Confronting and anticipating the unexpected! Presented By: Brandon

26 Slides2.99 MB

Confronting and anticipating the unexpected! Presented By: Brandon Dirkschneider CFP FSC CLTC

What Is Long-Term Care (LTC)? Personal care or supervision needed by persons of all ages for an extended period of time. LTC is associated with the effects of aging, but may be needed at any time, due to an accident or illness. Some conditions that may require LTC: Head Injury Stroke Cancer 91,00 15,60 0 Parkinson’s Disease Heart Disease 0 165,00 0 Multiple Sclerosis Alzheimer’s Disease / Dementia 2

What is A long term care TRIGGERING EVENT? Long Term Care is the type of assistance you would need if you: Are chronically ill and unable to handle some of the basic activities of daily living (ADLs) on your own – (Eating, Bathing, Dressing, Toileting, Continence, Transferring (from bed to chair)) Require substantial supervision due to a significant cognitive impairment (such as Alzheimer’s, brain injury or stroke) 3 3

Elimination Period The length of time before benefits are paid when the client first needs coverage (also may be referred to as the waiting period) During the EP, the client may pay for benefits out-of-pocket The EP must be satisfied only once in the life of the policy, and in most plans, the days do not need to be consecutive The EP can be Days of Service or Calendar Days Some options are 0, 20, 45, 90 or 100 days

Benefit Period The BP chosen is used to help calculate the total amount of benefit dollars (pool of money) available under the policy This “Total Lifetime Benefit (TLB)” (pool of money) is equal to the Nursing Home/Facility DBA multiplied by the number of years benefits can be paid Example: If the insured purchased 100 Daily Benefit Amount with a 5 year Benefit Period, the Total Lifetime Benefit (TLB) or pool of money would equal 182,500. 100 x 5 x 365 182,500

· A LTCI policy pays a maximum dollar amount calculated either as a Daily Benefit or Monthly Benefit Amount) The Daily Benefit Amount (DBA) The maximum dollar amount a policy will pay for care received by the insured on any given day The insured can choose their DBA based on the cost of care in their area and/or based on the percent of coverage they want to self-insure The DBA for Home Care may be different than the DBA for Facility Care, depending on the plan chosen

A Monthly DBA is calculated by taking the number of days in a given month times the DBA A LTCI policy can help cover the costs of long-term care services either by reimbursement or on an indemnity or cash payment basis: Reimbursement Plans The insured must receive QLTC services and must submit receipts for the services that are received. The LTCI policy then reimburses the insured for the cost of these services up to the Daily or Monthly Benefit Amount in effect at the time of claim. Indemnity Plans This type of plan will pay the Maximum DBA regardless of the cost of services received on a given day The insured must receive services, and must submit receipts of the service (or proof some services were received on a given day) to be paid the Maximum DBA for that day

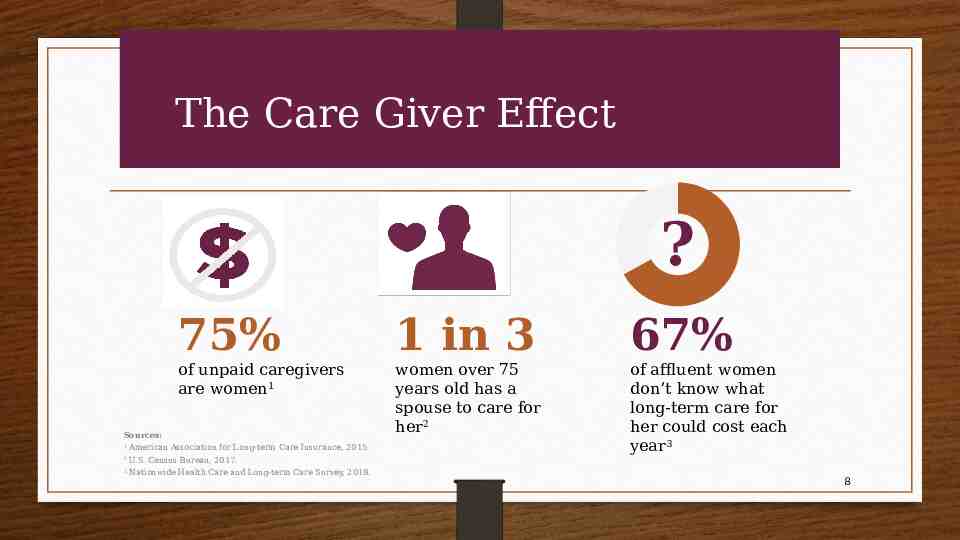

The Care Giver Effect ? 75% of unpaid caregivers are women1 Sources: 1 American Association for Long-term Care Insurance, 2015 2 U.S. Census Bureau, 2017. 3 Nationwide Health Care and Long-term Care Survey, 2018. 1 in 3 women over 75 years old has a spouse to care for her2 67% of affluent women don’t know what long-term care for her could cost each year3 8

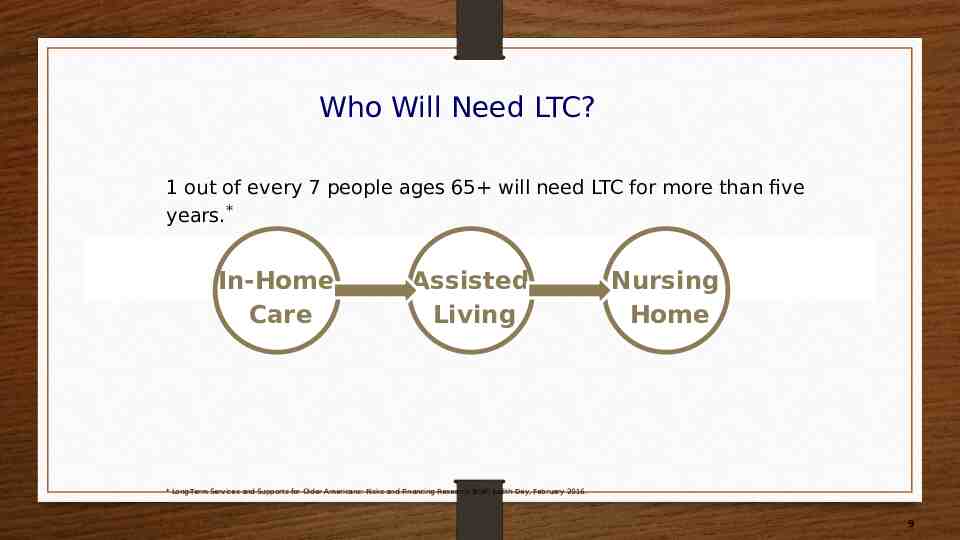

Who Will Need LTC? 1 out of every 7 people ages 65 will need LTC for more than five years.* In-Home Care Assisted Living Nursing Home * Long-Term Services and Supports for Older Americans: Risks and Financing Research Brief, Judith Dey, February 2016. 9

