ALL BUSINESS PAYCHECK PROTECTION PROGR

7 Slides180.85 KB

ALL BUSINESS PAYCHECK PROTECTION PROGR

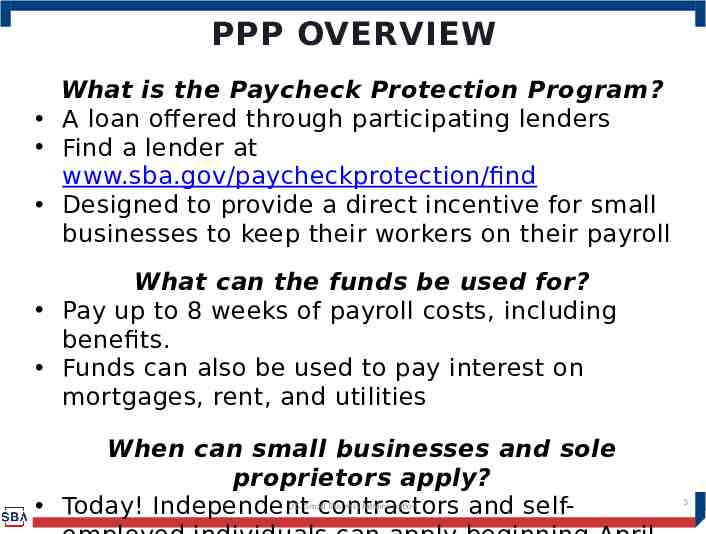

PPP OVERVIEW What is the Paycheck Protection Program? A loan offered through participating lenders Find a lender at www.sba.gov/paycheckprotection/find Designed to provide a direct incentive for small businesses to keep their workers on their payroll What can the funds be used for? Pay up to 8 weeks of payroll costs, including benefits. Funds can also be used to pay interest on mortgages, rent, and utilities When can small businesses and sole proprietors apply? Today! Independent contractors and selfU.S. Small Business Administration 3

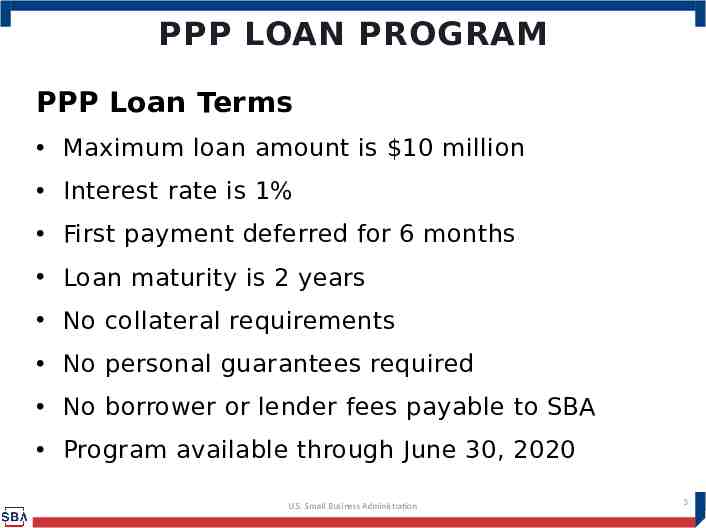

PPP LOAN PROGRAM PPP Loan Terms Maximum loan amount is 10 million Interest rate is 1% First payment deferred for 6 months Loan maturity is 2 years No collateral requirements No personal guarantees required No borrower or lender fees payable to SBA Program available through June 30, 2020 U.S. Small Business Administration 3

