Capital Budgeting

43 Slides334.59 KB

Capital Budgeting

Objectives Upon completion of this session, participants will be able to: Explain the role of capital budgeting in long-range planning Understand the concept of cash flow analysis Understand the difference between simple and discounted cash flow analysis Evaluate the strengths and weaknesses of alternative capital budgeting models

Objectives (continued) Calculate the discounted cash flows (DCF) Estimate the Net Present Value (NPV) of a project Determine the Internal rate of Return (IRR) of a project Calculate the Profitability Index (PI) of a project Determine the simple and discounted pay-back period of a project Evaluate the impact of taxes on the above measures

Capital Budgeting Decisions 1. Capital Budgeting Decisions include the acquisition of long-lived assets. 2. Require that capital (company funds) be expended to acquire additional resources. 3. Also known as Capital Expenditure Decisions.

Capital Budgeting Decisions: Examples 1. New retail store outlets. 2. Robotic manufacturing equipment. 3. Digital imaging systems for healthcare facilities. 4. New chairlift for a ski resort. 5. New fleets: Ships Planes Cars 6. New equipment for food preparation.

Evaluating Investment Opportunities: Time Value of Money Approaches 1. The Time Value of Money says: a dollar today is worth more than a dollar tomorrow. 2. It is necessary to convert future dollars into their equivalent present value dollars. 3. Two methods: a. Net Present Value. b. Internal Rate of Return.

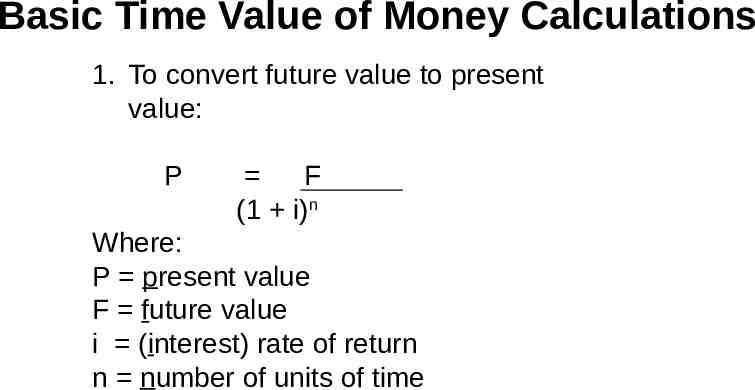

Basic Time Value of Money Calculations 1. To convert future value to present value: P F (1 i)n Where: P present value F future value i (interest) rate of return n number of units of time