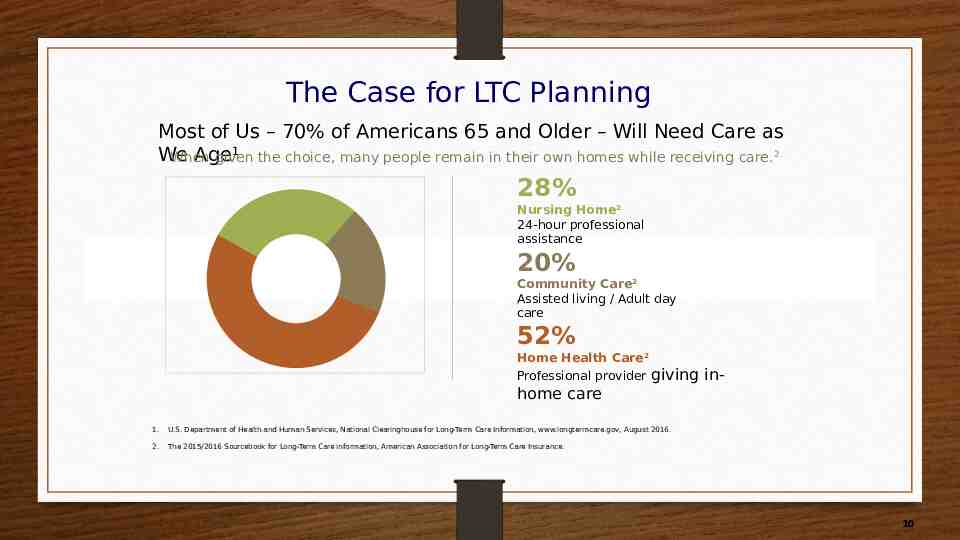

The Case for LTC Planning Most of Us – 70% of Americans 65 and Older – Will Need Care as 1 We Age When given the choice, many people remain in their own homes while receiving care. 2 28% Nursing Home2 24-hour professional assistance 20% Community Care2 Assisted living / Adult day care 52% Home Health Care2 Professional provider giving in- home care 1. U.S. Department of Health and Human Services, National Clearinghouse for Long-Term Care Information, www.longtermcare.gov, August 2016. 2. The 2015/2016 Sourcebook for Long-Term Care information, American Association for Long-Term Care Insurance. 10

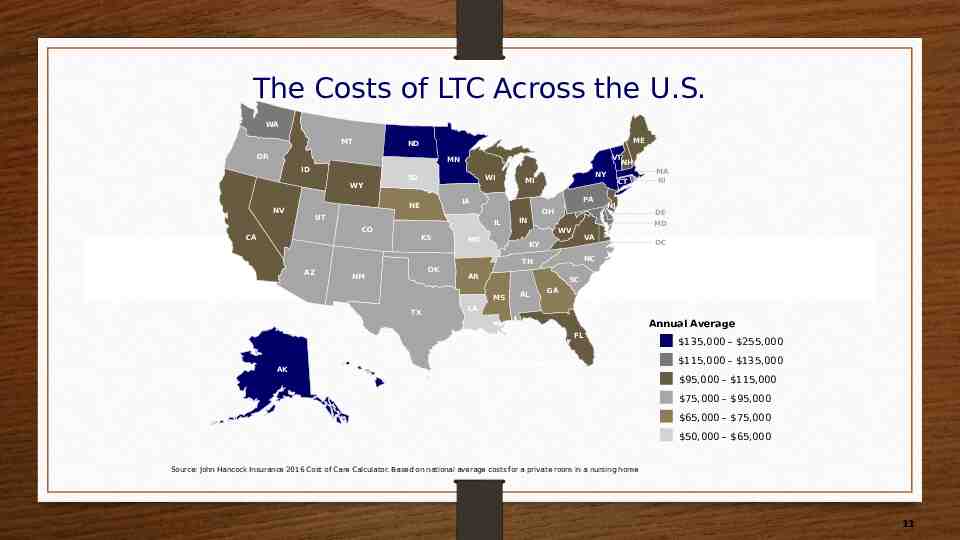

The Costs of LTC Across the U.S. WA MT ME ND OR VT NH MN ID WY NV SD WI OH UT IL CO KS AZ PA IA NE CA NY MI 91,000 NM MO WV AR MA RI DE MD VA KY DC NC SC MS TX NJ IN TN OK CT AL GA 15,600 LA Annual Average FL 135,000 – 255,000 115,000 – 135,000 AK HI 95,000 – 115,000 75,000 – 95,000 65,000 – 75,000 50,000 – 65,000 Source: John Hancock Insurance 2016 Cost of Care Calculator. Based on national average costs for a private room in a nursing home 11

