Customer engagement: worldwide market shares 2019 Customer engagement:

62 Slides3.39 MB

Customer engagement: worldwide market shares 2019 Customer engagement: worldwide market shares 2019 John Abraham

Customer engagement: worldwide market shares 2019 2 About this report This report provides market share data for communications service provider (CSP) spending on customer engagement software systems and related services for 2019. It provides details of how the spending varied by delivery model, service type, vendor and region. The report also includes profiles of the leading vendors in the market. It is based on several sources, including: interviews with CSPs and vendors worldwide Analysys Mason’s research conducted during the past year. GE OGRAPHICAL COVERAGE Worldwide Central and Eastern Europe Developed Asia–Pacific Emerging Asia–Pacific Latin America Middle East and North Africa North America Sub-Saharan Africa Western Europe SUB-SEGMENT COVERAGE Engagement platforms Sales Marketing Customer service KEY QUE STIONS ANSWERE D IN T HIS REPO RT W HO SHOUL D READ T HIS REPO RT What was the overall size of the market (customer engagement software systems for the telecoms industry) and what drove this spending among CSPs? How did the spending vary across different sub-segments of the customer engagement market? Who are the major vendors and what is their share of revenue in the customer engagement systems market? What are the different drivers and growth rates of CSP spending on products, product-related services and professional services? Vendor strategy teams that need to understand where growth is slowing and where it is increasing across different sub-segment categories. Product management teams responsible for feature functionality and geographical focus, and product marketing teams responsible for market-share growth. Market intelligence teams at vendors that want to understand how their competitors compare to each other. CSPs that are planning digital transformation journeys and want to ensure that their current vendors are staying up to date.

Customer engagement: worldwide market shares 2019 Contents Executive summary Market shares Overall telecoms market context Vendor analysis Market definition About the author and Analysys Mason

Customer engagement: worldwide market shares 2019 4 Digital channels are increasingly replacing traditional channels as CSPs’ investments in the customer engagement segment become more product-centred The customer engagement systems market grew by 0.3% worldwide in 2019, and this segment remains an area of strategic focus for CSPs. The market for customer engagement-related products grew by 5.4%, while that for professional services declined by 1.8%. This points to a shift from customised, services-heavy investments to spending on productised and standardised software systems. CSPs are continuing to dramatically reduce legacy customer engagement costs by increasing automation and using AI-based tools. The digitisation of customer touchpoints was a priority in 2019 as CSPs continued to promote digital engagements over human interactions. There are three key benefits of digital engagements from a CSP perspective: better customer experience and loyalty, lower cost of operations and improved public perception. The productisation of the engagement platform sub-segment continued in 2019; CSPs invested in building engagement frameworks that are cheaper to maintain and more-flexible in order to support future applications. CSPs’ investments in sales-related functions grew by 1.8%, but at a slower pace than in the past. Emerging enterprise opportunities remain a key driver for new spending. CSP spending on customer service (the largest subsegment by revenue) continues to decline, mainly Figure 1: Key pain-points that are driving CSPs to invest in digital engagement channels Limited selfcare capabilities High support costs Most self-care functions are quite basic, not selfcontained and incapable of driving deeper engagement with customers CSPs have large callcentre operations (outsourced or directly owned) that are expensive to run and impact margins Complex architecture frameworks Most incumbent systems are complex, disparate monoliths that slow down CSPs’ response to market Source: Analysys Mason changes

Customer engagement: worldwide market shares 2019 5 5G has had limited impact on consumer telecoms systems, but remains an important influencer of CSP spending on enterprise experience functions 5G had a limited direct impact on CSP spending on customer engagement functions in 2019. This is because the initial wave of 5G applications and use cases are expected to be consumer-focused, and CSPs are already in the process of digitising their engagement channels and customer service functions. However, 5G is influencing how CSPs are investing in customer engagement functions for new enterprise opportunities. This was an area of intense interest and discussion in 2019, but it only accounted for a small fraction of the overall spend in this segment. CSPs are investing to expand their capabilities around key functions in the enterprise customer engagement space. Figure 2 shows the top five enterprise-related functions that CSPs are investing in. The following two factors will influence 5G-related CSP spending on digital engagement systems for enterprises. CSPs are learning how to efficiently deliver value to enterprises from digital companies and are adopting their best practices. As a result, they are evaluating applications even from non-telecoms vendors and are favouring a software-centred, digital-only, pay-as-you-grow approach to new deployments. CSPs need sales processes that are largely automated in order to effectively serve small and Figure 2: Key enterprise functions and capabilities that CSPs are investing in CRM To improve customer understanding, management and service CPQ To simplify ordering, accelerate time to market and lower the cost of sales AI and automation To drive deeper insights and improve process automation to reduce operating costs Product catalogue To effectively and swiftly support emerging 5G-enabled business models Ecosystem enablers To seamlessly support new partner services and multi-dimensional value chains Source: Analysys Mason

Customer engagement: worldwide market shares 2019 6 SaaS has become the default delivery model for customer engagement functions Software-as-a-service (SaaS) has become the default delivery model for the majority of new deployments in this segment. A key driver of this is the widespread adoption of SaaS-based digital engagement functions in other industries. The growing ubiquity of Salesforce’s solutions, especially among CSPs in developed markets, is another factor that has made SaaS commonplace. SaaS is an important part of CSPs’ digital transformation initiatives. CSPs are increasingly willing to change process flows and organisation structures in order make better use of SaaS models. The lower cost of ownership and pre-defined annual payments help to build the support for SaaS among CSP finance teams; they have previously been hesitant about this delivery model because it shifts investments from capex to opex. The SaaS model will significantly reduce the overall CSP spending on customer engagement in the long term thanks to cuts in support, maintenance and other legacy system spending. Customer engagement functions are not considered to be mission-critical (as is the case for monetisation functions), so it is more common for SaaS-based applications to be used to support core functions and business cases in this segment. Public cloud deployments remain the popular choice, but some SaaS deployments continue to use vendor-owned private infrastructure. Figure 3: Key benefits of SaaS delivery models Key benefits of SaaS delivery models Source: Analysys Mason

Customer engagement: worldwide market shares 2019 Key recommendations 1 2 3 Software vendors should increase their visibility as end-to-end support providers for CSPs’ mobile-first and digital-only customer engagement strategies. CSPs are experimenting with and adopting a number of changes to their digital engagement channels. These include redesigning their mobile apps, introducing virtual assistants and trialling VR applications. The lack of end-to-end support from telecoms-focused vendors when adopting leading-edge customer engagement functions is forcing CSPs to look to other verticals for inspiration and support. Vendors should provide the option to use a SaaS delivery model for their customer engagement solutions. SaaS has become the default delivery model for customer experience functions. Indeed, SaaS is likely to become an essential pre-requisite for new deployments in this segment in the medium term. Vendors should prioritise and call attention to their enterprise experience strategies. CSPs are expected to make considerable investments in enterprise experience functions in the short-to-medium term. These systems are expected to become an essential ingredient in CSPs’ future operating frameworks. Telecoms vendors should partner with providers of enterprise functions or invest in developing appropriate expertise and solutions to pursue the enterprise customer engagement market. 7

Customer engagement: worldwide market shares 2019 Contents Executive summary Market shares Overall telecoms market context Vendor analysis Market definition About the author and Analysys Mason

Customer engagement: worldwide market shares 2019 9 Customer engagement revenue market share Figure 4: Customer engagement total revenue by type, worldwide, 2019 Figure 5: Customer engagement total revenue by vendor, worldwide, 2019 1 PRODUCT 9% 6% 6% 35% Total 2019: 5% USD14.3 billion Year-on-year growth: 65% 5% 0.3% 65% 53272% PROFESSIO NAL SERVICES Source: Analysys Mason Salesforce Accenture Other vendors include Atento, Huawei, Netcracker, Nokia and Teleperformance. We have revised the 2018 customer engagement revenue for Atento and Nokia based on new information and guidance provided. 1 Amdocs IBM Oracle Other Convergys Source: Analysys Mason

