DISCUSSION SOME PROVISION OF COMPANIES AMENDMENT ACT 2017 FCS

13 Slides145.04 KB

DISCUSSION SOME PROVISION OF COMPANIES AMENDMENT ACT 2017 FCS Rajiv Bajaj Central Council MemberICSI Sr. Associate Director – Panasonic AVC Networks

Amendment in Section 42 and 62 of companies act 2013

Amendment in Section 42 Limit of the Person to whom offer to be made: The Private Placement offer shall be only made to the selected group of persons who have been identified by the board namely IdentifiedPersons which shall not exceed50 and not more than 200 people as per Rule 14 of Companies (Prospectus and Allotment of Securities) Rules, 2014 but the limit of 200 people shall not includethe following persons in a financial year: Qualified Institutional Buyer Employees offered securities under Employees Stock Option Scheme To Whom Offer to be made Private Placement offer shall be made to Identified Persons as decided by the Board and whose name and addresses are recorded by the Company. Right to Renounce Private Placement offer does not carry the right to Renunciation which means that when a particular person denies or rejects to subscribe shares and transfer the right to subscribe shares to another person. Ways of Payment to Subscribe Shares under Private Placement: Subscription money shall be paid either by: Cheque OR Demand Draft OR Other Banking Channels But Cash not to be used as mode of payment to subscribe shares Utilization of Allotment Money Company shall not utilize the funds raised through Private Placement until the return of allotment through filing ofForm PAS-3 with the Registrar. Fresh Offer under Private Placement No fresh offer shall be made unless allotment with regard to the earlier offer has been completed or that particular offer has been withdrawn by the Company.

Maximum Number of Offers There are no restrictions on the number of offers to be made in a financial Year subject to that number of people to whom the offer is to be made should not be more than 200 people. Time limit for Allotment of Securities Following are the time limits which includes both When Company is able to allot its Securities and Vice versa: Company shall allot its Securities within 60 days from the date of receiving the application money. If Company is not able to allot its securities within 60days, then Company shall return the application money as received within 15 days from the expiry of 60 days. If Still the Company is not able to repay the application money within 15 days then Company is liable to repay the money along with the interest of 12% Per annum from the expiry of 60 days. Separate Bank Account Money received on application to be kept in a Separate Bank Account and further, to be only used for Allotment or its Repayment. No use of Distribution Channels No Company shall release any advertisements, marketing, or Distribution channels or Agents or Media in order to inform the public at large about the Securities offered under Private Placement. Return of Allotment When a Company makes allotment of Securities, it shall file the return of allotment within 15 days of allotment which includes the list of allottee along with their Names, Addresses and Securities which are allotted. Note: If a Company fails to file Return of Allotment within 15 days as prescribed, then both Promoters and Directors are liable to a penalty of One Thousand Rupees for each day till the default continues but not exceeding Rs. 25 Lakh. Penal Provision If a Company makes an offer to the limit beyond as defined under Section 42 of the Companies Act, 2013 i.e. 200 people then, The Company, Promoters of the Company AND Directors of the Company Shall be liable to a penalty which involves the amount raised through Private placement OR Two Crore Rupees, Which is lower.

