Central Bank of Egypt I. Portfolio Management Choices Prepared

87 Slides793.50 KB

Central Bank of Egypt I. Portfolio Management Choices Prepared & Presented By: Abdelhamid Mortagy March 2014 Abdelhamid Mortagy

Central Bank of Egypt Investment Philosophy 4000 The value of 1invested in the S&P 500 from 1926 to 2008 would have grown around 4000 times vs 100 times only if invested in Bonds. 3500 3000 2500 S&P 500 2000 Bond Market 1500 1000 500 0 March 2014 Abdelhamid Mortagy 1926 2008

Central Bank of Egypt Considerations in Investment Philosophy Market Timing (TAA) Inefficiency Illiquidity March 2014 Abdelhamid Mortagy

Central Bank of Egypt Investment Management There are THREE main decisions in IM: 1. 2. 3. Active vs. Passive Internal trading vs. External Managers In-house selection team vs. Consultants March 2014 Abdelhamid Mortagy

Central Bank of Egypt Management: Decision Tree Strategic Asset Allocation Investment Management Activity Active Management Passive Management Externally Managed Internally Managed Externally Managed External Consultants Internal Advisory Team External Consultants March 2014 Abdelhamid Mortagy Internally Managed Internal Advisory Team

Central Bank of Egypt Active Management alpha drivers: 1. 2. 3. 4. 5. 6. Market Inefficiency Illiquidity Leverage Skill Contrarian Thinking Long term time horizon March 2014 Abdelhamid Mortagy

Central Bank of Egypt Active Management Value Proposition 1. Active Management can add value to a portfolio. 2. It requires an ability to identify external managers who can generate future excess returns. 3. Exploring new investment strategies 4. Exploring new asset classes 5. Bringing new ideas at every stage of the investment process 6. Provide training 7. Provide business contacts. March 2014 Abdelhamid Mortagy

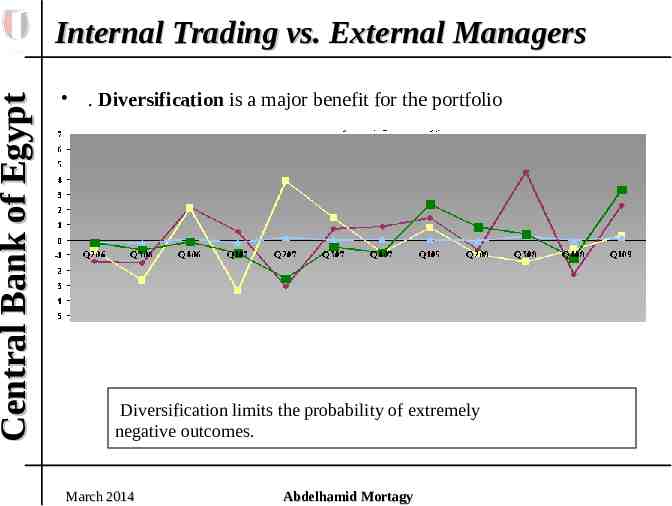

Central Bank of Egypt Internal Trading vs. External Managers . Diversification is a major benefit for the portfolio Diversification limits the probability of extremely negative outcomes. March 2014 Abdelhamid Mortagy

External Portfolio Management: Central Bank of Egypt The Activities of the External Managers Desk are as follows: Activities Mission and Governance .1 Asset Allocation .2 Risk Budget .3 External Managers selection process .4 Definition of Managers Guidelines .5 Legal Documentation .6 Compliance and Reporting .7 Risk Management .8 Portfolio Monitoring .9 Custodian Selection .10 Accounting and Back Office .11 The level of complexity of these activities increases with the complexity of the portfolio construction March 2014 Abdelhamid Mortagy

Central Bank of Egypt Cost/Benefit: Internal vs. External Managers Cost/Benefit Analysis Benefits of Using External Managers Costs of Using External Managers Intensive Investment Strategies .1 Difficult to control due to more risk .1 Best practice in the market .2 Requires significant experience in managing external managers Reduce staff turnover risk .3 No need for technical build up capability in selecting the .3 single investments Minimizing infrastructure costs .4 Slows down the opportunity of implementing changes in the portfolio March 2014 Abdelhamid Mortagy .2 .4