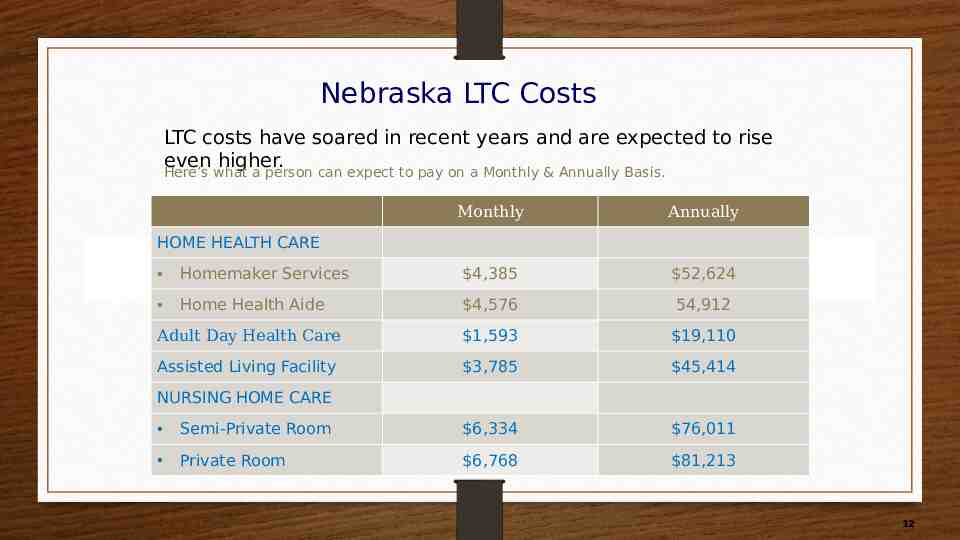

Nebraska LTC Costs LTC costs have soared in recent years and are expected to rise even higher. Here’s what a person can expect to pay on a Monthly & Annually Basis. Monthly Annually HOME HEALTH CARE Homemaker Services 4,385 52,624 Home Health Aide 4,576 54,912 Adult Day Health Care Assisted Living Facility 15,60 1,593 0 3,785 NURSING HOME CARE 19,110 165,00 45,414 0 Semi-Private Room 6,334 76,011 Private Room 6,768 81,213 12

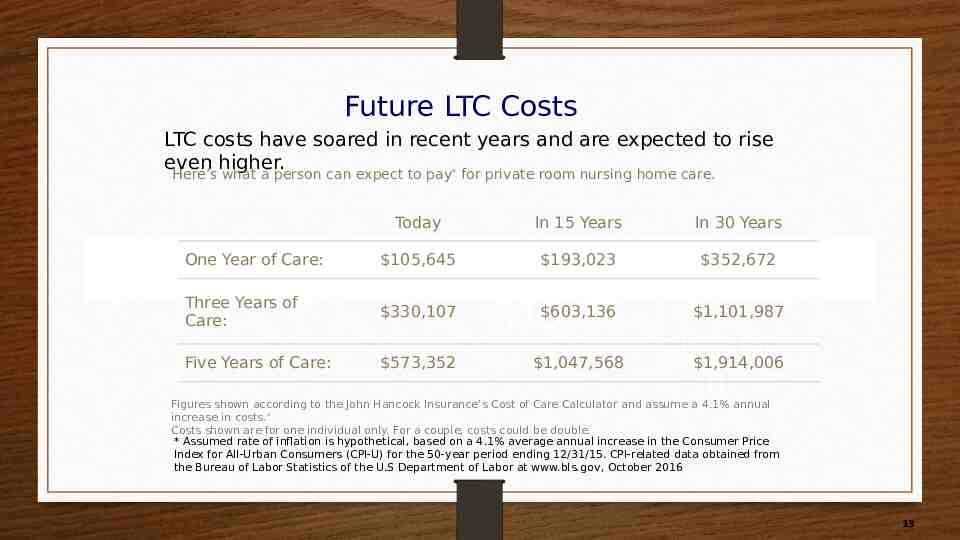

Future LTC Costs LTC costs have soared in recent years and are expected to rise even higher. * Here’s what a person can expect to pay for private room nursing home care. Today In 15 Years In 30 Years One Year of Care: 105,645 193,023 352,672 Three Years of Care: 330,107 Five Years of Care: 573,352 603,136 1,101,987 15,60 165,00 1,047,568 1,914,006 0 0 Figures shown according to the John Hancock Insurance’s Cost of Care Calculator and assume a 4.1% annual increase in costs.* Costs shown are for one individual only. For a couple, costs could be double. * Assumed rate of inflation is hypothetical, based on a 4.1% average annual increase in the Consumer Price Index for All-Urban Consumers (CPI-U) for the 50-year period ending 12/31/15. CPI-related data obtained from the Bureau of Labor Statistics of the U.S Department of Labor at www.bls.gov, October 2016 13

