Strategic Marketing 052 430 Instructor: Michael

55 Slides1.36 MB

Strategic Marketing 052 430 Instructor: Michael Cooke E-mail Address: [email protected] Office: IC room 817 Class hours: Friday 13:00-16:00 Class Location: IC room 806 Web:home/kku.ac.th/michco

Rebranding a Country

Rebranding a Country

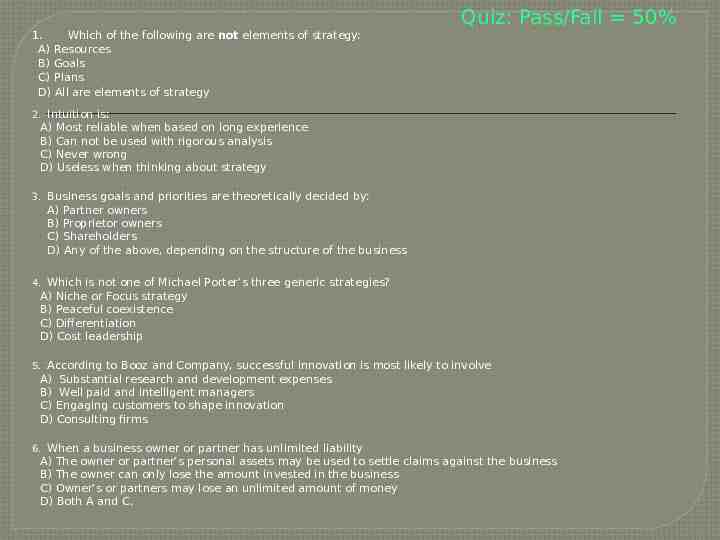

1. Which of the following are not elements of strategy: A) Resources B) Goals C) Plans D) All are elements of strategy Quiz: Pass/Fail 50% 2. Intuition is: A) Most reliable when based on long experience B) Can not be used with rigorous analysis C) Never wrong D) Useless when thinking about strategy 3. Business goals and priorities are theoretically decided by: A) Partner owners B) Proprietor owners C) Shareholders D) Any of the above, depending on the structure of the business 4. Which is not one of Michael Porter’s three generic strategies? A) Niche or Focus strategy B) Peaceful coexistence C) Differentiation D) Cost leadership 5. According to Booz and Company, successful innovation is most likely to involve A) Substantial research and development expenses B) Well paid and intelligent managers C) Engaging customers to shape innovation D) Consulting firms 6. When a business owner or partner has unlimited liability A) The owner or partner’s personal assets may be used to settle claims against the business B) The owner can only lose the amount invested in the business C) Owner’s or partners may lose an unlimited amount of money D) Both A and C.

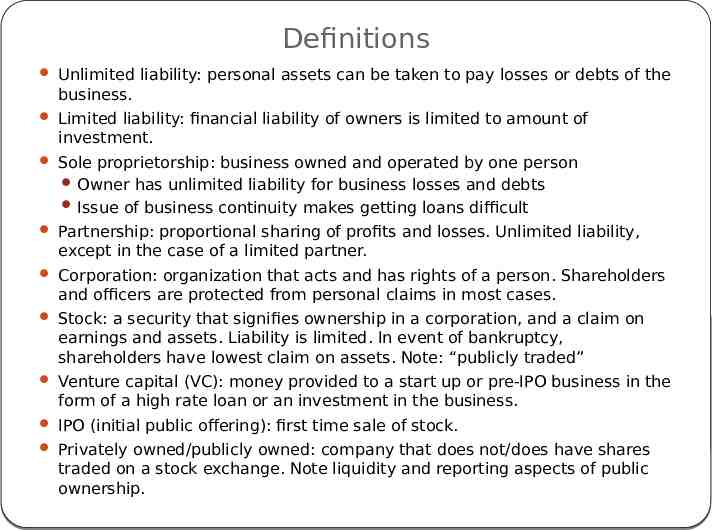

Definitions Unlimited liability: personal assets can be taken to pay losses or debts of the business. Limited liability: financial liability of owners is limited to amount of investment. Sole proprietorship: business owned and operated by one person Owner has unlimited liability for business losses and debts Issue of business continuity makes getting loans difficult Partnership: proportional sharing of profits and losses. Unlimited liability, except in the case of a limited partner. Corporation: organization that acts and has rights of a person. Shareholders and officers are protected from personal claims in most cases. Stock: a security that signifies ownership in a corporation, and a claim on earnings and assets. Liability is limited. In event of bankruptcy, shareholders have lowest claim on assets. Note: “publicly traded” Venture capital (VC): money provided to a start up or pre-IPO business in the form of a high rate loan or an investment in the business. IPO (initial public offering): first time sale of stock. Privately owned/publicly owned: company that does not/does have shares traded on a stock exchange. Note liquidity and reporting aspects of public ownership.

