UPDATE ON THE IMPLEMENTATION OF THE ELECTRONIC TAX INVOICE TAXPAYER

12 Slides2.31 MB

UPDATE ON THE IMPLEMENTATION OF THE ELECTRONIC TAX INVOICE TAXPAYER EDUCATION Presented by TIMS Operations office August 2022

INTRODUCTION & BACKGROUND ETR machines were introduced in 2005 as a record keeping tool to capture the details of sales transactions by VAT registered taxpayers. In order to better streamline VAT administration, KRA has introduced the electronic tax invoice This will be achieved through the implementation of the Tax Invoice Management System (TIMS) The overall objective is to increase: VAT compliance, minimize on VAT fraud and

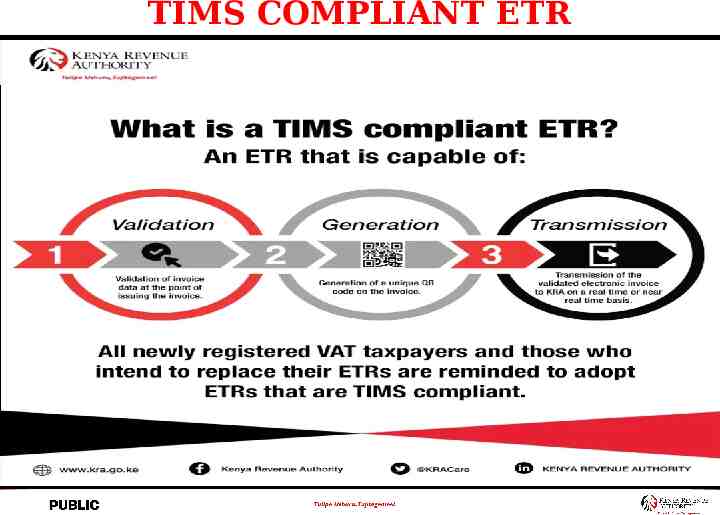

TIMS COMPLIANT ETR

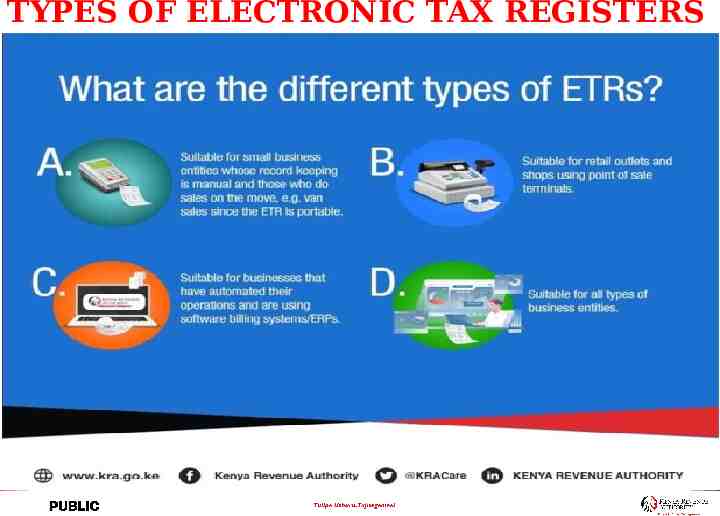

TYPES OF ELECTRONIC TAX REGISTERS

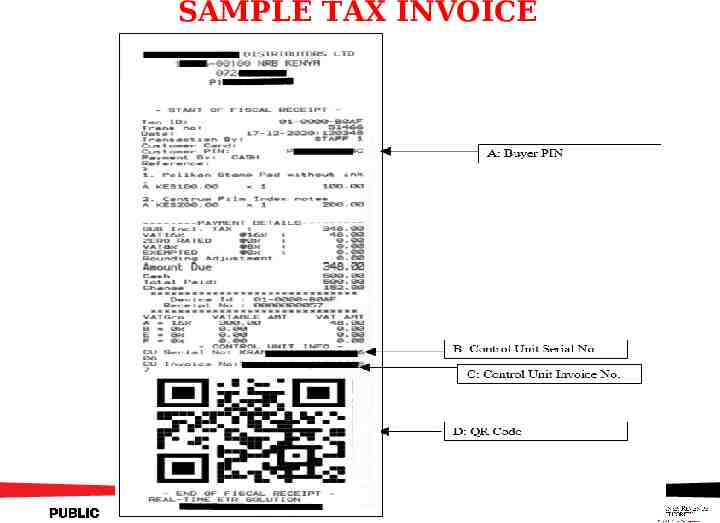

SAMPLE TAX INVOICE

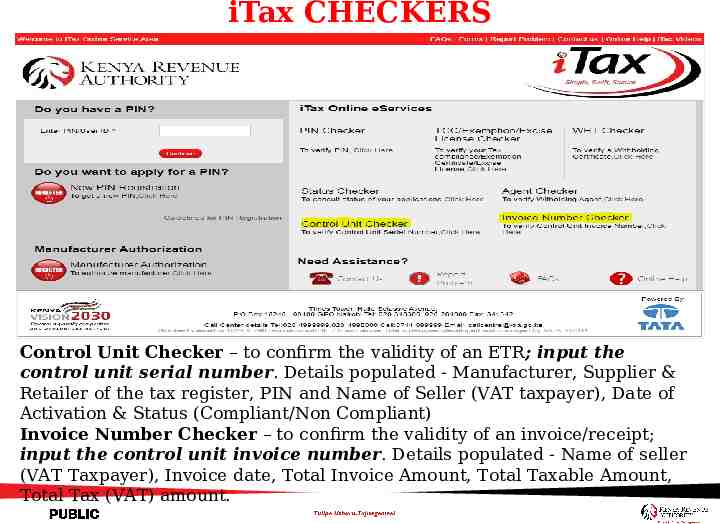

iTax CHECKERS Control Unit Checker – to confirm the validity of an ETR; input the control unit serial number. Details populated - Manufacturer, Supplier & Retailer of the tax register, PIN and Name of Seller (VAT taxpayer), Date of Activation & Status (Compliant/Non Compliant) Invoice Number Checker – to confirm the validity of an invoice/receipt; input the control unit invoice number. Details populated - Name of seller (VAT Taxpayer), Invoice date, Total Invoice Amount, Total Taxable Amount, Total Tax (VAT) amount.