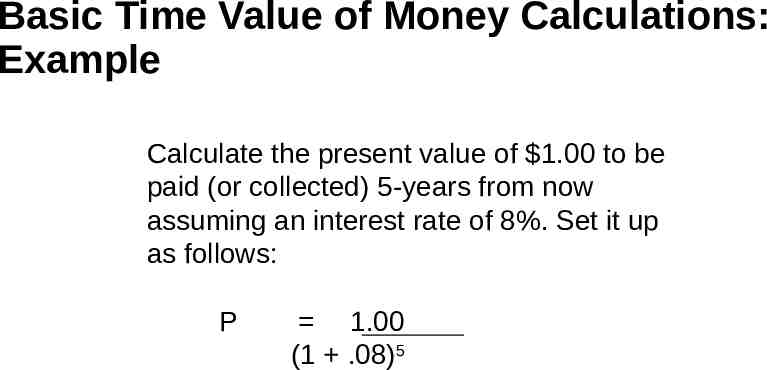

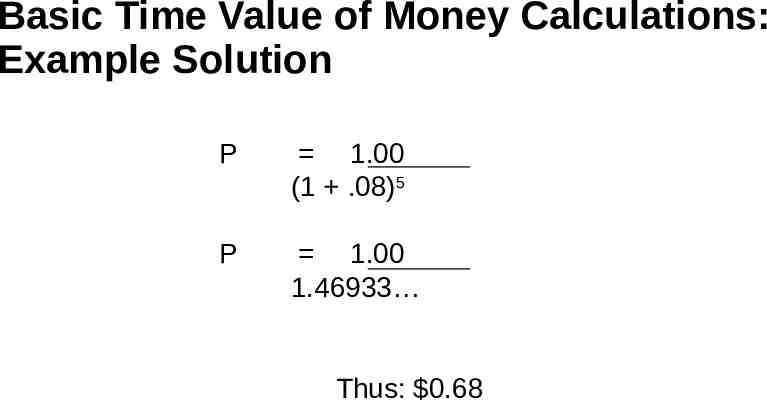

Basic Time Value of Money Calculations: Example Calculate the present value of 1.00 to be paid (or collected) 5-years from now assuming an interest rate of 8%. Set it up as follows: P 1.00 (1 .08)5

Basic Time Value of Money Calculations: Example Solution P 1.00 (1 .08)5 P 1.00 1.46933 Thus: 0.68

The Net Present Value Method 1. Based on the time-value of money. 2. Recall that only incremental cash flows are relevant. 3. Three-step process.

The Net Present Value Method: Step 1 Identify the amount and time period of each cash flow associated with a potential investment. Note: Investment projects have both cash inflows and cash outflows.

The Net Present Value Method: Step 2 Discount the cash flows to their present values using a required rate of return (a.k.a. hurdle rate). Note: This is the minimum return that management will accept.

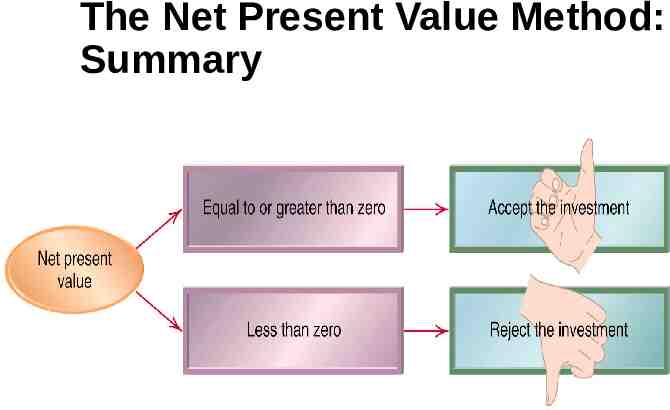

The Net Present Value Method: Step 3 Evaluate the net present value--the sum of all of the cash inflows less cash outflows. Note: if the net present value (NPV) is greater than or equal to zero, the investment should be made. If less than zero, it should not be made.

The Net Present Value Method: Example, Step 1 Identify the amount and time period of each cash flow associated with a potential investment. 1. Initial cash outlay: 70,000 2. Year 1 – 4 net cash savings: 21,000 per year. 3. Year 5 net cash savings: 26,000. 4. Required rate of return: 12%.

The Net Present Value Method: Example Step 2 Discount the cash flows to their present values using a required rate of return (a.k.a. hurdle rate). Initial outlay: 70,000 x 1.00 Year 1: 21,000 x .8929 Year 2: 21,000 x .7972 Year 3: 21,000 x .7118 Year 4: 21,000 x .6355 Year 5: 26,000 x .5674

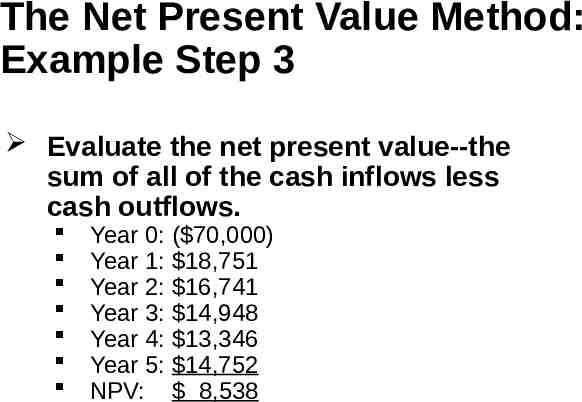

The Net Present Value Method: Example Step 3 Evaluate the net present value--the sum of all of the cash inflows less cash outflows. Year 0: ( 70,000) Year 1: 18,751 Year 2: 16,741 Year 3: 14,948 Year 4: 13,346 Year 5: 14,752 NPV: 8,538