Role of Strategic Market Management Marketing is in the best position to understand customers, competitors, environments, and trends Marketing has lead role in understanding brand portfolio, distribution channels, and new product development Marketing ought to be voice of the customer within the organization Business strategy makes no sense without marketing Marketing strategy depends on business competencies The marketing function often spans all areas and functions of the organization Ch 1 -6

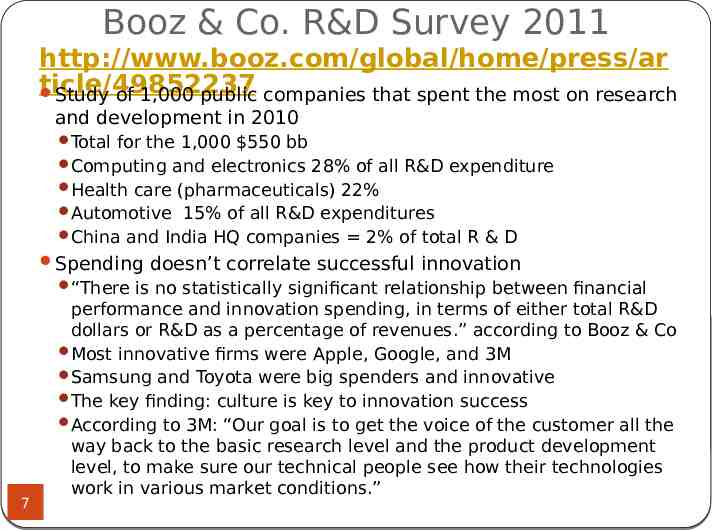

Booz & Co. R&D Survey 2011 http://www.booz.com/global/home/press/ar ticle/49852237 Study of 1,000 public companies that spent the most on research and development in 2010 Total for the 1,000 550 bb Computing and electronics 28% of all R&D expenditure Health care (pharmaceuticals) 22% Automotive 15% of all R&D expenditures China and India HQ companies 2% of total R & D Spending doesn’t correlate successful innovation “There is no statistically significant relationship between financial 7 performance and innovation spending, in terms of either total R&D dollars or R&D as a percentage of revenues.” according to Booz & Co Most innovative firms were Apple, Google, and 3M Samsung and Toyota were big spenders and innovative The key finding: culture is key to innovation success According to 3M: “Our goal is to get the voice of the customer all the way back to the basic research level and the product development level, to make sure our technical people see how their technologies work in various market conditions.”

Booz & Co. R&D Survey 2011 http://www.booz.com/global/home/press/ar ticle/49852237 Need Seekers, Market Readers and Technology Drivers Need Seekers consistently strive to be first movers and proactively engage customers to shape new innovations, and align innovation and business strategies (3M) Market Readers adopt a second mover strategy and emphasize incremental change (Samsung) Technology Drivers stress technology achievement and both incremental and breakthrough change (Google) If you align innovation strategy and culture to your business model, build the right capabilities, and execute, you can prevail no matter which strategy you follow There may be no more critical source of business success or failure than a company’s culture. It is more important than strategy and leadership. According to Booz & Co.: Companies whose strategic goals are clear, and whose cultures strongly support those goals, possess a huge advantage “Connect with the customer, find out their articulated and unarticulated needs, and then determine the capability at 3M that can be developed across the company that could solve that customer’s problem in a unique, proprietary, and sustainable way. Our businesses are all interdependent and collaborative.”

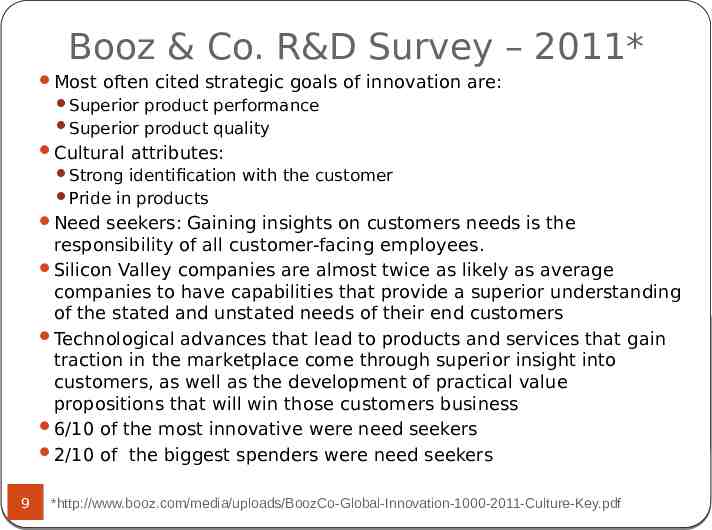

Booz & Co. R&D Survey – 2011* Most often cited strategic goals of innovation are: Superior product performance Superior product quality Cultural attributes: Strong identification with the customer Pride in products Need seekers: Gaining insights on customers needs is the responsibility of all customer-facing employees. Silicon Valley companies are almost twice as likely as average companies to have capabilities that provide a superior understanding of the stated and unstated needs of their end customers Technological advances that lead to products and services that gain traction in the marketplace come through superior insight into customers, as well as the development of practical value propositions that will win those customers business 6/10 of the most innovative were need seekers 2/10 of the biggest spenders were need seekers 9 *http://www.booz.com/media/uploads/BoozCo-Global-Innovation-1000-2011-Culture-Key.pdf

