Strategy: A View from the Top Chapter 6: Formulating Business

30 Slides466.21 KB

Strategy: A View from the Top Chapter 6: Formulating Business Unit Strategy Sterling Rose Justin Simpson Krista Wells Gwen Singleton Wayni Hebert

Introduction It involves creating competitive strategy within the industry. Focus on how firm should compete in given setting. optimal strategies depend on; Nature of industry, company’s mission, goals, objectives, current position, core competencies & major competitor’s strategic choices.

Foundations: Strategic Logic at the Business unit level What are principal factors behind a business unit’s profitability? How important are product superiority, cost, marketing and distribution effectiveness? Firms success is explained by the attractiveness of the industry and its relative position in the industry. Ex. Software industry vs. beer industry

How much does industry matter? According to study done by McGahan and Porter, industry, industry segment and corporations account 55% of the aggregate variance in business profits. Industry 32% Industry Segment 4% Corporate 19% Industry accounted for substantial 36% of profitability variation. Since industry determines profit potential, yes industry matters.

Relative Position Profitability of rival firms depends on the nature of their competitive position. Two generic competitive positioning are: Lower cost than competitors Differentiation The effectiveness of these competitive positioning depends on the choice of competitive scope.

Elements in scope of competitive strategy Number of products & buyer segment served. Number of different locations firm competes Extent of Vertical integration How coordinated is its position related to its business. Scope decisions are based on clear understanding of what customers value and on the companies opportunities and capabilities .

Importance of Market Share Are we managing for volume growth or value growth? The PIMS (profit impact of Market Strategy) project Market share is an important in determining long-term profitability. “Large Mkt share results from providing better value and lowering cost”. (Gale & Buzzell) Can this conclusion include today’s competitive dynamics?

The PIMS project (Profit Impact of Market Strategy) Findings of the PIMS study by Harvard Business School: 1. Absolute and relative Mkt share are strongly correlated with ROI. Firms with high Mkt share have economies of scale, experience, Mkt power and quality management, these factors led to their profitability. 2. Product quality leds to leadership, leading firms charge higher prices which gives them

Continued. 3. ROI is positively correlated with Mkt growth 4. Vertical integration can benefit in later product life. 5. High investment intensity tends to depress ROI, as do high inventory levels. 6. Capacity use is critical for businesses with large capacity this makes small companies vulnerable.

PIMS continued. PIMS findings helpful tools in explaining 80’s success stories, 90’s performance declines . PIMS has not fully explained the new dynamic and tech driven economy and business success and fall. PIMS research application is decreasing , and it calls for the need of updates to key strategic r/ships.

Formulating a Competitive Strategy Key Challenges in formulating competitive strategy at the business unit level: Analyzing the competitive environment Anticipating key competitors’ actions Generating strategic options Choosing among alternatives

Formulating a Competitive Strategy Key Challenges Analyzing the competitive environment With whom will we compete, now and in the future? What relative strengths will we have as a basis for creating a sustainable competitive advantage? Anticipating key competitors’ actions Understand how competitors are likely to respond and why. Generating strategic options Requires balancing opportunities and constraints to craft a diverse array of strategic options Choosing among alternatives Analysis of the long-term impact of different strategy options as a basis for a final choice.

Formulating a Competitive Strategy Competitive Advantage A firm has competitive advantage when it is successful in designing and implementing a valuecreating strategy that competitors are not currently using. It is sustainable when current or new competitors are not able to imitate or supplant it. Combine strengths i.e. McDonalds; Taco Bell Managers’ awareness of advantages Identify, Practice, Strengthen, and Instill throughout the organization

Formulating a Competitive Strategy Competitive Advantage Best way to foster competitive advantage: Focus on learning, creating, retaining, and motivating a skilled and knowledgeable workforce, especially in a rapidly changing business environment.

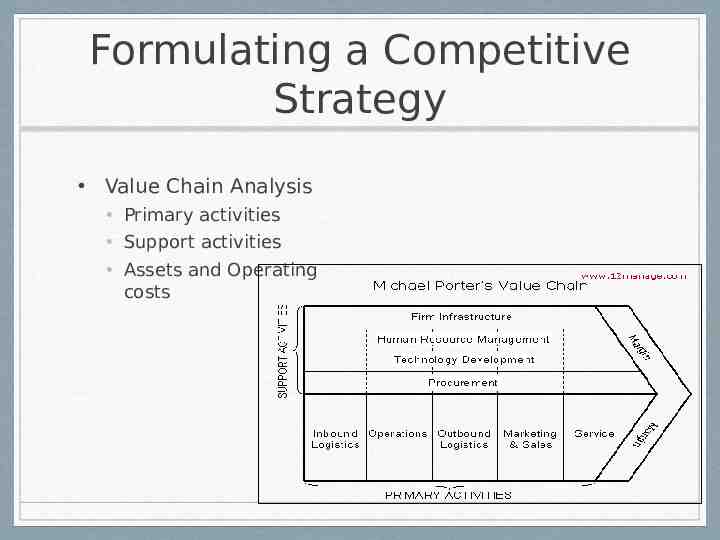

Formulating a Competitive Strategy Value Chain Analysis Value is the perceived benefit that a buyer is willing to pay a firm for what a firm provides. Building block for competitive advantage. Value chain is a model of business process that depicts the value creation process as a series of activites. Value chain analysis involves the study of costs and elements of product or service differentiation throughout the chain of activities and linkages to determine present and potential sources of competitive advantage.

