AARP Financial Marketing Plan Achieving our social and

34 Slides6.36 MB

AARP Financial Marketing Plan Achieving our social and financial mission 06/09/2006 Confidential — Do Not Distribute DRAFT

Overview Achieving our social and financial mission 2 The “Do More Than Dream” Tour 4 Why it works 6 Tour communication plan 7 The media mix 20 How much it will cost 30 06/09/2006 Confidential — Do Not Distribute 2

Achieving our social and financial mission Helping Americans save more for retirement Demonstrating AARP Financial’s new vision for the American investor Engaging AARP members and prospective members Involving the entire AARP organization Building assets in the AARP Funds Demonstrating our commitment to helping members and investors create a more secure financial future. Targeted rollout allows for ramp-up from pilot to national marketing 06/09/2006 Confidential — Do Not Distribute 3

A region-by-region national rollout A grassroots approach that brings your message to the mass market Supported by a major internal launch event Integration of advertising, public relations, Internet and direct mail delivers synergies and increases effectiveness Great opportunity to involve local state offices, volunteers and AARP Outreach Group Market-by-market media and direct response campaigns tied to local events Regional marketing allows for media testing and cost management National campaign overlay simultaneously increases awareness among target AARP members 06/09/2006 Confidential — Do Not Distribute 4

The “Do More Than Dream” Tour A unique advocacy and educational initiative in key regional markets A grassroots approach that brings our message to the mass market Creating opportunities to increase response rates to our direct marketing efforts Dreaming alone can’t get you to your goals. To build a secure financial future, you must do more — especially when you’re over 50. 06/09/2006 Confidential — Do Not Distribute 5

Why a tour? “Recent studies show that passive educational tools that rely on print media, newsletters and brochures generally work only modestly well to increase savings, while hightouch educational efforts, seminars and one-on-one phone and in-person counseling have been effective.” ANNAMARIA LUSARDI Pension Research Council The Wharton School 06/09/2006 Confidential — Do Not Distribute 6

Why it works Reaches out to our audience Targets key demographic areas Increases potential for free press and strong public relations Flexible, cost effective, exciting The tour creates opportunities to fulfill our social and financial mission. Generates excitement and word-of-mouth buzz 06/09/2006 Confidential — Do Not Distribute 7

Tour communications plan Tour events and seminars in prominent locations (e.g., Home Depot or mall parking lots) One-month local media saturation (TV, radio, newspaper, billboards) Regional direct mail and email campaigns timed to tour events Public relations initiatives to generate local press coverage The tour is scheduled to run from September to mid November 2006. “Do More Than Dream” microsite featuring tour blog Multiple opportunities to invest (on-site, direct mail, directresponse print/TV/radio, online, call center) Tour kickoff event in DC for national press coverage Tailor events to local audiences 06/09/2006 Confidential — Do Not Distribute 8

Tour route selection criteria Rollout markets were selected on the following criteria: A minimum of 0.5% of U.S. households (551,000 per market) – This allows for a big enough sample base for meaningful measurement projections Adults 50–64 make up a minimum of 20.7% of the market’s population* – This equates to a 93 index versus the average U.S. market (22.4% of the U.S. adult 18 population is aged 50–64) Adults 50 make up a minimum of 39.4% of the market’s population** – This equates to a 101 index versus the average U.S. market (39.% of the U.S. adult 18 population is aged 50 ) Active AARP members by selected states make up a minimum of 0.67% of the entire 22 million AARP households For the purposes of this document we have provided prototype media plan costs for two sizes of markets Large markets (1.4% of U.S. households or more) Midsize markets (0.7–1.3% of U.S. households) * Demographic definitions as per AC Nielsen. Does not include St. Louis, MO. **Does not include Anaheim, CA 06/09/2006 Confidential — Do Not Distribute 9