The Net Present Value Method: Example Do it! 8,538 0

The Net Present Value Method: Summary

The Internal Rate of Return Method 1. Internal Rate of Return (IRR) is an alternative to the Net Present Value (NPV) method. 2. IRR uses the time value of money. 3. IRR is the rate of return that equates the present value of future cash flows to the investment outlay.

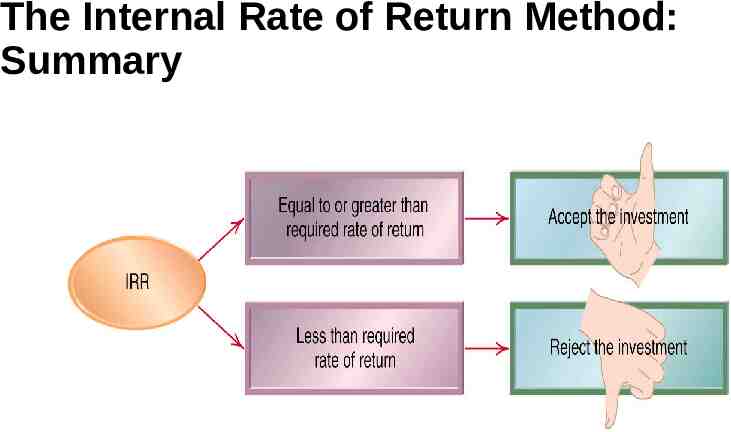

The Internal Rate of Return Method 1. Internal Rate of Return (IRR) is an alternative to the Net Present Value (NPV) method. 2. IRR uses the time value of money. 3. IRR is the rate of return that equates the present value of future cash flows to the investment outlay. 4. IRR analysis yields a yes (IRR hurdle rate) or no (IRR hurdle rate) result.

The Internal Rate of Return Method: Setup Present value factor Initial Outlay Annuity Amount

The Internal Rate of Return Method: Example Investment: 100 Expected 2-year return: 60 per year Present value factor 60 100

The Internal Rate of Return Method: Example 1. Present value factor 1.667 2. Approximately equal to the PV factor of 1.6681 or 13% (from PV tables).

The Internal Rate of Return Method: Summary

The Internal Rate of Return With Unequal Cash Flows 1. For cases with unequal yearly cash flows. 2. Thus one cannot use a single present value factor. 3. Must estimate the IRR (we will use EXCEL in class to calculate the NPV and IRR).

Summary of Net Present Value and Internal Rate of Return Methods 1. Both the Net Present Value method and the Internal Rate of Return method take into account the time value of money. 2. They differ in their approach to evaluating investment alternatives.

Estimating the Required Rate of Return 1. In the textbook examples, required rate of return was “given.” 2. In practice, required rate of return must be estimated by management. 3. Under certain conditions, the required rate of return should be equal to the cost of capital for the firm.

Additional Cash Flow Considerations 1. Both the NPV and IRR require proper specification of cash flows. 2. Only cash inflows and cash outflows are discounted back to the present, not revenues and expenses.

Cash Flows, Taxes, and The Depreciation Tax Shield 1. Previously the effect of income taxes on cash flows was ignored. 2. Tax considerations play a major role in capital budgeting decisions. 3. Though depreciation does not directly affect cash flows, it indirectly affects cash flows. 4. Depreciation reduces the amount of tax (which is paid in cash) a company must pay. 5. Thus it is called a Depreciation Tax Shield.