Central Bank of Egypt II. Active Management Considerations March 2014 Abdelhamid Mortagy

Central Bank of Egypt SAA for external managers Strategic Asset Allocation (SAA): A portfolio of global assets that meets a pre-specified investment objective (ALM) Steps in deciding on the strategic asset allocation 1. Setting objectives and deciding on the acceptable amount of risk 2. Choosing eligible asset classes 3. Determining allocation to each asset class 4. Selecting benchmarks that reflect the performance of each asset class March 2014 Abdelhamid Mortagy

Central Bank of Egypt Objectives and Horizon As a Central Bank our OBJECTIVE is: March 2014 Abdelhamid Mortagy

Central Bank of Egypt Risk Tolerance – Translating concerns of decision makers into quantifiable statistics. – Risk tolerance should reflect an institution’s ability to take risk and the current operating environment. March 2014 Abdelhamid Mortagy

Central Bank of Egypt Types of Portfolios P1 P2 P3 Expected Return 3.85% 5% 2.65% Expected Real Return 1.35% 2.5% 0.35% Standard Deviation 1.81% 4.19% 1.62% VaR 90% 0% 1%- 0.70% VaR 95% % .1 - 2.7%- 0% Prob (r 0) 10% 14% 6% March 2014 Abdelhamid Mortagy

Central Bank of Egypt Portfolio construction Most common approach employed by institutional investors and asset managers to determine optimal portfolios is mean variance optimization Mean variance optimization is a procedure that helps an investor find the portfolio that maximizes expected return for a given level of risk Key assumption: returns are normally distributed Inputs: – Expected return of each asset class – Standard deviation of each asset class – Correlation of returns between asset classes Output:–The efficient frontier, i.e. the set of portfolios with the highest expected return for a given level of risk March 2014 Abdelhamid Mortagy

Central Bank of Egypt Review of the SAA decision What are the factors driving an SAA review? Internal factors: changes in objectives, liquidity situation and liability structure could alter the risk-bearing capacity of the institution External factors: changes in market conditions or the market environment (e.g. level of yields) and changes in capital market outlook could alter the risk and return profile of the policy portfolio March 2014 Abdelhamid Mortagy

Central Bank of Egypt Appropriate Benchmarks What is a Benchmark ? An independent rate of return forming an objective test of the effective implementation of an investment strategy. – Starting point for portfolio construction – Yardstick for measuring and attributing the success of active or passive management – Pre-requisite for effective risk control What makes an Appropriate Benchmark? Reflect the institution’s long-term risk return profile, embodied in the SAA Expressing the appropriate SAA through selecting the right BM March 2014 Abdelhamid Mortagy

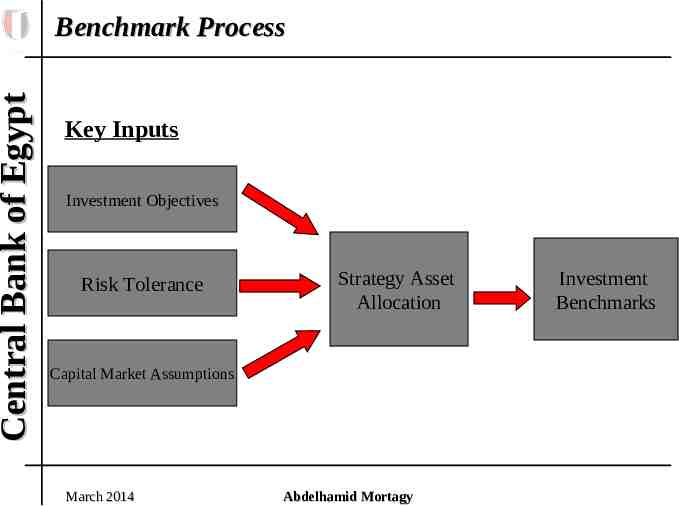

Central Bank of Egypt Benchmark Process Key Inputs Investment Objectives Risk Tolerance Strategy Asset Allocation Capital Market Assumptions March 2014 Abdelhamid Mortagy Investment Benchmarks

Central Bank of Egypt From SAA to Benchmarks Meeting the SAA requirements – Currency Composition – Eligible Asset Composition – Target Duration – Eligible Maturity Range – Liquidity Requirement Setting Benchmark Rebalancing Rules (MONTHLY) Other Considerations in constructing the benchmark – Source of the benchmark (BARCLAYS) – Choice of the providers (ML) March 2014 Abdelhamid Mortagy