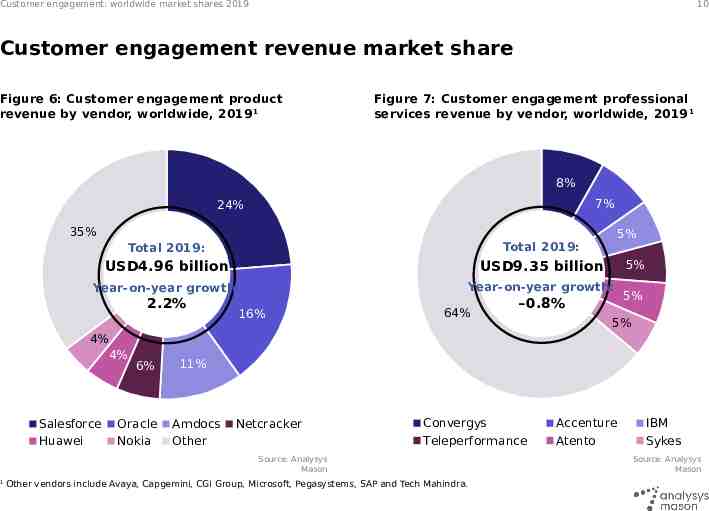

Customer engagement: worldwide market shares 2019 10 Customer engagement revenue market share Figure 6: Customer engagement product revenue by vendor, worldwide, 2019 1 Figure 7: Customer engagement professional services revenue by vendor, worldwide, 2019 1 8% 7% 24% 35% 5% Total 2019: Total 2019: USD4.96 billion USD9.35 billion Year-on-year growth: Year-on-year growth: 2.2% –0.8% 16% 64% 5% 5% 5% 4% 4% Salesforce Huawei 6% Oracle Nokia 11% Amdocs Other Netcracker Convergys Teleperformance Source: Analysys Mason 1 Other vendors include Avaya, Capgemini, CGI Group, Microsoft, Pegasystems, SAP and Tech Mahindra. Accenture Atento IBM Sykes Source: Analysys Mason

Customer engagement: worldwide market shares 2019 11 Engagement platforms product revenue market share Figure 8: Engagement platforms product revenue by vendor, worldwide, 2019 1 34% Total 2019: USD1.09 billion Year-on-year growth: 3% 3% 5% Salesforce Huawei 20% 10% 5% Year-on-year growth 2.1% 0% 14% Amdocs Nokia Oracle Other Netcracker -5% 0 50 100 150 200 250 300 Revenue (USD million) Source: Analysys Mason 1 Year-on-year revenue growth 15% 22% 2.1% Figure 9: Product revenue and growth of topsix vendors compared to overall product revenue growth in the engagement platforms 20% 2019 market, Other vendors include Avaya, Genesys, Microsoft, Pegasystems and SAP. Source: Analysys Mason

Customer engagement: worldwide market shares 2019 12 Engagement platforms professional services revenue market share Figure 10: Engagement platforms professional services revenue by vendor, worldwide, 2019 1 Figure 11: Professional services revenue and growth of top-six vendors compared to overall professional services revenue growth in the 3% engagement platforms market, 2019 2% 9% Total 2019: 5% USD2.04 billion 5% Year-on-year growth: 61% –0.1% 5% 5% Year-on-year revenue growth 9% 1% 0% Year-on-year growth – 0.1% -1% -2% -3% Accenture CGI Group Amdocs Atento Convergys Other Huawei -4% 0 40 60 80 100 120 140 160 180 200 Revenue (USD million) Source: Analysys Mason 1 20 Other vendors include Capgemini, IBM, Nokia, Sykes, Tech Mahindra and Teleperformance. Source: Analysys Mason

Customer engagement: worldwide market shares 2019 13 Sales product revenue market share Figure 12: Sales product revenue by vendor, worldwide, 2019 1 Figure 13: Product revenue and growth of topsix vendors compared to overall product revenue growth in the sales market, 2019 20% 15% Year-on-year revenue growth 22% 31% Total 2019: USD1.55 billion 6% Year-on-year growth: 3.9% 6% 6% 9% Salesforce Netcracker Oracle Other 22% Amdocs SAP Huawei 5% Year-on-year growth 3.9% 0% -5% 0 50 100 150 200 250 300 350 400 450 500 Revenue (USD million) Source: Analysys Mason 1 10% Other vendors include Hansen Technologies, IBM, Microsoft, Pegasystems and Tieto. Source: Analysys Mason

Customer engagement: worldwide market shares 2019 14 Sales professional services revenue market share Figure 14: Sales professional services revenue by vendor, worldwide, 2019 1 Figure 15: Professional services revenue and growth of top-six vendors compared to overall professional services revenue growth in the 4% sales market, 2019 6% 5% Total 2019: USD2.29 billion Year-on-year growth: 0.3% 4% 3% 3% 69% Accenture Convergys Atento Amdocs IBM Other CGI Group 2% Year-on-year growth 0.3% 0% -2% -4% 0 50 100 150 200 250 300 Revenue (USD million) Source: Analysys Mason 1 Year-on-year revenue growth 9% Other vendors include Capgemini, Huawei, Netcracker, Tech Mahindra and Tieto. Source: Analysys Mason

Customer engagement: worldwide market shares 2019 15 Marketing product revenue market share Figure 16: Marketing product revenue by vendor, worldwide, 2019 1 Figure 17: Product revenue and growth of topsix vendors compared to overall product revenue growth in the marketing market, 2019 14% 12% 15% Total 2019: Year-on-year revenue growth 42% 10% 15% USD767 million Year-on-year growth: 1.9% 10% 4% Oracle Amdocs 7% Salesforce Huawei 7% 6% 4% 2% Year-on-year growth 1.9% 0% -2% -4% Netcracker Other SAP -6% 0 20 40 60 80 100 120 140 160 180 200 Revenue (USD million) Source: Analysys Mason 1 8% Other vendors include Asiainfo, Comarch, IBM, Nokia and Pegasystems. Source: Analysys Mason

Customer engagement: worldwide market shares 2019 16 Marketing professional services revenue market share Figure 18: Marketing professional services revenue by vendor, worldwide, 2019 1 Figure 19: Professional services revenue and growth of top-six vendors compared to overall professional services revenue growth in the 6% marketing market, 2019 5% 15% USD858 million 12% 55% Year-on-year growth: 1.3% 6% 5% 4% 3% Year-on-year revenue growth Total 2019: 4% 3% 2% Year-on-year growth 1.3% 1% 0% -1% -2% IBM Accenture CGI Group Nokia Netcracker Other Huawei -3% 0 40 60 80 100 120 140 160 180 200 Revenue (USD million) Source: Analysys Mason 1 20 Other vendors include Amdocs, Capgemini, SAP, Tata Consultancy Services and Tech Mahindra. Source: Analysys Mason

Customer engagement: worldwide market shares 2019 17 Customer service product revenue market share Figure 20: Customer service product revenue by vendor, worldwide, 2019 1 Figure 21: Product revenue and growth of topsix vendors compared to overall product revenue growth in the customer service 12% 2019 market, 22% 37% Total 2019: USD1.56 billion Year-on-year growth: 0.8% 4% Salesforce Netcracker 4% 13% 10% 9% Oracle Huawei 8% 6% 4% 2% Year-on-year growth 0.8% 0% Nokia Other Amdocs -2% 0 50 100 150 200 250 300 350 400 Revenue (USD million) Source: Analysys Mason 1 Year-on-year revenue growth 10% Other vendors include Avaya, CSG International, Genesys, SAP and Sicap. Source: Analysys Mason

Customer engagement: worldwide market shares 2019 18 Customer service professional services revenue market share Figure 22: Customer service professional services revenue by vendor, worldwide, 2019 1 Figure 23: Professional services revenue and growth of top-six vendors compared to overall professional services revenue growth in the 3% service market, 2019 customer 2% Year-on-year revenue growth 14% 9% Total 2019: USD4.16 billion 54% Year-on-year growth: 8% –2.0% 6% 4% Convergys IBM 5% Teleperformance TeleTech 1% 0% -1% -3% -4% Sykes Other Atento -5% 0 Source: Analysys Mason 1 Year-on-year growth – 2.0% -2% Other vendors include Accenture, Amdocs, Capgemini CGI Group, Nokia and Tech Mahindra. 100 200 300 400 500 600 Revenue (USD million) Source: Analysys Mason

Customer engagement: worldwide market shares 2019 Contents Executive summary Market shares Overall telecoms market context Vendor analysis Market definition About the author and Analysys Mason

Customer engagement: worldwide market shares 2019 Overall telecoms services: revenue split and trends for regional markets Figure 24: Share of worldwide USD1.578 trillion telecoms service revenue and trends by region, 2019 NORTH AMERICA 32% WESTERN EUROPE 19% Fixed and mobile data service revenue growth will drive the total telecoms revenue growth. 5G take-up is expected to grow rapidly as 5G coverage improves and spectrum becomes available. Fixed broadband household penetration will continue to grow in all countries. The adoption of 5G will have a small impact on mobile revenue. LATIN AMERICA 6% SUB-SAHARAN AFRICA 2% Growth in fixed broadband, mobile handset and pay-TV revenue will drive overall growth. Investments in mobile and fixed infrastructure will increase. 5G will be launched in 2021. Mobile services will continue to generate the vast majority of telecoms revenue. Rapid handset data revenue growth drive the overall telecoms revenue growth. CENTRAL AND EASTERN EUROPE 5% Mobile handset data and fixed broadband are the largest areas for revenue growth. Operators will continue to invest in improving LTE network coverage and speeds. MIDDLE EAST AND NORTH AFRICA 4% Fixed broadband revenue growth will offset the decline in traditional voice services revenue. Spending on improving mobile data speeds and coverage will increase. DEVELOPED ASIA– PACIFIC 12% Revenue growth will be driven by demand for gigabit access speeds. The growing demand for 5G services and their rapid take-up will limit mobile ARPU decline. EMERGING ASIA– PACIFIC 20% Pay-TV revenue will grow sharply, driven by improved internet coverage and speeds. The mobile penetration rate is expected to grow strongly Analysys Mason in countries Source: with low starting bases.

