BEHIND THE DEMAND CURVE Price Elasticity of Demand

36 Slides4.58 MB

BEHIND THE DEMAND CURVE Price Elasticity of Demand

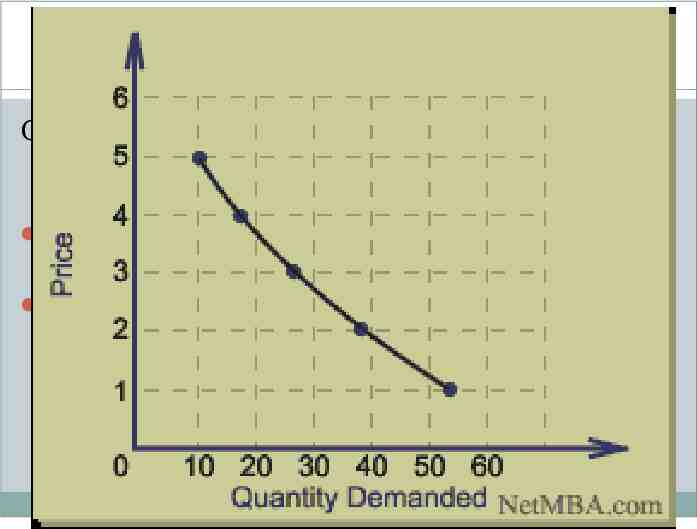

THE LAW OF DEMAND TELLS US: When price increases, the QUANTITY demanded decreases, and when prices decrease, the QUANTITY demanded increases.

Why does the Qd change? Consider what happens when Oakland apartment rents increase: Substitution effect: Consumers can switch to close substitutes when prices rise. Income effect: people have less purchasing power (feel poorer) when the price

Prices help allocate resources Ex: Higher rents would cause some consumers to find a roommate, look in other areas outside Oakland, live with parents, stay in a dorm, live in there car and some will just pay the higher price but be able to buy less of other stuff. The Higher price incentivizes people to act in ways that help balance the supply and demand of apartments. If the current prices DON’T cause balance because too few apartments are available, landlords will respond by increasing rents (price) and perhaps increasing the quantity of apartments (maybe by repairing a rundown place to quickly get it operating.

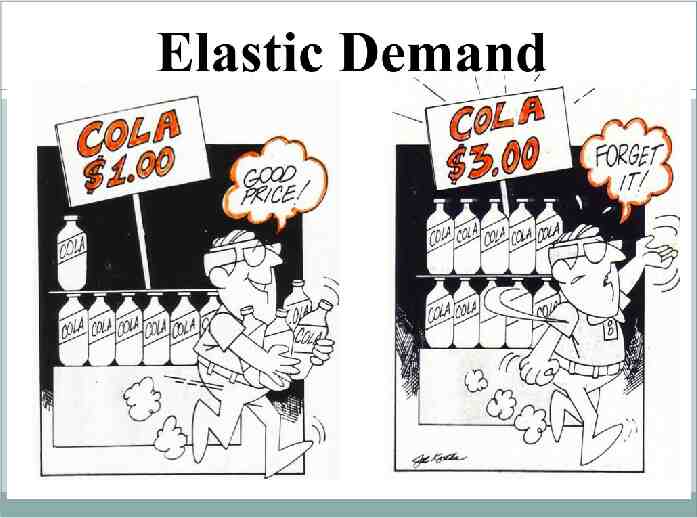

So, there is a relationship between prices and quantities but how much? ELASTICITY RESPONSIVENESS If demand is said to be ‘elastic’, then consumers respond a lot to it. Price Elasticity Consumers responding to changes in price PED Responsive to Prices

WARNING The next slide contains images that contain metaphors that have served as powerful learning devices for hundreds of econ students. If you have delicate sensibilities, look away.