Central Bank of Egypt Source of the Benchmark A benchmark may take any of the following forms: – A well recognized published index – A tailored composite of indexes – A peer group of similar funds or managers March 2014 Abdelhamid Mortagy

Central Bank of Egypt Characteristics of a Good Benchmark 1. Transparent (names and weights of securities) 2. Investible (investible securities) 3. Measurable (returns ) 4. Appropriate (represents the manager’s style 5. Specified in advance (evaluation) 6. Availability of historical data and index characteristics 7. Coverage 8. Documentation 9. Data Access 10. Relationship Management March 2014 Abdelhamid Mortagy

Central Bank of Egypt III. Portfolio Construction principles March 2014 Abdelhamid Mortagy

Central Bank of Egypt Understand The Benchmark The benchmark is the output of the asset allocation process and is an input in the portfolio construction and manager selection process. An analysis of the selected benchmark is useful to understand: – types of risks – types of skills – possible replication March 2014 Abdelhamid Mortagy

Central Bank of Egypt Understand The Benchmark Understand its risk components of the BM. Different asset classes, potentially included in your benchmark, have different risk/return profiles. The required managers’ skills set is a function of your benchmark Exploring passive investment alternatives will allow: A fair evaluation of managers returns The implementation of structures March 2014 Abdelhamid Mortagy

Central Bank of Egypt Understand The Benchmark Understanding how the benchmark can be passively replicated is important for: evaluate the performance of the active managers explore the possibility of specific investment alternatives March 2014 Abdelhamid Mortagy

Central Bank of Egypt Database Search Finding the best managers for you? Building an internal database is the starting point of the portfolio construction and manager selection process – Search the available information – Select and clean the data – Keep the database updated March 2014 Abdelhamid Mortagy

Central Bank of Egypt Database Search The internal database construction is an ongoing activity necessary for: Monitoring the portfolio: Evaluate existing and potential new managers: March 2014 Abdelhamid Mortagy

Central Bank of Egypt Portfolio Profile What type of managers are we going to select? Different alternatives: 1. 2. 3. Active managers Combination of specialized active managers Portable alpha strategies evaluate against the benchmark evaluate against one of the benchmarks sub components ( area, sectors, etc.) combine both the qualitative and the quantitative evaluation in your decision making March 2014 Abdelhamid Mortagy

Central Bank of Egypt Portfolio Profile Flexibility in the guidelines, increases the probability of achieving better risk adjusted returns specific legal documentation can be required to access certain instruments or markets ( Dodd-Franc and EMIR) broader due diligence Detailed guidelines are important in limiting downside potential March 2014 Abdelhamid Mortagy

Central Bank of Egypt Portfolio Profile Including a greater number of managers in the portfolio should result in a lower volatility of the overall excess returns Increasing the number of managers also reduces the probability of achieving very high excess returns DON’T PUT ALL YOUR EGGS IN ONE BASKET March 2014 Abdelhamid Mortagy

Central Bank of Egypt Conclusion 1. 2. 3. 4. 5. Understanding the benchmark Database search Portfolio composition Flexibility in the guidelines Optimal diversification March 2014 Abdelhamid Mortagy

Central Bank of Egypt IV. Key Risk/Return Indicators March 2014 Abdelhamid Mortagy

Central Bank of Egypt Indicators Overview Quantitative analysis: provides a framework for evaluation and comparison of a large set of managers most efficient method to screen out managers that do not meet investor’s minimum requirements March 2014 Abdelhamid Mortagy

Central Bank of Egypt Indicators Overview Risk-adjusted Performance Risk-adjusted performance indicators evaluate the manager’s ability to generate excess return, taking into account risk exposure as well. Consistency The goal of consistency indicators is to demonstrate the degree to which managers have stable and sustained performance combined with low volatility. Downside Risk Downside risk exposure metrics evaluate the manager’s ability to protect the investment against losses. March 2014 Abdelhamid Mortagy

Central Bank of Egypt Risk-adjusted Performance Alpha Information Ratio Sharpe Ratio Sortino Ratio March 2014 Abdelhamid Mortagy