Customer engagement: worldwide market shares 2019 21 Overall telecoms services: regional service breakouts Figure 25: Metrics for the eight regions modelled individually and worldwide, 2019 Telecoms revenue North America Latin America Western Europe Central and Eastern Europe Developed Asia–Pacific Emerging Asia–Pacific Middle East and North Africa Sub-Saharan Africa Worldwide Fixed Mobile broadban SIM d populatio populatio n n penetrati penetrati on2 on3 Populatio n (million)1 GDP (USD billio n)1 GDP per capita (USD thousand)1 367.6 651.1 422.5 23 172 5 285 17 714 63.0 8.1 41.9 202.3 48.6 114.8 3.4 0.6 2.2 192.8 32.8 99.8 102.6 14.5 76.9 106.2% 101.9% 122.6% 34.6% 13.4% 39.1% 407.9 4 473 11.0 39.4 0.9 16.6 14.8 132.9% 22.3% 247.0 4072.7 9 775 20 773 39.6 5.1 102.4 218.6 1.3 5.4 48.6 64.1 42.3 28.5 130.7% 96.4% 34.9% 12.6% 459.5 3 639 7.9 42.6 0.4 12.4 9.6 107.8% 7.5% 1123.7 1 726 86 556 1.5 32.1 0.3 4.0 2.7 76.9% 0.5% 11.2 800.9 14.5 471.2 291.8 99.6% 14.3% 7751.9 Mobile (USD billio n) IoT Consumer Business fixed fixed (USD billio (USD billio (USD billio n) n) n) Macroeconomic and general regional factors (such as population) provide significant context for the telecoms revenue figures that we track in the Analysys Mason DataHub. The availability of fixed broadband services remains limited in Latin America, emerging Asia–Pacific, the Middle East and North Africa and Sub-Saharan Africa because of the costs associated with infrastructure deployment and the low GDP per capita, both of which limit service affordability. Mobile SIM penetration in Sub-Saharan Africa is growing steadily, but remains considerably lower than 100% (it is close to, or above, 100% elsewhere). Almost 50 operators worldwide launched 5G services in 2019, and many more are preparing to do the same in 2020. Many 5G launches are associated with improved network capacity and data speeds, and several CSPs initially offered 5G in the form of fixed-wireless access broadband. CSPs in North America and developed Asia–Pacific are leading the 5G race, but those in emerging regions such as China are also 1 Population and GDP data is from the Economist Intelligence Unit. The rest of the data are from Analysys movingDataHub. quickly. Mason’s 2 3 Excludes IoT SIMs. Total fixed broadband connections (including business) expressed as a share of population.

Customer engagement: worldwide market shares 2019 22 Overall telecoms services: regional service comparison Figure 26: Overall telecoms revenue by region and service type, 2019 600 Total revenue (USD billion) 500 400 300 200 100 0 Business fixed Consumer fixed IoT Mobile Source: Analysys Mason

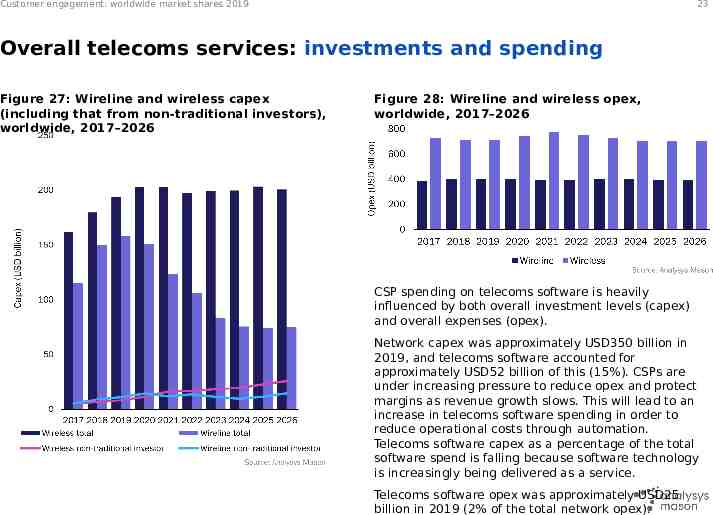

Customer engagement: worldwide market shares 2019 23 Overall telecoms services: investments and spending Figure 27: Wireline and wireless capex (including that from non-traditional investors), worldwide, 2017–2026 Figure 28: Wireline and wireless opex, worldwide, 2017–2026 CSP spending on telecoms software is heavily influenced by both overall investment levels (capex) and overall expenses (opex). Network capex was approximately USD350 billion in 2019, and telecoms software accounted for approximately USD52 billion of this (15%). CSPs are under increasing pressure to reduce opex and protect margins as revenue growth slows. This will lead to an increase in telecoms software spending in order to reduce operational costs through automation. Telecoms software capex as a percentage of the total software spend is falling because software technology is increasingly being delivered as a service. Telecoms software opex was approximately USD25 billion in 2019 (2% of the total network opex).

Customer engagement: worldwide market shares 2019 24 Overall telecoms services: key industry drivers Figure 29: key drivers of the telecoms software and services industry Driver Key elements 5G Cloud Moving current payloads to public cloud Cloud-native development Cloud technology for telecoms networks Platform data services/AI Edge computing Cloud is disrupting the way in which all industries work, including telecoms. The biggest near-term issue is moving existing payloads to the cloud. However, there is a greater emphasis on using software offered as a service, generally in the public cloud and for new cloud-native development, including of the network itself. Enterprise services SD-WAN IoT ecosystems Cloud IT services Enterprise digital experience/self service Private 5G CSPs are placing a greater emphasis on making money from enterprise services. There are a range of drivers including cloud IT services and IoT. SDWAN provides lower costs and faster deployments, thereby enabling new use cases. Enterprises now expect self-service through a digital experience. Digital transformatio n Digital experience Automated customer journeys Cloud-loop automation/lower TCO Use of cloud services/SaaS Culture change (to be like cloud providers) The telecoms industry has been pushing digital transformation for some time and is now getting significant pay-off. Nearly all CSPs have deployed and are improving digital customer channels. Increased levels of automation lower network operational costs. All this has been made possible by underlying changes to enable the use of cloud methods and more cloud services. Network disaggregatio n Impact of virtual networks Infrastructure capex changes Infrastructure as real estate Cell densification Private 5G Digital transformation has led to network disaggregation. The full vertical integration of networks and services is no longer necessary nor always efficient. Investors such as towercos, fibrecos and hosting centres provide wholesale access to fundamental infrastructure used by many retail service providers. Converged core Cloud RAN Infrastructure investments Network slicing Optimising capex/opex Discussion Investment in 5G is the biggest single factor driving the telecoms software and services industry. Such investments drive software spending for the network itself, for network orchestration and automation and for improvements to OSS and BSS.

Customer engagement: worldwide market shares 2019 Contents Executive summary Market shares Overall telecoms market context Vendor analysis Market definition About the author and Analysys Mason

Customer engagement: worldwide market shares 2019 CUSTOMER ENGAGEMENT Accenture www.accenture.com Founded PRODUCTS AND SERVICES Accenture offers a range of services to the telecoms sector, including strategy and business consulting, outsourced operations and systems integration services. Its digital customer interaction services help CSPs to personalise customer interactions across all channels using analytics and content management capabilities. It is supporting CSP clients in digital transformation projects for business support systems in order to deliver user-level engagement in an omnichannel environment. Analysys Mason Limited 2020 1989 Accenture is a global professional services firm that offers consulting and NBED operational services to multiple sectors, including banking, retail and telecoms. Key Key relationships relationships NBED Nokia NBED Oracle NBED SAP Dublin (HQ) STRATEGY Territory Worldwide Products It will enhance its services offerings to support CSPs’ initiatives to become digital service providers. Channels The company will continue to expand and build relationships with established and upcoming software vendors. ANALYSIS Accenture is highly regarded for its technology transformation, organisation change and digital experience expertise. The company has a wellentrenched presence in digital transformation projects at multiple Tier-1 CSPs. It has partnerships with leading customer engagement product vendors including Nokia, Oracle, Salesforce and SAP. However, many product vendors are beginning to offer services on their own – this may limit Accenture’s ability to use vendor partnerships to access CSPs. In addition, SaaS deployments, which require limited professional services support, are increasing.

