The Meaning of “Cost”? Product ProductCosts Costs The Thecost

45 Slides569.18 KB

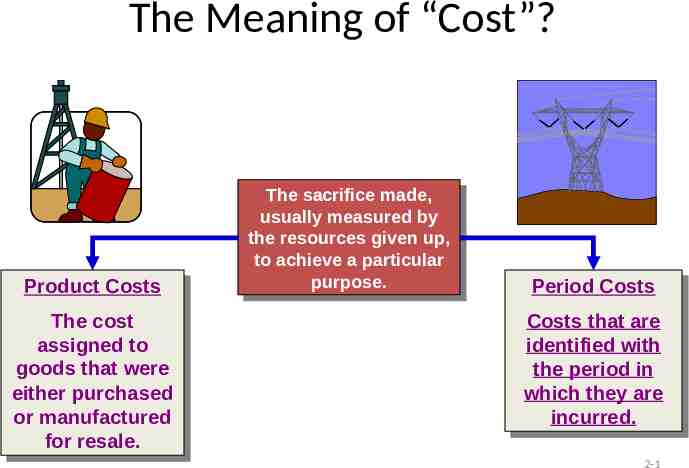

The Meaning of “Cost”? Product ProductCosts Costs The Thecost cost assigned assignedto to goods goodsthat thatwere were either eitherpurchased purchased or ormanufactured manufactured for forresale. resale. The Thesacrifice sacrificemade, made, usually usuallymeasured measuredby by the theresources resourcesgiven givenup, up, to toachieve achieveaaparticular particular purpose. purpose. Period PeriodCosts Costs Costs Coststhat thatare are identified identifiedwith with the theperiod periodin in which whichthey theyare are incurred. incurred. 2-1

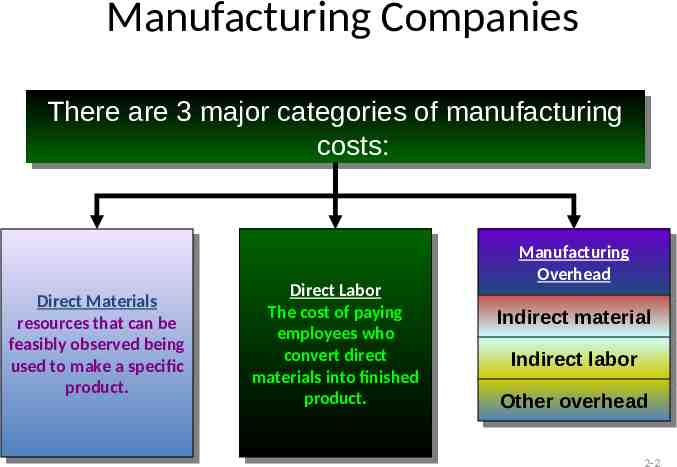

Manufacturing Companies There There are are 33 major major categories categories of of manufacturing manufacturing costs: costs: Direct DirectMaterials Materials resources resourcesthat thatcan canbe be feasibly feasiblyobserved observedbeing being used usedto tomake makeaaspecific specific product. product. Direct DirectLabor Labor The Thecost costof ofpaying paying employees employeeswho who convert convertdirect direct materials into materials intofinished finished product. product. Manufacturing Manufacturing Overhead Overhead Indirect Indirectmaterial material Indirect Indirectlabor labor Other Otheroverhead overhead 2-2

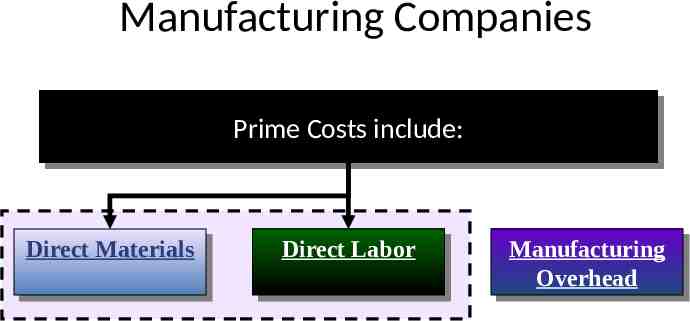

Manufacturing Companies Prime PrimeCosts Costsinclude: include: Direct DirectMaterials Materials Direct DirectLabor Labor Manufacturing Manufacturing Overhead Overhead 2-3

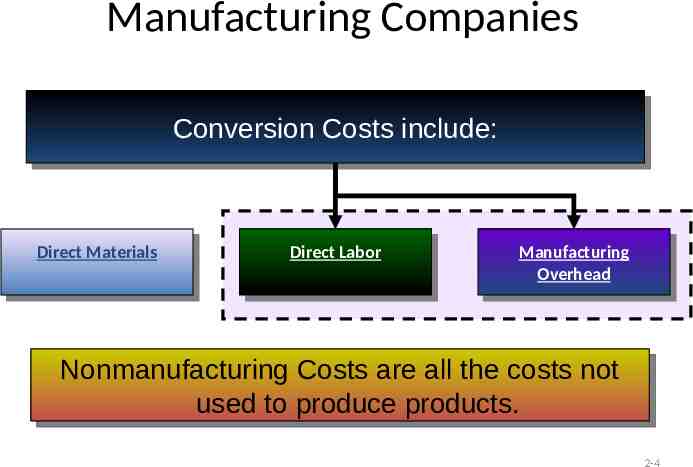

Manufacturing Companies Conversion Conversion Costs Costs include: include: Direct DirectMaterials Materials Direct DirectLabor Labor Manufacturing Manufacturing Overhead Overhead Nonmanufacturing Nonmanufacturing Costs Costs are are all all the the costs costs not not used used to to produce produce products. products. 2-4

PRODUCT COSTING –SAP R/3

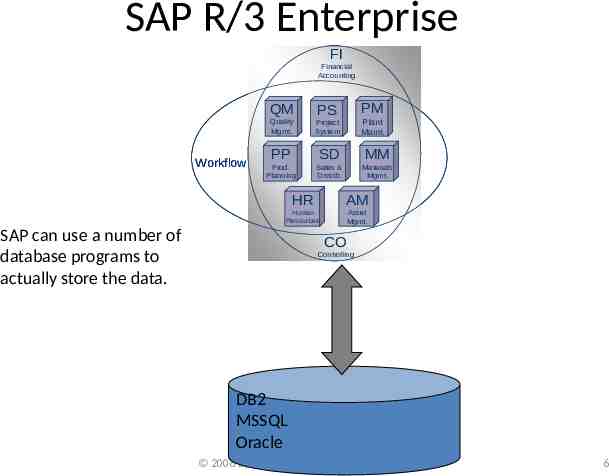

SAP R/3 Enterprise FI Financial Accounting Workflow QM PS Quality Mgmt. Project System PM Plant Maint. PP SD MM Prod. Planning Sales & Distrib. Materials Mgmt. AM HR Human Resources SAP can use a number of database programs to actually store the data. Asset Mgmt. CO Controlling DB2 MSSQL Oracle 2008 by SAP AG. All rights reserved. 6