Central Bank of Egypt Risk-adjusted Performance Alpha: A measure of the active return on investment. It assesses an active manager’s performance and is calculated as the return in excess of a benchmark index. March 2014 Abdelhamid Mortagy

Risk-adjusted Performance Central Bank of Egypt Information Ratio: – The ratio of the excess return of a portfolio to its tracking error – Measures active return per unit of risk. – Very helpful in comparing managers with different returns and different risk levels. March 2014 Abdelhamid Mortagy

Central Bank of Egypt Risk-adjusted Performance Sharpe Ratio – A measure of the manager excess return over the riskfree rate per unit of risk. – It is calculated as the manager’s return minus the riskfree rate, divided by the absolute standard deviation of the portfolio. – Used to characterize how well the return of an asset compensates the investor for the risk taken. March 2014 Abdelhamid Mortagy

Central Bank of Egypt Risk-adjusted Performance Sortino Ratio – The ratio of excess return to downside tracking error. It is designed to differentiate between ‘good’ and ‘bad’ volatility. – Provides a risk-adjusted measure of portfolio performance without penalizing it for upward price changes. – Helpful when volatility is not symmetrical. March 2014 Abdelhamid Mortagy

Central Bank of Egypt Consistency Tracking Error Hit Ratio Absolute Range Longest Outperformance March 2014 Abdelhamid Mortagy

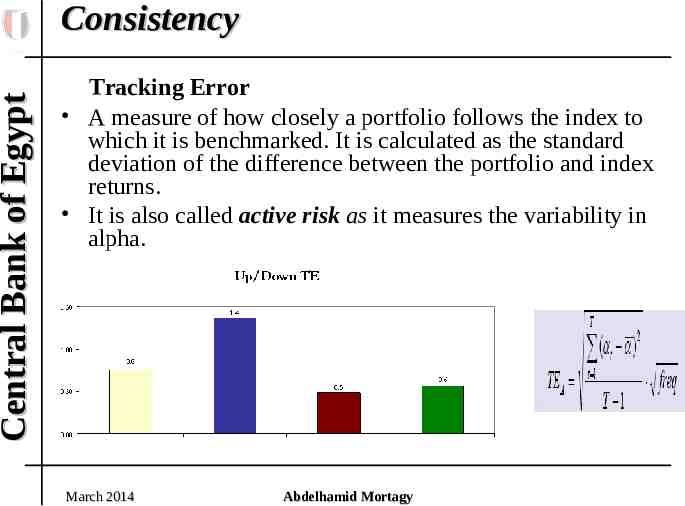

Central Bank of Egypt Consistency Tracking Error A measure of how closely a portfolio follows the index to which it is benchmarked. It is calculated as the standard deviation of the difference between the portfolio and index returns. It is also called active risk as it measures the variability in alpha. March 2014 Abdelhamid Mortagy

Central Bank of Egypt Consistency Hit Ratio The percentage of time a manager outperformed the benchmark historically. Hit Ratio Alpha Goldman PIMCO 52% 31% 0.05% 0.16% Which Manager do you prefer? March 2014 Abdelhamid Mortagy

Central Bank of Egypt Consistency Absolute Range: – The absolute difference between max monthly loss and max monthly gain. A measure of return dispersion. – It gives an indication of the magnitude, but not of the direction of the move. March 2014 Abdelhamid Mortagy

Central Bank of Egypt Consistency Longest Outperformance Maximum number of consecutive months with positive excess return. Longest Outperformance March 2014 Abdelhamid Mortagy

Central Bank of Egypt Downside Risk Downside Tracking Error Average Loss Maximum Loss Longest Underperformance Maximum Drawdown Longest Recovery Period March 2014 Abdelhamid Mortagy

Central Bank of Egypt Downside Tracking Error Downside Tracking Error – Standard deviation of excess returns below the average excess return. A measure of downside volatility. – If returns are symmetric, it is proportional to total tracking error. March 2014 Abdelhamid Mortagy

Central Bank of Egypt Downside Risk Average Loss The average of negative excess returns over the entire specified timeperiod. March 2014 Abdelhamid Mortagy

Central Bank of Egypt Downside Risk Maximum Loss The most negative excess return over a specified time-period. March 2014 Abdelhamid Mortagy