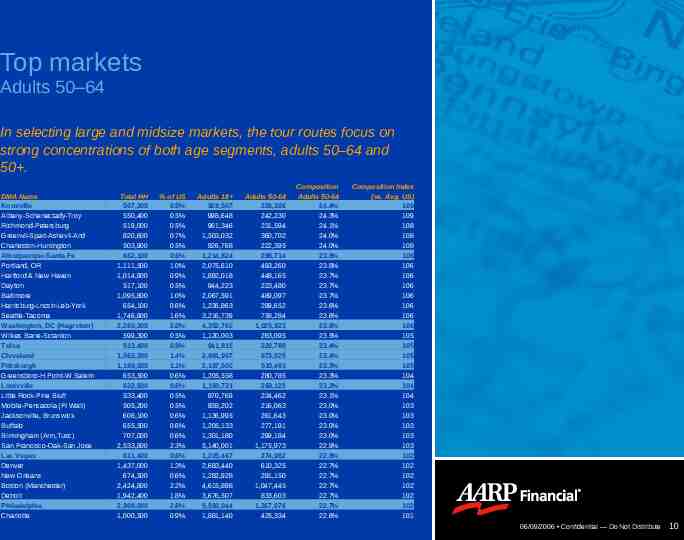

Top markets Adults 50–64 In selecting large and midsize markets, the tour routes focus on strong concentrations of both age segments, adults 50–64 and 50 . DMA Name Knoxville Albany-Schenectady-Troy Richmond-Petersburg Greenvll-Spart-Ashevll-And Charleston-Huntington Albuquerque-Santa Fe Portland, OR Hartford & New Haven Dayton Baltimore Harrisburg-Lncstr-Leb-York Seattle-Tacoma Washington, DC (Hagrstwn) Wilkes Barre-Scranton Tulsa Cleveland Pittsburgh Greensboro-H.Point-W.Salem Louisville Little Rock-Pine Bluff Mobile-Pensacola (Ft Walt) Jacksonville, Brunswick Buffalo Birmingham (Ann,Tusc) San Francisco-Oak-San Jose Las Vegas Denver New Orleans Boston (Manchester) Detroit Philadelphia Charlotte Total HH 507,300 550,400 519,000 820,600 503,900 662,100 1,111,500 1,014,900 517,100 1,095,800 654,100 1,746,900 2,260,300 599,300 513,400 1,563,300 1,189,000 653,500 632,600 533,400 505,200 608,100 655,500 707,000 2,533,800 611,400 1,437,000 674,500 2,424,800 1,942,400 2,908,000 1,000,500 % of US 0.5% 0.5% 0.5% 0.7% 0.5% 0.6% 1.0% 0.9% 0.5% 1.0% 0.6% 1.6% 2.0% 0.5% 0.5% 1.4% 1.1% 0.6% 0.6% 0.5% 0.5% 0.6% 0.6% 0.6% 2.3% 0.6% 1.3% 0.6% 2.2% 1.8% 2.6% 0.9% Adults 18 928,507 998,648 961,346 1,503,032 926,768 1,214,824 2,075,610 1,892,018 944,223 2,067,591 1,226,863 3,216,739 4,352,760 1,120,003 941,815 2,881,997 2,187,600 1,205,558 1,160,731 970,769 938,202 1,136,995 1,205,133 1,301,180 5,140,001 1,205,467 2,683,440 1,282,928 4,615,898 3,676,507 5,590,044 1,881,140 Adults 50-64 226,306 242,230 231,594 360,702 222,395 288,714 493,260 448,165 223,480 489,097 289,652 758,284 1,025,923 263,095 220,788 673,025 510,481 280,785 269,125 224,462 216,063 261,643 277,191 299,184 1,175,973 274,982 610,325 291,150 1,047,445 833,603 1,267,076 425,334 Composition Adults 50-64 24.4% 24.3% 24.1% 24.0% 24.0% 23.8% 23.8% 23.7% 23.7% 23.7% 23.6% 23.6% 23.6% 23.5% 23.4% 23.4% 23.3% 23.3% 23.2% 23.1% 23.0% 23.0% 23.0% 23.0% 22.9% 22.8% 22.7% 22.7% 22.7% 22.7% 22.7% 22.6% Composition Index (vs. Avg. US) 109 109 108 108 108 106 106 106 106 106 106 106 106 105 105 105 105 104 104 104 103 103 103 103 103 102 102 102 102 102 102 101 06/09/2006 Confidential — Do Not Distribute 10