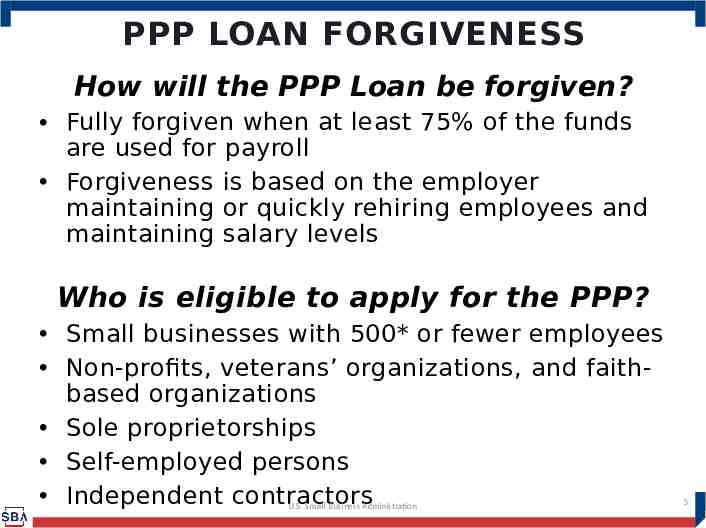

PPP LOAN FORGIVENESS How will the PPP Loan be forgiven? Fully forgiven when at least 75% of the funds are used for payroll Forgiveness is based on the employer maintaining or quickly rehiring employees and maintaining salary levels Who is eligible to apply for the PPP? Small businesses with 500* or fewer employees Non-profits, veterans’ organizations, and faithbased organizations Sole proprietorships Self-employed persons Independent contractors U.S. Small Business Administration 3

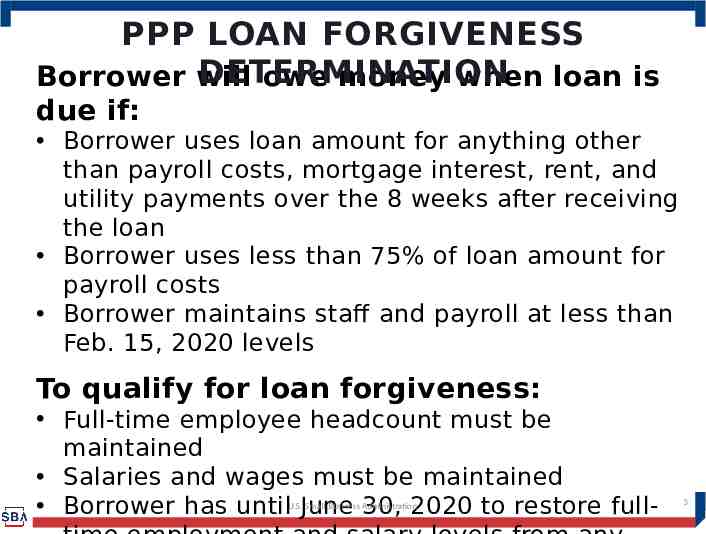

PPP LOAN FORGIVENESS DETERMINATION Borrower will owe money when loan is due if: Borrower uses loan amount for anything other than payroll costs, mortgage interest, rent, and utility payments over the 8 weeks after receiving the loan Borrower uses less than 75% of loan amount for payroll costs Borrower maintains staff and payroll at less than Feb. 15, 2020 levels To qualify for loan forgiveness: Full-time employee headcount must be maintained Salaries and wages must be maintained Borrower has until June 30, 2020 to restore fullU.S. Small Business Administration 3

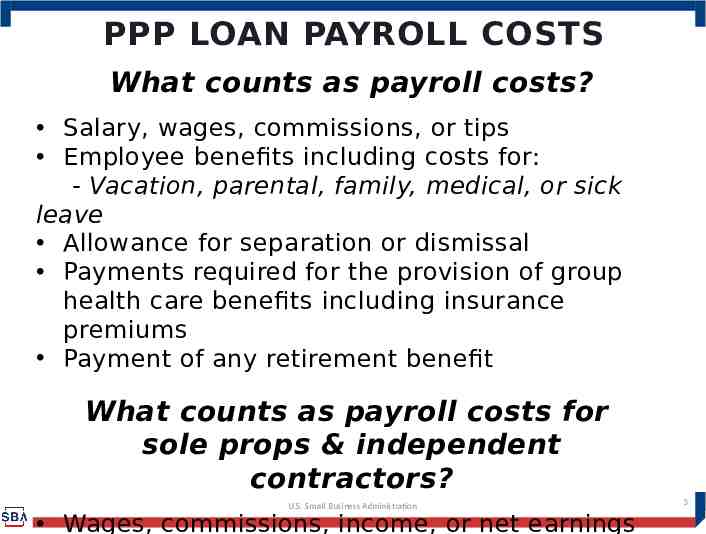

PPP LOAN PAYROLL COSTS What counts as payroll costs? Salary, wages, commissions, or tips Employee benefits including costs for: - Vacation, parental, family, medical, or sick leave Allowance for separation or dismissal Payments required for the provision of group health care benefits including insurance premiums Payment of any retirement benefit What counts as payroll costs for sole props & independent contractors? U.S. Small Business Administration Wages, commissions, income, or net earnings 3

Any Questions? For more information on SBA’s emergency capital programs visit: www.sba.gov/coronavirus 7 U.S. Small Business Administration