Elasticity Responsiveness

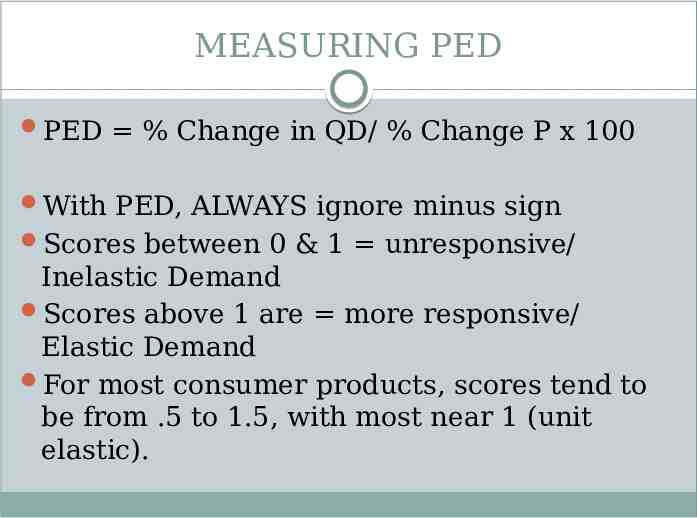

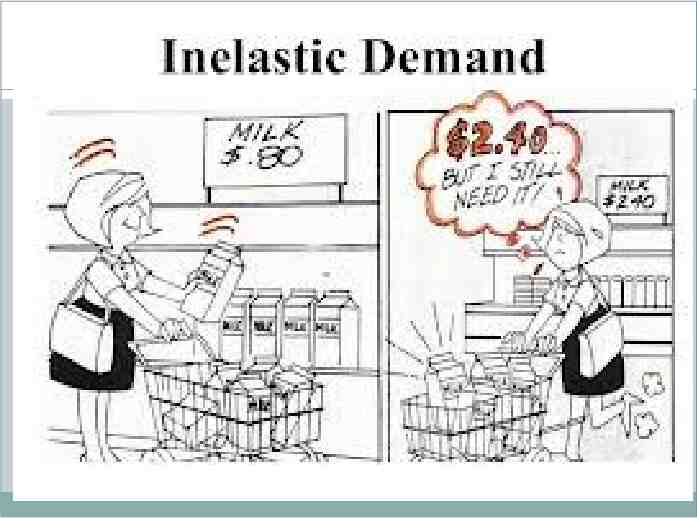

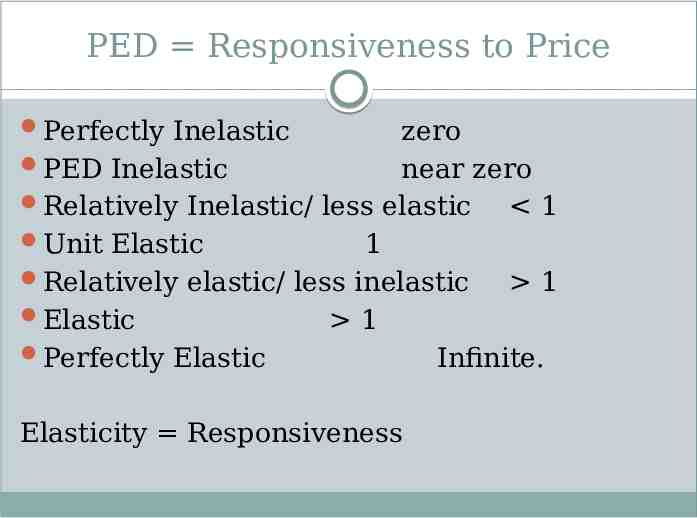

MEASURING PED PED % Change in QD/ % Change P x 100 With PED, ALWAYS ignore minus sign Scores between 0 & 1 unresponsive/ Inelastic Demand Scores above 1 are more responsive/ Elastic Demand For most consumer products, scores tend to be from .5 to 1.5, with most near 1 (unit elastic).