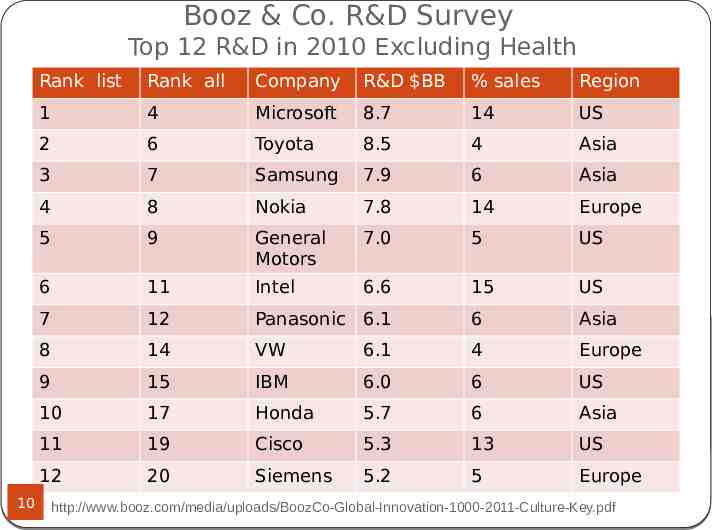

Booz & Co. R&D Survey Top 12 R&D in 2010 Excluding Health 10 Rank list Rank all Company R&D BB % sales Region 1 4 Microsoft 8.7 14 US 2 6 Toyota 8.5 4 Asia 3 7 Samsung 7.9 6 Asia 4 8 Nokia 7.8 14 Europe 5 9 General Motors 7.0 5 US 6 11 Intel 6.6 15 US 7 12 Panasonic 6.1 6 Asia 8 14 VW 6.1 4 Europe 9 15 IBM 6.0 6 US 10 17 Honda 5.7 6 Asia 11 19 Cisco 5.3 13 US 12 20 Siemens 5.2 5 Europe http://www.booz.com/media/uploads/BoozCo-Global-Innovation-1000-2011-Culture-Key.pdf

Booz & Co. R&D Survey 2011 Innovation As part of this year’s study, Booz & Co. surveyed almost 600 innovation leaders in companies around the world, large and small, in every major industry sector. As noted, almost half of the companies reported inadequate strategic alignment and poor cultural support for their innovation strategies. Possibly even more surprising, nearly 20 percent of companies said they didn’t have a well defined innovation strategy at all. http://www.booz.com/media/uploads/BoozCo-Global-Innovation-1000-2011-CultureKey.pdf 11

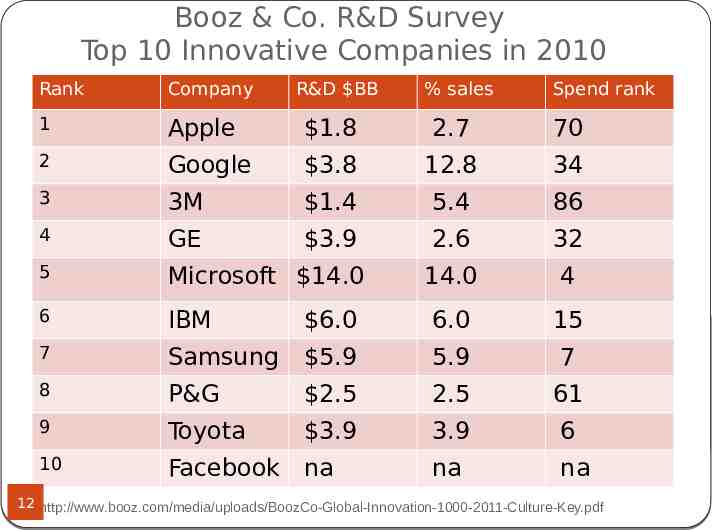

Booz & Co. R&D Survey Top 10 Innovative Companies in 2010 Rank Company R&D BB % sales Spend rank 1 Apple 1.8 2.7 70 2 Google 3.8 12.8 34 3 3M 1.4 5.4 86 4 GE 3.9 2.6 32 5 Microsoft 14.0 14.0 4 6 IBM 6.0 6.0 15 7 Samsung 5.9 5.9 7 8 P&G 2.5 2.5 61 9 Toyota 3.9 3.9 6 10 Facebook na na na 12 http://www.booz.com/media/uploads/BoozCo-Global-Innovation-1000-2011-Culture-Key.pdf

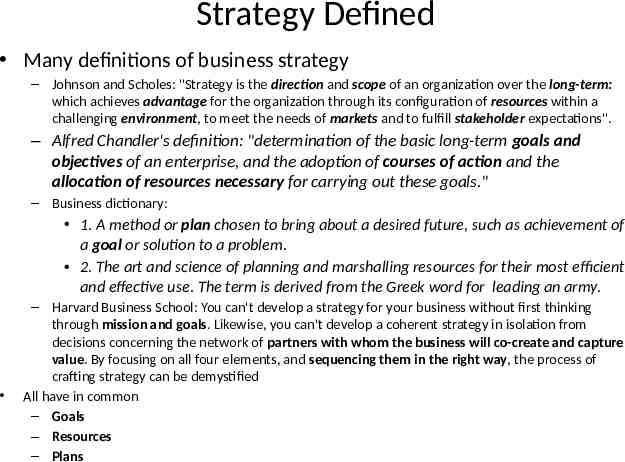

Strategy Defined Many definitions of business strategy – Johnson and Scholes: "Strategy is the direction and scope of an organization over the long-term: which achieves advantage for the organization through its configuration of resources within a challenging environment, to meet the needs of markets and to fulfill stakeholder expectations". – Alfred Chandler's definition: "determination of the basic long-term goals and objectives of an enterprise, and the adoption of courses of action and the allocation of resources necessary for carrying out these goals." – Business dictionary: 1. A method or plan chosen to bring about a desired future, such as achievement of a goal or solution to a problem. 2. The art and science of planning and marshalling resources for their most efficient and effective use. The term is derived from the Greek word for leading an army. – Harvard Business School: You can't develop a strategy for your business without first thinking through mission and goals. Likewise, you can't develop a coherent strategy in isolation from decisions concerning the network of partners with whom the business will co-create and capture value. By focusing on all four elements, and sequencing them in the right way, the process of crafting strategy can be demystified All have in common – Goals – Resources – Plans