Adjusting Cash Flows For Inflation 1. Inflation should not be ignored in net present value analysis. 2. Many worthwhile investment opportunities may be rejected. 3. For our calculations, we assume the future cash flows are inflation-adjusted.

Simplified Approaches To Capital Budgeting 1. Payback Period Method. 2. Accounting Rate of Return.

Payback Period Method 1. The length of time it takes to recover the initial cost of an investment. 2. Example: an investment costs 1,000 and returns 500 per year, it has a payback period of 2-years. 3. Two serious limitations: a. Does not consider cash inflows in years beyond the payback year. b. Does not consider the time value of money. 4. We can also do a Discounted Payback calculation.

Accounting Rate of Return 1. Accounting Rate of Return (ARR) is the average after-tax income from a project divided by the average investment in the project. 2. Example: ARR Average Net Income Average Investment 3. Ignores the time value of money.

Conflict Between Performance Evaluation and Capital Budgeting 1. Managers should use Net Present Value and Internal Rate of Return analyses to maximize shareholder wealth. 2. Manager’s performance (and bonus) is often measured in the short-term on accounting income. 3. Inherent conflict between what is good for the firm and what is good for the manager.

Quick Review Question #1 1. If the net present value (NPV) of a project is zero, the project is earning a return equal to: a. b. c. d. Zero. The rate of inflation. The accounting rate of return. The required rate of return.

Quick Review Answer #1 1. If the present value of a project is zero, the project is earning a return equal to: a. b. c. d. Zero. The rate of inflation. The accounting rate of return. The required rate of return.

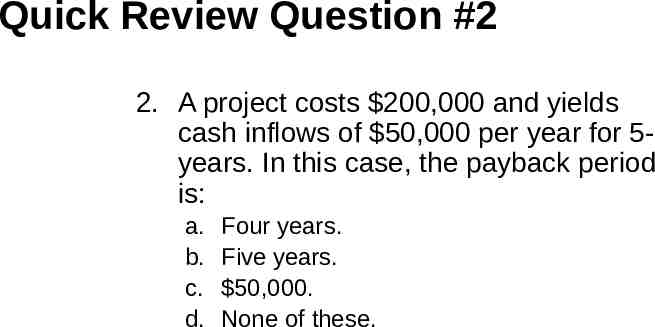

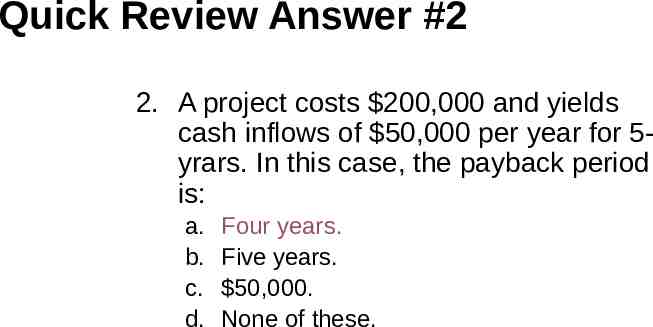

Quick Review Question #2 2. A project costs 200,000 and yields cash inflows of 50,000 per year for 5years. In this case, the payback period is: a. b. c. d. Four years. Five years. 50,000. None of these.

Quick Review Answer #2 2. A project costs 200,000 and yields cash inflows of 50,000 per year for 5yrars. In this case, the payback period is: a. b. c. d. Four years. Five years. 50,000. None of these.