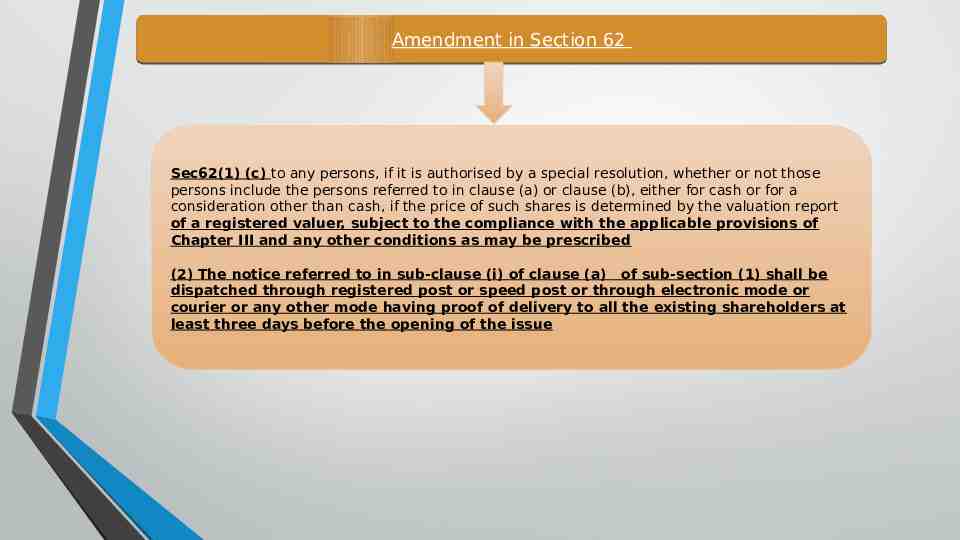

Amendment in Section 62 Sec62(1) (c) to any persons, if it is authorised by a special resolution, whether or not those persons include the persons referred to in clause (a) or clause (b), either for cash or for a consideration other than cash, if the price of such shares is determined by the valuation report of a registered valuer, subject to the compliance with the applicable provisions of Chapter III and any other conditions as may be prescribed (2) The notice referred to in sub-clause (i) of clause (a) of sub-section (1) shall be dispatched through registered post or speed post or through electronic mode or courier or any other mode having proof of delivery to all the existing shareholders at least three days before the opening of the issue

Connectivity Between Section 10, 42 and 62 Amendment

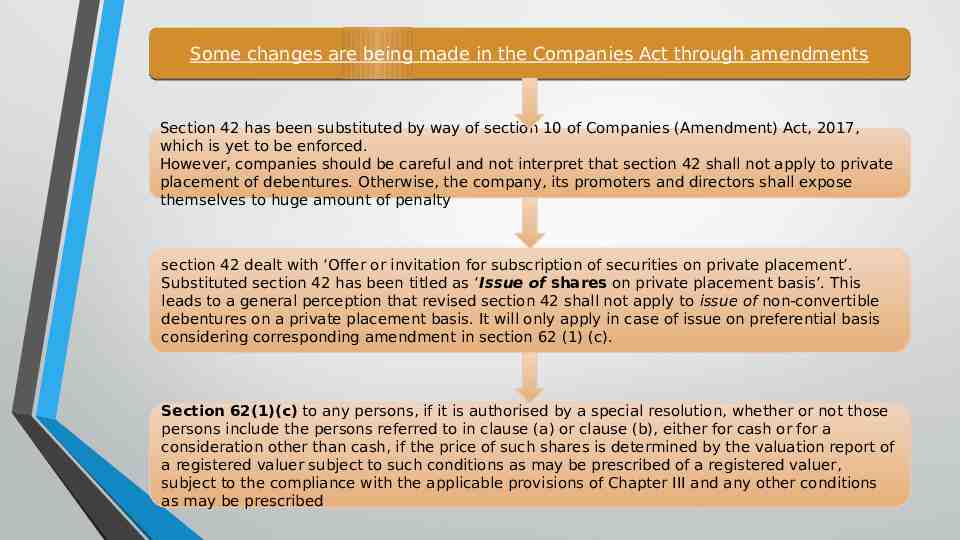

Some changes are being made in the Companies Act through amendments Section 42 has been substituted by way of section 10 of Companies (Amendment) Act, 2017, which is yet to be enforced. However, companies should be careful and not interpret that section 42 shall not apply to private placement of debentures. Otherwise, the company, its promoters and directors shall expose themselves to huge amount of penalty section 42 dealt with ‘Offer or invitation for subscription of securities on private placement’. Substituted section 42 has been titled as ‘Issue of shares on private placement basis’. This leads to a general perception that revised section 42 shall not apply to issue of non-convertible debentures on a private placement basis. It will only apply in case of issue on preferential basis considering corresponding amendment in section 62 (1) (c). Section 62(1)(c) to any persons, if it is authorised by a special resolution, whether or not those persons include the persons referred to in clause (a) or clause (b), either for cash or for a consideration other than cash, if the price of such shares is determined by the valuation report of a registered valuer subject to such conditions as may be prescribed of a registered valuer, subject to the compliance with the applicable provisions of Chapter III and any other conditions as may be prescribed