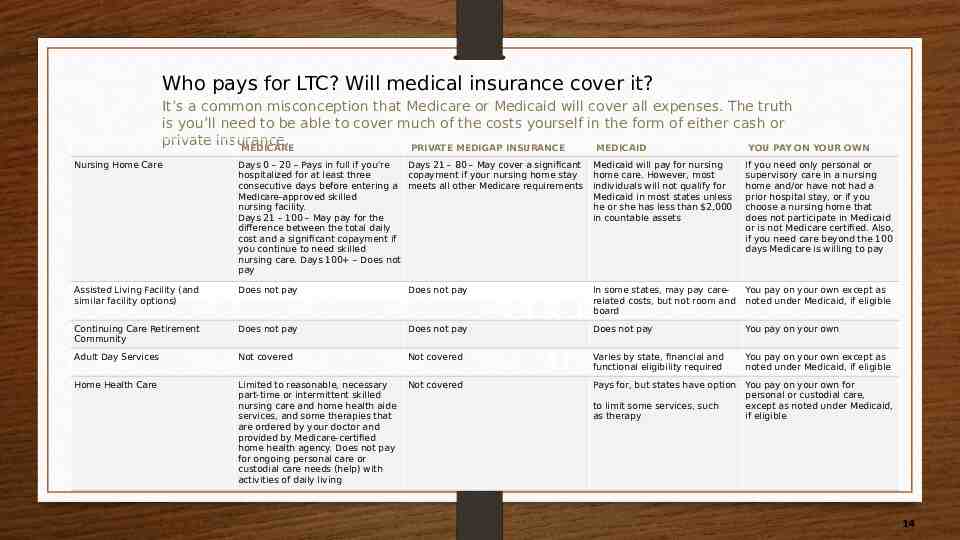

Who pays for LTC? Will medical insurance cover it? It’s a common misconception that Medicare or Medicaid will cover all expenses. The truth is you’ll need to be able to cover much of the costs yourself in the form of either cash or private insurance. MEDICARE PRIVATE MEDIGAP INSURANCE MEDICAID YOU PAY ON YOUR OWN Nursing Home Care Days 0 – 20 – Pays in full if you’re Days 21 – 80 – May cover a significant hospitalized for at least three copayment if your nursing home stay consecutive days before entering a meets all other Medicare requirements Medicare-approved skilled nursing facility. Days 21 – 100 – May pay for the difference between the total daily cost and a significant copayment if you continue to need skilled nursing care. Days 100 – Does not pay Medicaid will pay for nursing home care. However, most individuals will not qualify for Medicaid in most states unless he or she has less than 2,000 in countable assets If you need only personal or supervisory care in a nursing home and/or have not had a prior hospital stay, or if you choose a nursing home that does not participate in Medicaid or is not Medicare certified. Also, if you need care beyond the 100 days Medicare is willing to pay Assisted Living Facility (and similar facility options) Does not pay Does not pay In some states, may pay carerelated costs, but not room and board You pay on your own except as noted under Medicaid, if eligible Continuing Care Retirement Community Does not pay Does not pay Does not pay You pay on your own Adult Day Services Not covered Not covered Home Health Care Limited to reasonable, necessary part-time or intermittent skilled nursing care and home health aide services, and some therapies that are ordered by your doctor and provided by Medicare-certified home health agency. Does not pay for ongoing personal care or custodial care needs (help) with activities ofand daily living Source: LongTermCare.gov (Medicare Medicaid) 2017 Not covered 15,60 0 165,00 0 Varies by state, financial and functional eligibility required You pay on your own except as noted under Medicaid, if eligible Pays for, but states have option You pay on your own for personal or custodial care, except as noted under Medicaid, if eligible to limit some services, such as therapy 14

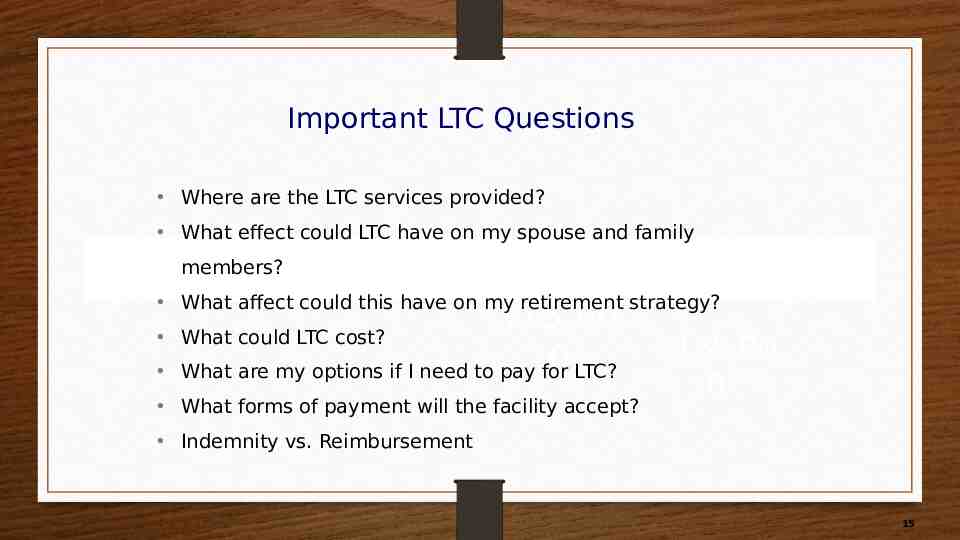

Important LTC Questions Where are the LTC services provided? What effect could LTC have on my spouse and family members? What affect could this have on my retirement strategy? 15,60 What could LTC cost? 0 LTC? What are my options if I need to pay for What forms of payment will the facility accept? 165,00 0 Indemnity vs. Reimbursement 15

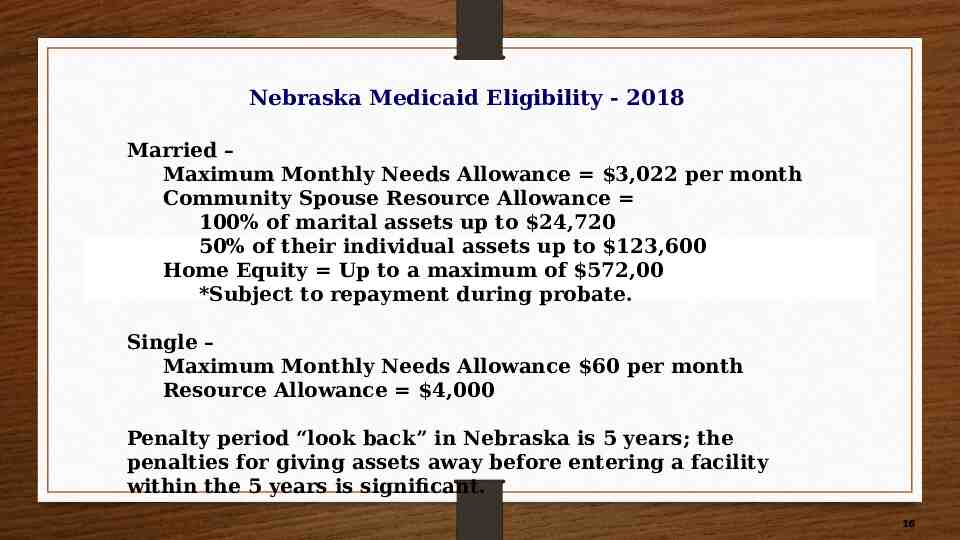

Nebraska Medicaid Eligibility - 2018 Married – Maximum Monthly Needs Allowance 3,022 per month Community Spouse Resource Allowance 100% of marital assets up to 24,720 50% of their individual assets up to 123,600 Home Equity Up to a maximum of 572,00 *Subject to repayment during probate. Single – Maximum Monthly Needs Allowance 60 per month Resource Allowance 4,000 Penalty period “look back” in Nebraska is 5 years; the penalties for giving assets away before entering a facility within the 5 years is significant. 16

Partnership Program A joint effort between states and private insurers to create an option to help individuals meet their future long-term care needs without depleting all of their countable assets and protecting state funds by self insuring for a period of time. If an approved Partnership long-term care insurance policy is purchased and the benefits under that insurance coverage are exhausted, the individual may apply for Medicaid (Medi-Cal in CA) coverage while retaining all or a portion of the assets he or she would otherwise have to “spend down”.