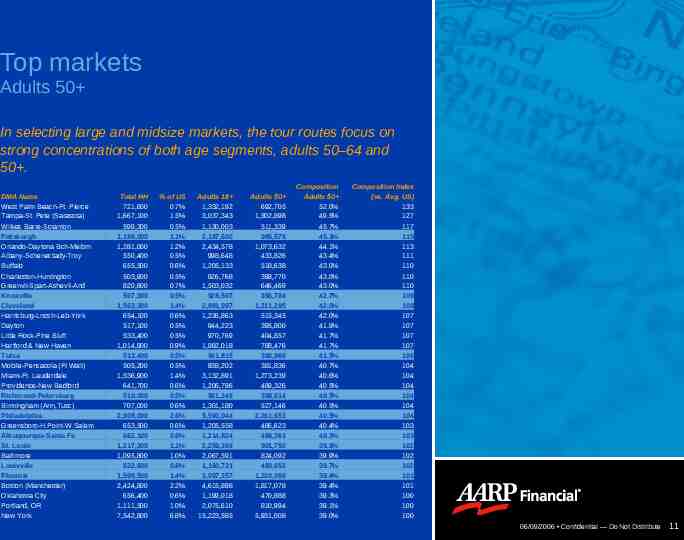

Top markets Adults 50 In selecting large and midsize markets, the tour routes focus on strong concentrations of both age segments, adults 50–64 and 50 . DMA Name West Palm Beach-Ft. Pierce Tampa-St. Pete (Sarasota) Wilkes Barre-Scranton Pittsburgh Orlando-Daytona Bch-Melbrn Albany-Schenectady-Troy Buffalo Charleston-Huntington Greenvll-Spart-Ashevll-And Knoxville Cleveland Harrisburg-Lncstr-Leb-York Dayton Little Rock-Pine Bluff Hartford & New Haven Tulsa Mobile-Pensacola (Ft Walt) Miami-Ft. Lauderdale Providence-New Bedford Richmond-Petersburg Birmingham (Ann,Tusc) Philadelphia Greensboro-H.Point-W.Salem Albuquerque-Santa Fe St. Louis Baltimore Louisville Phoenix Boston (Manchester) Oklahoma City Portland, OR New York Total HH 721,600 1,667,100 599,300 1,189,000 1,281,000 550,400 655,500 503,900 820,600 507,300 1,563,300 654,100 517,100 533,400 1,014,900 513,400 505,200 1,536,900 641,700 519,000 707,000 2,908,000 653,500 662,100 1,217,300 1,095,800 632,600 1,599,500 2,424,800 656,400 1,111,500 7,542,800 % of US 0.7% 1.5% 0.5% 1.1% 1.2% 0.5% 0.6% 0.5% 0.7% 0.5% 1.4% 0.6% 0.5% 0.5% 0.9% 0.5% 0.5% 1.4% 0.6% 0.5% 0.6% 2.6% 0.6% 0.6% 1.1% 1.0% 0.6% 1.4% 2.2% 0.6% 1.0% 6.8% Adults 18 1,332,192 3,037,343 1,120,003 2,187,600 2,434,578 998,648 1,205,133 926,768 1,503,032 928,507 2,881,997 1,226,863 944,223 970,769 1,892,018 941,815 938,202 3,132,891 1,206,796 961,346 1,301,180 5,590,044 1,205,558 1,214,824 2,259,368 2,067,591 1,160,731 3,097,357 4,615,898 1,199,018 2,075,610 15,223,585 Adults 50 692,705 1,502,898 511,339 985,578 1,073,632 433,826 518,638 398,770 646,469 396,704 1,211,295 515,345 395,800 404,857 788,476 390,966 381,836 1,273,239 489,326 389,614 527,146 2,261,653 486,623 489,361 901,750 824,092 460,652 1,220,066 1,817,078 470,888 810,994 5,931,008 Composition Adults 50 52.0% 49.5% 45.7% 45.1% 44.1% 43.4% 43.0% 43.0% 43.0% 42.7% 42.0% 42.0% 41.9% 41.7% 41.7% 41.5% 40.7% 40.6% 40.5% 40.5% 40.5% 40.5% 40.4% 40.3% 39.9% 39.9% 39.7% 39.4% 39.4% 39.3% 39.1% 39.0% Composition Index (vs. Avg. US) 133 127 117 115 113 111 110 110 110 109 108 107 107 107 107 106 104 104 104 104 104 104 103 103 102 102 102 101 101 100 100 100 06/09/2006 Confidential — Do Not Distribute 11

National multicity tour route Tour A Tulsa, OK Cleveland, OH Pittsburgh, PA Philadelphia, PA Washington, DC Anaheim, CA Coordinated with Life at 50 event (Oct 26–28) Las Vegas, NV Louisville, KY Albuquerque, NM Phoenix, AZ St. Louis, MO 06/09/2006 Confidential — Do Not Distribute 12

National multicity tour calendar Tour A – September through mid November 2006 Sept 3 10 17 24 1 8 October 15 22 29 November 5 12 National magazines Online 1-day kickoff event (W ashington, DC) Philadelphia, PA (9/7–9/10) Pittsburgh, PA (9/14–9/17) Cleveland, OH (9/21–9/24) Louisville, KY (9/28–10/1) St. Louis, MO (10/5–10/8) Tulsa, OK (10/12–10/15) Albuquerque, NM (10/19–10/22) Anaheim, CA (10/26–10/29) Las Vegas, NV (11/2–11/5) Phoenix, AZ (11/9–11/12) 06/09/2006 Confidential — Do Not Distribute 13