Formulating a Competitive Strategy Value Chain Analysis Primary activities Support activities Assets and Operating costs

Formulating a Competitive Strategy Value Chain Analysis Differentiation Provide something unique Activities that reduce a buyer’s cost Activities that provide a higher level of buyer satisfaction Primary activities: Build-to-order manufacturing Efficient and on-time delivery of goods Promptness in responding to customer service requests High quality Identify profit pools Change upstream and downstream market conditions to improve speed, cut costs, and enhance end customer’s perception of value

Formulating a Competitive Strategy Value Chain Analysis Physical Value Chain represents the use of raw materials and labor to deliver a tangible product. Virtual Value Chain represents the information flows underlying the physical activities evident within a firm.

Porter’s Generic Business Unit Strategies Differentiation or low cost? Both are generic competitive strategies. Related to choices about competitive scope. Low Cost In broad markets low cost strategy is aimed at cost leadership. In a narrow market low cost strategy is based on cost focus. Differentiation When aimed at a broad mass market seeks to create uniqueness on an industry wide basis. A differentiated focus targets customers wiling to pay for value added

Requirements for Success The two generic routes are fundamentally different. Cost leadership requires ruthless devotion to minimizing cost through continuous improvement in manufacturing, process engineering, and other cost reducing strategies. Requires tight control, an organizational structure & incentive system supportive of cost-focused discipline. With differentiation the concern is value added. The primary objective is to redefine the rules by which customers come to their purchase decisions by offering something unique. Most successful differentiation strategies involve multiple sources of differentiation. Requires a thorough understanding of what customers value and how much they are willing to pay.

Risks Cost leaders must concern themselves with technological change that can nullify past investments. The biggest challenge to differentiation is imitation, it narrows actual and perceived differentiation. The goal of both is to create sustainability! Cost leaders must continually improve efficiency, look for less expensive supplies, and reduce manufacturing & distribution costs. For differentiators the firm must erect barriers to entry around their dimensions of uniqueness.

Critique of Porter’s generic strategies Low cost production and differentiation are mutually exclusive, and when they exists together they result in sustained profitability. Differentiation can permit a firm to attain a low-cost position. The possibility of providing both improved quality and lower costs exists within the total quality management framework. There are dangers associated with pursuing a single strategy ex) Caterpillar

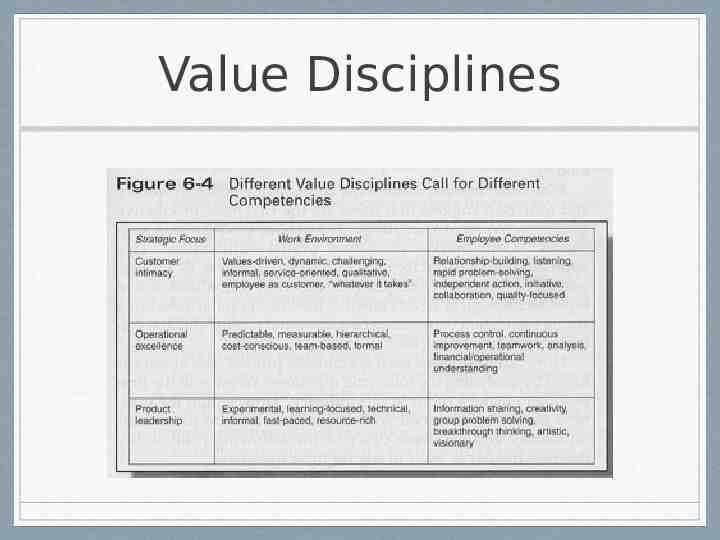

Value Discipline Product Leadership Operational Excellence Customer Intimacy

Product Leadership Encourage Innovation Risk-Oriented Management Style Success depends on talent Need to educate and lead the market

Operational Effectiveness Narrow Product Lines High expertise in chosen areas of focus Moderate change in technology or structure Focus on cost, efficiency/volume

Customer Intimacy Strong customer focus Relationship driven Two competitive requirements Quick movement in developing markets Efficient operations as markets mature

Value Disciplines

Designing a Profitable Business Model A profitable business model is essential when formulating a business unit strategy An effective model explains How the firm will gain profits The actions that will lead to success in the long term Adrian Slywotzky and David Morrison identified 22 business models that generated profits in unique ways

How do Businesses Earn Profits? In the past, market share led to profit. This is not the case anymore because of globalization and rapid technological changes. These days you have to ask yourself these questions Where will the firm be able to make a profit in this industry? How should the business model be designed so that the firm will be profitable?

McDonald’s Corp. Business Model Ray Kroc kept strict control over his franchises His policy was to sublease his properties to franchisees Real estate gave Kroc the cash flow needed for down payments on additional land to expand