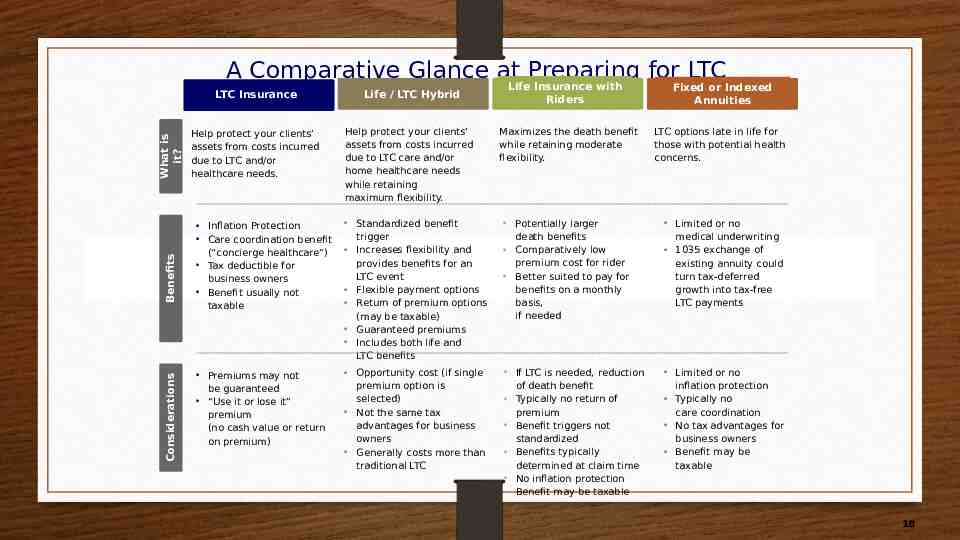

A Comparative Glance at Preparing for LTC Considerations Benefits What is it? LTC Insurance Help protect your clients’ assets from costs incurred due to LTC and/or healthcare needs. Life / LTC Hybrid Help protect your clients’ assets from costs incurred due to LTC care and/or home healthcare needs while retaining maximum flexibility. Life Insurance with Riders Maximizes the death benefit while retaining moderate flexibility. Fixed or Indexed Annuities LTC options late in life for those with potential health concerns. Inflation Protection Care coordination benefit (“concierge healthcare”) Tax deductible for business owners Benefit usually not taxable Standardized benefit trigger Increases flexibility and provides benefits for an LTC event Flexible payment options Return of premium options (may be taxable) Guaranteed premiums Includes both life and LTC benefits Potentially larger death benefits Comparatively low premium cost for rider Better suited to pay for benefits on a monthly basis, if needed Limited or no medical underwriting 1035 exchange of existing annuity could turn tax-deferred growth into tax-free LTC payments Premiums may not be guaranteed “Use it or lose it” premium (no cash value or return on premium) Opportunity cost (if single premium option is selected) Not the same tax advantages for business owners Generally costs more than traditional LTC If LTC is needed, reduction of death benefit Typically no return of premium Benefit triggers not standardized Benefits typically determined at claim time No inflation protection Benefit may be taxable Limited or no inflation protection Typically no care coordination No tax advantages for business owners Benefit may be taxable 18

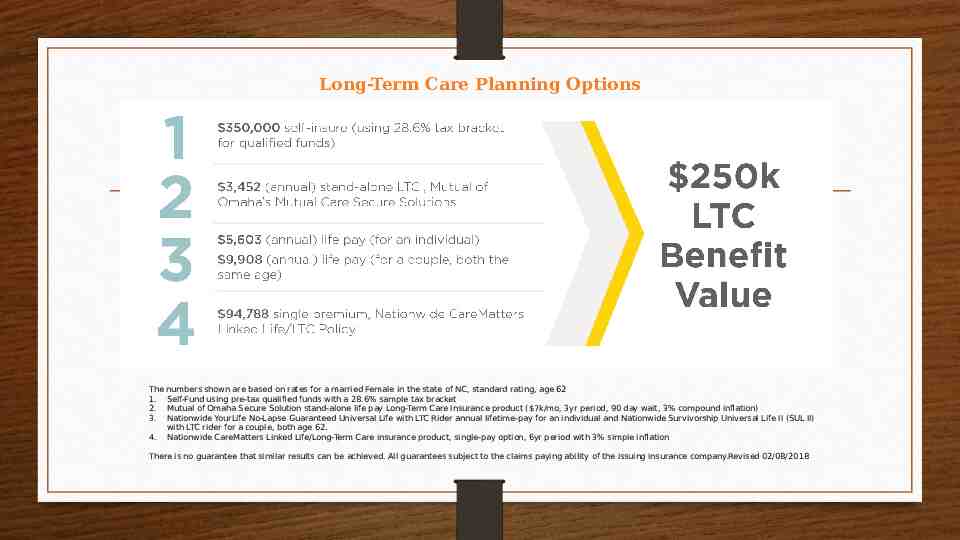

Long-Term Care Planning Options The 1. 2. 3. 4. numbers shown are based on rates for a married Female in the state of NC, standard rating, age 62 Self-Fund using pre-tax qualified funds with a 28.6% sample tax bracket Mutual of Omaha Secure Solution stand-alone life pay Long-Term Care Insurance product ( 7k/mo, 3yr period, 90 day wait, 3% compound inflation) Nationwide YourLife No-Lapse Guaranteed Universal Life with LTC Rider annual lifetime-pay for an individual and Nationwide Survivorship Universal Life II (SUL II) with LTC rider for a couple, both age 62. Nationwide CareMatters Linked Life/Long-Term Care insurance product, single-pay option, 6yr period with 3% simple inflation There is no guarantee that similar results can be achieved. All guarantees subject to the claims paying ability of the issuing insurance company.Revised 02/08/2018