“In terms of the three key players (competitors, customers, company) strategy is defined as the way in which a corporation endeavors to differentiate itself positively from its competitors, using its relative corporate strengths to better satisfy customer needs.” Kenichi Ohmae “The Mind of the Strategist” David Aaker, Damien McLoughlin, Strategic Market Management European Edition, 0470059869, Copyright 2007 John Wiley & Sons Ltd 14

Strategy or Strategic Planning Strategic planning is a process typically done in large companies when they perceive the need to change We will focus more on strategy, or how to achieve long range goals Strategy is often thought of as ‘how to achieve competitive advantage’ But many businesses simply want to co-exist All businesses need to have goals and plans

Sole Proprietorships Need Strategy Example sidewalk vendor in Bangkok Rents space in front of a business Buys food for cooking and resale Has a helper, or two Owns some basic equipment, purchased with family funds Skilled cook, good location, good price many customers But: Business and family funds are comingled Revenue from business goes to family consumption Expenses are ‘lumpy’ (due only at certain times) Problem arises when bills for rent or supplies are due, when equipment needs maintenance or replacement, or at payday Need to understand resources of the business and marketing

Strategy for Whom? We will focus on strategy for owners This might differ from strategy of managers Illustration from banking: Think of bank loan marketing Easy to make loans that will go bad in two years Short term profit in the loans, losses appear later Lending officer gets bonus based on his sales But he works against owner interests Think of bank customer service Branch manager can show bigger profit by cutting staff Customers wait, or face surly overworked staff If the bank had brand that said ‘great service’ the brand suffers How would an owner, or management that works for owners prevent this? In general, managers often have incentive to achieve short term profit by wasting brand equity where owners want to preserve B/E

Business Purpose Why does a business exist? In theory, a public company exists to benefit shareholder ‘owners’ A partnership or sole proprietorship exists to benefit owners (and in return they have unlimited risk) What happens when unlimited risk becomes limited? Company strategy may change, actions may become more risky Example of investment banking firms in USA, 1999 Some early investors want to ‘cash out’ by selling a company Management and owners of public companies may have different interests Managers can employ strategies that further manager interest Managers might be most interested in protecting their positions Fight ‘hostile’ merger or acquisition that is in interest of shareholders Jeff Bezos owns 19% of all AMZN stock ( 20BB). Which type of strategy would AMZN use?

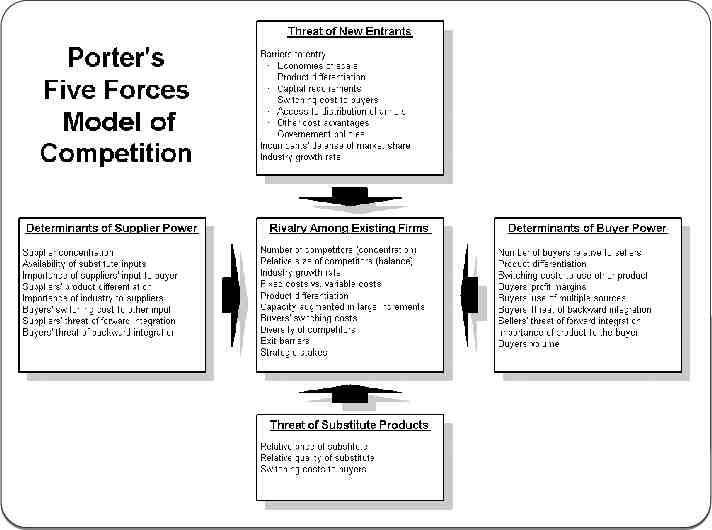

Apple and Amazon Two of the Three Generic Strategies. Michael Porter wrote about three basic strategies for competitive advantage Cost leadership Differentiation Niche (or Focus) strategy Amazon’s strategy is cost leadership Apple’s strategy is differentiation Each has profoundly different approaches See: “So Amazon unnerved investors” Word document Differences in approach to markets Differences in how resources are deployed Yet each creates barriers to entry Businesses may use niche strategy to compete with giants

Integrating Intuition & Analysis The strategic management process attempts to organize quantitative and qualitative information under conditions of uncertainty (Fred David) Strategy can be a formal planning process or informal Intuition is based on: Past experiences Judgment Feelings (often the ego leads to poor judgment) Intuition is useful for decision making in conditions of: Great uncertainty Little precedent Highly interrelated variables

There is no Substitute for Knowing the Business Maurice Greenberg CEO, AIG, Inc., 1968- 2005 AIG’s legendary risk management was mostly in the head of one man: Hank Greenberg He would get raw data. He made assessments. AIG became an extremely complex organization with hundreds of subsidiaries What happened when Maurice Greenberg left AIG? The new CEO did not understand risks

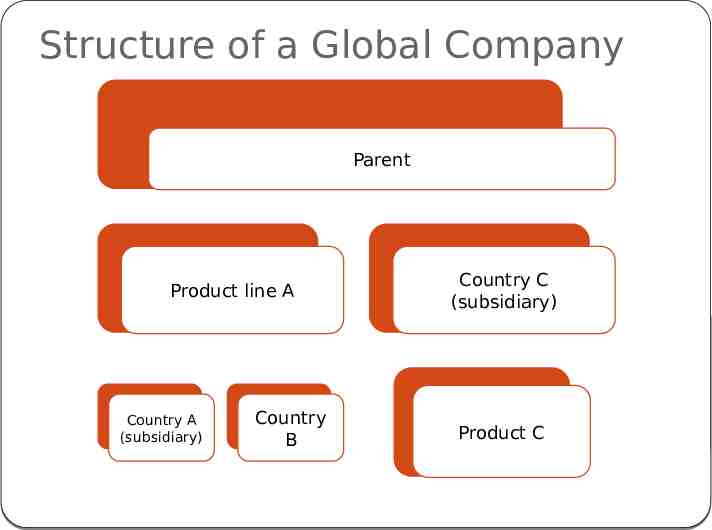

Structure of a Global Company Parent Product line A Country A (subsidiary) Country B Country C (subsidiary) Product C