Concentrated market tour route Tour B Cleveland, OH Pittsburgh, PA Washington, DC Richmond, VA Knoxville, TN Louisville, KY 06/09/2006 Confidential — Do Not Distribute 14

Concentrated market tour calendar Tour B – September through mid November 2006 Sept 3 Pittsburgh, PA 9/7–9/10 9/13–9/15 9/16–9/18 Cleveland, OH 9/21–9/24 9/27–9/29 9/30–10/2 Louisville, KY 10/5–10/8 10/11–10/13 10/14–10/16 10 17 24 1 8 October 15 22 29 November 5 12 1st location Media kickoff: Thurs–Sun 2nd location Small business traffic: Wed–Fri 3rd location Pedestrian traffic: Sat–Mon Knoxville, TN 10/19–10/22 10/25–10/27 10/28–10/30 Richmond, VA 11/2–11/5 11/8–11/10 11/11–11/13 06/09/2006 Confidential — Do Not Distribute 15

Event agenda Thursday, September 15 Friday, September 16 Morning: Truck arrival, site setup 10:00 – 12:00 Site setup 12:00 – 12:30 Afternoon: Do More Than Dream Tour kickoff speech from senior AARP representative Seminar: How to create enough retirement income to live on 12:30 – 1:00 Registration, site tours, retirement planning workshops, information distribution 1:00 – 2:00 Break/refreshments 2:00 – 2:30 Seminar: Retirement plans for small business owners 2:30 – 4:00 Ongoing registration, site tours, information distribution Seminar: How to retire on your terms 4:00 – 4:30 Seminar: How to create enough retirement income to live on Seminar: Retirement plans for small business owners 4:30 – 5:00 Break/ongoing seminar registration, site tours, information distribution 5:00 – 5:30 Seminar: Retirement plans for small business owners 5:30 – 6:00 Workshop: Retirement distribution basics 6:00 – 6:30 Seminar: How to create enough retirement income to live on 6:30 – 7:00 Break/refreshments 7:00 – 7:30 Seminar: How to retire on your terms 7:30 – 8:30 Registration for next days events Media event/interviews Entertainment – live music/BBQ Evening: 06/09/2006 Confidential — Do Not Distribute 16

Event agenda (continued) Saturday, September 16 Sunday, September 17 10:00 – 12:00 Site setup Repeat Saturday agenda 12:00 – 12:30 Seminar: How to retire on your terms 12:30 – 1:00 Registration, site tours, retirement planning workshops, information distribution 1:00 – 2:00 Break/refreshments 2:00 – 2:30 Seminar: Retirement plans for small business owners 2:30 – 4:00 Ongoing registration, site tours, information distribution 4:00 – 4:30 Seminar: How to create enough retirement income to live on 4:30 – 5:00 Break/ongoing seminar registration, site tours, information distribution 5:00 – 5:30 Seminar: How to retire on your terms 5:30 – 6:00 Workshop: Job transition basics 6:00 – 6:30 Seminar: How to create enough retirement income to live on 6:30 – 7:00 Break/refreshments 7:00 – 7:30 Seminar: How to retire on your terms 7:30 – 8:30 Registration for next days events 06/09/2006 Confidential — Do Not Distribute 17

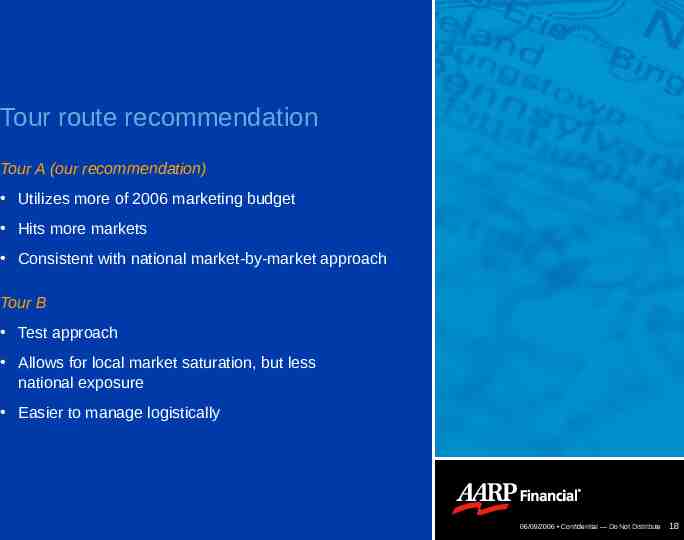

Tour route recommendation Tour A (our recommendation) Utilizes more of 2006 marketing budget Hits more markets Consistent with national market-by-market approach Tour B Test approach Allows for local market saturation, but less national exposure Easier to manage logistically 06/09/2006 Confidential — Do Not Distribute 18