Central Bank of Egypt Downside Risk Longest Underperformance Can you see the longest underperformance period? March 2014 Abdelhamid Mortagy

Central Bank of Egypt Downside Risk Maximum Drawdown – The largest cumulative loss from peak to trough over a period of time. March 2014 Abdelhamid Mortagy

Central Bank of Egypt Downside Risk Longest Recovery Period: The longest period (e.g. months) it took a manager to recover a loss. March 2014 Abdelhamid Mortagy

Central Bank of Egypt Summary Evaluate a manager against your investment objectives. Comparison among managers. Consistency or downside risk protection. Give an insight into the manager’s track record. March 2014 Abdelhamid Mortagy

Central Bank of Egypt V. Qualitative Due Diligence March 2014 Abdelhamid Mortagy

Central Bank of Egypt General Guiding Principles Due Diligence is an ART: – Do not fall in LOVE with: The manager The performance The strategy Stick to the PROCESS. March 2014 Abdelhamid Mortagy

Central Bank of Egypt General Guiding Principles You need to be: An Investment Professional A Risk Manager A Lawyer An Auditor / Forensic Accountant Management Consultant Psychologist March 2014 Abdelhamid Mortagy

Central Bank of Egypt General Guiding Principles Meet with everyone that could add value: Portfolio Manager Strategists Risk Manager Back Office Staff Business Client Service Traders and Front Desk March 2014 Abdelhamid Mortagy

Central Bank of Egypt Due Diligence Approach Business and Organization Risk Management Process Business Portfolio Staff Risk Factors Risk Monitoring Measures Infrastructure Investment Process Experience Edge Market Trading Manage Themes Trades r Opportunity set March 2014 Idea Generation Operational Due Diligence Sources of Risk Return & Portfolio Portfolio Construction P&L Cash Portfolio NAV Trading Abdelhamid Mortagy Pricing Action

Central Bank of Egypt Due Diligence Approach Examine firm processes Consistency with manager statements Consistency with other processes Consistency across time March 2014 Abdelhamid Mortagy

Central Bank of Egypt Business & Organization Examples of General Business Risks: Corporate culture versus investment team culture Future business plans and your product Products of the firm and your product Growth rate of assets under management Compensation structure versus market Unstructured business decision making process March 2014 Abdelhamid Mortagy

Central Bank of Egypt Business & Organization Staff (RED FLAG) : High turnover rate High DeMotivation Lack of cooperation between the team Running the business is lead by Portfolio Managers March 2014 Abdelhamid Mortagy

Central Bank of Egypt Business & Organization Infrastructure (RED FLAG) : No front –back office system No automated pricing source system No disaster recovery plan No portfolio management system March 2014 Abdelhamid Mortagy

Central Bank of Egypt Investment Strategy Experience Edge Market Opportunity set March 2014 Manager Sources of Risk Return & Themes Trades Idea Generation Abdelhamid Mortagy Portfolio Construction Portfolio Trading P&L

Central Bank of Egypt Investment Strategy 1.Opportunity Set : Ask the manager what is the best environment for his strategy 2. Manager Edge: Manager’s style of managing risks is an edge. 3. Investment Process & Idea Generation: Understand the process & examine how trades are being structured. 4. Portfolio Construction: Check historical portfolios & Understand the risks in the concentrated positions and sectors. 5. Trading: Is there a separation between PM and trader? How does the trader interact with the rest of the team? Any Chinese walls? 6. Sources of Risks and Returns: Understand all the sources of risks and their allocation in the different territories and sectors. March 2014 Abdelhamid Mortagy

Central Bank of Egypt Major types of risks Liquidity Risk FX Risk Basis Risk Concentration Risk Credit Risk Counterparty Risk Interest Rate Risk March 2014 Abdelhamid Mortagy

Central Bank of Egypt VI. Investment Guidelines March 2014 Abdelhamid Mortagy

Central Bank of Egypt Benchmark and Return Objective Define risk/return preference: Investment objective Used Benchmark Excess return target. Tracking error limit. March 2014 Abdelhamid Mortagy

Central Bank of Egypt Eligible Instruments Define flexibility: Govi Agencies CP Municipal Supras Corps MM Funds Derivatives March 2014 Abdelhamid Mortagy