How are Resources Allocated? Budgets are typically organized annually Can be thought of as communication documents Priorities are arranged within the framework of a strategic plan Resources are identified Management allocates resources according to priorities Mechanisms are set up for monitoring actual v budget Most companies have quarterly or rolling ‘reforecasts’ How are budget priorities established? A formal strategic plan is used to set global priorities, in some cases Resources allocated by negotiation at the highest levels Detailed assessment of strategic variables may occur within budget process Strategy is created or modified with information from all areas Often begin with ‘wish lists’ at lowest levels of hierarchy Ends with explicit or implicit broad company strategy Most organizations have flexible budgets – can redirect resources

From “Only the Paranoid Survive” Andy Grove We live in an age in which the pace of technological change is pulsating ever faster, causing waves that spread outward toward all industries. This increased rate of change will have an impact on you, no matter what you do for a living. It will bring new competition from new ways of doing things, from corners that you don't expect. If you run a business, you must recognize that no amount of formal planning can anticipate such changes (strategic inflection points). Does that mean you shouldn't plan? Not at all. You need to plan the way a fire department plans: It cannot anticipate where the next fire will be, so it has to shape an energetic and efficient team that is capable of responding to the unanticipated as well as to any ordinary event.

Course Correction Organizations typically review budget variances monthly Periodic re-forecasts (streamlined budget exercises) might be supplemented When variances point to unforeseen issues When new opportunities or threats arise How are these opportunities or threats discovered Many times through variance analysis (for example sales versus expected) Other times from external sources We will discuss innovation at length later Course corrections or resetting strategic priorities might occur outside of normal planning cycles Often found in conjunction with review of quarterly results (in the case of public companies)

Why do thriving small businesses fail? Often they lack information about their resources Formal bookkeeping does not happen or is sloppy Personal and business expenditures are mingled Or they under-estimate need for capital Revenue and expenses have cycles Revenues might spike before a holiday Expenses have cycles Pay employees Pay for materials Monthly rents, etc False sense of wealth before expenses loom or failure to borrow before crisis (the worst time to borrow is during crisis) Without having a sense of future income and expenses, the owner or manager ‘misallocates’ resources To survive, a business must be forward looking

Successful Businesses have Plans and Goals Bank lending facilities require long range plans Venture capitalists are demanding about strategy & calibration of plans Wise investors look for goals and plans How does a company plan to earn a profit (or generate capital)? When does a company plan to generate profit or pay back loans? Government demanded a strategic plan for automobile companies before injecting capital in 2008-2009 Sole proprietorships need to consider the

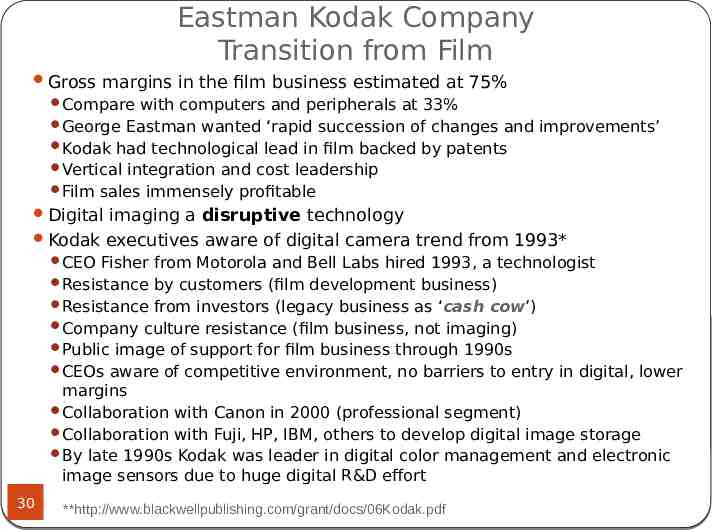

Eastman Kodak Company Background information Founded in 1880s, once an iconic US firm In 1976 Kodak sold between 85-90% of all film and cameras in the USA Fuji of Japan took market share in 1980s (economy segment) In 1994 Kodak 20th ranked US company by sales Kodak spins off Eastman Chemical, now thriving Apple launched a digital camera made by Kodak Kodak stops selling film cameras in 2004, becomes biggest retailer of digital cameras in 2005 Falls to 7th biggest digital camera retailer by 2010 Declares bankruptcy in 2012 29

Eastman Kodak Company Transition from Film Gross margins in the film business estimated at 75% Compare with computers and peripherals at 33% George Eastman wanted ‘rapid succession of changes and improvements’ Kodak had technological lead in film backed by patents Vertical integration and cost leadership Film sales immensely profitable Digital imaging a disruptive technology Kodak executives aware of digital camera trend from 1993* CEO Fisher from Motorola and Bell Labs hired 1993, a technologist Resistance by customers (film development business) Resistance from investors (legacy business as ‘cash cow’) Company culture resistance (film business, not imaging) Public image of support for film business through 1990s CEOs aware of competitive environment, no barriers to entry in digital, lower margins Collaboration with Canon in 2000 (professional segment) Collaboration with Fuji, HP, IBM, others to develop digital image storage By late 1990s Kodak was leader in digital color management and electronic image sensors due to huge digital R&D effort 30 **http://www.blackwellpublishing.com/grant/docs/06Kodak.pdf