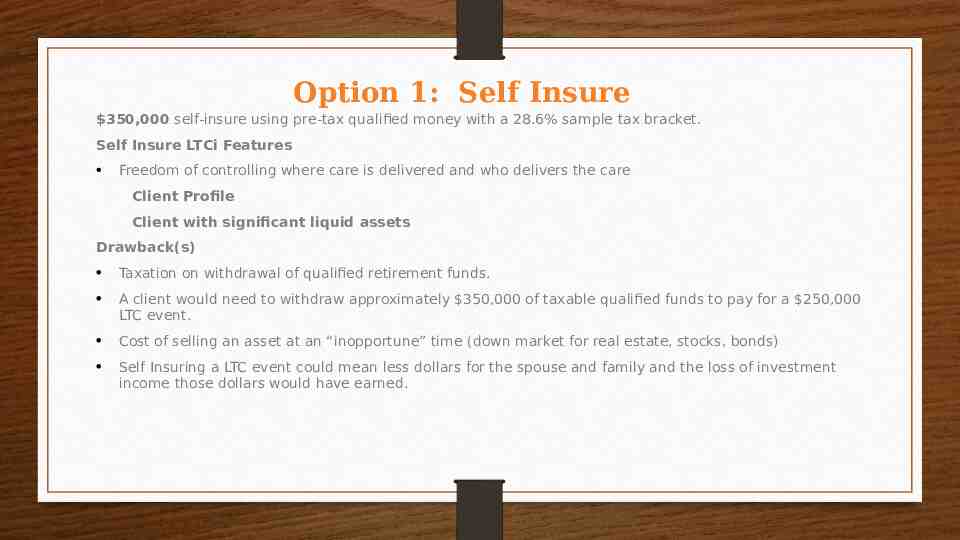

Option 1: Self Insure 350,000 self-insure using pre-tax qualified money with a 28.6% sample tax bracket. Self Insure LTCi Features Freedom of controlling where care is delivered and who delivers the care Client Profile Client with significant liquid assets Drawback(s) Taxation on withdrawal of qualified retirement funds. A client would need to withdraw approximately 350,000 of taxable qualified funds to pay for a 250,000 LTC event. Cost of selling an asset at an “inopportune” time (down market for real estate, stocks, bonds) Self Insuring a LTC event could mean less dollars for the spouse and family and the loss of investment income those dollars would have earned.

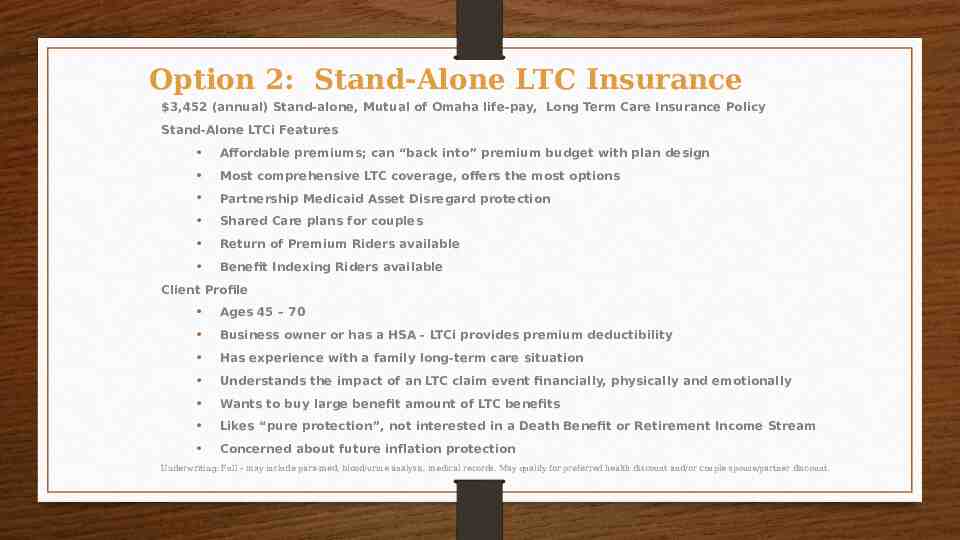

Option 2: Stand-Alone LTC Insurance 3,452 (annual) Stand‑alone, Mutual of Omaha life-pay, Long Term Care Insurance Policy Stand-Alone LTCi Features Affordable premiums; can “back into” premium budget with plan design Most comprehensive LTC coverage, offers the most options Partnership Medicaid Asset Disregard protection Shared Care plans for couples Return of Premium Riders available Benefit Indexing Riders available Client Profile Ages 45 – 70 Business owner or has a HSA - LTCi provides premium deductibility Has experience with a family long-term care situation Understands the impact of an LTC claim event financially, physically and emotionally Wants to buy large benefit amount of LTC benefits Likes “pure protection”, not interested in a Death Benefit or Retirement Income Stream Concerned about future inflation protection Underwriting: Full – may include para-med, blood/urine analysis, medical records. May qualify for preferred health discount and/or couple spouse/partner discount.