Central Bank of Egypt Portfolio Risks Define credit preference: Credit quality Credit Concentration Duration Risk Currency Risk Credit Risk Liquidity Risk Diversification Criteria Asset Exposure Counterparty Exposure March 2014 Abdelhamid Mortagy

Central Bank of Egypt VII. Management Fees March 2014 Abdelhamid Mortagy

Central Bank of Egypt Road Map Performance Fees vs. Flat Fees Fees in the Alternative Asset Classes Factors in Fee Negotiations March 2014 Abdelhamid Mortagy

Central Bank of Egypt Performance Fees vs. Flat Fees Standard Flat Fee based on AuM: First 15 Mio Next 20 Mio Next 25 Mio Next 30 Mio Next 35 Mio Thereafter BP 50 40 30 20 10 5 How much would you pay for a portfolio of 100 million AuM? March 2014 Abdelhamid Mortagy

Central Bank of Egypt Factors in Fee Negotiations The name recognition of the plan sponsor The larger the size of the mandate The smaller size of the money manager. The shorter the track record of the money manager The worst the track record of the money manager. March 2014 Abdelhamid Mortagy

Central Bank of Egypt VIII. Monitoring External Managers March 2014 Abdelhamid Mortagy

Central Bank of Egypt Keep asking these questions How is the portfolio doing? How are the managers in the portfolio doing? What to do with an out/under-performing manager? March 2014 Abdelhamid Mortagy

Central Bank of Egypt How is the manager doing? Analysis required for answering this question: Quantitative: – – – – Return & risk Return & risk attribution Ranking Service level and Relationship Qualitative: – – – – Business risk Key person risk Market exposure Some red flags: aggressive pursuit of AUM, change of ownership March 2014 Abdelhamid Mortagy

Central Bank of Egypt Return & Risk vs. Expectation March 2014 Abdelhamid Mortagy

Central Bank of Egypt Return Attribution March 2014 Abdelhamid Mortagy

Central Bank of Egypt Risk Attribution Risk attribution can be used together with return attribution to evaluate a manager’s skill and efficiency in generating excess return. To analyze Risk Attribution go back to the Quantitative Analysis section and start creating your map. March 2014 Abdelhamid Mortagy

Central Bank of Egypt Manager Ranking 1.Alpha ranking 2. IR ranking Alpha Attribution Ranking: measures the active return on investment from different alpha sources. It assesses an active manager’s performance and is calculated as the return in excess of the benchmark index. Information Ratio Ranking: measures excess return of the portfolio to its tracking error. It measures active return per unit of risk. March 2014 Abdelhamid Mortagy

Central Bank of Egypt Qualitative Issues Business risk Trading style change Key person risk Market exposure Some red flags: – Aggressive accumulation of AUM – AUM exceeds capacity of a certain strategy – Change of ownership March 2014 Abdelhamid Mortagy

Central Bank of Egypt IX. Governance March 2014 Abdelhamid Mortagy

Central Bank of Egypt Outline Principles of Good Governance Delegation of Authority and Accountability for decisions Governance Policy making is key to managing external managers IMA March 2014 Abdelhamid Mortagy

Central Bank of Egypt Principles of Good Governance Clear delegation of authority Informed policy making Oversight based on quantitative and qualitative performance indicators. Internal controls Transparency March 2014 Abdelhamid Mortagy

Central Bank of Egypt Governance Governance is the process of exercising fiduciary duties Central Bank of Egypt is responsible for setting the benchmark, the risk budget for active management and the investment guidelines specifying the types of strategies and limits the external managers are allowed to invest. Asset managers are agents who invest based on delegated authority and instructions – Benchmark performance is the responsibility of the CBE – Portfolio performance relative to the benchmark is the responsibility of the external manager. March 2014 Abdelhamid Mortagy

Central Bank of Egypt Policy making is key RMU Board Proposes SAA strategies with different risk/return profiles Endorses SAA Proposes benchmarks Endorses benchmark Propose risk allocation vs Passive Endorses risk allocation Reviews SAA March 2014 Abdelhamid Mortagy

Central Bank of Egypt IMA 1. The Investment Management Agreement specifies the legal rights and obligations of each party and defines the objective of the mandate 2. The benchmark. 3. The risk budget or tracking error target and limits on investment strategies relative to the benchmark. 4. Custodian of the assets 5. Fees. March 2014 Abdelhamid Mortagy