Customer engagement: worldwide market shares 2019 CUSTOMER ENGAGEMENT Amdocs www.amdocs.com Founded 1982 PRODUCTS AND SERVICES Amdocs DigitalONE is a Amdocs is a leading software products and services company that NBED specialises in BSS for the telecoms, media and entertainment industries. cloud-native platform that provides commerce and care functions across any channel. The platform is open, modular and built microservices. DigitalONE is part of the CES20 full BSS/OSS suite. Amdocs CatalogONE is a cloud-native catalogue solution for BSS and OSS. Amdocs Optima is a digital BSS suite covering care, commerce, billing and charging that is targeted at Tier-2/3 CSPs and MVNOs. Amdocs provides professional services, mainly business consulting and managed services capabilities. Amdocs also offers MS360 as a microservices foundation to enable CSPs to own or co-develop DevOps applications. Analysys Mason Limited 2020 ANALYSIS Amdocs is wellentrenched with many large CSPs and is one of the leading vendors with an end-to-end BSS offering. It can be deployed as best of breed thanks to its modular framework. The company has a growing vendor-agnostic professional services base, which may be attractive to CSPs preparing for digital transformation. The company has improved its reach among Tier-3/4 CSPs and MVNOs with Amdocs Optima. Amdocs has also been growing inorganically in this segment and in the media vertical, with key acquisitions of companies such as Vubiquity, Vindicia, UXPsystems, projeckt202, Brite:bill and Pontis. Key Key relationships relationships NBED IBM NBED Adobe NBED AWS Chesterfield, MO (HQ) STRATEGY Territory Amdocs’s inorganic growth through acquisitions will provide it with expanded coverage in telecoms and media verticals worldwide. Products It will continue to enhance its product and services offerings to support telecoms and media digital transformation initiatives. Channels Amdocs is establishing a partner ecosystem that offers complementary capabilities. It will aim to use this network for new sales.

Customer engagement: worldwide market shares 2019 CUSTOMER ENGAGEMENT Ericsson www.ericsson.com Founded 1876 PRODUCTS AND SERVICES Ericsson’s device management product suite includes Enterprise Mobility Management, Automatic Device Configuration and Remote Device Manager. Device Connection Platform is cloud-based and focused on the M2M sector. It has a strong professional services portfolio in the telecoms sector, including supporting CSPs with systems integration and managed services. It added product catalogue and order orchestration products to its portfolio through the acquisition of ConceptWave. Analysys Mason Limited 2020 Ericsson is a major equipment, software and services company that serves NBED multiple industry verticals, including telecoms. Key Key relationships relationships NBED NBED IBM NBED TCS Stockholm (HQ) STRATEGY Territory Ericsson will continue to focus on growth in emerging markets and also large transformation projects. Products It will enhance its device management product capability and expand its coverage for customer engagement. Channels The company will continue to partner with vendors to enhance its customer engagement systems portfolio. ANALYSIS In January 2019, Ericsson restructured its digital BSS business at a cost of around USD687 million. The company has since announced a strategic shift in its digital BSS portfolio, with a greater focus on a phased approach to digital transformation. Ericsson continues to have a strong brand, worldwide channel coverage and wellregarded managed services expertise. The company is wellpositioned in large endto-end transformations that include network components. Ericsson’s customer engagement capability is heavily partner-reliant. The company is working towards building some key functions in-house.

Customer engagement: worldwide market shares 2019 CUSTOMER ENGAGEMENT Flytxt www.flytxt.com Founded 2008 PRODUCTS AND SERVICES The NEON-dX platform has four main applications: Precision Marketer for multichannel campaign management and realtime contextual marketing, Intent Management for personalisation and nextbest offers, Insight Workbench for collaborative data analytics and Precision Ad Server for targeted mobile advertising. It also has multiple addons such as Digital-Plus for extending customer engagement over digital channels such as social media, Packaged Analytics Models for augmenting marketing decision making, Robo-X for autonomous marketing and Talk-2-Me for enabling human-like conversations over voice interfaces such as Amazon Alexa or Analysys Mason Limited 2020 Google Assistant. Flytxt is an independent supplier of customer data analytics and NBED intelligent marketing automation software in the telecoms sector. Key Key relationships relationships NBED Atos NBED VoltDB NBED Wipro Amsterdam (HQ) STRATEGY Territory It has presence in Asia, Latin America, Africa and the Middle East. It aims to expand to other regions, including Europe and North America. Products It will enhance its products with add-ons to accelerate the adoption and use of artificial intelligence and machine learning technologies. Channels The company aims to continue to grow organically as well as increase its focus on partnerships to expand its market reach. ANALYSIS Flytxt counts multiple Tier-1 CSPs in emerging markets as customers. Flytxt’s ambitions to further penetrate into developed markets have yet to gather traction. Operators are increasingly interested in analytics and AI-driven solutions, and Flytxt is well-placed to take advantage of this interest. Flytxt is increasingly investing in its engagement-focused capabilities, bringing in both products and associated services to the market. Its new positioning will help operators to solve specific business use cases.

Customer engagement: worldwide market shares 2019 CUSTOMER ENGAGEMENT Genesys www.genesys.com Founded 1990 PRODUCTS AND SERVICES The Genesys interactive voice response (IVR) system is widely deployed by CSPs to provide customer self-care support. The solution includes contact centre software, a voice platform, conversation management, intelligent routing and advanced reporting. Genesys also provides contact centre software, digital sales systems, workforce management solutions and automation support through voice and chat bots. Analysys Mason Limited 2020 Genesys is a provider of omni-channel customer experience and contact NBED centre solutions to mediumsized and large businesses. Key Key relationships relationships NBED Accenture NBED IBM NBED Daly City, CA (HQ) STRATEGY Territory It will continue to target WE, CEE and North America. Products It will enhance its product offerings to support CSPs’ objective of enabling digital user engagement. Channels It will continue with its current sales approach. ANALYSIS Genesys is one of the largest providers of customer support services supporting over 11000 customers across multiple industries. The Genesys offerings provide an overall customer contact centre platform for a wide variety of industries. Genesys, similar to other vendors that have traditionally offered CTIrelated software systems, is facing a challenging market environment as cloud-based systems mature. However, it is pivoting its strategy towards a cloudbased engagement function-driven offerings model.

Customer engagement: worldwide market shares 2019 CUSTOMER ENGAGEMENT Huawei Technologies www.huawei.com Founded 1987 PRODUCTS AND SERVICES Huawei’s BES portfolio includes cloud-based offerings for the customer engagement segment. It currently offers the following services. Huawei provides network infrastructure, software solutions NBED and professional services to the telecoms and enterprise sectors. Dealer Agent Cloud helps CSPs to expand their dealer networks by reducing the registration time by an order of magnitude, as well as simplifying the customer registration process. Huawei has a strong professional services offering that includes systems integration, outsourced operations and software productassociated managed services. Analysys Mason Limited 2020 Key Key relationships relationships NBED Accenture NBED SAP NBED Infosys Shenzhen (HQ) STRATEGY Territory Worldwide focus with the exception of some developed countries. Huawei will limit new customer engagement deals to some regions. Products Huawei will increase focus on its B2B portfolio and favour a cloud-hosted SaaS-based business model. Channels Huawei is expanding its channel coverage by partnering with professional services companies. ANALYSIS Huawei’s customer engagement revenue growth has slowed down, partly due to geopolitical factors and also due to the company increasing its focus on existing customers. Huawei’s portfolio in the customer engagement segment has a stronger presence in emerging markets where it is a lowcost provider. Its managed services and systems integration expertise, together with its product portfolio, enables it to deliver highly customised solutions to the market.