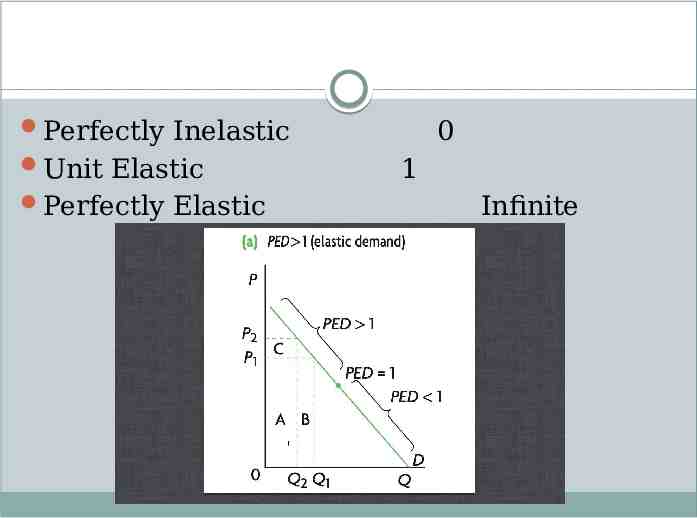

Perfectly Inelastic Unit Elastic Perfectly Elastic 0 1 Infinite

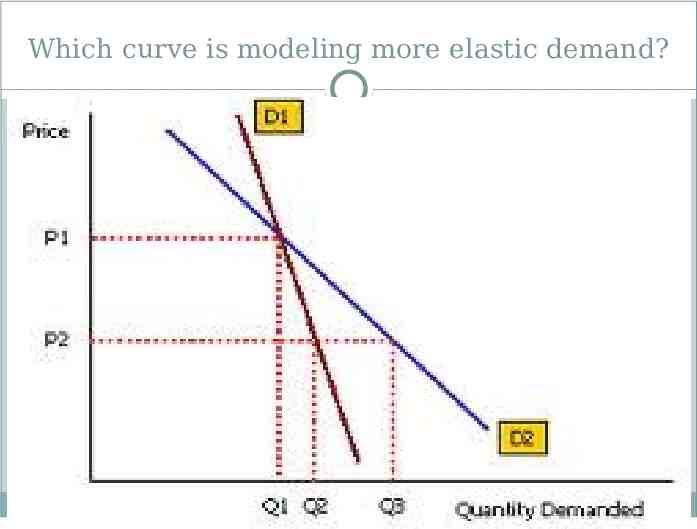

Which curve is modeling more elastic demand?

What factors influence Demand Elasticity (PED)? PORTION OF INCOME EASE OF SUBSTITUTION I S I T A N E C E S S I T Y O R A LU X U R Y TIME

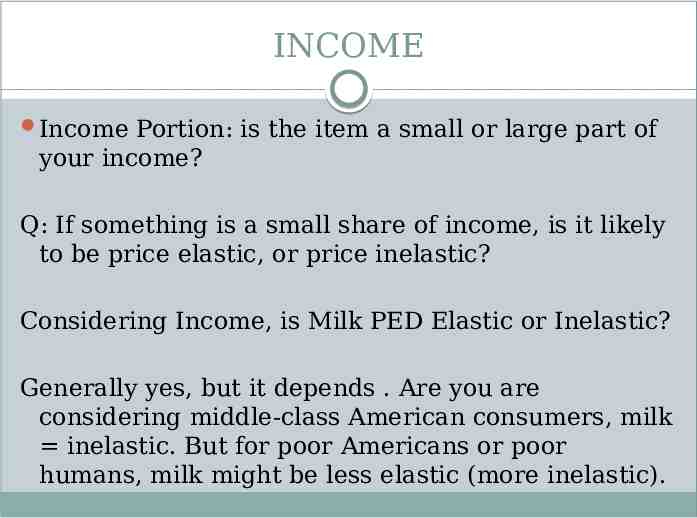

INCOME Income Portion: is the item a small or large part of your income? Q: If something is a small share of income, is it likely to be price elastic, or price inelastic? Considering Income, is Milk PED Elastic or Inelastic? Generally yes, but it depends . Are you are considering middle-class American consumers, milk inelastic. But for poor Americans or poor humans, milk might be less elastic (more inelastic).