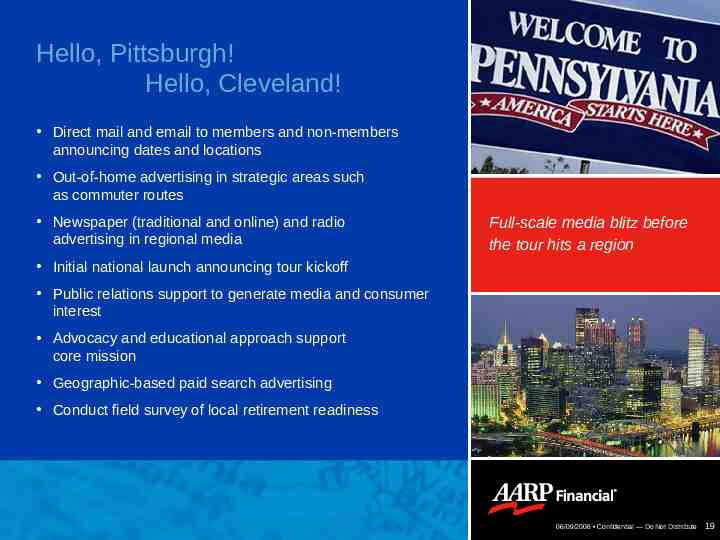

Hello, Pittsburgh! Hello, Cleveland! Direct mail and email to members and non-members announcing dates and locations Out-of-home advertising in strategic areas such as commuter routes Newspaper (traditional and online) and radio advertising in regional media Full-scale media blitz before the tour hits a region Initial national launch announcing tour kickoff Public relations support to generate media and consumer interest Advocacy and educational approach support core mission Geographic-based paid search advertising Conduct field survey of local retirement readiness 06/09/2006 Confidential — Do Not Distribute 19

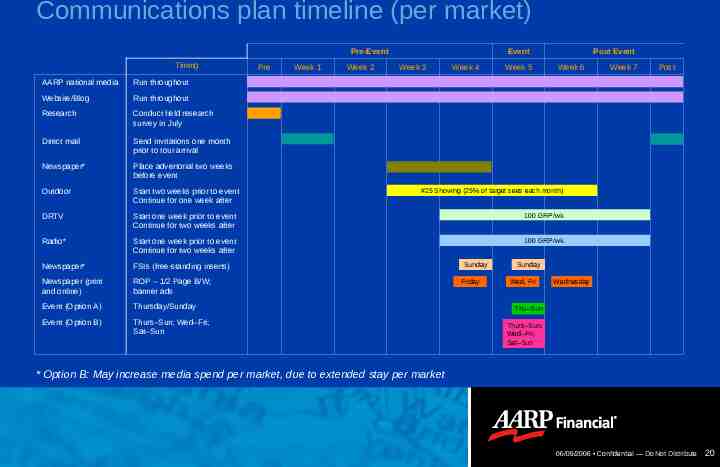

Communications plan timeline (per market) Pre-Event Timing Pre Week 1 Week 2 Event Week 3 Week 4 Week 5 Post Event Week 6 AARP national media Run throughout Website/Blog Run throughout Research Conduct field research survey in July Direct mail Send invitations one month prior to tour arrival Newspaper* Place advertorial two weeks before event Outdoor Start two weeks prior to event Continue for one week after DRTV Start one week prior to event Continue for two weeks after 100 GRP/wk. Radio* Start one week prior to event Continue for two weeks after 100 GRP/wk. Newspaper* FSIs (free-standing inserts) Newspaper (print and online) ROP – 1/2 Page B/W; banner ads Event (Option A) Thursday/Sunday Event (Option B) Thurs–Sun; Wed–Fri; Sat–Sun Week 7 Post #25 Showing (25% of target sees each month) Sunday Friday Sunday Wed, Fri Wednesday Thu–Sun Thurs–Sun; Wed–Fri; Sat–Sun * Option B: May increase media spend per market, due to extended stay per market 06/09/2006 Confidential — Do Not Distribute 20