Customer engagement: worldwide market shares 2019 CUSTOMER ENGAGEMENT IBM www.ibm.com Founded 1911 PRODUCTS AND SERVICES IBM is a global technology firm that offers business consulting services including customer experience, NBED operational efficiency and network optimisation to the telecoms sector. IBM Customer Experience Suite offers a wide variety of services for customer interactions including: – cloud and mobile solutions – omni-channel experience – intelligent campaigns and customer value optimisation. IBM has multiple solutions based on its cognitive system, WATSON. For customer engagement, this includes the following functions. – Assist agents to engage with customers and support multiple use cases, including CLV, churn and segmentation. – Virtual agent to deliver personalised engagement and reduces costs. Analysys Mason Limited 2020 Key Key relationships relationships NBED Oracle NBED SAP NBED Wipro North Castle, NY (HQ) STRATEGY Territory It has a global footprint, and will continue to focus on delivering to its customers. Products It will use its analytics and business process optimisation expertise to serve telecoms software segments. Channels It will continue to use its relationships and expertise in other sectors to expand in the telecoms market. ANALYSIS The company is the go-tomarket vendor for business process optimisation. In addition, it also has strong offerings in proactive care, behaviour-based customer insight, customer experience analytics and network analytics. Digital customer engagement is one of three strategic focus pillars for IBM. However, this is the smallest segment in terms of revenue contributions. It is a strong e-commerce player in the enterprise market and is using this experience to target the telecoms sector. The company is wellpositioned for opportunities around machine learning and artificial intelligence functions, which is attracting increasing investments from CSPs.

Customer engagement: worldwide market shares 2019 CUSTOMER ENGAGEMENT Microsoft www.microsoft.com Founded 1975 PRODUCTS AND SERVICES Microsoft Dynamics 365 is the company’s CRM and ERP solution portfolio targeted at enterprises. Its customers includes big and small companies across multiple verticals including CSPs. The Microsoft Dynamics 365 suite offers customer engagement NBED solutions to enterprises and the telecoms industry. Microsoft Dynamics 365 includes support multiple applications covering sales, customer service, marketing, commerce, operations, field service etc. The customisation of the company’s CRM software for a telecoms-specific audience is ongoing, but is dependent upon Microsoft’s ecosystem. Analysys Mason Limited 2020 Key Key relationships relationships NBED Hitachi NBED SunVizion NBED Redmond, WA (HQ) STRATEGY Territory Worldwide, with a specific focus on developed markets. Products The company will aim to enhance its current product suite to meet the demands of CSP clients. Channels Microsoft will endeavour to expand its new partnership programme with other leading ISVs. ANALYSIS Microsoft Dynamics CRM has a large existing CSP customer base, although many of these customers have CRM systems from other vendors as well. Microsoft’s is seeing increasing traction for the adoption of its CRM suite, although it continue to trail the primary competitors in the telco market by reasonable margins. For the telecoms sector, Microsoft’s objective of building an ecosystem around its Dynamics CRM 365 offerings has not reached its expected potential.

Customer engagement: worldwide market shares 2019 CUSTOMER ENGAGEMENT Netcracker www.netcracker.com Founded 1993 PRODUCTS AND SERVICES The Netcracker 2020 portfolio is a full-stack modular communications infrastructure solution that supports OSS and BSS functions. The platform is 5G ready and cloud-native compliant. Netcracker provides software solutions to the telecoms sector, including revenue NBED and customer management solutions. Netcracker 2020 covers two BSS product segments: Key Key relationships relationships NBED Accenture NBED Atos NBED HPE Waltham, MA (HQ) - Customer Engagement which includes channel, customer journey and marketing management - Digital BSS which includes customer, revenue and partner management. Netcracker also has platform management and analytics capabilities available across their portfolio. The company also provides well-established professional services for Analysys Limited 2020 itsMason offerings. STRATEGY Territory The company continues to strengthen its position in markets outside Japan and North America. Products The company will continue to build a more holistic OSS and BSS offering to support CSPs’ digitalisation objectives. Channels It will continue with its direct sales approach. ANALYSIS Netcracker 2020 platform emphasises mobile-first digital experience with a contextually aware omnichannel solution. It also provides enhanced support for partner-driven business models and access to a partner ecosystem. The majority of Netcracker’s customer engagement deals are as part of a full stack BSS transformation where the company is highly competitive. The company has extensive managed services expertise and a good delivery record for large-scale transformations across CSPs of all tiers.

Customer engagement: worldwide market shares 2019 CUSTOMER ENGAGEMENT Nokia www.nokia.com Founded 1865 PRODUCTS AND SERVICES Nokia’s Service Management Platform (SMP) helps CSPs to deliver an omni-channel care experience to customers. Nokia offers fixed, mobile access and home network insights and Nokia Customer Insights provides end-to-end subscriber visibility for NPS improvement. Nokia’s Device Management capabilities span mobile, home and IoT domains to provide zero-touch activation, support firmware campaigns and KPI monitoring. Integration with Salesforce and other technology partners enables additional customer engagement capabilities Nokia offers a full set of services related to customer engagement Analysys Mason Limited 2020 Nokia is a global provider of mobile telecoms equipment, NBED software solutions and professional services. Key Key relationships relationships NBED Salesforce NBED Accenture NBED IBM Microsoft Espoo (HQ) STRATEGY Territory Nokia has a worldwide footprint and customer base Products It will continue to enhance its product capabilities to support CSPs’ digitalisation strategies and the evolution to the IoT. Channels Nokia is addressing CSPs of all sizes and increasingly enterprises, either directly or jointly with a growing ecosystem of partners ANALYSIS Nokia’s Service Management Platform, Device Management and related Analytics capabilities are well regarded in the market. Nokia Software has made considerable investments to strengthen its Common Software Foundation and Common Service Delivery Framework driving towards a fully cloudnative portfolio Nokia has partnered with Salesforce and expects the combined, complementary portfolio to be a key driver for new sales. The Nokia solution has been pre-integrated into the Salesforce platform. Nokia has a strong services division, but also works increasingly with SI partners to complement its offerings and gain access to new markets.

Customer engagement: worldwide market shares 2019 CUSTOMER ENGAGEMENT Oracle www.oracle.com Founded PRODUCTS AND SERVICES Digital Experience for Communications (DX4C) is Oracle’s portfolio for CSPs that uses data and AI to help CSPs to transform their customer experience. Oracle DX4C Care Experience supports CSPs with omni-channel customer care through assisted and unassisted channels. Oracle Digital Assistant helps CSPs to drive AIenabled conversational experiences that can improve engagement and reduce costs. The DX4C solution integrates with the Oracle BRM solution to provide a full BSS stack. Analysys Mason Limited 2020 1977 Oracle offers vertically Key Key integrated BSS relationships relationships solutions for CSPs NBED Accenture based on a modular NBED Tech Mahindra NBED NBED and open Wipro architecture, configurability and industry standards. Redwood City, CA (HQ) STRATEGY Territory Oracle has a strong worldwide brand, which it will continue to use for its cloud solutions. Products It will continue to enhance its new cloud offering, as CSPs are increasingly demanding cloud-based deployments. Channels Oracle will target both existing and new customers for its cloud offerings, while also establishing partnerships with SI firms. ANALYSIS Oracle has a strong brand and broad product portfolio of enterprise and telecoms-specific software, which ensures its relevance at multiple levels within CSPs. With its large embedded base of Siebel, Oracle has adopted a strategy that uses cloud services to add new functionality, but makes use of the strong industrialisation and rich feature set of the currently deployed Siebel systems. This gives Oracle a dual-speed IT model for customer engagement. Oracle is reporting significant traction in the number of customers shifting from traditional on-premises model to cloud-based deployments.

Customer engagement: worldwide market shares 2019 CUSTOMER ENGAGEMENT Pegasystems www.pega.com Founded 1983 PRODUCTS AND SERVICES Pega is a software company that provides customer experience andNBED analytics solutions to multiple industry verticals, including telecoms and finance. Pegasystems (Pega) offers software applications for marketing, customer service, fulfilment operations (especially complex enterprise orders) and sales to telecoms and other industries. Its unified platform enables CSPs to integrate front- and back-office operations. It uses omnichannel, artificial intelligence and robotic automation capabilities to support telecoms operators in offering endto-end customer engagement. It also helps customer service representatives with nextbest actions, as well as targeting offers for customers. Its solutions and data model are aligned with TM Forum’s eTOM and SID requirements. Analysys Mason Limited 2020 Key Key relationships relationships NBED Accenture NBED Cognizant NBED Infosys Cambridge. MA (HQ) STRATEGY Territory Pega has a strong presence in EMEA and NA. It will aim to expand further in Asia–Pacific and Latin America. Products Pega is increasing investment in its telecoms CRM applications to apply analytics and ‘decisioning’ across the entire customer lifecycle. Channels Pega sells directly to CSPs, as well as through its SI partners. ANALYSIS Pega is a well-recognised vendor in the CRM market segment. Its configurable, unified platform is wellregarded by CSPs. The company’s exposure to other industry verticals gives it an advantage in the telecoms market. Pega’s growth in the telecoms sector may be hindered by moreestablished, larger vendors, such as Amdocs and Oracle. It also needs to compete with Salesforce’s extensive cloud-native offerings. The company was slow to embrace cloud-based architecture and delivery models. The company’s revenue growth has been significantly slower than its cloud-based competitors’.

