14th ACG Cross Training Seminar Operational Processes of

13 Slides98.44 KB

14th ACG Cross Training Seminar Operational Processes of Depositories in India Central Depository Services (India) Limited

Concept of Depository Demataterialisation (Demat) and Rematerialisation (Remat) of Securities Beneficial Owner Level Accounting No Nominee level accounting Challenges No Immobilization Multiple Exchanges Multiple Clearing Corporation Multiple Depositories Depository in India Started in 1996 More than 2 Crore (20 million) demat account Approximately INR 75 Lakh Crores (USD 1360 Billion) Central Depository Services (India) Limited 2 29-May-2012

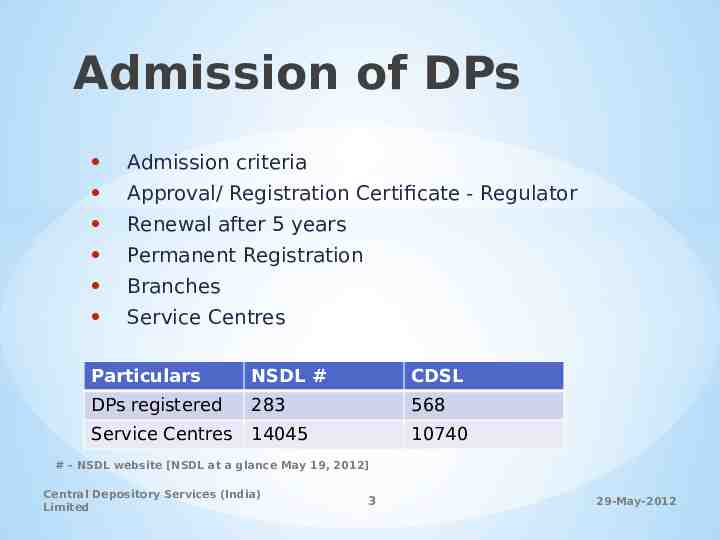

Admission of DPs Admission criteria Approval/ Registration Certificate - Regulator Renewal after 5 years Permanent Registration Branches Service Centres Particulars NSDL # CDSL DPs registered 283 568 Service Centres 14045 10740 # - NSDL website [NSDL at a glance May 19, 2012] Central Depository Services (India) Limited 3 29-May-2012

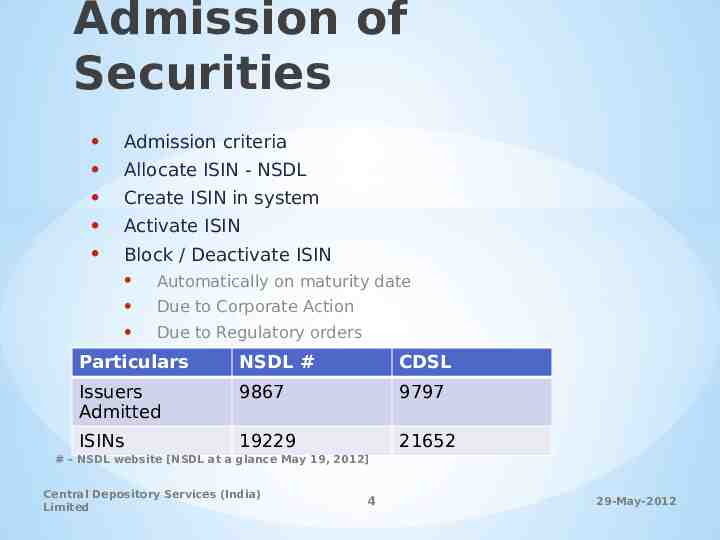

Admission of Securities Admission criteria Allocate ISIN - NSDL Create ISIN in system Activate ISIN Block / Deactivate ISIN Automatically on maturity date Due to Corporate Action Due to Regulatory orders Particulars NSDL # CDSL Issuers Admitted 9867 9797 ISINs 19229 21652 # - NSDL website [NSDL at a glance May 19, 2012] Central Depository Services (India) Limited 4 29-May-2012

Admission of RTAs Admission criteria Checking documents at CDSL Monitoring expiry of RTA registration Beneficiary Holding Position (BenPos) Weekly (Friday) Month end On demand RTA to be registered with both the Depositories before they start operations Central Depository Services (India) Limited 5 29-May-2012

Government Securities GSec pertaining to State Government Issued/Controlled by Central Bank Central Government Reserve Bank of India (RBI) NDS (Negotiated Dealing System) CDSL - RTA Demat /Remat of Gsec Processing of Interest / Redemption Central Depository Services (India) Limited 6 29-May-2012

Mutual Fund Units Subscription /Buying or Redemption/Selling through Trading Platform Order Entry Platform AMC RTA Depository through DP Types of Mutual Fund schemes Open ended Close ended Interval Funds Exchange Traded Funds Fixed Maturity Plans Central Depository Services (India) Limited 7 29-May-2012

Settlement of Securities Clearing Corporation of Stock Exchanges does clearing & settlement of Trades Settlement cycles Money as well as Securities simultaneously T 2 (equities, debentures, etc.) T 1 (Corporate Bonds, SLB) T 0 (Corporate Bonds) Securities and Money on different dates T 0 (Mutual funds – redemption - securities) T 1 to T 7 (Mutual Funds – redemption - money) Runs on time schedules From 0900 hours to 1700 hours Central Depository Services (India) Limited 8 29-May-2012

IPO/FPO IPO / FPO Setup of IPO/FPO Client (BOID) verification IPO Basis of Allotment Allotment Blocking securities Trading approval Unblocking securities on day of trading FPO Listing approval Allotment Trading approval Central Depository Services (India) Limited 9 29-May-2012

Corporate Action Corporate Action types Only Debit (Redemption, etc.) Both Debit & Credit (Split, Demerger, etc.) Processing at Only Credit (Bonus, etc.) SOD EOD Online Processing type Automatic Manual Central Depository Services (India) Limited 10 29-May-2012

Investor Services Internet access to account easiest Corporate Announcements SMS alerts (SMART) easi Debits, credits, Change in address/PoA/signature, etc. Grievance Redressal Mechanism – Arbitration Investor Awareness Programs (IAPs) Central Depository Services (India) Limited 11 29-May-2012

Commodities Commodity Exchange types Commodity types Settlement types e-Warehouse Receipts ICIN creation Demat Remat Revalidation Central Depository Services (India) Limited 12 29-May-2012

14th ACG Cross Training Seminar Thanks Q&A Central Depository Services (India) Limited