COURSE Final Expense Product Training Senior Market

47 Slides3.83 MB

COURSE Final Expense Product Training Senior Market Advisors University

Training Overview In this module, you will learn Why final expense coverage is important Ways to present final expense The final expense Needs Analysis process How to quote final expense What products we offer

Why Sell Final Expense Target Market: Existing Clients Company Model: “Serving the Underserved” Earn Extra Income o In 2012, 30 companies reported a total of 433 million in new final expense sales o Nearly 700,000 policies issued for an average premium of 649 o Average commission of 350 per sale Simple-Issue on final expense quick approval fast pay Retention: Stay in front of your clients Beat the Competition: The final expense target market is the Baby Boomer generation

Advantages You Have Existing Book of Business Client Retention Staying In Touch Trust/Rapport Referrals

Making the Difference An Example Current Policy Customer 75-Year-Old Female Preferred Health Status Moderate Income Variable UL 150,000 Cash Value 250,000 Face Amount 3,400 Premium/Year 12% Projected Interest Rate

Agent Proposal Guaranteed UL 0 Cash Value 500,000 Face Amount 2,134 Premium/Year 3.1% Guaranteed Interest Rate Policy Review Revealed Set to Expire on 77th Birthday Leaving No Life Insurance Leaving 0 Cash Value

Solution 1035 Exchange No Tax Consequences Rolled Cash Value Into New Policy Doubled Face Amount of Issue Lowered Premium by 1,266/Year Gained Client for Life Agent Commission 39,432

LESSON How to Sell Final Expense Policies Senior Market Advisors University

Final Expense Procedure 1 TMs Set Appointments for Existing Clients 2 3 Agents Perform Clients’ Needs Assessments New Policy Quoted/Policy Review Performed

Sales Sequence This is a PROCESS follow it EVERY TIME! 1. Walk through CHA’s In-Home “Family Protection Benefit” Presentation 2. You may also choose to show the video at this link: https://www.youtube.com/watch?v ZKHftmGWoEM&noredirect 1 3. Complete the Needs Assessment at lifehappens.org 4. Quote 3 options: “Good”, “Better” & “Best” 5. Explain the benefits of each plan quoted 6. The Close: Attempt to write new policy, OR Complete an Existing Policy Review, OR Explain process and importance of a Life Insurance Team Review

In-Home Presentation Family Protection Benefit Walk client through the following Final Expense Coverage presentation* Be sure to ask questions Wait for answers Listen, listen, listen *The following nine slides are a PPT presentation you can show on your appointment. The presentation ends with a “Questions?” slide.

LESSON Family Protection Benefit Senior Market Advisors University

Why Most People Request Final Expense Coverage 1. You don’t have a Family Protection or Final Expense Plan and you’re worried about leaving a large bill to your loved ones. 2. You have some Family Protection or a Final Expense Plan but could use more. Perhaps your coverage is outdated, not enough or the wrong type of coverage. 3. Maybe you have enough coverage for your Final Expenses but want to leave a small benefit for someone special like a child, grandchild or great grandchild. Which of these three best applies to you?

What are Final Expenses? Final Expenses are what an individual’s loved ones pay upon death to settle funeral cost and miscellaneous bills. The average cost of a funeral in 2013 was between 5,000 and 9,000 according to the National Funeral Directors Association. These numbers do not include cemetery costs. Once you include cemetery costs, such as the plot, the opening and closing of the vault, the headstone and any extras like flowers, obituary notices and transportation, such as limousines, the total cost can quickly boost between 10,000 and 14,000.

Regulated Policies Have Features Necessary for Secure Final Expense Protection 1. Affordable premiums through DISCOUNTS (such as using a local bank). 2. Premiums are GUARANTEED Never to Increase regardless of changes to your age or health. 3. Death Benefit is GUARANTEED Never to Decrease regardless of changes to your age or health. 4. Benefits are paid directly to your Beneficiary Income Tax Free. 5. Policy is GUARANTEED Never to be Cancelled because of changes to your age or health, and it is completely portable if you move. 6. These are all WHOLE LIFE policies that accumulate Cash Values that can be used for emergencies or other financial needs. 7. How many discounts do you qualify for? No Medical Exam or Doctors’ records necessary to qualify.