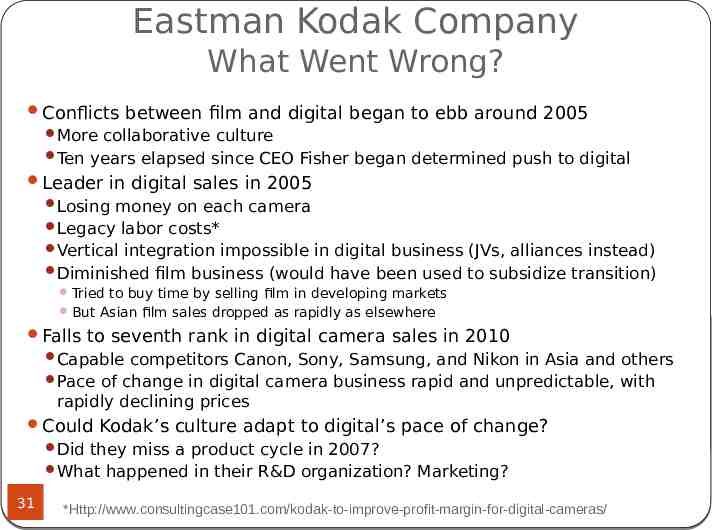

Eastman Kodak Company What Went Wrong? Conflicts between film and digital began to ebb around 2005 More collaborative culture Ten years elapsed since CEO Fisher began determined push to digital Leader in digital sales in 2005 Losing money on each camera Legacy labor costs* Vertical integration impossible in digital business (JVs, alliances instead) Diminished film business (would have been used to subsidize transition) Tried to buy time by selling film in developing markets But Asian film sales dropped as rapidly as elsewhere Falls to seventh rank in digital camera sales in 2010 Capable competitors Canon, Sony, Samsung, and Nikon in Asia and others Pace of change in digital camera business rapid and unpredictable, with rapidly declining prices Could Kodak’s culture adapt to digital’s pace of change? Did they miss a product cycle in 2007? What happened in their R&D organization? Marketing? 31 *Http://www.consultingcase101.com/kodak-to-improve-profit-margin-for-digital-cameras/

Objectives of Strategic Market Management (from McLoughlin p. 14) Precipitate consideration of strategic choices Assess opportunities and threats Organizations fail because strategic decisions were made too late Help a business cope with change Force a long range view Make the resource allocation decisions explicit These decisions are too often political or the result of inertia Promising businesses may get too few resources Aid strategic analysis and decision making Provide a strategic management and control system Provide both horizontal and vertical communication and coordination

The Strategy Planning Cycle Identify issues facing the firm (challenges, trends) Bring together people from all functional areas Adapt planning cycles to the business Differing regular intervals Trends or events can trigger strategy review Create a strategy performance system Progress goals (milestones) End objectives Identify barriers and ways around barriers

Exercise Select a company What business are they in? Who are the direct and indirect competitors? Is this company proactive or reactive? David Aaker, Damien McLoughlin, Strategic Market Management European Edition, 0470059869, Copyright 2007 John Wiley & Sons Ltd 34

What is a Business Strategy? The Product-Market Investment Strategy – Scope of the Business Products offered, not offered Often the most important strategic choice A resource allocation decision Markets served Competition a business chooses to engage or avoid Vertical integration Scope dynamics Product expansion (new products to existing markets) Market expansion (bring existing product to new markets) Diversification (Enter new product markets) Strategic investment choices Invest to grow or enter new markets Invest to maintain existing position Minimize investment (milk the business) Liquidate or divest (get rid of) the business Assets and Advantage) Competencies (to achieve Strategic Competitive Resources such as brands or customer base that is strong relative to competitors Competency: What does a business unit do well that has strategic importance? Avoidance of disadvantage might be enough 35

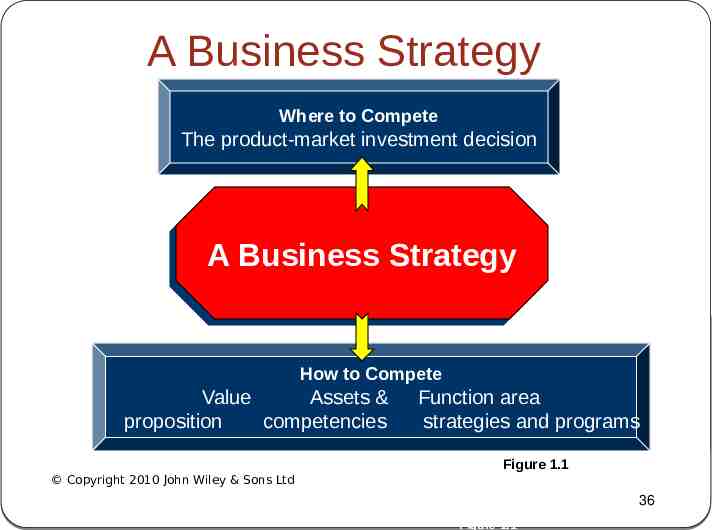

A Business Strategy Where to Compete The product-market investment decision A Business Business Strategy Strategy A How to Compete Value Assets & proposition competencies Function area strategies and programs Figure 1.1 Copyright 2010 John Wiley & Sons Ltd 36 Figure 1.1