Organization structure required

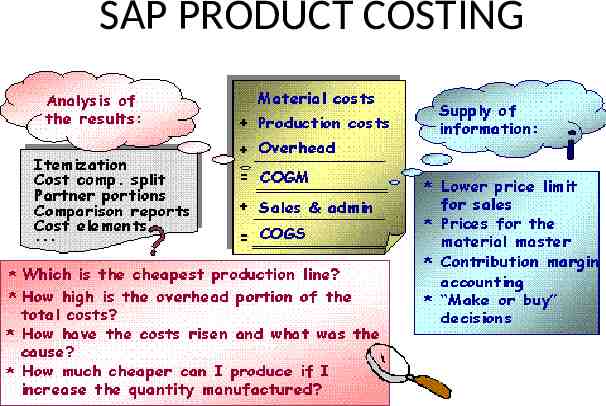

SAP PRODUCT COSTING

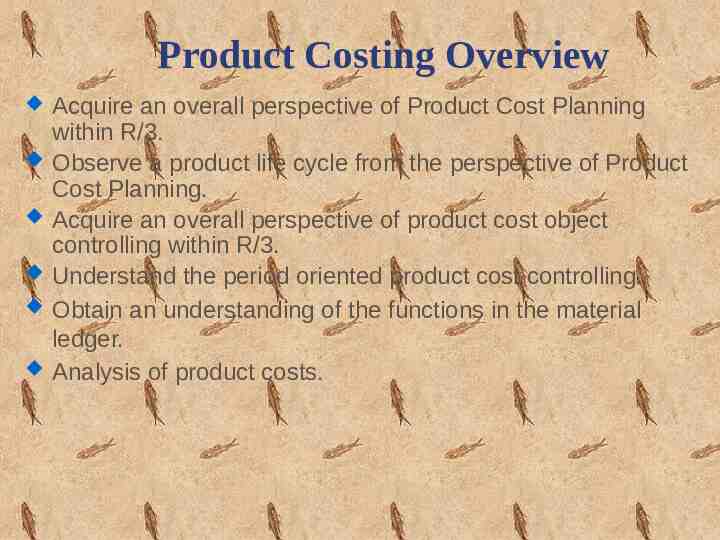

Product Costing Overview Acquire an overall perspective of Product Cost Planning within R/3. Observe a product life cycle from the perspective of Product Cost Planning. Acquire an overall perspective of product cost object controlling within R/3. Understand the period oriented product cost controlling. Obtain an understanding of the functions in the material ledger. Analysis of product costs.

Material Ledger Overview Obtain an understanding of the actual costing function in the material ledger. Know how to revaluate inventories of semi finished products, and finished products with calculated actual costs or accrue variances. Analysis of actual product costs.

Why utilize Product Costing? Product Costing is the backbone of a strong standard cost system. This is the process by which production activities are recorded at standard values and variances from actual costs are isolated. For planning purposes, the corporation wants a preliminary target of what they think it will cost to produce X units of a product. To set attainable standards by which efficiencies within the production operations can be measured. To provide feedback to management on the actual performance of the production process in relation to those targets. Identified variances may indicate inefficiencies that have to be investigated. Corrective action may have to be taken.

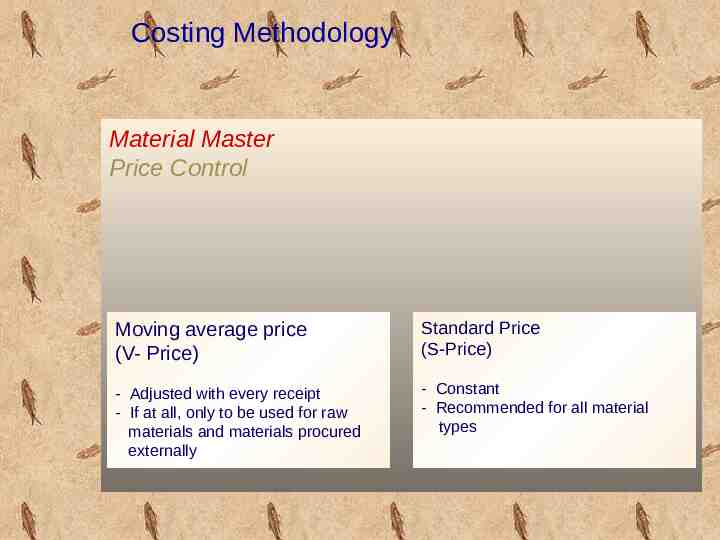

Costing Methodology Material Master Price Control Moving average price (V- Price) Standard Price (S-Price) - Adjusted with every receipt - If at all, only to be used for raw materials and materials procured externally - Constant - Recommended for all material types

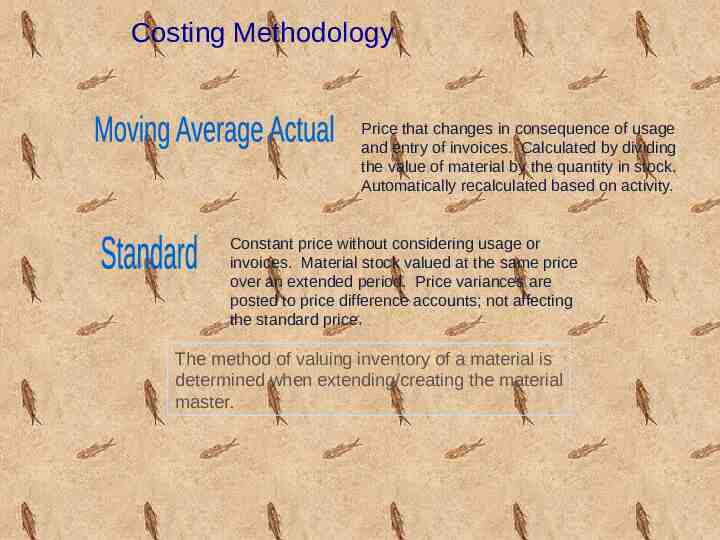

Costing Methodology Price that changes in consequence of usage and entry of invoices. Calculated by dividing the value of material by the quantity in stock. Automatically recalculated based on activity. Constant price without considering usage or invoices. Material stock valued at the same price over an extended period. Price variances are posted to price difference accounts; not affecting the standard price. The method of valuing inventory of a material is determined when extending/creating the material master.