Customer engagement: worldwide market shares 2019 CUSTOMER ENGAGEMENT Salesforce www.salesforce.com Founded 1999 PRODUCTS AND SERVICES Salesforce has a fully cloud-based customer engagement offering that enables CSPs to serve multiple use cases, including marketing, sales, ordering, service, commerce and analytics. Its cloud applications share a common platform, enabling a holistic view of the customer across all channels, which is further used by analytics and artificial intelligence capabilities. The company enables enterprises and CSPs to build their own applications by using resources from its platform. It has built a strong ecosystem on its platform, enabling it to provide a range of capabilities beyond its existing product portfolio. Analysys Mason Limited 2020 Salesforce offers cloud-based CRM to multiple industry verticals worldwide, NBED including communications, finance, healthcare and retail. Key Key relationships relationships NBED Accenture NBED CloudSense NBED Nokia San Francisco, CA (HQ) STRATEGY Territory Salesforce has a worldwide presence and will continue to develop this through its partnerships and engagements. Products The company will continue to expand its portfolio through product development, acquisitions and an expanding partner ecosystem. Channels Salesforce has worldwide reach and a broad ecosystem of global SI partners including Accenture, Deloitte, IBM and TCS. ANALYSIS Salesforce is the most dominant and one of the fastest-growing vendors in the customer engagement segment. Salesforce’s SaaS-based solutions have set the benchmark for CSPs that plan to transition to cloud-based engagement solutions. Salesforce’s solutions focus on helping CSPs to transform their customerfacing functions. Salesforce’s broad partner ecosystem includes many preintegrated vendor solutions that are readily available and natively built on the Salesforce platform with support for some back-office capabilities. Salesforce’s acquisition of Vlocity in 2020 has not been considered for this report.

Customer engagement: worldwide market shares 2019 CUSTOMER ENGAGEMENT SAP www.sap.com Founded PRODUCTS AND SERVICES SAP’s customer engagement solutions for CSPs are positioned under the wider SAP C/4 HANA portfolio. This includes a focus on: - contextual marketing - customer journeys across all channels 1972 SAP provides a crossindustry software platform for a wide variety of back-office NBED applications to a strong base of European CSP customers. - integrating revenue management and omni-channel commerce Key Key relationships relationships NBED Accenture NBED Atos NBED IBM Walldorf (HQ) - customer service using analytics capabilities. SAP’s acquisition of Hybris provided it with telecoms-specific omnichannel commerce solutions. SAP continues to grow inorganically through acquisitions such as CallidusCloud, Recast.AI and, more recently, Qualtrics. Analysys Mason Limited 2020 STRATEGY Territory SAP has worldwide sales channels and delivery capabilities, and a strong base of European CSP customers. Products SAP will aim to expand its product portfolio to offer complete customer engagement systems capabilities to the telecoms sector. Channels SAP will use its experience in the enterprise market to enhance its product and service offerings for the telecoms industry. ANALYSIS SAP continues to be heavily reliant on partners as a channel to market and for delivering its offerings. SAP has been very slow to use its formidable brand and reputation to enhance its recognition as an enabler of digital services with extensive experience in large enterprises within the telecoms vertical. The recent acquisitions will help SAP to expand its offerings in the vertical, but it lacks strategy and messaging for the telecoms sector overall. Many CSPs have already deployed some flavour of SAP's ERP solution or HANA database solution, which may be an advantage for upselling.

Customer engagement: worldwide market shares 2019 CUSTOMER ENGAGEMENT Tata Consultancy Services (TCS) www.tcs.com Founded 1968 PRODUCTS AND SERVICES TCS is an IT technology firm that offers professional services NBEDand BSS/OSS solutions for CSPs and other industry verticals. Tata Consultancy Services is a USD22 billion IT services and consulting firm headquartered in India. The company ahs a large practice providing professional services to CSPs worldwide. HOBS (Hosted BSS/OSS) is the TCS’s cloud native, multi tenant, digital subscription management platform for communications service providers (CSPs) and enterprises. TCS HOBS has a catalog centric architecture with a centralized product catalog driven order management framework. TCS HOBS is shifting towards an experience centric architecture that is conceptualized around modular platform ecosystems with orchestration capabilities. Analysys Mason Limited 2020 Key Key relationships relationships NBED Avaya NBED Oracle NBED SAP Mumbai (HQ) STRATEGY Territory It will continue to focus on expanding its global footprint. Products It will enhance its services offerings to support CSPs’ digital transformation needs and moves to the cloud. Channels It will continue to expand its partner relationships in areas adjacent to telecoms. ANALYSIS TCS has a strong worldwide presence and a large pool of skilled professionals. It has expertise in multi-vendor systems integration, custom development and business process outsourcing skills and capacity. HOBS provides a broad portfolio coverage in BSS/ OSS with a modular portfolio that is microservices based and offers support for DevOps frameworks. A high level of productisation is eroding systems integration opportunities. CSPs are increasingly opting for managed services deals for customer engagementrelated systems. TCS will need to strengthen its managed services offering to remain competitive in the market.

Customer engagement: worldwide market shares 2019 41 Summary of other players in the customer engagement market [1/2] Figure 30a: Other players in the customer engagement market NAME DESCRIPTION WEBSITE [24]7.ai [24]7.ai is a software and services vendor that offers cloud-based customer engagement solutions to multiple verticals including finance, retail and telecoms. www.247.ai AsiaInfo AsiaInfo is a telecoms-focused BSS software vendor that offers customer engagement, revenue management and analytics software. It focuses on Asia–Pacific, primarily China. www.asiainfo.com Aspect Software Aspect Software is a customer experience and engagement solution provider to multiple industry verticals, including finance, retail and telecoms. www.aspect.com CGI Group CGI Group focuses on multiple industries worldwide including telecoms, health, utilities and finance. It features in all sub-segments of customer engagement. Most of its revenue is derived from North America. www.cgi.com Comarch Comarch is a software vendor and systems integrator that serves multiple industries including telecoms. The company offers a full stack BSS solution alongside professional services for integrating its solutions. www.comarch.com RingCentral Dimelo provides cloud-native omni-digital customer service software solutions to multiple industry verticals including telecoms, finance and utilities. www.ringcentral.com eGain eGain is a North-America-focused software vendor that features in the engagement platforms sub-segment. It offers software to multiple industries including telecoms and retail. www.egain.com Etiya Etiya provides CRM, catalogue, B/OSS and social media analytics solutions to CSPs worldwide. The company has over 700 employees and is headquartered in Amsterdam. www.etiya.com Hansen Technologies Hansen Technologies provides customer care, billing and data management systems to CSPs and utility providers. The company acquired Sigma Systems, a leading provider of enterprise product catalogue, in 2019. www.hansencx.com

Customer engagement: worldwide market shares 2019 42 Summary of other players in the customer engagement market [2/2] Figure 30b: Other players in the customer engagement market NAME DESCRIPTION WEBSITE Nuance Communications Nuance Communications offers natural language processing software solutions to many industries. It features in the customer interaction sub-segment and has achieved impressive revenue growth in the past few years. www.nuance.com Verint Systems Verint Systems offers solutions in the customer engagement space. The company is product-oriented, rather than service-oriented. It has a worldwide focus. www.verint.com Vlocity (now part of Salesforce) Vlocity is a software vendor that provides industry-specific, cloud-native applications to the communications, media, energy, public sector and insurance industries. www.vlocity.com

Customer engagement: worldwide market shares 2019 Contents Executive summary Market shares Overall telecoms market context Vendor analysis Market definition About the author and Analysys Mason

Customer engagement: worldwide market shares 2019 44 Definition of geographical regions Figure 31: Regional breakdown used in this report North America Western Europe Western Europe Central and Eastern Europe Latin America Emerging Asia–Pacific Middle East and North Africa Sub-Saharan Africa Developed Asia– Pacific

Customer engagement: worldwide market shares 2019 45 Telecoms software market segmentation1 DELIVERY MODELS PRODUCTS MONETISATIO N PLATFORMS BILLING AND CHARGING PARTNER AND INTERCONNECT HOSTED/CLOUD VIDEO AND IDENTITY PLATFORMS CU STOMER ENGAGEMENT VIDEO MANAGEMENT AND DELIVERY ENGAGEMENT PLATFORMS MARKETING IDENTITY MANAGEMENT MEDIATION POLICY MANAGEMENT OUTSOURCED OPERATIONS SALES SUBSCRIBER DATA MANAGEMENT CUSTOMER SERVICE SYSTEMS INTEGRATION AND OTHER PROFESSIONAL SERVICES AUTOMATED ASSU RANCE SERVICE DESIGN AND ORCHESTRATI ON ORDER MANAGEMENT SERVICE MANAGEMENT INVENTORY MANAGEMENT INTELLIGENT PERFORMANCE AND FAULT MONITORING ACTIVATION WORKFORCE AUTOMATION ENGINEERING SYSTEMS PROBE SYSTEMS AI AND ANALYTIC S REVENUE ASSURANCE AND FRAUD MANAGEMENT BUSINESS ANALYTICS NETWORK ANALYTICS DIGITAL INFRASTRUCTU RE STRATEGIES NFV NETWORK AUTOMATION AND ORCHESTRATION EMS/NMS NETWORK ORCHESTRATORS WAN SDN SERVICE TYPES CONSUMER FIXED MOBILE SDN VIRTUAL INFRASTRUCTURE MANAGERS BUSINESS FIXED Note that Analysys Mason will be changing the coverage for some of its research programmes later in 2020. Please ask your account manager if you have any questions. 1 CLOUD COMPUTING IoT