Customer Value Proposition Examples Good value (Aldi – discount markets) Excellence on an important product or service attribute (El Bulli restaurant in Spain) The best overall quality (Krug Grande Cuvée) Product line breadth (Tesco) Innovative offerings (Logitech) A shared passion for an activity or a product (Ducati) Global connections and prestige (HSBC) Copyright 2010 John Wiley & Sons Ltd 37

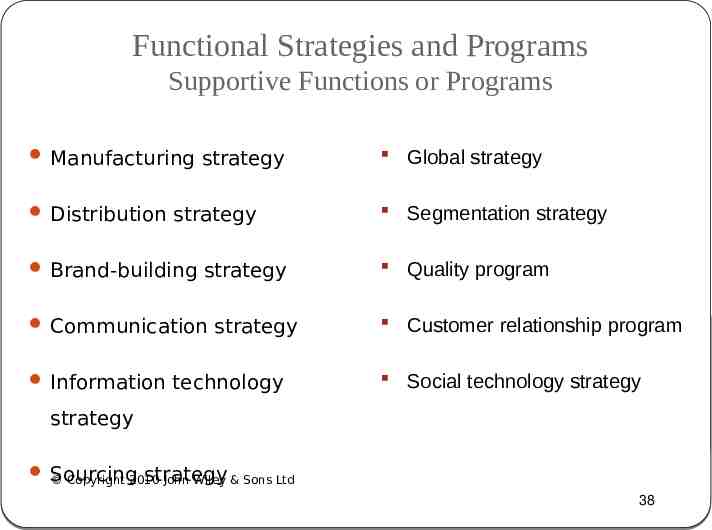

Functional Strategies and Programs Supportive Functions or Programs Manufacturing strategy Global strategy Distribution strategy Segmentation strategy Brand-building strategy Quality program Communication strategy Customer relationship program Information technology Social technology strategy strategy Sourcing strategy Copyright 2010 John Wiley & Sons Ltd 38

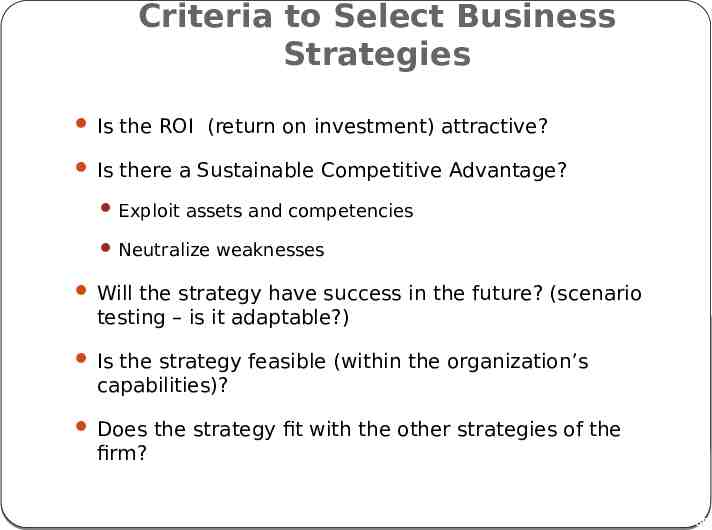

Criteria to Select Business Strategies Is the ROI (return on investment) attractive? Is there a Sustainable Competitive Advantage? Exploit assets and competencies Neutralize weaknesses Will the strategy have success in the future? (scenario testing – is it adaptable?) Is the strategy feasible (within the organization’s capabilities)? Does the strategy fit with the other strategies of the firm? PPT 1-39

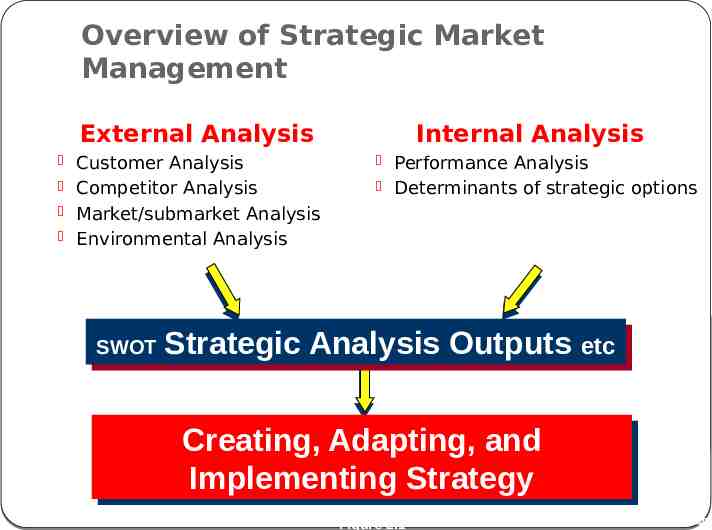

Overview of Strategic Market Management External Analysis Customer Analysis Competitor Analysis Internal Analysis Performance Analysis Determinants of strategic options Market/submarket Analysis Environmental Analysis SWOT SWOT Strategic Strategic Analysis Analysis Outputs Outputs etc etc Creating, Creating, Adapting, Adapting, and and Implementing Implementing Strategy Strategy Figure 2.1 PPT 1-40