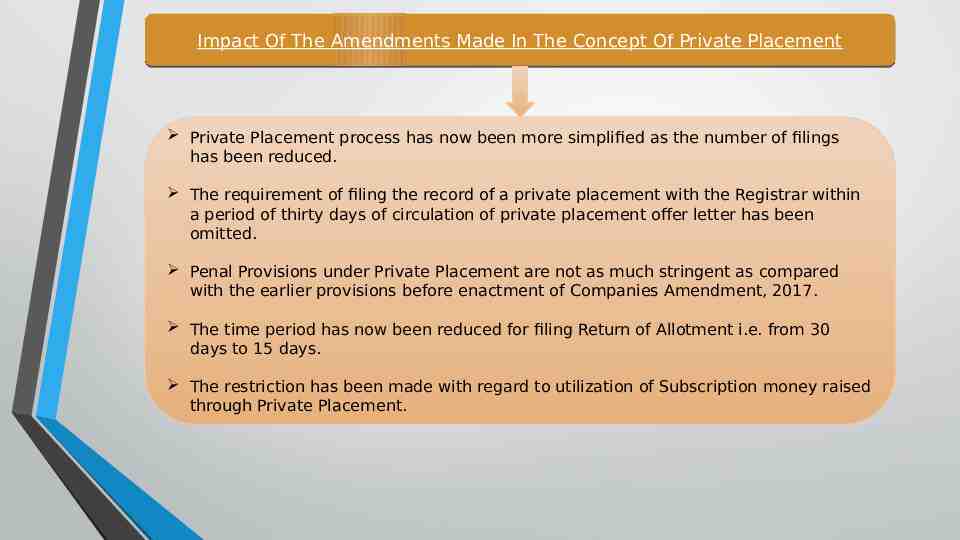

Impact Of The Amendments Made In The Concept Of Private Placement Private Placement process has now been more simplified as the number of filings has been reduced. The requirement of filing the record of a private placement with the Registrar within a period of thirty days of circulation of private placement offer letter has been omitted. Penal Provisions under Private Placement are not as much stringent as compared with the earlier provisions before enactment of Companies Amendment, 2017. The time period has now been reduced for filing Return of Allotment i.e. from 30 days to 15 days. The restriction has been made with regard to utilization of Subscription money raised through Private Placement.