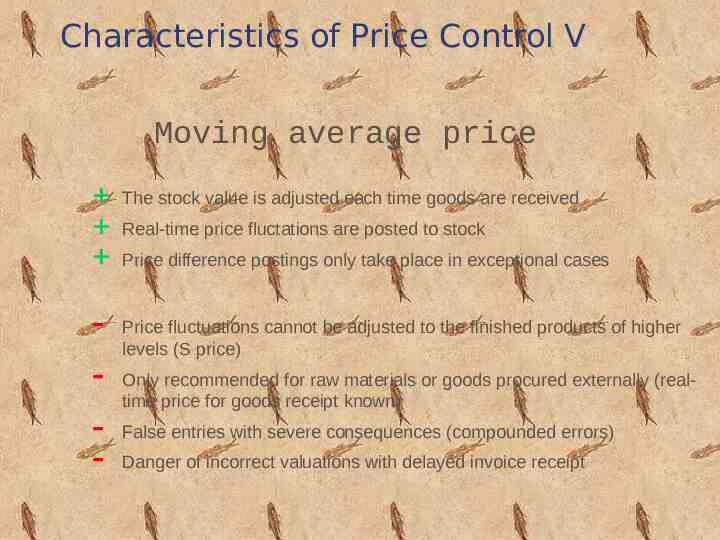

Characteristics of Price Control V Moving average price The stock value is adjusted each time goods are received - Price fluctuations cannot be adjusted to the finished products of higher levels (S price) Real-time price fluctations are posted to stock Price difference postings only take place in exceptional cases Only recommended for raw materials or goods procured externally (realtime price for goods receipt known) False entries with severe consequences (compounded errors) Danger of incorrect valuations with delayed invoice receipt

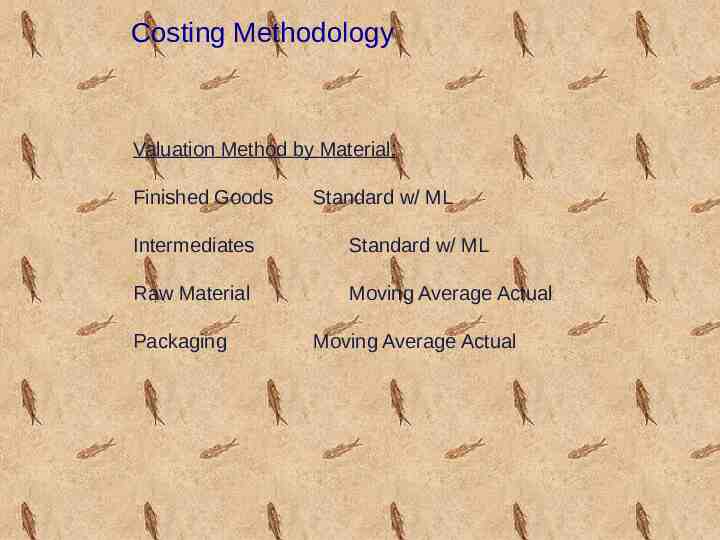

Costing Methodology Valuation Method by Material: Finished Goods Standard w/ ML Intermediates Standard w/ ML Raw Material Moving Average Actual Packaging Moving Average Actual

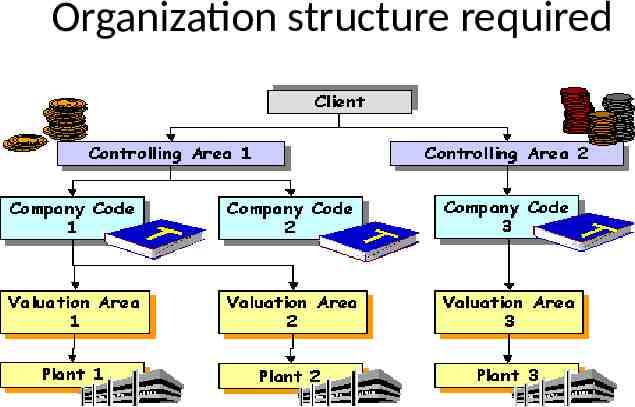

Valuation Area Organizational unit dividing up a company for the purpose of valuating stocks in a standardized and consistent manner. Level at which material value is managed. The valuation area may is defined: - by plant

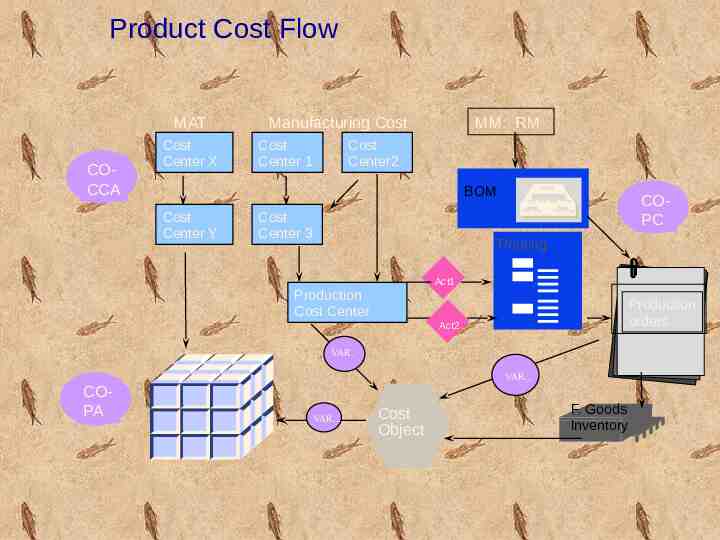

Product Cost Flow MAT COCCA Cost Center X Manufacturing Cost Cost Center 1 MM: RM Cost Center2 BOM Cost Center Y Cost Center 3 COPC Routing Act1 Production Cost Center Production orders Act2 VAR. VAR. COPA VAR. Cost Object F. Goods Inventory