Creating Debt Someone Else Has To Pay There are only four ways to pay for this debt: 1. Do Nothing: You could pass this burden on to your spouse, children, or grandchildren. However, most families are living paycheck to paycheck. Adding 10,000 or more of expenses could wipe them out financially or, at the very least, put a huge burden on them. 2. Use Money That You’ve Saved All Your Life: If a major illness or nursing home should become involved, that could wipe out your savings in a blink of an eye. 3. Pre Pay at a Local Funeral Home: This option can be VERY COSTLY! If you don’t have the funds to pay the cost in full, you will have to make payments to the funeral home with the possibility of finance charges being added to the balance. If you happened to pass prior to the balance being paid in full, your loved ones will be responsible for the remaining balance all at once. Even worse, the funeral home knows that your loved ones will not be shopping for the best price because they will be making decisions under duress.

Creating Debt Someone Else Has To Pay There are only four ways to pay for this debt: 4. Acquire a GUARANTEED Final Expense Plan: This is ultimately the BEST option available to you. You can make affordable monthly payments into a whole life program that provides a death benefit in the amount of protection you desire. When you pass, your loved ones will have NO PAYMENTS REMAINING even if you passed the day after approval. Your rates and benefits will always be GUARANTEED never to change! Which would you choose?

Common Questions: Planning for Final Expenses Q – Is there a downside to waiting on setting up a Final Expense Policy? A – YES. The cost of coverage is based on your age and increases as you get older. You will never be as young as you are right now, so waiting will only increase your monthly premium. Also, qualifying for a policy is based on your health. There is no guarantee that your health will remain the same and you will be eligible for coverage at a later date. Based on this information, purchase as much coverage as you can comfortably afford today. Q – What if I can not afford the full 10,000 to 14,000 of coverage that I need? A – We only recommend that you purchase a policy that you can comfortably afford to pay on a monthly basis. Many people will set up a “STARTER” policy first. This will give you some protection now with the hope that you will be able to add more coverage when you can. Q – Is this a Term Policy? A – NO. We would never recommend or offer a term life insurance policy for final expenses. By guaranteed, we mean that the premiums and benefits will never change and will be there for the rest of your life.

Determine Funeral Cost. Use this form to determine what a funeral will cost based upon life expectancy.

LESSON Needs Assessment Senior Market Advisors University

Needs Calculating Final Expense Coverage Assessment Amount The client must participate fully in the process of filling out form at lifehappens.org Don’t answer the questions for your client Complete a paper Needs Assessment to leave with the client as he/she answers the questions online (this helps their memory later!) Attach your contact information to the Needs Assessment