Customer engagement: worldwide market shares 2019 46 Customer engagement sub-segment definitions Figure 32: Definitions of customer engagement and its sub-segments SEGMENT OR SUBSEGMENT DEFINITION CUSTOMER ENGAGEMENT Customer engagement systems enable CSPs to interact with customers in a consistent and contextual manner, across all channels and for all types of engagement. The systems enable them to engage in an assisted or self-service manner, through human or automated interfaces and for inbound and outbound engagements. These systems help CSPs to deliver personalised engagement and increase revenue and satisfaction, while reducing costs. ENGAGEMENT PLATFORMS The engagement platforms sub-segment includes solutions that help CSPs’ customer-facing departments to engage with the customer in a consistent and contextual manner, for all types of engagements, such as marketing, sales or customer service. SALES The sales sub-segment focuses on software that enables businesses to streamline their sales operations, from lead generation to bringing in orders. It includes software that helps all CSP business lines, such as consumer and enterprise operations. MARKETING Marketing departments at CSPs focus on building and maintaining the brand image of the company. In the past, the role of the marketing department was to generate leads that were then handed over to the sales personnel. However, with the advent of social media and digital channels, their role has expanded to deliver and maintain a single view of the company across the company touchpoints, while understanding public sentiment and managing expectations. It includes taking responsibility for brand management. CUSTOMER SERVICE CSPs are investing in their customer service capabilities to deliver on expectations that are being set by the experience of customers using the services of webscale players. This sub-segment covers functions that help CSPs to engage with the customer, on any assisted or unassisted, human or automated channel, in a personalised and contextual manner. It helps them to deliver information that is consistent and up-to-date. 46

Customer engagement: worldwide market shares 2019 47 Engagement platforms The engagement platforms sub-segment includes solutions that help CSPs’ customer-facing departments to engage with the customer in a consistent and contextual manner, for all types of engagements, such as marketing, sales or customer service. Figure 33: Summary of the coverage of the engagement platforms sub-segment CHANNELS OF ENGAGEMENT The coverage includes systems that help CSPs to: manage customer journeys that span different channels and give CSPs the option to enable guided customer journeys across set paths deliver and maintain context across all channels, providing an omni-channel experience carry out natural language processing (NLP) and intent analysis to understand customer needs and wants so as to deliver a personalised engagement and experience use artificial intelligence capabilities that improve customer engagement, self-learn from experience and improve ongoing engagement. It also includes virtual assistants because they have the capability to support all types of customer engagements using AI, NLP and intent analysis capabilities. Some of these features may be included within the solution itself, but can also leverage the capabilities of the platform. ENGAGEMENT PLATFORMS OMNI-CHANNEL CO-ORDINATION AUTOMATED ATTENDANTS Source: Analysys Mason

Customer engagement: worldwide market shares 2019 48 Sales The sales sub-segment focuses on software that enables businesses to streamline their sales operations, from lead generation to bringing in orders. It focuses on software systems that help all CSP business lines, such as consumer and enterprise operations. CSPs need software systems that help them to assemble, analyse and present information to prospects and customers in a consistent and unified manner. CSPs want to present and deliver a single company view to the customer, rising above the traditional siloed business operations. The coverage under this sub-segment includes the following. Sales force automation that helps CSP sales personnel to engage and maintain prospects and clients in order to develop a continuous relationship. It includes lead management and email management as well as information management across different channels, which helps to deliver consistent and personalised interactions. Shopping carts that help with lead conversions if a customer channel-hops during their sales journey. Order handling and orchestration capabilities that perform high-level order decomposition, sequencing and error handling, and feed individual fulfilment stacks with orders to be fulfilled. Figure 34: Key functions of a sales system Sales force automation Shopping cart Order handling and orchestration Configure, price and quote (CPQ) Contract management CPQ systems that help CSP sales teams to engage with their enterprise customers in an intelligent and consistent manner. These systems can deliver pricing quotes in a timely manner, thereby reducing lead-to-order times. Contract management systems that are focused on managing the relationships with enterprise customers, engaging in a personalised manner and maintaining service levels. Sales engagement systems are increasingly using AI and NLP capabilities to personalise engagements with customers and prospects.

Customer engagement: worldwide market shares 2019 49 Marketing Marketing departments at CSPs focus on building and maintaining the brand image of the company. Their role includes: building a brand tone for the company that customers can associate with understanding market needs and requirements by analysing customers as well as competitors creating bundles and offers that are designed to generate sales from prospects and customers launching marketing campaigns and undertaking real-time analysis for continuous fine-tuning providing proactive support to customers by sharing information that will help customers to serve themselves (for example, videos to illustrate how to access and understand bills) or will make customers aware of forthcoming activities (for example, improvement works or new seasonal offers). This sub-segment covers software systems that help CSPs to achieve all of the above, working in conjunction with other departments with the company. These software solutions help marketing staff to understand purchasing patterns, as well as the effectiveness of new product and service campaigns. Figure 35: Key functions covered under the marketing sub-segment Campaign management Content management Contextual marketing Product bundling and offers In the past, the role of the marketing department was to generate leads that were then handed over to the sales personnel. However, with the advent of social media and digital channels, their role has expanded to deliver and maintain a single view of the company across the company touchpoints, while understanding the public sentiment and managing expectations. It includes taking responsibility for brand management.

Customer engagement: worldwide market shares 2019 50 Customer service CSPs are investing in customer service capabilities to deliver on expectations that are being set by the experience of customers using the services of webscale players. This sub-segment covers functions that help CSPs to engage with the customer, on any assisted or unassisted, human or automated channel, in a personalised and contextual manner. It helps them to deliver information that is consistent and up-to-date. The coverage includes the following solutions. Device management systems that can characterise, configure and manage the devices used by the customer. This could be done by the customer in a self-service manner, or remotely by CSP agents, reducing costs from false dispatches. The capability is becoming popular for CSPs’ enterprise customers in order to manage employees’ own devices, as well as for new M2M/IoT offerings. CSPs are also using this capability to support their own IoT offerings. Subscriber management systems that help CSP agents to deliver first-line support to customers with basic queries. These systems are being deployed with Tier-3 or Tier-4 CSPs, while Tier-1/2 CSPs are focusing on advanced customer service capabilities that are SaaS-based and offer agility and flexibility. Figure 36: Key functions of a customer service system Device management First-line support Case management Knowledge management Case management systems are popular with CSPs because customers want to be able to access information on their cases, ranging from the status of an order to repair status. The systems also provide representatives on the assisted channel with the up-to-date status of customer cases. Next-best-action solutions that help CSP agents to deliver personalised engagements to the customer, by using analytical processes to profile customers and understand their requirements. The systems can also support customer selfservice or provide support to other teams, such as sales personnel to better engage with their clients.