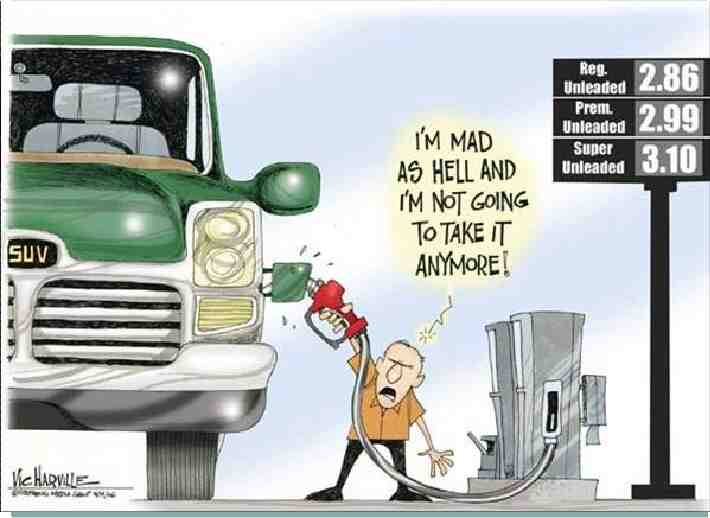

EASE OF SUBSTITION If you consume a product that is easily replaced It’s probably more elastic (less inelastic) Ex: If the price of gas rises, will EVERYONE drop their keys and grab their bus passes? Ex: If the price of Mercedes sedans rises, will people purchase a cheaper car? A bus pass? A bike?

Luxury of Necessity? A need must be fulfilled in a timely manner, while luxury purchases can be delayed without significant sacrifice. Will people who normally drive to work behave the same if gas prices rise? What if one of them lives just a few miles away and the other one has a 25 minute commute?

Time When a price changes, our ability to respond depends on how much time we have. Ex. You and the family woke up early, packed the car and drove two hours to Cedar Point, only to find that prices have doubled. What do you think your family would do? What would your family do if you learned that prices had doubled a week before your planned trip?

Practice Create a model that shows possible demand for Cedar point when you have no time to respond, and when you have a week to respond. Label the two curves SR (short run) and LR (long run). Identify a few items that you/your family considers luxuries that you would delay or reduce your demand for if prices went up. Model the cigarette market, then show the impact of a sales tax. Show the change in P & Q.

Which is a metaphor for PED Elastic?

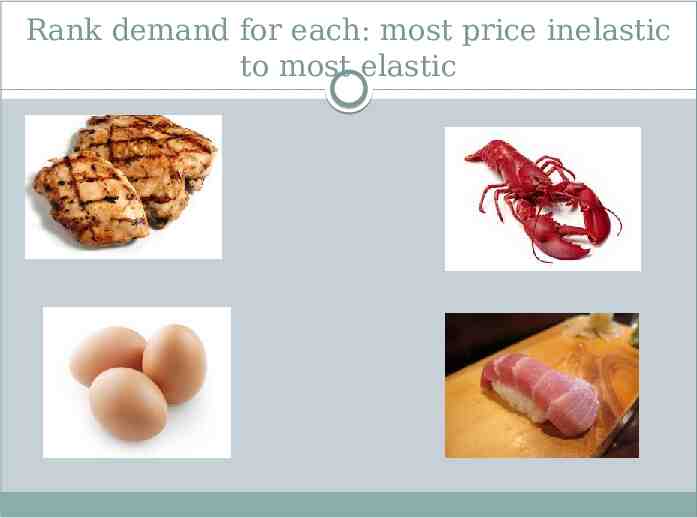

Rank demand for each: most price inelastic to most elastic

Compared with the other two, which would be a metaphor for something that was unit elastic?

Will it?

Taxes & Price ELASTIC Demand If: PED Elastic demand responsive to price increases And: Taxes reduce supply and increase prices Then: Taxes will reduce Qd significantly.