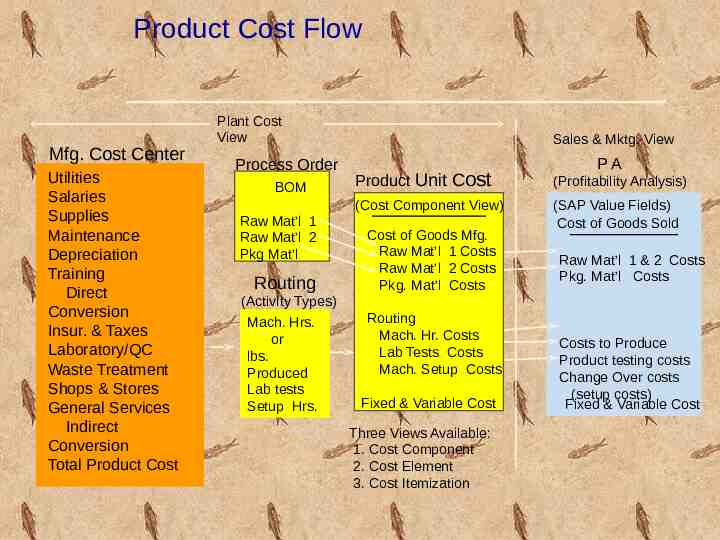

Product Cost Flow Mfg. Cost Center Utilities Salaries Supplies Maintenance Depreciation Training Direct Conversion Insur. & Taxes Laboratory/QC Waste Treatment Shops & Stores General Services Indirect Conversion Total Product Cost Plant Cost View Process Order BOM Raw Mat’l 1 Raw Mat’l 2 Pkg Mat’l Routing (Activity Types) Mach. Hrs. or lbs. Produced Lab tests Setup Hrs. Sales & Mktg. View PA Product Unit Cost (Profitability Analysis) (Cost Component View) (SAP Value Fields) Cost of Goods Sold Cost of Goods Mfg. Raw Mat’l 1 Costs Raw Mat’l 2 Costs Pkg. Mat’l Costs Routing Mach. Hr. Costs Lab Tests Costs Mach. Setup Costs Fixed & Variable Cost Three Views Available: 1. Cost Component 2. Cost Element 3. Cost Itemization Raw Mat’l 1 & 2 Costs Pkg. Mat’l Costs Costs to Produce Product testing costs Change Over costs (setup costs) Fixed & Variable Cost

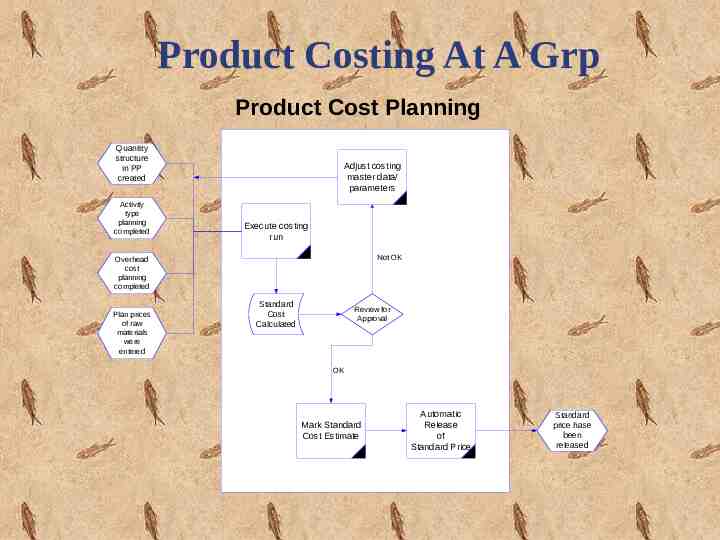

Product Costing At A Grp Product Cost Planning Quantity structure in PP created Activity type planning completed Adjust costing master data/ parameters Execute costing run Not OK Overhead cost planning completed Plan prices of raw materials were entered Standard Cost Calculated Review for Yes Approval OK Mark Standard Cost Estimate Automatic Release of Standard Price Standard price hase been released

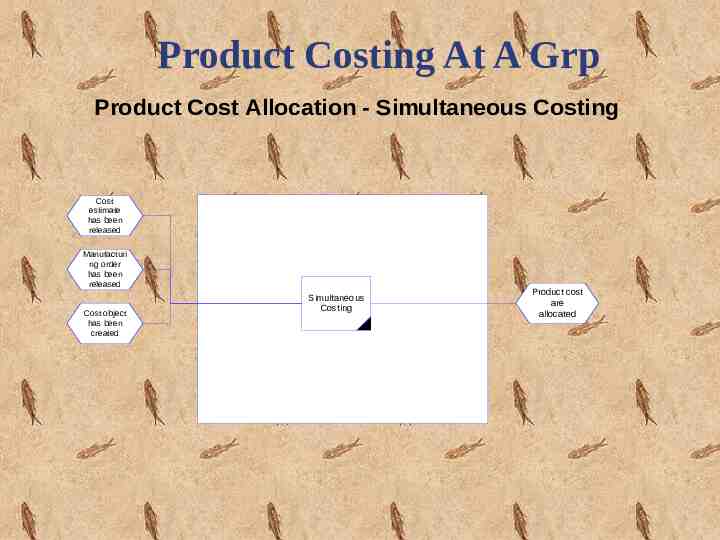

Product Costing At A Grp Product Cost Allocation - Simultaneous Costing Cost estimate has been released Manufacturi ng order has been released Cost object has been created Simultaneous Yes Costing Product cost are allocated

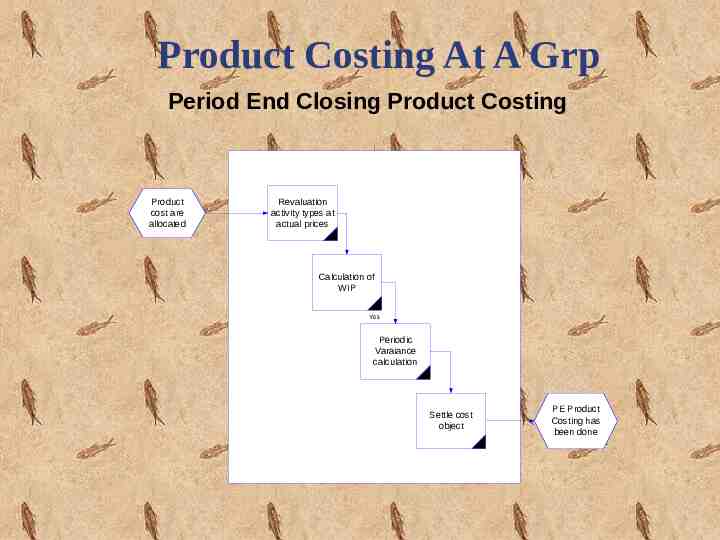

Product Costing At A Grp Period End Closing Product Costing Product cost are allocated Revaluation activity types at actual prices Calculation of WIP Yes Periodic Varaiance calculation Settle cost object PE Product Costing has been done

