Everything you wanted to know about Stochastic Trading …but

29 Slides718.39 KB

Everything you wanted to know about Stochastic Trading but were afraid to ask By Ken Hodor 8/18/10

Disclaimer Please realize your mileage may vary. These results are only for instructional purposes

Only Indicators Required Market direction up/down/sideways Trigger to get you in Trigger to get you out

Market Direction Moving Average Support / resistance Trendline (my personal favorite) – Connecting simple low or high – Regression channel KMovingAverage (my souped-up version)

Various Entry Triggers Stochastic Wilder RSI Williams %R Woodies CCI kStochastic Souped-up version by Hodorific

Exit Triggers Stochastic Adaptive Moving Average with Stochastic – Allows you to stay in the trade much longer Breaks through trendline (break trend) – Allows us to trade above this emergency stop

Compare Triggers

What Are Stochastics? The ratio of the distance between the close and the lowest low to the total range – Lowest price over past bars—call this LL – Highest price over past bars—call this HH – What is the closing price relative to these values? – Stochastic (Close – LowestLow)/(HighestHighLowestLow)

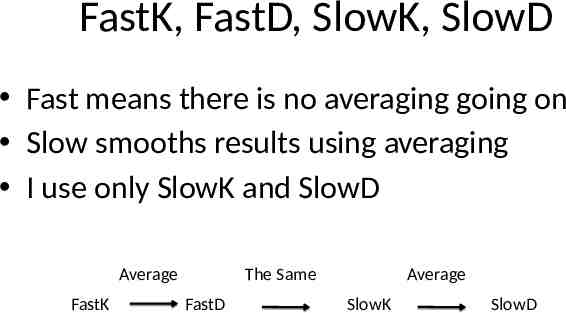

FastK, FastD, SlowK, SlowD Fast means there is no averaging going on Slow smooths results using averaging I use only SlowK and SlowD Average FastK The Same FastD Average SlowK SlowD

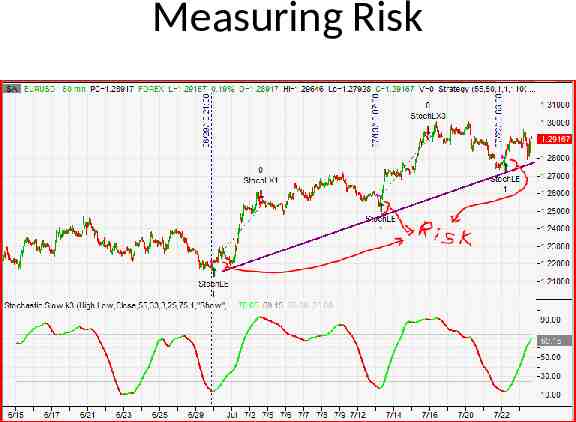

Measured Risk After a buy signal, measure the distance to your emergency exit trendline.

Measuring Risk

Subtleties of Stochastics Divergence – Stochastic usually correct – Price capitulates and follows Stochastic lead Phantom buys – Stochastic changes Red to Green just below 50% Greater risk but many times worth the gain.

Price Stochastic Divergence

Phantom Buys

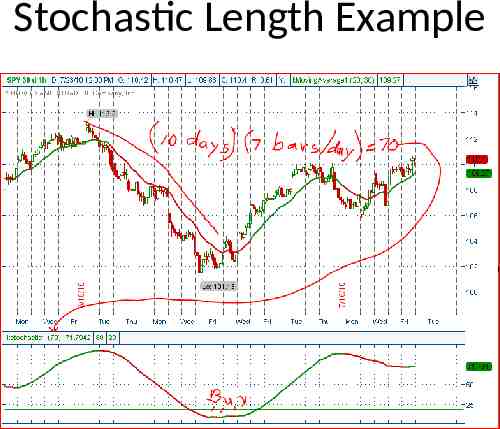

How to choose Stochastic Length? Decide the cycles you would like to catch – Buy at low point – Sell at high point Count number of bars from top to bottom – Use the center of rounded top – Use the center of rounded bottom Enter this number in kStochastic and Voila!

Stochastic Length Example

How to use Kstochastic on TOS? Enter an Indicator/Study – First import kStochastic1 – Insert Study in your chart Entering a Stochastic Alert – Type it in or cut and paste – Subsequently click on old alert Entering an “automated” Stochastic Buy – Type it in or cut and paste

