from the regular rate extra compensation paid at a “premium rate” for: certain hours worked in excess of 8 hours in a day or 40 hours in a workweek, or in excess of the employee’s normal or regular working hours. work on Saturdays, Sundays, or Holidays, regular days of rest, or the sixth or seventh day of the workweek if the premium rate is at least equal to one and one-half times the rate established in good faith for like work performed in nonovertime hours on other days. 2019 Final Rule Eliminated the requirement that these types of premium pay must be made pursuant to a written contract or agreement. Instead, they must be paid pursuant to a written or unwritten contact, agreement, understanding, handbook, policy, or practice. 29 C.F.R. §§ 778.202; 778.203; 778.205

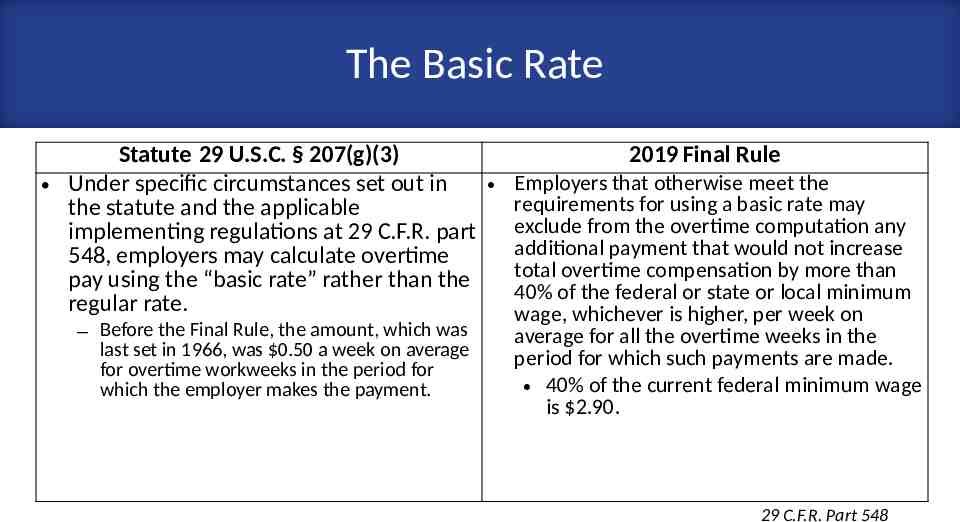

The Basic Rate Statute 29 U.S.C. § 207(g)(3) 2019 Final Rule Employers that otherwise meet the Under specific circumstances set out in requirements for using a basic rate may the statute and the applicable exclude from the overtime computation any implementing regulations at 29 C.F.R. part additional payment that would not increase 548, employers may calculate overtime total overtime compensation by more than pay using the “basic rate” rather than the 40% of the federal or state or local minimum regular rate. wage, whichever is higher, per week on – Before the Final Rule, the amount, which was last set in 1966, was 0.50 a week on average for overtime workweeks in the period for which the employer makes the payment. average for all the overtime weeks in the period for which such payments are made. 40% of the current federal minimum wage is 2.90. 29 C.F.R. Part 548

Conclusion The 2019 Final Rule: Addresses changes in employer-provided benefits and “perks.” Updates current regulations to specifically name some of the expanded employer-provided benefits and “perks.” Incorporates expanded benefits and “perks” in the regulations that correspond to the FLSA’s statutory exemptions. Eliminates a number of regulatory restrictions. Encourages employers to provide more benefits to their employees without uncertainty regarding what may be excluded from the regular rate.

2019 Final Rule Public Resources WHD website at: https://www.dol.gov/agencies/whd/overtime/2019-regular-rate The 2019 Final Rule in its entirety can be found at: https:// www.federalregister.gov/documents/2019/12/16/2019-26447/regular-rate-under-t he-fair-labor-standards-act The 56 Series Fact Sheets can be found at: https:// www.dol.gov/agencies/whd/fact-sheets Contact Local WHD Offices at 1-866-4-US-WAGE