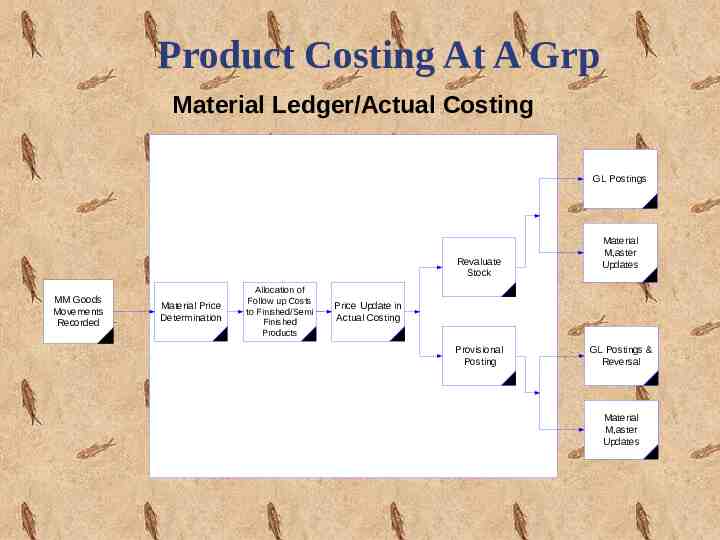

Product Costing At A Grp Material Ledger/Actual Costing GL Postings Revaluate Stock MM Goods Movements Recorded Material Price Determination Allocation of Follow up Costs to Finished/Semi Finished Products Material M,aster Updates Price Update in Actual Costing Provisional Posting GL Postings & Reversal Material M,aster Updates

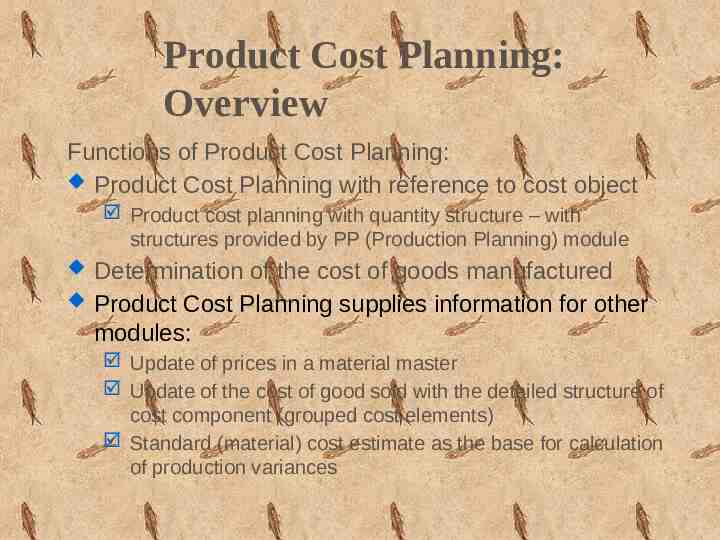

Product Cost Planning: Overview Functions of Product Cost Planning: Product Cost Planning with reference to cost object Product cost planning with quantity structure – with structures provided by PP (Production Planning) module Determination of the cost of goods manufactured Product Cost Planning supplies information for other modules: Update of prices in a material master Update of the cost of good sold with the detailed structure of cost component (grouped cost elements) Standard (material) cost estimate as the base for calculation of production variances

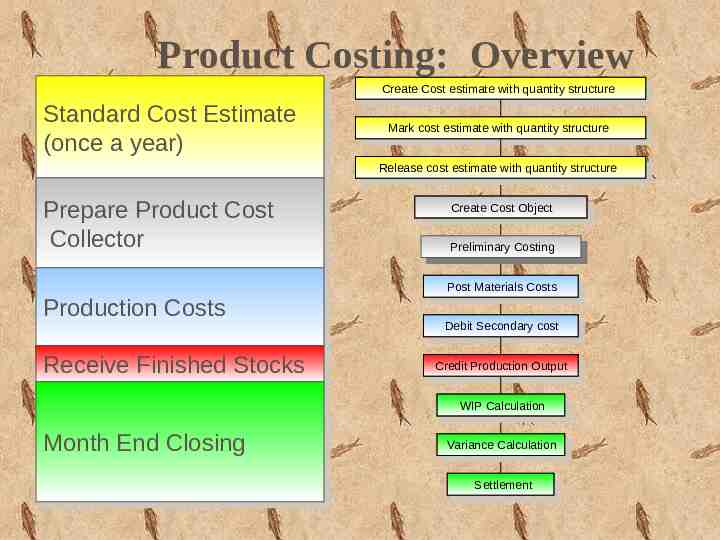

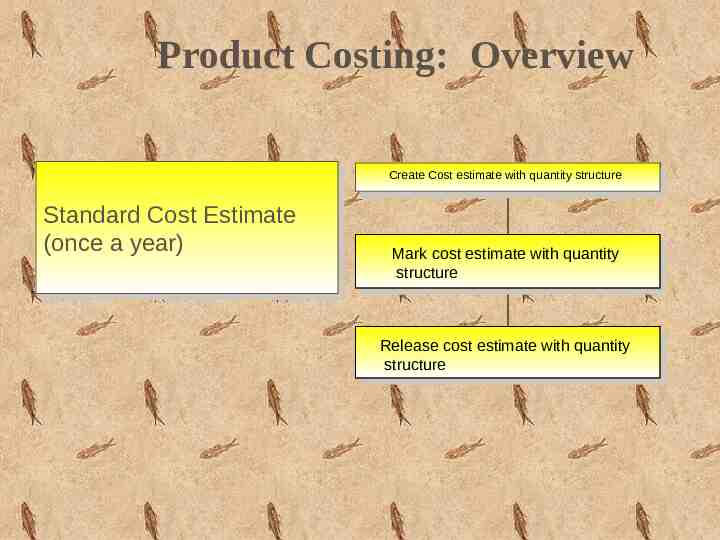

Product Costing: Overview Create Cost estimate with quantity structure Standard StandardCost CostEstimate Estimate (once (onceaayear) year) Prepare Prepare Product Product Cost Cost Collector Collector Mark cost estimate with quantity structure Release cost estimate with quantity structure Create Cost Object Preliminary Costing Post Materials Costs Production ProductionCosts Costs Receive ReceiveFinished FinishedStocks Stocks Debit Secondary cost Credit Production Output WIP Calculation Month MonthEnd EndClosing Closing Variance Calculation Settlement