TAXES & PRICE INELASTIC DEMAND IF: PED Inelastic demand unresponsive to increased price AND: Taxes increase prices. Then: Taxes won’t reduce quantity demand much.

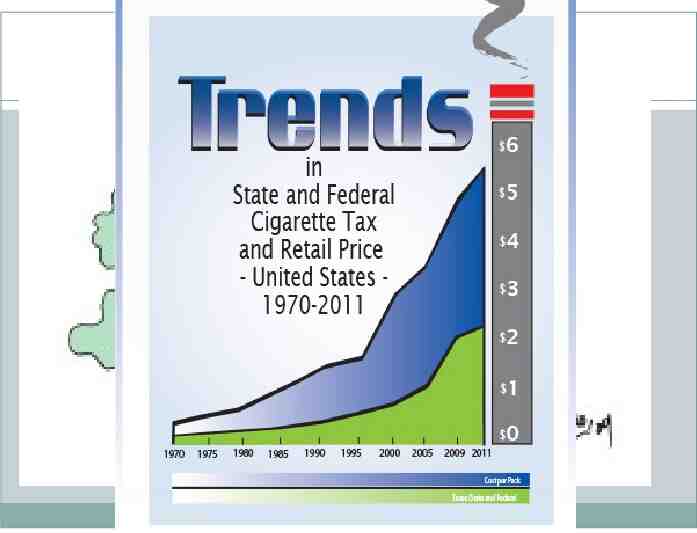

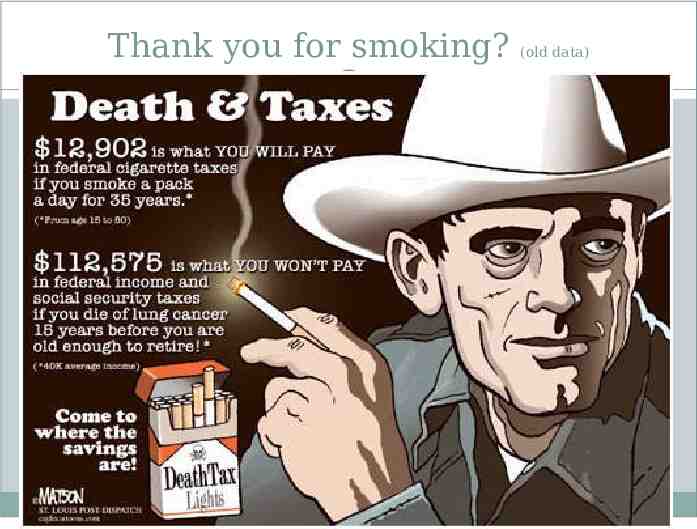

So, why are cigarettes taxed? Cigarettes do cause harm to the smoker, and society (smokers use more health care, are less productive, and reduce health of those nearby) Taxes can raise revenue and discourage consumption

‘Reds’ to 3 tax PA. Pennsylvania 1.60 3. Rhode Island 3.50 2. Hawaii 3.20 1. New York 4.35 Estimated external cost to society when a pack of ‘Reds’ is consumed is .20 cents.

Thank you for smoking? (old data)

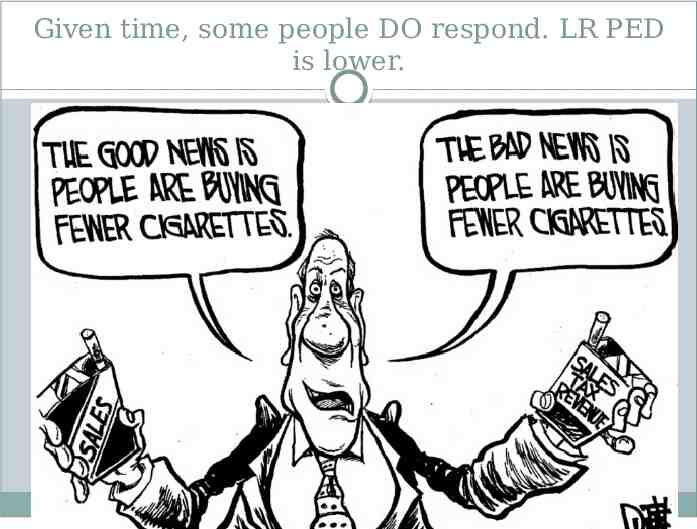

Given time, some people DO respond. LR PED is lower.