Print and outdoor advertising Generate local and national interest in the tour Drive lead generation Reinforce brand positioning and messages Strategic publication selection process based on: – Audience demographics – Editorial relevance – Target audience delivery efficiencies Advertising in AARP publications, regional newspapers, such as the Pittsburgh Post Gazette and financial publications emphasizes the educational nature and advocacy-based focus of the tour. 06/09/2006 Confidential — Do Not Distribute 21

Public relations Press releases to various national and regional media outlets Conduct investor polls focused on regional retirement preparedness Investor poll results released prior to road shows The road show allows AARP to capitalize on the power of the free press. Local angle generates additional media and investor interest 06/09/2006 Confidential — Do Not Distribute 22

Marketing collateral Develop retirement checklist, annual financial checkup Retirement calculator Create investor information and education series Produce life-event guides Complement core marketing materials with event support. Create educational seminars Seminar topics could include: How to create retirement income to live on How to retire on your terms Retirement plans for small business owners 06/09/2006 Confidential — Do Not Distribute 23

TV and radio Interviews with senior AARP executives Local radio spots Direct Response Television (DRTV) – Infomercials (product and educational approach) Local and national media plans are designed to increase tour attendance and sales of AARP Funds. 06/09/2006 Confidential — Do Not Distribute 24

Direct mail approach Maximize learning through testing Use a scientific approach Deliver constant flow of leads Focus on inquirers Drive to all channels Ongoing campaigns are focused on creating brand and product awareness, generating interest in events and increasing sales through educational, multi-channel follow-up. 06/09/2006 Confidential — Do Not Distribute 25

Direct mail campaigns Invitations with tour dates, locations and seminar topics Continue to develop AARP Funds’ benefits messages Promote advocacy and our new vision for the American investor Direct mail provides an effective way to drive consumers to events or to respond to specific offers. Free guides could include: Finding the money: 10 easy ways to save more AARP Financial’s five principles of sound investing 06/09/2006 Confidential — Do Not Distribute 26

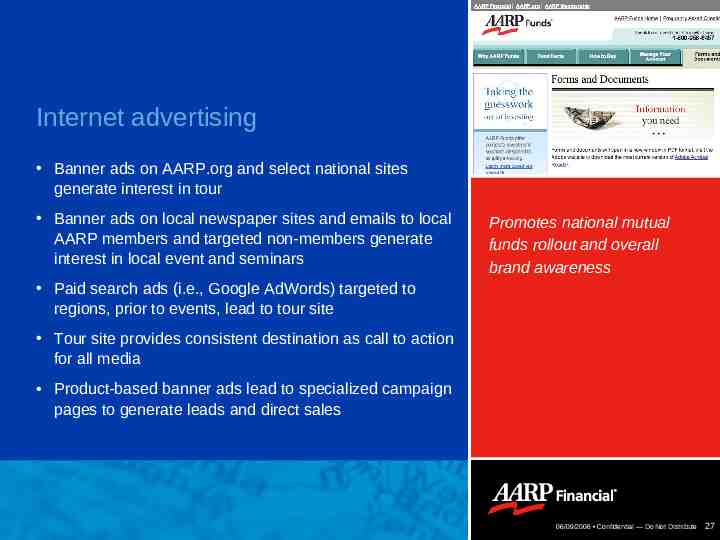

Internet advertising Banner ads on AARP.org and select national sites generate interest in tour Banner ads on local newspaper sites and emails to local AARP members and targeted non-members generate interest in local event and seminars Promotes national mutual funds rollout and overall brand awareness Paid search ads (i.e., Google AdWords) targeted to regions, prior to events, lead to tour site Tour site provides consistent destination as call to action for all media Product-based banner ads lead to specialized campaign pages to generate leads and direct sales 06/09/2006 Confidential — Do Not Distribute 27

Internet communications plan Do More Than Dream Tour site includes: – Information about the tour – Online quiz/retirement calculator – Blog about tour with videos Customized local pages provide survey results and pre-registration for seminars Leveraging the power of one of America’s most important Internet communities Collect information in return for alert when Flash-based seminar and/or podcast of seminar is available Links to AARPfunds.com for more education Generates interest in tour, leads and direct sales Leverage AARP.org 06/09/2006 Confidential — Do Not Distribute 28

Internal communications Increase involvement with state offices and AARP volunteers Increase membership drive potential Create excitement and participation across the entire AARP organization Build partnerships to reach members, to drive traffic to multiple channels and to provide valuable products and services. 06/09/2006 Confidential — Do Not Distribute 29