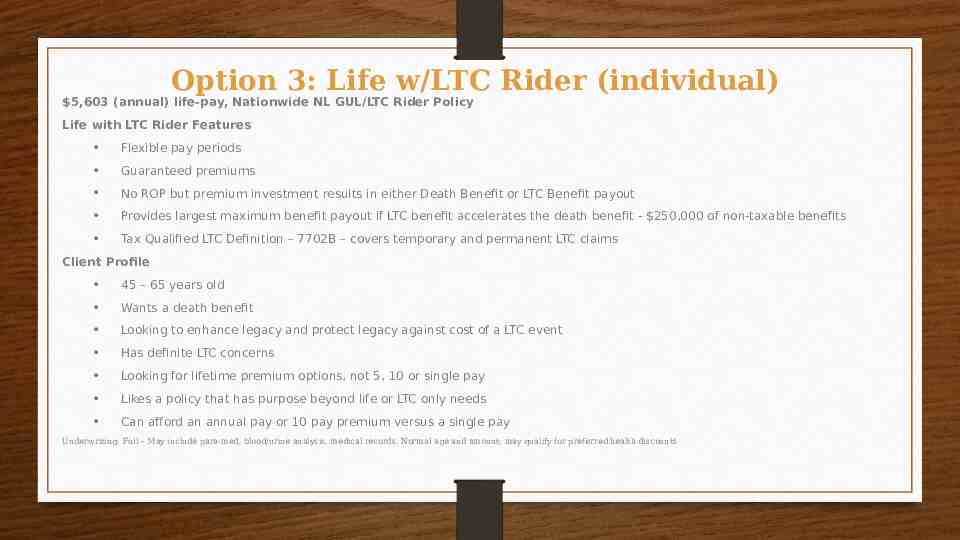

Option 3: Life w/LTC Rider (individual) 5,603 (annual) life-pay, Nationwide NL GUL/LTC Rider Policy Life with LTC Rider Features Flexible pay periods Guaranteed premiums No ROP but premium investment results in either Death Benefit or LTC Benefit payout Provides largest maximum benefit payout if LTC benefit accelerates the death benefit - 250,000 of non-taxable benefits Tax Qualified LTC Definition – 7702B – covers temporary and permanent LTC claims Client Profile 45 – 65 years old Wants a death benefit Looking to enhance legacy and protect legacy against cost of a LTC event Has definite LTC concerns Looking for lifetime premium options, not 5, 10 or single pay Likes a policy that has purpose beyond life or LTC only needs Can afford an annual pay or 10 pay premium versus a single pay Underwriting: Full – May include para-med, blood/urine analysis, medical records. Normal age and amount; may qualify for preferred health discounts

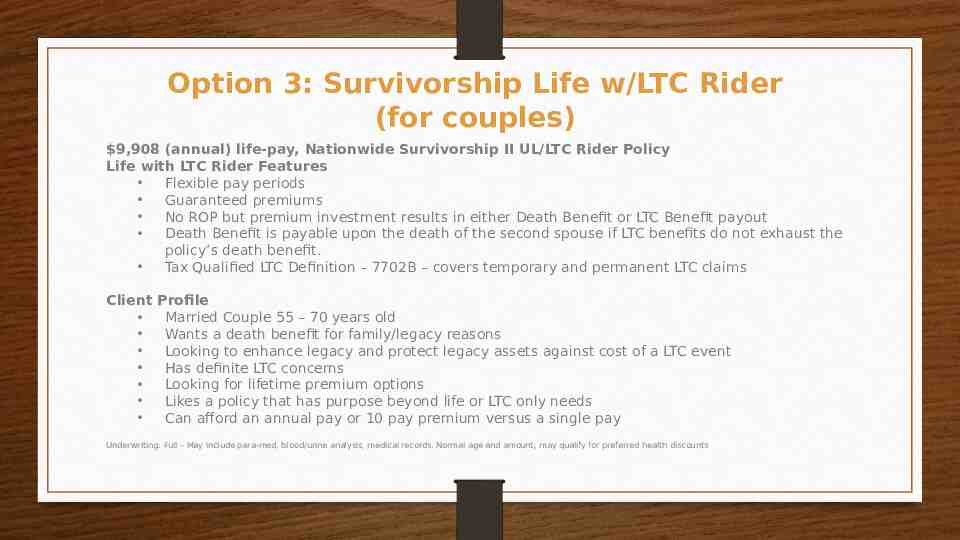

Option 3: Survivorship Life w/LTC Rider (for couples) 9,908 (annual) life-pay, Nationwide Survivorship II UL/LTC Rider Policy Life with LTC Rider Features Flexible pay periods Guaranteed premiums No ROP but premium investment results in either Death Benefit or LTC Benefit payout Death Benefit is payable upon the death of the second spouse if LTC benefits do not exhaust the policy’s death benefit. Tax Qualified LTC Definition – 7702B – covers temporary and permanent LTC claims Client Profile Married Couple 55 – 70 years old Wants a death benefit for family/legacy reasons Looking to enhance legacy and protect legacy assets against cost of a LTC event Has definite LTC concerns Looking for lifetime premium options Likes a policy that has purpose beyond life or LTC only needs Can afford an annual pay or 10 pay premium versus a single pay Underwriting: Full – May include para-med, blood/urine analysis, medical records. Normal age and amount; may qualify for preferred health discounts