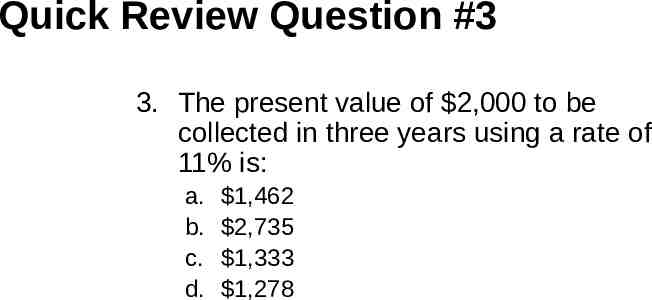

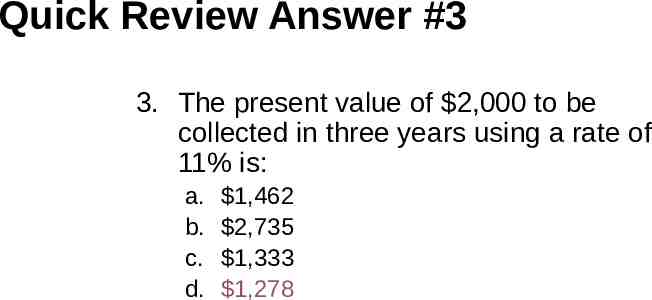

Quick Review Question #3 3. The present value of 2,000 to be collected in three years using a rate of 11% is: a. b. c. d. 1,462 2,735 1,333 1,278

Quick Review Answer #3 3. The present value of 2,000 to be collected in three years using a rate of 11% is: a. b. c. d. 1,462 2,735 1,333 1,278

Quick Review Question #4 4. New equipment costing 5,000 is expected to yield net cash inflows of 1,350 each year for the next five years. Assuming a required rate of return of 14%, should the equipment be purchased (use IRR)? a. Yes (accept). b. No (reject).

Quick Review Answer #4 4. New equipment costing 5,000 is expected to yield net cash inflows of 1,350 each year for the next five years. Assuming a required rate of return of 14%, should the equipment be purchased (use IRR)? a. Yes (accept). b. No (reject). Note: 1,350 * 3.4331 4,635

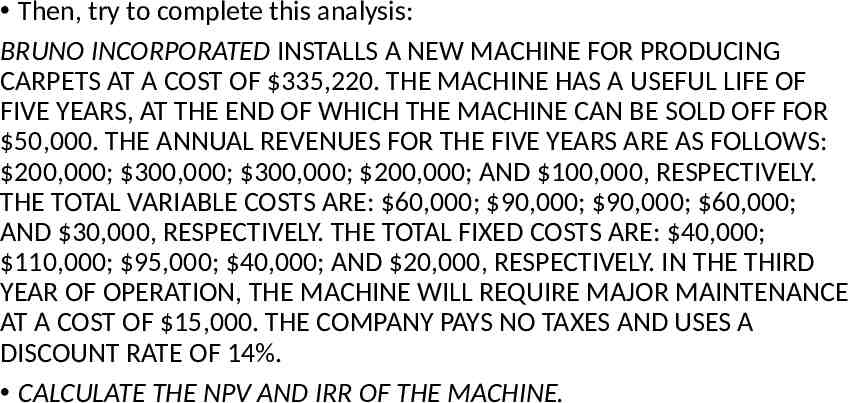

Then, try to complete this analysis: BRUNO INCORPORATED INSTALLS A NEW MACHINE FOR PRODUCING CARPETS AT A COST OF 335,220. THE MACHINE HAS A USEFUL LIFE OF FIVE YEARS, AT THE END OF WHICH THE MACHINE CAN BE SOLD OFF FOR 50,000. THE ANNUAL REVENUES FOR THE FIVE YEARS ARE AS FOLLOWS: 200,000; 300,000; 300,000; 200,000; AND 100,000, RESPECTIVELY. THE TOTAL VARIABLE COSTS ARE: 60,000; 90,000; 90,000; 60,000; AND 30,000, RESPECTIVELY. THE TOTAL FIXED COSTS ARE: 40,000; 110,000; 95,000; 40,000; AND 20,000, RESPECTIVELY. IN THE THIRD YEAR OF OPERATION, THE MACHINE WILL REQUIRE MAJOR MAINTENANCE AT A COST OF 15,000. THE COMPANY PAYS NO TAXES AND USES A DISCOUNT RATE OF 14%. CALCULATE THE NPV AND IRR OF THE MACHINE.