Support at the national level In addition to the targeted local marketing efforts, we recommend: Ongoing national direct mail campaigns National Internet advertising National advertising with AARP communication channels 06/09/2006 Confidential — Do Not Distribute 30

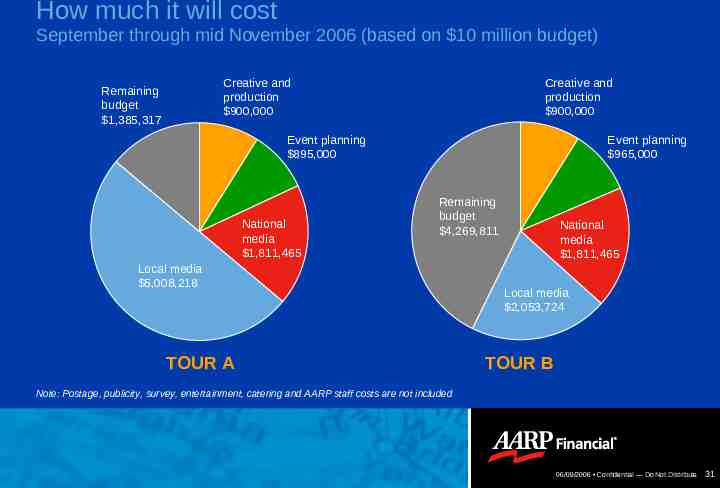

How much it will cost September through mid November 2006 (based on 10 million budget) Creative and production 900,000 Remaining budget 1,385,317 Creative and production 900,000 Event planning 895,000 National media 1,811,465 Event planning 965,000 Remaining budget 4,269,811 Local media 5,008,218 TOUR A National media 1,811,465 Local media 2,053,724 TOUR B Note: Postage, publicity, survey, entertainment, catering and AARP staff costs are not included 06/09/2006 Confidential — Do Not Distribute 31

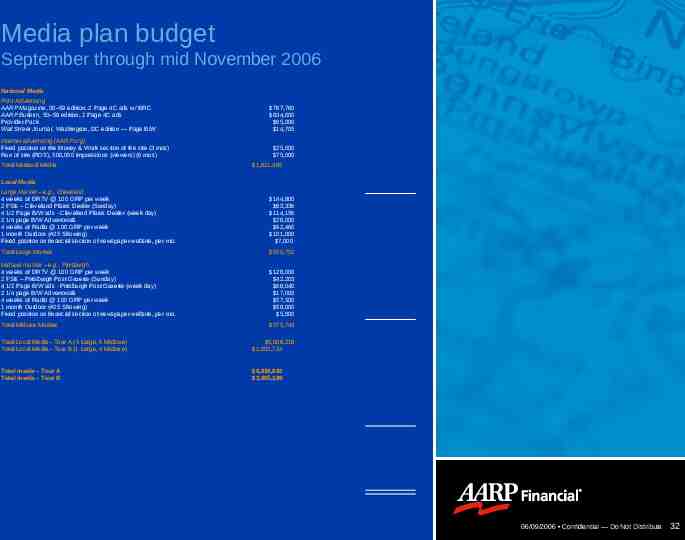

Media plan budget September through mid November 2006 National Media Print Advertising AARP Magazine, 50–59 edition; 2 Page 4C ads w/ BRC AARP Bulletin, 50–59 edition; 2 Page 4C ads Provider Pack Wall Street Journal, Washington, DC edition — Page B/W Internet advertising (AARP.org) Fixed position on the Money & Work section of the site (3 mos) Run of site (ROS), 500,000 impressions (viewers) (6 mos) Total National Media 797,760 834,000 65,000 14,705 25,000 75,000 1,811,465 Local Media Large Market – e.g., Cleveland 4 weeks of DRTV @ 100 GRP per week 2 FSIs – Cleveland Plains Dealer (Sunday) 4 1/2 Page B/W ads - Cleveland Plains Dealer (week day) 2 1/4 page B/W Advertorials 4 weeks of Radio @ 100 GRP per week 1 month Outdoor (#25 Showing) Fixed position on financial section of newspaper website, per mo. 144,800 63,336 114,156 28,000 92,460 101,000 7,000 Total Large Market 550,752 Midsize market – e.g., Pittsburgh 4 weeks of DRTV @ 100 GRP per week 2 FSIs – Pittsburgh Post Gazette (Sunday) 4 1/2 Page B/W ads - Pittsburgh Post Gazette (week day) 2 1/4 page B/W Advertorials 4 weeks of Radio @ 100 GRP per week 1 month Outdoor (#25 Showing) Fixed position on financial section of newspaper website, per mo. 128,000 42,203 68,040 17,000 57,500 58,000 5,000 Total Midsize Market 375,743 Total Local Media– Tour A (5 Large, 6 Midsize) Total Local Media– Tour B (1 Large, 4 Midsize) 5,008,218 2,053,724 Total media – Tour A Total media – Tour B 6,819,683 3,865,189 06/09/2006 Confidential — Do Not Distribute 32