PED Responsiveness to Price Perfectly Inelastic PED Inelastic zero near zero Relatively Inelastic/ less elastic 1 Unit Elastic 1 Relatively elastic/ less inelastic 1 Elastic 1 Perfectly Elastic Infinite. Elasticity Responsiveness

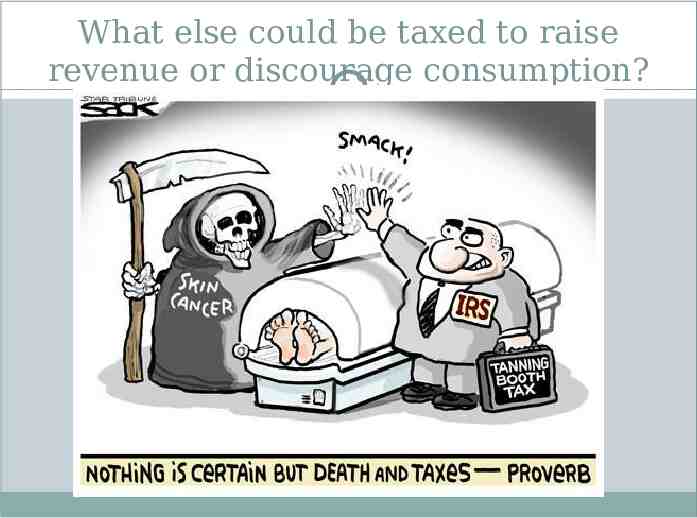

What else could be taxed to raise revenue or discourage consumption?

What else should be taxed for revenue or discouragement? (careful, this is normative not positive. Politics) Plastic water bottles to discourage (would probably reduce consumption quite a bitrelatively elastic? Bev companies would hate it b/c they would face a higher burden of taxes and sales would drop significantly.

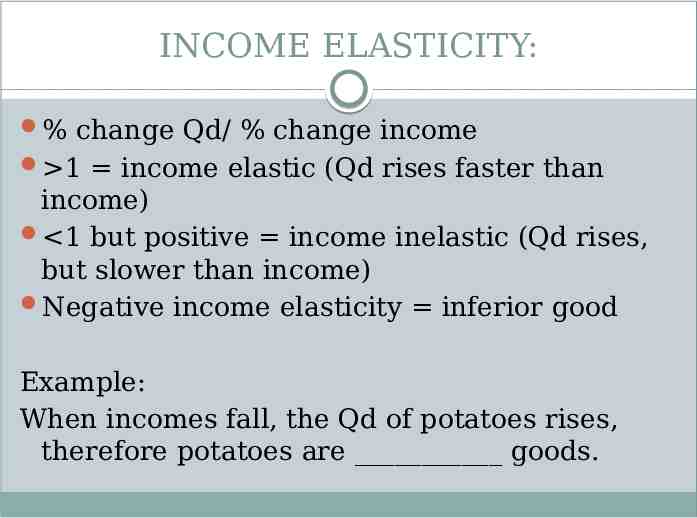

INCOME ELASTICITY: % change Qd/ % change income 1 income elastic (Qd rises faster than income) 1 but positive income inelastic (Qd rises, but slower than income) Negative income elasticity inferior good Example: When incomes fall, the Qd of potatoes rises, therefore potatoes are goods.

CROSS PRICE ELASTICITY % change in Qd of product A/ % change price of B Positive substitutes (burgers and pizza) Negative compliments (burgers and fries)

PES % change Qs/ % change price Determinates of PES: 1. Availability of inputs to production. 2. Time 3. Excess productive capacity