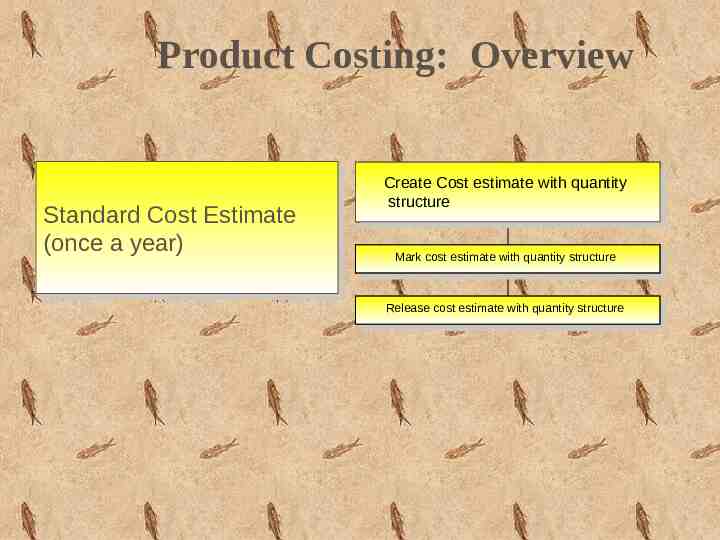

Product Costing: Overview Standard StandardCost CostEstimate Estimate (once (onceaayear) year) Create Cost estimate with quantity structure Mark cost estimate with quantity structure Release cost estimate with quantity structure

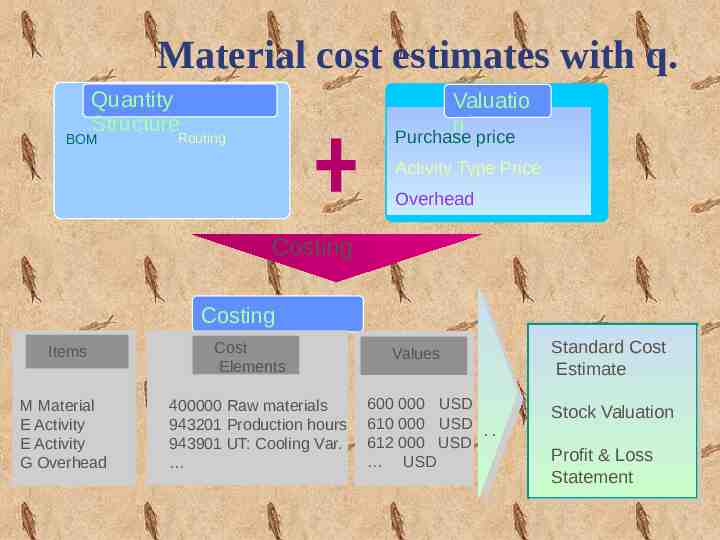

Material cost estimates with q. Quantity Valuatio s. Structure n BOM Purchase price Routing Activity Type Price Overhead Costing M Material E Activity E Activity G Overhead Elements 400000 Raw materials 943201 Production hours 943901 UT: Cooling Var. Values Standard Standard Cost Cost Estimate Estimate 600 000 USD 610 000 USD 612 000 USD USD Stock Stock Valuation Valuation :: Items Costing Results Cost Profit Profit & & Loss Loss Statement Statement

Product Costing: Overview Create Cost estimate with quantity structure Standard StandardCost CostEstimate Estimate (once (onceaayear) year) Mark cost estimate with quantity structure Release cost estimate with quantity structure

Cost Object Controlling: Overview Functions of Cost Object Controlling: Supporting make-or-buy decisions Determining price floors Performing complex cost analysis Determining inventory values

Cost Object Controlling: Overview Cost Object Controlling Scenarios: Product Cost by Period Product Cost by Period is used for recurring periodic cost control of products that are manufactured in the same way over a longer period of time. Product Cost by Order Product Cost by Order is mainly used to control the costs of individual production lots.

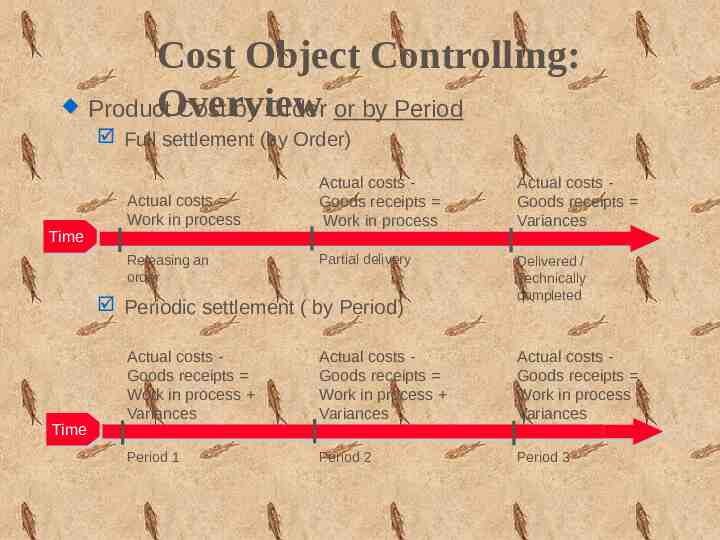

Cost Object Controlling: Product Overview Cost by Order or by Period Full settlement (by Order) Time Actual costs Work in process Releasing an order Actual costs Goods receipts Work in process Actual costs Goods receipts Variances Partial delivery Delivered / Technically completed Periodic settlement ( by Period) Time Actual costs Goods receipts Work in process Variances Actual costs Goods receipts Work in process Variances Actual costs Goods receipts Work in process Variances Period 1 Period 2 Period 3

Cost Object Controlling: Overview Functions of Product Costs by Period: Create product cost collectors. Create a preliminary cost estimate for product cost collectors. Calculate and analyze target costs and actual costs for product cost collectors. Calculate or update the work-in-process inventory and the finished goods inventory. Calculate and analyze variances for each period. Transfer data to: Financial Accounting, Profitability Analysis, Profit Center Accounting and Material Ledger.