Needs Assessment lifehappens.or g

Needs Assessment lifehappens.or g

Needs Assessment lifehappens.or g

Needs Assessment lifehappens.or g

Needs Assessment lifehappens.or g

Needs Assessment lifehappens.or g

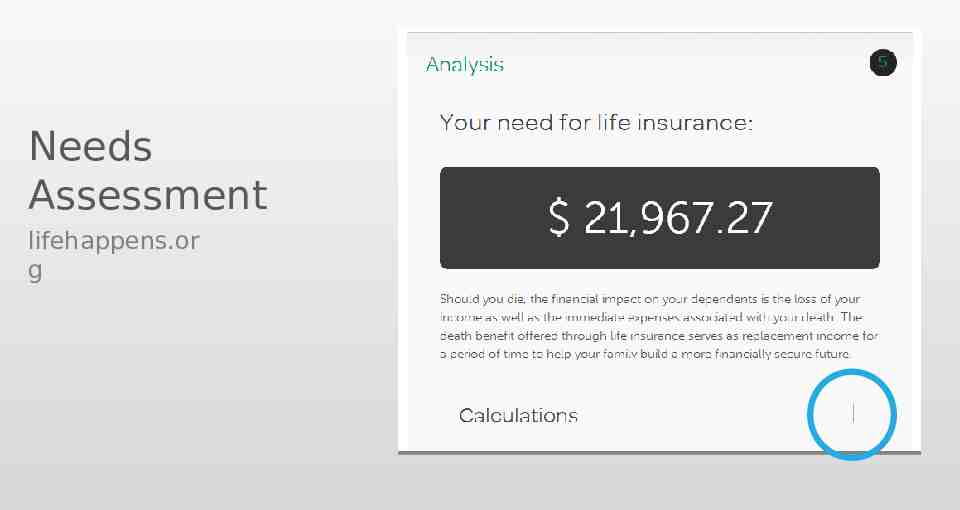

Quoting Creating Options Use the Funeral Cost Estimator from the Social Security Administration Use the analysis from lifehappens.org Create three quote options (good, better and best) for clients to choose from using the following three-slides

Quoting “Good” The difference between how much Final Expense coverage the client currently has and how much coverage the Social Security chart shows the client should have at his/her current age. Example: Ms. Jones has 15,000 of existing life insurance. 23,000 - 15,000 8,000 Ms. Jones would need 8,000 of additional insurance.

Quoting “Better” Use the Needs Assessment tool at lifehappens.org Answer the question “How many years should income be provided?” with the number “4” Don’t forget to fill out a paper Needs Assessment to leave behind with the client

Quoting “Best” Use the Needs Assessment tool at lifehappens.org Answer the question “How many years should income be provided?” with the number “7” Don’t forget to fill out a paper Needs Assessment to leave behind with the client

The Close Reiterate emotional answers from client during Needs Assessment Place finger on “Better” when presenting three options Wait for response from client, do not be the first to speak

Scenarios 4 Possible Outcomes 1 Inadequate Coverage Can Afford Write Policy 3 2 Inadequate Coverage Cannot Afford Team Review 4 Adequate Coverage Meet Stipulations Policy Review Unqualified Team Review

Life Insurance Team Importance of “Team Review” Grants peace of mind to customers, knowing that their best interests are in good hands Affords agents time to review policy options that best suit the customers needs and wishes Allows opportunity for third-party review from a fellow SMA team member Ensures recommendation of the best policy to protect the needs of the customer

Existing Policy What to Look For Review Existing Universal Life, Whole Life or Term policies with o Adequate coverage o Face amounts of 5,000 Policy owners aged 50 Policies at least four years old Premiums of 10,000 Policies with cash surrender values of 1,000

Existing Policy Review Objective of Review Owner understands exactly what they have & agent learns why Uncover opportunities for improvement in premium payments and/or coverage o Interest rates are at historical lows o Underwriting has changed with medical advance o Life insurance policies may not perform to the standard originally illustrated Review ownership and beneficiary structure o With longer life expectancy, policies may have become outdated o Premiums may be paid-up o Policies may be set to expire or terminate

Existing Policy Review Benefits of Review Lower Monthly Payment o “Refinance” to maintain/enhance current benefits & decrease payment Insure That Coverage Outlives Policy Owner Increased Benefits Peace of Mind o Knowledge that the policy will be in place to meet its intended purpose(s) o Ownership and beneficiary designations will be correct

Existing Policy Review Six Easy Steps 1. Collect a copy or snapshot of the most recent statement, if available 2. Complete “Fact Finder” & “Existing Coverage Analysis” forms 3. Help client fill out, sign & fax in “Authorization” form, if necessary 4. Conclude appointment & review/evaluate existing coverage with CHA team 5. Set follow-up appointment with client to discuss recommendations 6. Complete new application, 1035 exchange paperwork, state replacement forms, etc.

Existing Policy Review

LESSON Quoting Final Expense Senior Market Advisors University

CSG Quoting Tool Open lead view in CRM Click “CSG”

CSG Quoting Tool Choose “Run Quote“ for Final Expense Life

CSG Quoting Tool Fill out all fields Click “Get Quote”

CSG Quoting Tool Filter Results Underwritin g Tool Email, Print, PDF and Excel options to save to CRM

Agency Services One of Our Uplines Free to use anything on this site Quoting tools for Life, LTC, Disability and Annuities Applications Will contract new companies when first line of business is written

www.agencyservices.com