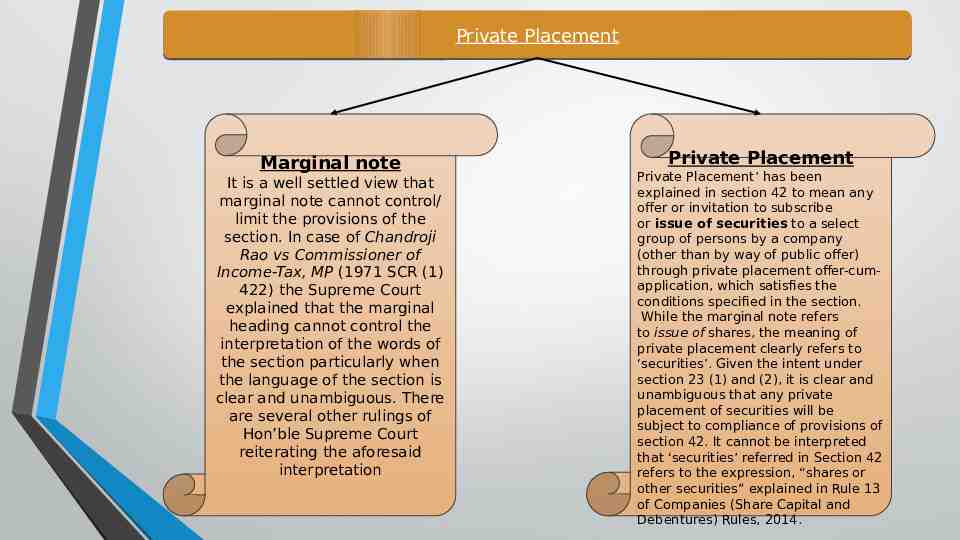

Private Placement Marginal note It is a well settled view that marginal note cannot control/ limit the provisions of the section. In case of Chandroji Rao vs Commissioner of Income-Tax, MP (1971 SCR (1) 422) the Supreme Court explained that the marginal heading cannot control the interpretation of the words of the section particularly when the language of the section is clear and unambiguous. There are several other rulings of Hon’ble Supreme Court reiterating the aforesaid interpretation Private Placement Private Placement’ has been explained in section 42 to mean any offer or invitation to subscribe or issue of securities to a select group of persons by a company (other than by way of public offer) through private placement offer-cumapplication, which satisfies the conditions specified in the section. While the marginal note refers to issue of shares, the meaning of private placement clearly refers to ‘securities’. Given the intent under section 23 (1) and (2), it is clear and unambiguous that any private placement of securities will be subject to compliance of provisions of section 42. It cannot be interpreted that ‘securities’ referred in Section 42 refers to the expression, “shares or other securities” explained in Rule 13 of Companies (Share Capital and Debentures) Rules, 2014.

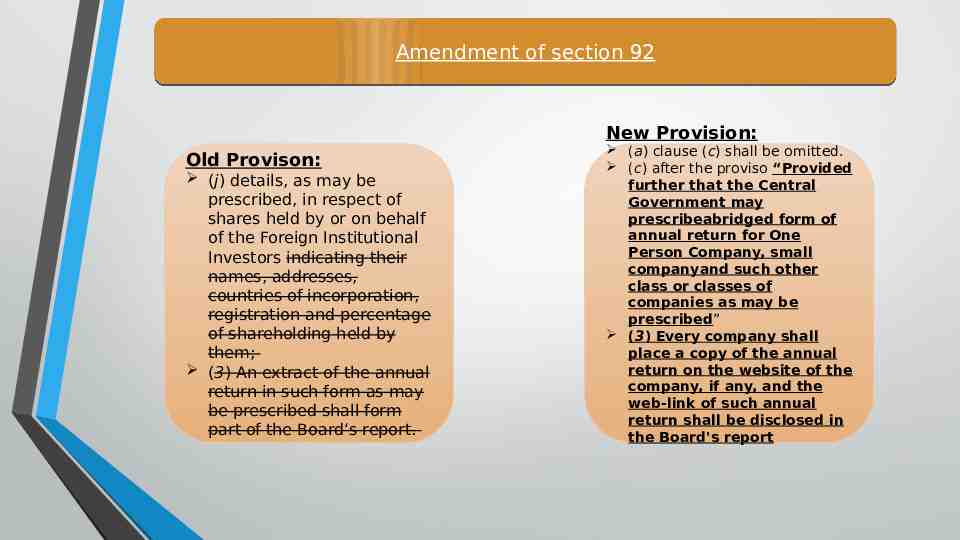

Amendment of section 92

Amendment of section 92 New Provision: Old Provison: (j) details, as may be prescribed, in respect of shares held by or on behalf of the Foreign Institutional Investors indicating their names, addresses, countries of incorporation, registration and percentage of shareholding held by them; (3) An extract of the annual return in such form as may be prescribed shall form part of the Board‘s report. (a) clause (c) shall be omitted. (c) after the proviso “Provided further that the Central Government may prescribeabridged form of annual return for One Person Company, small companyand such other class or classes of companies as may be prescribed” (3) Every company shall place a copy of the annual return on the website of the company, if any, and the web-link of such annual return shall be disclosed in the Board's report

Annual Return It is proposed to omit the requirement of MGT-9 i.e. extract of annual return to form part of the Board’s Report. Instead, the copy of annual return shall be uploaded on the website of the company, if any, and its link shall be disclosed in the Board’s report. The Central Government may prescribe abridged form of annual return for One Person Company (‘OPC’), Small Company and such other class or classes of companies as may be prescribed It is also proposed to omit the requirement related to disclosing indebtedness and details with respect to name, address, country of incorporation etc. of FII in the annual return of the company. Time limit of 270 days within which annual return could be filed on payment of additional fee has been done away with. It is proposed that a company can file the annual return with ROC at any time on payment of prescribed additional fee

Content of Annual Return Annual return is a detailed document in electronic form which contains the relevant data of the company in respect of one financial year and the same is prepared for the purpose of filing with the Registrar in terms of Section 92 of the Act. Some of the particulars of the return includes Basic details like CIN, registered office address, email-id, principal business activities, share capital and indebtness; Names of the holding, subsidiary and associate companies; Date of Annual General Meeting (‘AGM’); Turnover and net worth; Details of KMP and directors and remuneration drawn by them, Meeting details; Penalty, punishments, etc