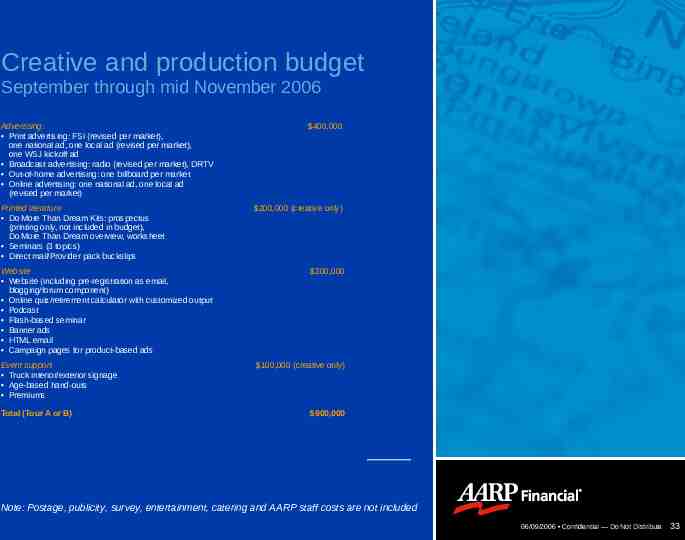

Creative and production budget September through mid November 2006 Advertising: Print advertising: FSI (revised per market), one national ad, one local ad (revised per market), one WSJ kickoff ad Broadcast advertising: radio (revised per market), DRTV Out-of-home advertising: one billboard per market Online advertising: one national ad, one local ad (revised per market) Printed literature Do More Than Dream Kits: prospectus (printing only, not included in budget), Do More Than Dream overview, worksheet Seminars (3 topics) Direct mail/Provider pack buckslips Website Website (including pre-registration as email, blogging/forum component) Online quiz/retirement calculator with customized output Podcast Flash-based seminar Banner ads HTML email Campaign pages for product-based ads Event support Truck interior/exterior signage Age-based hand-outs Premiums Total (Tour A or B) 400,000 200,000 (creative only) 200,000 100,000 (creative only) 900,000 Note: Postage, publicity, survey, entertainment, catering and AARP staff costs are not included 06/09/2006 Confidential — Do Not Distribute 33

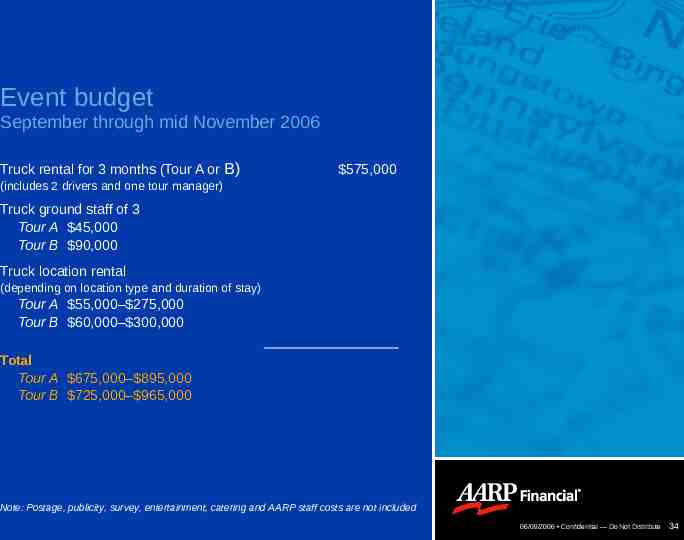

Event budget September through mid November 2006 Truck rental for 3 months (Tour A or B) 575,000 (includes 2 drivers and one tour manager) Truck ground staff of 3 Tour A 45,000 Tour B 90,000 Truck location rental (depending on location type and duration of stay) Tour A 55,000– 275,000 Tour B 60,000– 300,000 Total Tour A 675,000– 895,000 Tour B 725,000– 965,000 Note: Postage, publicity, survey, entertainment, catering and AARP staff costs are not included 06/09/2006 Confidential — Do Not Distribute 34