BENEFITS TO VAT TAXPAYERS Foster fair business environment Automated activation of tax register Simplified VAT Return filing (Pre-Filled) Solution to the VAA Process (Invoice inconsistencies) Faster processing of VAT refunds Ability to verify the validity of an invoice

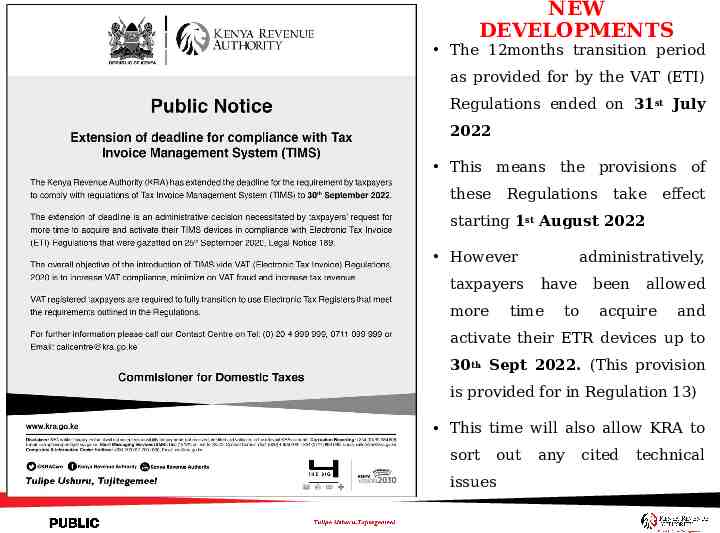

NEW DEVELOPMENTS The 12months transition period as provided for by the VAT (ETI) Regulations ended on 31st July 2022 This means the provisions of these Regulations take effect starting 1st August 2022 However taxpayers more administratively, have time to been allowed acquire and activate their ETR devices up to 30th Sept 2022. (This provision is provided for in Regulation 13) This time will also allow KRA to sort issues out any cited technical

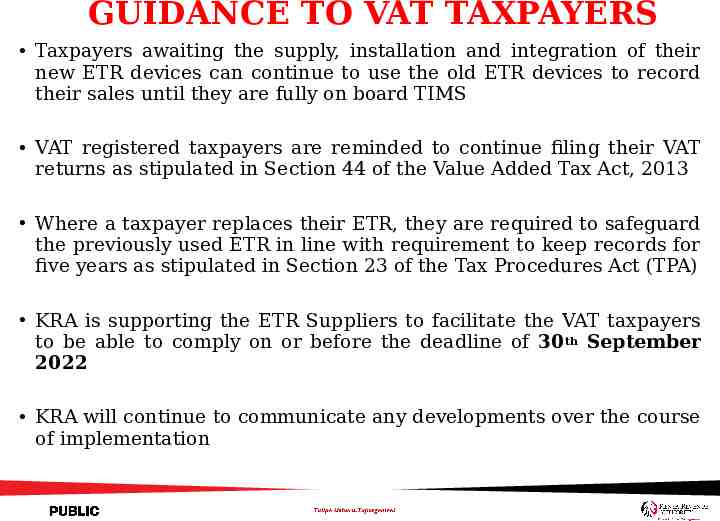

GUIDANCE TO VAT TAXPAYERS Taxpayers awaiting the supply, installation and integration of their new ETR devices can continue to use the old ETR devices to record their sales until they are fully on board TIMS VAT registered taxpayers are reminded to continue filing their VAT returns as stipulated in Section 44 of the Value Added Tax Act, 2013 Where a taxpayer replaces their ETR, they are required to safeguard the previously used ETR in line with requirement to keep records for five years as stipulated in Section 23 of the Tax Procedures Act (TPA) KRA is supporting the ETR Suppliers to facilitate the VAT taxpayers to be able to comply on or before the deadline of 30th September 2022 KRA will continue to communicate any developments over the course of implementation