Customer engagement: worldwide market shares 2019 Definitions: products and professional services Figure 37: Definitions of product and professional services revenue TYPE DEFINITION OVERALL We divide our coverage of telecoms software and related services into two broad categories: products and professional services. PRODUCTS Product revenue includes that from licensed software products (‘product’) and the closely related services (‘productrelated services’); see the specific definitions on the following slide. The emergence of SaaS leads us to explicitly include the licences for SaaS products in our coverage of products. PROFESSIONAL SERVICES Professional services include all software-related services that are not explicitly tied to software products. This includes hosted/cloud, outsourced operations and systems integration and other services; see the specific definitions on the following slides. These definitions include all the professional services that we previously covered, but we have adjusted the definitions of particular areas to embrace cloud as a way to provide hosted IT services and to reduce the number of distinct sub-segments for professional services. 51

Customer engagement: worldwide market shares 2019 52 Definitions: overall view of delivery types Figure 38: Definitions of delivery types TYPE PRODUCT DEFINITION Product revenue includes that from licence software and maintenance, as well as a proportion of SaaS revenue that reflects the value of the software product used to provide the SaaS service It also includes the proportion of the managed services revenue that reflects the value of the software product used to provide the managed services (see the ‘Definitions: revenue distribution associated with delivery types’ slide for more details). Product revenue also includes revenue from product-related services, such as installation, training and lifecycle management services related to a specific telecoms software deployment. This category also includes professional services related specifically to a supplier’s own product. These are services that only the product supplier will be able to provide in nearly all cases. Services related to third-party products are part of the systems integration sub-segment. HOSTED/ CLOUD Revenue from hosted/cloud delivery services includes that that is attributed to the vendor that hosts the product for the CSP. The product can be supplied by the vendor using its own or third-party infrastructure. The product can be delivered through a private traditional or cloud-based site, or on a public cloud. OUTSOURCED OPERATIONS This category accounts for revenue that is associated with managing systems for CSPs. It includes business process outsourcing (BPO). This category also includes revenue generated from outsourced operations that are professional or specialist services provided by external suppliers’ human resources to operate and maintain a CSP’s assets, which can include all related operational responsibilities. This involves the transfer of operations from a CSP to external suppliers. In this scenario, the assets (systems and software) are owned by the CSP and reside in the CSP’s environment and the supplier manages the network from a CSP co-located site or other local or regional (for example, regional NOC) site. It includes responsibility for onsite operations and related activities in a particular country or region. SYSTEMS INTEGRATION AND OTHER PROFESSIONAL SERVICES This category covers all new development that is carried out uniquely for the CSP. This includes business consulting, design consulting, custom development and systems integration. Overall, systems integration accounts for the largest proportion of professional services, although any of the other areas may be the focus in any given deal.

Customer engagement: worldwide market shares 2019 53 Definitions: detailed explanation of ‘systems integration and other professional services’ [1/2] Figure 39a: Definitions of the systems integration and other professional services delivery type TYPE DEFINITION Systems integration concerns the services required to manage and deliver major telecoms software projects in the OSS, BSS, NFV/SDN software and other applications areas to meet CSPs’ specific requirements. These are services that go beyond the boundaries of a single product or suite (such items are covered in the product-related services segment), and involve other systems in the CSP environment in order to meet the project’s requirements. This category includes, but is not limited to: SYSTEMS INTEGRATION SYSTEMS INTEGRATION AND OTHER PROFESSIONAL SERVICES integration with third-party (other vendor or proprietary) data sources, systems and interfaces, including VNF onboarding and data analytics/AI-driven automation applications data loading and migration customisation and configurations of software extensions and modules (without coding) to provide customised software features and capabilities, such as network equipment adapters, point-to-point interfaces and enterprise application integration (EAI) detailed requirements, technical specifications and detailed designs integration testing, not normal unit and functional system testing, such as for the integration of open multi-vendor components into a full stack solution (for example for open RAN implementations) project management services. Services related to third-party products (not owned by the supplier) are included in this systems integration sub-segment. BUSINESS CONSULTING Business consulting describes advisory services in the areas of business process, workflows, organisation issues and strategic planning, such as how to enter a market or how to package a service. This includes, but is not limited to transformational strategy, business case development and ROI modelling, business process re-engineering and optimisation, organisation restructuring, optimisation and change management, assisting CSPs to develop new products and services to deliver to their subscribers (ranging from tariffs to value-added services), go-to-market strategies, regulatory compliance review and reporting requirements and marketing and campaign strategies.

Customer engagement: worldwide market shares 2019 54 Definitions: detailed explanation of ‘systems integration and other professional services’ [2/2] Figure 39b: Definitions of the systems integration and other professional services delivery type TYPE DEFINITION DESIGN CONSULTING Design consulting describes the provision of advisory design services prior to the implementation of a telecoms network, software and/or system in such areas as OSS, BSS and virtualised network or cloud architecture, automation, network planning and optimisation and data or information models. These services typically contribute towards developing requirements for procuring the systems and software needed. This category includes, but is not limited to network planning and optimisation designs for both fixed and mobile networks and their transition to virtual/hybrid networks, OSS, BSS, cloud and data analytics platforms, and integrated architectural design, developing technical requirement for tender documents, high-level migration plans and roadmapping, analysis of established systems, data modelling, high-level interface definitions and designs. CUSTOM DEVELOPMEN T Custom development refers to telecoms software that is written specifically for an individual CSP, typically as a result of its ownership of legacy and proprietary systems, software or interfaces. It includes any development that requires coding to meet an unusual requirement, such as the development of a customised application store on an SDP or Microsoft .NET platform, an API for interfacing with legacy or proprietary systems, data migration scripts and custom plug-ins for VNF or NFV/SDN-related functional integration. This is internal development that is typically performed by large CSPs. The spending in this category only includes CSP spending on paying other firms for custom development, not the spending required for their own staff to do custom development. This includes some applications development management (ADM). SYSTEMS INTEGRATION AND OTHER PROFESSIONAL SERVICES

Customer engagement: worldwide market shares 2019 55 Definitions: revenue distribution associated with delivery types Figure 40: Delivery types and typical associated revenue distribution Supply and operations Vendor revenue distribution Who supplies the software? Who runs the IT infrastructu re? Who leads the operations? Product Hosted/ cloud Outsourced operations Managed services Vendor Vendor Vendor 40% 15% 45% Managed services CSP-controlled Vendor Vendor 0% 25% 75% SaaS Vendor Vendor CSP 70% 30% 0% Traditional vendor Vendor CSP CSP 100% 0% 0% CSP CSP CSP 0% 0% 0% CSP CSP Vendor 0% 0% 100% Vendor CSP Vendor 30% 0% 70% CSP Vendor CSP 0% 100% 0% Delivery type In-house developed Outsourced operations Outsourced operations Hosted cloud delivery

Customer engagement: worldwide market shares 2019 56 Definitions: service types Figure 41: Definitions of service types SERVICE DEFINITION MOBILE Software- and professional services-related to mobile services for consumer and business, but excluding IoT. This includes software/services related to handset and mobile broadband service revenue. We have used a single category because business mobile support does not differ significantly in OSS/BSS from consumer support. In the future, we may add a category to include 5G-based edge computing applications that are wireless, but not necessarily mobile. CONSUMER FIXED Software and professional services related to consumer fixed retail services. Consumer fixed services primarily revolve around broadband data access; traditional PSTN is also included, but PSTN revenue and that for the related software and professional services is in steep decline. We have also included pay-TV services in this grouping. IoT Software and professional services related to IoT. This is a small business services category in terms of spending, but we expect it to grow. It includes CSP IoT connectivity revenue only for cellular and fixed (Wi-Fi and broadband) networks. LPWA-related revenue, typically offered by non-traditional providers, is not included. BUSINESS FIXED Software and professional services related to business services such as internet access, hosting services, IP VPN, Ethernet, managed IT services and wholesale carrier services (typically provided using physical or virtual IP/optical network elements or cloud-based software). Fixed IoT services are excluded. This sub-segment includes IP/optical transport and backhaul services.

Customer engagement: worldwide market shares 2019 Contents Executive summary Market shares Overall telecoms market context Vendor analysis Market definition About the author and Analysys Mason

Customer engagement: worldwide market shares 2019 58 About the author John Abraham (Principal Analyst) leads our digital transformation research, including three research programmes: Customer Engagement, Monetisation Platforms and Digital Experience. His areas of focus include customer journeys and experience, the impact of 5G on BSS systems, telecoms enterprise opportunities, cost transformation, ecosystems and value chains, and micro-services-based architecture models. John has over a decade of experience in the telecoms industry. At Analysys Mason, he has worked on a range of telecoms projects for operators in Africa, Europe, India and the Middle East. Before joining Analysys Mason, he worked for Subex, a BSS vendor, and before that for Dell in India. John holds a bachelor's degree in computer science from Anna University (India) and an MBA from Bradford University School of Management (UK).

Customer engagement: worldwide market shares 2019 59 Analysys Mason’s consulting and research are uniquely positioned Analysys Mason’s consulting services and research portfolio Consulting We deliver tangible benefits to clients across the telecoms industry: communications and digital service providers, vendors, financial and strategic investors, private equity and infrastructure funds, governments, regulators, broadcasters and service and content providers Our sector specialists understand the distinct local challenges facing clients, in addition to the wider effects of global forces. We are future-focused and help clients understand the challenges and opportunities new technology brings. Research Our dedicated team of analysts track and forecast the different services accessed by consumers and enterprises. We offer detailed insight into the software, infrastructure and technology delivering those services. Clients benefit from regular and timely intelligence, and direct access to analysts.

Customer engagement: worldwide market shares 2019 Research from Analysys Mason 60

Customer engagement: worldwide market shares 2019 Our consulting expertise covers the breadth of TMT issues and challenges 61