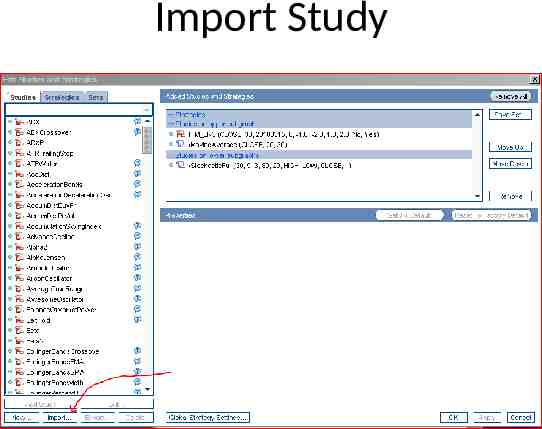

Import Study

Load Study

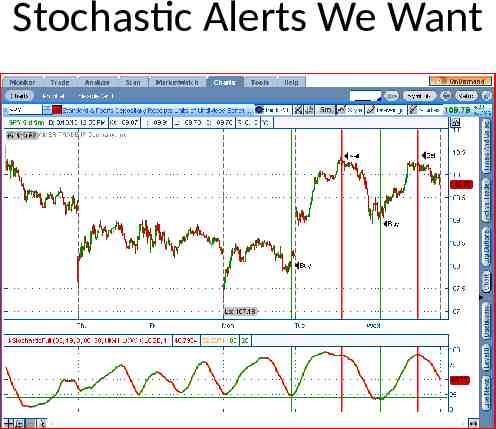

Stochastic Alerts We Want

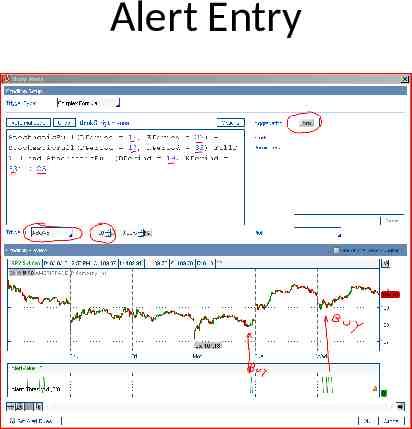

Alert Entry

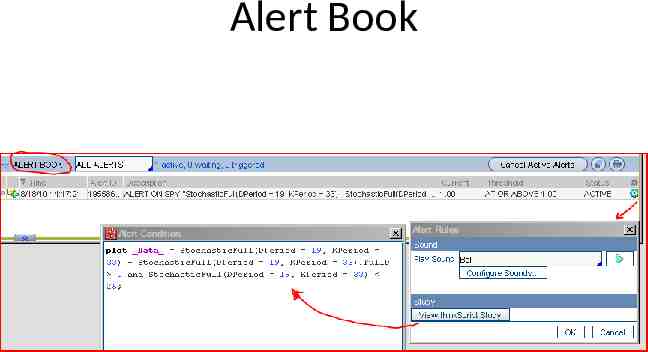

Alert Book

For The Advanced Auto-Trading Don’t miss opportunities Autotrading eliminates emotion It brings with it a new concern of turning over control to your computer This does not use TOS Prodigio

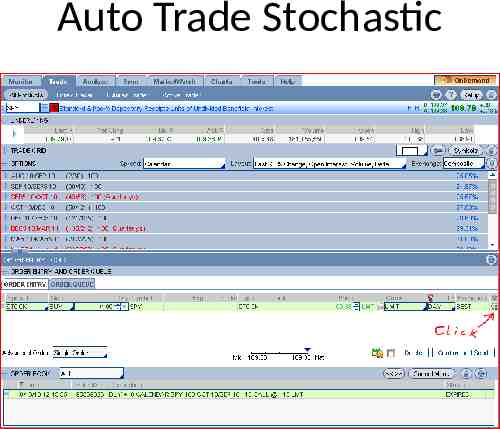

Auto Trade Stochastic

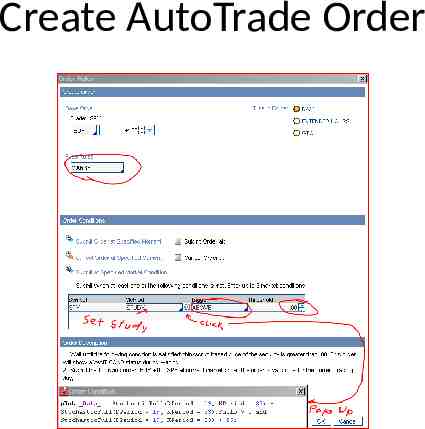

Create AutoTrade Order

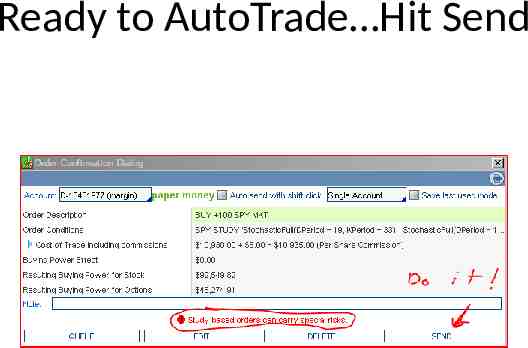

Ready to AutoTrade Hit Send

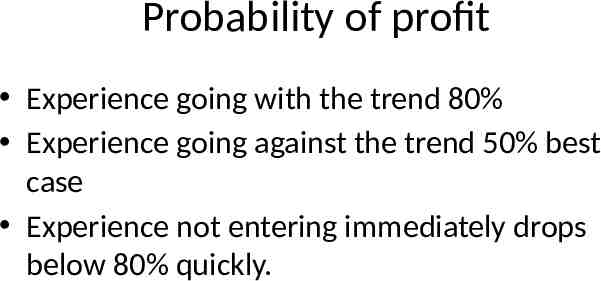

Probability of profit Experience going with the trend 80% Experience going against the trend 50% best case Experience not entering immediately drops below 80% quickly.

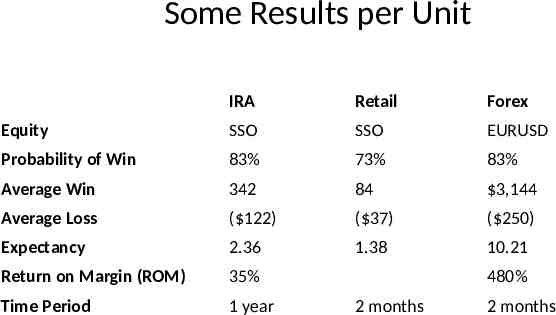

Some Results per Unit IRA Retail Forex Equity SSO SSO EURUSD Probability of Win 83% 73% 83% Average Win 342 84 3,144 Average Loss ( 122) ( 37) ( 250) Expectancy 2.36 1.38 10.21 Return on Margin (ROM) 35% Time Period 1 year 480% 2 months 2 months

Summary of What We Covered What is the Stochastic? When to use it? Why you might want to use it? How to use it on TOS for: – Discretionary trading as an Indicator – As an Alerts – AutoTrading