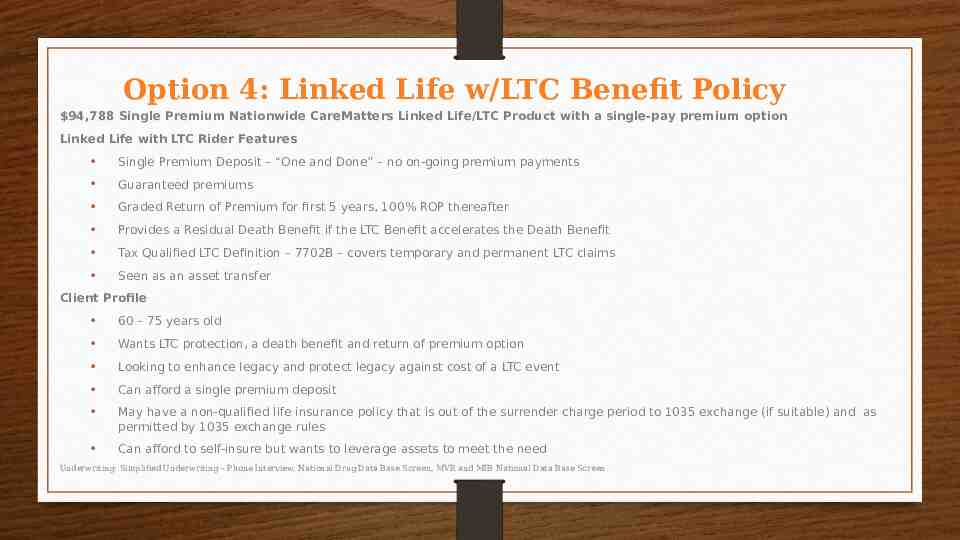

Option 4: Linked Life w/LTC Benefit Policy 94,788 Single Premium Nationwide CareMatters Linked Life/LTC Product with a single-pay premium option Linked Life with LTC Rider Features Single Premium Deposit – “One and Done” – no on-going premium payments Guaranteed premiums Graded Return of Premium for first 5 years, 100% ROP thereafter Provides a Residual Death Benefit if the LTC Benefit accelerates the Death Benefit Tax Qualified LTC Definition – 7702B – covers temporary and permanent LTC claims Seen as an asset transfer Client Profile 60 – 75 years old Wants LTC protection, a death benefit and return of premium option Looking to enhance legacy and protect legacy against cost of a LTC event Can afford a single premium deposit May have a non-qualified life insurance policy that is out of the surrender charge period to 1035 exchange (if suitable) and as permitted by 1035 exchange rules Can afford to self-insure but wants to leverage assets to meet the need Underwriting: Simplified Underwriting – Phone Interview, National Drug Data Base Screen, MVR and MIB National Data Base Screen

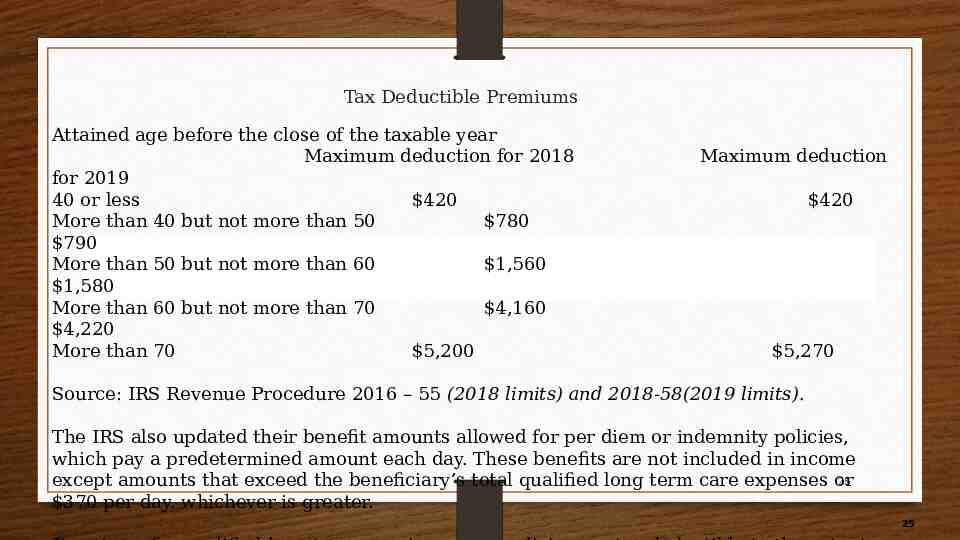

Tax Deductible Premiums Attained age before the close of the taxable year Maximum deduction for 2018 for 2019 40 or less 420 More than 40 but not more than 50 780 790 More than 50 but not more than 60 1,560 1,580 More than 60 but not more than 70 4,160 4,220 More than 70 5,200 Maximum deduction 420 5,270 Source: IRS Revenue Procedure 2016 – 55 (2018 limits) and 2018-58(2019 limits). The IRS also updated their benefit amounts allowed for per diem or indemnity policies, which pay a predetermined amount each day. These benefits are not included in income 25 except amounts that exceed the beneficiary’s total qualified long term care expenses or 370 per day. whichever is greater. 25

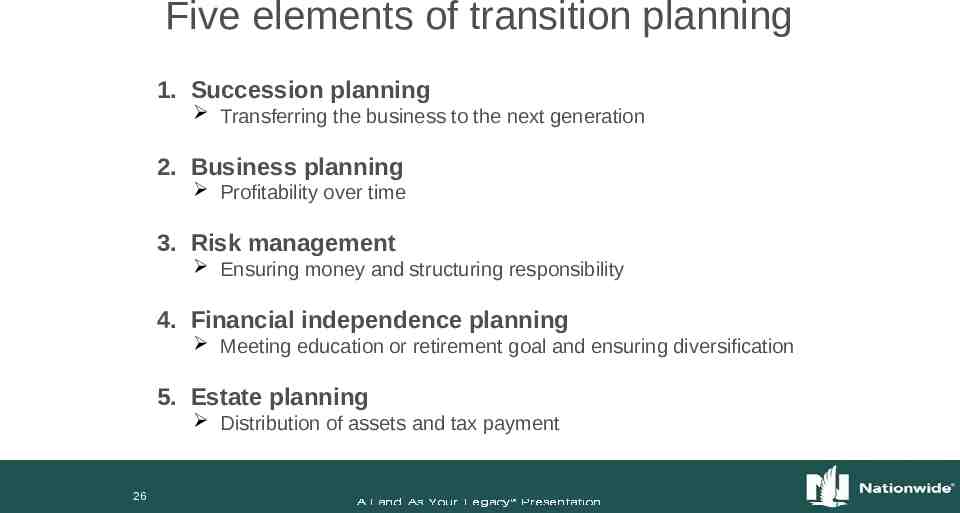

Five elements of transition planning 1. Succession planning Transferring the business to the next generation 2. Business planning Profitability over time 3. Risk management Ensuring money and structuring responsibility 4. Financial independence planning Meeting education or retirement goal and ensuring diversification 5. Estate planning Distribution of assets and tax payment 26