Building Business Acumen Series: Making Dollars and Sense of

16 Slides127.50 KB

Building Business Acumen Series: Making Dollars and Sense of Financial Statements Presented by : The Dean Consulting Group Diane D. Dean Principal December 4, 2007

Outcomes At the end of today’s session, you will: Be financially literate. Acquire a better understanding of key financial terminology. Reviewed the tools necessary to get a handle on your business finances. Be familiar with the functions of the basic financial statements: balance sheet, income and cash flow statements. Know how to speak the language of and analyze numbers. The Dean Consulting Group

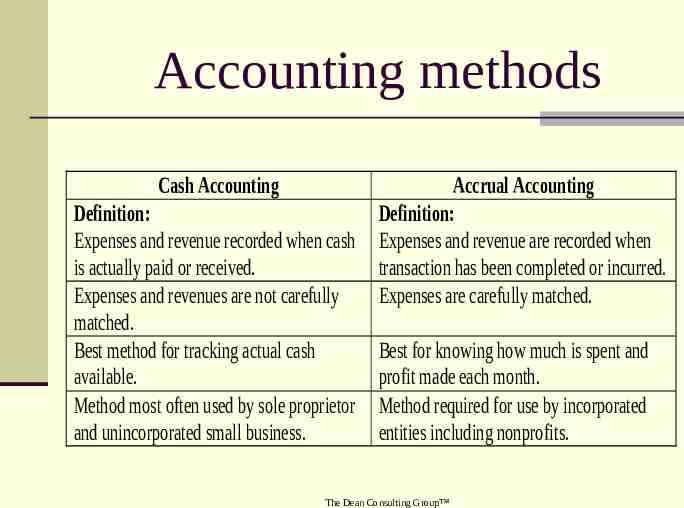

Accounting methods Cash Accounting Accrual Accounting Definition: Definition: Expenses and revenue recorded when cash Expenses and revenue are recorded when is actually paid or received. transaction has been completed or incurred. Expenses and revenues are not carefully Expenses are carefully matched. matched. Best method for tracking actual cash Best for knowing how much is spent and available. profit made each month. Method most often used by sole proprietor Method required for use by incorporated and unincorporated small business. entities including nonprofits. The Dean Consulting Group

Components of the Annual Report Auditor’s Report Balance Sheet/Statement of Financial Position Income Statement/Statement of Activities Statement of Cash Flow Notes to the Financial Statements Manager’s Discussion and Analysis The Dean Consulting Group

Auditor’s Report Introductory Paragraph - denotes timeframe of the audit and who is responsible for the financial statements. This is where the auditor attempts to limit their responsibility for possible inaccuracies. The Dean Consulting Group

Auditor’s Report Scope Paragraph – Explains how auditors carried out the audit and they met the generally accepted audit standards (GAAS). The Dean Consulting Group

Auditor’s Report Opinion Paragraph – Where the auditors state their opinion about the financial statements. If there are no problems, they will state "In conformity with generally accepted accounting principles" (GAAP). The Dean Consulting Group

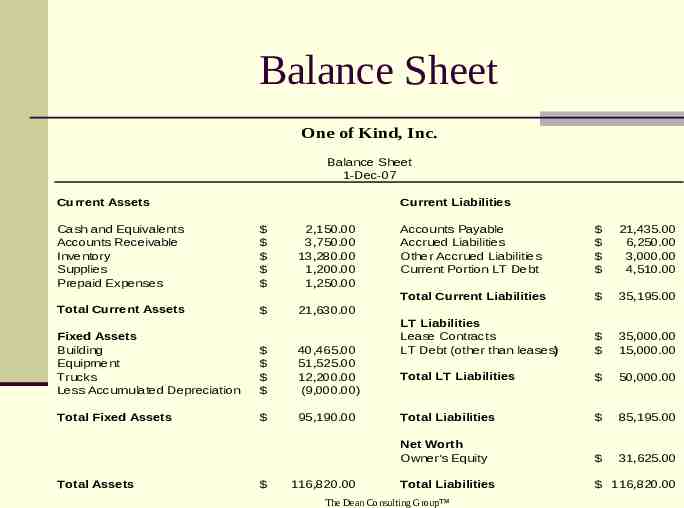

Balance Sheet One of Kind, Inc. Balance Sheet 1-Dec-07 Current Assets Cash and Equivalents Accounts Receivable Inventory Supplies Prepaid Expenses Total Current Assets Current Liabilities 2,150.00 3,750.00 13,280.00 1,200.00 1,250.00 40,465.00 51,525.00 12,200.00 (9,000.00) Total Fixed Assets 95,190.00 21,435.00 6,250.00 3,000.00 4,510.00 Total Current Liabilities 35,195.00 LT Liabilities Lease Contracts LT Debt (other than leases) 35,000.00 15,000.00 Total LT Liabilities 50,000.00 Total Liabilities 85,195.00 Net Worth Owner's Equity 31,625.00 Total Liabilities 116,820.00 21,630.00 Fixed Assets Building Equipment Trucks Less Accumulated Depreciation Total Assets Accounts Payable Accrued Liabilities Other Accrued Liabilities Current Portion LT Debt 116,820.00 The Dean Consulting Group