Actual costs Production Order Step 1 – Created and release - Maintenance of Master Data Status - RELEASED STATUS- CREATED STATUS - RELEASED This status allows for actual postings

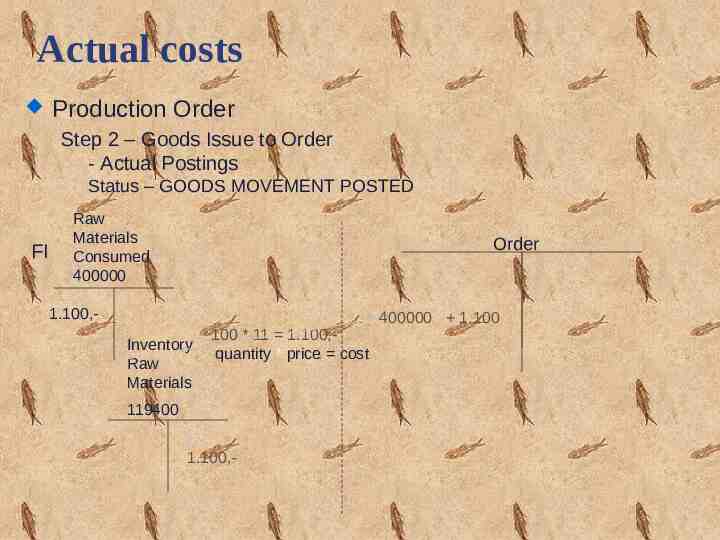

Actual costs Production Order Step 2 – Goods Issue to Order - Actual Postings Status – GOODS MOVEMENT POSTED FI Raw Materials Consumed 400000 Order 1.100,Inventory Raw Materials 100 * 11 1.100,quantity * price cost 119400 1.100,- 400000 1.100

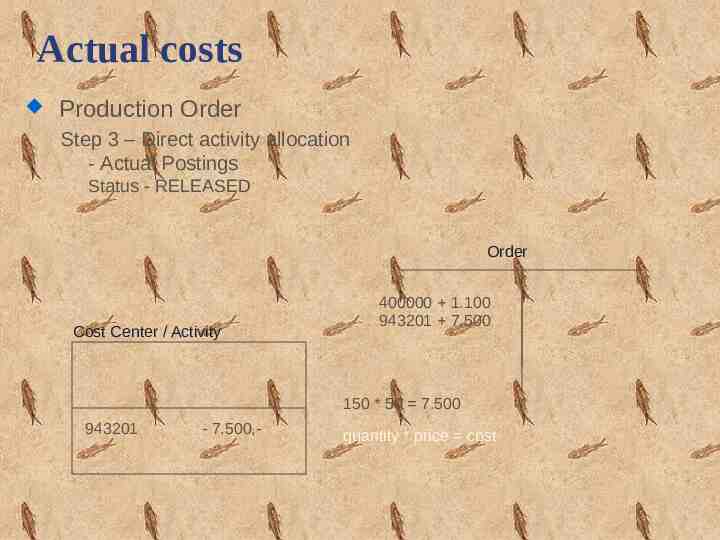

Actual costs Production Order Step 3 – Direct activity allocation - Actual Postings Status - RELEASED Order Cost Center / Activity 400000 1.100 943201 7.500 150 * 50 7.500 943201 - 7.500,- quantity * price cost

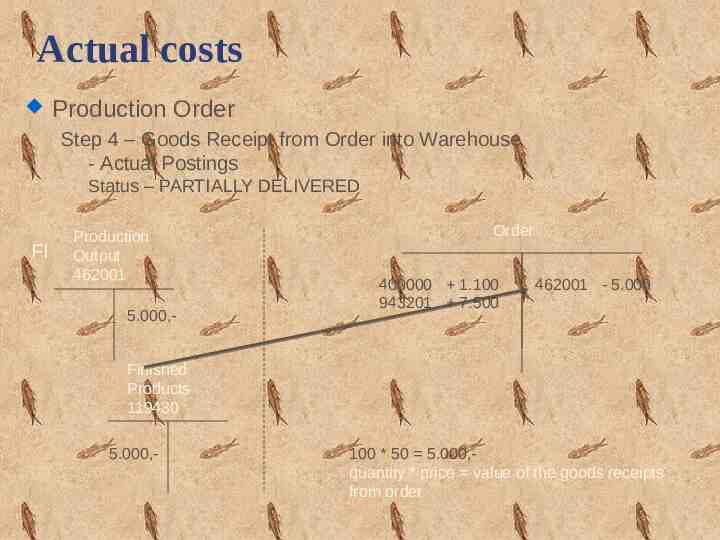

Actual costs Production Order Step 4 – Goods Receipt from Order into Warehouse - Actual Postings Status – PARTIALLY DELIVERED FI Production Output 462001 5.000,- Order 400000 1.100 943201 7.500 462001 - 5.000 Finished Products 119430 5.000,- 100 * 50 5.000,quantity * price value of the goods receipts from order

Actual costs - Summary The results from the output receipts, plus material & resource consumptions, update the stock records and provide valuation of production according to standard cost approach.

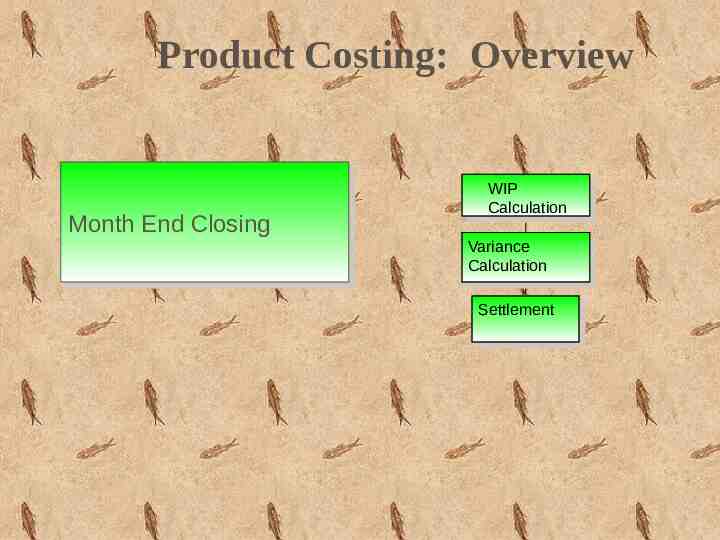

Product Costing: Overview Month MonthEnd EndClosing Closing WIP Calculation Variance Calculation Settlement