Why Strategic Market Management? Precipitate the consideration of strategic choices. Help a business cope with change. Force a long-range view. Make visible the resource allocation decision. Aid strategic analysis and decision making. Provide a strategic management and control system. Provide both horizontal and vertical communication and coordination systems. PPT 1-41

Strategic Options Quality Product quality Innovation Product line breadth Focus Corporate social responsibility Being global Product attribute Brand familiarity Customer intimacy Product design Copyright 2010 John Wiley & Sons Ltd 42

Key Ideas A business strategy includes the determination of the productmarket investment strategy, the customer value proposition, assets and competencies, and functional area strategy. Strategy needs to be developed and executed in the context of a dynamic market. To cope, it is important to develop competencies in strategic analysis, innovation, managing multiple businesses, and developing Sustainable Competitive Advantages. Strategic market management is a system designed to help visions. A strategic vision is a vision of a future strategy or sets of strategies. Strategic market management includes a strategic analysis of the business to identify existing or emerging opportunities, threats, trends, strategic uncertainties, and strategic alternatives. The CMO role has grown over the years and is now often charged with being a partner in developing strategies and a vehicle to deal with the dysfunctions of the product market silos. Copyright 2010 John Wiley & Sons Ltd 43

“It isn’t that they can’t see the solution, it’s that they can’t see the problem.” G. K. Chesterton David Aaker, Damien McLoughlin, Strategic Market Management European Edition, 0470059869, Copyright 2007 John Wiley & Sons Ltd 44

“Strategy is a framework which guides those choices that determine the nature and direction of an organisation.” Benjamin B. Tregoe & John W. Zimmerman “Top Management Strategy” David Aaker, Damien McLoughlin, Strategic Market Management European Edition, 0470059869, Copyright 2007 John Wiley & Sons Ltd 45

“Strategy is the creation of a unique and valuable position, involving a different set of activities.” Michael Porter, “What is Strategy?” Harvard Business Review David Aaker, Damien McLoughlin, Strategic Market Management European Edition, 0470059869, Copyright 2007 John Wiley & Sons Ltd 46

“Four dimensions define a business strategy: the product-market investment strategy, the customer value proposition, assets and competencies, and functional strategies and programs. The first specifies where to compete, and the remaining three indicate how to compete to win.” David Aaker and Damien McLoughlin “Strategic Market Management” David Aaker, Damien McLoughlin, Strategic Market Management European Edition, 0470059869, Copyright 2007 John Wiley & Sons Ltd 47

Adapting to Change Organizations should continually monitor internal and external events and trends so that timely changes can be made as needed Copyright 2011 Pearson Education, Inc. Publishing as Prentice Hall Ch 1 -48

According to Fred David: “Strategic Management is Gaining and Maintaining Competitive Advantage” Competitive advantage is “Anything that a firm does especially well compared to rival firms” But: self interest and greed are distinct Self interest often means helping others Gains from greed are usually short term

Achieving Sustained Competitive Advantage 1. Continually adapting to changes in external trends and events and internal capabilities, competencies, and resources 2. Effectively formulating, implementing, and evaluating strategies that capitalize on those factors Copyright 2011 Pearson Education, Inc. Publishing as Prentice Hall Ch 1 -50

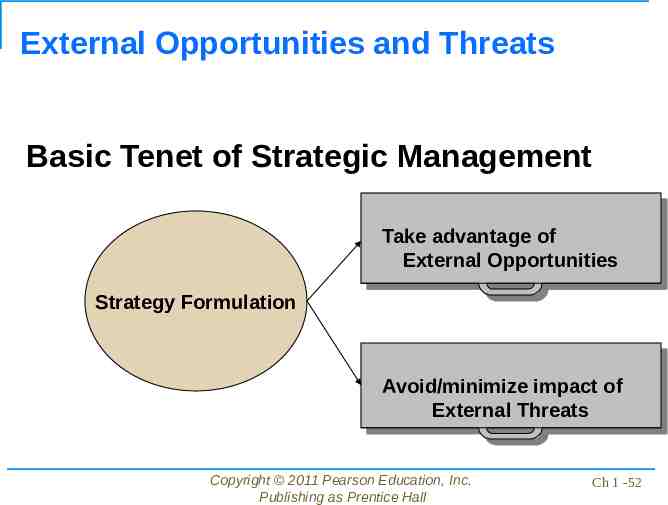

External Opportunities and Threats Analysis of Trends Social, Economic, Demographic Cultural Political, Legal, Governmental Technological Competitors Larger companies may have people designated to monitor external threats and opportunities Lobbying seeks to influence government

External Opportunities and Threats Basic Tenet of Strategic Management Take Takeadvantage advantageof of External ExternalOpportunities Opportunities Strategy Formulation Avoid/minimize Avoid/minimizeimpact impactof of External ExternalThreats Threats Copyright 2011 Pearson Education, Inc. Publishing as Prentice Hall Ch 1 -52

Internal Strengths and Weaknesses Controllable activities performed especially well or poorly Determined relative to competitors Copyright 2011 Pearson Education, Inc. Publishing as Prentice Hall Ch 1 -53

Internal Strengths and Weaknesses Typically located in functional areas of the firm Management Marketing Finance/Accounting Production/Operations Research & Development Management Information Systems Copyright 2011 Pearson Education, Inc. Publishing as Prentice Hall Ch 1 -54

Strategies Examples Geographic expansion Diversification Acquisition Product development Market penetration Retrenchment Divestiture Liquidation Joint venture Copyright 2011 Pearson Education, Inc. Publishing as Prentice Hall Ch 1 -55