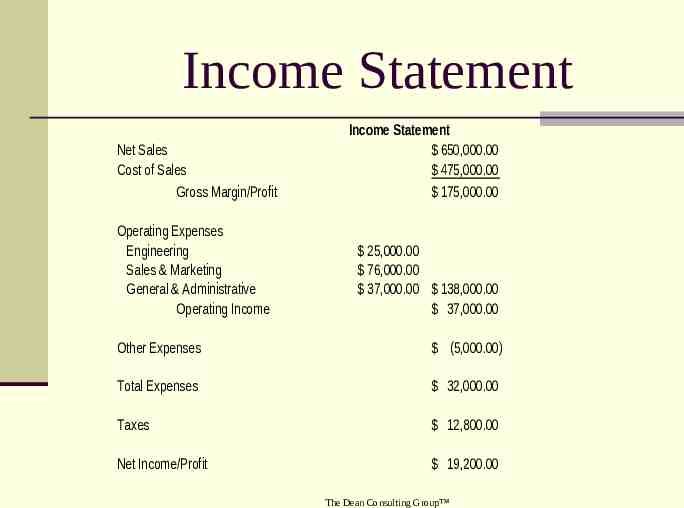

Income Statement Net Sales Cost of Sales Gross Margin/Profit Operating Expenses Engineering Sales & Marketing General & Administrative Operating Income Income Statement 650,000.00 475,000.00 175,000.00 25,000.00 76,000.00 37,000.00 138,000.00 37,000.00 Other Expenses (5,000.00) Total Expenses 32,000.00 Taxes 12,800.00 Net Income/Profit 19,200.00 The Dean Consulting Group

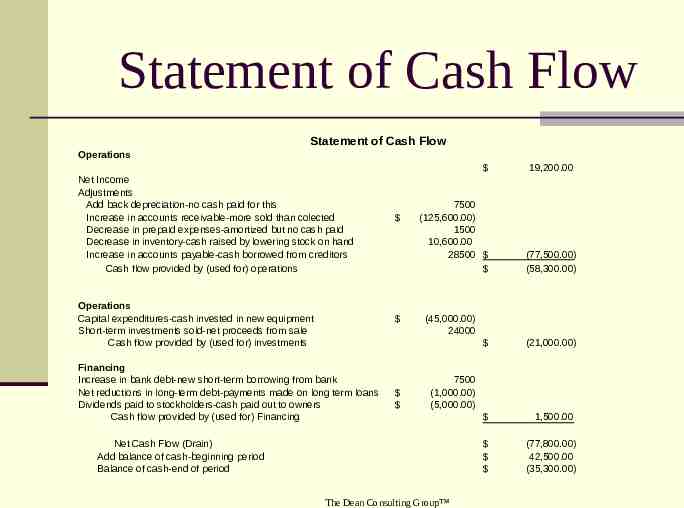

Statement of Cash Flow Statement of Cash Flow Operations Net Income Adjustments Add back depreciation-no cash paid for this Increase in accounts receivable-more sold than colected Decrease in prepaid expenses-amortized but no cash paid Decrease in inventory-cash raised by lowering stock on hand Increase in accounts payable-cash borrowed from creditors Cash flow provided by (used for) operations Operations Capital expenditures-cash invested in new equipment Short-term investments sold-net proceeds from sale Cash flow provided by (used for) investments Financing Increase in bank debt-new short-term borrowing from bank Net reductions in long-term debt-payments made on long term loans Dividends paid to stockholders-cash paid out to owners Cash flow provided by (used for) Financing 7500 (125,600.00) 1500 10,600.00 28500 19,200.00 (77,500.00) (58,300.00) (45,000.00) 24000 (21,000.00) 1,500.00 (77,800.00) 42,500.00 (35,300.00) 7500 (1,000.00) (5,000.00) Net Cash Flow (Drain) Add balance of cash-beginning period Balance of cash-end of period The Dean Consulting Group

Notes to the Financial Statements Very important notes listed on various pages after the financial statements. It includes: The accounting methods used Red flags about the company’s finances Any legal entanglements that may threaten organization's future. The Dean Consulting Group

Manager’s Discussion and Analysis (MD&A) You find in this section key discussions about what went well and did not. The Dean Consulting Group

Manager’s Discussion and Analysis (MD&A) Three key areas: Company operations Capital resources Liquidity The Dean Consulting Group

Channeling Your Inner CSI: Analysis The Dean Consulting Group

Channeling Your Inner CSI: Analysis MD&A Financial Statements Working capital/fund balance (NFP) Current Ratio Gross Margin Trend Analysis The Dean Consulting Group

Q&A The Dean Consulting Group