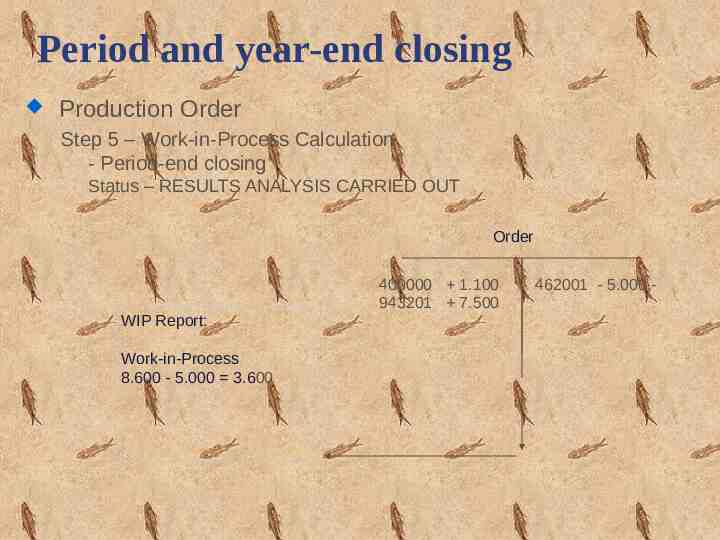

Period and year-end closing Production Order Step 5 – Work-in-Process Calculation - Period-end closing Status – RESULTS ANALYSIS CARRIED OUT Order 400000 1.100 943201 7.500 WIP Report: Work-in-Process 8.600 - 5.000 3.600 462001 - 5.000,-

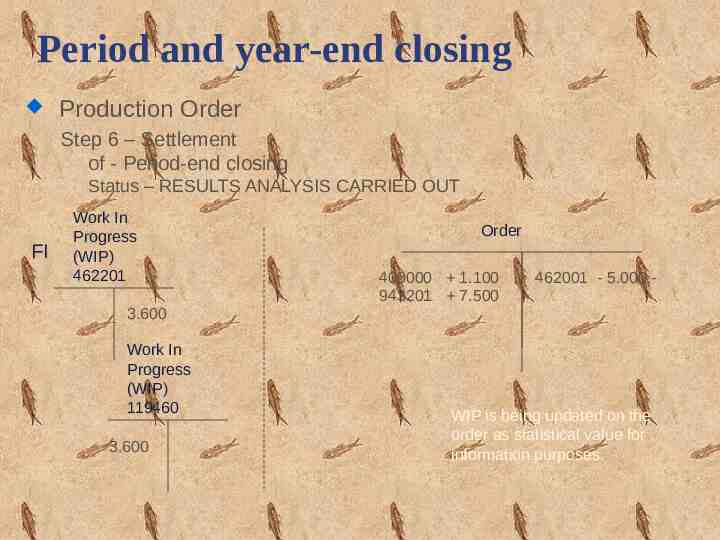

Period and year-end closing Production Order Step 6 – Settlement of - Period-end closing Status – RESULTS ANALYSIS CARRIED OUT FI Work In Progress (WIP) 462201 Order 400000 1.100 943201 7.500 462001 - 5.000,- 3.600 Work In Progress (WIP) 119460 3.600 WIP is being updated on the order as statistical value for information purposes.

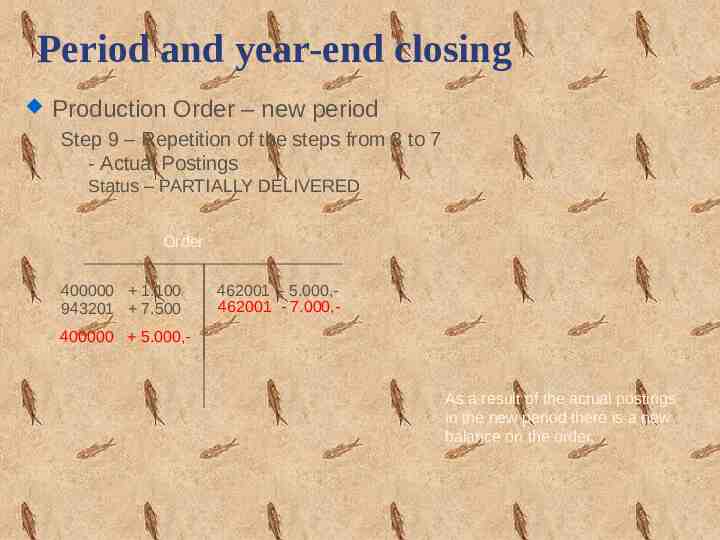

Period and year-end closing Production Order – new period Step 9 – Repetition of the steps from 3 to 7 - Actual Postings Status – PARTIALLY DELIVERED Order 400000 1.100 943201 7.500 462001 - 5.000,462001 - 7.000,- 400000 5.000,- As a result of the actual postings in the new period there is a new balance on the order.

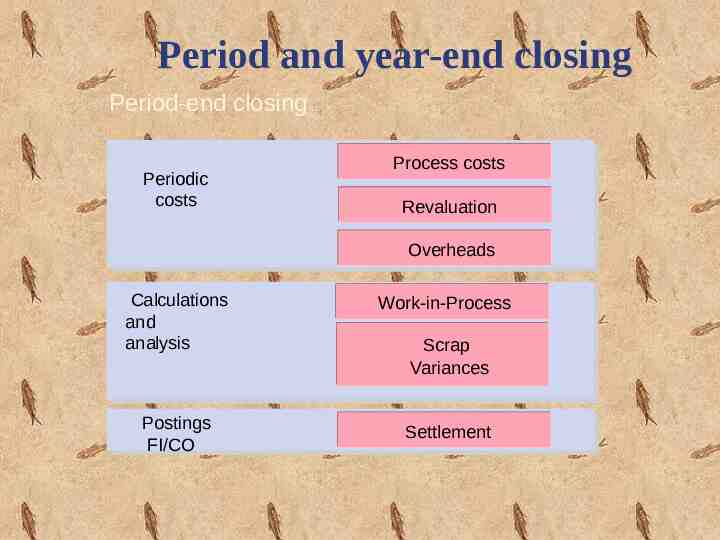

Period and year-end closing Period-end closing Periodic costs Process costs Revaluation Overheads Calculations and analysis Work-in-Process Postings FI/CO Settlement Scrap Variances

What is SAP Product Costing To identify accurate cost of production. It’s a production portfolio Help to understand for calculation of COGM and COGS. Analysis of value addition in each process of production What is cost breakdown including primary cost and transfer price.

How to control the excess overhead involve in Production. To know the breakup of each cost involve in production process and like material,labour,overhead-analysis and control on the cost. Can we supply the product at competitive price in market.

Product cost Planning Help for Product cost planning, Show the production efficiency Calculate COGM and COGS Report at each level of components in process,

2-45